Key Insights

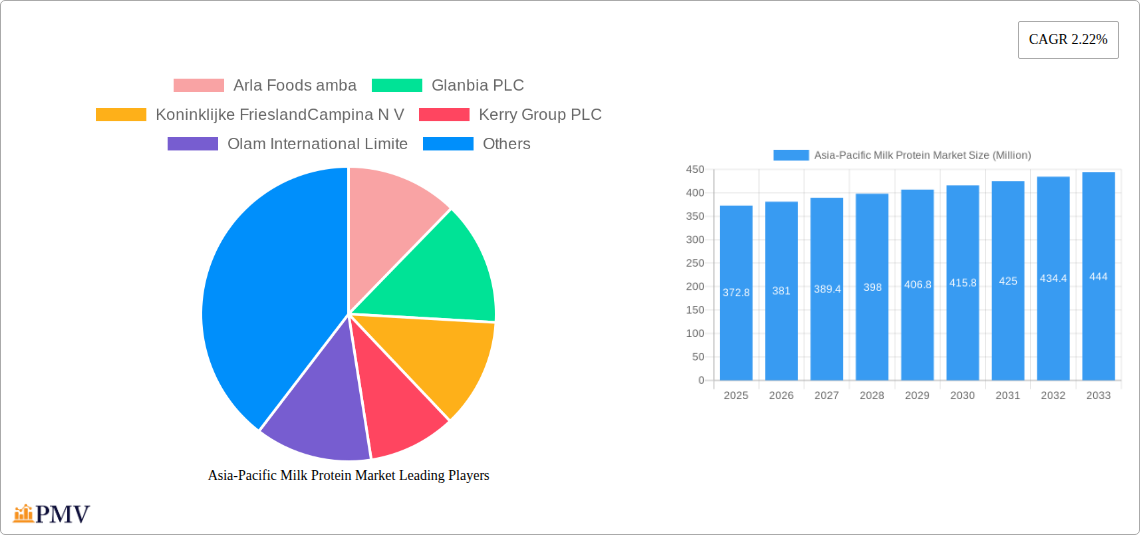

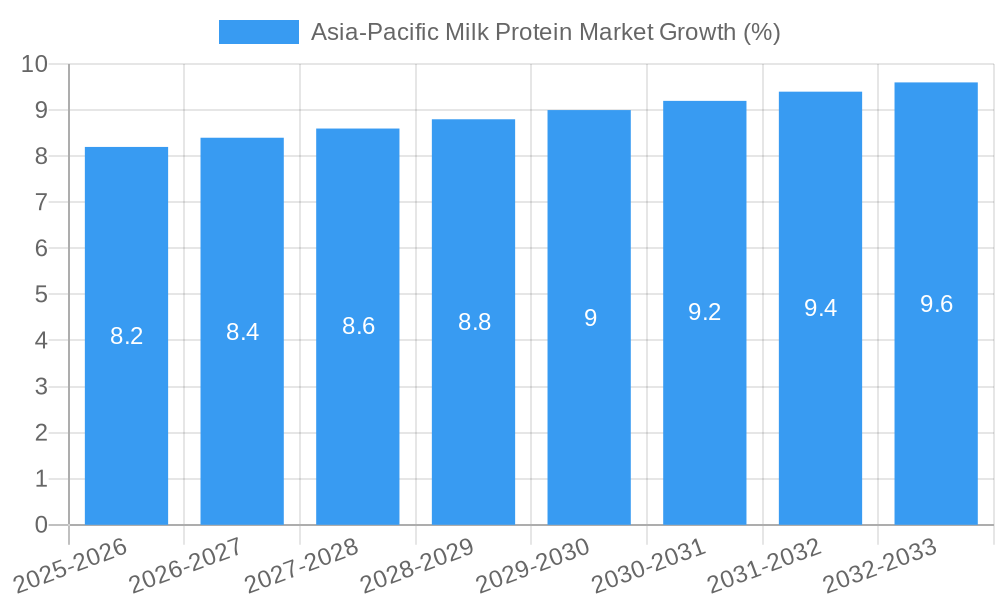

The Asia-Pacific milk protein market, valued at $372.8 million in 2025, is projected to experience steady growth, driven by increasing demand for nutritional supplements, functional foods, and animal feed. The region's large and growing population, coupled with rising disposable incomes and health consciousness, are key factors fueling this expansion. Specific segments like sports nutrition and functional beverages are showing particularly strong growth potential, reflecting a shift towards healthier lifestyles and performance enhancement. While the overall CAGR of 2.22% suggests moderate growth, certain countries within the Asia-Pacific region, such as China and India, are expected to exhibit faster growth rates due to their large populations and developing economies. The market is segmented by form (concentrates and isolates) and end-user (animal feed, food & beverages, and sports/performance nutrition), allowing for a nuanced understanding of growth drivers within each category. Concentrates, due to their cost-effectiveness, are currently dominating the market, but isolates, with their higher protein content, are expected to witness faster growth in the coming years. The competitive landscape is characterized by a mix of multinational corporations and regional players, with key companies investing heavily in research and development to innovate and cater to the evolving consumer preferences. The increasing adoption of sustainable and ethical sourcing practices is also impacting the market dynamics.

The market's growth is anticipated to be primarily driven by rising health awareness, increasing demand for convenient and nutritious food products, and the expanding sports nutrition sector. However, challenges such as fluctuating raw material prices and stringent regulations related to food safety and labeling could potentially impede growth. Nonetheless, the overall outlook for the Asia-Pacific milk protein market remains optimistic, with continued expansion projected throughout the forecast period (2025-2033). Innovation in product formulations, coupled with effective marketing strategies targeting health-conscious consumers, will be crucial for market participants to maintain a competitive edge. The market's segmentation by country offers valuable insights into regional specificities and growth opportunities. Countries with established dairy industries and strong consumer demand for value-added products are expected to be key growth drivers within this dynamic market.

Asia-Pacific Milk Protein Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific milk protein market, offering actionable insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report delves into market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key challenges. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Asia-Pacific Milk Protein Market Structure & Competitive Dynamics

The Asia-Pacific milk protein market is characterized by a moderately concentrated competitive landscape with several multinational corporations and regional players vying for market share. Market concentration is influenced by factors such as economies of scale, brand recognition, and access to raw materials. Innovation ecosystems are dynamic, driven by research and development efforts focused on improving product functionality, nutritional value, and sustainability. Regulatory frameworks vary across countries within the region, impacting product approvals and labeling requirements. Product substitutes, such as plant-based proteins, pose a growing challenge, necessitating continuous innovation to maintain market relevance. End-user trends indicate a rising demand for high-protein products across food and beverages, sports nutrition, and animal feed segments. Mergers and acquisitions (M&A) activity has been moderate, driven by strategic expansion and portfolio diversification, with deal values averaging approximately xx Million.

- Key Market Players: Arla Foods amba, Glanbia PLC, Koninklijke FrieslandCampina N.V., Kerry Group PLC, Olam International Limited, Groupe Lactalis, Fonterra Co-operative Group Limited, Morinaga Milk Industry Co. Ltd, Milligans Food Group Limited.

- Market Share: The top five players account for approximately xx% of the market share.

- M&A Activity: Recent M&A deals have focused on consolidating market share and accessing new geographical markets.

Asia-Pacific Milk Protein Market Industry Trends & Insights

The Asia-Pacific milk protein market is experiencing robust growth, driven by several key factors. Rising disposable incomes and changing consumer preferences towards healthier and protein-rich diets are significant growth drivers. Technological advancements in milk protein processing and formulation are leading to improved product quality, functionality, and shelf life. The increasing adoption of sports nutrition and functional foods is also boosting demand. Competitive dynamics are intense, with players focusing on product differentiation, brand building, and strategic partnerships to gain a competitive edge. The market penetration rate for milk protein concentrates and isolates is increasing steadily, particularly in developing economies within the region.

Dominant Markets & Segments in Asia-Pacific Milk Protein Market

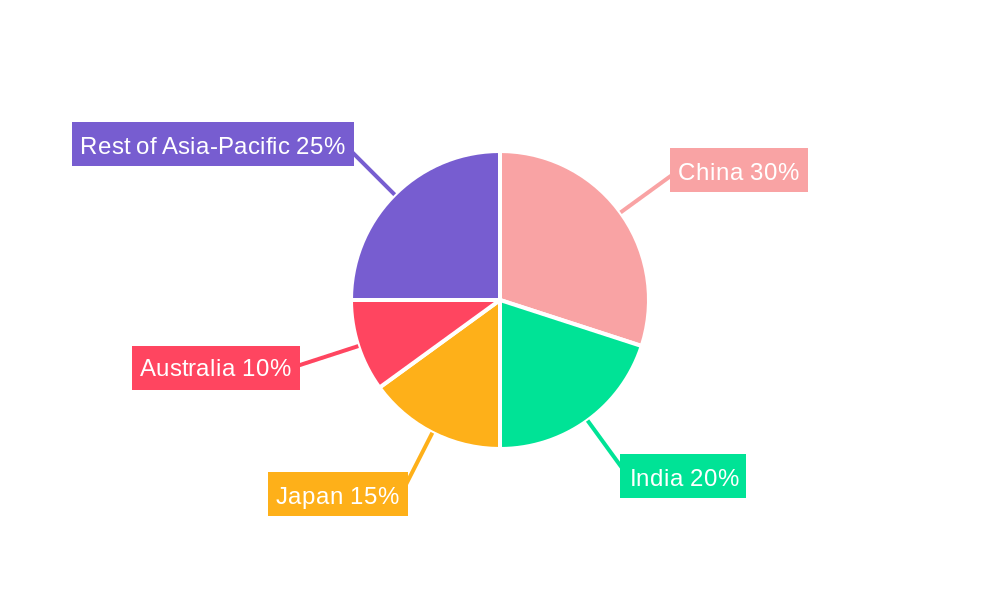

China and India represent the largest markets for milk protein in the Asia-Pacific region, driven by their significant populations, growing economies, and increasing consumer demand for protein-rich food products. Within the product segments, isolates are witnessing faster growth compared to concentrates, due to their higher protein content and versatility in applications. The food and beverages sector is the largest end-user segment, followed by the animal feed sector. The sports/performance nutrition segment is exhibiting the fastest growth, fueled by rising health consciousness and fitness trends.

- Key Drivers for China and India:

- Rapid urbanization and rising disposable incomes.

- Increased awareness of the health benefits of protein consumption.

- Growing demand for convenient and nutritious food products.

- Supportive government policies promoting dairy farming and processing.

- Dominant Segments: Isolates exhibit a high growth rate due to their superior functional properties, making them suitable for various applications. The food and beverage segment holds the largest market share due to extensive applications in dairy products, beverages, and meat alternatives.

Asia-Pacific Milk Protein Market Product Innovations

Recent innovations have focused on developing milk protein ingredients with enhanced functional properties, such as improved solubility, emulsification, and foaming capabilities. Micellar casein isolates and specialized blends designed for dry-blending in infant formula are gaining traction. These advancements cater to the increasing demand for convenient and high-quality protein sources, aligning with evolving consumer preferences and technological advancements in food processing.

Report Segmentation & Scope

This report segments the Asia-Pacific milk protein market based on form (concentrates and isolates), end-user (animal feed, food and beverages, sports/performance nutrition), and country (Australia, China, India, Indonesia, Japan, Malaysia, New Zealand, South Korea, Thailand, Vietnam, and Rest of Asia-Pacific). Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed, providing a granular understanding of the market's structure.

Key Drivers of Asia-Pacific Milk Protein Market Growth

The Asia-Pacific milk protein market’s growth is primarily driven by rising health awareness, increasing disposable incomes, and a shift towards convenient and protein-rich diets. Government initiatives supporting dairy farming and processing contribute significantly. The region’s expanding food and beverage industry, coupled with the surge in the sports nutrition segment, fuels the market's expansion.

Challenges in the Asia-Pacific Milk Protein Market Sector

Fluctuations in raw material prices and supply chain disruptions pose significant challenges. Varying regulatory frameworks across different countries can impact product approvals and labeling. The presence of substitutes like plant-based proteins also presents intense competition. These factors can affect market growth and profitability.

Leading Players in the Asia-Pacific Milk Protein Market

- Arla Foods amba

- Glanbia PLC

- Koninklijke FrieslandCampina N.V.

- Kerry Group PLC

- Olam International Limited

- Groupe Lactalis

- Fonterra Co-operative Group Limited

- Morinaga Milk Industry Co. Ltd

- Milligans Food Group Limited

Key Developments in Asia-Pacific Milk Protein Market Sector

- August 2021: Arla Foods AmbA launched MicelPure™ Milk Protein, a micellar casein isolate available in standard and organic versions (87% native proteins).

- August 2021: Lactalis India launched Lactel Turbo Yoghurt Drink, a protein-packed yogurt drink in mango and strawberry flavors.

- February 2021: Arla Foods AmbA launched a new dry-blend protein for infant formula manufacturers, reducing production costs without compromising safety or quality.

Strategic Asia-Pacific Milk Protein Market Outlook

The Asia-Pacific milk protein market presents significant growth opportunities, driven by increasing health consciousness, expanding food and beverage industries, and rising demand for convenient, high-protein products. Strategic investments in research and development, focusing on innovative product formulations and sustainable sourcing practices, will be crucial for success in this dynamic market. Companies can leverage the increasing demand for plant-based protein alternatives by incorporating milk protein into blended solutions to cater to a broader consumer base.

Asia-Pacific Milk Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Dairy and Dairy Alternative Products

- 2.2.1.5. RTE/RTC Food Products

- 2.2.1.6. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Asia-Pacific Milk Protein Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Milk Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.22% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trend and Increasing Inclination towards Protein-rich Functional Food and Beverages; Increasing Awareness about Health Benefits Associated with Animal Protein

- 3.3. Market Restrains

- 3.3.1. Competition from Vegan/Plant-based Protein Sources

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Dairy and Dairy Alternative Products

- 5.2.2.1.5. RTE/RTC Food Products

- 5.2.2.1.6. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. China Asia-Pacific Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Arla Foods amba

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Glanbia PLC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Koninklijke FrieslandCampina N V

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Kerry Group PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Olam International Limite

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Groupe LACTALIS

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Fonterra Co-operative Group Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Morinaga Milk Industry Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Milligans Food Group Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Arla Foods amba

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Arla Foods amba

List of Figures

- Figure 1: Asia-Pacific Milk Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Milk Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Milk Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Milk Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Milk Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 4: Asia-Pacific Milk Protein Market Volume K Tons Forecast, by Form 2019 & 2032

- Table 5: Asia-Pacific Milk Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Asia-Pacific Milk Protein Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 7: Asia-Pacific Milk Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Milk Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific Milk Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia-Pacific Milk Protein Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: China Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: India Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South Korea Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Taiwan Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Asia-Pacific Milk Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 26: Asia-Pacific Milk Protein Market Volume K Tons Forecast, by Form 2019 & 2032

- Table 27: Asia-Pacific Milk Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 28: Asia-Pacific Milk Protein Market Volume K Tons Forecast, by End User 2019 & 2032

- Table 29: Asia-Pacific Milk Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Milk Protein Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: China Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: China Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Japan Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: South Korea Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Korea Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: India Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Australia Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: New Zealand Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: New Zealand Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Indonesia Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Indonesia Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Malaysia Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Malaysia Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Singapore Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Singapore Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: Thailand Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Thailand Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Vietnam Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Vietnam Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 53: Philippines Asia-Pacific Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Philippines Asia-Pacific Milk Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Milk Protein Market?

The projected CAGR is approximately 2.22%.

2. Which companies are prominent players in the Asia-Pacific Milk Protein Market?

Key companies in the market include Arla Foods amba, Glanbia PLC, Koninklijke FrieslandCampina N V, Kerry Group PLC, Olam International Limite, Groupe LACTALIS, Fonterra Co-operative Group Limited, Morinaga Milk Industry Co Ltd, Milligans Food Group Limited, Arla Foods amba.

3. What are the main segments of the Asia-Pacific Milk Protein Market?

The market segments include Form, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 372.8 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trend and Increasing Inclination towards Protein-rich Functional Food and Beverages; Increasing Awareness about Health Benefits Associated with Animal Protein.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Vegan/Plant-based Protein Sources.

8. Can you provide examples of recent developments in the market?

August 2021: Arla Foods AmbA launched a micellar casein isolate called MicelPure™ Milk Protein, which comes in standard and organic versions. The product contains 87% native proteins.August 2021: Lactalis India launched a protein-packed yogurt drink called Lactel Turbo Yoghurt Drink. The drink is available in mango and strawberry flavors.February 2021: Arla Foods AmbA launched a new dry-blend protein that helps infant formula manufacturers reduce production costs without compromising safety or quality. It is known to be the first protein ingredient designed for dry blending. This process allows manufacturers to reduce energy usage and production costs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Milk Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Milk Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Milk Protein Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Milk Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence