Key Insights

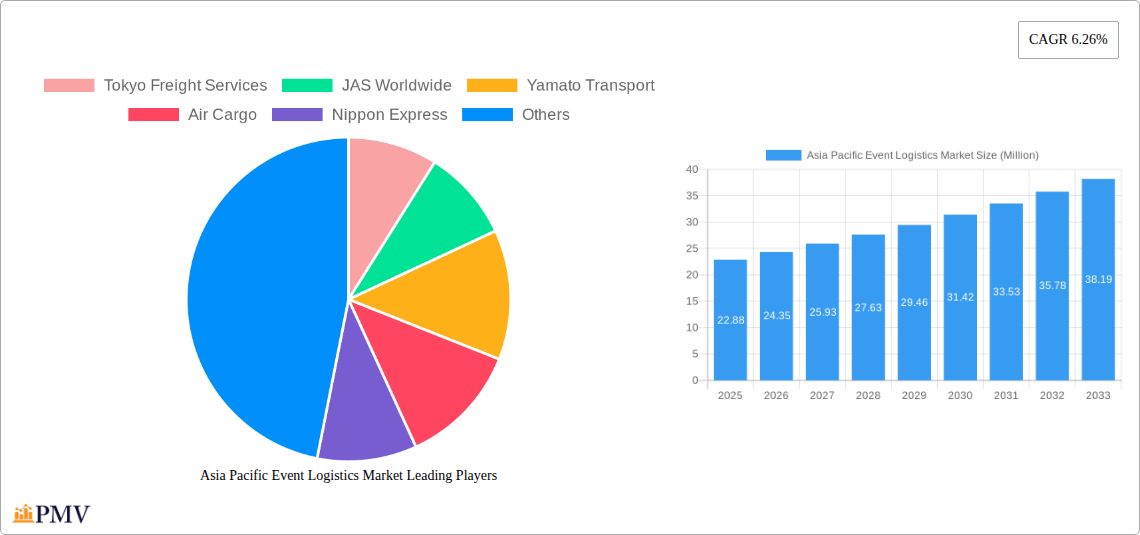

The Asia Pacific event logistics market, valued at $22.88 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.26% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning entertainment and sports industries within the region are creating a significant demand for efficient and reliable logistics solutions for events of all scales, from concerts and sporting events to large-scale trade fairs. Increased government investment in infrastructure development, particularly in transportation networks across key Asian economies like China, India, and Japan, further enhances the market's potential. Growing tourism and a rise in international events are also contributing factors. Furthermore, technological advancements in logistics management systems, such as real-time tracking and inventory management software, are optimizing efficiency and reducing operational costs, stimulating market growth. While challenges such as fluctuating fuel prices and geopolitical uncertainties exist, the overall market outlook remains positive, indicating significant growth opportunities for logistics providers specializing in event management.

Asia Pacific Event Logistics Market Market Size (In Million)

The market segmentation reveals noteworthy trends. Inventory control and distribution systems are leading segments by type, reflecting the crucial role of efficient inventory management in ensuring smooth event operations. The entertainment sector dominates application-based segmentation, underscoring the significant logistics needs of the entertainment industry. Geographically, China and India are projected to be the fastest-growing markets, fueled by their expanding economies and burgeoning event industries. While data for individual countries beyond 2025 is not explicitly provided, projecting growth based on the overall CAGR and regional market dynamics suggests a consistent expansion across the Asia-Pacific region. The presence of established global logistics players alongside regional specialists indicates a competitive but dynamic market landscape. This competitive landscape fosters innovation and enhances service offerings, ultimately benefiting event organizers and contributing to market growth.

Asia Pacific Event Logistics Market Company Market Share

Asia Pacific Event Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific event logistics market, offering valuable insights for businesses, investors, and industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence to navigate the dynamic landscape of event logistics across the Asia-Pacific region. The market is segmented by type (Inventory Control, Distribution Systems, Logistics Solutions), application (Entertainment, Sports, Trade fairs, Others), and country (China, South Korea, India, Japan, Rest of Asia Pacific). The report's market size estimations for 2025 are in Millions.

Asia Pacific Event Logistics Market Market Structure & Competitive Dynamics

The Asia Pacific event logistics market exhibits a moderately concentrated structure, with several key players holding significant market share. Market concentration is influenced by the presence of both global giants and regional specialists. Innovation ecosystems are evolving rapidly, driven by technological advancements in areas such as AI-powered route optimization, blockchain for enhanced transparency, and IoT-enabled real-time tracking. Regulatory frameworks vary across the region, influencing operational costs and compliance requirements. Product substitutes are limited, primarily focused on alternative transportation methods. End-user trends highlight increasing demands for efficient, sustainable, and technologically advanced logistics solutions.

Mergers and acquisitions (M&A) are frequent, reflecting the desire for market expansion and consolidation. Notable M&A activities include the recent acquisition of smaller firms by larger players, indicating a drive towards vertical integration and enhanced service offerings. For example, the xx Million acquisition of a smaller logistics company by a larger player illustrates this trend. Overall, the market's competitive intensity is high, necessitating continuous innovation and operational efficiency to maintain competitiveness.

- Market Share: Top 5 players hold approximately xx% of the market share.

- M&A Deal Values (2019-2024): Total deal value estimated at xx Million.

- Average Deal Size: xx Million.

Asia Pacific Event Logistics Market Industry Trends & Insights

The Asia Pacific event logistics market is experiencing robust growth, driven by a multitude of factors. The increasing frequency and scale of events across the region are significant growth drivers. Technological disruptions, such as the adoption of advanced analytics and automation, are transforming operational efficiency and customer experience. Consumer preferences are shifting towards personalized, seamless, and sustainable logistics solutions. Competitive dynamics are shaping market evolution, prompting innovation and strategic alliances.

The market's compound annual growth rate (CAGR) from 2025 to 2033 is projected to be xx%, significantly influenced by rising disposable incomes, government support for large-scale events, and technological progress. Market penetration is high in established markets like Japan and China, while considerable growth opportunities remain in emerging economies like India. The increasing adoption of sustainable practices and the growing demand for specialized logistics solutions for niche events further enhance market growth.

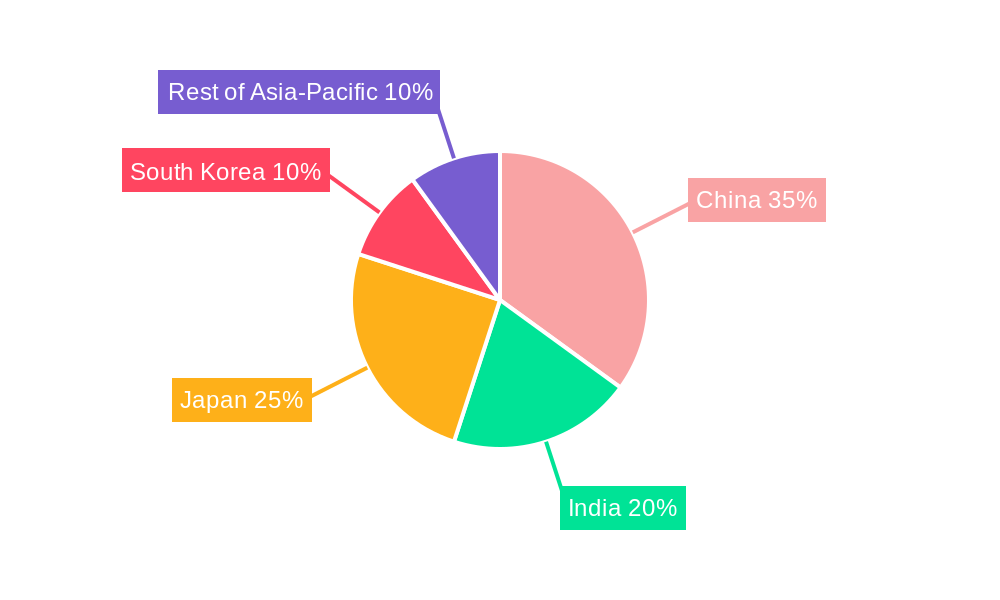

Dominant Markets & Segments in Asia Pacific Event Logistics Market

- By Country: China dominates the Asia Pacific event logistics market due to its large and growing event industry. Key drivers include:

- Robust economic growth fueling increased event spending.

- Extensive infrastructure development supporting efficient logistics networks.

- Government initiatives promoting tourism and large-scale events.

- By Type: Logistics Solutions holds the largest segment share, driven by the increasing demand for comprehensive, integrated solutions.

- By Application: The Entertainment segment accounts for the largest share, fueled by a surge in music festivals, concerts, and film productions.

Japan's well-developed infrastructure and established event ecosystem contribute to its significant position, particularly for large-scale international events, as showcased by Nippon Express's involvement with Expo 2025. India, despite infrastructural challenges, presents significant growth opportunities due to its expanding event landscape and burgeoning economy. South Korea also enjoys a significant position due to its robust entertainment industry. The "Rest of Asia Pacific" segment, while diverse, reflects emerging market dynamics and opportunities across the region.

Asia Pacific Event Logistics Market Product Innovations

Recent innovations in the Asia Pacific event logistics market are centered around technology-driven solutions. Real-time tracking and monitoring systems powered by the Internet of Things (IoT) are transforming visibility and responsiveness. AI-based route optimization and predictive analytics are enhancing efficiency and reducing costs. The integration of blockchain technology is enhancing transparency and security. These advancements cater to growing client demands for reliable, cost-effective, and environmentally conscious solutions, securing a strong market fit.

Report Segmentation & Scope

By Type: Inventory Control, Distribution Systems, and Logistics Solutions segments are analyzed, covering market size, growth projections, and competitive dynamics for each. Logistics Solutions is projected to witness the highest growth rate, driven by increasing demand for comprehensive services.

By Application: The Entertainment, Sports, Trade Fair, and Others segments are explored in detail. The Entertainment segment demonstrates the highest growth potential, propelled by the rise in large-scale events.

By Country: China, South Korea, India, Japan, and the Rest of Asia Pacific are thoroughly analyzed. China represents the largest market, followed by Japan and South Korea, while India showcases high growth potential.

Key Drivers of Asia Pacific Event Logistics Market Growth

Several factors contribute to the market's robust growth. Firstly, the burgeoning event industry across the region, driven by increasing disposable incomes and government support for large-scale events, significantly boosts demand. Secondly, technological advancements, such as AI and IoT integration, enhance efficiency and create new service offerings. Finally, supportive government policies and infrastructure development foster a favorable business environment.

Challenges in the Asia Pacific Event Logistics Market Sector

The Asia Pacific event logistics market faces challenges such as varying regulatory frameworks across countries, creating operational complexities. Infrastructure limitations in certain regions may lead to delays and increased costs. Intense competition, especially from established global players, demands continuous innovation to remain competitive. Finally, fluctuations in global economic conditions can impact event budgets and affect demand.

Leading Players in the Asia Pacific Event Logistics Market Market

- Tokyo Freight Services

- JAS Worldwide

- Yamato Transport

- Air Cargo

- Nippon Express

- Kuehne + Nagel

- CEVA Logistics

- YTO Express

- Geodis

- Sagwa Express

- Sankayu Inc

- DP World

Key Developments in Asia Pacific Event Logistics Market Sector

- November 2023: Global Critical Logistics (GCL) acquires Auckland-based Time Frame Logistics and Wellington-based Xtreme Forwarding, strengthening its position in live event logistics.

- August 2022: Nippon Express is selected as the recommended logistics partner for Expo 2025 in Japan, highlighting its significant market presence and expertise.

Strategic Asia Pacific Event Logistics Market Market Outlook

The Asia Pacific event logistics market presents significant growth opportunities. Continued infrastructure development, rising event frequency, and the adoption of innovative technologies will fuel market expansion. Strategic partnerships and acquisitions will shape the competitive landscape. Focusing on sustainable practices and tailored event solutions will offer companies a competitive edge and unlock new growth avenues within this dynamic and expanding market.

Asia Pacific Event Logistics Market Segmentation

-

1. Type

- 1.1. Inventory Control

- 1.2. Distribution Systems

- 1.3. Logistics Solutions

-

2. Application

- 2.1. Entertainment

- 2.2. Sports

- 2.3. Trade fair

- 2.4. Others

Asia Pacific Event Logistics Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Event Logistics Market Regional Market Share

Geographic Coverage of Asia Pacific Event Logistics Market

Asia Pacific Event Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exhibitions and Conferences are driving the market; Sports Events are driving the market growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Sports Events are Driving the Market in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inventory Control

- 5.1.2. Distribution Systems

- 5.1.3. Logistics Solutions

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Entertainment

- 5.2.2. Sports

- 5.2.3. Trade fair

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tokyo Freight Services

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JAS Worldwide

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yamato Transport

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Air Cargo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuhene + Nagel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 YTO Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Geodis

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sagwa Express

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sankayu Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DP World

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Tokyo Freight Services

List of Figures

- Figure 1: Asia Pacific Event Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Event Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia Pacific Event Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Asia Pacific Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Event Logistics Market?

The projected CAGR is approximately 6.26%.

2. Which companies are prominent players in the Asia Pacific Event Logistics Market?

Key companies in the market include Tokyo Freight Services, JAS Worldwide, Yamato Transport, Air Cargo, Nippon Express, Kuhene + Nagel, CEVA Logistics, YTO Express, Geodis, Sagwa Express, Sankayu Inc, DP World.

3. What are the main segments of the Asia Pacific Event Logistics Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Exhibitions and Conferences are driving the market; Sports Events are driving the market growth.

6. What are the notable trends driving market growth?

Sports Events are Driving the Market in the Region.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

November 2023: Global Critical Logistics, Asia Pacific’s largest time-critical & live event logistics company, has acquired two New Zealand forwarders. GCL announced the acquisition of Auckland-based time frame logistics and Wellington-based Xtreme forwarding yesterday. Time Frame is a leading provider of live event logistics services and will see its assets and operations transferred to GCL's live event business, Rock-it Global. Xtreme forwarding will now be renamed Rock-it New Zealand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Event Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Event Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Event Logistics Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Event Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence