Key Insights

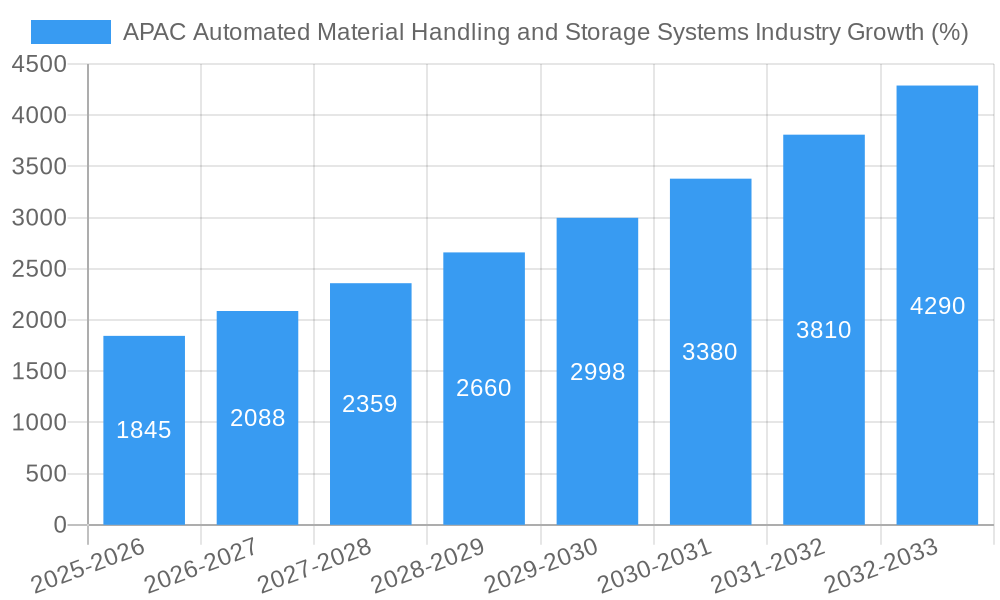

The Asia-Pacific (APAC) automated material handling and storage systems market is experiencing robust growth, driven by the region's expanding e-commerce sector, increasing automation adoption across industries, and a focus on improving supply chain efficiency. A 12.30% CAGR indicates significant potential for expansion over the forecast period (2025-2033). Key drivers include the rising demand for faster order fulfillment, labor shortages across various industries, and the need to optimize warehouse space utilization. Growth is particularly pronounced in countries like China, India, and Japan, which are experiencing rapid industrialization and urbanization, leading to increased warehouse automation needs. The market is segmented by product type (hardware, software, services), equipment type (AGVs, AMRs, ASRS, conveyor systems, palletizers), and end-user industry (e-commerce, automotive, food & beverage, pharmaceuticals, etc.). While the initial investment costs for automated systems can be high, this is offset by long-term gains in efficiency, reduced labor costs, and improved accuracy. The increasing availability of sophisticated, user-friendly software solutions, coupled with advancements in robotics and AI, are further accelerating market growth. Challenges include high implementation costs, integration complexities, and the need for skilled workforce to operate and maintain these systems. However, ongoing technological advancements and government support for automation initiatives are mitigating these challenges.

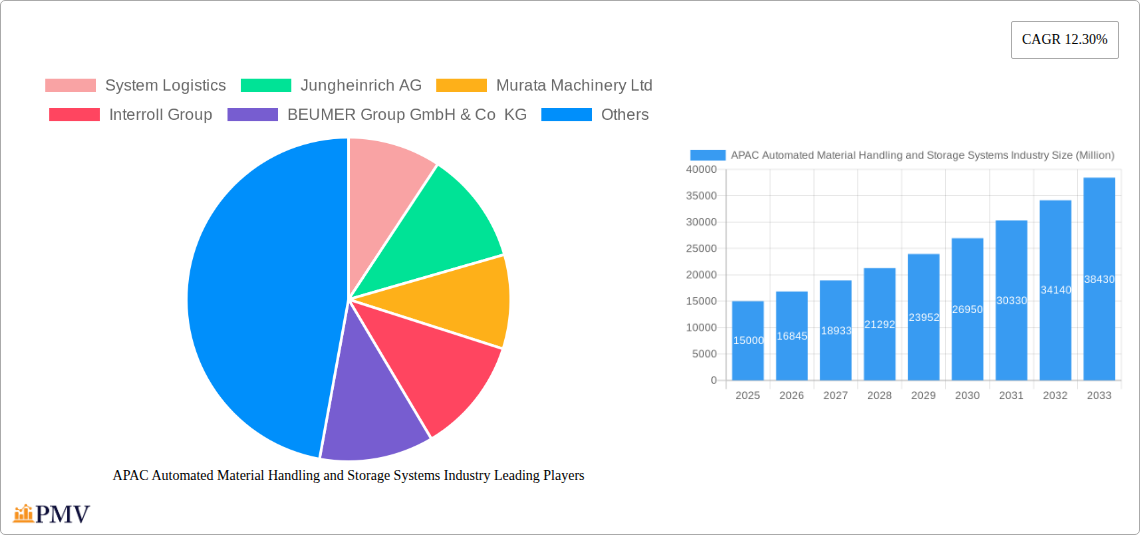

The market's structure is highly competitive, with both international players like KION Group, Daifuku, and Jungheinrich, and regional players like VisionNav Robotics vying for market share. The dominance of specific segments varies across countries. For instance, China shows a strong preference for AGVs in manufacturing, while Japan leads in ASRS adoption across diverse sectors. Future growth will be significantly influenced by technological innovations such as the integration of 5G, AI, and the Internet of Things (IoT) into automated systems, leading to greater efficiency, predictive maintenance, and improved data analytics capabilities. The increasing demand for customized solutions, catering to the specific needs of various industries, will also drive market growth. The focus on sustainability and environmentally friendly solutions will likely emerge as a significant factor influencing future investment decisions.

APAC Automated Material Handling and Storage Systems Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Asia-Pacific (APAC) Automated Material Handling and Storage Systems industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is estimated to reach xx Million by 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

APAC Automated Material Handling and Storage Systems Industry Market Structure & Competitive Dynamics

The APAC automated material handling and storage systems market is characterized by a moderately concentrated landscape, with a few dominant players and numerous smaller, specialized firms. Market share is largely determined by technological innovation, brand reputation, and a strong distribution network. The industry is witnessing increased M&A activity, driven by the desire to expand market reach, acquire cutting-edge technologies, and achieve economies of scale. Deal values for major acquisitions have exceeded xx Million in recent years.

The regulatory framework varies across APAC countries, impacting the adoption of automated systems. However, government initiatives promoting automation and Industry 4.0 are creating a favorable environment for growth. Significant innovation is evident across various segments, with a focus on AI-powered systems, IoT integration, and improved energy efficiency. Product substitutes include traditional manual handling methods, but their adoption is declining due to escalating labor costs and efficiency requirements. End-user trends show a preference for flexible, scalable, and data-driven solutions that improve supply chain visibility and responsiveness.

- Market Concentration: Moderately Concentrated

- Key Players' Market Share: System Logistics (xx%), Jungheinrich AG (xx%), Daifuku Co Ltd (xx%), etc. (Note: Exact figures require further research.)

- M&A Activity: Significant, with deals valued at over xx Million in recent years.

- Regulatory Framework: Varies across APAC countries, generally supportive of automation.

APAC Automated Material Handling and Storage Systems Industry Industry Trends & Insights

The APAC automated material handling and storage systems market is experiencing robust growth, driven primarily by the booming e-commerce sector, rising labor costs, and the increasing demand for enhanced supply chain efficiency. The adoption of advanced technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and robotics is revolutionizing warehouse operations and significantly improving productivity. Consumer preferences are shifting towards faster delivery times and personalized services, pushing businesses to adopt automation to meet these demands. The market is also experiencing increasing competitive intensity, with companies focusing on innovation, cost optimization, and strategic partnerships to maintain their market position. The CAGR for the forecast period is estimated at xx%, signifying significant market expansion. Market penetration of automated systems is steadily increasing across various end-user industries, particularly in warehousing and distribution centers. This growth is fueled by the need for increased efficiency, reduced operational costs, and improved accuracy in material handling.

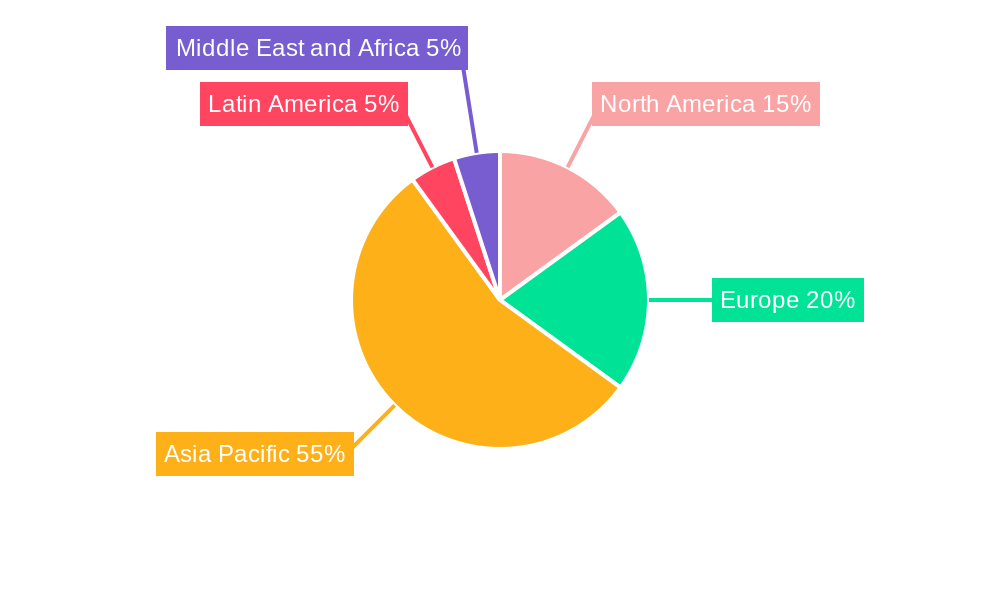

Dominant Markets & Segments in APAC Automated Material Handling and Storage Systems Industry

Dominant Region: China, due to its massive manufacturing sector and rapid e-commerce growth.

Dominant Country: China contributes the largest market share, followed by Japan, South Korea, and India.

Dominant Segments:

- Product Type: Hardware dominates, owing to the substantial investment in physical equipment. However, software and services are growing rapidly due to the increasing need for system integration and maintenance.

- Equipment Type: Mobile robots (AGVs and AMRs) are experiencing the fastest growth, driven by their flexibility and adaptability. Automated Storage and Retrieval Systems (ASRS) also hold significant market share.

- End-User Industry: Retail/Warehousing/Distribution Centers/Logistic Centers represent the largest segment, fueled by the e-commerce boom. The automotive and electronics and semiconductor manufacturing sectors are also experiencing significant growth.

Key Drivers for Dominant Markets:

- China: Strong government support for automation, booming e-commerce, massive manufacturing base, and robust infrastructure development.

- Japan: Highly developed manufacturing sector, focus on technological advancements, and a strong robotics industry.

- India: Rapid economic growth, expanding e-commerce sector, and increasing foreign direct investment.

APAP Automated Material Handling and Storage Systems Industry Product Innovations

Recent innovations focus on enhancing the efficiency, safety, and adaptability of automated systems. This includes advanced AI-powered navigation for AMRs, improved integration capabilities via IoT, and the development of energy-efficient solutions. These innovations are streamlining warehouse operations, reducing operational costs, and allowing for greater flexibility in handling diverse product types and order volumes. The market is witnessing a significant increase in the use of cloud-based software solutions for improved data management and remote monitoring. This trend enhances system performance, provides actionable insights and facilitates proactive maintenance.

Report Segmentation & Scope

This report segments the APAC automated material handling and storage systems market based on product type (hardware, software, services), equipment type (mobile robots, ASRS, automated conveyors, overhead pallet systems, etc.), end-user industry (e.g., automotive, retail, food & beverage, pharmaceuticals), and country (China, Japan, India, etc.). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail, providing a comprehensive overview of the market landscape. Growth projections for each segment vary considerably, with the fastest growth expected in mobile robotics and software solutions within the warehousing and logistics sector. Competitive dynamics are shaped by factors such as technological advancements, pricing strategies, and market access.

Key Drivers of APAC Automated Material Handling and Storage Systems Industry Growth

The APAC automated material handling and storage systems market's growth is driven by several key factors:

- E-commerce Boom: The rapid expansion of e-commerce is creating a massive demand for efficient warehousing and logistics solutions.

- Rising Labor Costs: The increasing cost of labor in many APAC countries is making automation a cost-effective alternative.

- Technological Advancements: Continuous improvements in robotics, AI, and IoT are enhancing the capabilities and affordability of automated systems.

- Government Initiatives: Many governments in the region are promoting automation through supportive policies and financial incentives.

Challenges in the APAC Automated Material Handling and Storage Systems Industry Sector

Despite the significant growth opportunities, the APAC automated material handling and storage systems industry faces several challenges:

- High Initial Investment Costs: The high upfront cost of implementing automated systems can be a barrier to entry for some businesses.

- Integration Complexity: Integrating automated systems with existing infrastructure can be complex and time-consuming.

- Skill Gaps: A shortage of skilled labor to operate and maintain these systems can hinder adoption.

- Cybersecurity Concerns: The increasing reliance on interconnected systems raises concerns about data security and cyber threats.

Leading Players in the APAC Automated Material Handling and Storage Systems Industry Market

- System Logistics

- Jungheinrich AG

- Murata Machinery Ltd

- Interroll Group

- BEUMER Group GmbH & Co KG

- VisionNav Robotics

- SSI Schaefer AG

- Witron Logistik

- KION Group

- Kardex Group

- JBT Corporation

- Honeywell Intelligrated Inc

- Daifuku Co Ltd

- Toyota Industries Corporation

- Kuka AG

Key Developments in APAC Automated Material Handling and Storage Systems Industry Sector

- April 2022: KION Battery Systems GmbH (KBS) expanded its production facility, boosting its capacity for 24-volt batteries used in mobile warehouse equipment. This strengthens KION Group's position in supplying critical components for the industry.

- April 2022: Jungheinrich opened a new software and hardware development hub in Zagreb, Croatia, focusing on mobile robots, control systems, and ASRS. This strengthens their R&D capabilities and expands their technological edge in the market.

Strategic APAC Automated Material Handling and Storage Systems Industry Market Outlook

The future of the APAC automated material handling and storage systems market looks bright. Continued growth in e-commerce, increasing labor costs, and technological advancements will fuel demand for automated solutions. Companies that can offer innovative, cost-effective, and easily integrated systems will be well-positioned to succeed. Strategic opportunities exist in developing customized solutions for specific industry segments, expanding into underserved markets, and forging strategic partnerships to enhance market reach and technological capabilities. The focus on sustainability and energy efficiency will also shape future product development and market positioning.

APAC Automated Material Handling and Storage Systems Industry Segmentation

-

1. Product Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Equipment Type

-

2.1. Mobile Robots

-

2.1.1. Automated Guided Vehicle (AGV)

- 2.1.1.1. Automated Forklift

- 2.1.1.2. Automated Tow/Tractor/Tug

- 2.1.1.3. Unit Load

- 2.1.1.4. Assembly Line

- 2.1.1.5. Special Purpose

- 2.1.2. Autonomous Mobile Robots (AMR)

-

2.1.1. Automated Guided Vehicle (AGV)

-

2.2. Automated Storage and Retrieval System (ASRS)

- 2.2.1. Fixed Aisle

- 2.2.2. Carousel

- 2.2.3. Vertical Lift Module

-

2.3. Automated Conveyor

- 2.3.1. Belt

- 2.3.2. Roller

- 2.3.3. Pallet

- 2.3.4. Overhead

-

2.4. Palletizer

- 2.4.1. Conventional

- 2.4.2. Robotic

- 2.5. Sortation System

-

2.1. Mobile Robots

-

3. End-user Industry

- 3.1. Airport

- 3.2. Automotive

- 3.3. Food and Beverage

- 3.4. Retail/W

- 3.5. General Manufacturing

- 3.6. Pharmaceuticals

- 3.7. Post and Parcel

- 3.8. Electronics and Semiconductor Manufacturing

- 3.9. Other End-user Industries

APAC Automated Material Handling and Storage Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Automated Material Handling and Storage Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements Aiding Market Growth; Industry 4.0 Investments driving the demand for automation and material Handling; Rapid Growth of E-commerce

- 3.3. Market Restrains

- 3.3.1. High Initial Costs; Unavailability of Skilled Workforce

- 3.4. Market Trends

- 3.4.1. Assembly Line to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Automated Material Handling and Storage Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Mobile Robots

- 5.2.1.1. Automated Guided Vehicle (AGV)

- 5.2.1.1.1. Automated Forklift

- 5.2.1.1.2. Automated Tow/Tractor/Tug

- 5.2.1.1.3. Unit Load

- 5.2.1.1.4. Assembly Line

- 5.2.1.1.5. Special Purpose

- 5.2.1.2. Autonomous Mobile Robots (AMR)

- 5.2.1.1. Automated Guided Vehicle (AGV)

- 5.2.2. Automated Storage and Retrieval System (ASRS)

- 5.2.2.1. Fixed Aisle

- 5.2.2.2. Carousel

- 5.2.2.3. Vertical Lift Module

- 5.2.3. Automated Conveyor

- 5.2.3.1. Belt

- 5.2.3.2. Roller

- 5.2.3.3. Pallet

- 5.2.3.4. Overhead

- 5.2.4. Palletizer

- 5.2.4.1. Conventional

- 5.2.4.2. Robotic

- 5.2.5. Sortation System

- 5.2.1. Mobile Robots

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Airport

- 5.3.2. Automotive

- 5.3.3. Food and Beverage

- 5.3.4. Retail/W

- 5.3.5. General Manufacturing

- 5.3.6. Pharmaceuticals

- 5.3.7. Post and Parcel

- 5.3.8. Electronics and Semiconductor Manufacturing

- 5.3.9. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America APAC Automated Material Handling and Storage Systems Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Equipment Type

- 6.2.1. Mobile Robots

- 6.2.1.1. Automated Guided Vehicle (AGV)

- 6.2.1.1.1. Automated Forklift

- 6.2.1.1.2. Automated Tow/Tractor/Tug

- 6.2.1.1.3. Unit Load

- 6.2.1.1.4. Assembly Line

- 6.2.1.1.5. Special Purpose

- 6.2.1.2. Autonomous Mobile Robots (AMR)

- 6.2.1.1. Automated Guided Vehicle (AGV)

- 6.2.2. Automated Storage and Retrieval System (ASRS)

- 6.2.2.1. Fixed Aisle

- 6.2.2.2. Carousel

- 6.2.2.3. Vertical Lift Module

- 6.2.3. Automated Conveyor

- 6.2.3.1. Belt

- 6.2.3.2. Roller

- 6.2.3.3. Pallet

- 6.2.3.4. Overhead

- 6.2.4. Palletizer

- 6.2.4.1. Conventional

- 6.2.4.2. Robotic

- 6.2.5. Sortation System

- 6.2.1. Mobile Robots

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Airport

- 6.3.2. Automotive

- 6.3.3. Food and Beverage

- 6.3.4. Retail/W

- 6.3.5. General Manufacturing

- 6.3.6. Pharmaceuticals

- 6.3.7. Post and Parcel

- 6.3.8. Electronics and Semiconductor Manufacturing

- 6.3.9. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America APAC Automated Material Handling and Storage Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Equipment Type

- 7.2.1. Mobile Robots

- 7.2.1.1. Automated Guided Vehicle (AGV)

- 7.2.1.1.1. Automated Forklift

- 7.2.1.1.2. Automated Tow/Tractor/Tug

- 7.2.1.1.3. Unit Load

- 7.2.1.1.4. Assembly Line

- 7.2.1.1.5. Special Purpose

- 7.2.1.2. Autonomous Mobile Robots (AMR)

- 7.2.1.1. Automated Guided Vehicle (AGV)

- 7.2.2. Automated Storage and Retrieval System (ASRS)

- 7.2.2.1. Fixed Aisle

- 7.2.2.2. Carousel

- 7.2.2.3. Vertical Lift Module

- 7.2.3. Automated Conveyor

- 7.2.3.1. Belt

- 7.2.3.2. Roller

- 7.2.3.3. Pallet

- 7.2.3.4. Overhead

- 7.2.4. Palletizer

- 7.2.4.1. Conventional

- 7.2.4.2. Robotic

- 7.2.5. Sortation System

- 7.2.1. Mobile Robots

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Airport

- 7.3.2. Automotive

- 7.3.3. Food and Beverage

- 7.3.4. Retail/W

- 7.3.5. General Manufacturing

- 7.3.6. Pharmaceuticals

- 7.3.7. Post and Parcel

- 7.3.8. Electronics and Semiconductor Manufacturing

- 7.3.9. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe APAC Automated Material Handling and Storage Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Equipment Type

- 8.2.1. Mobile Robots

- 8.2.1.1. Automated Guided Vehicle (AGV)

- 8.2.1.1.1. Automated Forklift

- 8.2.1.1.2. Automated Tow/Tractor/Tug

- 8.2.1.1.3. Unit Load

- 8.2.1.1.4. Assembly Line

- 8.2.1.1.5. Special Purpose

- 8.2.1.2. Autonomous Mobile Robots (AMR)

- 8.2.1.1. Automated Guided Vehicle (AGV)

- 8.2.2. Automated Storage and Retrieval System (ASRS)

- 8.2.2.1. Fixed Aisle

- 8.2.2.2. Carousel

- 8.2.2.3. Vertical Lift Module

- 8.2.3. Automated Conveyor

- 8.2.3.1. Belt

- 8.2.3.2. Roller

- 8.2.3.3. Pallet

- 8.2.3.4. Overhead

- 8.2.4. Palletizer

- 8.2.4.1. Conventional

- 8.2.4.2. Robotic

- 8.2.5. Sortation System

- 8.2.1. Mobile Robots

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Airport

- 8.3.2. Automotive

- 8.3.3. Food and Beverage

- 8.3.4. Retail/W

- 8.3.5. General Manufacturing

- 8.3.6. Pharmaceuticals

- 8.3.7. Post and Parcel

- 8.3.8. Electronics and Semiconductor Manufacturing

- 8.3.9. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa APAC Automated Material Handling and Storage Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Equipment Type

- 9.2.1. Mobile Robots

- 9.2.1.1. Automated Guided Vehicle (AGV)

- 9.2.1.1.1. Automated Forklift

- 9.2.1.1.2. Automated Tow/Tractor/Tug

- 9.2.1.1.3. Unit Load

- 9.2.1.1.4. Assembly Line

- 9.2.1.1.5. Special Purpose

- 9.2.1.2. Autonomous Mobile Robots (AMR)

- 9.2.1.1. Automated Guided Vehicle (AGV)

- 9.2.2. Automated Storage and Retrieval System (ASRS)

- 9.2.2.1. Fixed Aisle

- 9.2.2.2. Carousel

- 9.2.2.3. Vertical Lift Module

- 9.2.3. Automated Conveyor

- 9.2.3.1. Belt

- 9.2.3.2. Roller

- 9.2.3.3. Pallet

- 9.2.3.4. Overhead

- 9.2.4. Palletizer

- 9.2.4.1. Conventional

- 9.2.4.2. Robotic

- 9.2.5. Sortation System

- 9.2.1. Mobile Robots

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Airport

- 9.3.2. Automotive

- 9.3.3. Food and Beverage

- 9.3.4. Retail/W

- 9.3.5. General Manufacturing

- 9.3.6. Pharmaceuticals

- 9.3.7. Post and Parcel

- 9.3.8. Electronics and Semiconductor Manufacturing

- 9.3.9. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific APAC Automated Material Handling and Storage Systems Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Equipment Type

- 10.2.1. Mobile Robots

- 10.2.1.1. Automated Guided Vehicle (AGV)

- 10.2.1.1.1. Automated Forklift

- 10.2.1.1.2. Automated Tow/Tractor/Tug

- 10.2.1.1.3. Unit Load

- 10.2.1.1.4. Assembly Line

- 10.2.1.1.5. Special Purpose

- 10.2.1.2. Autonomous Mobile Robots (AMR)

- 10.2.1.1. Automated Guided Vehicle (AGV)

- 10.2.2. Automated Storage and Retrieval System (ASRS)

- 10.2.2.1. Fixed Aisle

- 10.2.2.2. Carousel

- 10.2.2.3. Vertical Lift Module

- 10.2.3. Automated Conveyor

- 10.2.3.1. Belt

- 10.2.3.2. Roller

- 10.2.3.3. Pallet

- 10.2.3.4. Overhead

- 10.2.4. Palletizer

- 10.2.4.1. Conventional

- 10.2.4.2. Robotic

- 10.2.5. Sortation System

- 10.2.1. Mobile Robots

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Airport

- 10.3.2. Automotive

- 10.3.3. Food and Beverage

- 10.3.4. Retail/W

- 10.3.5. General Manufacturing

- 10.3.6. Pharmaceuticals

- 10.3.7. Post and Parcel

- 10.3.8. Electronics and Semiconductor Manufacturing

- 10.3.9. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America APAC Automated Material Handling and Storage Systems Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe APAC Automated Material Handling and Storage Systems Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 France

- 12.1.3 Italy

- 12.1.4 Germany

- 12.1.5 Rest of Europe

- 13. Asia Pacific APAC Automated Material Handling and Storage Systems Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Rest of Asia Pacific

- 14. Latin America APAC Automated Material Handling and Storage Systems Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Mexico

- 14.1.4 Rest of Latin America

- 15. Middle East and Africa APAC Automated Material Handling and Storage Systems Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Israel

- 15.1.3 Saudi Arabia

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 System Logistics

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Jungheinrich AG

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Murata Machinery Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Interroll Group

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 BEUMER Group GmbH & Co KG

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 VisionNav Robotics

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 SSI Schaefer AG

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Witron Logistik

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 KION Group

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Kardex Group

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 JBT Corporation

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Honeywell Intelligrated Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Daifuku Co Ltd

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Toyota Industries Corporation

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Kuka AG

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 System Logistics

List of Figures

- Figure 1: Global APAC Automated Material Handling and Storage Systems Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 15: North America APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 16: North America APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 21: South America APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: South America APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 23: South America APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 24: South America APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: South America APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: South America APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: South America APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Europe APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Europe APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 31: Europe APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 32: Europe APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Europe APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Europe APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East & Africa APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Middle East & Africa APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Middle East & Africa APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 39: Middle East & Africa APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 40: Middle East & Africa APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Middle East & Africa APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Middle East & Africa APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 45: Asia Pacific APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 46: Asia Pacific APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 47: Asia Pacific APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 48: Asia Pacific APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 49: Asia Pacific APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 50: Asia Pacific APAC Automated Material Handling and Storage Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific APAC Automated Material Handling and Storage Systems Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 4: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Mexico APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Latin America APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South Africa APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Israel APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Saudi Arabia APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Middle East and Africa APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 32: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 33: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 39: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 40: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Brazil APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Argentina APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of South America APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 45: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 46: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 47: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: United Kingdom APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Germany APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: France APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Italy APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Spain APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Russia APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Benelux APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Nordics APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 58: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 59: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 60: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 61: Turkey APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Israel APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: GCC APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: North Africa APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: South Africa APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of Middle East & Africa APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 68: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 69: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 70: Global APAC Automated Material Handling and Storage Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 71: China APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: India APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Japan APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: South Korea APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: ASEAN APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Oceania APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Rest of Asia Pacific APAC Automated Material Handling and Storage Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Automated Material Handling and Storage Systems Industry?

The projected CAGR is approximately 12.30%.

2. Which companies are prominent players in the APAC Automated Material Handling and Storage Systems Industry?

Key companies in the market include System Logistics, Jungheinrich AG, Murata Machinery Ltd, Interroll Group, BEUMER Group GmbH & Co KG, VisionNav Robotics, SSI Schaefer AG, Witron Logistik, KION Group, Kardex Group, JBT Corporation, Honeywell Intelligrated Inc, Daifuku Co Ltd, Toyota Industries Corporation, Kuka AG.

3. What are the main segments of the APAC Automated Material Handling and Storage Systems Industry?

The market segments include Product Type, Equipment Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements Aiding Market Growth; Industry 4.0 Investments driving the demand for automation and material Handling; Rapid Growth of E-commerce.

6. What are the notable trends driving market growth?

Assembly Line to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Initial Costs; Unavailability of Skilled Workforce.

8. Can you provide examples of recent developments in the market?

April 2022 - KION Battery Systems GmbH (KBS) expanded its production facility at the Karlstein site and set the next milestone in its path of growth and innovation. The company, a partnership between KION GROUP AG and BMZ Holding GmbH, has officially established a second production line for manufacturing 24-volt batteries used in mobile warehouse handling equipment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Automated Material Handling and Storage Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Automated Material Handling and Storage Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Automated Material Handling and Storage Systems Industry?

To stay informed about further developments, trends, and reports in the APAC Automated Material Handling and Storage Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence