Key Insights

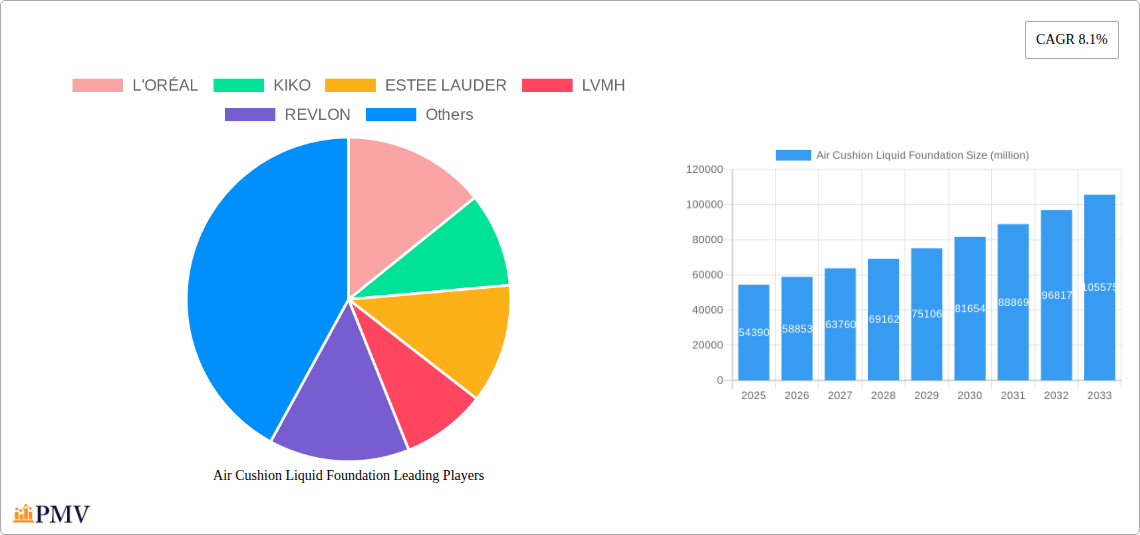

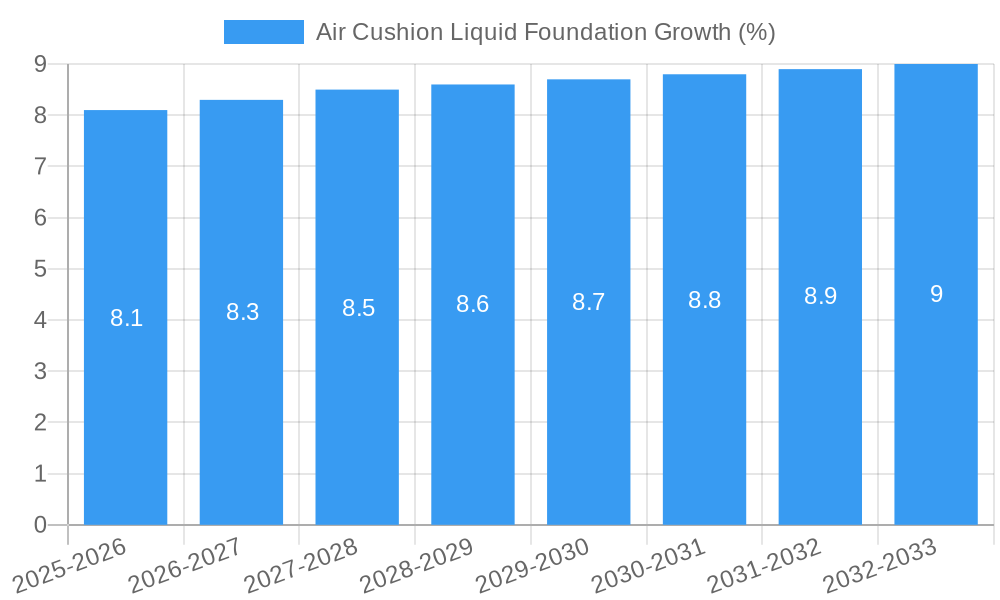

The global Air Cushion Liquid Foundation market is poised for significant expansion, projected to reach a substantial market size of $54,390 million by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 8.1% throughout the forecast period of 2025-2033. The inherent convenience and innovative delivery system of air cushion foundations, offering a lightweight feel, buildable coverage, and portability, are key drivers attracting a broad consumer base. These foundations cater to a diverse range of skincare needs and cosmetic preferences, making them a popular choice for both everyday wear and special occasions. The market is segmented by application, with the '20 to 30' and '30 to 40' age demographics representing significant consumer groups likely to drive demand, owing to their increasing disposable income and focus on sophisticated beauty routines. Furthermore, the 'Sheer' and 'Light' coverage types are expected to dominate due to the prevailing trend towards natural-looking makeup.

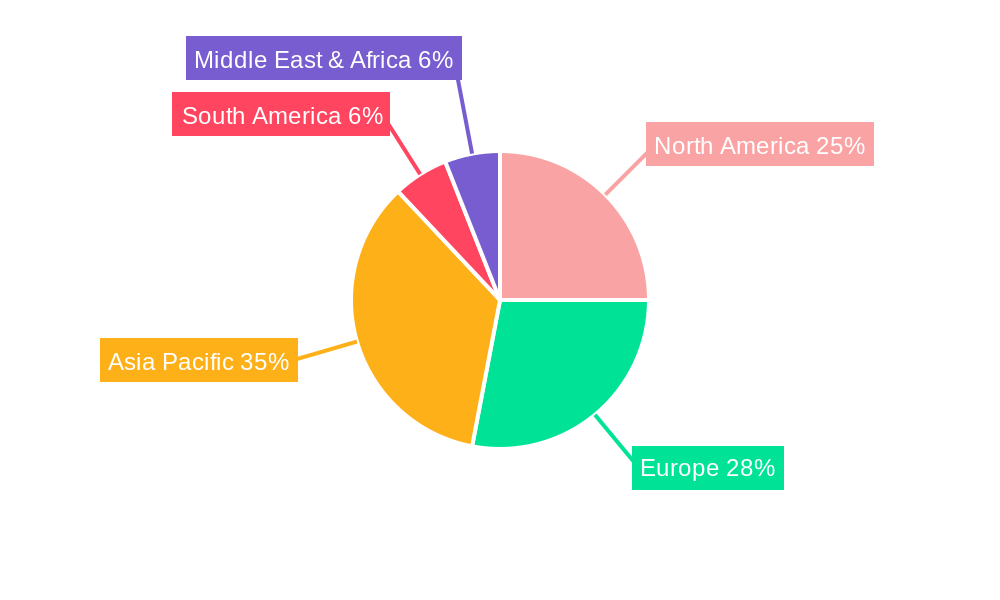

The competitive landscape is characterized by the presence of major global beauty conglomerates such as L'ORÉAL, ESTEE LAUDER, LVMH, and REVLON, alongside specialized brands like KIKO and Christian Dior, all actively innovating within the air cushion foundation segment. Asia Pacific, particularly China and South Korea, is a leading region in adoption and innovation, influencing global trends. North America and Europe also represent substantial markets, with consumers increasingly seeking hybrid products that offer skincare benefits alongside cosmetic enhancements. While the market demonstrates strong growth potential, potential restraints could include intense competition, the need for continuous product innovation to combat market saturation, and the impact of economic fluctuations on consumer discretionary spending. Nevertheless, the ongoing emphasis on clean beauty, sustainable packaging, and advanced formulation technologies is expected to further propel the market forward.

This in-depth market research report delivers a meticulous analysis of the global Air Cushion Liquid Foundation market, covering the historical period from 2019 to 2024, a base year of 2025, and an extensive forecast period extending to 2033. We provide unparalleled insights into market dynamics, consumer behavior, technological advancements, and competitive strategies that are shaping the future of air cushion foundations. This report is essential for stakeholders seeking to capitalize on the booming demand for lightweight, long-lasting, and skin-benefiting cosmetic innovations. With projected market sizes in the billions, understanding the intricate factors driving growth and the competitive landscape is paramount.

Air Cushion Liquid Foundation Market Structure & Competitive Dynamics

The global Air Cushion Liquid Foundation market exhibits a dynamic and evolving structure, characterized by a mix of established beauty conglomerates and agile emerging brands. Market concentration varies across regions, with mature markets like North America and Europe demonstrating higher consolidation, while Asia Pacific showcases rapid growth and fragmentation. Innovation ecosystems are robust, fueled by significant R&D investments from major players. Regulatory frameworks, while generally supportive of cosmetic product safety, present varied compliance requirements across different jurisdictions, impacting market entry and product formulations. Product substitutes, including traditional liquid foundations, powders, and BB/CC creams, exert competitive pressure, but the unique application and sensorial experience of air cushion foundations continue to carve out a distinct niche. End-user trends lean towards demand for skincare benefits integrated into makeup, customizable coverage, and clean beauty formulations. Merger and acquisition (M&A) activities are notable, with companies strategically acquiring smaller, innovative brands to expand their product portfolios and market reach. For instance, significant M&A deals valued in the hundreds of millions have been observed as companies vie for market share and technological leadership in this premium segment. The overall market is highly competitive, demanding continuous innovation and responsive marketing strategies to maintain relevance.

Air Cushion Liquid Foundation Industry Trends & Insights

The Air Cushion Liquid Foundation industry is experiencing a period of robust expansion, driven by a confluence of powerful market growth drivers. The increasing consumer preference for effortless application, a natural-looking finish, and multi-functional products that offer skincare benefits alongside cosmetic coverage is a primary catalyst. Technological disruptions, such as advancements in formulation science leading to lighter textures, improved longevity, and enhanced skincare properties (e.g., SPF, hydration, anti-aging), are significantly impacting product development. Furthermore, the rise of social media influence and the continuous stream of beauty tutorials showcasing the ease and efficacy of air cushion foundations contribute to heightened consumer awareness and adoption. The growing disposable income in emerging economies and the expanding middle-class population are also key contributors, increasing accessibility to premium beauty products. The competitive dynamics are intense, with brands differentiating themselves through unique ingredient stories, innovative packaging, and targeted marketing campaigns. The Compound Annual Growth Rate (CAGR) for the air cushion foundation market is estimated to be a healthy XX%, with market penetration steadily increasing across demographics. Key industry developments include the integration of advanced skincare actives, the exploration of sustainable packaging solutions, and the personalization of shades and finishes to cater to a wider spectrum of skin tones and preferences. The market penetration for air cushion foundations, which stood at XX% in 2023, is projected to reach XX% by 2033, signifying substantial growth potential.

Dominant Markets & Segments in Air Cushion Liquid Foundation

The global Air Cushion Liquid Foundation market's dominance is clearly established within specific geographical regions and demographic segments, reflecting diverse consumer needs and purchasing power.

Leading Region: Asia Pacific, particularly South Korea and China, continues to be the dominant force in the air cushion liquid foundation market. This dominance is attributed to:

- Early Adoption & Trendsetting: South Korea's K-beauty influence has been instrumental in popularizing cushion foundations globally, setting trends in formulation and packaging.

- High Demand for Natural Looks: Asian consumers often prefer a dewy, lightweight finish, which air cushion foundations excel at providing.

- Economic Policies & Infrastructure: Favorable economic conditions and robust retail and e-commerce infrastructure facilitate market penetration and accessibility.

- Technological Innovation: Local brands are at the forefront of developing innovative formulas and packaging.

Dominant Country: China represents the largest single market by revenue and volume, driven by a massive consumer base and rapidly growing interest in premium beauty products.

Dominant Application Segment: The 20 to 30 age group is the most dominant application segment. This is due to:

- Tech-Savvy Consumers: This demographic is highly engaged with social media, beauty influencers, and online purchasing channels, where air cushion foundations are frequently promoted.

- Interest in Trendy Products: Young adults are more receptive to adopting new beauty trends and seeking innovative product formats.

- Desire for Flawless, Effortless Application: This group often seeks quick and easy makeup solutions that provide a polished look for daily wear and social media.

- Disposable Income: A significant portion of this segment has increasing disposable income to spend on beauty and personal care.

Dominant Type Segment: Medium coverage type dominates the market. This preference stems from its versatility, offering sufficient coverage to even out skin tone and conceal minor imperfections without appearing heavy or cakey. This balance caters to a broad range of consumers seeking a natural yet perfected complexion.

Key Drivers for Segment Dominance:

- Cultural Influences: Beauty standards and preferred aesthetics play a crucial role in segment dominance.

- Marketing & Branding: Targeted marketing campaigns by brands effectively reach and resonate with specific age groups and coverage preferences.

- Product Affordability & Accessibility: The price point and availability of air cushion foundations influence their adoption across different segments.

- Evolving Consumer Preferences: A continuous shift towards lightweight, skin-friendly formulations favors medium-coverage options that mimic natural skin.

Air Cushion Liquid Foundation Product Innovations

Product innovations in the air cushion liquid foundation market are intensely focused on enhancing user experience and delivering added skincare benefits. Companies are actively developing formulas with improved longevity, transfer-resistance, and a wider spectrum of shade offerings to cater to diverse skin tones. Technological advancements are leading to lighter, more breathable textures, often incorporating advanced skincare ingredients like hyaluronic acid for hydration, vitamin C for brightening, and SPF for sun protection. This integration of "skincare-in-makeup" is a significant competitive advantage, appealing to consumers seeking multi-functional beauty solutions. Innovations in cushion delivery systems also aim to optimize product dispensing and hygiene. These advancements collectively contribute to a superior product performance and align with evolving consumer demands for efficacy and wellness in their beauty routines, ensuring market relevance and driving consumer loyalty.

Report Segmentation & Scope

This comprehensive report meticulously segments the Air Cushion Liquid Foundation market to provide granular insights into its various facets. The segmentation encompasses:

Application by Age Group:

- Under 20: This segment shows nascent but growing interest, driven by influencer marketing and early adoption of new beauty trends. Market size is projected to reach $XX million by 2033.

- 20 to 30: The dominant segment, characterized by high engagement with social media and a preference for innovative, convenient beauty products. This segment's market size is estimated at $XXX million by 2033.

- 30 to 40: Consumers in this group increasingly seek sophisticated formulations with added skincare benefits. Projected market size is $XX million by 2033.

- Above 40: This segment focuses on anti-aging properties and hydrating formulations. Market size is projected to reach $XX million by 2033.

Type of Coverage:

- Sheer: Appeals to consumers seeking a natural, barely-there finish. Projected market size is $XX million by 2033.

- Light: Offers a subtle enhancement and evening of skin tone. Market size is estimated at $XX million by 2033.

- Medium: The leading category, providing balanced coverage and versatility. Projected market size is $XXX million by 2033.

- Full: Caters to consumers requiring significant coverage for blemishes or discoloration. Market size is estimated at $XX million by 2033.

The scope of this report extends globally, analyzing market trends and competitive landscapes across all major regions.

Key Drivers of Air Cushion Liquid Foundation Growth

Several key factors are propelling the growth of the Air Cushion Liquid Foundation market. Technological advancements in formulation science, leading to improved texture, longevity, and the integration of skincare benefits, are paramount. The increasing consumer preference for lightweight, natural-looking finishes and the convenience of the cushion applicator significantly boost adoption. The pervasive influence of social media and beauty influencers plays a critical role in driving awareness and demand, particularly among younger demographics. Furthermore, rising disposable incomes in emerging economies and a growing interest in premium beauty products contribute to market expansion. The "skincare-in-makeup" trend, where foundations offer hydrating, anti-aging, or sun protection properties, is a major differentiator and growth accelerator.

Challenges in the Air Cushion Liquid Foundation Sector

Despite its growth, the Air Cushion Liquid Foundation sector faces several challenges. Fierce competition from established cosmetic brands and new entrants necessitates continuous innovation and aggressive marketing strategies, which can strain resources. The pricing of premium air cushion foundations can be a barrier for price-sensitive consumers, limiting market penetration in certain segments. Regulatory hurdles related to ingredient approvals and labeling vary across different countries, impacting product development and market access. Supply chain complexities, particularly for specialized ingredients and packaging components, can lead to production delays and increased costs. Moreover, the increasing consumer demand for clean beauty and sustainable practices requires significant investment in reformulation and eco-friendly packaging, posing a challenge for legacy brands. The potential for product substitutes, such as traditional liquid foundations and tinted moisturizers, also presents a competitive pressure that requires continuous product differentiation.

Leading Players in the Air Cushion Liquid Foundation Market

- L'ORÉAL

- KIKO

- ESTEE LAUDER

- LVMH

- REVLON

- Christian Dior

- Chanel

- AMORE PACIFIC

- SHISEIDO

- P&G

- Johnson&Johnson

- Kao

- POLA

- Walgreens Boots Alliance

- Laura Mercier

- KOSÉ

- AVON

- Stylenanda

- Elizabeth Arden

- Burberry

Key Developments in Air Cushion Liquid Foundation Sector

- 2024 Q1: Launch of innovative, refillable cushion compacts by multiple brands, focusing on sustainability.

- 2024 Q2: Introduction of cushion foundations with advanced skincare actives like peptides and ceramides to address aging concerns.

- 2023 Q4: Increased market entry of niche brands focusing on clean beauty and ethically sourced ingredients.

- 2023 Q3: Expansion of shade ranges by major players to cater to a wider diversity of skin tones globally.

- 2023 Q2: Strategic partnerships between beauty brands and tech companies to develop AI-powered shade matching for online sales.

- 2022 Q4: M&A activity saw larger corporations acquiring smaller, trend-setting cushion foundation brands to bolster their portfolios.

- 2022 Q3: Significant R&D investment in developing transfer-proof and long-wear cushion formulas.

Strategic Air Cushion Liquid Foundation Market Outlook

The strategic outlook for the Air Cushion Liquid Foundation market remains exceptionally positive, driven by sustained consumer demand for convenient, multi-functional, and high-performance beauty products. Future growth will be accelerated by continued innovation in formulation science, with an emphasis on incorporating advanced skincare ingredients and achieving personalized coverage. The expansion into emerging markets, coupled with the increasing digital presence and direct-to-consumer (DTC) strategies of brands, will further bolster market penetration. Sustainability, in terms of packaging and ingredient sourcing, is poised to become a key differentiator, attracting environmentally conscious consumers. Brands that can effectively leverage influencer marketing, create engaging online content, and offer bespoke product experiences will be best positioned for success. The market is expected to witness further consolidation through strategic acquisitions and collaborations as companies strive to capture greater market share and leverage synergistic opportunities. The integration of smart beauty technologies, such as personalized shade matching via augmented reality, will also play a crucial role in enhancing customer engagement and driving sales.

Air Cushion Liquid Foundation Segmentation

-

1. Application

- 1.1. Under 20

- 1.2. 20 to 30

- 1.3. 30 to 40

- 1.4. Above 40

-

2. Types

- 2.1. Sheer

- 2.2. Light

- 2.3. Medium

- 2.4. Full

Air Cushion Liquid Foundation Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Air Cushion Liquid Foundation REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Air Cushion Liquid Foundation Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Under 20

- 5.1.2. 20 to 30

- 5.1.3. 30 to 40

- 5.1.4. Above 40

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Sheer

- 5.2.2. Light

- 5.2.3. Medium

- 5.2.4. Full

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Air Cushion Liquid Foundation Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Under 20

- 6.1.2. 20 to 30

- 6.1.3. 30 to 40

- 6.1.4. Above 40

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Sheer

- 6.2.2. Light

- 6.2.3. Medium

- 6.2.4. Full

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Air Cushion Liquid Foundation Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Under 20

- 7.1.2. 20 to 30

- 7.1.3. 30 to 40

- 7.1.4. Above 40

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Sheer

- 7.2.2. Light

- 7.2.3. Medium

- 7.2.4. Full

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Air Cushion Liquid Foundation Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Under 20

- 8.1.2. 20 to 30

- 8.1.3. 30 to 40

- 8.1.4. Above 40

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Sheer

- 8.2.2. Light

- 8.2.3. Medium

- 8.2.4. Full

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Air Cushion Liquid Foundation Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Under 20

- 9.1.2. 20 to 30

- 9.1.3. 30 to 40

- 9.1.4. Above 40

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Sheer

- 9.2.2. Light

- 9.2.3. Medium

- 9.2.4. Full

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Air Cushion Liquid Foundation Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Under 20

- 10.1.2. 20 to 30

- 10.1.3. 30 to 40

- 10.1.4. Above 40

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Sheer

- 10.2.2. Light

- 10.2.3. Medium

- 10.2.4. Full

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 L'ORÉAL

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 KIKO

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ESTEE LAUDER

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LVMH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 REVLON

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Christian Dior

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chanel

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AMORE PACIFIC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SHISEIDO

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 P&G

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Johnson&Johnson

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kao

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 POLA

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Walgreens Boots Alliance

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Laura Mercier

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 KOSÉ

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 AVON

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Stylenanda

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Elizabeth Arden

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Burberry

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 L'ORÉAL

List of Figures

- Figure 1: Global Air Cushion Liquid Foundation Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Air Cushion Liquid Foundation Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Air Cushion Liquid Foundation Revenue (million), by Application 2024 & 2032

- Figure 4: North America Air Cushion Liquid Foundation Volume (K), by Application 2024 & 2032

- Figure 5: North America Air Cushion Liquid Foundation Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Air Cushion Liquid Foundation Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Air Cushion Liquid Foundation Revenue (million), by Types 2024 & 2032

- Figure 8: North America Air Cushion Liquid Foundation Volume (K), by Types 2024 & 2032

- Figure 9: North America Air Cushion Liquid Foundation Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Air Cushion Liquid Foundation Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Air Cushion Liquid Foundation Revenue (million), by Country 2024 & 2032

- Figure 12: North America Air Cushion Liquid Foundation Volume (K), by Country 2024 & 2032

- Figure 13: North America Air Cushion Liquid Foundation Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Air Cushion Liquid Foundation Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Air Cushion Liquid Foundation Revenue (million), by Application 2024 & 2032

- Figure 16: South America Air Cushion Liquid Foundation Volume (K), by Application 2024 & 2032

- Figure 17: South America Air Cushion Liquid Foundation Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Air Cushion Liquid Foundation Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Air Cushion Liquid Foundation Revenue (million), by Types 2024 & 2032

- Figure 20: South America Air Cushion Liquid Foundation Volume (K), by Types 2024 & 2032

- Figure 21: South America Air Cushion Liquid Foundation Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Air Cushion Liquid Foundation Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Air Cushion Liquid Foundation Revenue (million), by Country 2024 & 2032

- Figure 24: South America Air Cushion Liquid Foundation Volume (K), by Country 2024 & 2032

- Figure 25: South America Air Cushion Liquid Foundation Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Air Cushion Liquid Foundation Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Air Cushion Liquid Foundation Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Air Cushion Liquid Foundation Volume (K), by Application 2024 & 2032

- Figure 29: Europe Air Cushion Liquid Foundation Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Air Cushion Liquid Foundation Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Air Cushion Liquid Foundation Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Air Cushion Liquid Foundation Volume (K), by Types 2024 & 2032

- Figure 33: Europe Air Cushion Liquid Foundation Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Air Cushion Liquid Foundation Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Air Cushion Liquid Foundation Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Air Cushion Liquid Foundation Volume (K), by Country 2024 & 2032

- Figure 37: Europe Air Cushion Liquid Foundation Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Air Cushion Liquid Foundation Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Air Cushion Liquid Foundation Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Air Cushion Liquid Foundation Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Air Cushion Liquid Foundation Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Air Cushion Liquid Foundation Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Air Cushion Liquid Foundation Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Air Cushion Liquid Foundation Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Air Cushion Liquid Foundation Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Air Cushion Liquid Foundation Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Air Cushion Liquid Foundation Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Air Cushion Liquid Foundation Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Air Cushion Liquid Foundation Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Air Cushion Liquid Foundation Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Air Cushion Liquid Foundation Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Air Cushion Liquid Foundation Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Air Cushion Liquid Foundation Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Air Cushion Liquid Foundation Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Air Cushion Liquid Foundation Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Air Cushion Liquid Foundation Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Air Cushion Liquid Foundation Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Air Cushion Liquid Foundation Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Air Cushion Liquid Foundation Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Air Cushion Liquid Foundation Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Air Cushion Liquid Foundation Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Air Cushion Liquid Foundation Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Air Cushion Liquid Foundation Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Air Cushion Liquid Foundation Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Air Cushion Liquid Foundation Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Air Cushion Liquid Foundation Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Air Cushion Liquid Foundation Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Air Cushion Liquid Foundation Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Air Cushion Liquid Foundation Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Air Cushion Liquid Foundation Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Air Cushion Liquid Foundation Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Air Cushion Liquid Foundation Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Air Cushion Liquid Foundation Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Air Cushion Liquid Foundation Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Air Cushion Liquid Foundation Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Air Cushion Liquid Foundation Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Air Cushion Liquid Foundation Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Air Cushion Liquid Foundation Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Air Cushion Liquid Foundation Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Air Cushion Liquid Foundation Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Air Cushion Liquid Foundation Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Air Cushion Liquid Foundation Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Air Cushion Liquid Foundation Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Air Cushion Liquid Foundation Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Air Cushion Liquid Foundation Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Air Cushion Liquid Foundation Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Air Cushion Liquid Foundation Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Air Cushion Liquid Foundation Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Air Cushion Liquid Foundation Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Air Cushion Liquid Foundation Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Air Cushion Liquid Foundation Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Air Cushion Liquid Foundation Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Air Cushion Liquid Foundation Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Air Cushion Liquid Foundation Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Air Cushion Liquid Foundation Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Air Cushion Liquid Foundation Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Air Cushion Liquid Foundation Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Air Cushion Liquid Foundation Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Air Cushion Liquid Foundation Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Air Cushion Liquid Foundation Volume K Forecast, by Country 2019 & 2032

- Table 81: China Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Air Cushion Liquid Foundation Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Air Cushion Liquid Foundation Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Air Cushion Liquid Foundation?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Air Cushion Liquid Foundation?

Key companies in the market include L'ORÉAL, KIKO, ESTEE LAUDER, LVMH, REVLON, Christian Dior, Chanel, AMORE PACIFIC, SHISEIDO, P&G, Johnson&Johnson, Kao, POLA, Walgreens Boots Alliance, Laura Mercier, KOSÉ, AVON, Stylenanda, Elizabeth Arden, Burberry.

3. What are the main segments of the Air Cushion Liquid Foundation?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 54390 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Air Cushion Liquid Foundation," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Air Cushion Liquid Foundation report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Air Cushion Liquid Foundation?

To stay informed about further developments, trends, and reports in the Air Cushion Liquid Foundation, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence