Key Insights

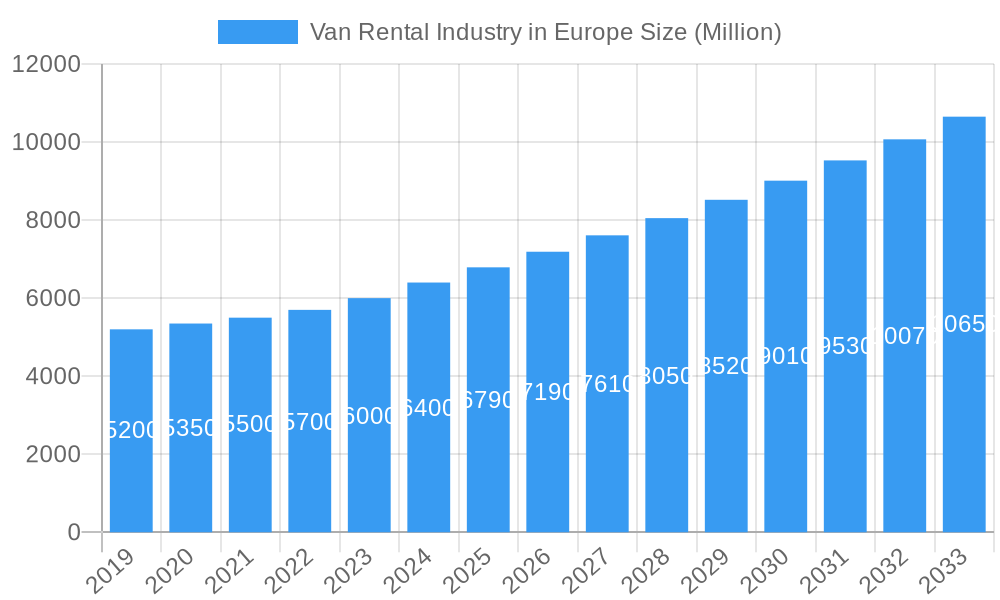

The European Van Rental market is poised for robust expansion, projected to reach a substantial 7.19 million value units by 2025, exhibiting a compelling Compound Annual Growth Rate (CAGR) of 5.60% through 2033. This growth is primarily propelled by escalating demand from the e-commerce sector, which necessitates efficient and flexible last-mile delivery solutions. The burgeoning freelance economy and the increasing adoption of a gig-based workforce further amplify the need for accessible van rental services, catering to individuals and small businesses requiring temporary transport for goods and services. Furthermore, the growing trend of businesses opting for operational leasing over outright van ownership, driven by cost-efficiency and reduced maintenance burdens, significantly contributes to market expansion. The convenience of short-term rentals for immediate needs, coupled with the cost-effectiveness of long-term leases for established operations, caters to a diverse range of customer requirements.

Van Rental Industry in Europe Market Size (In Billion)

Several key trends are shaping the European Van Rental landscape. The integration of advanced digital platforms for online booking, fleet management, and customer service is becoming paramount, enhancing user experience and operational efficiency. Telematics and IoT technologies are increasingly being adopted to optimize fleet utilization, monitor vehicle health, and improve safety. While the market benefits from strong growth drivers, certain restraints could influence its trajectory. Fluctuations in fuel prices and the ongoing transition towards electric vehicles (EVs) present both challenges and opportunities. The initial high cost of electric van acquisition and the development of charging infrastructure are factors that rental companies need to strategically address. However, the increasing availability of government incentives for EV adoption and the growing consumer preference for sustainable transportation are expected to mitigate these challenges and unlock new avenues for growth in the longer term.

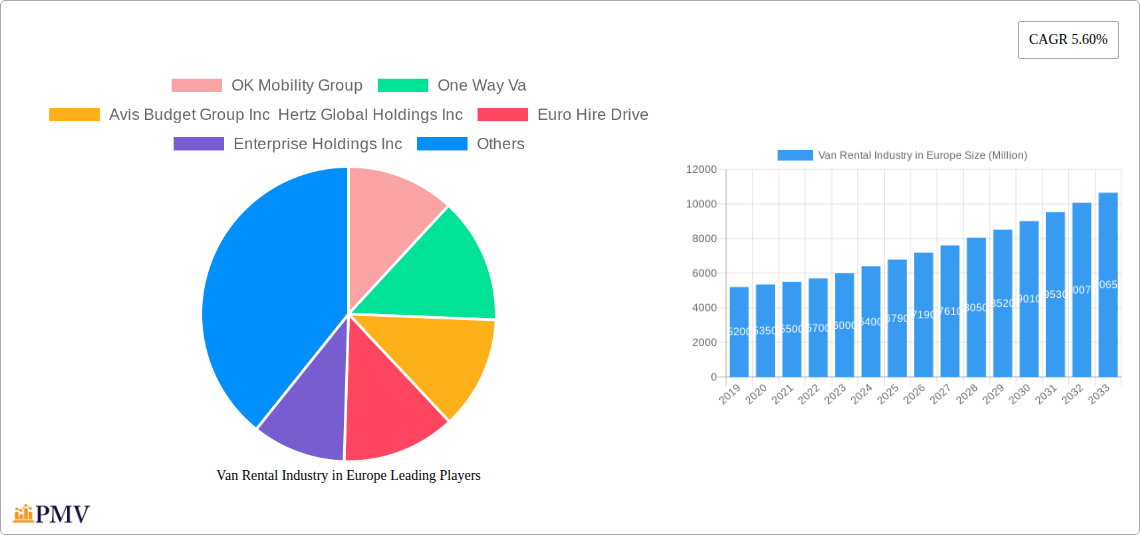

Van Rental Industry in Europe Company Market Share

Van Rental Industry in Europe Market Structure & Competitive Dynamics

The European van rental market is characterized by a moderately concentrated structure, with a few dominant global players alongside a growing number of regional and specialized providers. Innovation is being driven by the imperative for fleet electrification and digital transformation, creating dynamic competition. Regulatory frameworks, particularly concerning emissions standards and commercial vehicle usage, significantly influence market dynamics. Product substitutes include commercial vehicle leasing, outright purchase, and alternative logistics solutions, though dedicated van rental offers flexibility. End-user trends lean towards on-demand access, cost-efficiency, and sustainable transportation options. Mergers and acquisitions (M&A) remain a key strategy for market consolidation and expansion. For instance, M&A deal values are projected to reach over XX Million in the forecast period, indicating significant consolidation activity. The market share of key players like Enterprise Holdings Inc. and Europcar Mobility Group is substantial, estimated to be around XX% combined in the historical period.

Van Rental Industry in Europe Industry Trends & Insights

The European van rental industry is experiencing robust growth, driven by an expanding e-commerce sector, increasing demand for flexible transportation solutions for small and medium-sized enterprises (SMEs), and a surge in last-mile delivery services. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033), reaching an estimated market size of XX Billion by 2033. Technological advancements are profoundly reshaping the industry, with a significant push towards fleet electrification. Developments such as SIXT's comprehensive electrification package and Hertz's investment in UFODRIVE underscore this trend. Consumer preferences are evolving, with a greater emphasis on convenience, seamless booking experiences facilitated by online platforms and mobile apps, and eco-friendly options. The competitive landscape is intensifying, with companies vying for market share through fleet modernization, strategic partnerships, and enhanced service offerings. The integration of telematics and IoT solutions for fleet management, route optimization, and predictive maintenance is also becoming increasingly prevalent, leading to operational efficiencies and improved customer service. The shift from traditional rental models to more integrated mobility solutions, including subscription services and integrated fleet management for businesses, is another key trend. The historical period (2019–2024) saw initial recovery and adaptation post-pandemic, with increasing digital adoption. The base year (2025) represents a pivotal point where sustainability and digital integration are becoming mainstream. The market penetration of electric van rentals is expected to rise significantly from XX% in 2025 to XX% by 2033.

Dominant Markets & Segments in Van Rental Industry in Europe

The Business segment consistently dominates the European van rental market, driven by the logistical needs of diverse industries. Small and medium-sized enterprises (SMEs) rely heavily on flexible van rentals for their daily operations, from construction and trades to deliveries and event logistics. The Online booking type is rapidly gaining prominence, mirroring broader digital transformation trends. Customers increasingly prefer the convenience and transparency offered by online booking platforms and mobile applications for swift reservations and fleet management. The Short-term rental duration segment also holds a significant share, catering to immediate operational needs, seasonal demands, and project-based requirements.

- Dominant Region: Germany is projected to remain a dominant market due to its strong industrial base, extensive logistics network, and a high adoption rate of new technologies, including electric vehicles. The country's commitment to sustainability and stringent emission regulations further fuels the demand for cleaner van rental solutions.

- Application Type (Business): The business segment is driven by the need for flexible fleet solutions for a wide array of commercial activities. Key drivers include e-commerce growth, expansion of the gig economy, and the operational requirements of sectors like construction, manufacturing, and event management.

- Booking Type (Online): The shift towards online booking is fueled by the demand for speed, convenience, and real-time availability. Key drivers include user-friendly interfaces, mobile app integration, and competitive pricing readily available online.

- Rental Duration (Short-term): This segment caters to fluctuating business demands, project-specific needs, and seasonal peaks. Drivers include the avoidance of capital expenditure on owned fleets and the flexibility to scale operations up or down rapidly.

Van Rental Industry in Europe Product Innovations

Product innovations in the European van rental sector are heavily focused on sustainability and digital integration. The introduction of electric vans (EVs) by major players like SIXT and the joint venture between Inzile and OK Mobility Group are central. These innovations aim to reduce operational costs, meet environmental regulations, and appeal to eco-conscious customers. Enhanced telematics for real-time tracking, route optimization, and predictive maintenance are becoming standard, improving fleet efficiency and customer experience. Furthermore, the development of specialized vans for specific industry needs, such as temperature-controlled units for food delivery or larger capacity vehicles for logistics, offers competitive advantages.

Report Segmentation & Scope

The Van Rental Industry in Europe report is segmented across key parameters to provide comprehensive market insights. The Application Type segmentation includes Leisure/Tourism and Business, with the Business segment projected to hold a dominant market share of approximately XX% by 2033 due to higher rental volumes and recurring demand. The Booking Type is divided into Offline and Online, with the Online segment anticipated to grow at a CAGR of XX%, reaching XX% market penetration by 2033, driven by digital convenience. Rental Duration encompasses Short-term and Long-term rentals; while short-term rentals currently dominate, long-term rental solutions are expected to see substantial growth, particularly for businesses seeking predictable fleet costs, with a projected market share of XX% by 2033. The scope covers the period from 2019–2033, with a base year of 2025.

Key Drivers of Van Rental Industry in Europe Growth

Several key drivers are propelling the growth of the van rental industry in Europe. The exponential growth of e-commerce and the resulting surge in last-mile delivery services necessitate a flexible and readily available supply of commercial vans. Government initiatives promoting sustainability and emissions reduction are accelerating the adoption of electric vans, creating new market opportunities. The increasing trend of outsourcing non-core logistics functions by businesses, particularly SMEs, fuels the demand for rental solutions over outright ownership. Furthermore, the development of user-friendly digital booking platforms and integrated fleet management solutions enhances operational efficiency and customer convenience, thereby driving market expansion.

Challenges in the Van Rental Industry in Europe Sector

The van rental industry in Europe faces several significant challenges. The high upfront cost of transitioning to electric van fleets, coupled with the ongoing development of charging infrastructure, remains a substantial barrier. Fluctuations in fuel prices can impact operational costs and pricing strategies. Regulatory complexities across different European countries, including varying emission standards and road usage charges, can create operational hurdles. Supply chain disruptions, particularly in the automotive sector, can lead to extended vehicle delivery times and impact fleet availability. Intense competition from established players and emerging mobility service providers also exerts pressure on profit margins.

Leading Players in the Van Rental Industry in Europe Market

- OK Mobility Group

- One Way Va

- Avis Budget Group Inc

- Hertz Global Holdings Inc

- Euro Hire Drive

- Enterprise Holdings Inc

- Fraikin SAS

- SIXT SE

- Peugeot Europe

- Lease Plan Corporation

- Europcar Mobility Group

Key Developments in Van Rental Industry in Europe Sector

- September 2022: SIXT approved a comprehensive package of measures to electrify the fleet and establish its own charging infrastructure. The global SIXT fleet's electrified vehicle share (including plug-in hybrid electric vehicles (PHEVs) and mild hybrid electric vehicles (MHEV)) is expected to reach 12 to 15% by the end of 2023. By 2030, 70 to 90% of the company's vehicles in Europe will be electrified, and all of them will be bookable through the SIXT App.

- February 2022: Hertz announced an investment to expand electric vehicle commitment with a new UFODRIVE partnership. As Hertz's commitment to leading the future of mobility, the company invested in UFODRIVE - the leading self-service electric vehicle rental company and e-Mobility service provider in Europe.

- February 2022: Inzile and the Spanish OK Mobility Group formed a joint venture company to commercialize electric vehicles (EV) for the European rental sector. With the assistance and experience of OK Mobility Group and its marketing organization, Inzile will design, homologate, and manufacture compact electric vehicles for delivery to this sector.

Strategic Van Rental Industry in Europe Market Outlook

The strategic outlook for the European van rental industry is exceptionally positive, driven by ongoing digital transformation and the accelerating shift towards sustainable mobility. Key growth accelerators include the continued expansion of e-commerce logistics, requiring flexible and on-demand commercial vehicle solutions. The increasing regulatory push for decarbonization will further bolster the demand for electric van rentals. Companies that invest in robust digital platforms, offer integrated fleet management solutions, and prioritize the expansion of their electric vehicle fleets are poised for significant market success. Strategic partnerships, particularly with EV manufacturers and charging infrastructure providers, will also be crucial for competitive advantage and long-term growth. The market presents substantial opportunities for innovation in flexible rental models and value-added services catering to evolving business needs.

Van Rental Industry in Europe Segmentation

-

1. Application Type

- 1.1. Leisure/Tourism

- 1.2. Business

-

2. Booking Type

- 2.1. Offline

- 2.2. Online

-

3. Rental Duration

- 3.1. Short-term

- 3.2. Long-term

Van Rental Industry in Europe Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Belgium

- 6. Netherlands

- 7. Austria

- 8. Ireland

- 9. Luxembourg

- 10. Rest of Europe

Van Rental Industry in Europe Regional Market Share

Geographic Coverage of Van Rental Industry in Europe

Van Rental Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Logistics Company may Drive the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Government Incentives for Buying New EV May Hamper the Market

- 3.4. Market Trends

- 3.4.1. Business Rental Segment Anticipated to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Leisure/Tourism

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Rental Duration

- 5.3.1. Short-term

- 5.3.2. Long-term

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Spain

- 5.4.5. Belgium

- 5.4.6. Netherlands

- 5.4.7. Austria

- 5.4.8. Ireland

- 5.4.9. Luxembourg

- 5.4.10. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Germany Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Leisure/Tourism

- 6.1.2. Business

- 6.2. Market Analysis, Insights and Forecast - by Booking Type

- 6.2.1. Offline

- 6.2.2. Online

- 6.3. Market Analysis, Insights and Forecast - by Rental Duration

- 6.3.1. Short-term

- 6.3.2. Long-term

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. United Kingdom Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Leisure/Tourism

- 7.1.2. Business

- 7.2. Market Analysis, Insights and Forecast - by Booking Type

- 7.2.1. Offline

- 7.2.2. Online

- 7.3. Market Analysis, Insights and Forecast - by Rental Duration

- 7.3.1. Short-term

- 7.3.2. Long-term

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. France Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Leisure/Tourism

- 8.1.2. Business

- 8.2. Market Analysis, Insights and Forecast - by Booking Type

- 8.2.1. Offline

- 8.2.2. Online

- 8.3. Market Analysis, Insights and Forecast - by Rental Duration

- 8.3.1. Short-term

- 8.3.2. Long-term

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Spain Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Leisure/Tourism

- 9.1.2. Business

- 9.2. Market Analysis, Insights and Forecast - by Booking Type

- 9.2.1. Offline

- 9.2.2. Online

- 9.3. Market Analysis, Insights and Forecast - by Rental Duration

- 9.3.1. Short-term

- 9.3.2. Long-term

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. Belgium Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application Type

- 10.1.1. Leisure/Tourism

- 10.1.2. Business

- 10.2. Market Analysis, Insights and Forecast - by Booking Type

- 10.2.1. Offline

- 10.2.2. Online

- 10.3. Market Analysis, Insights and Forecast - by Rental Duration

- 10.3.1. Short-term

- 10.3.2. Long-term

- 10.1. Market Analysis, Insights and Forecast - by Application Type

- 11. Netherlands Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application Type

- 11.1.1. Leisure/Tourism

- 11.1.2. Business

- 11.2. Market Analysis, Insights and Forecast - by Booking Type

- 11.2.1. Offline

- 11.2.2. Online

- 11.3. Market Analysis, Insights and Forecast - by Rental Duration

- 11.3.1. Short-term

- 11.3.2. Long-term

- 11.1. Market Analysis, Insights and Forecast - by Application Type

- 12. Austria Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Application Type

- 12.1.1. Leisure/Tourism

- 12.1.2. Business

- 12.2. Market Analysis, Insights and Forecast - by Booking Type

- 12.2.1. Offline

- 12.2.2. Online

- 12.3. Market Analysis, Insights and Forecast - by Rental Duration

- 12.3.1. Short-term

- 12.3.2. Long-term

- 12.1. Market Analysis, Insights and Forecast - by Application Type

- 13. Ireland Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Application Type

- 13.1.1. Leisure/Tourism

- 13.1.2. Business

- 13.2. Market Analysis, Insights and Forecast - by Booking Type

- 13.2.1. Offline

- 13.2.2. Online

- 13.3. Market Analysis, Insights and Forecast - by Rental Duration

- 13.3.1. Short-term

- 13.3.2. Long-term

- 13.1. Market Analysis, Insights and Forecast - by Application Type

- 14. Luxembourg Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Application Type

- 14.1.1. Leisure/Tourism

- 14.1.2. Business

- 14.2. Market Analysis, Insights and Forecast - by Booking Type

- 14.2.1. Offline

- 14.2.2. Online

- 14.3. Market Analysis, Insights and Forecast - by Rental Duration

- 14.3.1. Short-term

- 14.3.2. Long-term

- 14.1. Market Analysis, Insights and Forecast - by Application Type

- 15. Rest of Europe Van Rental Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by Application Type

- 15.1.1. Leisure/Tourism

- 15.1.2. Business

- 15.2. Market Analysis, Insights and Forecast - by Booking Type

- 15.2.1. Offline

- 15.2.2. Online

- 15.3. Market Analysis, Insights and Forecast - by Rental Duration

- 15.3.1. Short-term

- 15.3.2. Long-term

- 15.1. Market Analysis, Insights and Forecast - by Application Type

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 OK Mobility Group

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 One Way Va

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Avis Budget Group Inc Hertz Global Holdings Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Euro Hire Drive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Enterprise Holdings Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Fraikin SAS

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 SIXT SE

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Peugeot Europe

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Lease Plan Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Europcar Mobility Group

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 OK Mobility Group

List of Figures

- Figure 1: Van Rental Industry in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Van Rental Industry in Europe Share (%) by Company 2025

List of Tables

- Table 1: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 3: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 4: Van Rental Industry in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 7: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 8: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 10: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 11: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 12: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 14: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 15: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 16: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 18: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 19: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 20: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 22: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 23: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 24: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 26: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 27: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 28: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 30: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 31: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 32: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 34: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 35: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 36: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 38: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 39: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 40: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Van Rental Industry in Europe Revenue Million Forecast, by Application Type 2020 & 2033

- Table 42: Van Rental Industry in Europe Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 43: Van Rental Industry in Europe Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 44: Van Rental Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Van Rental Industry in Europe?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Van Rental Industry in Europe?

Key companies in the market include OK Mobility Group, One Way Va, Avis Budget Group Inc Hertz Global Holdings Inc, Euro Hire Drive, Enterprise Holdings Inc, Fraikin SAS, SIXT SE, Peugeot Europe, Lease Plan Corporation, Europcar Mobility Group.

3. What are the main segments of the Van Rental Industry in Europe?

The market segments include Application Type, Booking Type, Rental Duration.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Logistics Company may Drive the Growth of the Market.

6. What are the notable trends driving market growth?

Business Rental Segment Anticipated to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

Government Incentives for Buying New EV May Hamper the Market.

8. Can you provide examples of recent developments in the market?

September 2022: SIXT approved a comprehensive package of measures to electrify the fleet and establish its own charging infrastructure. The global SIXT fleet's electrified vehicle share (including plug-in hybrid electric vehicles (PHEVs) and mild hybrid electric vehicles (MHEV)) is expected to reach 12 to 15% by the end of 2023. By 2030, 70 to 90% of the company's vehicles in Europe will be electrified, and all of them will be bookable through the SIXT App.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Van Rental Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Van Rental Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Van Rental Industry in Europe?

To stay informed about further developments, trends, and reports in the Van Rental Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence