Key Insights

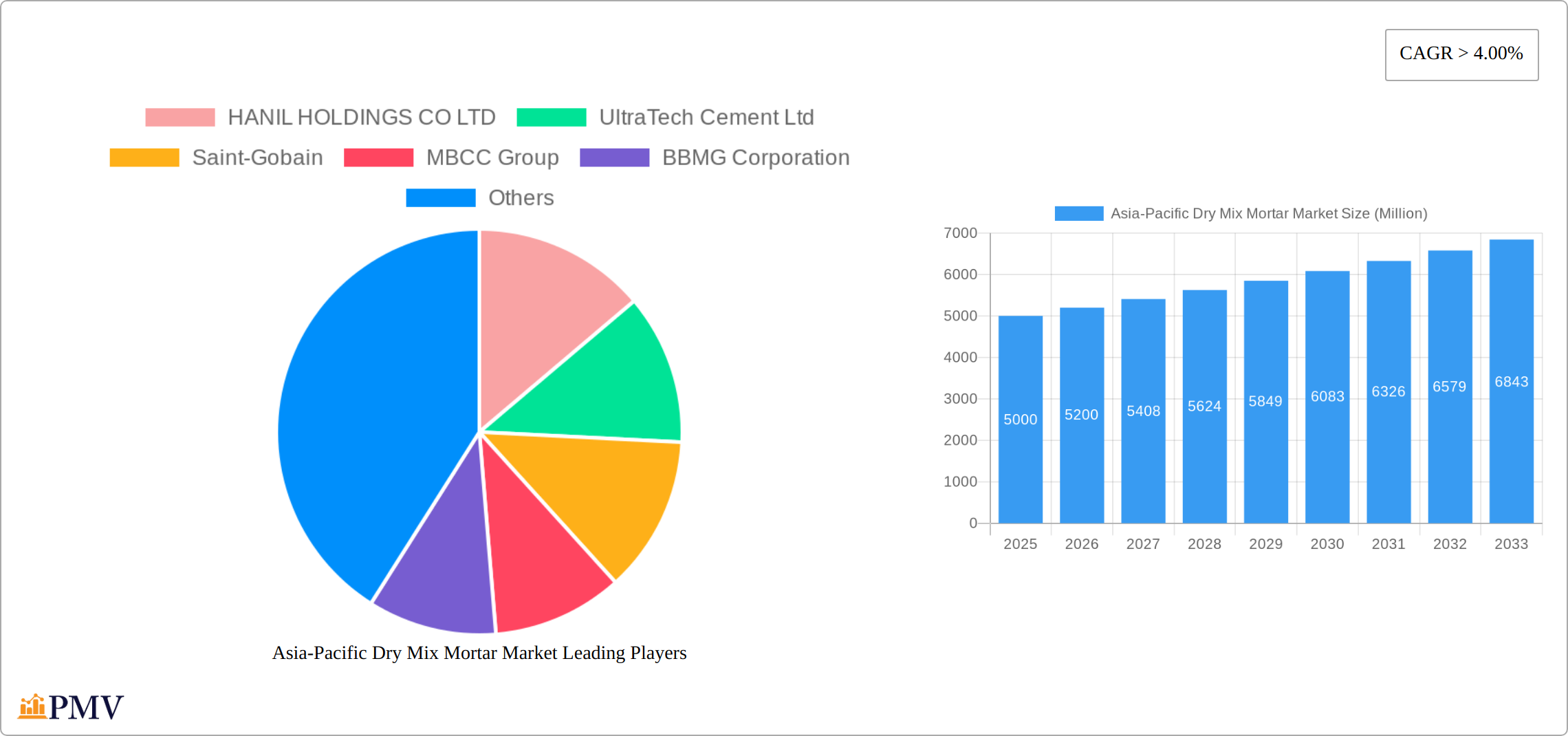

The Asia-Pacific dry mix mortar market is experiencing robust growth, driven by the region's burgeoning construction industry and increasing urbanization. With a current market size exceeding several billion dollars (exact figures omitted due to lack of explicit data) and a Compound Annual Growth Rate (CAGR) exceeding 4%, the market is poised for significant expansion through 2033. Key drivers include rising infrastructure development across countries like India, China, and Indonesia, coupled with a preference for high-performance, ready-to-use building materials that enhance efficiency and reduce labor costs. The increasing adoption of sustainable building practices further fuels market growth, as dry mix mortars offer environmentally friendly alternatives to traditional methods. Strong growth is observed across various applications, including concrete protection and renovation, grouts, insulation and finishing systems, and waterproofing slurries. While specific segment breakdowns aren't provided, it's plausible to assume that the infrastructure and residential end-use sectors are major contributors, reflecting the broader construction boom. Potential restraints include fluctuations in raw material prices and regional economic conditions; however, the long-term outlook remains positive given the region's sustained economic progress and ongoing infrastructure projects. Major players like UltraTech Cement, Saint-Gobain, Sika AG, and others are actively shaping the market landscape through innovation and strategic expansion.

The market's diverse segments, encompassing applications such as concrete protection, grouts, and waterproofing, indicate a multifaceted growth pattern. China, India, and other rapidly developing economies within the Asia-Pacific region are major contributors to market expansion. Competition among established players and emerging regional companies is intense, leading to product innovation and price competitiveness. Further research into specific regional market dynamics within countries like Australia, Japan, and South Korea could provide a deeper understanding of localized market trends. Analyzing the market through the lens of government regulations promoting sustainable building materials and infrastructure development initiatives will also yield valuable insights. Overall, the Asia-Pacific dry mix mortar market presents compelling opportunities for industry stakeholders, driven by urbanization, construction activity, and the transition towards sustainable building practices.

This comprehensive report provides an in-depth analysis of the Asia-Pacific dry mix mortar market, offering valuable insights for industry stakeholders, investors, and researchers. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period from 2025 to 2033. It segments the market by application, country, and end-use sector, providing a granular understanding of market dynamics and growth potential. Key players such as HANIL HOLDINGS CO LTD, UltraTech Cement Ltd, Saint-Gobain, MBCC Group, BBMG Corporation, Asia Cement Co Ltd, Sika AG, Oriental Yuhong, SCG, and SAMPYO GROUP are analyzed for their market share, competitive strategies, and recent activities.

Asia-Pacific Dry Mix Mortar Market Structure & Competitive Dynamics

The Asia-Pacific dry mix mortar market exhibits a moderately consolidated structure, with several major players holding significant market share. The market is characterized by a dynamic competitive landscape influenced by factors such as intense competition, technological innovation, and evolving regulatory frameworks. Innovation ecosystems are flourishing, with companies investing heavily in R&D to develop advanced products and improve efficiency. Product substitution remains a factor, with alternative materials competing for market share in specific applications. End-user trends toward sustainable and high-performance building materials are driving product development.

Mergers and acquisitions (M&A) are a key driver of market consolidation. Recent deals include:

- October 2023: Beijing BBMG Mortar Co. Ltd acquired 30% of equities in Tianjin Jinyu Treasure Bright Mortar Co. Ltd for approximately USD 2430 Million, significantly impacting market share dynamics.

- May 2023: MBCC Group's divestment of its construction systems business to Sika AG reshaped the competitive landscape, altering market share and competitive dynamics.

Market share data for individual companies is currently under review and will be available in the full report. Further analysis of regulatory landscapes across different countries within the Asia-Pacific region, including variations in building codes and environmental regulations, will also be provided. The report delves deeper into the impact of these factors and the overall competitive intensity.

Asia-Pacific Dry Mix Mortar Market Industry Trends & Insights

The Asia-Pacific dry mix mortar market is experiencing robust and dynamic growth, propelled by a confluence of powerful factors. Rapid urbanization remains a primary driver, fueling demand for efficient and reliable construction materials across the region. Coupled with this is significant and sustained investment in infrastructure development, from transportation networks to public facilities, particularly in burgeoning economies like India and China. These large-scale projects necessitate high-volume, consistent-quality building materials.

The market is projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 7.5% - 8.5% during the forecast period (2025-2033). Increased government investment in infrastructure projects, particularly in countries like India and China, is a major growth catalyst. Technological advancements, such as the adoption of smart technologies and automation in production processes, are also contributing to market expansion, leading to improved efficiency, reduced waste, and enhanced product consistency.

Consumer preferences are evolving, with a growing emphasis on high-performance, eco-friendly, and convenient dry mix mortar products. This trend is driving innovation in product development, with a focus on enhanced functionalities like superior durability, exceptional water resistance, and advanced thermal insulation properties. The market is witnessing a surging demand for specialized mortars meticulously tailored to specific applications, including those required for the construction of high-rise buildings and sustainable green buildings. The inherent advantages of dry mix mortars, such as ease of use, reduced on-site waste, and consistent quality compared to traditional wet mortars, are accelerating their market penetration. Competitive dynamics are intensifying, compelling companies to focus on strategic product diversification, forging strategic partnerships, and investing heavily in technological advancements to secure and expand their competitive edge. The report provides an in-depth analysis of these critical aspects, supported by granular regional and segment-level data.

Dominant Markets & Segments in Asia-Pacific Dry Mix Mortar Market

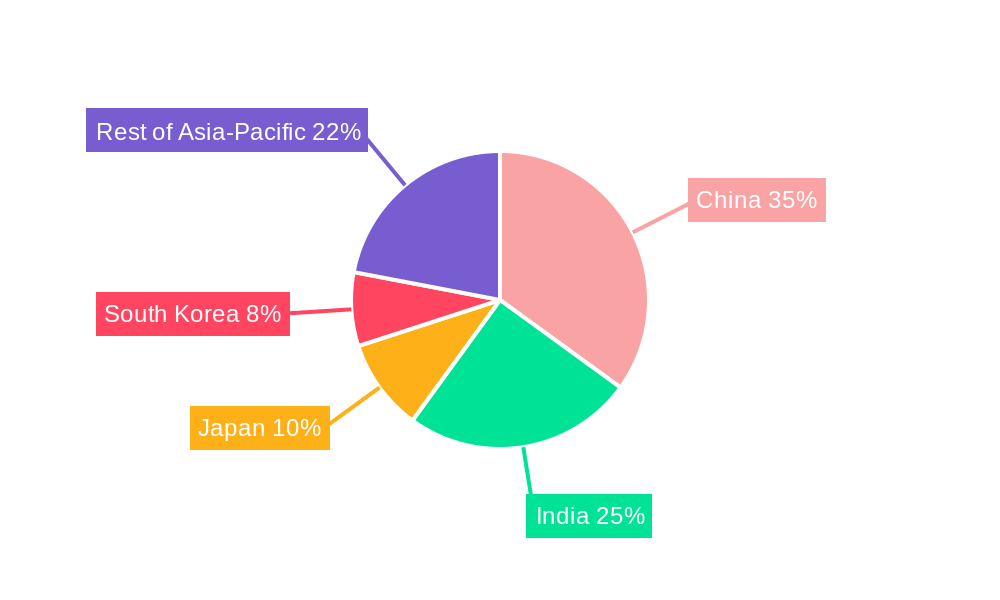

Within the expansive Asia-Pacific region, China and India stand out as the dominant markets for dry mix mortar, largely attributed to their exceptionally robust construction activities and substantial government investments in critical infrastructure projects. Beyond these two giants, other significant markets contributing to regional growth include Indonesia, Japan, South Korea, and Thailand, each with its unique set of growth drivers.

Key Drivers:

- China & India: Driven by sustained strong economic growth, ambitious large-scale infrastructure development programs, and relentless rapid urbanization, these two nations are at the forefront of market expansion.

- Rest of Asia-Pacific: A combination of increasing construction activities, ongoing infrastructure development initiatives, and proactive government policies aimed at fostering housing and industrial growth are propelling the market forward in these countries.

Dominant Segments:

- Application: The Tile Adhesive segment is experiencing remarkable growth, fueled by the escalating demand for ceramic and vitrified tiles in both residential and commercial construction projects across the region. Concurrently, the Concrete Protection and Renovation segment is proving to be a significant driver of market expansion, as there is a growing emphasis on improving the long-term durability, structural integrity, and lifespan of existing concrete infrastructure.

- End-Use Sector: The Residential and Infrastructure segments collectively represent the major end-use sectors. The relentless pace of urbanization, coupled with ongoing new housing construction and the development of essential public infrastructure, ensures consistent and high demand from these sectors.

The comprehensive report offers a granular analysis of the performance of each segment and its underlying growth drivers. This analysis includes detailed market size estimations, projected growth rates, and an assessment of competitive intensity for every segment and geographical region.

Asia-Pacific Dry Mix Mortar Market Product Innovations

Recent product innovations in the Asia-Pacific dry mix mortar market are strategically focused on augmenting crucial performance characteristics, such as enhanced compressive and tensile strength, superior durability under various environmental conditions, and significantly improved ease of application for construction professionals. Companies are actively developing specialized mortars engineered for niche applications, while simultaneously incorporating advanced eco-friendly materials to proactively address and satisfy the growing environmental consciousness of consumers and regulatory bodies.

A notable example of this innovation is the launch of PCI Novoment Flow in May 2023. This ready-mixed flowable screed mortar is designed for rapid setting and curing times, which directly translates into substantial improvements in construction efficiency and project timelines. Furthermore, the market is witnessing an increasing and sustained focus on developing mortars with demonstrably enhanced sustainability features. This includes formulations that contribute to a reduced carbon footprint throughout their lifecycle and the incorporation of recyclable components, aligning with global efforts towards a circular economy. This trend is expected to continue shaping the trajectory of technological advancements and product development within the dry mix mortar industry.

Report Segmentation & Scope

The report segments the Asia-Pacific dry mix mortar market across multiple dimensions:

By Application: Concrete Protection and Renovation, Grouts, Insulation and Finishing Systems, Plaster, Render, Tile Adhesive, Water Proofing Slurries, Other Applications. Each segment's growth projections, market sizes, and competitive dynamics are detailed in the report.

By Country: Australia, China, India, Indonesia, Japan, Malaysia, South Korea, Thailand, Vietnam, Rest of Asia-Pacific. Each country's market characteristics, growth potential, and key players are profiled.

By End-Use Sector: Commercial, Industrial and Institutional, Infrastructure, Residential. Each sector's demand dynamics and growth drivers are analyzed, accounting for the varying material needs and application techniques. Growth projections for each segment are included.

Key Drivers of Asia-Pacific Dry Mix Mortar Market Growth

The Asia-Pacific dry mix mortar market is propelled by several key growth drivers:

- Rapid Urbanization: The ongoing urbanization across the region is driving demand for new construction and infrastructure projects, which in turn fuels demand for dry mix mortars.

- Infrastructure Development: Government initiatives focused on improving infrastructure, including roads, bridges, and buildings, are significantly increasing the demand.

- Rising Disposable Incomes: Increasing disposable incomes in many countries are boosting construction activities.

- Technological Advancements: The introduction of novel materials and techniques leads to improved products and more efficient construction processes.

Challenges in the Asia-Pacific Dry Mix Mortar Market Sector

Despite its robust growth trajectory, the Asia-Pacific dry mix mortar market encounters several significant challenges that require strategic navigation:

- Fluctuating Raw Material Prices: The prices of key raw materials, such as cement, aggregates (sand and gravel), and chemical additives, are subject to considerable volatility. These price fluctuations can significantly impact production costs, erode profit margins, and necessitate agile pricing strategies.

- Stringent Environmental Regulations: Increasingly rigorous environmental regulations across various Asia-Pacific nations necessitate substantial investments in cleaner production technologies, waste reduction initiatives, and the adoption of sustainable sourcing practices. Compliance with these regulations, while crucial, adds to operational costs.

- Intense Competition: The market is characterized by a high level of competition, with a considerable number of established global and regional players, as well as emerging local manufacturers, vying for market share. This intense competition compels companies to engage in continuous innovation, implement aggressive marketing and distribution strategies, and optimize operational efficiencies to remain competitive.

Leading Players in the Asia-Pacific Dry Mix Mortar Market Market

- HANIL HOLDINGS CO LTD

- UltraTech Cement Ltd

- Saint-Gobain

- MBCC Group

- BBMG Corporation

- Asia Cement Co Ltd

- Sika AG

- Oriental Yuhong

- SCG

- SAMPYO GROUP

Key Developments in Asia-Pacific Dry Mix Mortar Market Sector

- October 2023: Beijing BBMG Mortar Co. Ltd acquired 30% of equities in Tianjin Jinyu Treasure Bright Mortar Co. Ltd for around USD 2430 Million. This acquisition significantly increased BBMG's market share and expanded its presence in the region.

- May 2023: PCI, an affiliate of MBCC Group, launched PCI Novoment Flow, a ready-mixed flowable screed mortar. This product innovation caters to the demand for efficient and high-performance construction materials.

- May 2023: MBCC Group divested its construction systems business to Sika AG. This divestiture reshaped the competitive landscape, with Sika AG gaining a significant advantage in the market.

Strategic Asia-Pacific Dry Mix Mortar Market Outlook

The Asia-Pacific dry mix mortar market holds substantial future potential, driven by ongoing urbanization, infrastructure development, and technological advancements. Strategic opportunities exist for companies to capitalize on the growing demand for specialized mortars, sustainable products, and efficient construction solutions. Companies focusing on innovation, strategic partnerships, and effective marketing strategies are well-positioned to capture market share and achieve significant growth in the coming years. The report concludes by providing specific strategies for both market entrants and incumbents.

Asia-Pacific Dry Mix Mortar Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Application

- 2.1. Concrete Protection and Renovation

- 2.2. Grouts

- 2.3. Insulation and Finishing Systems

- 2.4. Plaster

- 2.5. Render

- 2.6. Tile Adhesive

- 2.7. Water Proofing Slurries

- 2.8. Other Applications

Asia-Pacific Dry Mix Mortar Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. Southeast Asia

- 1.7. Rest of Asia Pacific

Asia-Pacific Dry Mix Mortar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Construction Industry; Government Policies to Promote the Usage of Fly Ash

- 3.3. Market Restrains

- 3.3.1. Harmful Properties of Fly Ash; Non-suitability in Cold Weather Conditions

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Dry Mix Mortar Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Concrete Protection and Renovation

- 5.2.2. Grouts

- 5.2.3. Insulation and Finishing Systems

- 5.2.4. Plaster

- 5.2.5. Render

- 5.2.6. Tile Adhesive

- 5.2.7. Water Proofing Slurries

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. China Asia-Pacific Dry Mix Mortar Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Dry Mix Mortar Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Dry Mix Mortar Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Dry Mix Mortar Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Dry Mix Mortar Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Dry Mix Mortar Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Dry Mix Mortar Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 HANIL HOLDINGS CO LTD

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 UltraTech Cement Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Saint-Gobain

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 MBCC Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BBMG Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Asia Cement Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Sika AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Oriental Yuhong

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 SCG

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 SAMPYO GROUP

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 HANIL HOLDINGS CO LTD

List of Figures

- Figure 1: Asia-Pacific Dry Mix Mortar Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Dry Mix Mortar Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Dry Mix Mortar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Dry Mix Mortar Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 4: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 5: Asia-Pacific Dry Mix Mortar Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: Asia-Pacific Dry Mix Mortar Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific Dry Mix Mortar Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: China Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: India Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South Korea Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Taiwan Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Asia-Pacific Dry Mix Mortar Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 26: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 27: Asia-Pacific Dry Mix Mortar Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 29: Asia-Pacific Dry Mix Mortar Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Dry Mix Mortar Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: China Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: China Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Japan Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: South Korea Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Korea Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: India Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Australia Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Southeast Asia Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Southeast Asia Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific Asia-Pacific Dry Mix Mortar Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Asia Pacific Asia-Pacific Dry Mix Mortar Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Dry Mix Mortar Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Asia-Pacific Dry Mix Mortar Market?

Key companies in the market include HANIL HOLDINGS CO LTD, UltraTech Cement Ltd, Saint-Gobain, MBCC Group, BBMG Corporation, Asia Cement Co Ltd, Sika AG, Oriental Yuhong, SCG, SAMPYO GROUP.

3. What are the main segments of the Asia-Pacific Dry Mix Mortar Market?

The market segments include End Use Sector, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Construction Industry; Government Policies to Promote the Usage of Fly Ash.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Harmful Properties of Fly Ash; Non-suitability in Cold Weather Conditions.

8. Can you provide examples of recent developments in the market?

October 2023: Beijing BBMG Mortar Co. Ltd acquired 30% of equities in Tianjin Jinyu Treasure Bright Mortar Co. Ltd for around USD 2430 million.May 2023: PCI, an affiliate of MBCC Group, formulated a ready-mixed flowable screed mortar, PCI Novoment Flow, offering multiple benefits like quick setting and curing.May 2023: MBCC group divested its construction systems business, including its subsidiaries, product portfolio, and advanced technologies, to Sika AG.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Dry Mix Mortar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Dry Mix Mortar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Dry Mix Mortar Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Dry Mix Mortar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence