Key Insights

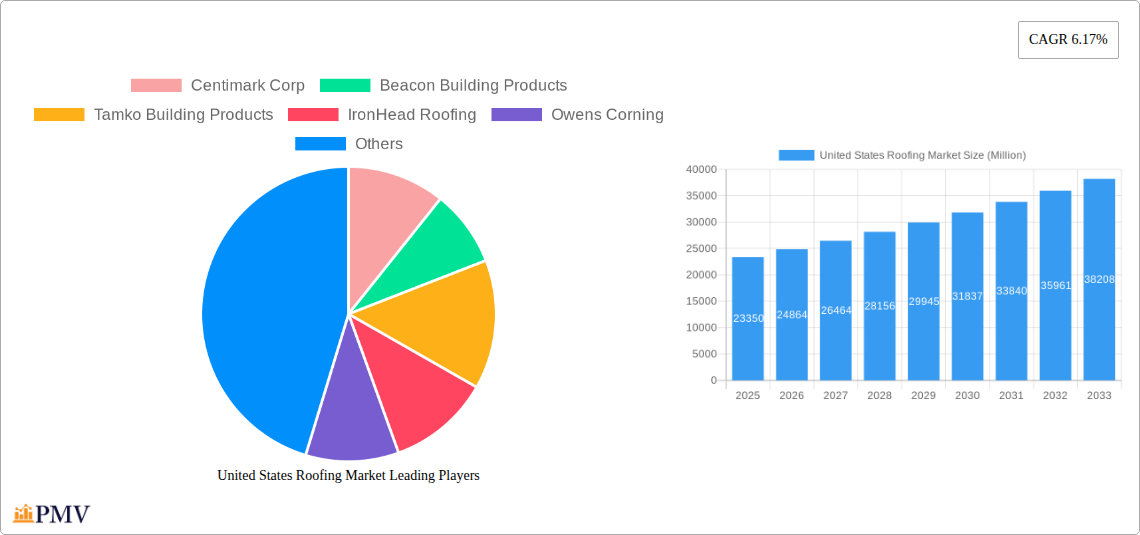

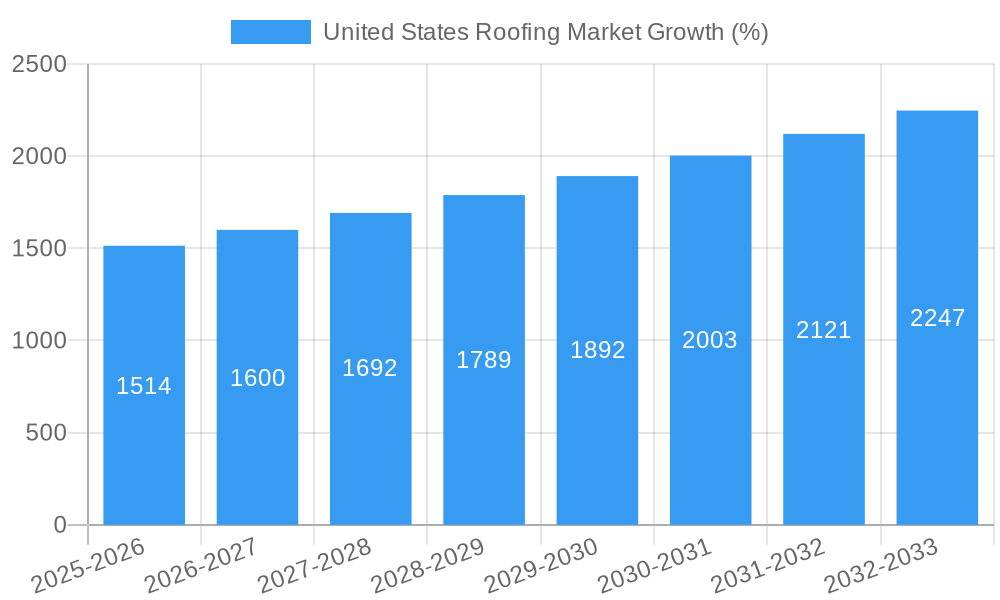

The United States roofing market, valued at $23.35 billion in 2025, is projected to experience robust growth, driven by a combination of factors. Increasing residential and commercial construction activity, fueled by a growing population and expanding economy, is a primary driver. Furthermore, aging infrastructure necessitates significant roof replacements across various sectors, creating substantial demand. The rising adoption of energy-efficient roofing materials, such as modified bitumen and thermoplastic polyolefins, is another key trend. These materials offer superior durability and energy savings, appealing to both builders and homeowners. While material cost fluctuations and potential labor shortages could pose challenges, the overall market outlook remains positive. The segmentation reveals a diverse landscape, with commercial construction holding a significant share, followed by residential and industrial sectors. Modified bitumen continues to dominate the materials segment due to its cost-effectiveness and performance. Flat roofs, prevalent in commercial buildings, contribute significantly to the roofing type segment. Key players like Centimark Corp, Beacon Building Products, and GAF Materials Corporation are strategically investing in innovation and expanding their product portfolios to cater to the growing market needs. The market's consistent growth trajectory over the forecast period (2025-2033) is expected to be propelled by ongoing infrastructure development and the increasing focus on sustainable building practices.

The forecast period of 2025-2033 anticipates a continuation of this positive trend. The compound annual growth rate (CAGR) of 6.17% suggests a steady expansion of the market, with projected growth fueled by several key factors. Government initiatives promoting energy efficiency in buildings are likely to stimulate demand for advanced roofing materials. Furthermore, technological advancements in roofing materials and installation techniques will further enhance market growth. However, potential economic downturns or disruptions in the supply chain could impact the market's trajectory. Nevertheless, the long-term outlook remains optimistic given the continuous need for roof maintenance and replacement across diverse sectors and the projected increase in construction activities. The competitive landscape remains dynamic, with established players and emerging companies vying for market share through innovation and strategic partnerships.

United States Roofing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States roofing market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The report incorporates detailed segmentation by sector (commercial, residential, industrial), material (modified bitumen, EPDM rubber, thermoplastic polyolefin, PVC membrane, metals, tiles, others), and roofing type (flat, slope). Key players such as Centimark Corp, Beacon Building Products, Tamko Building Products, IronHead Roofing, Owens Corning, Baker Roofing, Tecta America, GAF Materials Corporation, Atlas Roofing Corporation, IKO Industries, Flynn Group, and CertainTeed Corporation are analyzed, providing a holistic view of this dynamic market. The report projects a xx Million market value by 2033, highlighting significant growth opportunities.

United States Roofing Market Structure & Competitive Dynamics

The US roofing market exhibits a moderately concentrated structure, with several large players dominating significant market share. The market is characterized by a dynamic competitive landscape influenced by continuous innovation, stringent regulatory frameworks, and the emergence of substitute materials. Analyzing market share data from 2019-2024 reveals a clear trend towards consolidation, driven by mergers and acquisitions (M&A) activity. The significant M&A activity observed during the historical period reflects intense competition for market share and expansion into new segments. For example, Beacon Building Products' acquisition of Roofers Supply in February 2024 represents a significant move in this consolidation trend. The deal values of these acquisitions range from xx Million to xx Million, impacting overall market concentration and competitive dynamics. The innovation ecosystem is driven by R&D investment in new materials, sustainable roofing solutions, and improved installation techniques. Regulatory changes regarding energy efficiency and environmental sustainability continue to shape product development and market entry. End-user preferences are shifting towards longer-lasting, sustainable, and aesthetically pleasing roofing solutions.

- Market Concentration: Moderately concentrated with key players controlling significant share.

- Innovation Ecosystem: Active R&D in materials, sustainability, and installation techniques.

- Regulatory Frameworks: Stringent building codes and environmental regulations.

- Product Substitutes: Growing competition from alternative roofing solutions.

- End-User Trends: Increasing demand for durable, energy-efficient, and aesthetically pleasing roofs.

- M&A Activity: Significant consolidation through acquisitions, impacting market share and competition.

United States Roofing Market Industry Trends & Insights

The US roofing market demonstrates consistent growth, driven by several key factors. The construction industry's expansion, particularly in residential and commercial sectors, fuels significant demand for roofing materials and services. Technological advancements, like the development of lightweight, durable, and energy-efficient roofing materials, further boost market growth. Changing consumer preferences towards sustainable and aesthetically pleasing roofing options also play a crucial role. The market is witnessing a notable shift towards eco-friendly materials and installation methods. The increasing adoption of energy-efficient roofing solutions, driven by government incentives and rising energy costs, also contributes significantly to market expansion. This combined effect results in a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of new materials, such as thermoplastic polyolefin, is steadily increasing, though modified bitumen still commands the largest market share. Competitive dynamics are shaping the landscape, with major players investing heavily in innovation and strategic acquisitions to maintain market position.

Dominant Markets & Segments in United States Roofing Market

The residential construction sector dominates the US roofing market, driven by factors such as population growth, new housing construction, and increasing disposable incomes among homeowners. The modified bitumen segment holds the largest market share in terms of material type, owing to its cost-effectiveness and durability. Flat roofs are more prevalent in commercial and industrial sectors, while slope roofs are predominantly used in residential construction.

By Sector:

- Residential Construction: Largest segment due to population growth and housing demand. Key drivers include rising disposable income and housing market activity.

- Commercial Construction: Significant growth potential driven by new building projects and renovations. Economic activity and real estate development influence this segment.

- Industrial Construction: Relatively smaller segment, but steady growth projected based on industrial expansion. Government infrastructure projects and industrial development are crucial drivers.

By Material:

- Modified Bitumen: Largest market share due to affordability and durability.

- EPDM Rubber: Growing popularity for flat roofs due to its waterproofing properties.

- Thermoplastic Polyolefin (TPO): Increasing adoption due to its energy efficiency and durability.

- PVC Membrane: Significant market presence due to its longevity and ease of installation.

- Metals: Niche segment primarily used for commercial and industrial applications.

- Tiles: Popular choice for residential applications, driven by aesthetic appeal.

By Roofing Type:

- Flat Roof: Dominates the commercial and industrial segments due to its suitability for large buildings.

- Slope Roof: Predominantly used in residential constructions and smaller commercial buildings.

United States Roofing Market Product Innovations

Recent product innovations focus on enhanced durability, energy efficiency, and sustainability. Lightweight materials, improved insulation properties, and self-healing membranes are prominent features in newly developed roofing products. These innovations cater to the growing demand for longer-lasting, energy-efficient, and environmentally friendly roofing solutions, thus improving market fit and competitive advantages. The integration of smart technology for remote monitoring and predictive maintenance is also gaining traction.

Report Segmentation & Scope

This report segments the US roofing market comprehensively by sector (residential, commercial, industrial), material (modified bitumen, EPDM rubber, TPO, PVC membrane, metals, tiles, others), and roofing type (flat, slope). Each segment’s growth projections, market size, and competitive landscape are analyzed in detail. The report provides a thorough understanding of the dynamics within each segment, including key drivers, restraints, and opportunities. Growth projections for each segment vary, with the residential sector expected to show the strongest growth in the forecast period.

Key Drivers of United States Roofing Market Growth

Several key factors drive the growth of the US roofing market. These include increasing construction activity, particularly in residential and commercial sectors, driven by population growth and economic expansion. The demand for energy-efficient roofing solutions is also increasing due to rising energy costs and government incentives. Technological advancements in materials and installation techniques further enhance market growth. Lastly, the increasing awareness of sustainability and environmental concerns pushes the adoption of eco-friendly roofing materials.

Challenges in the United States Roofing Market Sector

The US roofing market faces several challenges. Supply chain disruptions can lead to material shortages and increased costs. Fluctuations in raw material prices significantly impact production costs and profitability. Stringent building codes and environmental regulations can add complexity to product development and market entry. Lastly, intense competition among established and emerging players keeps profit margins under pressure.

Leading Players in the United States Roofing Market Market

- Centimark Corp

- Beacon Building Products (Beacon Building Products)

- Tamko Building Products (Tamko Building Products)

- IronHead Roofing

- Owens Corning (Owens Corning)

- Baker Roofing

- Tecta America

- GAF Materials Corporation (GAF Materials Corporation)

- Atlas Roofing Corporation (Atlas Roofing Corporation)

- IKO Industries (IKO Industries)

- Flynn Group

- CertainTeed Corporation (CertainTeed Corporation)

Key Developments in United States Roofing Market Sector

- December 2023: Soundcore Capital Partners completed the acquisition of Roofing Corp.

- November 2023: Roofing Corporation of Americas LLC (Roofing Corp) was acquired by FirstService Corporation.

- February 2024: Beacon Building Products completed its largest acquisition to date, acquiring Roofers Supply.

Strategic United States Roofing Market Market Outlook

The US roofing market presents significant growth opportunities driven by continued construction activity, increasing demand for sustainable solutions, and technological advancements. Strategic investments in R&D, expansion into new segments, and strategic acquisitions will be crucial for success in this competitive market. Focusing on providing energy-efficient, durable, and sustainable roofing solutions will allow companies to capitalize on the market’s future potential.

United States Roofing Market Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

-

2. Material

- 2.1. Modified Bitumen

- 2.2. EPDM Rubber

- 2.3. Thermoplastic Polyolefin

- 2.4. PVC Membrane

- 2.5. Metals

- 2.6. Tiles

- 2.7. Others

-

3. Roofing Type

- 3.1. Flat Roof

- 3.2. Slope Roof

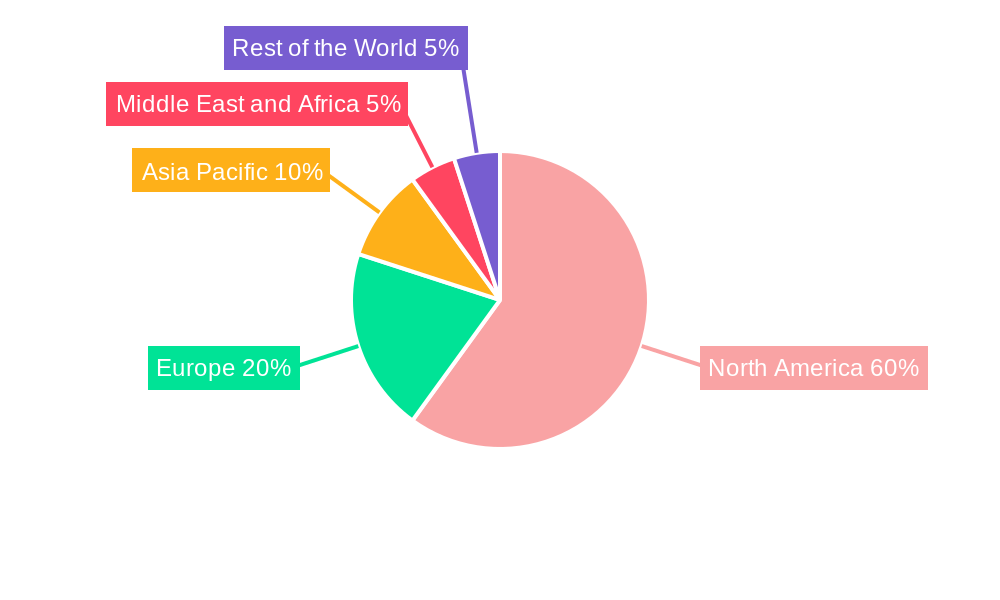

United States Roofing Market Segmentation By Geography

- 1. United States

United States Roofing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.17% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions

- 3.3. Market Restrains

- 3.3.1. The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Single-Ply Roofing Products are Expected to Gain Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Modified Bitumen

- 5.2.2. EPDM Rubber

- 5.2.3. Thermoplastic Polyolefin

- 5.2.4. PVC Membrane

- 5.2.5. Metals

- 5.2.6. Tiles

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Roofing Type

- 5.3.1. Flat Roof

- 5.3.2. Slope Roof

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Middle East and Africa United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Rest of the World United States Roofing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Centimark Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Beacon Building Products

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tamko Building Products

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IronHead Roofing

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Owens Corning

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baker Roofing**List Not Exhaustive 7 2 *List Not Exhaustive7 3 Other Companie

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tecta America

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GAF Materials Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Atlas Roofing Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 IKO Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Flynn Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CertainTeed Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Centimark Corp

List of Figures

- Figure 1: United States Roofing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Roofing Market Share (%) by Company 2024

List of Tables

- Table 1: United States Roofing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Roofing Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: United States Roofing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: United States Roofing Market Revenue Million Forecast, by Roofing Type 2019 & 2032

- Table 5: United States Roofing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States Roofing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Roofing Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 17: United States Roofing Market Revenue Million Forecast, by Material 2019 & 2032

- Table 18: United States Roofing Market Revenue Million Forecast, by Roofing Type 2019 & 2032

- Table 19: United States Roofing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Roofing Market?

The projected CAGR is approximately 6.17%.

2. Which companies are prominent players in the United States Roofing Market?

Key companies in the market include Centimark Corp, Beacon Building Products, Tamko Building Products, IronHead Roofing, Owens Corning, Baker Roofing**List Not Exhaustive 7 2 *List Not Exhaustive7 3 Other Companie, Tecta America, GAF Materials Corporation, Atlas Roofing Corporation, IKO Industries, Flynn Group, CertainTeed Corporation.

3. What are the main segments of the United States Roofing Market?

The market segments include Sector, Material, Roofing Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions.

6. What are the notable trends driving market growth?

Single-Ply Roofing Products are Expected to Gain Market Share.

7. Are there any restraints impacting market growth?

The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

February 2024: Beacon, a commercial roofing distributor serving North America, announced the completion of its largest acquisition to date. Roofers Supply, based in Greenville, South Carolina, has two additional branches in Charlotte, North Carolina, and Raleigh, North Carolina. This acquisition marks Beacon’s first in 2024. In 2023, Beacon achieved its Ambition 2025 goals for revenue and shareholder return and continues to progress towards full Ambition 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Roofing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Roofing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Roofing Market?

To stay informed about further developments, trends, and reports in the United States Roofing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence