Key Insights

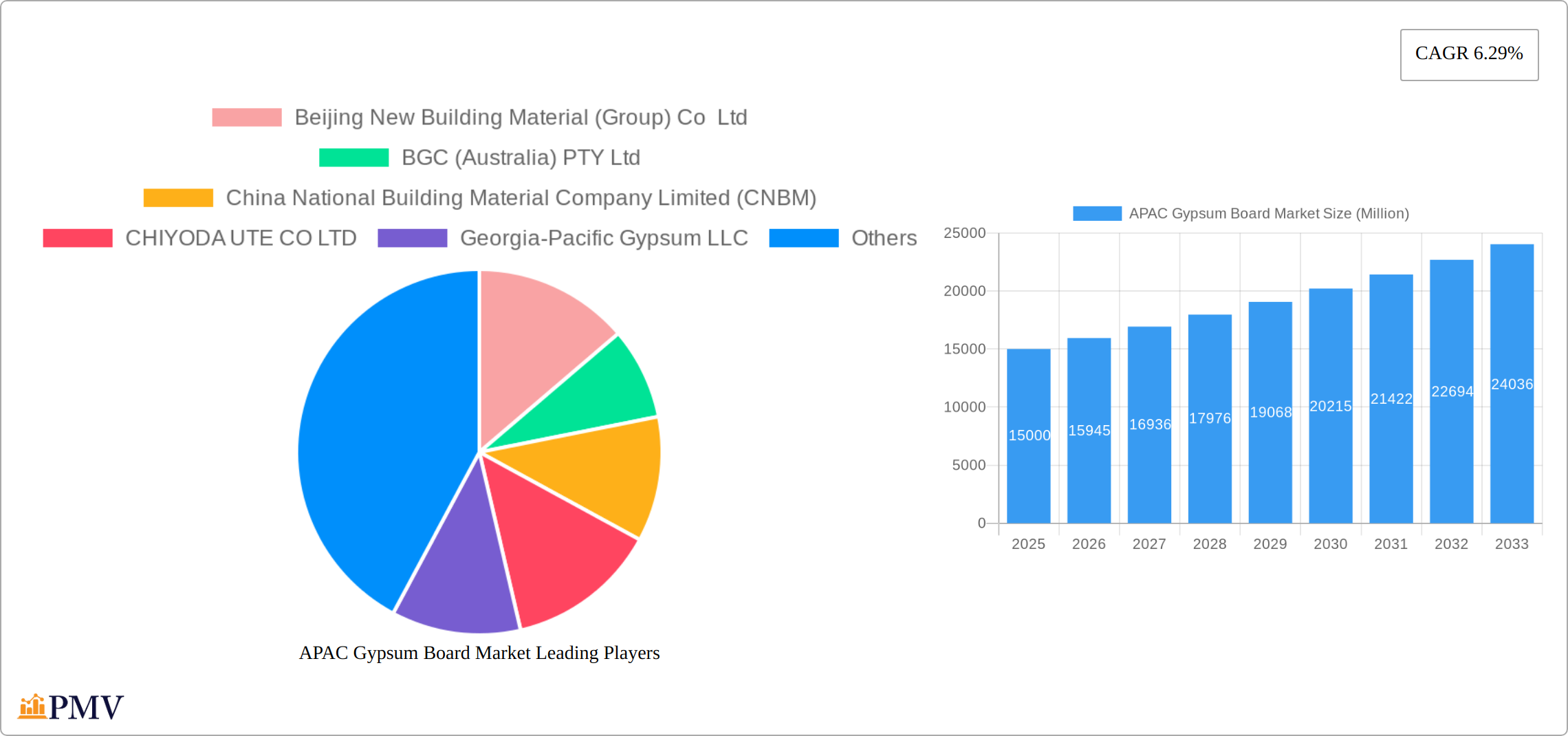

The APAC gypsum board market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.29% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, the burgeoning construction industry across the Asia-Pacific region, particularly in rapidly developing economies like India, China, and Southeast Asian nations, is creating significant demand for gypsum board as a crucial building material. Secondly, the increasing preference for lightweight, fire-resistant, and cost-effective construction solutions is bolstering the adoption of gypsum boards over traditional materials. Furthermore, government initiatives promoting sustainable building practices and energy efficiency are indirectly driving market growth, as gypsum boards align well with these objectives. However, the market faces certain restraints. Fluctuations in raw material prices, particularly gypsum, can impact production costs and profitability. Moreover, the presence of substitute materials, such as cement boards and wood panels, presents competition. Market segmentation reveals a diverse landscape, encompassing various types of gypsum boards based on properties and applications (e.g., standard, fire-resistant, moisture-resistant), as well as distinct geographical segments. Leading players, including Beijing New Building Material (Group) Co Ltd, BGC (Australia) PTY Ltd, and Saint-Gobain Gyproc, are strategically expanding their production capacity and distribution networks to capitalize on the growing market opportunities. The historical period (2019-2024) likely witnessed considerable growth, laying the foundation for the projected future expansion. The forecast period (2025-2033) anticipates continued market penetration driven by factors outlined above.

The competitive landscape is characterized by a mix of both large multinational corporations and regional players. Strategic partnerships, mergers, and acquisitions are expected to shape the market dynamics over the forecast period. Product innovation, focusing on enhanced performance characteristics such as improved fire resistance and water resistance, will be crucial for companies to gain a competitive edge. The regional variations within APAC will also influence market growth, with countries experiencing rapid urbanization and infrastructure development witnessing faster expansion. Analyzing individual country-specific market trends, construction regulations, and consumer preferences will be vital for companies seeking market share. The long-term outlook for the APAC gypsum board market remains positive, reflecting the sustained growth of the construction sector and the increasing demand for high-performance building materials in the region.

APAC Gypsum Board Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) gypsum board market, offering crucial insights for businesses seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence for strategic decision-making. The report leverages extensive data analysis to project a xx Million market size by 2033, showcasing significant growth opportunities.

APAC Gypsum Board Market Market Structure & Competitive Dynamics

The APAC gypsum board market exhibits a moderately consolidated structure, with several key players dominating the landscape. Market share is heavily influenced by established players like Saint-Gobain Gyproc, Knauf Gips KG, and China National Building Material Company Limited (CNBM), while regional players contribute significantly to the overall market volume. The market exhibits a high level of innovation, driven by advancements in material composition, improved fire resistance, and enhanced acoustic properties. Regulatory frameworks, particularly those focusing on building codes and environmental standards, significantly impact market growth. Product substitutes, such as cement boards and fiber cement boards, present competitive pressures. End-user trends, predominantly driven by the booming construction industry in several APAC nations, are a major growth driver. M&A activity has been moderate in recent years, with deal values averaging xx Million per transaction. Key M&A activities observed involved the consolidation of smaller players by larger multinational companies.

- Market Concentration: Moderately consolidated, with a few major players holding significant market share.

- Innovation Ecosystem: Active, with ongoing developments in material science and manufacturing processes.

- Regulatory Frameworks: Significant influence on market dynamics, especially regarding building codes and environmental compliance.

- Product Substitutes: Cement boards and fiber cement boards pose moderate competition.

- End-User Trends: Driven by strong growth in construction and infrastructure development across the APAC region.

- M&A Activities: Moderate activity, focused primarily on consolidation and expansion.

APAC Gypsum Board Market Industry Trends & Insights

The APAC gypsum board market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This upward trajectory is fueled by a confluence of powerful drivers. Rapid urbanization across the region is creating an insatiable demand for new residential, commercial, and industrial spaces. Concurrently, a rising tide of disposable incomes is empowering individuals and businesses to invest more in construction projects, further stimulating market expansion. Government initiatives focused on robust infrastructure development, including transportation networks, public facilities, and urban renewal projects, are acting as significant catalysts. Technological advancements are also playing a pivotal role. The adoption of highly automated production lines is enhancing manufacturing efficiency and consistency, while the development of advanced material formulations is leading to superior product quality, improved performance characteristics, and enhanced durability. In line with global sustainability trends, consumer preferences are increasingly leaning towards eco-friendly and environmentally responsible building materials. This is translating into a growing demand for gypsum boards manufactured with recycled content and those that minimize their environmental footprint throughout their lifecycle. The competitive landscape is dynamic and characterized by fierce competition among well-established global players and agile, emerging regional manufacturers. Significant untapped potential for future market penetration lies within the less-developed regions of APAC, offering promising avenues for expansion and market share acquisition.

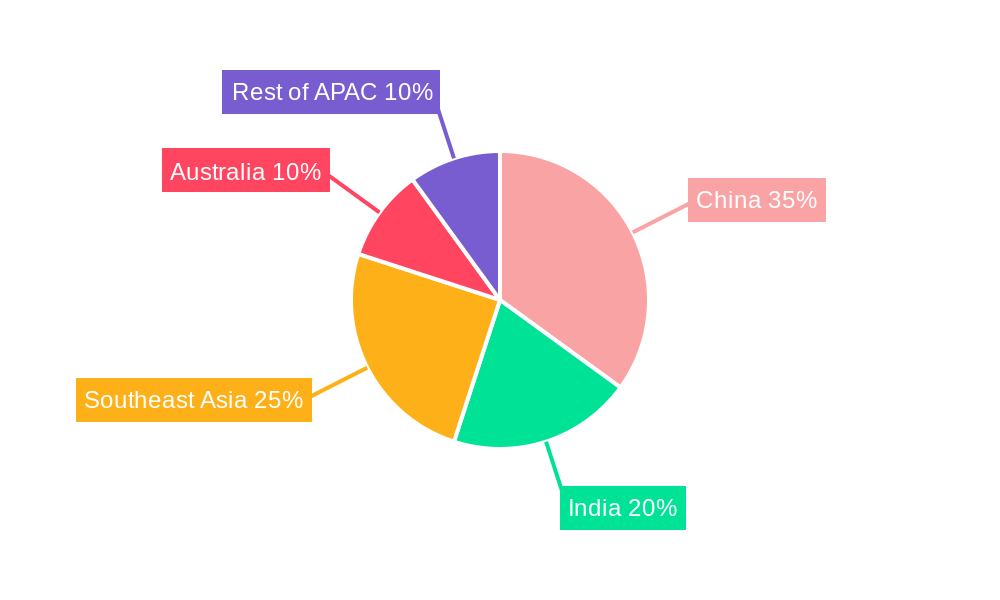

Dominant Markets & Segments in APAC Gypsum Board Market

China remains the dominant market within the APAC region, accounting for xx% of the total market volume in 2025. This dominance is driven by rapid economic growth, extensive infrastructure development, and a large and expanding construction sector. India represents a significant secondary market, showing strong growth potential fueled by government initiatives and urban expansion.

Key Drivers of China's Dominance:

- Strong economic growth and sustained urbanization.

- Massive infrastructure projects and housing developments.

- Government policies supporting construction and real estate sectors.

Key Drivers of India's Growth:

- Government investment in infrastructure and affordable housing.

- Rapid urbanization and population growth.

- Increased private sector investment in the construction industry.

The report further provides a detailed segment-wise analysis of the market, including regional breakdowns, product types (standard, fire-resistant, moisture-resistant, etc.), and application segments (residential, commercial, industrial).

APAC Gypsum Board Market Product Innovations

Recent product innovations focus on enhanced performance characteristics, including improved fire resistance, moisture resistance, and acoustic properties. Manufacturers are increasingly integrating recycled materials and sustainable production practices to meet growing environmental concerns. This focus on enhanced performance and eco-friendliness provides competitive advantages in a market driven by both performance and sustainability demands. Technological trends indicate a move towards lighter, more efficient, and environmentally friendly gypsum board products.

Report Segmentation & Scope

The report segments the APAC gypsum board market based on product type (standard, fire-resistant, moisture-resistant, etc.), application (residential, commercial, industrial), and geography (country-level analysis for key markets). Growth projections, market sizes, and competitive dynamics are detailed for each segment. Each segment is further analyzed based on factors such as material composition, price point, performance characteristics, and market demand within its respective applications.

Key Drivers of APAC Gypsum Board Market Growth

The APAC gypsum board market's growth is fueled by several key drivers:

- Rapid Urbanization and Infrastructure Development: The ongoing expansion of cities across the APAC region drives substantial demand for construction materials, including gypsum boards.

- Growing Construction Sector: The burgeoning construction industry, driven by both residential and commercial projects, fuels significant market growth.

- Government Initiatives and Policies: Government investment in infrastructure development and affordable housing programs create a strong demand for building materials.

Challenges in the APAC Gypsum Board Market Sector

Despite the promising growth prospects, the APAC gypsum board market is not without its hurdles:

- Price Volatility of Key Raw Materials: The market is susceptible to significant fluctuations in the prices of essential raw materials, most notably gypsum. These unpredictable price swings can exert considerable pressure on profit margins and necessitate agile pricing strategies for manufacturers.

- Navigating Evolving Environmental Regulations: The region is witnessing an increase in the stringency of environmental regulations governing manufacturing processes and product standards. Adhering to these evolving regulations often entails increased production costs and adds layers of operational complexity.

- Intensified Competitive Pressures: The APAC gypsum board market is a highly competitive arena. Manufacturers must continuously invest in research and development, optimize their operational efficiencies, and enhance their product portfolios to stay ahead and maintain market relevance.

Leading Players in the APAC Gypsum Board Market Market

- Beijing New Building Material (Group) Co Ltd

- BGC (Australia) PTY Ltd

- China National Building Material Company Limited (CNBM)

- CHIYODA UTE CO LTD

- Georgia-Pacific Gypsum LLC

- Jason Plasterboard (Jiaxing) Co Ltd

- KCC CORPORATION

- Knauf Gips KG

- Saint-Gobain Gyproc

- VANS Gypsum

- YOSHINO GYPSUM CO LTD

List Not Exhaustive

Key Developments in APAC Gypsum Board Market Sector

- 2022 Q4: Saint-Gobain Gyproc bolstered its product offering in India by launching an innovative new line of high-performance, fire-resistant gypsum boards designed to meet stringent safety standards.

- 2023 Q1: Demonstrating its commitment to expanding its regional footprint, Knauf Gips KG announced a substantial investment earmarked for the establishment of a state-of-the-art new manufacturing facility in Vietnam, aiming to cater to the growing demand in Southeast Asia.

- 2023 Q2: In a strategic move to consolidate market presence and leverage synergies, a significant merger was successfully finalized between two prominent regional gypsum board manufacturers operating within Southeast Asia. (Further detailed insights into this development and its implications are available within the comprehensive market report.)

The full report provides an exhaustive compilation of key strategic developments shaping the APAC gypsum board market.

Strategic APAC Gypsum Board Market Market Outlook

The APAC gypsum board market is brimming with significant growth opportunities that are expected to unfold over the forthcoming years. The relentless pace of urbanization, coupled with sustained and robust investments in critical infrastructure development projects across the region, will continue to be the primary engines driving market expansion. Strategic opportunities abound for market participants who can adeptly focus on fostering innovation, championing sustainability in their operations and product offerings, and precisely tailoring their solutions to meet the diverse and evolving needs of various regional markets within APAC. Companies that embrace and implement highly efficient production methodologies and proactively offer value-added services beyond basic product supply are poised to gain a distinct and sustainable competitive advantage. The overarching emphasis on the development and adoption of eco-friendly products and environmentally conscious manufacturing practices will undoubtedly shape the future dynamics of the market, presenting considerable potential for both lucrative growth and strategic investment.

APAC Gypsum Board Market Segmentation

-

1. Type

- 1.1. Wall Board

- 1.2. Ceiling Board

- 1.3. Pre-decorated Board

-

2. Thickness

- 2.1. 1/2-inch

- 2.2. 5/8-inch

- 2.3. Other Thicknesses

-

3. Application

- 3.1. Residential Sector

- 3.2. Institutional Sector

- 3.3. Industrial Sector

- 3.4. Commercial Sector

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. South Korea

- 4.5. Thailand

- 4.6. Philippines

- 4.7. Vietnam

- 4.8. Indonesia

- 4.9. Malaysia

- 4.10. Australia and New Zealand

- 4.11. Rest of Asia-Pacific

APAC Gypsum Board Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Thailand

- 6. Philippines

- 7. Vietnam

- 8. Indonesia

- 9. Malaysia

- 10. Australia and New Zealand

- 11. Rest of Asia Pacific

APAC Gypsum Board Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.29% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investment in the Construction Sector in the Emerging Economies; Increasing Demand from Residential Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Investment in the Construction Sector in the Emerging Economies; Increasing Demand from Residential Sector; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Investments in the Construction Sector in the Emerging Economies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wall Board

- 5.1.2. Ceiling Board

- 5.1.3. Pre-decorated Board

- 5.2. Market Analysis, Insights and Forecast - by Thickness

- 5.2.1. 1/2-inch

- 5.2.2. 5/8-inch

- 5.2.3. Other Thicknesses

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Residential Sector

- 5.3.2. Institutional Sector

- 5.3.3. Industrial Sector

- 5.3.4. Commercial Sector

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Thailand

- 5.4.6. Philippines

- 5.4.7. Vietnam

- 5.4.8. Indonesia

- 5.4.9. Malaysia

- 5.4.10. Australia and New Zealand

- 5.4.11. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.5.5. Thailand

- 5.5.6. Philippines

- 5.5.7. Vietnam

- 5.5.8. Indonesia

- 5.5.9. Malaysia

- 5.5.10. Australia and New Zealand

- 5.5.11. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China APAC Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wall Board

- 6.1.2. Ceiling Board

- 6.1.3. Pre-decorated Board

- 6.2. Market Analysis, Insights and Forecast - by Thickness

- 6.2.1. 1/2-inch

- 6.2.2. 5/8-inch

- 6.2.3. Other Thicknesses

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Residential Sector

- 6.3.2. Institutional Sector

- 6.3.3. Industrial Sector

- 6.3.4. Commercial Sector

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. South Korea

- 6.4.5. Thailand

- 6.4.6. Philippines

- 6.4.7. Vietnam

- 6.4.8. Indonesia

- 6.4.9. Malaysia

- 6.4.10. Australia and New Zealand

- 6.4.11. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India APAC Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wall Board

- 7.1.2. Ceiling Board

- 7.1.3. Pre-decorated Board

- 7.2. Market Analysis, Insights and Forecast - by Thickness

- 7.2.1. 1/2-inch

- 7.2.2. 5/8-inch

- 7.2.3. Other Thicknesses

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Residential Sector

- 7.3.2. Institutional Sector

- 7.3.3. Industrial Sector

- 7.3.4. Commercial Sector

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. South Korea

- 7.4.5. Thailand

- 7.4.6. Philippines

- 7.4.7. Vietnam

- 7.4.8. Indonesia

- 7.4.9. Malaysia

- 7.4.10. Australia and New Zealand

- 7.4.11. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan APAC Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wall Board

- 8.1.2. Ceiling Board

- 8.1.3. Pre-decorated Board

- 8.2. Market Analysis, Insights and Forecast - by Thickness

- 8.2.1. 1/2-inch

- 8.2.2. 5/8-inch

- 8.2.3. Other Thicknesses

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Residential Sector

- 8.3.2. Institutional Sector

- 8.3.3. Industrial Sector

- 8.3.4. Commercial Sector

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. South Korea

- 8.4.5. Thailand

- 8.4.6. Philippines

- 8.4.7. Vietnam

- 8.4.8. Indonesia

- 8.4.9. Malaysia

- 8.4.10. Australia and New Zealand

- 8.4.11. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea APAC Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wall Board

- 9.1.2. Ceiling Board

- 9.1.3. Pre-decorated Board

- 9.2. Market Analysis, Insights and Forecast - by Thickness

- 9.2.1. 1/2-inch

- 9.2.2. 5/8-inch

- 9.2.3. Other Thicknesses

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Residential Sector

- 9.3.2. Institutional Sector

- 9.3.3. Industrial Sector

- 9.3.4. Commercial Sector

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. South Korea

- 9.4.5. Thailand

- 9.4.6. Philippines

- 9.4.7. Vietnam

- 9.4.8. Indonesia

- 9.4.9. Malaysia

- 9.4.10. Australia and New Zealand

- 9.4.11. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Thailand APAC Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wall Board

- 10.1.2. Ceiling Board

- 10.1.3. Pre-decorated Board

- 10.2. Market Analysis, Insights and Forecast - by Thickness

- 10.2.1. 1/2-inch

- 10.2.2. 5/8-inch

- 10.2.3. Other Thicknesses

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Residential Sector

- 10.3.2. Institutional Sector

- 10.3.3. Industrial Sector

- 10.3.4. Commercial Sector

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Japan

- 10.4.4. South Korea

- 10.4.5. Thailand

- 10.4.6. Philippines

- 10.4.7. Vietnam

- 10.4.8. Indonesia

- 10.4.9. Malaysia

- 10.4.10. Australia and New Zealand

- 10.4.11. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Philippines APAC Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Wall Board

- 11.1.2. Ceiling Board

- 11.1.3. Pre-decorated Board

- 11.2. Market Analysis, Insights and Forecast - by Thickness

- 11.2.1. 1/2-inch

- 11.2.2. 5/8-inch

- 11.2.3. Other Thicknesses

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Residential Sector

- 11.3.2. Institutional Sector

- 11.3.3. Industrial Sector

- 11.3.4. Commercial Sector

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. India

- 11.4.3. Japan

- 11.4.4. South Korea

- 11.4.5. Thailand

- 11.4.6. Philippines

- 11.4.7. Vietnam

- 11.4.8. Indonesia

- 11.4.9. Malaysia

- 11.4.10. Australia and New Zealand

- 11.4.11. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Vietnam APAC Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Wall Board

- 12.1.2. Ceiling Board

- 12.1.3. Pre-decorated Board

- 12.2. Market Analysis, Insights and Forecast - by Thickness

- 12.2.1. 1/2-inch

- 12.2.2. 5/8-inch

- 12.2.3. Other Thicknesses

- 12.3. Market Analysis, Insights and Forecast - by Application

- 12.3.1. Residential Sector

- 12.3.2. Institutional Sector

- 12.3.3. Industrial Sector

- 12.3.4. Commercial Sector

- 12.4. Market Analysis, Insights and Forecast - by Geography

- 12.4.1. China

- 12.4.2. India

- 12.4.3. Japan

- 12.4.4. South Korea

- 12.4.5. Thailand

- 12.4.6. Philippines

- 12.4.7. Vietnam

- 12.4.8. Indonesia

- 12.4.9. Malaysia

- 12.4.10. Australia and New Zealand

- 12.4.11. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Indonesia APAC Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - by Type

- 13.1.1. Wall Board

- 13.1.2. Ceiling Board

- 13.1.3. Pre-decorated Board

- 13.2. Market Analysis, Insights and Forecast - by Thickness

- 13.2.1. 1/2-inch

- 13.2.2. 5/8-inch

- 13.2.3. Other Thicknesses

- 13.3. Market Analysis, Insights and Forecast - by Application

- 13.3.1. Residential Sector

- 13.3.2. Institutional Sector

- 13.3.3. Industrial Sector

- 13.3.4. Commercial Sector

- 13.4. Market Analysis, Insights and Forecast - by Geography

- 13.4.1. China

- 13.4.2. India

- 13.4.3. Japan

- 13.4.4. South Korea

- 13.4.5. Thailand

- 13.4.6. Philippines

- 13.4.7. Vietnam

- 13.4.8. Indonesia

- 13.4.9. Malaysia

- 13.4.10. Australia and New Zealand

- 13.4.11. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Type

- 14. Malaysia APAC Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - by Type

- 14.1.1. Wall Board

- 14.1.2. Ceiling Board

- 14.1.3. Pre-decorated Board

- 14.2. Market Analysis, Insights and Forecast - by Thickness

- 14.2.1. 1/2-inch

- 14.2.2. 5/8-inch

- 14.2.3. Other Thicknesses

- 14.3. Market Analysis, Insights and Forecast - by Application

- 14.3.1. Residential Sector

- 14.3.2. Institutional Sector

- 14.3.3. Industrial Sector

- 14.3.4. Commercial Sector

- 14.4. Market Analysis, Insights and Forecast - by Geography

- 14.4.1. China

- 14.4.2. India

- 14.4.3. Japan

- 14.4.4. South Korea

- 14.4.5. Thailand

- 14.4.6. Philippines

- 14.4.7. Vietnam

- 14.4.8. Indonesia

- 14.4.9. Malaysia

- 14.4.10. Australia and New Zealand

- 14.4.11. Rest of Asia-Pacific

- 14.1. Market Analysis, Insights and Forecast - by Type

- 15. Australia and New Zealand APAC Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - by Type

- 15.1.1. Wall Board

- 15.1.2. Ceiling Board

- 15.1.3. Pre-decorated Board

- 15.2. Market Analysis, Insights and Forecast - by Thickness

- 15.2.1. 1/2-inch

- 15.2.2. 5/8-inch

- 15.2.3. Other Thicknesses

- 15.3. Market Analysis, Insights and Forecast - by Application

- 15.3.1. Residential Sector

- 15.3.2. Institutional Sector

- 15.3.3. Industrial Sector

- 15.3.4. Commercial Sector

- 15.4. Market Analysis, Insights and Forecast - by Geography

- 15.4.1. China

- 15.4.2. India

- 15.4.3. Japan

- 15.4.4. South Korea

- 15.4.5. Thailand

- 15.4.6. Philippines

- 15.4.7. Vietnam

- 15.4.8. Indonesia

- 15.4.9. Malaysia

- 15.4.10. Australia and New Zealand

- 15.4.11. Rest of Asia-Pacific

- 15.1. Market Analysis, Insights and Forecast - by Type

- 16. Rest of Asia Pacific APAC Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - by Type

- 16.1.1. Wall Board

- 16.1.2. Ceiling Board

- 16.1.3. Pre-decorated Board

- 16.2. Market Analysis, Insights and Forecast - by Thickness

- 16.2.1. 1/2-inch

- 16.2.2. 5/8-inch

- 16.2.3. Other Thicknesses

- 16.3. Market Analysis, Insights and Forecast - by Application

- 16.3.1. Residential Sector

- 16.3.2. Institutional Sector

- 16.3.3. Industrial Sector

- 16.3.4. Commercial Sector

- 16.4. Market Analysis, Insights and Forecast - by Geography

- 16.4.1. China

- 16.4.2. India

- 16.4.3. Japan

- 16.4.4. South Korea

- 16.4.5. Thailand

- 16.4.6. Philippines

- 16.4.7. Vietnam

- 16.4.8. Indonesia

- 16.4.9. Malaysia

- 16.4.10. Australia and New Zealand

- 16.4.11. Rest of Asia-Pacific

- 16.1. Market Analysis, Insights and Forecast - by Type

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Beijing New Building Material (Group) Co Ltd

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 BGC (Australia) PTY Ltd

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 China National Building Material Company Limited (CNBM)

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 CHIYODA UTE CO LTD

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Georgia-Pacific Gypsum LLC

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Jason Plasterboard (Jiaxing) Co Ltd

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 KCC CORPORATION

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Knauf Gips KG

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Saint-Gobain Gyproc

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 VANS Gypsum

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 YOSHINO GYPSUM CO LTD *List Not Exhaustive

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 Beijing New Building Material (Group) Co Ltd

List of Figures

- Figure 1: Global APAC Gypsum Board Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: China APAC Gypsum Board Market Revenue (Million), by Type 2024 & 2032

- Figure 3: China APAC Gypsum Board Market Revenue Share (%), by Type 2024 & 2032

- Figure 4: China APAC Gypsum Board Market Revenue (Million), by Thickness 2024 & 2032

- Figure 5: China APAC Gypsum Board Market Revenue Share (%), by Thickness 2024 & 2032

- Figure 6: China APAC Gypsum Board Market Revenue (Million), by Application 2024 & 2032

- Figure 7: China APAC Gypsum Board Market Revenue Share (%), by Application 2024 & 2032

- Figure 8: China APAC Gypsum Board Market Revenue (Million), by Geography 2024 & 2032

- Figure 9: China APAC Gypsum Board Market Revenue Share (%), by Geography 2024 & 2032

- Figure 10: China APAC Gypsum Board Market Revenue (Million), by Country 2024 & 2032

- Figure 11: China APAC Gypsum Board Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: India APAC Gypsum Board Market Revenue (Million), by Type 2024 & 2032

- Figure 13: India APAC Gypsum Board Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: India APAC Gypsum Board Market Revenue (Million), by Thickness 2024 & 2032

- Figure 15: India APAC Gypsum Board Market Revenue Share (%), by Thickness 2024 & 2032

- Figure 16: India APAC Gypsum Board Market Revenue (Million), by Application 2024 & 2032

- Figure 17: India APAC Gypsum Board Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: India APAC Gypsum Board Market Revenue (Million), by Geography 2024 & 2032

- Figure 19: India APAC Gypsum Board Market Revenue Share (%), by Geography 2024 & 2032

- Figure 20: India APAC Gypsum Board Market Revenue (Million), by Country 2024 & 2032

- Figure 21: India APAC Gypsum Board Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Japan APAC Gypsum Board Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Japan APAC Gypsum Board Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Japan APAC Gypsum Board Market Revenue (Million), by Thickness 2024 & 2032

- Figure 25: Japan APAC Gypsum Board Market Revenue Share (%), by Thickness 2024 & 2032

- Figure 26: Japan APAC Gypsum Board Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Japan APAC Gypsum Board Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Japan APAC Gypsum Board Market Revenue (Million), by Geography 2024 & 2032

- Figure 29: Japan APAC Gypsum Board Market Revenue Share (%), by Geography 2024 & 2032

- Figure 30: Japan APAC Gypsum Board Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Japan APAC Gypsum Board Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: South Korea APAC Gypsum Board Market Revenue (Million), by Type 2024 & 2032

- Figure 33: South Korea APAC Gypsum Board Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: South Korea APAC Gypsum Board Market Revenue (Million), by Thickness 2024 & 2032

- Figure 35: South Korea APAC Gypsum Board Market Revenue Share (%), by Thickness 2024 & 2032

- Figure 36: South Korea APAC Gypsum Board Market Revenue (Million), by Application 2024 & 2032

- Figure 37: South Korea APAC Gypsum Board Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: South Korea APAC Gypsum Board Market Revenue (Million), by Geography 2024 & 2032

- Figure 39: South Korea APAC Gypsum Board Market Revenue Share (%), by Geography 2024 & 2032

- Figure 40: South Korea APAC Gypsum Board Market Revenue (Million), by Country 2024 & 2032

- Figure 41: South Korea APAC Gypsum Board Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Thailand APAC Gypsum Board Market Revenue (Million), by Type 2024 & 2032

- Figure 43: Thailand APAC Gypsum Board Market Revenue Share (%), by Type 2024 & 2032

- Figure 44: Thailand APAC Gypsum Board Market Revenue (Million), by Thickness 2024 & 2032

- Figure 45: Thailand APAC Gypsum Board Market Revenue Share (%), by Thickness 2024 & 2032

- Figure 46: Thailand APAC Gypsum Board Market Revenue (Million), by Application 2024 & 2032

- Figure 47: Thailand APAC Gypsum Board Market Revenue Share (%), by Application 2024 & 2032

- Figure 48: Thailand APAC Gypsum Board Market Revenue (Million), by Geography 2024 & 2032

- Figure 49: Thailand APAC Gypsum Board Market Revenue Share (%), by Geography 2024 & 2032

- Figure 50: Thailand APAC Gypsum Board Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Thailand APAC Gypsum Board Market Revenue Share (%), by Country 2024 & 2032

- Figure 52: Philippines APAC Gypsum Board Market Revenue (Million), by Type 2024 & 2032

- Figure 53: Philippines APAC Gypsum Board Market Revenue Share (%), by Type 2024 & 2032

- Figure 54: Philippines APAC Gypsum Board Market Revenue (Million), by Thickness 2024 & 2032

- Figure 55: Philippines APAC Gypsum Board Market Revenue Share (%), by Thickness 2024 & 2032

- Figure 56: Philippines APAC Gypsum Board Market Revenue (Million), by Application 2024 & 2032

- Figure 57: Philippines APAC Gypsum Board Market Revenue Share (%), by Application 2024 & 2032

- Figure 58: Philippines APAC Gypsum Board Market Revenue (Million), by Geography 2024 & 2032

- Figure 59: Philippines APAC Gypsum Board Market Revenue Share (%), by Geography 2024 & 2032

- Figure 60: Philippines APAC Gypsum Board Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Philippines APAC Gypsum Board Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Vietnam APAC Gypsum Board Market Revenue (Million), by Type 2024 & 2032

- Figure 63: Vietnam APAC Gypsum Board Market Revenue Share (%), by Type 2024 & 2032

- Figure 64: Vietnam APAC Gypsum Board Market Revenue (Million), by Thickness 2024 & 2032

- Figure 65: Vietnam APAC Gypsum Board Market Revenue Share (%), by Thickness 2024 & 2032

- Figure 66: Vietnam APAC Gypsum Board Market Revenue (Million), by Application 2024 & 2032

- Figure 67: Vietnam APAC Gypsum Board Market Revenue Share (%), by Application 2024 & 2032

- Figure 68: Vietnam APAC Gypsum Board Market Revenue (Million), by Geography 2024 & 2032

- Figure 69: Vietnam APAC Gypsum Board Market Revenue Share (%), by Geography 2024 & 2032

- Figure 70: Vietnam APAC Gypsum Board Market Revenue (Million), by Country 2024 & 2032

- Figure 71: Vietnam APAC Gypsum Board Market Revenue Share (%), by Country 2024 & 2032

- Figure 72: Indonesia APAC Gypsum Board Market Revenue (Million), by Type 2024 & 2032

- Figure 73: Indonesia APAC Gypsum Board Market Revenue Share (%), by Type 2024 & 2032

- Figure 74: Indonesia APAC Gypsum Board Market Revenue (Million), by Thickness 2024 & 2032

- Figure 75: Indonesia APAC Gypsum Board Market Revenue Share (%), by Thickness 2024 & 2032

- Figure 76: Indonesia APAC Gypsum Board Market Revenue (Million), by Application 2024 & 2032

- Figure 77: Indonesia APAC Gypsum Board Market Revenue Share (%), by Application 2024 & 2032

- Figure 78: Indonesia APAC Gypsum Board Market Revenue (Million), by Geography 2024 & 2032

- Figure 79: Indonesia APAC Gypsum Board Market Revenue Share (%), by Geography 2024 & 2032

- Figure 80: Indonesia APAC Gypsum Board Market Revenue (Million), by Country 2024 & 2032

- Figure 81: Indonesia APAC Gypsum Board Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: Malaysia APAC Gypsum Board Market Revenue (Million), by Type 2024 & 2032

- Figure 83: Malaysia APAC Gypsum Board Market Revenue Share (%), by Type 2024 & 2032

- Figure 84: Malaysia APAC Gypsum Board Market Revenue (Million), by Thickness 2024 & 2032

- Figure 85: Malaysia APAC Gypsum Board Market Revenue Share (%), by Thickness 2024 & 2032

- Figure 86: Malaysia APAC Gypsum Board Market Revenue (Million), by Application 2024 & 2032

- Figure 87: Malaysia APAC Gypsum Board Market Revenue Share (%), by Application 2024 & 2032

- Figure 88: Malaysia APAC Gypsum Board Market Revenue (Million), by Geography 2024 & 2032

- Figure 89: Malaysia APAC Gypsum Board Market Revenue Share (%), by Geography 2024 & 2032

- Figure 90: Malaysia APAC Gypsum Board Market Revenue (Million), by Country 2024 & 2032

- Figure 91: Malaysia APAC Gypsum Board Market Revenue Share (%), by Country 2024 & 2032

- Figure 92: Australia and New Zealand APAC Gypsum Board Market Revenue (Million), by Type 2024 & 2032

- Figure 93: Australia and New Zealand APAC Gypsum Board Market Revenue Share (%), by Type 2024 & 2032

- Figure 94: Australia and New Zealand APAC Gypsum Board Market Revenue (Million), by Thickness 2024 & 2032

- Figure 95: Australia and New Zealand APAC Gypsum Board Market Revenue Share (%), by Thickness 2024 & 2032

- Figure 96: Australia and New Zealand APAC Gypsum Board Market Revenue (Million), by Application 2024 & 2032

- Figure 97: Australia and New Zealand APAC Gypsum Board Market Revenue Share (%), by Application 2024 & 2032

- Figure 98: Australia and New Zealand APAC Gypsum Board Market Revenue (Million), by Geography 2024 & 2032

- Figure 99: Australia and New Zealand APAC Gypsum Board Market Revenue Share (%), by Geography 2024 & 2032

- Figure 100: Australia and New Zealand APAC Gypsum Board Market Revenue (Million), by Country 2024 & 2032

- Figure 101: Australia and New Zealand APAC Gypsum Board Market Revenue Share (%), by Country 2024 & 2032

- Figure 102: Rest of Asia Pacific APAC Gypsum Board Market Revenue (Million), by Type 2024 & 2032

- Figure 103: Rest of Asia Pacific APAC Gypsum Board Market Revenue Share (%), by Type 2024 & 2032

- Figure 104: Rest of Asia Pacific APAC Gypsum Board Market Revenue (Million), by Thickness 2024 & 2032

- Figure 105: Rest of Asia Pacific APAC Gypsum Board Market Revenue Share (%), by Thickness 2024 & 2032

- Figure 106: Rest of Asia Pacific APAC Gypsum Board Market Revenue (Million), by Application 2024 & 2032

- Figure 107: Rest of Asia Pacific APAC Gypsum Board Market Revenue Share (%), by Application 2024 & 2032

- Figure 108: Rest of Asia Pacific APAC Gypsum Board Market Revenue (Million), by Geography 2024 & 2032

- Figure 109: Rest of Asia Pacific APAC Gypsum Board Market Revenue Share (%), by Geography 2024 & 2032

- Figure 110: Rest of Asia Pacific APAC Gypsum Board Market Revenue (Million), by Country 2024 & 2032

- Figure 111: Rest of Asia Pacific APAC Gypsum Board Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Gypsum Board Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Gypsum Board Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global APAC Gypsum Board Market Revenue Million Forecast, by Thickness 2019 & 2032

- Table 4: Global APAC Gypsum Board Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global APAC Gypsum Board Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Global APAC Gypsum Board Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global APAC Gypsum Board Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Global APAC Gypsum Board Market Revenue Million Forecast, by Thickness 2019 & 2032

- Table 9: Global APAC Gypsum Board Market Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Global APAC Gypsum Board Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: Global APAC Gypsum Board Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global APAC Gypsum Board Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Global APAC Gypsum Board Market Revenue Million Forecast, by Thickness 2019 & 2032

- Table 14: Global APAC Gypsum Board Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global APAC Gypsum Board Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Global APAC Gypsum Board Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Global APAC Gypsum Board Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global APAC Gypsum Board Market Revenue Million Forecast, by Thickness 2019 & 2032

- Table 19: Global APAC Gypsum Board Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global APAC Gypsum Board Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global APAC Gypsum Board Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global APAC Gypsum Board Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global APAC Gypsum Board Market Revenue Million Forecast, by Thickness 2019 & 2032

- Table 24: Global APAC Gypsum Board Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global APAC Gypsum Board Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Global APAC Gypsum Board Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global APAC Gypsum Board Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global APAC Gypsum Board Market Revenue Million Forecast, by Thickness 2019 & 2032

- Table 29: Global APAC Gypsum Board Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Global APAC Gypsum Board Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 31: Global APAC Gypsum Board Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global APAC Gypsum Board Market Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global APAC Gypsum Board Market Revenue Million Forecast, by Thickness 2019 & 2032

- Table 34: Global APAC Gypsum Board Market Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global APAC Gypsum Board Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 36: Global APAC Gypsum Board Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Global APAC Gypsum Board Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Global APAC Gypsum Board Market Revenue Million Forecast, by Thickness 2019 & 2032

- Table 39: Global APAC Gypsum Board Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Global APAC Gypsum Board Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 41: Global APAC Gypsum Board Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global APAC Gypsum Board Market Revenue Million Forecast, by Type 2019 & 2032

- Table 43: Global APAC Gypsum Board Market Revenue Million Forecast, by Thickness 2019 & 2032

- Table 44: Global APAC Gypsum Board Market Revenue Million Forecast, by Application 2019 & 2032

- Table 45: Global APAC Gypsum Board Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Global APAC Gypsum Board Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Global APAC Gypsum Board Market Revenue Million Forecast, by Type 2019 & 2032

- Table 48: Global APAC Gypsum Board Market Revenue Million Forecast, by Thickness 2019 & 2032

- Table 49: Global APAC Gypsum Board Market Revenue Million Forecast, by Application 2019 & 2032

- Table 50: Global APAC Gypsum Board Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 51: Global APAC Gypsum Board Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global APAC Gypsum Board Market Revenue Million Forecast, by Type 2019 & 2032

- Table 53: Global APAC Gypsum Board Market Revenue Million Forecast, by Thickness 2019 & 2032

- Table 54: Global APAC Gypsum Board Market Revenue Million Forecast, by Application 2019 & 2032

- Table 55: Global APAC Gypsum Board Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 56: Global APAC Gypsum Board Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Global APAC Gypsum Board Market Revenue Million Forecast, by Type 2019 & 2032

- Table 58: Global APAC Gypsum Board Market Revenue Million Forecast, by Thickness 2019 & 2032

- Table 59: Global APAC Gypsum Board Market Revenue Million Forecast, by Application 2019 & 2032

- Table 60: Global APAC Gypsum Board Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 61: Global APAC Gypsum Board Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Gypsum Board Market?

The projected CAGR is approximately 6.29%.

2. Which companies are prominent players in the APAC Gypsum Board Market?

Key companies in the market include Beijing New Building Material (Group) Co Ltd, BGC (Australia) PTY Ltd, China National Building Material Company Limited (CNBM), CHIYODA UTE CO LTD, Georgia-Pacific Gypsum LLC, Jason Plasterboard (Jiaxing) Co Ltd, KCC CORPORATION, Knauf Gips KG, Saint-Gobain Gyproc, VANS Gypsum, YOSHINO GYPSUM CO LTD *List Not Exhaustive.

3. What are the main segments of the APAC Gypsum Board Market?

The market segments include Type, Thickness, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investment in the Construction Sector in the Emerging Economies; Increasing Demand from Residential Sector; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Investments in the Construction Sector in the Emerging Economies.

7. Are there any restraints impacting market growth?

Increasing Investment in the Construction Sector in the Emerging Economies; Increasing Demand from Residential Sector; Other Drivers.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the market studied are covered in the complete report.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Gypsum Board Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Gypsum Board Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Gypsum Board Market?

To stay informed about further developments, trends, and reports in the APAC Gypsum Board Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence