Key Insights

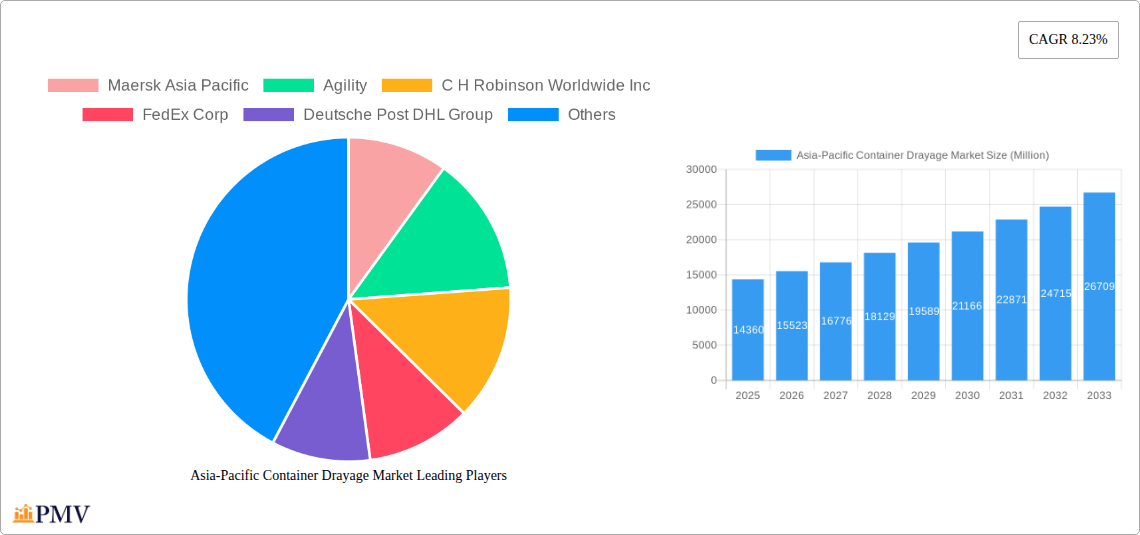

The Asia-Pacific container drayage market, valued at $14.36 billion in 2025, is projected to experience robust growth, driven by the region's expanding e-commerce sector, increasing port congestion necessitating efficient last-mile delivery solutions, and a surge in manufacturing and export activities. The market's Compound Annual Growth Rate (CAGR) of 8.23% from 2025 to 2033 indicates a significant expansion, with the market expected to surpass $28 billion by 2033. Key growth drivers include the continuous modernization of port infrastructure, increasing adoption of technological advancements such as real-time tracking and route optimization software, and a rising focus on supply chain resilience and efficiency. Furthermore, government initiatives promoting trade and logistics within the Asia-Pacific region are expected to contribute to market growth.

Asia-Pacific Container Drayage Market Market Size (In Billion)

However, challenges such as driver shortages, fluctuating fuel prices, and increasing regulatory compliance costs could potentially impede market growth. Competition among established players like Maersk, Agility, C.H. Robinson, FedEx, and DHL, along with the emergence of smaller, specialized drayage companies, is intense. The market is segmented by mode of transport (truck, rail, intermodal), cargo type, and geographical location. To gain a competitive edge, companies are investing in technological solutions to enhance operational efficiency, improve customer service, and optimize pricing strategies. The market's future growth will largely depend on addressing these challenges while capitalizing on opportunities presented by technological advancements and expanding trade volumes within the Asia-Pacific region.

Asia-Pacific Container Drayage Market Company Market Share

Asia-Pacific Container Drayage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific container drayage market, offering valuable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033, this report delivers critical data and actionable intelligence to navigate the complexities of this dynamic sector. The market size is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Asia-Pacific Container Drayage Market Market Structure & Competitive Dynamics

The Asia-Pacific container drayage market is characterized by a moderately concentrated structure, with several major players holding significant market share. Key players like Maersk Asia Pacific, Agility, C.H. Robinson Worldwide Inc, FedEx Corp, Deutsche Post DHL Group, Hitachi Ltd, CMA CGM SA Group, DB Schenker, United Parcel Services Inc, Ceva Logistics, and Yusen Logistics Co Ltd, along with 63 other companies, compete for market dominance. The market share distribution among these players varies considerably, with Maersk and DHL holding a leading position.

Innovation ecosystems are evolving rapidly, driven by technological advancements in areas such as automation, IoT, and AI. Regulatory frameworks differ across countries, impacting operational efficiency and costs. Product substitutes, such as rail freight and intermodal transportation, are influencing market dynamics. End-user trends toward faster delivery times and increased transparency are shaping demand. M&A activity has been moderate in recent years, with deal values ranging from xx Million to xx Million, primarily focused on enhancing operational capabilities and geographical reach. Specific examples of M&A activity are not publicly available at this time.

Asia-Pacific Container Drayage Market Industry Trends & Insights

The Asia-Pacific container drayage market is experiencing robust growth, driven by several factors. The burgeoning e-commerce sector fuels demand for efficient last-mile delivery solutions, while increased cross-border trade expands the market. Technological disruptions, such as the adoption of autonomous vehicles and digital freight platforms, are enhancing operational efficiency and reducing costs. Consumer preferences for faster and more reliable delivery are influencing market trends. Intense competition is driving innovation and pushing prices downwards, benefiting end-users. The market penetration of advanced technologies remains relatively low, indicating significant growth potential. The CAGR for the forecast period is estimated at xx%, driven by the increasing adoption of technology and the growth of e-commerce.

Dominant Markets & Segments in Asia-Pacific Container Drayage Market

China and India currently dominate the Asia-Pacific container drayage market due to their massive economies, extensive port infrastructure, and high volumes of import/export activities. Other significant markets include Singapore, Japan, South Korea, and Australia.

- Key Drivers in China: Strong economic growth, expanding manufacturing base, extensive port infrastructure (Shanghai, Ningbo-Zhoushan), and government support for logistics development.

- Key Drivers in India: Rapid economic expansion, increasing manufacturing output, development of major ports (Mumbai, Jawaharlal Nehru Port), and government initiatives to improve infrastructure.

- Key Drivers in Singapore: Strategic location, world-class port infrastructure (Port of Singapore), efficient logistics networks, and supportive regulatory environment.

This dominance is primarily attributed to strong economic growth, favorable government policies, and well-established logistics infrastructure in these countries.

Asia-Pacific Container Drayage Market Product Innovations

Recent product innovations in the container drayage market focus on enhancing efficiency and sustainability. This includes the adoption of telematics for real-time tracking, route optimization software leveraging AI and machine learning, and the integration of autonomous vehicles and drones for enhanced delivery capabilities. These innovations address critical challenges such as delivery delays, fuel costs, and environmental concerns, providing a significant competitive advantage to companies that effectively implement them.

Report Segmentation & Scope

The Asia-Pacific container drayage market is segmented by mode of transport (road, rail, intermodal), cargo type (dry, refrigerated), and region (China, India, Southeast Asia, etc.). Growth projections vary across segments. The road segment holds a significant share, while the intermodal segment is expected to experience faster growth due to its efficiency and cost-effectiveness. Competitive dynamics are intense within each segment, with players focusing on differentiation strategies based on technology, service quality, and cost.

Key Drivers of Asia-Pacific Container Drayage Market Growth

Several key factors fuel the growth of the Asia-Pacific container drayage market. Firstly, the burgeoning e-commerce sector continuously increases demand for efficient and reliable last-mile delivery services. Secondly, increasing volumes of intra-regional and international trade create a growing need for effective container transportation. Thirdly, technological advancements such as AI-powered route optimization and automation are improving efficiency and reducing costs. Finally, supportive government policies and infrastructure investments across several Asia-Pacific nations are fostering market growth.

Challenges in the Asia-Pacific Container Drayage Market Sector

The Asia-Pacific container drayage market faces significant challenges. These include infrastructure limitations in some regions, leading to congestion and delays. Fluctuating fuel prices and driver shortages contribute to operational cost volatility. Stringent environmental regulations require investments in cleaner technologies. Intense competition requires companies to constantly innovate and improve efficiency to maintain profitability. Furthermore, port congestion and customs clearance procedures can contribute to significant delays impacting overall efficiency.

Leading Players in the Asia-Pacific Container Drayage Market Market

Key Developments in Asia-Pacific Container Drayage Market Sector

- July 2024: DP World launched 51 new freight forwarding offices across the Asia-Pacific, expanding its reach in air and ocean freight. This significantly increases its market presence and capacity.

- February 2024: HERE Technologies partnered with PSA Singapore to enhance the efficiency of Singapore's container truck ecosystem using location technology. This collaboration aims to optimize transportation within the world's second-busiest container port, potentially impacting industry standards.

Strategic Asia-Pacific Container Drayage Market Market Outlook

The Asia-Pacific container drayage market presents substantial growth potential. Continued expansion of e-commerce, increasing cross-border trade, and ongoing technological advancements will drive demand for efficient and reliable transportation solutions. Strategic opportunities exist for companies that can leverage technology, optimize logistics networks, and offer innovative and sustainable solutions to meet evolving customer needs. Focusing on enhancing operational efficiency, expanding into high-growth markets, and investing in advanced technologies will be crucial for success in this dynamic market.

Asia-Pacific Container Drayage Market Segmentation

-

1. Mode of Transport

- 1.1. Rail

- 1.2. Road

- 1.3. Other Modes of Transport

-

2. Geography

- 2.1. China

- 2.2. Japan

- 2.3. India

- 2.4. South Korea

- 2.5. Indonesia

- 2.6. Vietnam

- 2.7. Australia

- 2.8. Rest of Asia-Pacific

Asia-Pacific Container Drayage Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Indonesia

- 6. Vietnam

- 7. Australia

- 8. Rest of Asia Pacific

Asia-Pacific Container Drayage Market Regional Market Share

Geographic Coverage of Asia-Pacific Container Drayage Market

Asia-Pacific Container Drayage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Railway Trade4.; Growing E-commerce Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Railway Trade4.; Growing E-commerce Sector

- 3.4. Market Trends

- 3.4.1 Port Congestion Easing in Key Asian Hubs

- 3.4.2 Surge in Demand for Container Drayage Driving the Transportation Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Container Drayage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.1.1. Rail

- 5.1.2. Road

- 5.1.3. Other Modes of Transport

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Japan

- 5.2.3. India

- 5.2.4. South Korea

- 5.2.5. Indonesia

- 5.2.6. Vietnam

- 5.2.7. Australia

- 5.2.8. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. South Korea

- 5.3.5. Indonesia

- 5.3.6. Vietnam

- 5.3.7. Australia

- 5.3.8. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6. China Asia-Pacific Container Drayage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 6.1.1. Rail

- 6.1.2. Road

- 6.1.3. Other Modes of Transport

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Japan

- 6.2.3. India

- 6.2.4. South Korea

- 6.2.5. Indonesia

- 6.2.6. Vietnam

- 6.2.7. Australia

- 6.2.8. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 7. Japan Asia-Pacific Container Drayage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 7.1.1. Rail

- 7.1.2. Road

- 7.1.3. Other Modes of Transport

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Japan

- 7.2.3. India

- 7.2.4. South Korea

- 7.2.5. Indonesia

- 7.2.6. Vietnam

- 7.2.7. Australia

- 7.2.8. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 8. India Asia-Pacific Container Drayage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 8.1.1. Rail

- 8.1.2. Road

- 8.1.3. Other Modes of Transport

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Japan

- 8.2.3. India

- 8.2.4. South Korea

- 8.2.5. Indonesia

- 8.2.6. Vietnam

- 8.2.7. Australia

- 8.2.8. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 9. South Korea Asia-Pacific Container Drayage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 9.1.1. Rail

- 9.1.2. Road

- 9.1.3. Other Modes of Transport

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Japan

- 9.2.3. India

- 9.2.4. South Korea

- 9.2.5. Indonesia

- 9.2.6. Vietnam

- 9.2.7. Australia

- 9.2.8. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 10. Indonesia Asia-Pacific Container Drayage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 10.1.1. Rail

- 10.1.2. Road

- 10.1.3. Other Modes of Transport

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. Japan

- 10.2.3. India

- 10.2.4. South Korea

- 10.2.5. Indonesia

- 10.2.6. Vietnam

- 10.2.7. Australia

- 10.2.8. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 11. Vietnam Asia-Pacific Container Drayage Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 11.1.1. Rail

- 11.1.2. Road

- 11.1.3. Other Modes of Transport

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. Japan

- 11.2.3. India

- 11.2.4. South Korea

- 11.2.5. Indonesia

- 11.2.6. Vietnam

- 11.2.7. Australia

- 11.2.8. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 12. Australia Asia-Pacific Container Drayage Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 12.1.1. Rail

- 12.1.2. Road

- 12.1.3. Other Modes of Transport

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. China

- 12.2.2. Japan

- 12.2.3. India

- 12.2.4. South Korea

- 12.2.5. Indonesia

- 12.2.6. Vietnam

- 12.2.7. Australia

- 12.2.8. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 13. Rest of Asia Pacific Asia-Pacific Container Drayage Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 13.1.1. Rail

- 13.1.2. Road

- 13.1.3. Other Modes of Transport

- 13.2. Market Analysis, Insights and Forecast - by Geography

- 13.2.1. China

- 13.2.2. Japan

- 13.2.3. India

- 13.2.4. South Korea

- 13.2.5. Indonesia

- 13.2.6. Vietnam

- 13.2.7. Australia

- 13.2.8. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Mode of Transport

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Maersk Asia Pacific

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Agility

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 C H Robinson Worldwide Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 FedEx Corp

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Deutsche Post DHL Group

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Hitachi Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 CMA CGM SA Group

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 DB Schenker

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 United Parcel Services Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Ceva Logistics

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Yusen Logistics Co Ltd**List Not Exhaustive 6 3 Other Companie

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Maersk Asia Pacific

List of Figures

- Figure 1: Global Asia-Pacific Container Drayage Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Asia-Pacific Container Drayage Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: China Asia-Pacific Container Drayage Market Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 4: China Asia-Pacific Container Drayage Market Volume (Billion), by Mode of Transport 2025 & 2033

- Figure 5: China Asia-Pacific Container Drayage Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 6: China Asia-Pacific Container Drayage Market Volume Share (%), by Mode of Transport 2025 & 2033

- Figure 7: China Asia-Pacific Container Drayage Market Revenue (Million), by Geography 2025 & 2033

- Figure 8: China Asia-Pacific Container Drayage Market Volume (Billion), by Geography 2025 & 2033

- Figure 9: China Asia-Pacific Container Drayage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: China Asia-Pacific Container Drayage Market Volume Share (%), by Geography 2025 & 2033

- Figure 11: China Asia-Pacific Container Drayage Market Revenue (Million), by Country 2025 & 2033

- Figure 12: China Asia-Pacific Container Drayage Market Volume (Billion), by Country 2025 & 2033

- Figure 13: China Asia-Pacific Container Drayage Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: China Asia-Pacific Container Drayage Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Japan Asia-Pacific Container Drayage Market Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 16: Japan Asia-Pacific Container Drayage Market Volume (Billion), by Mode of Transport 2025 & 2033

- Figure 17: Japan Asia-Pacific Container Drayage Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 18: Japan Asia-Pacific Container Drayage Market Volume Share (%), by Mode of Transport 2025 & 2033

- Figure 19: Japan Asia-Pacific Container Drayage Market Revenue (Million), by Geography 2025 & 2033

- Figure 20: Japan Asia-Pacific Container Drayage Market Volume (Billion), by Geography 2025 & 2033

- Figure 21: Japan Asia-Pacific Container Drayage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 22: Japan Asia-Pacific Container Drayage Market Volume Share (%), by Geography 2025 & 2033

- Figure 23: Japan Asia-Pacific Container Drayage Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Japan Asia-Pacific Container Drayage Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Japan Asia-Pacific Container Drayage Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Japan Asia-Pacific Container Drayage Market Volume Share (%), by Country 2025 & 2033

- Figure 27: India Asia-Pacific Container Drayage Market Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 28: India Asia-Pacific Container Drayage Market Volume (Billion), by Mode of Transport 2025 & 2033

- Figure 29: India Asia-Pacific Container Drayage Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 30: India Asia-Pacific Container Drayage Market Volume Share (%), by Mode of Transport 2025 & 2033

- Figure 31: India Asia-Pacific Container Drayage Market Revenue (Million), by Geography 2025 & 2033

- Figure 32: India Asia-Pacific Container Drayage Market Volume (Billion), by Geography 2025 & 2033

- Figure 33: India Asia-Pacific Container Drayage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 34: India Asia-Pacific Container Drayage Market Volume Share (%), by Geography 2025 & 2033

- Figure 35: India Asia-Pacific Container Drayage Market Revenue (Million), by Country 2025 & 2033

- Figure 36: India Asia-Pacific Container Drayage Market Volume (Billion), by Country 2025 & 2033

- Figure 37: India Asia-Pacific Container Drayage Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: India Asia-Pacific Container Drayage Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South Korea Asia-Pacific Container Drayage Market Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 40: South Korea Asia-Pacific Container Drayage Market Volume (Billion), by Mode of Transport 2025 & 2033

- Figure 41: South Korea Asia-Pacific Container Drayage Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 42: South Korea Asia-Pacific Container Drayage Market Volume Share (%), by Mode of Transport 2025 & 2033

- Figure 43: South Korea Asia-Pacific Container Drayage Market Revenue (Million), by Geography 2025 & 2033

- Figure 44: South Korea Asia-Pacific Container Drayage Market Volume (Billion), by Geography 2025 & 2033

- Figure 45: South Korea Asia-Pacific Container Drayage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 46: South Korea Asia-Pacific Container Drayage Market Volume Share (%), by Geography 2025 & 2033

- Figure 47: South Korea Asia-Pacific Container Drayage Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South Korea Asia-Pacific Container Drayage Market Volume (Billion), by Country 2025 & 2033

- Figure 49: South Korea Asia-Pacific Container Drayage Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South Korea Asia-Pacific Container Drayage Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Indonesia Asia-Pacific Container Drayage Market Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 52: Indonesia Asia-Pacific Container Drayage Market Volume (Billion), by Mode of Transport 2025 & 2033

- Figure 53: Indonesia Asia-Pacific Container Drayage Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 54: Indonesia Asia-Pacific Container Drayage Market Volume Share (%), by Mode of Transport 2025 & 2033

- Figure 55: Indonesia Asia-Pacific Container Drayage Market Revenue (Million), by Geography 2025 & 2033

- Figure 56: Indonesia Asia-Pacific Container Drayage Market Volume (Billion), by Geography 2025 & 2033

- Figure 57: Indonesia Asia-Pacific Container Drayage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 58: Indonesia Asia-Pacific Container Drayage Market Volume Share (%), by Geography 2025 & 2033

- Figure 59: Indonesia Asia-Pacific Container Drayage Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Indonesia Asia-Pacific Container Drayage Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Indonesia Asia-Pacific Container Drayage Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Indonesia Asia-Pacific Container Drayage Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Vietnam Asia-Pacific Container Drayage Market Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 64: Vietnam Asia-Pacific Container Drayage Market Volume (Billion), by Mode of Transport 2025 & 2033

- Figure 65: Vietnam Asia-Pacific Container Drayage Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 66: Vietnam Asia-Pacific Container Drayage Market Volume Share (%), by Mode of Transport 2025 & 2033

- Figure 67: Vietnam Asia-Pacific Container Drayage Market Revenue (Million), by Geography 2025 & 2033

- Figure 68: Vietnam Asia-Pacific Container Drayage Market Volume (Billion), by Geography 2025 & 2033

- Figure 69: Vietnam Asia-Pacific Container Drayage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 70: Vietnam Asia-Pacific Container Drayage Market Volume Share (%), by Geography 2025 & 2033

- Figure 71: Vietnam Asia-Pacific Container Drayage Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Vietnam Asia-Pacific Container Drayage Market Volume (Billion), by Country 2025 & 2033

- Figure 73: Vietnam Asia-Pacific Container Drayage Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Vietnam Asia-Pacific Container Drayage Market Volume Share (%), by Country 2025 & 2033

- Figure 75: Australia Asia-Pacific Container Drayage Market Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 76: Australia Asia-Pacific Container Drayage Market Volume (Billion), by Mode of Transport 2025 & 2033

- Figure 77: Australia Asia-Pacific Container Drayage Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 78: Australia Asia-Pacific Container Drayage Market Volume Share (%), by Mode of Transport 2025 & 2033

- Figure 79: Australia Asia-Pacific Container Drayage Market Revenue (Million), by Geography 2025 & 2033

- Figure 80: Australia Asia-Pacific Container Drayage Market Volume (Billion), by Geography 2025 & 2033

- Figure 81: Australia Asia-Pacific Container Drayage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 82: Australia Asia-Pacific Container Drayage Market Volume Share (%), by Geography 2025 & 2033

- Figure 83: Australia Asia-Pacific Container Drayage Market Revenue (Million), by Country 2025 & 2033

- Figure 84: Australia Asia-Pacific Container Drayage Market Volume (Billion), by Country 2025 & 2033

- Figure 85: Australia Asia-Pacific Container Drayage Market Revenue Share (%), by Country 2025 & 2033

- Figure 86: Australia Asia-Pacific Container Drayage Market Volume Share (%), by Country 2025 & 2033

- Figure 87: Rest of Asia Pacific Asia-Pacific Container Drayage Market Revenue (Million), by Mode of Transport 2025 & 2033

- Figure 88: Rest of Asia Pacific Asia-Pacific Container Drayage Market Volume (Billion), by Mode of Transport 2025 & 2033

- Figure 89: Rest of Asia Pacific Asia-Pacific Container Drayage Market Revenue Share (%), by Mode of Transport 2025 & 2033

- Figure 90: Rest of Asia Pacific Asia-Pacific Container Drayage Market Volume Share (%), by Mode of Transport 2025 & 2033

- Figure 91: Rest of Asia Pacific Asia-Pacific Container Drayage Market Revenue (Million), by Geography 2025 & 2033

- Figure 92: Rest of Asia Pacific Asia-Pacific Container Drayage Market Volume (Billion), by Geography 2025 & 2033

- Figure 93: Rest of Asia Pacific Asia-Pacific Container Drayage Market Revenue Share (%), by Geography 2025 & 2033

- Figure 94: Rest of Asia Pacific Asia-Pacific Container Drayage Market Volume Share (%), by Geography 2025 & 2033

- Figure 95: Rest of Asia Pacific Asia-Pacific Container Drayage Market Revenue (Million), by Country 2025 & 2033

- Figure 96: Rest of Asia Pacific Asia-Pacific Container Drayage Market Volume (Billion), by Country 2025 & 2033

- Figure 97: Rest of Asia Pacific Asia-Pacific Container Drayage Market Revenue Share (%), by Country 2025 & 2033

- Figure 98: Rest of Asia Pacific Asia-Pacific Container Drayage Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 2: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 3: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 5: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 8: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 9: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 11: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 14: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 15: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 17: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 20: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 21: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 26: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 27: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 29: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 32: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 33: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 35: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 38: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 39: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 40: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 41: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 43: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 44: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 45: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 47: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Mode of Transport 2020 & 2033

- Table 50: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Mode of Transport 2020 & 2033

- Table 51: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 52: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 53: Global Asia-Pacific Container Drayage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Asia-Pacific Container Drayage Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Container Drayage Market?

The projected CAGR is approximately 8.23%.

2. Which companies are prominent players in the Asia-Pacific Container Drayage Market?

Key companies in the market include Maersk Asia Pacific, Agility, C H Robinson Worldwide Inc, FedEx Corp, Deutsche Post DHL Group, Hitachi Ltd, CMA CGM SA Group, DB Schenker, United Parcel Services Inc, Ceva Logistics, Yusen Logistics Co Ltd**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Asia-Pacific Container Drayage Market?

The market segments include Mode of Transport, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.36 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Railway Trade4.; Growing E-commerce Sector.

6. What are the notable trends driving market growth?

Port Congestion Easing in Key Asian Hubs. Surge in Demand for Container Drayage Driving the Transportation Segment.

7. Are there any restraints impacting market growth?

4.; Increasing Railway Trade4.; Growing E-commerce Sector.

8. Can you provide examples of recent developments in the market?

July 2024: DP World, the Dubai-based ports and logistics leader, unveiled 51 fresh freight forwarding offices in the Asia-Pacific. These new offices, specializing in air and ocean freight, leverage DP World's robust infrastructure, spanning ports, terminals, warehouses, trucks, rail, and vessels.February 2024: HERE Technologies, a leading provider of location data and technology solutions, partnered with PSA Singapore, the operator of the world's largest transshipment hub, to transform Singapore's container truck ecosystem. Their goal is to boost the efficiency of goods transportation within Singapore's terminals. Singapore, a global maritime leader, hosts the world's second busiest container port, the Port of Singapore. PSA's network spans 600+ ports globally, and in the previous year, it managed an impressive 38.8 million TEUs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Container Drayage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Container Drayage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Container Drayage Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Container Drayage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence