Key Insights

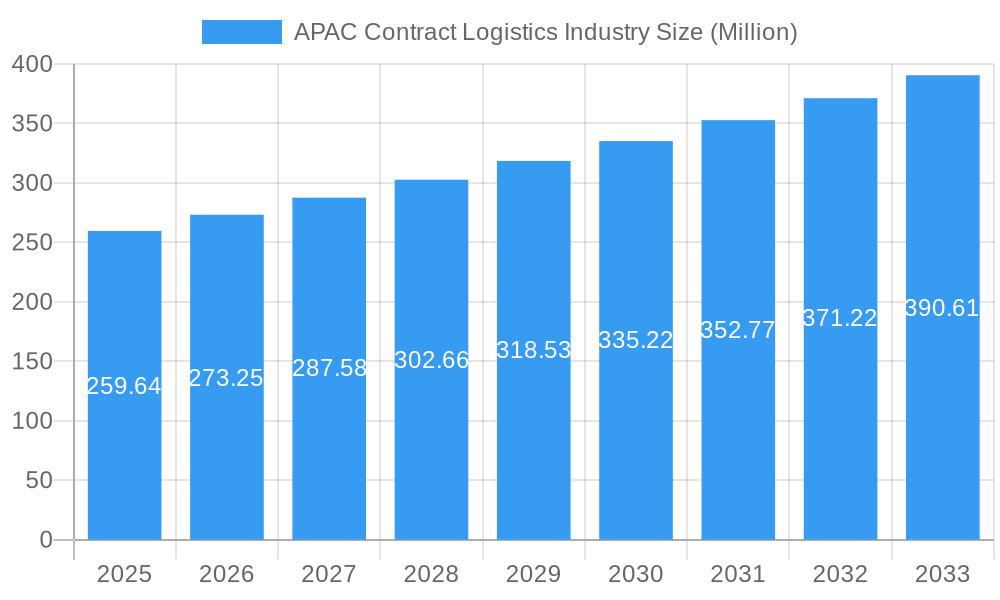

The Asia-Pacific (APAC) Contract Logistics Industry, valued at $259.64 million in 2025, is poised for significant growth with a Compound Annual Growth Rate (CAGR) of 5.25% during the forecast period from 2025 to 2033. This growth is driven by the region's robust economic expansion, increasing industrialization, and the rising demand for efficient supply chain management across various sectors. Key drivers include the rapid growth in manufacturing and automotive sectors, as well as the consumer goods and retail industries, which are increasingly outsourcing logistics operations to streamline processes and reduce costs. Major trends shaping the market include the adoption of advanced technologies such as IoT, AI, and blockchain, enhancing visibility and efficiency in logistics operations. The market is segmented by type into insourced and outsourced logistics, with outsourced logistics gaining traction due to its cost-effectiveness and flexibility.

APAC Contract Logistics Industry Market Size (In Million)

The APAC region's diverse market dynamics are evident in its segmentation by end users, which includes manufacturing and automotive, consumer goods and retail, high-tech, healthcare and pharmaceuticals, and other end users. Countries like China, Japan, and India lead the market, with China being the largest contributor due to its vast manufacturing base and e-commerce growth. Other significant markets include South Korea, Australia, and Southeast Asian countries like Singapore, Malaysia, Indonesia, and Thailand. Key players in the APAC Contract Logistics Industry include DB Schenker, Logisteed Ltd, Ceva Logistics, Yusen Logistics Co Ltd, and Nippon Express Co Ltd, among others. These companies are focusing on expanding their service offerings and geographical presence to capitalize on the growing demand for logistics services in the region. Restraints such as regulatory challenges and infrastructure limitations pose hurdles, but strategic investments and collaborations are expected to mitigate these issues, ensuring continued market growth.

APAC Contract Logistics Industry Company Market Share

APAC Contract Logistics Industry Market Structure & Competitive Dynamics

The Asia-Pacific contract logistics industry presents a complex landscape of intense competition within a highly concentrated market. While a few major players, including DB Schenker, Nippon Express Co Ltd, and Deutsche Post DHL Group, command a significant share (approximately 35%), the overall market is incredibly dynamic. This dynamism is fueled by a robust innovation ecosystem leveraging cutting-edge technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) to optimize logistics solutions and gain a competitive edge. However, navigating this market requires careful consideration of the diverse regulatory frameworks across the APAC region. For example, China's stringent regulations present considerable hurdles for foreign entrants, contrasting sharply with the more open and investment-friendly policies of Singapore. The rise of in-house logistics solutions by large manufacturers presents a competitive challenge, yet outsourced logistics remains dominant due to inherent cost efficiencies and scalability. A key trend amongst end-users, particularly within the manufacturing and automotive sectors, is a strong preference for integrated logistics services that streamline operations and reduce complexity. Finally, mergers and acquisitions (M&A) continue to reshape the industry landscape, with significant transactions like the $3.5 billion acquisition of Kerry Logistics Network Limited by S.F. Holding Co Ltd in 2021 demonstrating the pursuit of expanded market reach and enhanced service capabilities.

- Market Concentration: Oligopolistic structure with significant market share held by leading global players.

- Innovation Ecosystem: Rapid adoption of IoT and AI driving efficiency and transparency improvements.

- Regulatory Landscape: Highly varied across APAC nations, impacting market access and operational strategies.

- Competitive Pressure: Increased competition from both established players and the growth of in-house logistics functions.

- End-User Demand: Growing preference for integrated, end-to-end logistics solutions.

- Consolidation: Strategic M&A activity continues to define market structure and competitive positioning.

APAC Contract Logistics Industry Industry Trends & Insights

The APAC contract logistics industry is poised for robust growth, with a projected CAGR of 6.2% from 2025 to 2033. This growth is primarily fueled by the expansion of e-commerce and the increasing demand for efficient supply chain management across various sectors. Technological disruptions, such as the integration of blockchain for transparency and autonomous vehicles for last-mile delivery, are reshaping the industry landscape. Consumer preferences are shifting towards faster and more reliable delivery options, pushing logistics providers to innovate. The competitive dynamics are intense, with companies like DB Schenker and Nippon Express Co Ltd investing heavily in digital solutions to enhance their service offerings. Market penetration is significant in countries like China and India, where the demand for logistics services is high due to their manufacturing bases and burgeoning consumer markets. However, the industry faces challenges such as infrastructure limitations in certain regions and the need for skilled labor. Despite these hurdles, the APAC contract logistics sector remains a lucrative market, with continuous efforts towards sustainability and efficiency driving future growth.

Dominant Markets & Segments in APAC Contract Logistics Industry

China reigns supreme as the largest market within APAC contract logistics, driven by its massive manufacturing base and the world's largest e-commerce market. Government initiatives like the Belt and Road Initiative have significantly boosted infrastructure development, solidifying China's position as a crucial logistics hub. Key growth factors in China include:

- Government Policy: Strategic infrastructure investments through initiatives like the Belt and Road Initiative.

- Infrastructure Development: Rapid expansion and modernization of transportation and logistics networks.

- Manufacturing Sector: The world's largest manufacturing economy, generating substantial demand for logistics services.

- E-commerce Boom: Explosive growth in online retail driving demand for last-mile delivery and fulfillment solutions.

In terms of service segments, outsourced logistics maintains its leadership due to its inherent cost-effectiveness and ability to scale to meet fluctuating demand. The manufacturing and automotive sector remains the dominant end-user segment, projected to reach a substantial market size (insert updated market size figure here) by 2025, with a forecasted CAGR of 5.8% throughout the forecast period. This strong demand reflects the substantial volume of goods requiring efficient and reliable logistics solutions. The healthcare and pharmaceuticals sector is also experiencing accelerated growth, fueled by the increasing need for specialized temperature-controlled logistics and stringent regulatory compliance.

- Outsourced Logistics: Cost-effective and scalable solutions preferred by a wide range of businesses.

- Manufacturing & Automotive: Largest segment driven by high-volume, time-sensitive delivery requirements.

- Healthcare & Pharmaceuticals: Rapid growth due to increasing demand for specialized logistics and regulatory adherence.

APAC Contract Logistics Industry Product Innovations

The APAC contract logistics industry is witnessing significant product innovations, particularly in the integration of advanced technologies. Companies are leveraging IoT and AI to enhance visibility and efficiency in supply chains. Autonomous delivery vehicles and drones are being tested for last-mile delivery solutions, promising faster and more reliable services. These innovations not only improve operational efficiency but also align with the market's demand for sustainable and technologically advanced logistics solutions.

Report Segmentation & Scope

This report segments the APAC contract logistics industry by service type (insourced and outsourced), end-user sector, and country. While the insourced logistics segment holds a market value of (insert updated market size figure here) in 2025, with a projected growth rate of 4.5% through 2033, reflecting companies' desire for greater supply chain control, the outsourced logistics segment dominates, exhibiting a larger market size of (insert updated market size figure here) in 2025 and a CAGR of 6.2%. By end-user, manufacturing and automotive remains the largest sector (insert updated market size figure here) in 2025, followed by consumer goods and retail (insert updated market size figure here). The high-tech and healthcare & pharmaceuticals sectors are experiencing impressive growth, reaching market sizes of (insert updated market size figures here) respectively in 2025. Geographically, China maintains its leading position with a market size of (insert updated market size figure here) in 2025, followed by India (insert updated market size figure here), Japan (insert updated market size figure here), and other key economies like South Korea, Australia, and Singapore, all significantly contributing to the region's dynamic market.

Key Drivers of APAC Contract Logistics Industry Growth

The APAC contract logistics industry is driven by several key factors. Technological advancements, such as IoT and AI, are revolutionizing logistics operations, enhancing efficiency and reducing costs. Economic growth in countries like China and India is fueling demand for logistics services, supported by robust manufacturing sectors and burgeoning e-commerce markets. Regulatory reforms, such as liberalization policies in Singapore and Malaysia, are attracting foreign investment and fostering competition. These drivers are pivotal in shaping the industry's growth trajectory.

Challenges in the APAC Contract Logistics Industry Sector

The APAC contract logistics sector faces several challenges. Regulatory hurdles, particularly in countries like China and India, can impede market entry and operations. Supply chain disruptions, such as those caused by natural disasters or geopolitical tensions, pose significant risks. Competitive pressures are intense, with companies vying for market share through aggressive pricing and service enhancements. These challenges impact the industry's growth, with potential losses estimated at $xx Million annually due to supply chain inefficiencies.

Leading Players in the APAC Contract Logistics Industry Market

- DB Schenker

- Logisteed Ltd

- Ceva Logistics

- Yusen Logistics Co Ltd

- Nippon Express Co Ltd

- Hellmann Worldwide Logistics

- S F Holding Co Ltd

- Kerry Logistics Network Limited

- Yamato Holdings Co Ltd

- Leschaco Japan K K

- Agility Logistics Ltd

- Rhenus Logistics

- GAC

- Geodis

- Linc Group

- BCR Australia Pty Ltd

- Silk Contract Logistics

- DSV A/S

- Deutsche Post DHL Group

- CJ Logistics

- United Parcel Services Inc

- Toll Group

Key Developments in APAC Contract Logistics Industry Sector

- January 2021: S.F. Holding Co Ltd's acquisition of Kerry Logistics Network Limited for $3.5 Billion significantly reshaped the competitive landscape.

- March 2022: DB Schenker's expansion of e-commerce logistics solutions in Southeast Asia highlights the growing importance of this segment.

- June 2023: Nippon Express Co Ltd's launch of a blockchain-based platform underscores the industry's commitment to enhanced supply chain transparency and efficiency. (Add more recent developments here with dates and brief descriptions)

Strategic APAC Contract Logistics Industry Market Outlook

The APAC contract logistics industry is set for continued growth, driven by technological advancements and the expansion of e-commerce. The integration of AI and IoT will further enhance operational efficiencies, while the rise of sustainable logistics solutions will cater to increasing environmental concerns. Strategic opportunities lie in expanding into emerging markets like Indonesia and Thailand, where infrastructure development is on the rise. Companies that focus on innovation, sustainability, and regional expansion are well-positioned to capitalize on the industry's potential, with a projected market size of $xx Million by 2033.

APAC Contract Logistics Industry Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods and Retail

- 2.3. High-Tech

- 2.4. Healthcare and Pharmaceuticals

- 2.5. Other End Users

APAC Contract Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Contract Logistics Industry Regional Market Share

Geographic Coverage of APAC Contract Logistics Industry

APAC Contract Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; E-commerce Growth4.; Global Trade and Supply Chain Resilience

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment

- 3.4. Market Trends

- 3.4.1. Demand From The Manufacturing And Automotive Sector Is Driving The Contract Logistics Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Contract Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods and Retail

- 5.2.3. High-Tech

- 5.2.4. Healthcare and Pharmaceuticals

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America APAC Contract Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Insourced

- 6.1.2. Outsourced

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Manufacturing and Automotive

- 6.2.2. Consumer Goods and Retail

- 6.2.3. High-Tech

- 6.2.4. Healthcare and Pharmaceuticals

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America APAC Contract Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Insourced

- 7.1.2. Outsourced

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Manufacturing and Automotive

- 7.2.2. Consumer Goods and Retail

- 7.2.3. High-Tech

- 7.2.4. Healthcare and Pharmaceuticals

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe APAC Contract Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Insourced

- 8.1.2. Outsourced

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Manufacturing and Automotive

- 8.2.2. Consumer Goods and Retail

- 8.2.3. High-Tech

- 8.2.4. Healthcare and Pharmaceuticals

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa APAC Contract Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Insourced

- 9.1.2. Outsourced

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Manufacturing and Automotive

- 9.2.2. Consumer Goods and Retail

- 9.2.3. High-Tech

- 9.2.4. Healthcare and Pharmaceuticals

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific APAC Contract Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Insourced

- 10.1.2. Outsourced

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Manufacturing and Automotive

- 10.2.2. Consumer Goods and Retail

- 10.2.3. High-Tech

- 10.2.4. Healthcare and Pharmaceuticals

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Logisteed Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ceva Logistics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yusen Logistics Co Ltd**List Not Exhaustive 6 3 Other companies (Key Information/Overview)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nippon Express Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hellmann Worldwide Logistics S F Holding Co Ltd Kerry Logistics Network Limited Yamato holdings Co Ltd Leschaco Japan K K Agility Logistics Ltd Rhenus Logistics GAC Geodis Linc Group BCR Australia Pty Ltd Silk Contract Logistics DSV A/S

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Deutsche Post DHL Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CJ Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 United Parcel Services Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Toll Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global APAC Contract Logistics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Contract Logistics Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America APAC Contract Logistics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America APAC Contract Logistics Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America APAC Contract Logistics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America APAC Contract Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America APAC Contract Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America APAC Contract Logistics Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: South America APAC Contract Logistics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America APAC Contract Logistics Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: South America APAC Contract Logistics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: South America APAC Contract Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America APAC Contract Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe APAC Contract Logistics Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe APAC Contract Logistics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe APAC Contract Logistics Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Europe APAC Contract Logistics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe APAC Contract Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe APAC Contract Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa APAC Contract Logistics Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa APAC Contract Logistics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa APAC Contract Logistics Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Middle East & Africa APAC Contract Logistics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East & Africa APAC Contract Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa APAC Contract Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific APAC Contract Logistics Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific APAC Contract Logistics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific APAC Contract Logistics Industry Revenue (Million), by End User 2025 & 2033

- Figure 29: Asia Pacific APAC Contract Logistics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific APAC Contract Logistics Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific APAC Contract Logistics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Contract Logistics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global APAC Contract Logistics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global APAC Contract Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global APAC Contract Logistics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global APAC Contract Logistics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global APAC Contract Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global APAC Contract Logistics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global APAC Contract Logistics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global APAC Contract Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global APAC Contract Logistics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global APAC Contract Logistics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global APAC Contract Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global APAC Contract Logistics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global APAC Contract Logistics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global APAC Contract Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global APAC Contract Logistics Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global APAC Contract Logistics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 39: Global APAC Contract Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific APAC Contract Logistics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Contract Logistics Industry?

The projected CAGR is approximately 5.25%.

2. Which companies are prominent players in the APAC Contract Logistics Industry?

Key companies in the market include DB Schenker, Logisteed Ltd, Ceva Logistics, Yusen Logistics Co Ltd**List Not Exhaustive 6 3 Other companies (Key Information/Overview), Nippon Express Co Ltd, Hellmann Worldwide Logistics S F Holding Co Ltd Kerry Logistics Network Limited Yamato holdings Co Ltd Leschaco Japan K K Agility Logistics Ltd Rhenus Logistics GAC Geodis Linc Group BCR Australia Pty Ltd Silk Contract Logistics DSV A/S, Deutsche Post DHL Group, CJ Logistics, United Parcel Services Inc, Toll Group.

3. What are the main segments of the APAC Contract Logistics Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 259.64 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; E-commerce Growth4.; Global Trade and Supply Chain Resilience.

6. What are the notable trends driving market growth?

Demand From The Manufacturing And Automotive Sector Is Driving The Contract Logistics Services.

7. Are there any restraints impacting market growth?

4.; High Initial Investment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Contract Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Contract Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Contract Logistics Industry?

To stay informed about further developments, trends, and reports in the APAC Contract Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence