Key Insights

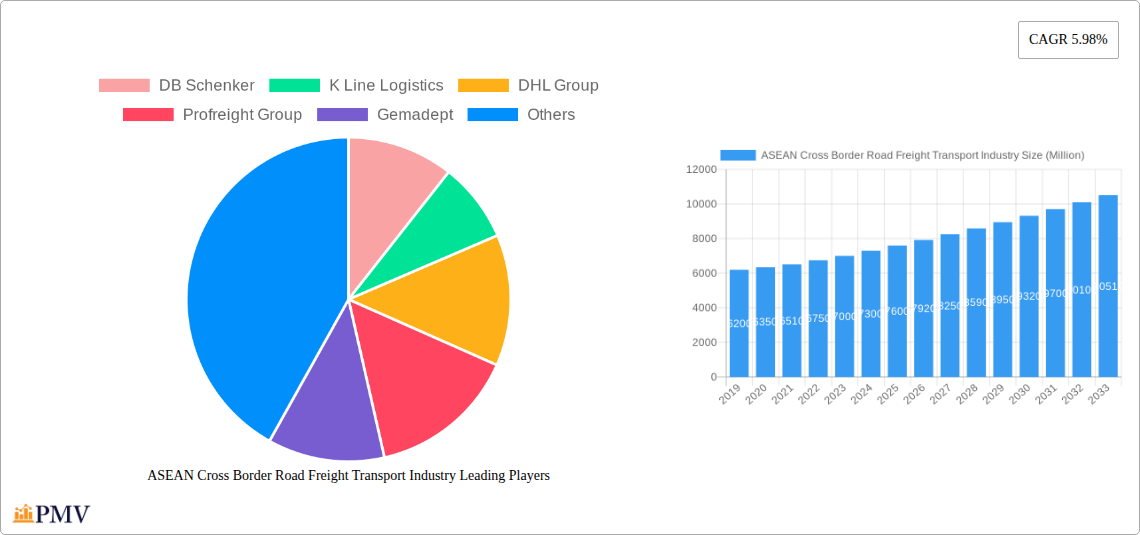

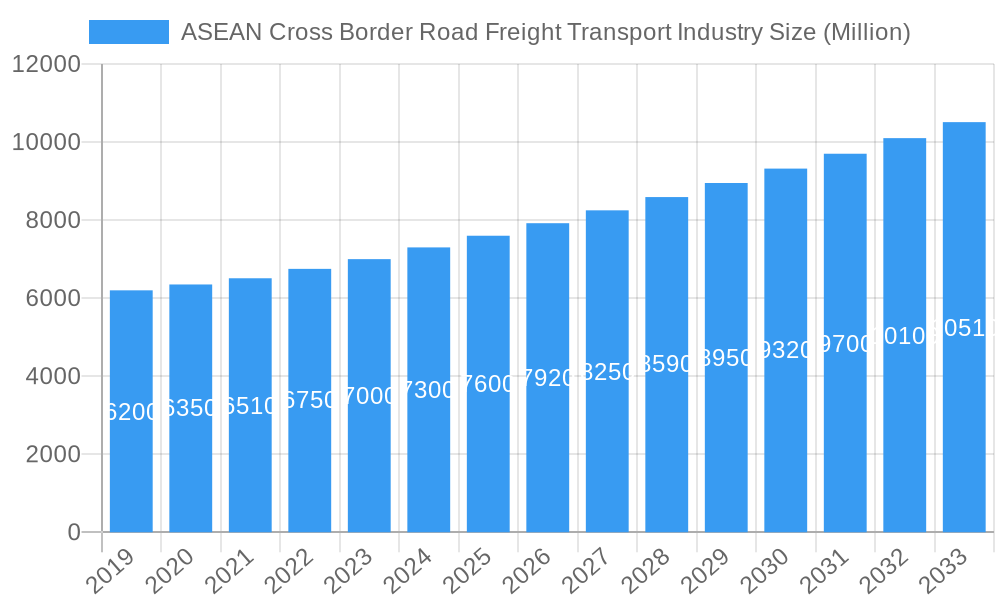

The ASEAN Cross Border Road Freight Transport market is set for substantial growth, projected to reach USD 8500 Million by 2025 and expand at a CAGR of 5.98% through 2033. Key growth drivers include increasing intra-regional trade, rising foreign direct investment within ASEAN, and ongoing cross-border infrastructure development. The booming e-commerce sector significantly fuels this expansion, demanding efficient and timely cross-border road freight solutions to connect supply chains. Furthermore, robust manufacturing and construction activities in nations like Vietnam, Thailand, and Indonesia are increasing freight volumes. Government initiatives, such as the ASEAN Economic Community (AEC) blueprint promoting free trade, are also bolstering industry expansion by reducing logistical barriers.

ASEAN Cross Border Road Freight Transport Industry Market Size (In Billion)

The industry's growth may be tempered by several factors, including volatile fuel prices impacting operational costs, and evolving cross-border regulations leading to potential compliance challenges and delays. A shortage of skilled truck drivers and logistical personnel also presents a significant operational hurdle. Nevertheless, emerging trends like the adoption of advanced tracking and fleet management technologies, a focus on sustainable logistics, and increasing demand for specialized freight services, such as cold chain logistics, are reshaping the market. Key end-user industries, including Manufacturing, Wholesale and Retail Trade, and Construction, are expected to drive freight volumes, while major players like DB Schenker, DHL Group, and Konoike Group are actively enhancing their networks and service portfolios.

ASEAN Cross Border Road Freight Transport Industry Company Market Share

This report offers a comprehensive analysis of the ASEAN cross-border road freight transport sector, detailing market dynamics, competitive landscapes, critical trends, and future prospects. Covering the study period from 2019–2033, with 2025 as the base year and forecast commencement, and a forecast period from 2025–2033, this analysis is essential for stakeholders navigating this evolving market. The market, estimated at over USD 500 Million in the base year, is poised for significant expansion.

ASEAN Cross Border Road Freight Transport Industry Market Structure & Competitive Dynamics

The ASEAN cross border road freight transport industry exhibits a moderately concentrated market structure, with leading global and regional players holding substantial market share. Major companies like DB Schenker, DHL Group, and K Line Logistics command significant portions of the market due to their extensive networks, technological investments, and established client relationships. Innovation is driven by the adoption of advanced logistics technologies, including real-time tracking, route optimization software, and digital freight platforms, creating a more efficient and transparent ecosystem. Regulatory frameworks across ASEAN nations, while striving for greater harmonization, still present variations in customs procedures and vehicle standards, impacting ease of cross-border movement. Product substitutes are limited in the context of immediate, cost-effective cross-border road freight, though air and sea freight serve alternative modes for different cargo types and timelines. End-user trends favor faster delivery times, increased visibility, and sustainable logistics solutions. Mergers and acquisitions (M&A) are a notable aspect, with deal values often reaching tens of millions, driven by the pursuit of market consolidation, network expansion, and technological integration. For instance, strategic acquisitions of smaller local freight forwarders by larger entities are common, aiming to bolster regional presence and service offerings.

ASEAN Cross Border Road Freight Transport Industry Industry Trends & Insights

The ASEAN cross border road freight transport industry is experiencing robust growth, fueled by several key trends. The Compound Annual Growth Rate (CAGR) is projected to be approximately 7.5% from 2025–2033, indicating a significant expansion in market value. This growth is primarily driven by the burgeoning intra-ASEAN trade, facilitated by economic integration initiatives and Free Trade Agreements (FTAs) that reduce tariffs and streamline customs processes. The rise of e-commerce across the region further amplifies demand for efficient and cost-effective road freight solutions, particularly for last-mile delivery and inter-warehouse transfers. Technological disruptions are at the forefront, with investments in digitalization, automation, and Artificial Intelligence (AI) transforming operational efficiency. This includes the adoption of smart fleet management systems, predictive maintenance, and AI-powered route optimization to minimize transit times and fuel consumption. Consumer preferences are shifting towards greater supply chain visibility, with clients demanding real-time tracking of shipments and proactive communication regarding potential delays. This has pushed logistics providers to invest in advanced IT infrastructure and customer relationship management (CRM) systems. Competitive dynamics are intensifying, with companies differentiating themselves through service specialization, such as cold chain logistics, hazardous material transport, and temperature-controlled cargo. The increasing emphasis on environmental sustainability is also a significant driver, pushing companies to explore and adopt greener transportation alternatives, including electric vehicles and alternative fuels, thereby influencing fleet modernization strategies and operational planning. Market penetration of advanced logistics technologies is steadily increasing, driven by the need to remain competitive and meet evolving customer expectations in a rapidly growing regional market.

Dominant Markets & Segments in ASEAN Cross Border Road Freight Transport Industry

The Manufacturing sector is a dominant end-user industry in the ASEAN cross border road freight transport market, contributing significantly to freight volumes and revenues. The robust growth of manufacturing hubs across countries like Vietnam, Thailand, and Malaysia, particularly in electronics, automotive, and consumer goods, necessitates extensive inbound and outbound logistics for raw materials, components, and finished products.

- Manufacturing:

- Key Drivers: Economic diversification, foreign direct investment (FDI) in manufacturing, and the establishment of regional supply chains.

- Dominance Analysis: The sector benefits from consistent demand for the movement of high-value goods and components across borders. Companies often require specialized handling and timely delivery to maintain production schedules, making efficient road freight crucial. The establishment of special economic zones further stimulates cross-border logistics needs.

The Wholesale and Retail Trade segment is another major contributor, driven by the rapid expansion of e-commerce and the increasing consumer demand for goods across the region. The efficient movement of consumer products from distribution centers to retail outlets and directly to consumers is heavily reliant on road freight.

- Wholesale and Retail Trade:

- Key Drivers: Growing middle class, increasing disposable incomes, and the proliferation of online retail platforms.

- Dominance Analysis: This segment thrives on high-volume, time-sensitive deliveries. The ability of road freight to reach diverse geographical locations, including remote areas, makes it indispensable. The growing trend of omnichannel retail further integrates road freight into complex distribution networks.

The Construction sector also plays a vital role, especially in countries undergoing significant infrastructure development projects. The transport of building materials, heavy machinery, and equipment across borders is a consistent requirement.

- Construction:

- Key Drivers: Government infrastructure spending, urbanization, and large-scale construction projects.

- Dominance Analysis: This segment often involves the transportation of oversized and heavy loads, requiring specialized vehicles and permits, which are integral to cross-border road freight operations.

While Agriculture, Fishing, and Forestry, Oil and Gas, Mining and Quarrying, and Others represent smaller but significant segments, their demand for road freight is often characterized by specific logistical challenges and seasonal variations. For example, the transportation of agricultural produce or mined materials may require temperature-controlled or specialized handling equipment. The overall dominance is clearly established by the Manufacturing and Wholesale & Retail Trade sectors, reflecting the broader economic landscape of the ASEAN region.

ASEAN Cross Border Road Freight Transport Industry Product Innovations

Product innovations in the ASEAN cross border road freight transport industry are primarily focused on enhancing efficiency, sustainability, and customer experience. Developments include the integration of advanced telematics for real-time fleet tracking and diagnostics, enabling predictive maintenance and optimized route planning. The deployment of electric and hybrid vehicles for last-mile delivery is gaining traction, driven by environmental regulations and corporate sustainability goals. Digital platforms that facilitate seamless booking, freight matching, and document management are also key innovations, improving transparency and reducing administrative overhead. These innovations provide competitive advantages by lowering operational costs, improving delivery times, and offering greater visibility to clients, aligning with market demands for greener and more technologically advanced logistics solutions.

Report Segmentation & Scope

The ASEAN Cross Border Road Freight Transport Industry report is segmented by End User Industry. This comprehensive segmentation covers:

- Agriculture, Fishing, and Forestry: This segment includes the transportation of raw agricultural products, seafood, and forestry resources across borders, often requiring specialized handling and temperature control.

- Construction: This segment focuses on the movement of building materials, heavy machinery, and construction equipment, crucial for regional infrastructure development.

- Manufacturing: This segment encompasses the transportation of raw materials, intermediate goods, and finished manufactured products, reflecting the region's robust industrial base.

- Oil and Gas: This segment involves the logistics of equipment, components, and related materials for the exploration, extraction, and processing of oil and gas.

- Mining and Quarrying: This segment covers the transportation of minerals, ores, and related supplies for the mining industry.

- Wholesale and Retail Trade: This segment is critical for the movement of consumer goods, facilitated by the growth of e-commerce and traditional retail channels.

- Others: This category includes a diverse range of industries and niche transport requirements not covered by the primary segments.

Each segment's growth projections, market sizes, and competitive dynamics are analyzed to provide a granular understanding of the market landscape.

Key Drivers of ASEAN Cross Border Road Freight Transport Industry Growth

The ASEAN cross border road freight transport industry's growth is propelled by several key factors. Economic integration initiatives, such as the ASEAN Economic Community (AEC), have significantly eased trade barriers and fostered increased intra-regional commerce. The expanding middle class and rising disposable incomes are fueling consumer demand, particularly for goods delivered through e-commerce, which heavily relies on efficient road freight networks. Furthermore, government investments in infrastructure development, including roads, bridges, and border crossing facilities, are crucial enablers, improving connectivity and reducing transit times. Technological advancements, such as digitalization and automation in logistics operations, are enhancing efficiency and transparency, making road freight more attractive. The growing emphasis on sustainability and green logistics is also driving innovation and investment in eco-friendly transportation solutions.

Challenges in the ASEAN Cross Border Road Freight Transport Industry Sector

Despite its growth potential, the ASEAN cross border road freight transport industry faces several challenges. Divergent regulatory frameworks and customs procedures across member states can lead to delays, increased costs, and operational complexities. Infrastructure limitations, particularly in certain sub-regions, can hinder smooth transit and increase delivery times. Intense competition from both global and local players, coupled with rising fuel prices and operational costs, puts pressure on profit margins. Labor shortages, particularly of skilled truck drivers, and security concerns, including cargo theft and road safety, also pose significant hurdles. Furthermore, the lack of standardized technology adoption across all participants can lead to interoperability issues within supply chains.

Leading Players in the ASEAN Cross Border Road Freight Transport Industry Market

- DB Schenker

- K Line Logistics

- DHL Group

- Profreight Group

- Gemadept

- MOL Logistics

- Overland Total Logistic

- Konoike Group

- Yatfai Group

- Tiong Nam Logistics

- Kerry Logistics Network Limited

Key Developments in ASEAN Cross Border Road Freight Transport Industry Sector

- June 2023: DHL Express deployed 24 electric vans in Jakarta and Bandung to electrify its last-mile delivery fleet, complementing its existing electric vans and bikes in Jakarta and Surabaya.

- June 2023: Chery Malaysia signed a logistics services agreement with Tiong Nam Logistics Holdings Berhad for spare parts warehousing and transportation, covering heavy-duty vehicle models in Malaysia.

- May 2023: Kerry Express (KEX) partnered with All Speedy Co. to extend its express parcel delivery services to 7-Eleven branches nationwide, leveraging their extensive retail network.

Strategic ASEAN Cross Border Road Freight Transport Industry Market Outlook

The strategic outlook for the ASEAN cross border road freight transport industry is highly positive, driven by sustained economic growth and increasing trade liberalization. Key growth accelerators include the continued expansion of e-commerce, which necessitates efficient and agile last-mile delivery solutions. Investments in digital transformation, including AI-powered route optimization and blockchain for enhanced supply chain visibility, will create significant competitive advantages. The push towards sustainable logistics, with a focus on electrification and alternative fuels, presents opportunities for early adopters. Furthermore, governments' commitment to improving cross-border infrastructure and harmonizing regulations will further streamline operations. Strategic partnerships and collaborations among logistics providers, technology companies, and end-users will be crucial for unlocking new market potential and navigating evolving customer demands. The market is poised for further consolidation and innovation, offering substantial opportunities for businesses that can adapt to these dynamic changes.

ASEAN Cross Border Road Freight Transport Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

ASEAN Cross Border Road Freight Transport Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

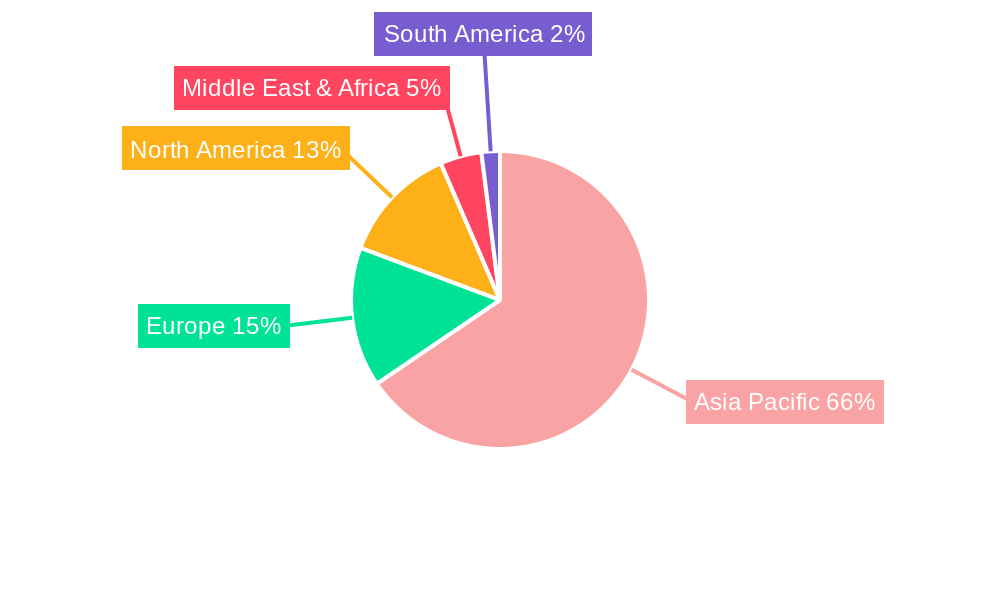

ASEAN Cross Border Road Freight Transport Industry Regional Market Share

Geographic Coverage of ASEAN Cross Border Road Freight Transport Industry

ASEAN Cross Border Road Freight Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific ASEAN Cross Border Road Freight Transport Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 K Line Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DHL Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Profreight Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gemadept

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MOL Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Overland Total Logistic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Konoike Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yatfai Grou

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tiong Nam Logistics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kerry Logistics Network Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global ASEAN Cross Border Road Freight Transport Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 3: North America ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 4: North America ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 7: South America ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 8: South America ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: South America ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 11: Europe ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 12: Europe ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 15: Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 16: Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by End User Industry 2025 & 2033

- Figure 19: Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 20: Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 4: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 9: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 25: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 33: Global ASEAN Cross Border Road Freight Transport Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific ASEAN Cross Border Road Freight Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Cross Border Road Freight Transport Industry?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the ASEAN Cross Border Road Freight Transport Industry?

Key companies in the market include DB Schenker, K Line Logistics, DHL Group, Profreight Group, Gemadept, MOL Logistics, Overland Total Logistic, Konoike Group, Yatfai Grou, Tiong Nam Logistics, Kerry Logistics Network Limited.

3. What are the main segments of the ASEAN Cross Border Road Freight Transport Industry?

The market segments include End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 282.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

June 2023: DHL Express has geared up to electrify its last-mile delivery fleet by deploying 24 electric vans in Jakarta and Bandung. The new electric vehicles will join the existing fleet which includes four electric vans and six electric bikes serving areas in Jakarta and Surabaya.June 2023: Chery Malaysia signed a logistic services agreement with Tiong Nam Logistics Holdings Berhad, which is responsible for spare parts warehousing and transportation logistics services. Tiong Nam Logistics has obtained the rights to handle Chery’s spare parts warehousing and transportation in Malaysia, including heavy-duty vehicle models such as TIGGO 8 PRO and OMODA5.May 2023: Kerry Express (KEX),has announced a partnership with All Speedy Co, a subsidiary of CP All, to extend its services to 7-Eleven branches across the country. This cooperation between Kerry Express and All Speedy is aimed at increasing the availability of their express parcel delivery service by leveraging the extensive nationwide network of 7-Eleven outlets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Cross Border Road Freight Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Cross Border Road Freight Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Cross Border Road Freight Transport Industry?

To stay informed about further developments, trends, and reports in the ASEAN Cross Border Road Freight Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence