Key Insights

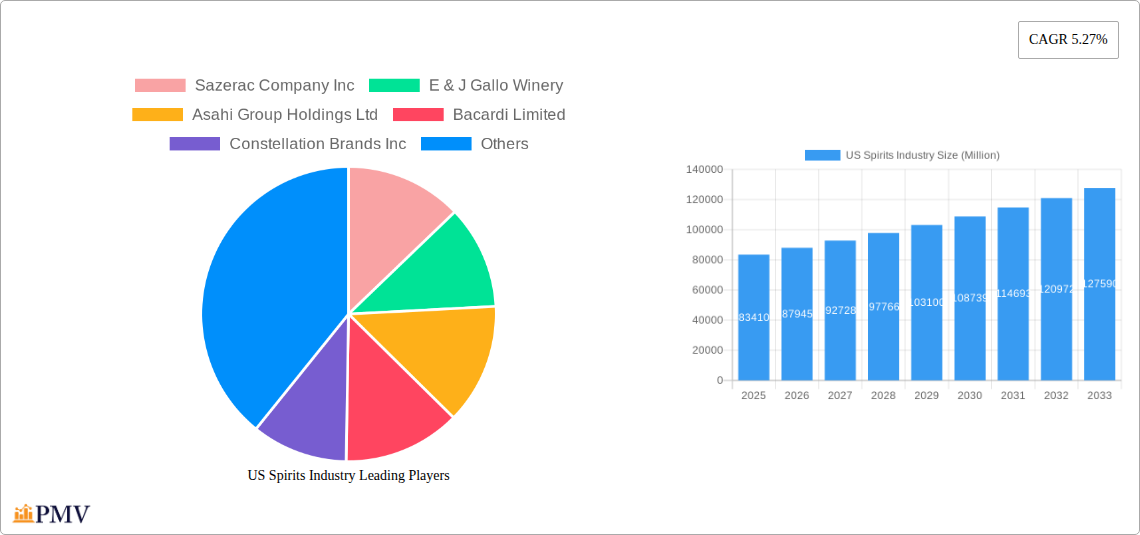

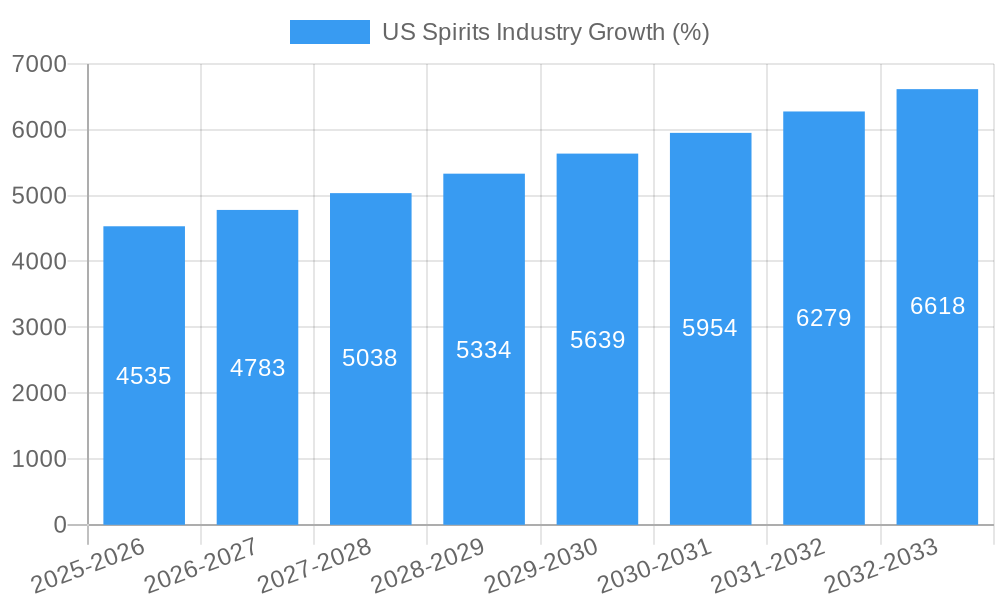

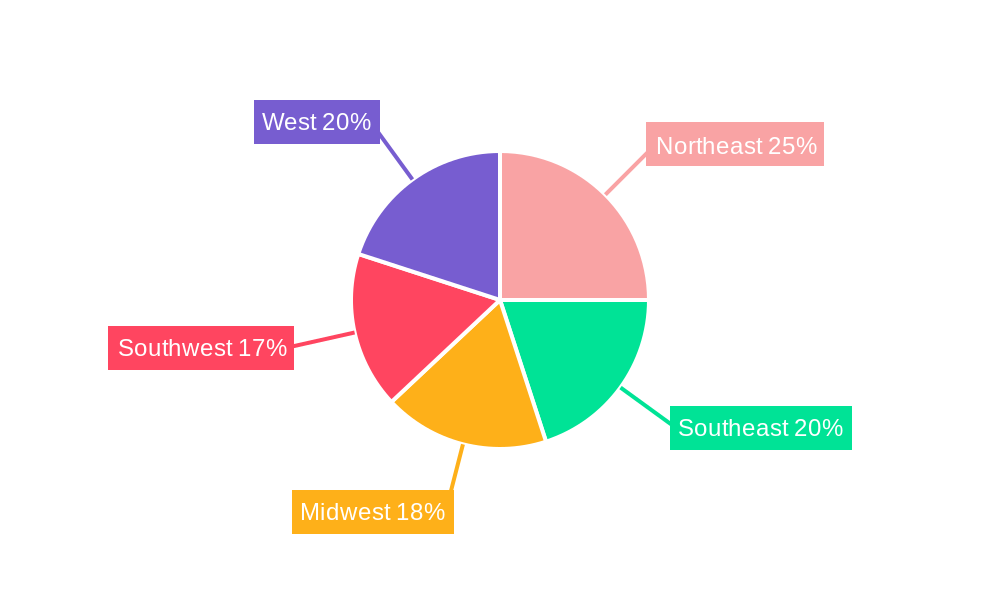

The US spirits industry, valued at $83.41 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 5.27% from 2025 to 2033. This expansion is fueled by several key factors. Premiumization, a trend towards higher-priced, craft, and imported spirits, is driving revenue growth. Changing consumer preferences, including a rising interest in diverse spirit categories like craft whiskey and premium gin, alongside the increasing popularity of ready-to-drink (RTD) cocktails, contribute significantly. The on-trade sector, encompassing bars and restaurants, is recovering strongly post-pandemic, boosting sales. Furthermore, innovative marketing strategies, including experiential marketing and targeted digital campaigns, are enhancing brand awareness and driving sales. However, challenges remain, including increased excise taxes and potential economic downturns that might impact consumer spending on discretionary items like premium spirits. Competitive pressures from both established multinational companies and emerging craft distilleries also shape the market landscape. Geographical variations exist, with regions like the Northeast and West potentially demonstrating faster growth due to higher disposable incomes and a strong presence of affluent consumers.

The market segmentation reveals significant opportunities. Whiskey remains a dominant category, followed by vodka and rum. The off-trade channel (retail stores) holds a substantial market share but the on-trade channel’s recovery is expected to balance this. Major players like Diageo, Brown-Forman, and Bacardi maintain a strong presence, but smaller, craft distilleries are actively challenging this dominance through innovative products and targeted marketing, creating a dynamic market landscape. Analyzing regional data (Northeast, Southeast, Midwest, Southwest, West) allows for targeted marketing strategies and efficient resource allocation. The forecast period (2025-2033) anticipates continued expansion, though the pace might fluctuate slightly based on macroeconomic conditions and evolving consumer trends.

US Spirits Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the US spirits industry, covering market structure, competitive dynamics, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The report uses data from the historical period of 2019-2024 to provide a robust foundation for future projections. The total market size is predicted to reach xx Million by 2033, showing significant growth potential. This report is essential for industry stakeholders, investors, and anyone seeking a comprehensive understanding of this dynamic market.

US Spirits Industry Market Structure & Competitive Dynamics

The US spirits market is characterized by a mix of large multinational corporations and smaller, regional distilleries. Market concentration is moderate, with a few major players holding significant market share, but a vibrant landscape of smaller brands competing for niche segments. Key players like Diageo PLC, Pernod Ricard, and Brown-Forman Corporation dominate various spirit categories. Market share varies significantly across segments. For example, Diageo holds a leading share in Scotch whisky, while Brown-Forman excels in bourbon. Innovation ecosystems are driven by both large companies investing in R&D and smaller craft distilleries introducing unique products. The regulatory framework, including federal and state-level alcohol regulations, significantly impacts market access and distribution. Product substitutes, such as wine, beer, and non-alcoholic beverages, exert competitive pressure. End-user trends, such as increasing demand for premium and craft spirits, along with health-conscious options, influence market dynamics. Mergers and acquisitions (M&A) activities have been relatively frequent, with deal values reaching xx Million in recent years, as large players seek to expand their portfolio and market reach.

- Market Concentration: Moderate, with a few dominant players.

- Innovation: Driven by both large and small companies.

- Regulatory Framework: Complex, varying by state and impacting market access.

- M&A Activity: Significant, with deal values reaching xx Million annually.

US Spirits Industry Industry Trends & Insights

The US spirits market exhibits strong growth, driven by several key factors. Premiumization is a prominent trend, with consumers increasingly willing to spend more on high-quality, craft spirits. The ready-to-drink (RTD) segment is experiencing rapid expansion, fueled by convenience and innovative flavor profiles. Technological advancements, such as improved distillation techniques and sustainable packaging, contribute to industry innovation. Changing consumer preferences, including a shift towards healthier options and an emphasis on experiential consumption, shape market dynamics. The CAGR for the US spirits market is projected at xx% during the forecast period (2025-2033), with market penetration rates expected to increase across various segments. The competitive landscape is dynamic, with existing players expanding their product lines and new entrants entering the market. This competition fosters innovation and drives prices down, benefiting consumers.

Dominant Markets & Segments in US Spirits Industry

Leading Region: The Western US continues to dominate due to economic strength and high per capita consumption.

Dominant Spirit Types: Whiskey (especially Bourbon and Rye) maintains its leading position, followed by Vodka and Tequila. Growth in RTD cocktails is driving innovation and expansion across categories. The popularity of craft spirits is increasing market segmentation.

Distribution Channel: The off-trade (retail) channel remains the largest, though on-trade (bars and restaurants) contributes significantly to revenue and brand visibility. The growth of e-commerce channels is increasing its market share.

Key Drivers:

- Strong consumer spending in key regions

- Increasing disposable incomes

- Growth of craft distilleries

- Favorable regulatory environment in some states

The dominance of specific segments is influenced by factors such as consumer preferences, pricing, and distribution strategies. For instance, whiskey's leading position is fueled by its strong cultural heritage and the growing appreciation for premium bourbons and ryes. Meanwhile, vodka's popularity is sustained through broad appeal and marketing strategies. The growth of the RTD segment underscores the trend towards convenient and ready-to-consume beverages.

US Spirits Industry Product Innovations

Recent innovations in the US spirits industry focus on premiumization, flavor diversification, and convenience. We are seeing a rise in artisanal and small-batch spirits, along with unique flavor infusions and blends. The RTD category has witnessed significant innovation, with companies introducing innovative packaging and flavor combinations. Technology is playing a crucial role, with advancements in distillation, filtration, and packaging methods improving product quality and sustainability. These innovations are well-aligned with evolving consumer preferences, driving market growth and competitiveness.

Report Segmentation & Scope

This report segments the US spirits market by type (Whiskey, Vodka, Rum, Brandy, Gin, Other Spirits) and distribution channel (Off-trade, On-trade). Each segment's market size, growth projection, and competitive dynamics are analyzed in detail. The "Other Spirits" category includes Tequila, Mezcal, and other emerging spirits, exhibiting rapid growth. The on-trade channel is segmented further by venue type (bars, restaurants, nightclubs), offering insights into consumption patterns. Growth projections for each segment are presented based on market trends and industry forecasts.

Key Drivers of US Spirits Industry Growth

Several factors drive growth in the US spirits industry. Economic growth and rising disposable incomes fuel increased consumer spending on premium spirits. Favorable regulatory environments, particularly in certain states, encourage the growth of craft distilleries. Technological advancements, such as improved production processes and sustainable packaging, contribute to efficiency and innovation. Furthermore, targeted marketing campaigns and creative product launches continuously engage consumers and broaden the appeal of various spirits categories.

Challenges in the US Spirits Industry Sector

The US spirits industry faces challenges like increased competition from both established and emerging brands, leading to price pressure. Supply chain disruptions and volatility in raw material prices impact production costs and profitability. Strict regulatory environments in several states impose limitations on market access and distribution. Additionally, consumer health concerns and shifting preferences towards lower-alcohol beverages pose a challenge to the industry's long-term growth. The economic impact of these factors is significant, potentially impacting revenue and overall market performance.

Leading Players in the US Spirits Industry Market

- Sazerac Company Inc

- E & J Gallo Winery

- Asahi Group Holdings Ltd

- Bacardi Limited

- Constellation Brands Inc

- Suntory Holdings Limited

- Heaven Hill Distilleries Inc

- The Brown-Forman Corporation

- Pernod Ricard

- Diageo PLC

Key Developments in US Spirits Industry Sector

October 2022: Smirnoff Vodka (Diageo Plc) partnered with Gorillaz, releasing new cocktails and a limited-edition bottle. This collaboration enhanced brand visibility and appealed to a younger demographic.

November 2022: Pernod Ricard USA invested USD 22 Million in a new RTD canning line, boosting its capacity to meet growing demand in this segment.

March 2023: Constellation Brands partnered with Tastemade to create a content studio, driving consumer engagement through social and streaming media. This move leverages digital marketing to strengthen brand presence.

Strategic US Spirits Industry Market Outlook

The US spirits industry's future growth is promising, driven by increasing premiumization, RTD expansion, and sustained consumer interest in craft and artisanal spirits. Strategic opportunities lie in embracing sustainable practices, leveraging digital marketing, and exploring emerging consumer segments. Companies that successfully adapt to changing consumer preferences, innovate in product offerings, and manage supply chain challenges will likely thrive in this competitive yet dynamic market. The focus on premiumization and RTDs will remain crucial for continued market expansion.

US Spirits Industry Segmentation

-

1. Type

- 1.1. Whiskey

- 1.2. Vodka

- 1.3. Rum

- 1.4. Brandy

- 1.5. Gin

- 1.6. Other Spirits

-

2. Distribution Channel

-

2.1. Off-trade

- 2.1.1. Specialist Retailers

- 2.1.2. Supermarkets/Hypermarkets

- 2.1.3. Online Retail

- 2.1.4. Other Channels

- 2.2. On-trade

-

2.1. Off-trade

US Spirits Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Spirits Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.27% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Flavored Spirits; Growing Consumption of Premium Alcoholic Beverages

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Pertaining to Spirits

- 3.4. Market Trends

- 3.4.1. Growing Demand for Premium Alcoholic Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Spirits Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Whiskey

- 5.1.2. Vodka

- 5.1.3. Rum

- 5.1.4. Brandy

- 5.1.5. Gin

- 5.1.6. Other Spirits

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-trade

- 5.2.1.1. Specialist Retailers

- 5.2.1.2. Supermarkets/Hypermarkets

- 5.2.1.3. Online Retail

- 5.2.1.4. Other Channels

- 5.2.2. On-trade

- 5.2.1. Off-trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Spirits Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Whiskey

- 6.1.2. Vodka

- 6.1.3. Rum

- 6.1.4. Brandy

- 6.1.5. Gin

- 6.1.6. Other Spirits

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Off-trade

- 6.2.1.1. Specialist Retailers

- 6.2.1.2. Supermarkets/Hypermarkets

- 6.2.1.3. Online Retail

- 6.2.1.4. Other Channels

- 6.2.2. On-trade

- 6.2.1. Off-trade

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Spirits Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Whiskey

- 7.1.2. Vodka

- 7.1.3. Rum

- 7.1.4. Brandy

- 7.1.5. Gin

- 7.1.6. Other Spirits

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Off-trade

- 7.2.1.1. Specialist Retailers

- 7.2.1.2. Supermarkets/Hypermarkets

- 7.2.1.3. Online Retail

- 7.2.1.4. Other Channels

- 7.2.2. On-trade

- 7.2.1. Off-trade

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Spirits Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Whiskey

- 8.1.2. Vodka

- 8.1.3. Rum

- 8.1.4. Brandy

- 8.1.5. Gin

- 8.1.6. Other Spirits

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Off-trade

- 8.2.1.1. Specialist Retailers

- 8.2.1.2. Supermarkets/Hypermarkets

- 8.2.1.3. Online Retail

- 8.2.1.4. Other Channels

- 8.2.2. On-trade

- 8.2.1. Off-trade

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Spirits Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Whiskey

- 9.1.2. Vodka

- 9.1.3. Rum

- 9.1.4. Brandy

- 9.1.5. Gin

- 9.1.6. Other Spirits

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Off-trade

- 9.2.1.1. Specialist Retailers

- 9.2.1.2. Supermarkets/Hypermarkets

- 9.2.1.3. Online Retail

- 9.2.1.4. Other Channels

- 9.2.2. On-trade

- 9.2.1. Off-trade

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Spirits Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Whiskey

- 10.1.2. Vodka

- 10.1.3. Rum

- 10.1.4. Brandy

- 10.1.5. Gin

- 10.1.6. Other Spirits

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Off-trade

- 10.2.1.1. Specialist Retailers

- 10.2.1.2. Supermarkets/Hypermarkets

- 10.2.1.3. Online Retail

- 10.2.1.4. Other Channels

- 10.2.2. On-trade

- 10.2.1. Off-trade

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Northeast US Spirits Industry Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US Spirits Industry Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US Spirits Industry Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US Spirits Industry Analysis, Insights and Forecast, 2019-2031

- 15. West US Spirits Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Sazerac Company Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 E & J Gallo Winery

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Asahi Group Holdings Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Bacardi Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Constellation Brands Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Suntory Holdings Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Heaven Hill Distilleries Inc *List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 The Brown-Forman Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Pernod Ricard

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Diageo PLC

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Sazerac Company Inc

List of Figures

- Figure 1: Global US Spirits Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US Spirits Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US Spirits Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Spirits Industry Revenue (Million), by Type 2024 & 2032

- Figure 5: North America US Spirits Industry Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America US Spirits Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America US Spirits Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America US Spirits Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: North America US Spirits Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America US Spirits Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: South America US Spirits Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America US Spirits Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America US Spirits Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America US Spirits Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: South America US Spirits Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe US Spirits Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe US Spirits Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe US Spirits Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe US Spirits Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe US Spirits Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe US Spirits Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa US Spirits Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Middle East & Africa US Spirits Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa US Spirits Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa US Spirits Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa US Spirits Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa US Spirits Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific US Spirits Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific US Spirits Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific US Spirits Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific US Spirits Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific US Spirits Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific US Spirits Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Spirits Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Spirits Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global US Spirits Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global US Spirits Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global US Spirits Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Northeast US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Southeast US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Midwest US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southwest US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global US Spirits Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global US Spirits Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global US Spirits Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global US Spirits Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global US Spirits Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global US Spirits Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global US Spirits Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global US Spirits Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Global US Spirits Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global US Spirits Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global US Spirits Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: Global US Spirits Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global US Spirits Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 45: Global US Spirits Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 46: Global US Spirits Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific US Spirits Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Spirits Industry?

The projected CAGR is approximately 5.27%.

2. Which companies are prominent players in the US Spirits Industry?

Key companies in the market include Sazerac Company Inc, E & J Gallo Winery, Asahi Group Holdings Ltd, Bacardi Limited, Constellation Brands Inc, Suntory Holdings Limited, Heaven Hill Distilleries Inc *List Not Exhaustive, The Brown-Forman Corporation, Pernod Ricard, Diageo PLC.

3. What are the main segments of the US Spirits Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 83.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Flavored Spirits; Growing Consumption of Premium Alcoholic Beverages.

6. What are the notable trends driving market growth?

Growing Demand for Premium Alcoholic Beverages.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Pertaining to Spirits.

8. Can you provide examples of recent developments in the market?

March 2023: Constellation Brands, partnered with Tastemade, a modern media company, to launch a first-of-its-kind content studio that will create and distribute social and streaming content to drive consumer engagement globally for Constellation Brands Wine & Spirits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Spirits Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Spirits Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Spirits Industry?

To stay informed about further developments, trends, and reports in the US Spirits Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence