Key Insights

The wireless electric vehicle (EV) charging market is experiencing explosive growth, projected to reach a market size of $152.30 million in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 38.40%. This surge is driven by several key factors. Increasing environmental concerns and government regulations promoting sustainable transportation are pushing the adoption of EVs. Simultaneously, consumer demand for convenient and aesthetically pleasing charging solutions is fueling the preference for wireless charging over traditional wired methods. The ease of use, improved safety features (eliminating exposed charging cables), and potential for automated charging systems are further contributing to market expansion. Segment-wise, passenger car applications currently dominate the market, but commercial vehicle adoption is expected to witness significant growth as technology matures and infrastructure develops. Geographically, North America and Europe are currently leading the market, boosted by early technological advancements and supportive government policies. However, the Asia-Pacific region, particularly China, is poised for rapid expansion due to its massive EV market and increasing focus on technological innovation. The market faces challenges including high initial infrastructure costs, limited range compared to wired charging, and the need for standardization across different wireless charging technologies. However, ongoing technological advancements addressing these limitations, coupled with increasing investments in research and development, suggest a robust future for this burgeoning sector.

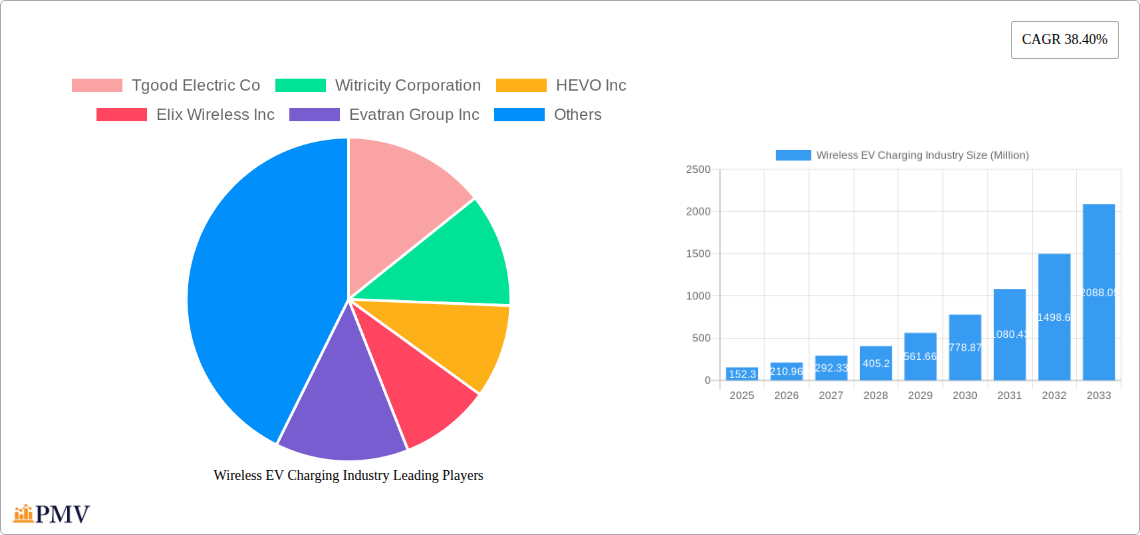

Wireless EV Charging Industry Market Size (In Million)

The competitive landscape is dynamic, featuring a mix of established automotive giants like Toyota and Bosch, alongside specialized wireless charging companies such as WiTricity and Momentum Dynamics. These companies are actively engaged in developing and deploying various wireless charging technologies, creating a competitive environment that fosters innovation and cost reduction. The forecast period (2025-2033) promises even more substantial growth driven by the increasing affordability of wireless charging systems, advancements in charging efficiency and power delivery, and broader integration into EV charging infrastructure. This ultimately will translate to higher adoption rates among consumers and fleet operators, solidifying wireless EV charging's position as a crucial element of the future transportation ecosystem.

Wireless EV Charging Industry Company Market Share

Wireless EV Charging Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Wireless EV Charging industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and growth. The report covers key market segments, leading players, and emerging technologies, providing actionable intelligence to navigate the dynamic landscape of wireless EV charging. The total market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Wireless EV Charging Industry Market Structure & Competitive Dynamics

The wireless EV charging market is characterized by a moderately concentrated structure with several key players vying for market share. Market concentration is influenced by factors such as technological advancements, regulatory frameworks, and the increasing adoption of electric vehicles. Innovation ecosystems are crucial, driving continuous improvements in charging efficiency, power transfer capabilities, and overall system reliability. Regulatory frameworks, including safety standards and interoperability guidelines, play a significant role in shaping market development. Product substitutes, primarily wired charging solutions, continue to compete, although the convenience and potential for infrastructure optimization offered by wireless charging are driving its adoption. End-user trends, particularly the growing preference for convenient and seamless charging solutions, fuel market growth. M&A activities have played a vital role in consolidating market share and acquiring key technologies. For example, WiTricity's acquisition of Qualcomm Halo™ in 2022 significantly expanded its patent portfolio and market position. Estimated M&A deal values in the sector totaled xx Million in 2022. Major players like Tgood Electric Co, Witricity Corporation, HEVO Inc, and Elix Wireless Inc hold significant market share, ranging from xx% to xx%, respectively. The competitive landscape is further defined by the activities of established automotive players like Continental AG and Toyota Motor Corporation, reflecting the industry's increasing integration into the broader automotive ecosystem.

Wireless EV Charging Industry Industry Trends & Insights

The wireless EV charging market is experiencing robust growth, driven by several key factors. The escalating demand for electric vehicles is a primary driver, necessitating the development of efficient and convenient charging infrastructure. Technological advancements, including improvements in power transfer efficiency and the development of dynamic wireless charging systems, are further accelerating market growth. Consumer preferences are shifting towards user-friendly and aesthetically pleasing charging solutions, leading to the development of more sophisticated and integrated systems. The market is characterized by intense competitive dynamics, with companies focusing on innovation, partnerships, and strategic acquisitions to gain a competitive edge. The market penetration of wireless EV charging is currently at xx% and is projected to reach xx% by 2033. This growth will be driven by factors such as government incentives, falling prices of wireless EV chargers, and increasing consumer awareness. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated to be xx%.

Dominant Markets & Segments in Wireless EV Charging Industry

The market for wireless EV charging is experiencing significant growth across various segments and geographies. Currently, the xx region exhibits the highest market dominance due to supportive government policies, robust infrastructure development, and a high concentration of EV manufacturers. Within this region, xx country shows remarkable growth owing to xx.

By Vehicle Type:

- Passenger Cars: This segment dominates the market due to the higher volume of passenger EVs compared to commercial vehicles. Key drivers include increasing consumer adoption of EVs and the convenience factor associated with wireless charging.

- Commercial Vehicles: This segment is showing promising growth potential, driven by the increasing demand for efficient charging solutions for fleets and the potential for cost savings through optimized charging management.

By Application Type:

- Residential: Residential installations are growing, driven by the increasing adoption of home EV charging. Convenient at-home charging becomes a key factor.

- Commercial: The commercial segment is witnessing significant growth, driven by the need for efficient charging solutions for public spaces, workplaces, and fleet operations. The ability to integrate wireless charging into existing parking spaces is a significant advantage.

The continued expansion of electric vehicle adoption globally will further fuel the market growth across all segments, particularly in regions with supportive government policies and substantial investments in charging infrastructure.

Wireless EV Charging Industry Product Innovations

Recent product innovations focus on enhancing charging efficiency, power transfer capabilities, and overall system reliability. New systems offer improved compatibility with various EV models and integrate seamlessly with smart home and grid management systems. Manufacturers are increasingly focusing on dynamic wireless charging solutions, which allow vehicles to charge while in motion. This approach has the potential to revolutionize the way electric vehicles are charged, particularly in public transportation and logistics sectors. These advancements address market needs for improved convenience, reduced charging time, and enhanced energy efficiency.

Report Segmentation & Scope

This report segments the wireless EV charging market based on vehicle type (passenger cars and commercial vehicles) and application type (residential and commercial). Each segment is analyzed separately, providing detailed insights into market size, growth projections, and competitive dynamics. For instance, the passenger car segment is expected to demonstrate faster growth in the coming years due to the increasing adoption of EVs, while the commercial vehicle segment is expected to show considerable growth due to the rising need for efficient charging solutions for fleet management. Similarly, the residential segment is projected to expand significantly in the coming years, while the commercial sector is expected to show a rapid growth trajectory due to the expanding charging infrastructure in public places and workplaces. The competitive landscape within each segment is analyzed, highlighting key players and their strategic positioning.

Key Drivers of Wireless EV Charging Industry Growth

The wireless EV charging industry's growth is fueled by several key drivers. Firstly, the rising adoption of electric vehicles globally necessitates efficient and convenient charging infrastructure. Secondly, technological advancements leading to higher charging efficiency and power transfer capabilities are boosting market growth. Thirdly, supportive government policies and incentives promoting the adoption of EVs and wireless charging technologies contribute significantly. For instance, the xx government's initiative to install wireless charging infrastructure along highways is driving market expansion. Finally, the increasing consumer preference for convenience and seamless charging experiences further stimulates demand for wireless charging solutions.

Challenges in the Wireless EV Charging Industry Sector

Several challenges hinder the widespread adoption of wireless EV charging. High initial investment costs for infrastructure development can be a significant barrier, especially for smaller businesses and residential consumers. Regulatory uncertainties and the lack of standardized protocols across different systems can impede interoperability and widespread market acceptance. Furthermore, concerns about charging efficiency, range anxiety, and the potential for electromagnetic interference are common obstacles that need to be addressed for broader consumer acceptance. These challenges collectively impact market penetration and necessitate concerted efforts from stakeholders across the industry to resolve them effectively. For example, the estimated impact of regulatory hurdles on market growth in 2024 was xx Million.

Leading Players in the Wireless EV Charging Industry Market

- Tgood Electric Co

- Witricity Corporation

- HEVO Inc

- Elix Wireless Inc

- Evatran Group Inc

- EFACEC

- Continental AG

- Toshiba Corporation

- Robert Bosch GmbH

- ZTE Corporation

- Momentum Dynamics Corporation

- Hella Kgaa Hueck & Co

- Toyota Motor Corporation

- Hella Aglaia Mobile Vision

- Mojo Mobility

Key Developments in Wireless EV Charging Industry Sector

- December 2022: Electreon Germany GmbH initiated a project to establish public wireless charging infrastructure for electric cars in Germany, installing two static charging stations along a 1 km road stretch.

- 2022: WiTricity acquired Qualcomm Halo™, securing WEVC patents and an exclusive license from Auckland UniServices, bolstering its technological leadership.

Strategic Wireless EV Charging Industry Market Outlook

The future of the wireless EV charging industry looks promising, with significant growth potential driven by technological innovation, rising EV adoption, and supportive government policies. Strategic opportunities exist in developing dynamic wireless charging systems, improving charging efficiency, and creating seamless integration with smart grid technologies. The market is expected to witness further consolidation through mergers and acquisitions, and the emergence of new players with innovative technologies. Focus on addressing cost challenges, standardization efforts, and enhanced consumer education will play crucial roles in unlocking the full market potential and driving widespread adoption of wireless EV charging.

Wireless EV Charging Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Application Type

- 2.1. Residential

- 2.2. Commercial

Wireless EV Charging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. Australia

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Wireless EV Charging Industry Regional Market Share

Geographic Coverage of Wireless EV Charging Industry

Wireless EV Charging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 38.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Adoption Of Electric Vehicles; Government Support And Incentives

- 3.3. Market Restrains

- 3.3.1. Higher Cost May hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Passenger Car Sales To Propel The Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Tgood Electric Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Witricity Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 HEVO Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Elix Wireless Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Evatran Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 EFACEC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Continental AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toshiba Corporation*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Robert Bosch GmbH

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ZTE Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Momentum Dynamics Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Hella Kgaa Hueck & Co

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Toyota Motor Corporation

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Hella Aglaia Mobile Vision

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Mojo Mobility

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Tgood Electric Co

List of Figures

- Figure 1: Global Wireless EV Charging Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wireless EV Charging Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Wireless EV Charging Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Wireless EV Charging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 5: North America Wireless EV Charging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Wireless EV Charging Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Wireless EV Charging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Wireless EV Charging Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: Europe Wireless EV Charging Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Wireless EV Charging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 11: Europe Wireless EV Charging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: Europe Wireless EV Charging Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Wireless EV Charging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Wireless EV Charging Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Wireless EV Charging Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Wireless EV Charging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 17: Asia Pacific Wireless EV Charging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Asia Pacific Wireless EV Charging Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Wireless EV Charging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Wireless EV Charging Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World Wireless EV Charging Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World Wireless EV Charging Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 23: Rest of the World Wireless EV Charging Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Rest of the World Wireless EV Charging Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Wireless EV Charging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wireless EV Charging Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Wireless EV Charging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Global Wireless EV Charging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Wireless EV Charging Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Wireless EV Charging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Global Wireless EV Charging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Wireless EV Charging Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Wireless EV Charging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 12: Global Wireless EV Charging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Wireless EV Charging Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Wireless EV Charging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 19: Global Wireless EV Charging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Wireless EV Charging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Wireless EV Charging Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 25: Global Wireless EV Charging Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 26: Global Wireless EV Charging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless EV Charging Industry?

The projected CAGR is approximately 38.40%.

2. Which companies are prominent players in the Wireless EV Charging Industry?

Key companies in the market include Tgood Electric Co, Witricity Corporation, HEVO Inc, Elix Wireless Inc, Evatran Group Inc, EFACEC, Continental AG, Toshiba Corporation*List Not Exhaustive, Robert Bosch GmbH, ZTE Corporation, Momentum Dynamics Corporation, Hella Kgaa Hueck & Co, Toyota Motor Corporation, Hella Aglaia Mobile Vision, Mojo Mobility.

3. What are the main segments of the Wireless EV Charging Industry?

The market segments include Vehicle Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 152.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Adoption Of Electric Vehicles; Government Support And Incentives.

6. What are the notable trends driving market growth?

Increasing Passenger Car Sales To Propel The Market Growth.

7. Are there any restraints impacting market growth?

Higher Cost May hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

In December 2022, Electreon Germany GmbH, a subsidiary of Electreon Wireless LTD, a provider of wireless charging solutions for electric vehicles, started their project of public wireless charging infrastructure for electric cars in Germany. The company will also install two static charging stations along a 1 km stretch of road, and the two locations will be chosen based on the bus route and the stops the bus makes while operating.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wireless EV Charging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wireless EV Charging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wireless EV Charging Industry?

To stay informed about further developments, trends, and reports in the Wireless EV Charging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence