Key Insights

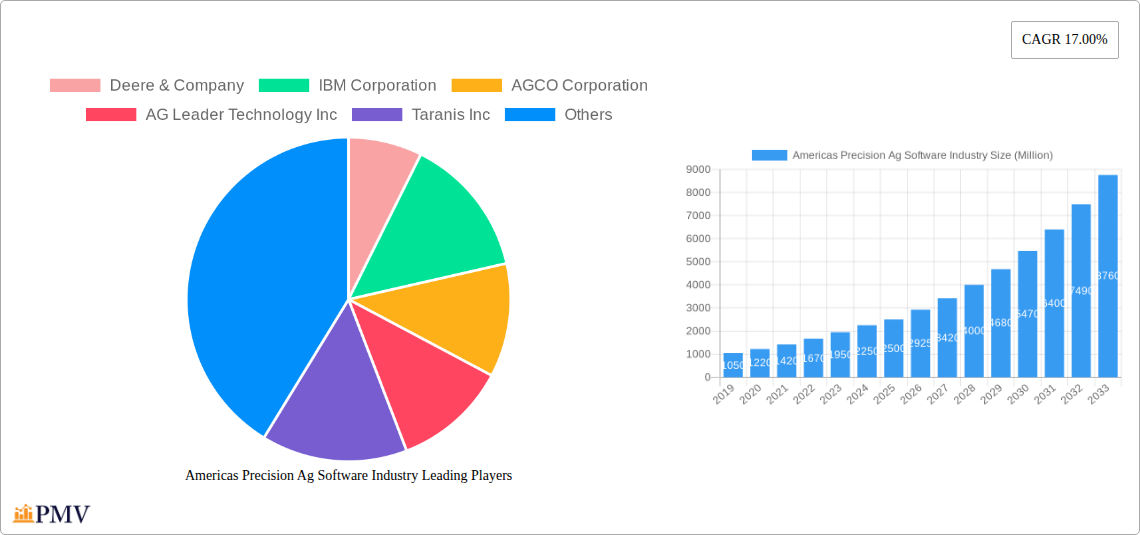

The Americas Precision Ag Software market is poised for significant expansion, projected to reach an impressive market size of USD 2,500 Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 17.00% through 2033. This surge is primarily fueled by the increasing adoption of advanced technologies in agriculture across the United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, and Peru. Key drivers include the escalating demand for enhanced crop yields, reduced operational costs, and sustainable farming practices. Farmers are increasingly recognizing the value of data-driven decision-making, leveraging precision agriculture software to optimize resource allocation for fertilizers, pesticides, and water. The shift towards cloud-based solutions is a major trend, offering greater accessibility, scalability, and real-time data analytics capabilities. This technological evolution is instrumental in addressing the challenges posed by climate change and a growing global population.

Americas Precision Ag Software Industry Market Size (In Billion)

The market's growth trajectory is further supported by a confluence of technological advancements and supportive government initiatives aimed at modernizing agricultural practices. However, certain restraints may temper this growth, such as the high initial investment costs associated with implementing precision agriculture systems and a potential lack of awareness or digital literacy among a segment of the farming community. Despite these hurdles, the long-term outlook remains exceptionally positive. The increasing integration of AI and machine learning within precision ag software is set to unlock new frontiers in predictive analytics, disease detection, and automated farm management. Furthermore, the expanding network of IoT devices in agriculture is continuously generating a wealth of data, which, when analyzed by sophisticated software, empowers farmers to make more informed and profitable decisions, solidifying the Americas' position as a leader in agricultural innovation.

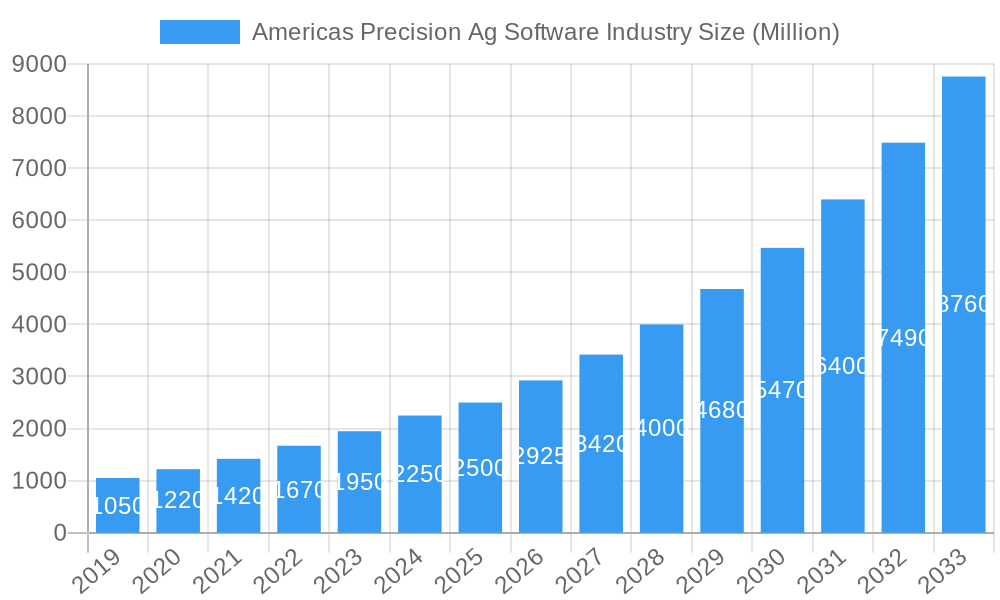

Americas Precision Ag Software Industry Company Market Share

Americas Precision Ag Software Industry: Market Analysis, Trends, and Strategic Outlook 2025-2033

Unlock the future of agriculture with the comprehensive Americas Precision Ag Software Industry report. This in-depth analysis delves into market structure, competitive dynamics, emerging trends, and growth strategies for precision agriculture software across North and South America. Driven by innovations in farm management software, data analytics, IoT in agriculture, and AI in farming, the market is set to witness significant expansion. Discover key players like Deere & Company, IBM Corporation, AGCO Corporation, Trimble Inc., and Bayer CropScience AG as they navigate the evolving landscape of digital agriculture and smart farming solutions. With a study period spanning from 2019 to 2033, and a base year of 2025, this report provides a robust forecast of market penetration, technological advancements, and regional dominance, essential for stakeholders seeking to capitalize on the burgeoning precision agriculture market.

Americas Precision Ag Software Industry Market Structure & Competitive Dynamics

The Americas Precision Ag Software Industry exhibits a dynamic market structure characterized by a blend of established agricultural giants and agile technology innovators. Market concentration varies by segment, with larger corporations like Deere & Company and IBM Corporation holding significant market share in the enterprise-level solutions, particularly in farm management software. However, the rise of specialized companies such as Taranis Inc. and AgDNA Technologies Inc. highlights a vibrant innovation ecosystem focused on specific applications like crop monitoring software and yield prediction. Regulatory frameworks, while supportive of technological adoption for enhanced efficiency and sustainability, can introduce complexities, especially concerning data privacy and agricultural subsidies. Product substitutes, while present in traditional farming methods, are increasingly being displaced by integrated precision farming technology. End-user trends strongly favor data-driven decision-making, leading to increased adoption of cloud-based precision agriculture solutions and web-based farm management platforms. Mergers and acquisitions (M&A) play a crucial role in shaping the competitive landscape, with notable deals (estimated deal values ranging from xx to xx Million USD) aimed at consolidating market share and acquiring cutting-edge technologies. Key M&A activities are anticipated to continue, driving further integration of services and expansion of product portfolios.

Americas Precision Ag Software Industry Industry Trends & Insights

The Americas Precision Ag Software Industry is experiencing a robust growth trajectory, propelled by a confluence of market growth drivers and technological disruptions. The increasing demand for enhanced crop yields and improved farm profitability, coupled with a growing awareness of sustainable agricultural practices, are primary market growth drivers. Technological advancements in areas such as Artificial Intelligence (AI), the Internet of Things (IoT), and Big Data analytics are fundamentally reshaping how farmers manage their operations. These technologies enable real-time monitoring, predictive analytics for pest and disease outbreaks, optimized resource allocation (water, fertilizers, pesticides), and enhanced crop yield optimization.

Consumer preferences are increasingly leaning towards food traceability and sustainability, further incentivizing the adoption of precision farming technologies that can provide verifiable data on farming practices. Competitive dynamics are intense, with established players continually innovating and smaller, niche players carving out specific market segments. The market penetration of digital farm management solutions is steadily increasing, particularly in regions with higher agricultural output and greater technological infrastructure.

Specific metrics highlight this expansion: The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period (2025–2033). Market penetration for key precision agriculture software solutions is expected to reach over xx% of the total addressable agricultural land in the Americas by 2033. The adoption of IoT sensors for agriculture is also projected to grow exponentially, feeding valuable data into these software platforms. The development of user-friendly interfaces and mobile applications is crucial for broader adoption, catering to a wider range of farmers, including those in developing regions of the Americas. Furthermore, the integration of drone technology and satellite imagery analytics is providing unprecedented insights into crop health and field variability, driving demand for sophisticated farm analytics software. The continuous evolution of AI algorithms is enabling more accurate predictions and automated decision-making, pushing the boundaries of what is possible in precision agriculture.

Dominant Markets & Segments in Americas Precision Ag Software Industry

Within the Americas Precision Ag Software Industry, the United States stands out as the dominant market, driven by its advanced agricultural infrastructure, high adoption rates of technology, and significant government support for innovation. Economic policies that encourage the adoption of precision agriculture solutions, coupled with robust investment in research and development, solidify the US's leadership position. The infrastructure supporting widespread internet connectivity and advanced machinery integration is also a key driver.

Among the segments, Cloud-based precision agriculture software is experiencing unparalleled dominance. This is primarily due to the inherent scalability, accessibility, and cost-effectiveness of cloud solutions. Farmers can access their data and management tools from anywhere, on any device, facilitating remote monitoring and decision-making. The ability of cloud platforms to handle vast amounts of data generated by IoT devices in agriculture, coupled with advanced analytics capabilities, further cements their leading position.

- Key Drivers for Cloud Dominance:

- Scalability and Flexibility: Cloud platforms can easily scale to accommodate growing data volumes and user bases, offering flexibility for farms of all sizes.

- Accessibility and Remote Management: Farmers can access critical data and control systems remotely, improving efficiency and responsiveness.

- Data Integration and Analytics: Cloud environments are ideal for integrating data from various sources (sensors, drones, machinery) for comprehensive analysis.

- Lower Upfront Costs: Compared to on-premises solutions, cloud-based software typically involves lower initial investment, making it more accessible.

- Automatic Updates and Maintenance: Cloud providers handle software updates and maintenance, reducing the IT burden on farmers.

The Local/Web-based segment still holds a significant presence, particularly for farmers who prefer direct control over their data or have limited internet connectivity in certain rural areas. However, the trend is clearly shifting towards cloud solutions due to their superior capabilities in handling the complexity and volume of data generated by modern precision farming technologies. The integration of AI and machine learning algorithms, which require substantial processing power, also favors the cloud infrastructure. The growth in adoption of precision spraying technology, variable rate application systems, and automated irrigation systems all contribute to the demand for integrated, data-driven platforms, which are predominantly cloud-based. Countries like Canada and Brazil are also significant contributors to the overall market growth, with increasing investments in agritech solutions.

Americas Precision Ag Software Industry Product Innovations

Product innovations in the Americas Precision Ag Software Industry are primarily focused on enhancing data utilization, automation, and predictive capabilities. Companies are developing more sophisticated AI-powered crop analysis tools that can identify diseases and nutrient deficiencies with high accuracy. Advancements in IoT sensor technology are enabling granular data collection on soil moisture, temperature, and pest activity. Competitive advantages are being derived from seamlessly integrating these data streams into intuitive farm management dashboards and providing actionable insights for yield optimization and resource management. The development of autonomous farming equipment integration capabilities is also a key trend, allowing software to directly control machinery for precise operations.

Report Segmentation & Scope

This report meticulously segments the Americas Precision Ag Software Industry by Type: Cloud and Local/Web-based. The Cloud-based segment is projected to dominate the market, driven by its scalability, accessibility, and advanced analytics capabilities. Market size for this segment is estimated at $xx Million in 2025, with a projected growth to $xx Million by 2033, exhibiting a CAGR of xx%. Competitive dynamics within this segment are characterized by intense innovation and strategic partnerships.

The Local/Web-based segment is also a vital part of the market, catering to specific user needs and connectivity constraints. Its market size is estimated at $xx Million in 2025, with a projected growth to $xx Million by 2033, at a CAGR of xx%. While experiencing slower growth compared to cloud solutions, this segment offers distinct advantages in terms of data control and offline functionality.

Key Drivers of Americas Precision Ag Software Industry Growth

Several key factors are propelling the growth of the Americas Precision Ag Software Industry. Technologically, the relentless advancements in AI, IoT, and Big Data analytics are enabling more sophisticated precision farming solutions, from real-time crop monitoring to predictive pest management. Economically, the increasing need for higher crop yields to feed a growing global population, coupled with volatile commodity prices, drives farmers to adopt technologies that enhance efficiency and reduce input costs. Regulatory factors, such as government incentives for sustainable agriculture and the push for data-driven traceability, also play a significant role. For instance, initiatives promoting digital agriculture and environmental stewardship encourage investment in farm management software.

Challenges in the Americas Precision Ag Software Industry Sector

Despite robust growth, the Americas Precision Ag Software Industry faces several challenges. Regulatory hurdles related to data ownership and privacy can create uncertainty for both developers and end-users. Supply chain issues, particularly for specialized hardware components required for IoT in agriculture, can impact product availability and timelines. Furthermore, competitive pressures from established players and the continuous need for innovation to stay ahead of emerging technologies require substantial investment. The digital divide, where limited internet access in certain rural areas restricts the adoption of cloud-based precision agriculture solutions, remains a significant barrier to full market penetration. Quantifiable impacts include delayed product rollouts and increased development costs.

Leading Players in the Americas Precision Ag Software Industry Market

- Deere & Company

- IBM Corporation

- AGCO Corporation

- AG Leader Technology Inc

- Taranis Inc

- AGJunction Inc

- Harris Geospatial Solutions Inc

- Trimble Inc

- AgDNA Technologies Inc

- Granular Inc

- Bayer CropScience AG

Key Developments in Americas Precision Ag Software Industry Sector

- 2023/09: Launch of advanced AI-driven disease prediction modules for crop management software, significantly enhancing early detection and intervention capabilities.

- 2023/11: Major merger between two leading agritech companies, consolidating their offerings in IoT-enabled farm monitoring and data analytics platforms. Estimated deal value: $xxx Million.

- 2024/01: Introduction of new cloud-based precision spraying technology integration, enabling hyper-targeted application of inputs and reduced environmental impact.

- 2024/03: Expansion of precision agriculture software offerings into South American markets, focusing on scalable solutions for diverse farming operations.

- 2024/06: Release of enhanced yield prediction algorithms leveraging machine learning for more accurate forecasting and optimized harvest planning.

Strategic Americas Precision Ag Software Industry Market Outlook

The strategic outlook for the Americas Precision Ag Software Industry is overwhelmingly positive, driven by accelerating adoption of digital agriculture and a persistent demand for data-driven farming. Future market potential lies in further integration of AI and machine learning for predictive analytics, autonomous operations, and personalized farm management. Strategic opportunities exist in developing more user-friendly interfaces that cater to a broader range of farmers, including smallholders. The increasing focus on sustainable agriculture and food security will continue to drive investments in smart farming solutions, creating a fertile ground for growth and innovation in the precision agriculture market. Expansion into emerging technologies like blockchain for supply chain traceability also presents significant avenues for strategic development.

Americas Precision Ag Software Industry Segmentation

-

1. Type

- 1.1. Cloud

- 1.2. Local/Web-based

Americas Precision Ag Software Industry Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Brazil

- 1.5. Argentina

- 1.6. Chile

- 1.7. Colombia

- 1.8. Peru

Americas Precision Ag Software Industry Regional Market Share

Geographic Coverage of Americas Precision Ag Software Industry

Americas Precision Ag Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Adoption of Precision Technology in the Sustainable and Efficient Agriculture Sector in Americas; Shortage of Farm labor

- 3.2.2 Along with Increasing Farm Size Across North America

- 3.3. Market Restrains

- 3.3.1. ; High Capital Cost and Complexity Regarding System Upgrades

- 3.4. Market Trends

- 3.4.1. Cloud-based Precision Farming Software is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Americas Precision Ag Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cloud

- 5.1.2. Local/Web-based

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Americas

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deere & Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AGCO Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AG Leader Technology Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Taranis Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGJunction Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Harris Geospatial Solutions Inc *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trimble Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AgDNA Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Granular Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bayer CropScience AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Deere & Company

List of Figures

- Figure 1: Americas Precision Ag Software Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Americas Precision Ag Software Industry Share (%) by Company 2025

List of Tables

- Table 1: Americas Precision Ag Software Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Americas Precision Ag Software Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Americas Precision Ag Software Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Americas Precision Ag Software Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Brazil Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Argentina Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Chile Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Colombia Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Peru Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Americas Precision Ag Software Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Americas Precision Ag Software Industry?

Key companies in the market include Deere & Company, IBM Corporation, AGCO Corporation, AG Leader Technology Inc, Taranis Inc, AGJunction Inc, Harris Geospatial Solutions Inc *List Not Exhaustive, Trimble Inc, AgDNA Technologies Inc, Granular Inc, Bayer CropScience AG.

3. What are the main segments of the Americas Precision Ag Software Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Adoption of Precision Technology in the Sustainable and Efficient Agriculture Sector in Americas; Shortage of Farm labor. Along with Increasing Farm Size Across North America.

6. What are the notable trends driving market growth?

Cloud-based Precision Farming Software is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

; High Capital Cost and Complexity Regarding System Upgrades.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Americas Precision Ag Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Americas Precision Ag Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Americas Precision Ag Software Industry?

To stay informed about further developments, trends, and reports in the Americas Precision Ag Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence