Key Insights

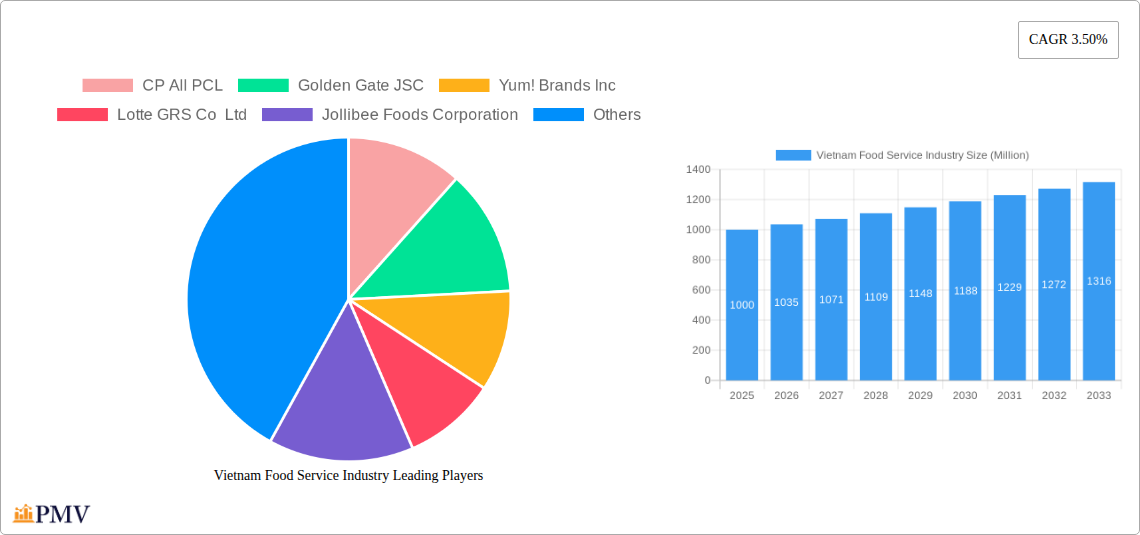

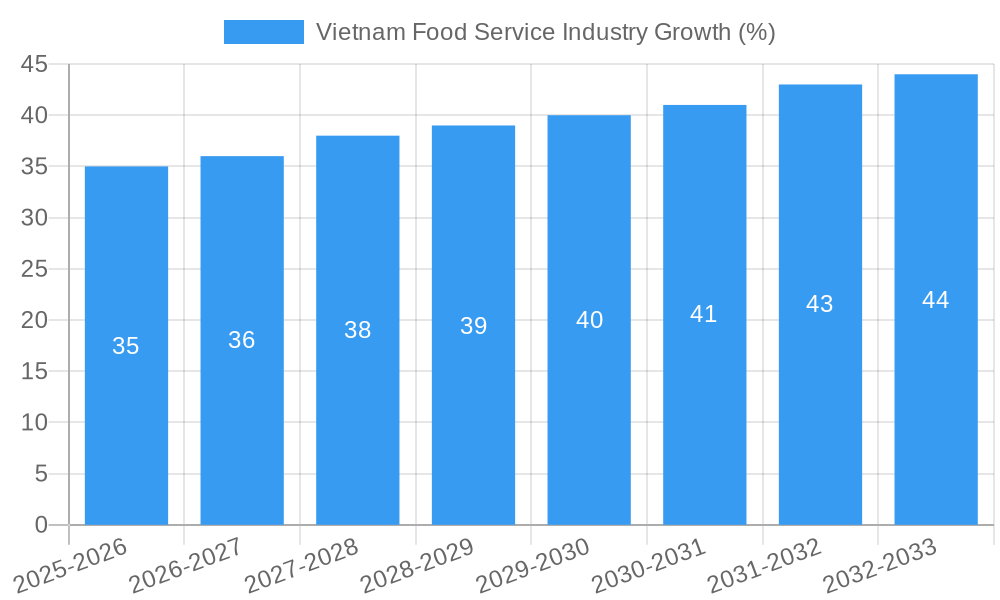

The Vietnam food service industry, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.5% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning middle class with increasing disposable incomes is driving higher demand for diverse dining experiences, ranging from quick-service restaurants (QSRs) to upscale cafes and bars. Tourism's resurgence post-pandemic also significantly contributes to the industry's growth, with visitors seeking local culinary experiences. Furthermore, the rise of food delivery platforms and online ordering systems has expanded market reach and convenience, catering to busy lifestyles. The industry is segmented by food service type (cafes & bars, other QSR cuisines), outlet type (chained vs. independent), and location (leisure, lodging, retail, standalone, travel). Key players like CP All PCL, Golden Gate JSC, Yum! Brands Inc., and Jollibee Foods Corporation are actively shaping the competitive landscape through strategic expansion and menu innovation. However, challenges remain. Rising food costs and labor shortages pose potential restraints on profitability. Maintaining consistent food quality and hygiene standards amid rapid expansion is also crucial for sustaining consumer trust. The growth trajectory will likely see a shift toward healthier options and more diverse culinary offerings to cater to evolving consumer preferences. The industry's success hinges on adapting to these trends and effectively managing the challenges to unlock the substantial growth potential projected for the coming decade.

The dominance of chained outlets suggests a preference for established brands offering consistent quality and experience. However, the presence of a significant independent outlet segment indicates opportunities for smaller, specialized restaurants to carve a niche. Geographical distribution across leisure, lodging, retail, and travel locations reflects the diverse settings where food service is consumed. Future growth will be influenced by government regulations concerning food safety and hygiene, as well as infrastructural developments supporting the growth of the tourism and hospitality sectors. Competitors are likely to invest in technology to enhance efficiency and customer experience, such as implementing robust point-of-sale systems and loyalty programs. Sustainable practices and ethically sourced ingredients are also expected to gain increasing importance, influencing consumer choices and shaping industry practices.

Vietnam Food Service Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Vietnam food service industry, offering invaluable insights for businesses, investors, and stakeholders seeking to understand and capitalize on this dynamic market. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report leverages extensive data and analysis to present a clear picture of current market dynamics and future growth potential. The market size is estimated at xx Million in 2025.

Vietnam Food Service Industry Market Structure & Competitive Dynamics

The Vietnam food service industry exhibits a complex interplay of market concentration, innovation, regulation, and competitive pressures. While major players like CP All PCL, Golden Gate JSC, Yum! Brands Inc, Lotte GRS Co Ltd, and Jollibee Foods Corporation dominate the chained outlet segment, a significant portion of the market comprises independent outlets. Market share data for 2024 suggests that the top five players control approximately 40% of the overall market, indicating a moderately concentrated landscape.

Recent M&A activity has been modest, with total deal values in 2022 estimated at xx Million. However, the regulatory environment, characterized by xx, influences market entry and expansion strategies. The rise of online food delivery platforms and the increasing popularity of diverse cuisines represent significant disruptions. End-user trends show a growing preference for healthier options and personalized experiences, driving innovation within the industry. The competitive landscape is further shaped by the availability of numerous product substitutes and the ongoing evolution of consumer preferences.

Vietnam Food Service Industry Industry Trends & Insights

The Vietnam food service industry is experiencing robust growth, driven by several key factors. Rising disposable incomes, rapid urbanization, and a burgeoning young population with increasing spending power are significant market drivers. The CAGR for the period 2025-2033 is projected to be xx%, with market penetration expected to reach xx% by 2033. Technological advancements, including online ordering and delivery platforms, are transforming consumer behavior and operational efficiency. A notable shift towards healthier and more diverse food choices is evident, influencing menu development and marketing strategies. The competitive landscape, characterized by both established players and emerging entrants, fosters innovation and enhances customer choice. However, challenges like rising input costs and fluctuations in consumer spending require careful strategic planning by food service businesses.

Dominant Markets & Segments in Vietnam Food Service Industry

The Vietnamese food service market demonstrates significant heterogeneity across various segments.

Leading Foodservice Type: The "Other QSR Cuisines" segment enjoys the largest market share, fueled by the increasing popularity of international and fusion cuisines. Cafes and Bars also contribute considerably.

Dominant Outlet Type: Chained outlets command a substantial portion of the market, benefiting from brand recognition and economies of scale. However, independent outlets remain prevalent, particularly in smaller towns and cities.

Key Location: Standalone outlets represent the most dominant location segment, offering businesses flexibility and control. However, strong growth is observed in the retail and travel segments.

Key Drivers of Segment Dominance:

- Economic Policies: Supportive government policies promoting tourism and foreign investment stimulate market expansion.

- Infrastructure: Improvements in transportation and logistics networks facilitate efficient supply chains and access to wider consumer bases.

- Consumer Preferences: Changing tastes and preferences among Vietnamese consumers influence culinary trends and market demand.

Vietnam Food Service Industry Product Innovations

Recent product innovations reflect the growing emphasis on convenience, health, and personalization. Quick-service restaurants are introducing healthier menu options, while cafes are experimenting with unique coffee blends and artisanal food items. Technological advancements, such as self-ordering kiosks and personalized meal customization apps, are enhancing customer experience. These innovations are crucial for securing competitive advantage in an increasingly crowded market.

Report Segmentation & Scope

This report segments the Vietnam food service industry based on foodservice type (Cafes & Bars, Other QSR Cuisines), outlet type (Chained Outlets, Independent Outlets), and location (Leisure, Lodging, Retail, Standalone, Travel). Each segment is analyzed, providing growth projections, market size estimates (in Millions), and competitive dynamics. For example, the Chained Outlets segment is projected to grow at a CAGR of xx% over the forecast period, driven by expansion plans of major players and increasing consumer preference for branded experiences. The Standalone location segment offers diverse opportunities for both large and small businesses.

Key Drivers of Vietnam Food Service Industry Growth

Several key factors contribute to the growth of Vietnam's food service industry. A rising middle class with increased disposable income fuels demand for dining out. Tourism growth boosts revenues in key locations. Government initiatives supporting the hospitality sector and infrastructure improvements facilitate business expansion. The adoption of technology, from online ordering to point-of-sale systems, streamlines operations and enhances customer experience.

Challenges in the Vietnam Food Service Industry Sector

The industry faces challenges including supply chain disruptions affecting ingredient costs and availability. Intense competition requires constant innovation and effective marketing strategies. Stringent food safety regulations necessitate high operational standards and compliance. Labor shortages and rising labor costs impact profitability. These factors exert pressure on businesses, requiring strategic adaptation to maintain competitiveness.

Leading Players in the Vietnam Food Service Industry Market

- CP All PCL

- Golden Gate JSC

- Yum! Brands Inc

- Lotte GRS Co Ltd

- Jollibee Foods Corporation

- The Al Fresco's Group Vietnam

- Starbucks Corporation

- Restaurant Brands International Inc

- Mesa Group

- Imex Pan Pacific Group

Key Developments in Vietnam Food Service Industry Sector

- December 2022: KFC launched Charcoal Grilled Chicken Rice, showcasing product innovation.

- January 2023: Restaurant Brands International Inc. opened Burger King and Popeyes stores in Hanoi, signaling market entry.

- March 2023: Starbucks' expansion with 13 new stores demonstrates significant growth ambition.

Strategic Vietnam Food Service Industry Market Outlook

The Vietnam food service industry presents significant opportunities for growth. Strategic investments in technology, diversified menus, and superior customer service will be crucial for success. Expansion into underserved regions and catering to evolving consumer preferences will offer competitive advantages. The market's long-term growth potential is supported by a robust economy and increasing consumer spending power. The industry is poised for continued expansion, driven by both domestic and international players.

Vietnam Food Service Industry Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Vietnam Food Service Industry Segmentation By Geography

- 1. Vietnam

Vietnam Food Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Cocoa Butter Equivalents Among Food Manufacturers; Rising Application in Food Industry

- 3.3. Market Restrains

- 3.3.1. Health Concerns Pertaining to the Excessive Consumption of Fats and Oils

- 3.4. Market Trends

- 3.4.1. Michelin Guide and Vietnam Tourism Promote Vietnamese Cuisine drives the expansion of the full service restaurants across the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 CP All PCL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Golden Gate JSC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yum! Brands Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lotte GRS Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jollibee Foods Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Al Fresco's Group Vietnam

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Starbucks Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Restaurant Brands International Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mesa Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Imex Pan Pacific Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CP All PCL

List of Figures

- Figure 1: Vietnam Food Service Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Food Service Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Vietnam Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Vietnam Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Vietnam Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Vietnam Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Vietnam Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 8: Vietnam Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 9: Vietnam Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 10: Vietnam Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Food Service Industry?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Vietnam Food Service Industry?

Key companies in the market include CP All PCL, Golden Gate JSC, Yum! Brands Inc, Lotte GRS Co Ltd, Jollibee Foods Corporation, The Al Fresco's Group Vietnam, Starbucks Corporation, Restaurant Brands International Inc, Mesa Group, Imex Pan Pacific Group.

3. What are the main segments of the Vietnam Food Service Industry?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Cocoa Butter Equivalents Among Food Manufacturers; Rising Application in Food Industry.

6. What are the notable trends driving market growth?

Michelin Guide and Vietnam Tourism Promote Vietnamese Cuisine drives the expansion of the full service restaurants across the country.

7. Are there any restraints impacting market growth?

Health Concerns Pertaining to the Excessive Consumption of Fats and Oils.

8. Can you provide examples of recent developments in the market?

March 2023: Starbucks is committed to expanding in the country. It inaugurated 13 new stores to reach 100 stores by the end of 2023.January 2023: Restaurant Brands International Inc. opened a single store for both Burger King and Popeyes in Hanoi City.December 2022: KFC launched Charcoal Grilled Chicken Rice in Vietnam, which contains chicken fillets grilled on charcoal with Japanese Teriyaki sauce.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Food Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Food Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Food Service Industry?

To stay informed about further developments, trends, and reports in the Vietnam Food Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence