Key Insights

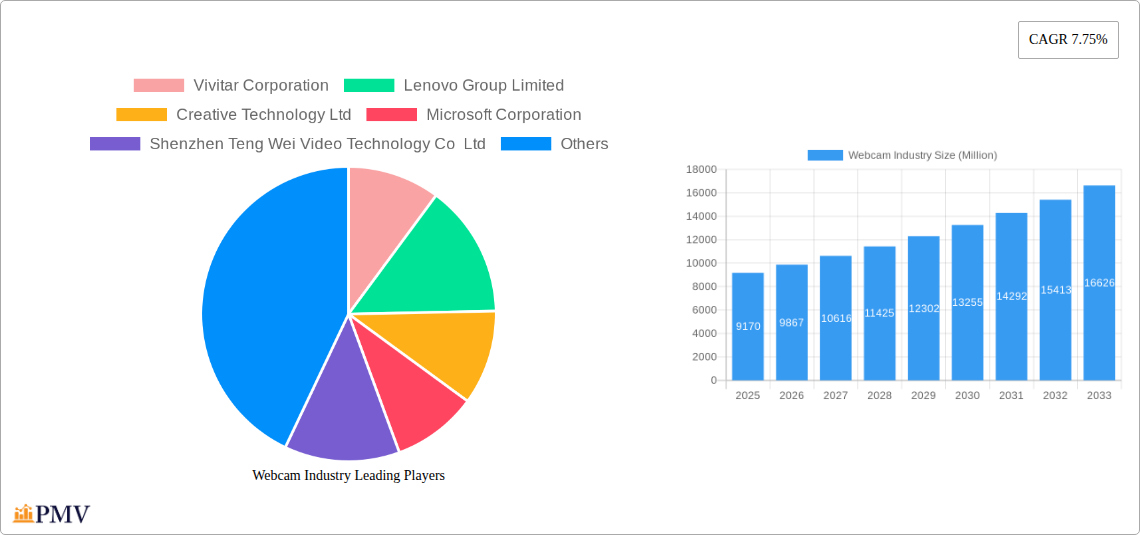

The global webcam market, valued at $9.17 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing adoption of remote work and online learning, fueled by technological advancements and the enduring impact of the COVID-19 pandemic, significantly boosted demand for high-quality webcams. This trend is further amplified by the rising popularity of video conferencing for both personal and professional use, encompassing activities like virtual meetings, online gaming, and social interactions. Furthermore, continuous innovation in webcam technology, including improved resolution, enhanced features like auto-focus and noise cancellation, and integration with sophisticated software, contributes to market expansion. The market is segmented into external and embedded webcams, with external webcams expected to maintain a larger market share due to their versatility and upgradeability. Leading players like Logitech, Microsoft, and Razer are actively investing in research and development to introduce innovative products and capture a larger market share. Competition is fierce, prompting companies to focus on offering competitive pricing, superior image quality, and unique features to stand out in a rapidly evolving market.

Despite the positive growth outlook, certain challenges persist. Supply chain disruptions and fluctuating component costs pose potential restraints on market growth. Moreover, the increasing saturation in developed markets may necessitate companies to explore emerging economies for further expansion. However, the overall trajectory remains positive, supported by a continuously expanding user base and ongoing technological advancements. The 7.75% CAGR projected through 2033 suggests a substantial market expansion, creating opportunities for both established players and new entrants to capitalize on emerging trends. Strategic partnerships, focused marketing campaigns, and product diversification are crucial strategies for achieving sustained success in this dynamic market.

Webcam Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global webcam industry, covering market size, segmentation, competitive landscape, and future growth projections from 2019 to 2033. The report uses 2025 as its base and estimated year, with a forecast period extending to 2033 and a historical period encompassing 2019-2024. The market is valued in Millions of dollars.

Webcam Industry Market Structure & Competitive Dynamics

The global webcam market exhibits a moderately concentrated structure, with several key players holding significant market share. However, the presence of numerous smaller players and emerging brands contributes to a competitive landscape. Market concentration is estimated at xx% in 2025, with the top 5 players holding approximately xx% of the market share. Logitech International S.A., Logitech, and Microsoft Corporation are currently leading the market, followed by Razer Inc., and others. The industry's innovation ecosystem is dynamic, characterized by continuous advancements in image sensor technology, lens capabilities, and software integration. Regulatory frameworks concerning data privacy and cybersecurity are increasingly influencing market dynamics. Product substitutes, such as built-in laptop cameras and smartphone cameras, exert competitive pressure. However, the demand for high-quality video conferencing and streaming solutions continues to drive growth in the external webcam segment. M&A activity in the industry has been relatively moderate in recent years, with deal values totaling approximately xx Million in the past five years. Key acquisitions often focus on enhancing technology or expanding market reach.

- Market Concentration: xx% in 2025 (estimated)

- Top 5 Players Market Share: xx% (estimated)

- M&A Deal Value (2019-2024): xx Million (estimated)

- Key M&A Trends: Focus on technological advancements and market expansion.

Webcam Industry Industry Trends & Insights

The global webcam market is experiencing robust growth, driven by several key factors. The increasing adoption of remote work and online education has significantly boosted demand for high-quality video conferencing solutions. The rising popularity of live streaming and video content creation is another significant growth driver, particularly among younger demographics. Technological advancements such as improved image sensors, enhanced resolution, and integrated features (like AI-powered noise reduction) are further propelling market expansion. Consumer preferences are shifting towards webcams with better low-light performance, wider field of view, and ease of use. Competitive dynamics are characterized by innovation, product differentiation, and pricing strategies. The Compound Annual Growth Rate (CAGR) for the webcam market is estimated to be xx% during the forecast period (2025-2033). Market penetration is expected to reach approximately xx% by 2033. Increased competition and price pressures from low-cost manufacturers are also noticeable trends.

Dominant Markets & Segments in Webcam Industry

The North American and European regions currently dominate the global webcam market, driven by high internet penetration rates, a strong emphasis on remote work, and a large base of consumers with a high disposable income. Within these regions, the external webcam segment holds the larger market share due to the demand for high-quality video conferencing and live streaming capabilities.

Leading Region: North America

Key Drivers in North America: High internet penetration, strong adoption of remote work, high disposable income.

Leading Region: Europe

Key Drivers in Europe: Similar to North America, with robust digital infrastructure and growing demand for remote work solutions.

By Webcam Type:

- External Webcams: This segment is dominant due to its versatility and superior image quality compared to embedded webcams. The market size for external webcams is estimated at xx Million in 2025.

- Embedded Webcams: While typically integrated into laptops and other devices, this segment shows moderate growth driven by increasing demand for built-in cameras in high-quality laptops and tablets. The market size for embedded webcams is estimated at xx Million in 2025.

Webcam Industry Product Innovations

Recent product innovations focus on improved image quality, advanced features, and enhanced user experience. Manufacturers are integrating features like advanced autofocus, high dynamic range (HDR) imaging, and noise reduction technology. The market is also witnessing the integration of AI-powered features such as automatic framing and background blur. These innovations cater to the increasing demands for professional-grade video conferencing and high-quality live streaming experiences. The market fit for these features is strong, particularly amongst professionals and content creators.

Report Segmentation & Scope

This report segments the webcam market by webcam type:

External Webcams: This segment is projected to grow at a CAGR of xx% from 2025 to 2033, driven by the growing demand for high-quality video conferencing and streaming. Competitive dynamics are intense due to the presence of numerous players offering a wide range of products at varying price points.

Embedded Webcams: This segment is anticipated to grow at a CAGR of xx% from 2025 to 2033. Growth is primarily driven by the increasing integration of webcams into laptops, tablets, and other devices. Competitive dynamics are moderately intense, largely influenced by the device manufacturers themselves.

Key Drivers of Webcam Industry Growth

The webcam industry’s growth is propelled by several key factors:

- Rise of Remote Work & Online Education: The COVID-19 pandemic accelerated the shift to remote work and online learning, significantly boosting demand for webcams.

- Growth of Live Streaming & Video Content Creation: The popularity of live streaming platforms and the increase in online video content have fueled the demand for high-quality webcams among content creators and streamers.

- Technological Advancements: Improvements in image sensor technology, lens capabilities, and software features are enhancing webcam performance and driving consumer adoption.

Challenges in the Webcam Industry Sector

The webcam industry faces several challenges:

- Intense Competition: The market is highly competitive, with a large number of players offering similar products at varying price points.

- Supply Chain Disruptions: Global supply chain disruptions have affected the availability and cost of components used in webcam manufacturing.

- Price Pressure from Low-Cost Manufacturers: The presence of low-cost manufacturers puts pressure on pricing and profit margins for established players.

Leading Players in the Webcam Industry Market

- Vivitar Corporation

- Lenovo Group Limited

- Creative Technology Ltd

- Microsoft Corporation

- Shenzhen Teng Wei Video Technology Co Ltd

- KYE Systems Corp (Genius)

- Logitech International S.A.

- Razer Inc

- A4Tech Co Ltd

- Ausdom Global

Key Developments in Webcam Industry Sector

June 2023: BenQ launched the Ideacam S1 Pro and Ideacam S1 Plus webcams, targeting professionals with high-quality video conferencing features, including an 8MP Sony CMOS sensor and 3264x2448p resolution. This signifies a push towards higher-quality professional webcam options.

April 2023: Microsoft announced it would cease manufacturing webcams under its own brand, instead focusing on Surface-branded accessories. This suggests a strategic shift towards integrating webcams within its Surface product line rather than maintaining a separate webcam business unit.

Strategic Webcam Industry Market Outlook

The webcam market presents significant growth opportunities in the coming years. Continued technological advancements, coupled with the sustained growth of remote work and online activities, are expected to drive market expansion. Strategic opportunities exist for companies that can offer innovative features, superior image quality, and seamless integration with various platforms. Focusing on niche markets, such as professional-grade webcams or webcams for specific applications (e.g., healthcare, education), can also offer strong growth potential. The market will continue to evolve with an increasing emphasis on AI integration and enhanced security features.

Webcam Industry Segmentation

-

1. Webcam Type

- 1.1. External Webcam

- 1.2. Embedded Webcam

Webcam Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Webcam Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Penetration of Teleconferencing and Virtual Meetings; Steep Decline in Average Selling Price of Webcams

- 3.3. Market Restrains

- 3.3.1. Poor Internet Penetration in Developing Countries; Increasing Cases of Webcam Hacking (Privacy Concerns)

- 3.4. Market Trends

- 3.4.1. External Webcam Expected to Gain Considerable Significance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Webcam Type

- 5.1.1. External Webcam

- 5.1.2. Embedded Webcam

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Webcam Type

- 6. North America Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Webcam Type

- 6.1.1. External Webcam

- 6.1.2. Embedded Webcam

- 6.1. Market Analysis, Insights and Forecast - by Webcam Type

- 7. Europe Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Webcam Type

- 7.1.1. External Webcam

- 7.1.2. Embedded Webcam

- 7.1. Market Analysis, Insights and Forecast - by Webcam Type

- 8. Asia Pacific Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Webcam Type

- 8.1.1. External Webcam

- 8.1.2. Embedded Webcam

- 8.1. Market Analysis, Insights and Forecast - by Webcam Type

- 9. Latin America Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Webcam Type

- 9.1.1. External Webcam

- 9.1.2. Embedded Webcam

- 9.1. Market Analysis, Insights and Forecast - by Webcam Type

- 10. Middle East and Africa Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Webcam Type

- 10.1.1. External Webcam

- 10.1.2. Embedded Webcam

- 10.1. Market Analysis, Insights and Forecast - by Webcam Type

- 11. North America Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Vivitar Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Lenovo Group Limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Creative Technology Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Microsoft Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Shenzhen Teng Wei Video Technology Co Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 KYE Systems Corp (Genius)*List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Logitech International S A

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Razer Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 A4Tech Co Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Ausdom Global

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Vivitar Corporation

List of Figures

- Figure 1: Global Webcam Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Webcam Industry Revenue (Million), by Webcam Type 2024 & 2032

- Figure 13: North America Webcam Industry Revenue Share (%), by Webcam Type 2024 & 2032

- Figure 14: North America Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Webcam Industry Revenue (Million), by Webcam Type 2024 & 2032

- Figure 17: Europe Webcam Industry Revenue Share (%), by Webcam Type 2024 & 2032

- Figure 18: Europe Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Webcam Industry Revenue (Million), by Webcam Type 2024 & 2032

- Figure 21: Asia Pacific Webcam Industry Revenue Share (%), by Webcam Type 2024 & 2032

- Figure 22: Asia Pacific Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Webcam Industry Revenue (Million), by Webcam Type 2024 & 2032

- Figure 25: Latin America Webcam Industry Revenue Share (%), by Webcam Type 2024 & 2032

- Figure 26: Latin America Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Webcam Industry Revenue (Million), by Webcam Type 2024 & 2032

- Figure 29: Middle East and Africa Webcam Industry Revenue Share (%), by Webcam Type 2024 & 2032

- Figure 30: Middle East and Africa Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Webcam Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Webcam Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Webcam Industry Revenue Million Forecast, by Webcam Type 2019 & 2032

- Table 3: Global Webcam Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Germany Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: China Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Asia Pacific Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Webcam Industry Revenue Million Forecast, by Webcam Type 2019 & 2032

- Table 22: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: United States Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Canada Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Webcam Industry Revenue Million Forecast, by Webcam Type 2019 & 2032

- Table 26: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United Kingdom Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Germany Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: France Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Webcam Industry Revenue Million Forecast, by Webcam Type 2019 & 2032

- Table 32: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: China Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: India Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Asia Pacific Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Webcam Industry Revenue Million Forecast, by Webcam Type 2019 & 2032

- Table 38: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Global Webcam Industry Revenue Million Forecast, by Webcam Type 2019 & 2032

- Table 40: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Webcam Industry?

The projected CAGR is approximately 7.75%.

2. Which companies are prominent players in the Webcam Industry?

Key companies in the market include Vivitar Corporation, Lenovo Group Limited, Creative Technology Ltd, Microsoft Corporation, Shenzhen Teng Wei Video Technology Co Ltd, KYE Systems Corp (Genius)*List Not Exhaustive, Logitech International S A, Razer Inc, A4Tech Co Ltd, Ausdom Global.

3. What are the main segments of the Webcam Industry?

The market segments include Webcam Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Penetration of Teleconferencing and Virtual Meetings; Steep Decline in Average Selling Price of Webcams.

6. What are the notable trends driving market growth?

External Webcam Expected to Gain Considerable Significance.

7. Are there any restraints impacting market growth?

Poor Internet Penetration in Developing Countries; Increasing Cases of Webcam Hacking (Privacy Concerns).

8. Can you provide examples of recent developments in the market?

June 2023: BenQ introduced two new webcams for professionals seeking high-quality video conferencing solutions: the Ideacam S1 Pro and Ideacam S1 Plus. These cameras include numerous shooting modes and an 8MP Sony CMOS sensor. The Ideacam S1 series boasts a resolution of up to 3264x2448 p and a 15X macro lens that can zoom in on any surface or material to provide detailed photos.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Webcam Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Webcam Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Webcam Industry?

To stay informed about further developments, trends, and reports in the Webcam Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence