Key Insights

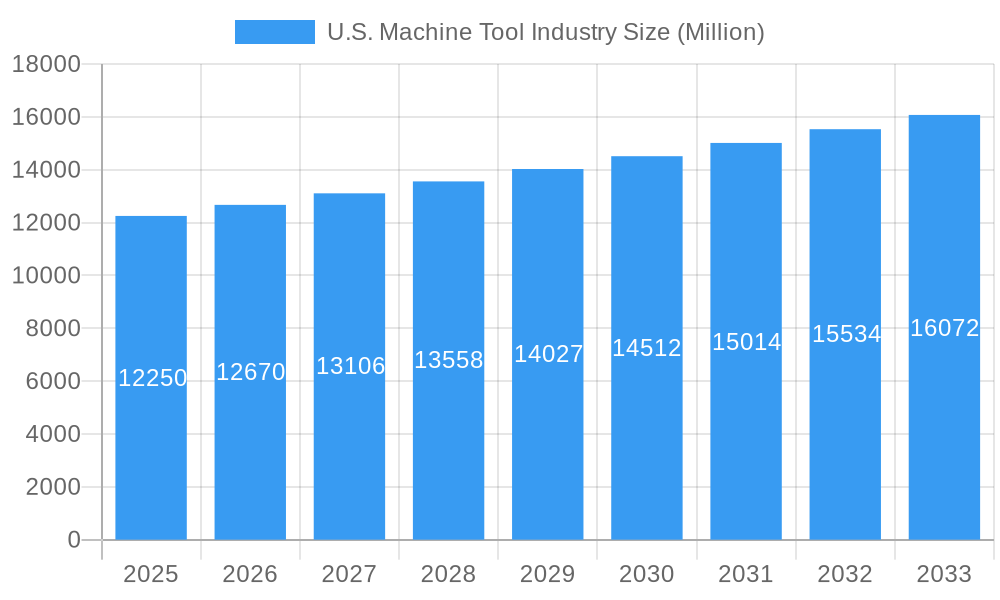

The U.S. machine tool industry, valued at $12.25 billion in 2025, is projected to experience steady growth, driven by increasing automation in manufacturing, reshoring initiatives, and investments in advanced technologies like robotics and artificial intelligence. The 3.38% CAGR suggests a consistent expansion over the forecast period (2025-2033), although this rate may fluctuate yearly due to economic cycles and global events. Key growth drivers include the automotive, aerospace, and energy sectors' need for high-precision machining, alongside rising demand for customized manufacturing solutions. Trends such as digitalization (smart factories, IoT integration), sustainable manufacturing practices (reduced waste, energy efficiency), and the adoption of additive manufacturing (3D printing) are shaping the industry's future, leading to increased productivity and improved product quality. While potential restraints include supply chain disruptions, skilled labor shortages, and fluctuating raw material costs, the overall outlook remains positive, fueled by ongoing technological advancements and government initiatives promoting domestic manufacturing.

U.S. Machine Tool Industry Market Size (In Billion)

The industry's segmentation likely includes metal cutting machines (lathes, milling machines, grinders), metal forming machines (press brakes, stamping presses), and related tooling and accessories. Major players like TRUMPF, Haas Automation, and Amada dominate the market through technological innovation, extensive distribution networks, and strong brand recognition. However, smaller, specialized companies also contribute significantly by offering niche solutions and catering to specific industry requirements. The regional data, while not provided, would likely show a strong concentration in the Midwest and Southeast US, areas historically known for manufacturing hubs. Future growth will depend on continued investment in R&D, collaboration between manufacturers and technology providers, and the successful adaptation to evolving customer demands for greater efficiency and flexibility.

U.S. Machine Tool Industry Company Market Share

U.S. Machine Tool Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the U.S. machine tool industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report examines market structure, competitive dynamics, key trends, and future growth potential. The report incorporates extensive data, including market size projections in Millions, CAGR, and analysis of significant M&A activities, providing actionable intelligence for informed decision-making.

U.S. Machine Tool Industry Market Structure & Competitive Dynamics

The U.S. machine tool industry presents a moderately concentrated market structure, dominated by several key players commanding significant market share. The competitive landscape is fiercely dynamic, shaped by relentless innovation, strict regulatory compliance, the emergence of disruptive technologies (like 3D printing), evolving end-user demands, and a robust mergers and acquisitions (M&A) environment. Preliminary 2024 market share data suggests the top five players control approximately [Insert Percentage]% of the total market, with industry stalwarts such as Haas Automation, TRUMPF, and Amada consistently ranking among the leaders. However, the precise figures are subject to ongoing analysis and verification.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the U.S. machine tool industry is estimated at [Insert HHI Value] in 2024, indicating a moderately concentrated market. This concentration reflects the significant investments and expertise required to compete effectively in this sector.

- Innovation Ecosystems: Strong collaboration among machine tool manufacturers, cutting-edge software providers, and leading research institutions fuels innovation across key areas such as automation, digitalization, and advanced materials processing. This collaborative approach accelerates the development and deployment of next-generation technologies.

- Regulatory Frameworks: Adherence to stringent safety and environmental regulations substantially impacts manufacturing processes and operational costs. Companies must navigate complex regulatory landscapes to ensure compliance and maintain a competitive edge.

- Product Substitutes: Additive manufacturing technologies, including 3D printing, pose a growing competitive challenge, particularly in low-volume production applications. However, traditional machine tools still hold significant advantages in high-volume, high-precision manufacturing.

- End-User Trends: The industry is experiencing a surge in demand for automation, enhanced precision, and increased manufacturing flexibility. These factors drive the adoption of sophisticated machine tools across a diverse range of sectors.

- M&A Activities: Recent years have seen considerable industry consolidation, exemplified by significant transactions such as Sandvik's acquisition of Peterson Tool Company in July 2022 (valued at approximately [Insert Value] Million). This trend toward vertical integration and broader product portfolios reflects strategic efforts to enhance competitiveness and market reach. The cumulative value of M&A deals within the industry during 2019-2024 is estimated at approximately [Insert Value] Million, highlighting the ongoing consolidation process.

U.S. Machine Tool Industry Industry Trends & Insights

The U.S. machine tool industry is experiencing a period of significant transformation, driven by technological advancements, evolving consumer preferences, and shifting global economic dynamics. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Key growth drivers include increased automation in manufacturing, the adoption of Industry 4.0 technologies, growing demand for high-precision machine tools in industries like aerospace and automotive, and government initiatives promoting advanced manufacturing. However, challenges such as supply chain disruptions and skilled labor shortages continue to influence market dynamics. Market penetration of advanced technologies like AI-powered machine learning and digital twinning is currently at xx%, expected to increase to xx% by 2033.

Dominant Markets & Segments in U.S. Machine Tool Industry

The automotive and aerospace sectors represent the dominant end-use markets for machine tools in the U.S., fueling significant demand for high-precision, high-speed machining capabilities. The Midwest region maintains the largest market share, a legacy of its established manufacturing base and concentration of automotive and industrial production facilities. However, other regions are also experiencing growth in specific segments.

- Key Drivers in Dominant Regions:

- Midwest: A robust manufacturing infrastructure, a high concentration of automotive and industrial plants, and a skilled workforce contribute to the region's dominance.

- Southeast: The Southeast is experiencing growth driven by the expansion of aerospace and advanced manufacturing industries.

- Southwest: Expanding semiconductor and electronics manufacturing in the Southwest is creating new opportunities for machine tool suppliers.

The automotive and aerospace segments' prominence is rooted in their substantial need for precision machining, complex geometries, and high production volumes. The estimated market size for these segments in 2024 was approximately [Insert Automotive Value] Million and [Insert Aerospace Value] Million, respectively. These figures represent preliminary estimates subject to final data verification.

U.S. Machine Tool Industry Product Innovations

Recent product innovations in the U.S. machine tool industry are focused on enhancing automation, precision, and efficiency. Key trends include the integration of artificial intelligence (AI), machine learning (ML), and digital twin technology for predictive maintenance and process optimization. Multi-axis machining centers with advanced control systems offer increased flexibility and precision. The development of hybrid manufacturing processes combining traditional machining with additive manufacturing techniques provides new possibilities for complex component production. These innovations offer significant competitive advantages by improving productivity, reducing costs, and enabling the manufacturing of high-value components.

Report Segmentation & Scope

This report segments the U.S. machine tool industry based on several key parameters:

- By Machine Type: This includes milling machines, turning machines, grinding machines, EDM machines, and others. The milling machine segment is projected to witness the fastest growth during the forecast period due to its versatility and applicability across diverse industries.

- By Technology: This includes CNC machines, conventional machines, and hybrid machines. CNC machines constitute the largest segment, driven by automation and precision.

- By End-User Industry: This covers the automotive, aerospace, medical, energy, and other sectors. Automotive and aerospace are the largest end-user segments.

- By Geography: The report analyzes market dynamics across different regions of the U.S., including the Midwest, Southeast, and Southwest, reflecting regional variations in industrial activity and manufacturing capabilities.

Each segment’s growth projections, market sizes, and competitive dynamics are detailed within the full report.

Key Drivers of U.S. Machine Tool Industry Growth

The growth of the U.S. machine tool industry is primarily driven by:

- Technological Advancements: The adoption of advanced technologies like AI, IoT, and digital twinning is increasing productivity and efficiency.

- Economic Growth: Expansion in key end-user industries like automotive and aerospace fuels demand for machine tools.

- Government Initiatives: Government programs supporting advanced manufacturing and reshoring initiatives stimulate investments in the sector.

These factors are expected to fuel significant market expansion over the forecast period.

Challenges in the U.S. Machine Tool Industry Sector

Several key factors pose significant challenges to the U.S. machine tool industry:

- Supply Chain Disruptions: Ongoing global supply chain disruptions continue to impact component availability and inflate manufacturing costs, demanding agile and resilient supply chain strategies.

- Skilled Labor Shortages: A persistent shortage of skilled workers hinders production capacity and innovation, necessitating targeted workforce development initiatives.

- Intense Competition: Fierce competition from foreign manufacturers exerts pressure on pricing and profitability. These combined challenges contributed to an estimated [Insert Percentage]% decrease in production efficiency during 2022, emphasizing the need for improved operational efficiency and strategic adaptation.

Leading Players in the U.S. Machine Tool Industry Market

- TRUMPF Inc

- Haas Automation Inc

- Amada Co Ltd

- Lincoln Electric Holdings Inc

- Multipress Inc

- MITUSA Inc

- MC Machinery Systems Inc

- Mate Precision Tooling Inc

- Bystronic Inc

- Laser Mechanisms Inc

- Koike Aronson Inc /Ransome

- FENN Metal Forming Machinery Solutions

- Cincinnati Inc

List Not Exhaustive

Key Developments in U.S. Machine Tool Industry Sector

- July 2022: Sandvik acquired the assets of Peterson Tool Company, Inc., expanding its tooling portfolio and strengthening its presence in the automotive and general engineering sectors. This acquisition is expected to significantly impact the market share of custom carbide form inserts.

- June 2022: Doosan Machine Tools rebranded as DN Solutions, signaling a shift towards providing complete manufacturing solutions. This strategic move could reshape the competitive dynamics within the industry, emphasizing the move toward integrated manufacturing solutions.

Strategic U.S. Machine Tool Industry Market Outlook

The U.S. machine tool industry is well-positioned for sustained growth, propelled by ongoing technological advancements, increased automation adoption, and reshoring initiatives. Key strategic opportunities lie in developing innovative solutions for high-precision machining, seamlessly integrating AI and digital twin technologies, and prioritizing sustainable manufacturing practices. The industry's future potential is substantial, with expanding applications across diverse sectors promising sustained growth and market expansion for innovative players who adapt to the evolving industry dynamics.

U.S. Machine Tool Industry Segmentation

-

1. Type

- 1.1. Metalworking Machines

- 1.2. Parts and Accessories

- 1.3. Installation

- 1.4. Repair

- 1.5. Maintenance

-

2. End User

- 2.1. Automotive

- 2.2. Fabrication and Industrial Machinery Manufacturing

- 2.3. Marine, Aerospace & Defense

- 2.4. Precision Engineering

- 2.5. Other End Users

U.S. Machine Tool Industry Segmentation By Geography

- 1. U.S.

U.S. Machine Tool Industry Regional Market Share

Geographic Coverage of U.S. Machine Tool Industry

U.S. Machine Tool Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing demand for domestic machine tools driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.S. Machine Tool Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Metalworking Machines

- 5.1.2. Parts and Accessories

- 5.1.3. Installation

- 5.1.4. Repair

- 5.1.5. Maintenance

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Fabrication and Industrial Machinery Manufacturing

- 5.2.3. Marine, Aerospace & Defense

- 5.2.4. Precision Engineering

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. U.S.

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TRUMPF Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haas Automation Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amada Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lincoln Electric Holdings Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Multipress Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MITUSA Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MC Machinery Systems Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mate Precision Tooling Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bystronic Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Laser Mechanisms Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Koike Aronson Inc /Ransome

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 FENN Metal Forming Machinery Solutions

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Cincinnati Inc **List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 TRUMPF Inc

List of Figures

- Figure 1: U.S. Machine Tool Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: U.S. Machine Tool Industry Share (%) by Company 2025

List of Tables

- Table 1: U.S. Machine Tool Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: U.S. Machine Tool Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 3: U.S. Machine Tool Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: U.S. Machine Tool Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 5: U.S. Machine Tool Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: U.S. Machine Tool Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: U.S. Machine Tool Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: U.S. Machine Tool Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 9: U.S. Machine Tool Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: U.S. Machine Tool Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 11: U.S. Machine Tool Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: U.S. Machine Tool Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Machine Tool Industry?

The projected CAGR is approximately 3.38%.

2. Which companies are prominent players in the U.S. Machine Tool Industry?

Key companies in the market include TRUMPF Inc, Haas Automation Inc, Amada Co Ltd, Lincoln Electric Holdings Inc, Multipress Inc, MITUSA Inc, MC Machinery Systems Inc, Mate Precision Tooling Inc, Bystronic Inc, Laser Mechanisms Inc, Koike Aronson Inc /Ransome, FENN Metal Forming Machinery Solutions, Cincinnati Inc **List Not Exhaustive.

3. What are the main segments of the U.S. Machine Tool Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.25 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing demand for domestic machine tools driving the market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: Peterson Tool Company, Inc. ("PTC"), a leading provider of machine-specific custom insert tooling solutions, had the previously announced finalized acquisition of its assets by Sandvik. Custom carbide form inserts are part of the product line and are used mainly in the general engineering and automotive industries for high-production turning and grooving applications. The operation will be referred to as Walter's GWS Tool division, which is a part of the Sandvik Manufacturing and Machining Solutions business area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.S. Machine Tool Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.S. Machine Tool Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.S. Machine Tool Industry?

To stay informed about further developments, trends, and reports in the U.S. Machine Tool Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence