Key Insights

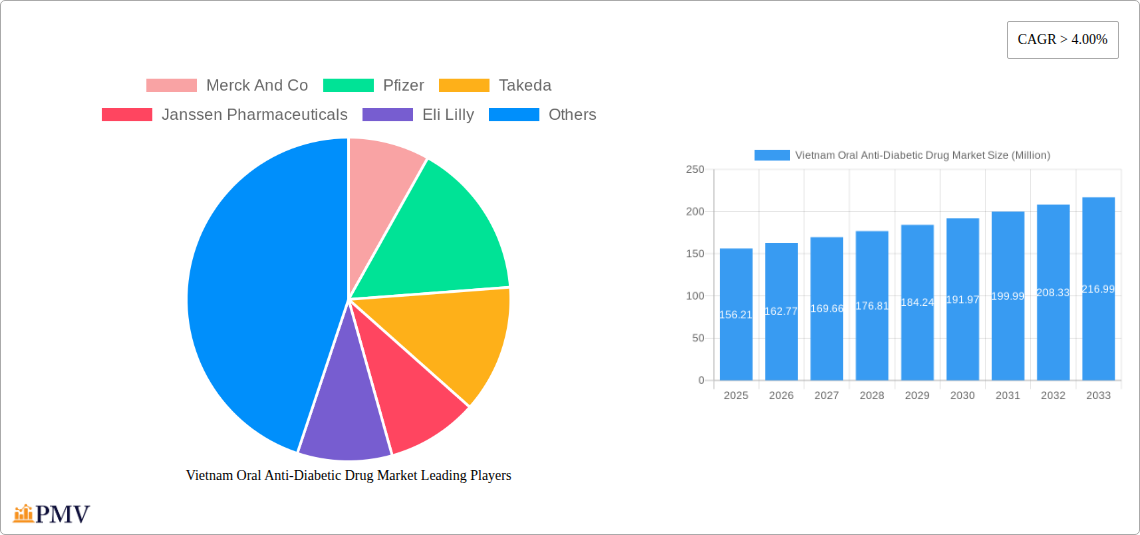

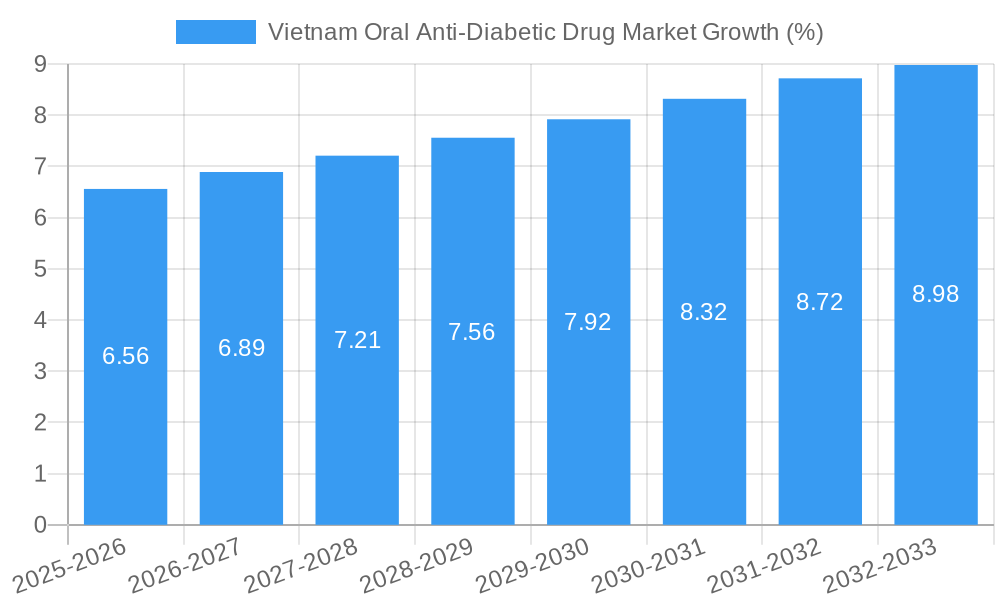

The Vietnam oral anti-diabetic drug market, valued at $156.21 million in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 4.00% from 2025 to 2033. This expansion is driven by several factors. The rising prevalence of diabetes in Vietnam, fueled by an aging population, increasing urbanization, and lifestyle changes leading to higher rates of obesity and sedentary lifestyles, significantly contributes to market growth. Furthermore, increasing healthcare awareness and improved access to affordable healthcare are facilitating earlier diagnosis and treatment, boosting demand for oral anti-diabetic drugs. The market is segmented into various drug classes, including SGLT-2 inhibitors, DPP-4 inhibitors, sulfonylureas, meglitinides, biguanides, alpha-glucosidase inhibitors, and dopamine D2 receptor agonists, each catering to specific patient needs and treatment preferences. The presence of major pharmaceutical players such as Merck & Co, Pfizer, and Novo Nordisk, among others, ensures a competitive landscape fostering innovation and the availability of advanced treatment options.

However, certain restraints might influence the market's trajectory. These include the affordability and accessibility of medications, particularly in rural areas, and potential side effects associated with some drug classes, leading to patient non-compliance. Nevertheless, the ongoing research and development efforts focused on developing safer and more effective oral anti-diabetic drugs, combined with government initiatives aimed at improving diabetes management and patient education, are expected to mitigate these challenges and sustain market growth throughout the forecast period. The growing acceptance of generic medications also presents an opportunity for market expansion, increasing affordability and accessibility. The significant investments in healthcare infrastructure and the continuous efforts to strengthen the primary healthcare system are also contributing positively to the market growth.

This detailed report provides a comprehensive analysis of the Vietnam oral anti-diabetic drug market, offering invaluable insights for stakeholders across the pharmaceutical industry. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report meticulously forecasts market trends and dynamics until 2033. The report leverages extensive market research, incorporating historical data (2019-2024) and projections to deliver actionable intelligence.

Vietnam Oral Anti-Diabetic Drug Market Market Structure & Competitive Dynamics

The Vietnam oral anti-diabetic drug market exhibits a moderately concentrated structure, with key players such as Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, and Astellas holding significant market share. Market concentration is influenced by factors including regulatory approvals, pricing strategies, and brand recognition. The innovative ecosystem is growing, with ongoing research and development in novel drug classes and delivery systems. The regulatory framework, while evolving, plays a significant role in market access and pricing. Substitute therapies, such as lifestyle modifications and insulin therapies, exert competitive pressure. End-user trends are shifting towards improved patient adherence and preference for convenient oral formulations. M&A activity has been moderate in recent years, with deal values averaging approximately xx Million USD annually (2019-2024). Some key observations include:

- Market leader's share: xx% (estimated 2025)

- Top 5 players' combined market share: xx% (estimated 2025)

- Average M&A deal value (2019-2024): xx Million USD

- Number of M&A deals (2019-2024): xx

Vietnam Oral Anti-Diabetic Drug Market Industry Trends & Insights

The Vietnam oral anti-diabetic drug market is poised for substantial growth, driven primarily by the rising prevalence of type 2 diabetes (T2D) fueled by changing lifestyles and an aging population. The market is witnessing a significant increase in the adoption of newer drug classes like SGLT-2 inhibitors and DPP-4 inhibitors, due to their efficacy and improved safety profiles. Technological disruptions, particularly in digital health and personalized medicine, are enhancing treatment efficacy and patient adherence. Consumer preferences are shifting towards convenient, once-daily formulations with minimized side effects. Competitive dynamics are shaping the market through pricing strategies, new product launches, and the growing influence of generic medications. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033.

Dominant Markets & Segments in Vietnam Oral Anti-Diabetic Drug Market

The Metformin segment currently dominates the Vietnam oral anti-diabetic drug market due to its established efficacy, cost-effectiveness, and widespread availability. However, SGLT-2 inhibitors and DPP-4 inhibitors are experiencing rapid growth, driven by their superior glycemic control and cardiovascular benefits. The market is segmented as follows:

- Bromocriptin: SGLT-2 inhibitors: Driven by increasing awareness of cardiovascular benefits and improved patient outcomes.

- Suglat (Ipragliflozin): DPP-4 inhibitors: This segment benefits from improved patient compliance and ease of use.

- Galvus (Vildagliptin): Sulfonylureas: The market share is influenced by cost considerations and availability.

- Sulfonylureas: Meglitinides: This segment experiences moderate growth due to its established use but faces competition from newer drug classes.

- Oral Anti-diabetic drugs: Biguanides: Metformin's dominance is largely due to cost-effectiveness and extensive clinical data.

- Metformin: Alpha-Glucosidase Inhibitors: This combination therapy is gaining traction due to synergistic effects.

- Alpha-Glucosidase Inhibitors: Dopamine D2 receptor agonist: This segment is smaller, with niche applications and potential for growth.

Key drivers for the dominant segments include increasing healthcare expenditure, government initiatives to improve diabetes management, and rising awareness campaigns. The urban areas show higher market penetration compared to rural areas, reflecting better access to healthcare facilities and higher disposable incomes.

Vietnam Oral Anti-Diabetic Drug Market Product Innovations

Recent product innovations focus on enhancing treatment efficacy, improving patient convenience, and reducing adverse effects. This includes the development of fixed-dose combination therapies, novel drug delivery systems (e.g., once-weekly formulations), and personalized medicine approaches tailored to individual patient characteristics. Technological advancements in drug discovery and development are paving the way for newer, more effective oral anti-diabetic drugs with improved safety profiles, catering to the growing market need for better diabetes management.

Report Segmentation & Scope

This report segments the Vietnam oral anti-diabetic drug market by drug class (SGLT-2 inhibitors, DPP-4 inhibitors, Sulfonylureas, Meglitinides, Biguanides, Alpha-Glucosidase Inhibitors), by distribution channel (hospital pharmacies, retail pharmacies, online pharmacies), and by geography (urban vs. rural). Each segment's growth projections, market sizes (in Millions USD), and competitive landscape are detailed within the full report.

Key Drivers of Vietnam Oral Anti-Diabetic Drug Market Growth

The growth of the Vietnam oral anti-diabetic drug market is propelled by several factors: the escalating prevalence of diabetes driven by lifestyle changes and an aging population; increasing healthcare expenditure and improved healthcare infrastructure; government initiatives promoting diabetes awareness and management; and the launch of innovative drugs with improved efficacy and safety profiles.

Challenges in the Vietnam Oral Anti-Diabetic Drug Market Sector

The Vietnam oral anti-diabetic drug market faces challenges such as the high cost of newer drugs, affordability concerns, particularly in rural areas, the need for improved healthcare access and patient education, and potential regulatory hurdles impacting market entry for new products. Generic competition also puts pressure on pricing and profitability.

Leading Players in the Vietnam Oral Anti-Diabetic Drug Market Market

- Merck And Co (Merck And Co)

- Pfizer (Pfizer)

- Takeda (Takeda)

- Janssen Pharmaceuticals (Janssen Pharmaceuticals)

- Eli Lilly (Eli Lilly)

- Novartis (Novartis)

- Sanofi (Sanofi)

- AstraZeneca (AstraZeneca)

- Bristol Myers Squibb (Bristol Myers Squibb)

- Novo Nordisk (Novo Nordisk)

- Boehringer Ingelheim (Boehringer Ingelheim)

- Astellas (Astellas)

Key Developments in Vietnam Oral Anti-Diabetic Drug Market Sector

- January 2024: Lupin gets USFDA approval to market generic medication to treat diabetes. This development is expected to increase competition and lower prices in the Vietnamese market.

- November 2022: A pre-post study evaluating a peer-based club intervention for T2D self-management in rural Vietnam. This highlights efforts to improve patient outcomes and management strategies.

Strategic Vietnam Oral Anti-Diabetic Drug Market Market Outlook

The Vietnam oral anti-diabetic drug market presents significant growth opportunities for pharmaceutical companies. Strategic focus areas include expanding access to newer drug classes in rural areas, developing cost-effective treatment options, strengthening patient education programs, and leveraging technological advancements to improve diabetes management. The market's future potential lies in personalized medicine, innovative drug delivery systems, and collaborations to improve overall diabetes care in Vietnam.

Vietnam Oral Anti-Diabetic Drug Market Segmentation

-

1. Drug Class

- 1.1. Biguanides

- 1.2. Alpha-glucosidase inhibitors

- 1.3. Dopamine D2 receptor agonists

- 1.4. SGLT-2 inhibitors

- 1.5. DPP-4 inhibitors

- 1.6. Sulfonylureas

- 1.7. Meglitinides

-

2. Indication

- 2.1. Type 1 diabetes

- 2.2. Type 2 diabetes

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Retail pharmacies

-

4. Region

- 4.1. Northern

- 4.2. Central

- 4.3. Southern

Vietnam Oral Anti-Diabetic Drug Market Segmentation By Geography

- 1. Vietnam

Vietnam Oral Anti-Diabetic Drug Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures

- 3.3. Market Restrains

- 3.3.1. Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs

- 3.4. Market Trends

- 3.4.1. Sulfonylureas Segment Occupied the Highest Market Share in the Vietnam Oral Anti-Diabetic Drugs Market in the current year.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Oral Anti-Diabetic Drug Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Biguanides

- 5.1.2. Alpha-glucosidase inhibitors

- 5.1.3. Dopamine D2 receptor agonists

- 5.1.4. SGLT-2 inhibitors

- 5.1.5. DPP-4 inhibitors

- 5.1.6. Sulfonylureas

- 5.1.7. Meglitinides

- 5.2. Market Analysis, Insights and Forecast - by Indication

- 5.2.1. Type 1 diabetes

- 5.2.2. Type 2 diabetes

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Retail pharmacies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Northern

- 5.4.2. Central

- 5.4.3. Southern

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Merck And Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pfizer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janssen Pharmaceuticals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novartis

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sanofi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AstraZeneca

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bristol Myers Squibb

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Novo Nordisk

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Boehringer Ingelheim

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Astellas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Merck And Co

List of Figures

- Figure 1: Vietnam Oral Anti-Diabetic Drug Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Oral Anti-Diabetic Drug Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Drug Class 2019 & 2032

- Table 4: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Drug Class 2019 & 2032

- Table 5: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2019 & 2032

- Table 6: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2019 & 2032

- Table 7: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Drug Class 2019 & 2032

- Table 16: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Drug Class 2019 & 2032

- Table 17: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Indication 2019 & 2032

- Table 18: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Indication 2019 & 2032

- Table 19: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 21: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Region 2019 & 2032

- Table 22: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 23: Vietnam Oral Anti-Diabetic Drug Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Vietnam Oral Anti-Diabetic Drug Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Oral Anti-Diabetic Drug Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Vietnam Oral Anti-Diabetic Drug Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, Sanofi, AstraZeneca, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Astellas.

3. What are the main segments of the Vietnam Oral Anti-Diabetic Drug Market?

The market segments include Drug Class, Indication, End User, Region.

4. Can you provide details about the market size?

The market size is estimated to be USD 156.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures.

6. What are the notable trends driving market growth?

Sulfonylureas Segment Occupied the Highest Market Share in the Vietnam Oral Anti-Diabetic Drugs Market in the current year..

7. Are there any restraints impacting market growth?

Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs.

8. Can you provide examples of recent developments in the market?

January 2024: Lupin gets USFDA approval to market generic medication to treat diabetes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Oral Anti-Diabetic Drug Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Oral Anti-Diabetic Drug Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Oral Anti-Diabetic Drug Market?

To stay informed about further developments, trends, and reports in the Vietnam Oral Anti-Diabetic Drug Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence