Key Insights

The Asia Pacific contract packaging market is poised for significant expansion, driven by the escalating demand for outsourced packaging solutions across diverse industries. Key growth catalysts include the burgeoning consumer goods sector, particularly in food & beverage, pharmaceuticals, and beauty & personal care. Companies are increasingly leveraging contract packaging for specialized expertise, operational efficiency, and cost reduction. This trend is notably prominent in major economies like China, India, and Japan. The market is projected to reach $8.66 billion by 2025, with a robust CAGR of 13.95%. Factors such as rising disposable incomes, evolving consumer preferences, and the accelerating adoption of e-commerce are further propelling market growth. The comprehensive range of services, from primary to tertiary packaging, addresses a wide array of client requirements, underscoring the market's dynamism. While regulatory compliance and raw material price volatility present challenges, the market outlook remains optimistic with sustained growth projected through 2033.

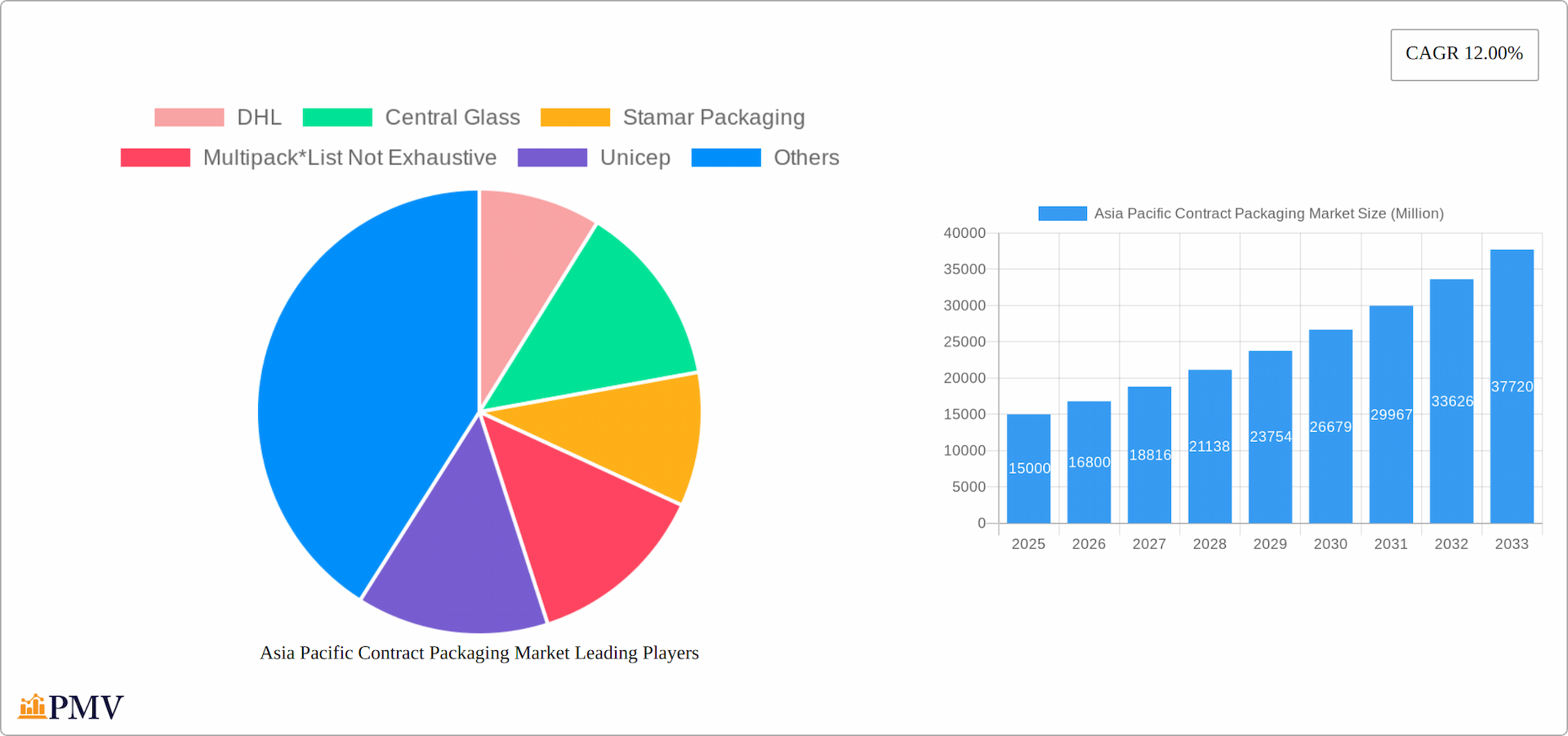

Asia Pacific Contract Packaging Market Market Size (In Billion)

Market segmentation highlights strong performance in key verticals. The food & beverage and pharmaceutical industries command substantial market shares, attributed to high volumes and stringent packaging demands, respectively. Home & fabric care, and beauty care sectors also offer considerable opportunities, fueled by increasing consumer expenditure and product innovation. Geographic concentration is observed in China, India, and Japan, reflecting their expansive consumer bases and advanced manufacturing capabilities. A competitive yet dynamic landscape is characterized by numerous established contract packaging providers, including global entities and specialized regional players. Future growth will be shaped by advancements in packaging materials and automation, leading to enhanced efficiency and cost-effectiveness for both service providers and their clients.

Asia Pacific Contract Packaging Market Company Market Share

Asia Pacific Contract Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific contract packaging market, offering invaluable insights for businesses operating within or planning to enter this dynamic sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period from 2025-2033. The historical period analyzed is 2019-2024. This report meticulously examines market size, segmentation, growth drivers, challenges, and competitive landscape, providing actionable intelligence for strategic decision-making.

Asia Pacific Contract Packaging Market Structure & Competitive Dynamics

The Asia Pacific contract packaging market exhibits a moderately concentrated structure with several major players vying for market share. Key factors influencing this dynamic include rapid technological advancements, evolving regulatory frameworks, and the increasing preference for outsourced packaging solutions by diverse end-user verticals. Innovation ecosystems are flourishing, driven by collaborations between contract packaging providers and material suppliers, leading to improved packaging efficiency and sustainability. Market share is primarily determined by factors such as production capacity, geographical reach, service offerings, and technological capabilities. Significant M&A activities have reshaped the competitive landscape, with deal values ranging from USD xx million to USD xx million in recent years, consolidating market power and expanding service portfolios.

- Market Concentration: Moderately concentrated with top players holding approximately xx% of the market share.

- Innovation Ecosystems: Strong collaborations between contract packaging providers and material suppliers, focusing on sustainability and efficiency.

- Regulatory Frameworks: Varying regulations across countries influencing packaging standards and compliance costs.

- Product Substitutes: Limited direct substitutes but increasing pressure from in-house packaging operations for certain segments.

- End-User Trends: Growing demand for sustainable, convenient, and customized packaging solutions.

- M&A Activities: Significant consolidation through mergers and acquisitions, leading to larger, more integrated players with broader service offerings.

Asia Pacific Contract Packaging Market Industry Trends & Insights

The Asia Pacific contract packaging market is experiencing robust growth, driven by several key factors. The CAGR during the forecast period (2025-2033) is estimated at xx%, fueled by the burgeoning e-commerce sector, rising consumer demand for convenience, and the increasing adoption of advanced packaging technologies. Market penetration of contract packaging services is steadily increasing across various verticals, particularly in the food and beverage, pharmaceutical, and beauty care sectors. Technological disruptions, such as automation and digitalization, are enhancing efficiency and reducing costs, while consumer preferences for sustainable and aesthetically pleasing packaging are shaping innovation. Competitive dynamics are characterized by price competition, service differentiation, and strategic partnerships.

Dominant Markets & Segments in Asia Pacific Contract Packaging Market

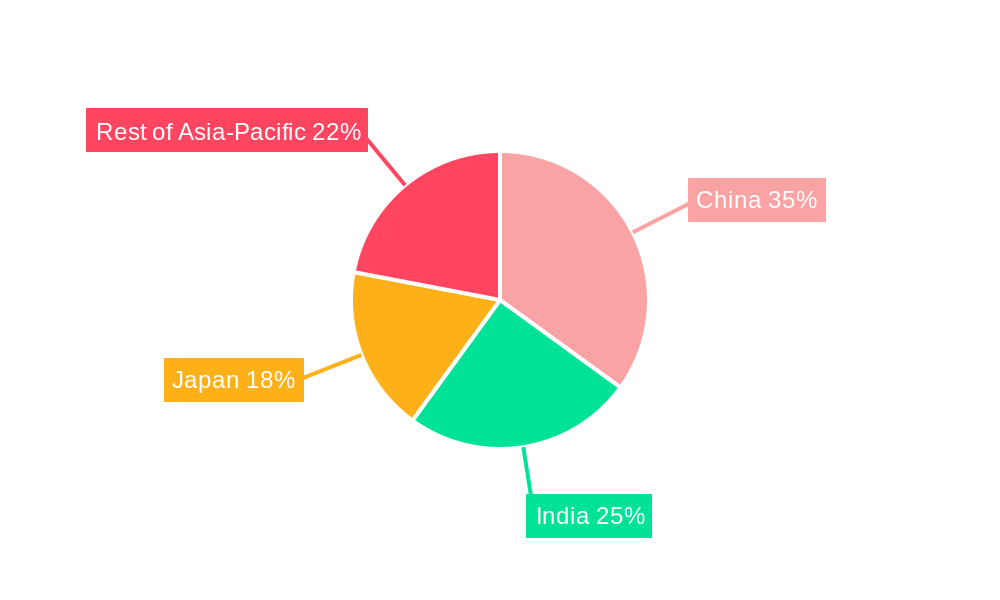

The Asia Pacific contract packaging market is experiencing robust growth, driven by a confluence of factors including rising consumer spending, e-commerce expansion, and the increasing need for sustainable packaging solutions. China remains the region's dominant market, followed by India and Japan, each exhibiting unique characteristics and growth trajectories.

Market Dynamics by Geography:

- China: Maintains its leading position due to its massive consumer base, thriving manufacturing sector, supportive government policies promoting industrial expansion, and a diverse range of contract packaging services catering to various industries.

- India: Rapid economic growth and a burgeoning middle class fuel significant demand for packaged goods, creating substantial opportunities for contract packaging providers. Increased focus on domestic manufacturing further strengthens the market.

- Japan: Characterized by a sophisticated consumer base demanding high-quality and innovative packaging solutions, Japan's market reflects a strong emphasis on technology and precision in contract packaging services.

- Australia: While a smaller market compared to its regional counterparts, Australia demonstrates high per capita consumption and a preference for premium packaging materials and sustainable practices, attracting specialized contract packaging providers.

- Other Southeast Asian Countries: These markets are witnessing increasing growth, driven by factors such as rising urbanization, a young and growing population, and expanding e-commerce sectors. Specific countries like Vietnam, Indonesia, and Thailand present exciting growth potential.

Market Segmentation by Service Type:

- Primary Packaging: This segment continues to dominate, encompassing the initial packaging of products and directly impacting consumer interaction. Innovation in materials and designs drives growth within this sector.

- Secondary Packaging: Experiencing significant expansion due to the importance of safe and efficient product transportation and storage. This segment is increasingly incorporating sustainable and protective features.

- Tertiary Packaging: Growth is fueled by the need for efficient supply chain management and bulk packaging solutions for large-scale distribution. Optimization strategies and cost-effective solutions are key drivers.

Market Segmentation by Industry Vertical:

- Food & Beverages: This remains the largest segment, propelled by the rising demand for processed foods and beverages, coupled with stringent food safety regulations and the growing popularity of convenience foods.

- Pharmaceuticals: Stringent regulatory requirements and the increasing demand for pharmaceutical products drive substantial growth in this segment, necessitating specialized contract packaging expertise.

- Beauty & Personal Care: High consumer spending and a preference for attractive and innovative packaging fuel significant growth within this sector, placing an emphasis on aesthetics and branding.

- Other Verticals: Industries such as home and personal care, consumer electronics, and industrial goods also contribute significantly to the market's overall growth, presenting diversified opportunities.

Key Growth Drivers:

- Rising Disposable Incomes and Changing Consumer Preferences: Increased purchasing power fuels demand for packaged goods across various sectors.

- E-commerce Expansion: The booming online retail industry necessitates robust and efficient packaging solutions for safe and timely delivery.

- Technological Advancements: Automation and innovative packaging technologies enhance efficiency, reduce costs, and improve overall supply chain operations.

- Sustainability Concerns: Growing consumer and regulatory pressure for eco-friendly and sustainable packaging practices is driving innovation and adoption of recyclable and biodegradable materials.

- Outsourcing Trends: Companies increasingly outsource packaging to specialize contract packagers to optimize costs, improve efficiency, and focus on core competencies.

Recent Key Developments:

- October 2022: Mold-Tek Packaging's contract with Grasim Industries highlights the significant investment and growth potential within the Indian market, particularly in the Northern region and across food and FMCG sectors.

- [Add other recent key developments and news here, including mergers, acquisitions, new product launches, and other significant industry events.]

Asia Pacific Contract Packaging Market Product Innovations

Recent advancements in contract packaging involve the adoption of sustainable materials (e.g., biodegradable plastics and recycled content), advanced automation technologies (e.g., robotic palletizing and automated filling lines), and improved printing and labeling techniques for enhanced brand appeal. These innovations contribute to reduced packaging costs, improved supply chain efficiency, and enhanced product presentation, thereby driving market growth and creating a competitive advantage for leading players.

Report Segmentation & Scope

This report segments the Asia Pacific contract packaging market by service (primary, secondary, and tertiary packaging), vertical (beverages, food, pharmaceuticals, home and fabric care, beauty care, and others), and country (China, India, Japan, Australia, and others). Each segment is analyzed based on market size, growth projections, and competitive dynamics, offering detailed insights into their unique characteristics and growth trajectories. For example, the pharmaceutical segment showcases strong growth due to stringent regulations, while the food and beverage segment benefits from growing consumer demand and urbanization. China represents the largest market, exhibiting robust growth across all segments.

Key Drivers of Asia Pacific Contract Packaging Market Growth

The Asia Pacific contract packaging market's growth is primarily driven by:

- Rising consumer demand: Increasing disposable incomes and changing lifestyles are boosting consumption of packaged goods.

- E-commerce boom: The rapid expansion of online retail necessitates efficient and reliable packaging solutions.

- Technological advancements: Automation and innovation are improving efficiency and reducing costs.

- Focus on sustainability: Growing consumer and regulatory pressure to adopt eco-friendly packaging.

Challenges in the Asia Pacific Contract Packaging Market Sector

Key challenges impacting the market include:

- Fluctuating raw material prices: Increasing volatility in the prices of packaging materials negatively impacts profitability.

- Stringent regulatory compliance: Meeting diverse packaging regulations across different countries adds complexity and cost.

- Intense competition: The presence of numerous players necessitates continuous innovation and cost optimization.

- Supply chain disruptions: Global events and logistical challenges impact the timely delivery of packaging materials.

Leading Players in the Asia Pacific Contract Packaging Market Market

- DHL

- Central Glass

- Stamar Packaging

- Multipack

- Unicep

- Sharp Packaging Services

- Berkeley Contract Packaging

- Premier Packaging

- TricorBraun

- MJS Packaging

Key Developments in Asia Pacific Contract Packaging Market Sector

- October 2022: Mold-Tek Packaging secured a contract from Grasim Industries' Paints Division for supplying pail packaging materials, leading to a new USD 3.68 million co-located plant in Panipat, India. This investment signals growing demand for packaging in the Northern India region, particularly within the food and FMCG sectors.

Strategic Asia Pacific Contract Packaging Market Outlook

The Asia Pacific contract packaging market presents significant growth opportunities, driven by the continued rise in e-commerce, escalating consumer demand, and the expanding adoption of sustainable packaging practices. Strategic partnerships, investments in automation, and expansion into high-growth markets will be crucial for success. Focus on innovation, sustainability, and efficient supply chain management will allow companies to capitalize on the immense potential of this thriving market.

Asia Pacific Contract Packaging Market Segmentation

-

1. Service

- 1.1. Primary Packaging

- 1.2. Secondary Packaging

- 1.3. Tertiary Packaging

-

2. Vertical

- 2.1. Beverages

- 2.2. Food

- 2.3. Pharmaceuticals

- 2.4. Home and Fabric Care

- 2.5. Beauty Care

Asia Pacific Contract Packaging Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Contract Packaging Market Regional Market Share

Geographic Coverage of Asia Pacific Contract Packaging Market

Asia Pacific Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Technology Advancements; Development in the Retail Chain

- 3.3. Market Restrains

- 3.3.1. In-house packaging

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Sector is Observing Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Primary Packaging

- 5.1.2. Secondary Packaging

- 5.1.3. Tertiary Packaging

- 5.2. Market Analysis, Insights and Forecast - by Vertical

- 5.2.1. Beverages

- 5.2.2. Food

- 5.2.3. Pharmaceuticals

- 5.2.4. Home and Fabric Care

- 5.2.5. Beauty Care

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Central Glass

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stamar Packaging

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Multipack*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Unicep

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sharp Packaging Services

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Berkeley Contract Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Premier Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TricorBraun

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MJS Packaging

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: Asia Pacific Contract Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Contract Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Contract Packaging Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Asia Pacific Contract Packaging Market Revenue billion Forecast, by Vertical 2020 & 2033

- Table 3: Asia Pacific Contract Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Contract Packaging Market Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Asia Pacific Contract Packaging Market Revenue billion Forecast, by Vertical 2020 & 2033

- Table 6: Asia Pacific Contract Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Contract Packaging Market?

The projected CAGR is approximately 13.95%.

2. Which companies are prominent players in the Asia Pacific Contract Packaging Market?

Key companies in the market include DHL, Central Glass, Stamar Packaging, Multipack*List Not Exhaustive, Unicep, Sharp Packaging Services, Berkeley Contract Packaging, Premier Packaging, TricorBraun, MJS Packaging.

3. What are the main segments of the Asia Pacific Contract Packaging Market?

The market segments include Service, Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.66 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid Technology Advancements; Development in the Retail Chain.

6. What are the notable trends driving market growth?

Pharmaceutical Sector is Observing Significant Growth.

7. Are there any restraints impacting market growth?

In-house packaging.

8. Can you provide examples of recent developments in the market?

October 2022 - Mold-Tek Packaging was awarded a contract by Grasim Industries' Paints Division to supply packing materials (PAILS). As a result, a co-located plant will be built in Panipat to meet their needs. By the end of the current year, the new facility should be set up and running. A total of about Rs 30 crore (~USD 3.68 million) would be invested in the project. Further, to meet the demand for these goods in Northern India, the business wants to establish food and FMCG IML container production facilities in Panipat.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Contract Packaging Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence