Key Insights

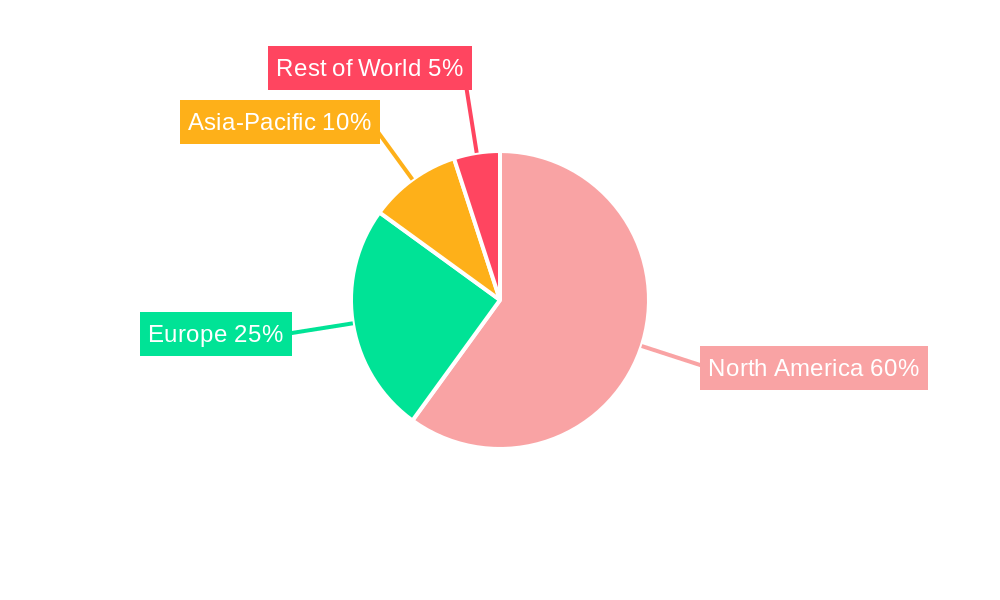

The US meat substitutes market, a dynamic sector within the broader plant-based food industry, is projected to experience robust growth over the forecast period (2025-2033). With a current market size exceeding $1.8 billion (assuming the global market size of 1889.1 million reflects a significant portion from the US), the sector benefits from several key drivers. Increasing consumer awareness of health and environmental benefits associated with reduced meat consumption is a primary catalyst. Growing demand for sustainable and ethical food sources, coupled with rising prevalence of vegetarianism and veganism, fuels market expansion. Innovation in product development, focusing on improved taste, texture, and nutritional profiles of meat substitutes, further enhances market appeal. The market is segmented by product type (tempeh, TVP, tofu, and other meat alternatives like seitan and jackfruit) and distribution channels (off-trade encompassing supermarkets and grocery stores, and on-trade including restaurants and cafes). Major players like Beyond Meat, Impossible Foods, and established food companies like Kellogg's and Conagra Brands are actively competing, driving innovation and market penetration. The US market, a significant portion of the global market, benefits from strong consumer purchasing power and established retail infrastructure, solidifying its position as a key growth area for meat substitutes.

The competition within the US meat substitutes market is intensifying, with both established food giants and innovative startups vying for market share. Successful players will need to focus on effective marketing strategies that highlight the health, environmental, and ethical benefits of their products, while also addressing consumer concerns regarding taste and price. Product diversification, expanding beyond core offerings to cater to diverse consumer preferences, is crucial for sustained growth. Furthermore, strategic partnerships and collaborations will play a vital role in market penetration and supply chain optimization. The continued growth of online grocery shopping offers additional avenues for market expansion, necessitating an omni-channel approach to distribution. Successful companies will adapt to changing consumer trends and preferences, employing data-driven insights to tailor product development and marketing initiatives for maximum impact. The future trajectory of the US meat substitutes market hinges on factors like regulatory landscape, technological advancements in plant-based protein production, and fluctuating consumer demand.

USA Meat Substitutes Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the USA meat substitutes industry, offering invaluable insights for businesses, investors, and stakeholders. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive primary and secondary research to provide accurate market sizing and forecasting. The market is segmented by type (Tempeh, Textured Vegetable Protein (TVP), Tofu, Other Meat Substitutes) and distribution channel (Off-Trade, On-Trade), offering granular understanding of market dynamics. The total market value in 2025 is estimated at $XX Million.

USA Meat Substitutes Industry Market Structure & Competitive Dynamics

The USA meat substitutes market exhibits a moderately consolidated structure with several large players and numerous smaller niche competitors. Market share is highly dynamic, influenced by product innovation, marketing strategies, and M&A activity. The regulatory landscape, while generally supportive of plant-based alternatives, faces evolving scrutiny concerning labeling and ingredient sourcing. Innovation ecosystems are thriving, with significant R&D investment driving the development of increasingly realistic and appealing meat substitutes. Consumer trends strongly favor healthier, more sustainable food options, boosting demand. M&A activity has been significant, with larger companies acquiring smaller, innovative players to expand their product portfolios and market reach. For example, the acquisition of Gathered Foods by Wicked Kitchen in September 2022 signaled increased consolidation. The total value of M&A deals within the period 2019-2024 was estimated at $XX Million. Key players' market share in 2025 is estimated as follows: Beyond Meat (XX%), Impossible Foods (XX%), Kellogg's (XX%), and others (XX%).

USA Meat Substitutes Industry Industry Trends & Insights

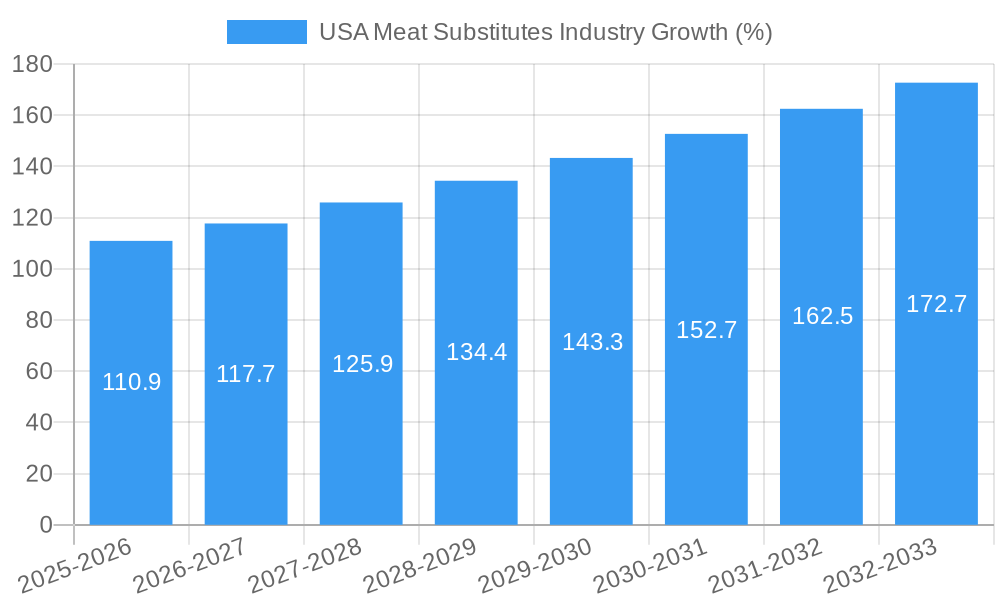

The USA meat substitutes market has experienced robust growth, driven by several key factors. Rising consumer awareness of health and environmental concerns associated with traditional meat consumption is a primary driver. The increasing adoption of flexitarian and vegetarian diets fuels demand for plant-based alternatives. Technological advancements have led to significant improvements in the taste, texture, and nutritional profile of meat substitutes, making them more appealing to a broader consumer base. The market has seen a Compound Annual Growth Rate (CAGR) of XX% during the historical period (2019-2024) and is projected to maintain a CAGR of XX% during the forecast period (2025-2033). This growth is further fueled by increasing investments in research and development leading to innovative product launches. Market penetration is expected to increase from XX% in 2025 to XX% by 2033. However, competitive dynamics remain intense, with established food companies competing with emerging plant-based specialists, leading to pricing pressures and intense marketing campaigns.

Dominant Markets & Segments in USA Meat Substitutes Industry

The dominant segment in the USA meat substitutes market is "Other Meat Substitutes," encompassing a variety of products like seitan, Quorn, and jackfruit, owing to their versatility and adaptability to diverse culinary applications. The Off-Trade distribution channel, encompassing supermarkets and grocery stores, holds the largest market share, reflecting the widespread availability and accessibility of meat substitutes to consumers. Key drivers for the dominance of these segments include:

- Consumer preference: A growing preference for convenient, readily available products drives Off-Trade dominance. The versatility of "Other Meat Substitutes" allows for greater culinary innovation.

- Retail infrastructure: Well-developed retail networks provide extensive reach for meat substitutes in supermarkets and grocery stores.

- Economic factors: Growing disposable incomes and increased consumer spending on health and wellness products contribute to segment growth.

The Western region of the USA displays the highest consumption and market share due to factors such as higher health consciousness and a higher concentration of vegetarian and vegan populations.

USA Meat Substitutes Industry Product Innovations

Recent innovations in the meat substitutes industry focus on enhancing taste, texture, and nutritional content to mimic the experience of consuming real meat more closely. Technological advances in protein extraction, fermentation, and 3D-printing are improving product quality. Companies are strategically developing products that cater to diverse culinary preferences, ranging from plant-based burgers and sausages to more complex items like pepperoni and chicken fillets. This reflects a market push towards product differentiation and meeting consumer demand for diverse flavor profiles and food applications.

Report Segmentation & Scope

This report segments the USA meat substitutes market by Type: Tempeh, Textured Vegetable Protein (TVP), Tofu, and Other Meat Substitutes (seitan, Quorn, jackfruit, etc.). The growth projections for each segment vary, with "Other Meat Substitutes" expected to show the highest growth due to its versatility. The market is further segmented by Distribution Channel: Off-Trade (supermarkets, grocery stores) and On-Trade (restaurants, cafes). The Off-Trade segment is projected to dominate due to its higher accessibility and convenience for consumers. Competitive dynamics vary across segments, with differing levels of market concentration and innovation.

Key Drivers of USA Meat Substitutes Industry Growth

Several factors drive the growth of the USA meat substitutes industry. Increasing consumer awareness of health benefits linked to reduced meat consumption plays a crucial role. Growing concerns about the environmental impact of traditional livestock farming also fuel demand. Technological advancements leading to more realistic and palatable alternatives are another major factor. Furthermore, supportive government policies and initiatives promoting sustainable food systems contribute to market expansion.

Challenges in the USA Meat Substitutes Industry Sector

The USA meat substitutes industry faces several challenges. Maintaining cost-competitiveness compared to traditional meat products remains a significant hurdle. Supply chain disruptions and volatility in raw material prices pose ongoing concerns. Addressing consumer perceptions related to taste, texture, and nutritional value is also crucial. Finally, navigating evolving regulatory landscapes and labeling requirements presents further complexities. For example, the increase in raw material cost resulted in an estimated XX Million loss to the industry during 2022.

Leading Players in the USA Meat Substitutes Industry Market

- The Kellogg Company

- Beyond Meat Inc

- The Campbell Soup Company

- The Hain Celestial Group Inc

- Conagra Brands Inc

- Wicked Foods Inc

- The Kraft Heinz Company

- Hormel Foods Corporation

- Amy's Kitchen Inc

- Maple Leaf Foods

- Impossible Foods Inc

Key Developments in USA Meat Substitutes Industry Sector

- September 2022: Gathered Foods acquired by Wicked Kitchen.

- February 2023: Impossible Foods launched plant-based spicy chicken nuggets, patties, and tenders.

- April 2023: Beyond Meat launched Beyond Pepperoni and Beyond Chicken Fillet.

These developments showcase the industry's dynamism and ongoing efforts to expand product offerings and cater to evolving consumer preferences.

Strategic USA Meat Substitutes Industry Market Outlook

The USA meat substitutes market presents significant growth potential. Continued innovation in product development, coupled with increasing consumer demand for healthier and more sustainable food options, will drive market expansion. Strategic partnerships and collaborations between established food companies and innovative startups will further accelerate growth. The market's future potential is substantial, presenting opportunities for both established players and new entrants. Focusing on sustainability, enhanced taste profiles and cost-effective manufacturing processes are predicted to influence this growth.

USA Meat Substitutes Industry Segmentation

-

1. Type

- 1.1. Tempeh

- 1.2. Textured Vegetable Protein

- 1.3. Tofu

- 1.4. Other Meat Substitutes

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

USA Meat Substitutes Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Meat Substitutes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Meat Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tempeh

- 5.1.2. Textured Vegetable Protein

- 5.1.3. Tofu

- 5.1.4. Other Meat Substitutes

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America USA Meat Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Tempeh

- 6.1.2. Textured Vegetable Protein

- 6.1.3. Tofu

- 6.1.4. Other Meat Substitutes

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Off-Trade

- 6.2.1.1. Convenience Stores

- 6.2.1.2. Online Channel

- 6.2.1.3. Supermarkets and Hypermarkets

- 6.2.1.4. Others

- 6.2.2. On-Trade

- 6.2.1. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America USA Meat Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Tempeh

- 7.1.2. Textured Vegetable Protein

- 7.1.3. Tofu

- 7.1.4. Other Meat Substitutes

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Off-Trade

- 7.2.1.1. Convenience Stores

- 7.2.1.2. Online Channel

- 7.2.1.3. Supermarkets and Hypermarkets

- 7.2.1.4. Others

- 7.2.2. On-Trade

- 7.2.1. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe USA Meat Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Tempeh

- 8.1.2. Textured Vegetable Protein

- 8.1.3. Tofu

- 8.1.4. Other Meat Substitutes

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Off-Trade

- 8.2.1.1. Convenience Stores

- 8.2.1.2. Online Channel

- 8.2.1.3. Supermarkets and Hypermarkets

- 8.2.1.4. Others

- 8.2.2. On-Trade

- 8.2.1. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa USA Meat Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Tempeh

- 9.1.2. Textured Vegetable Protein

- 9.1.3. Tofu

- 9.1.4. Other Meat Substitutes

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Off-Trade

- 9.2.1.1. Convenience Stores

- 9.2.1.2. Online Channel

- 9.2.1.3. Supermarkets and Hypermarkets

- 9.2.1.4. Others

- 9.2.2. On-Trade

- 9.2.1. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific USA Meat Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Tempeh

- 10.1.2. Textured Vegetable Protein

- 10.1.3. Tofu

- 10.1.4. Other Meat Substitutes

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Off-Trade

- 10.2.1.1. Convenience Stores

- 10.2.1.2. Online Channel

- 10.2.1.3. Supermarkets and Hypermarkets

- 10.2.1.4. Others

- 10.2.2. On-Trade

- 10.2.1. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America USA Meat Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. South America USA Meat Substitutes Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Brazil

- 12.1.2 Argentina

- 12.1.3 Rest of South America

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 The Kellogg Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Beyond Meat Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 The Campbell Soup Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 The Hain Celestial Group Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Conagra Brands Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Wicked Foods Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Kraft Heinz Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Hormel Foods Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Amy's Kitchen Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Maple Leaf Foods

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Impossible Foods Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 The Kellogg Company

List of Figures

- Figure 1: Global USA Meat Substitutes Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America USA Meat Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America USA Meat Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: South America USA Meat Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: South America USA Meat Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America USA Meat Substitutes Industry Revenue (Million), by Type 2024 & 2032

- Figure 7: North America USA Meat Substitutes Industry Revenue Share (%), by Type 2024 & 2032

- Figure 8: North America USA Meat Substitutes Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 9: North America USA Meat Substitutes Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 10: North America USA Meat Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America USA Meat Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America USA Meat Substitutes Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: South America USA Meat Substitutes Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: South America USA Meat Substitutes Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 15: South America USA Meat Substitutes Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 16: South America USA Meat Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: South America USA Meat Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe USA Meat Substitutes Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe USA Meat Substitutes Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe USA Meat Substitutes Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: Europe USA Meat Substitutes Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: Europe USA Meat Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe USA Meat Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Middle East & Africa USA Meat Substitutes Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Middle East & Africa USA Meat Substitutes Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Middle East & Africa USA Meat Substitutes Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 27: Middle East & Africa USA Meat Substitutes Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 28: Middle East & Africa USA Meat Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Middle East & Africa USA Meat Substitutes Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific USA Meat Substitutes Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific USA Meat Substitutes Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific USA Meat Substitutes Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Asia Pacific USA Meat Substitutes Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Asia Pacific USA Meat Substitutes Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific USA Meat Substitutes Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global USA Meat Substitutes Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global USA Meat Substitutes Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global USA Meat Substitutes Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global USA Meat Substitutes Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global USA Meat Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global USA Meat Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Argentina USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of South America USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global USA Meat Substitutes Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Global USA Meat Substitutes Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Global USA Meat Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global USA Meat Substitutes Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global USA Meat Substitutes Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Global USA Meat Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global USA Meat Substitutes Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Global USA Meat Substitutes Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 27: Global USA Meat Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global USA Meat Substitutes Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Global USA Meat Substitutes Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 39: Global USA Meat Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Turkey USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Israel USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: GCC USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: North Africa USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Middle East & Africa USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global USA Meat Substitutes Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 47: Global USA Meat Substitutes Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: Global USA Meat Substitutes Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Japan USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Korea USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: ASEAN USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Oceania USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific USA Meat Substitutes Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Meat Substitutes Industry?

The projected CAGR is approximately 6.02%.

2. Which companies are prominent players in the USA Meat Substitutes Industry?

Key companies in the market include The Kellogg Company, Beyond Meat Inc, The Campbell Soup Company, The Hain Celestial Group Inc, Conagra Brands Inc, Wicked Foods Inc, The Kraft Heinz Company, Hormel Foods Corporation, Amy's Kitchen Inc, Maple Leaf Foods, Impossible Foods Inc.

3. What are the main segments of the USA Meat Substitutes Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1,889.1 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

April 2023: Beyond Meat, a leader in plant-based meat, announced the launch of Beyond Pepperoni and Beyond Chicken Fillet, building on their recent rollout of Beyond Steak.February 2023: Impossible foods launched plant based spicy chicken nuggets, spicy chicken patties, and chicken tenders.September 2022: Gathered Foods has been acquired by Wicked Kitchen a plant-based product selling brand based in North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Meat Substitutes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Meat Substitutes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Meat Substitutes Industry?

To stay informed about further developments, trends, and reports in the USA Meat Substitutes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence