Key Insights

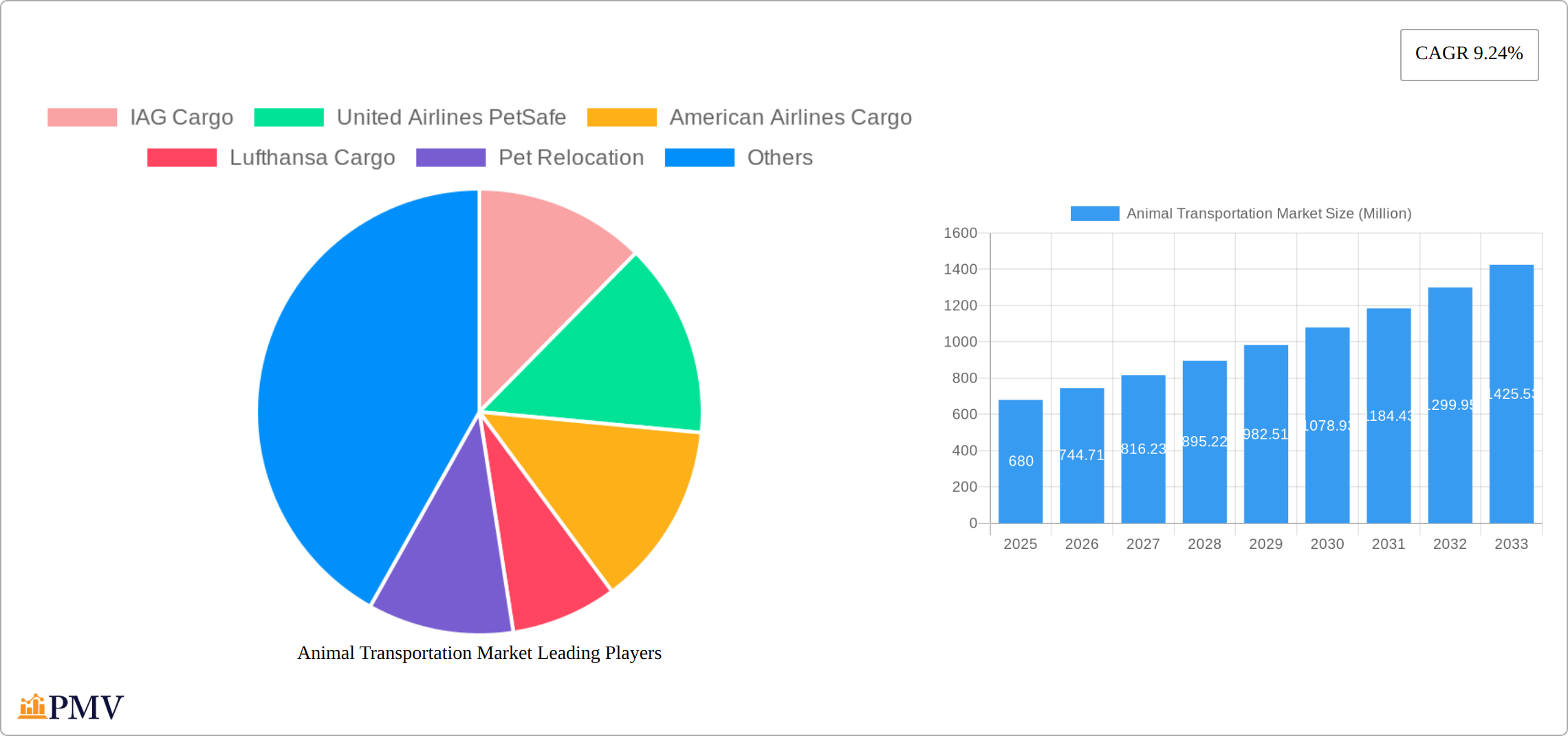

The global animal transportation market, valued at $0.68 billion in 2025, is projected to experience robust growth, driven by several key factors. Increasing pet ownership globally, coupled with rising disposable incomes and a growing human-animal bond, fuels demand for safe and reliable pet relocation services. The rise of e-commerce and online pet adoption platforms further contributes to this trend, creating a need for efficient and specialized transportation solutions. Furthermore, advancements in animal welfare regulations and the increasing availability of specialized pet carriers and airlines offering dedicated animal transport services are propelling market expansion. The market is segmented by service type (e.g., air, land, sea), animal type (dogs, cats, birds, etc.), and distance traveled.

Competition in the animal transportation market is moderately intense, with established players like IAG Cargo, United Airlines PetSafe, American Airlines Cargo, and Lufthansa Cargo alongside smaller specialized pet relocation companies like Pet Relocation, Happy Tail Travels, Air Animal Pet Movers, Starwood Animal Transport Services, and Pet Express. While air transport currently dominates, the market is witnessing a growing demand for land and sea transport options, especially for shorter distances or less urgent relocations. The market's growth trajectory, while positive, may be influenced by factors such as fluctuating fuel prices, economic downturns affecting consumer spending, and potential disruptions to global supply chains. The 9.24% CAGR suggests substantial growth opportunities over the forecast period (2025-2033), but precise regional breakdowns require additional data.

Animal Transportation Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Animal Transportation Market, covering the period 2019-2033. With a focus on market structure, competitive dynamics, industry trends, and future outlook, this report offers invaluable insights for businesses, investors, and stakeholders in the animal transportation sector. The base year for this analysis is 2025, with estimations for 2025 and forecasts extending to 2033.

Animal Transportation Market Market Structure & Competitive Dynamics

The animal transportation market exhibits a moderately concentrated structure, with key players holding significant market share. The market is characterized by a dynamic interplay of established airlines, specialized pet relocation services, and smaller niche players. Market concentration is estimated at xx%, with the top 5 players holding approximately xx% of the overall market share in 2025. Innovation within the sector is primarily driven by advancements in animal welfare technology, improved transportation infrastructure, and the development of specialized services catering to diverse animal species and transportation needs.

Regulatory frameworks, particularly concerning animal welfare and biosecurity, significantly influence market operations. Stringent regulations drive investment in compliant technologies and operational practices. Product substitutes, while limited, include alternative transportation modes (e.g., ground transport for shorter distances), posing a niche challenge to air and sea transport. End-user trends, such as increasing pet ownership and a growing awareness of animal welfare, fuel market growth. M&A activity in the sector is moderate, with deal values averaging xx Million in recent years. Notable acquisitions include (examples only, specific deals to be added based on research):

- Acquisition of xx company by xx company for xx Million in 2024.

- Merger of xx company and xx company in 2023 resulting in a combined market share of xx%.

Animal Transportation Market Industry Trends & Insights

The global animal transportation market is experiencing robust growth, projected to reach [Insert Updated Market Value] by 2033, exhibiting a CAGR of [Insert Updated CAGR]% during the forecast period (2025-2033). This significant expansion is fueled by a confluence of factors:

- Surging Pet Ownership: A global increase in pet ownership across diverse demographics is driving the demand for reliable and safe pet transportation services. Market penetration of pet transportation services is estimated at [Insert Updated 2025 Penetration]% in 2025, with projected growth to [Insert Updated 2033 Penetration]% by 2033. This upward trend is particularly strong in [Mention specific regions or demographics showing highest growth].

- Technological Advancements: Innovations in animal containment, such as improved climate-controlled transport vehicles and specialized crates, coupled with real-time GPS tracking and advanced monitoring systems, significantly enhance animal welfare and operational efficiency, driving market expansion. The adoption of [Mention specific technologies like AI-powered monitoring or drone delivery, if applicable] is further accelerating growth.

- Increased Cross-Border Travel and Relocation: The growing trend of international travel and relocation, both for individuals and businesses, is significantly boosting the demand for efficient and reliable animal transportation solutions. This includes both personal pet relocation and the transport of animals for research, exhibition, or breeding purposes.

- Evolving Consumer Preferences and Focus on Animal Welfare: Consumers are increasingly demanding premium, high-quality services that prioritize animal welfare. This heightened focus on ethical and humane transportation is fueling the growth of specialized pet relocation services offering personalized care and stress-reduction strategies.

- Stringent Regulations and Compliance: While adherence to increasingly stringent regulations presents challenges, it also fosters market credibility, ensures higher safety standards, and drives standardization across service providers, ultimately benefitting both animals and consumers.

Dominant Markets & Segments in Animal Transportation Market

The North American region currently dominates the animal transportation market, driven by high pet ownership rates and developed logistics infrastructure. Key factors contributing to its leading position include:

- High disposable incomes: High disposable incomes in North America allow pet owners to invest in premium pet transportation services.

- Robust logistics network: Well-developed transportation infrastructure enables efficient and timely delivery of animals across long distances.

- Favorable government policies: Supportive regulations foster market growth and encourage investment in the sector.

Other key regional markets with significant growth potential include Europe and Asia-Pacific, fueled by increasing pet ownership and growing awareness of animal welfare.

Animal Transportation Market Product Innovations

Recent innovations are prioritizing animal welfare throughout the transportation process. This includes the development of: improved climate-controlled containers with enhanced ventilation and temperature regulation; advanced GPS tracking systems providing real-time location and environmental data; specialized handling procedures to minimize stress and ensure the safety of animals; and the integration of [Mention any emerging technologies e.g., biometric monitoring systems or AI-driven route optimization]. These technological advancements are directly improving service quality, enhancing consumer trust, and contributing to increased market penetration by addressing the evolving demand for enhanced animal well-being.

Report Segmentation & Scope

This report segments the animal transportation market based on:

- Animal Type: This includes companion animals (dogs, cats, birds, etc.), livestock (cattle, pigs, poultry, etc.), zoo animals, and other animals. The companion animal segment currently holds the largest market share, driven by the aforementioned increase in pet ownership, while the livestock segment is significant due to the global food production industry.

- Transportation Mode: This covers air, sea, and road transport. While air freight remains dominant for long-distance transport due to its speed and efficiency, [mention trends like the growing use of road transport for shorter distances or the increasing role of specialized sea freight for larger animals].

- Service Type: This includes pet relocation services, livestock transportation, zoological animal transport, equine transport, and other specialized services (e.g., wildlife rescue and rehabilitation transportation). Pet relocation services, catering to the growing luxury pet travel market, represent a significant high-growth segment.

- Geographic Region: The market is segmented across North America, Europe, Asia-Pacific, and the Rest of the World (ROW), with [mention regions showing fastest growth or unique market characteristics].

Key Drivers of Animal Transportation Market Growth

Several factors drive the growth of the animal transportation market. These include:

- Rising disposable incomes globally: Increased purchasing power allows consumers to spend more on pet-related services, including transportation.

- Technological advancements in animal welfare: Innovations in tracking devices, climate-controlled transportation, and improved handling practices are increasing demand for high-quality services.

- Stringent animal welfare regulations: Although imposing compliance costs, these regulations create a more standardized and reliable market.

Challenges in the Animal Transportation Market Sector

Challenges include:

- Stringent regulations and compliance costs: Meeting strict animal welfare standards requires significant investment in infrastructure and technology.

- Supply chain disruptions: Global events (e.g., pandemics) can severely impact the availability of transportation resources.

- Fluctuations in fuel prices: Fuel costs significantly impact transportation expenses and profitability, particularly in air and sea freight.

- Competition from established players and new entrants: The market faces competition from established airlines and emerging specialized service providers.

Leading Players in the Animal Transportation Market Market

- IAG Cargo

- United Airlines PetSafe

- American Airlines Cargo

- Lufthansa Cargo

- Pet Relocation

- Happy Tail Travels

- Air Animal Pet Movers

- Starwood Animal Transport Services

- Pet Express

- Pet Air Carrier

- 63 Other Companies

Key Developments in Animal Transportation Market Sector

- December 2023: The European Union (EU) proposed significant overhauls to animal welfare regulations in transportation, incorporating cutting-edge research and technology. This will drive investment in compliant solutions and impact market operations across Europe.

- May 2024: The UK Government banned the export of live animals for slaughter, impacting livestock transportation within and from the UK. This strengthens the focus on ethical and humane animal transport practices.

Strategic Animal Transportation Market Market Outlook

The animal transportation market presents significant growth opportunities driven by factors like rising pet ownership, technological advancements, and evolving consumer preferences. Strategic investments in advanced technologies, development of specialized services, and expansion into new geographical markets will be crucial for achieving sustainable growth. Focus on enhancing animal welfare and adhering to increasingly stringent regulations will be critical for success in this evolving market.

Animal Transportation Market Segmentation

-

1. Type

- 1.1. Livestock

- 1.2. Pets

- 1.3. Others

Animal Transportation Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

- 5. South America

Animal Transportation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing pet ownership driving the market4.; Increased awareness of animal welfare driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing pet ownership driving the market4.; Increased awareness of animal welfare driving the market

- 3.4. Market Trends

- 3.4.1. Growing pet adoption rates

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Animal Transportation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Livestock

- 5.1.2. Pets

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Animal Transportation Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Livestock

- 6.1.2. Pets

- 6.1.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Animal Transportation Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Livestock

- 7.1.2. Pets

- 7.1.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Animal Transportation Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Livestock

- 8.1.2. Pets

- 8.1.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East Animal Transportation Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Livestock

- 9.1.2. Pets

- 9.1.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Animal Transportation Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Livestock

- 10.1.2. Pets

- 10.1.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IAG Cargo

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 United Airlines PetSafe

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 American Airlines Cargo

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lufthansa Cargo

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pet Relocation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Happy Tail Travels

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Air Animal Pet Movers

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Starwood Animal Transport Services

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pet Express

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pet Air Carrier**List Not Exhaustive 6 3 Other Companie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 IAG Cargo

List of Figures

- Figure 1: Global Animal Transportation Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Animal Transportation Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Animal Transportation Market Revenue (Million), by Type 2024 & 2032

- Figure 4: North America Animal Transportation Market Volume (Billion), by Type 2024 & 2032

- Figure 5: North America Animal Transportation Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Animal Transportation Market Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Animal Transportation Market Revenue (Million), by Country 2024 & 2032

- Figure 8: North America Animal Transportation Market Volume (Billion), by Country 2024 & 2032

- Figure 9: North America Animal Transportation Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Animal Transportation Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Europe Animal Transportation Market Revenue (Million), by Type 2024 & 2032

- Figure 12: Europe Animal Transportation Market Volume (Billion), by Type 2024 & 2032

- Figure 13: Europe Animal Transportation Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: Europe Animal Transportation Market Volume Share (%), by Type 2024 & 2032

- Figure 15: Europe Animal Transportation Market Revenue (Million), by Country 2024 & 2032

- Figure 16: Europe Animal Transportation Market Volume (Billion), by Country 2024 & 2032

- Figure 17: Europe Animal Transportation Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Animal Transportation Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Asia Pacific Animal Transportation Market Revenue (Million), by Type 2024 & 2032

- Figure 20: Asia Pacific Animal Transportation Market Volume (Billion), by Type 2024 & 2032

- Figure 21: Asia Pacific Animal Transportation Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Asia Pacific Animal Transportation Market Volume Share (%), by Type 2024 & 2032

- Figure 23: Asia Pacific Animal Transportation Market Revenue (Million), by Country 2024 & 2032

- Figure 24: Asia Pacific Animal Transportation Market Volume (Billion), by Country 2024 & 2032

- Figure 25: Asia Pacific Animal Transportation Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Animal Transportation Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Middle East Animal Transportation Market Revenue (Million), by Type 2024 & 2032

- Figure 28: Middle East Animal Transportation Market Volume (Billion), by Type 2024 & 2032

- Figure 29: Middle East Animal Transportation Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East Animal Transportation Market Volume Share (%), by Type 2024 & 2032

- Figure 31: Middle East Animal Transportation Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Middle East Animal Transportation Market Volume (Billion), by Country 2024 & 2032

- Figure 33: Middle East Animal Transportation Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East Animal Transportation Market Volume Share (%), by Country 2024 & 2032

- Figure 35: South America Animal Transportation Market Revenue (Million), by Type 2024 & 2032

- Figure 36: South America Animal Transportation Market Volume (Billion), by Type 2024 & 2032

- Figure 37: South America Animal Transportation Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: South America Animal Transportation Market Volume Share (%), by Type 2024 & 2032

- Figure 39: South America Animal Transportation Market Revenue (Million), by Country 2024 & 2032

- Figure 40: South America Animal Transportation Market Volume (Billion), by Country 2024 & 2032

- Figure 41: South America Animal Transportation Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: South America Animal Transportation Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Animal Transportation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Animal Transportation Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Animal Transportation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Animal Transportation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Global Animal Transportation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Animal Transportation Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Global Animal Transportation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Global Animal Transportation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 9: Global Animal Transportation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Animal Transportation Market Volume Billion Forecast, by Country 2019 & 2032

- Table 11: Global Animal Transportation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global Animal Transportation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Global Animal Transportation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Animal Transportation Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Global Animal Transportation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Animal Transportation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 17: Global Animal Transportation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Animal Transportation Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Global Animal Transportation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Animal Transportation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 21: Global Animal Transportation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Animal Transportation Market Volume Billion Forecast, by Country 2019 & 2032

- Table 23: Global Animal Transportation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Animal Transportation Market Volume Billion Forecast, by Type 2019 & 2032

- Table 25: Global Animal Transportation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Animal Transportation Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Animal Transportation Market?

The projected CAGR is approximately 9.24%.

2. Which companies are prominent players in the Animal Transportation Market?

Key companies in the market include IAG Cargo, United Airlines PetSafe, American Airlines Cargo, Lufthansa Cargo, Pet Relocation, Happy Tail Travels, Air Animal Pet Movers, Starwood Animal Transport Services, Pet Express, Pet Air Carrier**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Animal Transportation Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.68 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing pet ownership driving the market4.; Increased awareness of animal welfare driving the market.

6. What are the notable trends driving market growth?

Growing pet adoption rates.

7. Are there any restraints impacting market growth?

4.; Increasing pet ownership driving the market4.; Increased awareness of animal welfare driving the market.

8. Can you provide examples of recent developments in the market?

May 2024: The UK Government has officially banned the practice of exporting live animals for slaughter by passing the Animal Welfare (Livestock Exports) Bill. The bill aims to cease the export of UK livestock for fattening and slaughter and builds upon the foundations laid by the Animal Welfare (Kept Animals) Bill.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Animal Transportation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Animal Transportation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Animal Transportation Market?

To stay informed about further developments, trends, and reports in the Animal Transportation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence