Key Insights

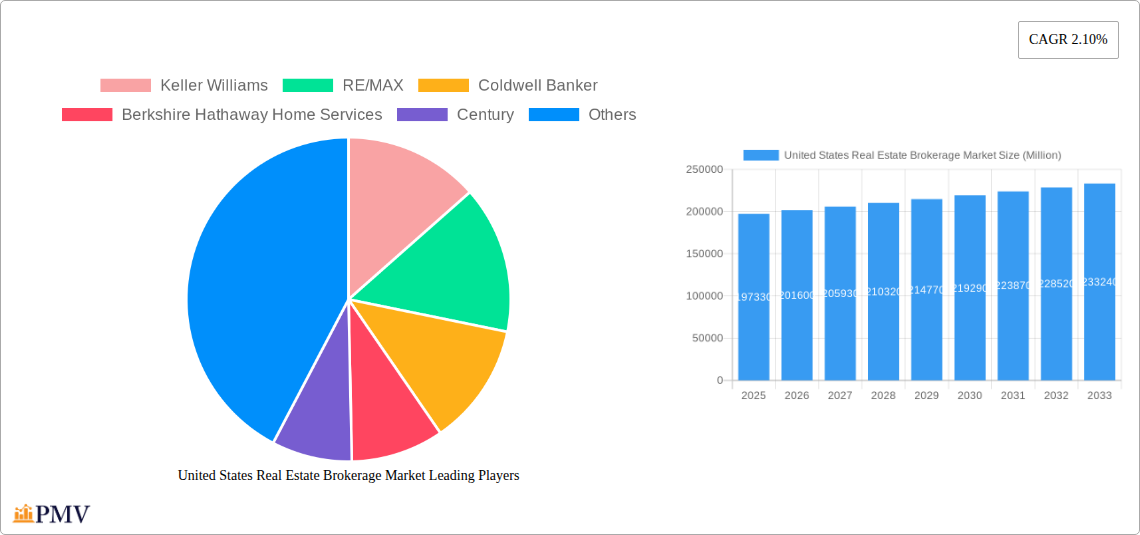

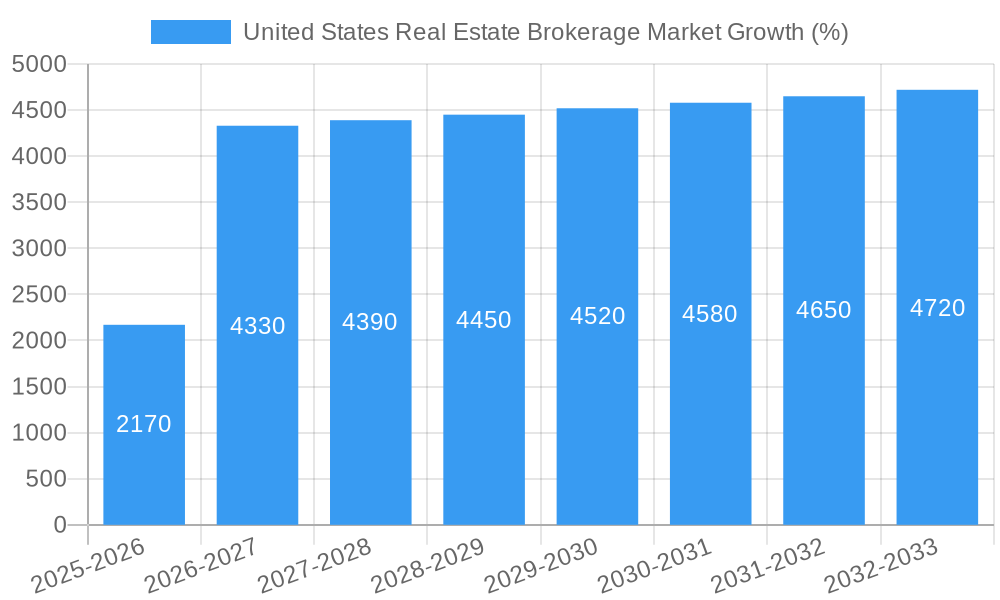

The United States real estate brokerage market, valued at $197.33 billion in 2025, exhibits a steady growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 2.10% from 2025 to 2033. This growth is fueled by several key factors. The increasing population and urbanization in the US drive demand for housing, creating opportunities for brokerage firms. Technological advancements, such as improved online platforms and virtual tours, are enhancing efficiency and broadening market reach. Furthermore, a growing preference for professional assistance in navigating complex real estate transactions contributes to market expansion. The market is characterized by a blend of established players like Keller Williams, RE/MAX, and Coldwell Banker, and newer, tech-focused firms like Compass and Redfin, leading to increased competition and innovation. While regulatory changes and economic fluctuations can present challenges, the long-term outlook remains positive, driven by consistent demand for residential and commercial properties.

Despite the positive outlook, the market faces some headwinds. Interest rate hikes and potential economic downturns can impact buyer demand and consequently, brokerage revenues. Competition within the industry is fierce, requiring firms to continually innovate and differentiate their offerings to maintain market share. The increasing use of technology also presents challenges, requiring brokers to adapt and invest in digital solutions. The market is segmented based on various factors like service type (residential, commercial), transaction size, and geographic location. Understanding these nuances is crucial for firms aiming to capture specific market segments. The success of individual firms hinges on their ability to adapt to changing market conditions, leverage technology effectively, and provide superior customer service.

United States Real Estate Brokerage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States real estate brokerage market, encompassing market structure, competitive dynamics, industry trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for investors, industry professionals, and strategic decision-makers. The report utilizes data from the historical period of 2019-2024 to build robust forecasts. Total market value in 2025 is estimated at $xx Million.

United States Real Estate Brokerage Market Market Structure & Competitive Dynamics

The U.S. real estate brokerage market is characterized by a mix of large national players and smaller regional firms. Market concentration is moderate, with a few dominant players holding significant market share, but numerous smaller brokerages contributing to the overall landscape. Leading players include Keller Williams, RE/MAX, Coldwell Banker, Berkshire Hathaway Home Services, Century 21, Sotheby's International Realty, Compass, eXp Realty, Realogy Holdings Corp, and Redfin, along with 63 other companies.

- Market Share: The top 5 players collectively hold an estimated xx% market share, while the remaining share is distributed among numerous smaller firms. Precise figures vary by segment and region.

- Innovation Ecosystems: Technological advancements like iBuyers, proptech platforms, and advanced data analytics are transforming the brokerage landscape, fostering innovation and competition.

- Regulatory Frameworks: Federal and state regulations governing real estate transactions, licensing, and fair housing practices significantly influence market operations.

- Product Substitutes: The rise of iBuyers and online real estate portals offer alternative transaction methods, posing some competitive pressure to traditional brokerages.

- End-User Trends: Millennials and Gen Z are increasingly leveraging technology for property searches and transactions, shaping demand for digital tools and services.

- M&A Activities: Significant M&A activity is observed, with large players acquiring smaller firms to expand geographic reach and enhance service offerings. The total value of M&A deals in the past five years is estimated at $xx Million. Notable examples include Compass' acquisitions of Parks Real Estate and Latter & Blum (detailed below).

United States Real Estate Brokerage Market Industry Trends & Insights

The U.S. real estate brokerage market exhibits a dynamic interplay of growth drivers, technological disruptions, and evolving consumer preferences. Market growth is influenced by demographic shifts (e.g., population growth, urbanization), economic conditions (e.g., interest rates, housing affordability), and regulatory changes. Technological advancements, such as virtual tours, AI-powered valuation tools, and digital marketing strategies, are significantly impacting market dynamics. Consumer preference is shifting toward a more tech-savvy, efficient, and transparent real estate experience. Competitive pressures are intensifying due to the entry of new players and the expansion of existing firms.

The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), driven by factors mentioned above. Market penetration of digital tools and platforms is expected to increase to xx% by 2033. The industry is witnessing increased competition and consolidation, with major players focusing on strategic acquisitions and technological investments to maintain their market positions.

Dominant Markets & Segments in United States Real Estate Brokerage Market

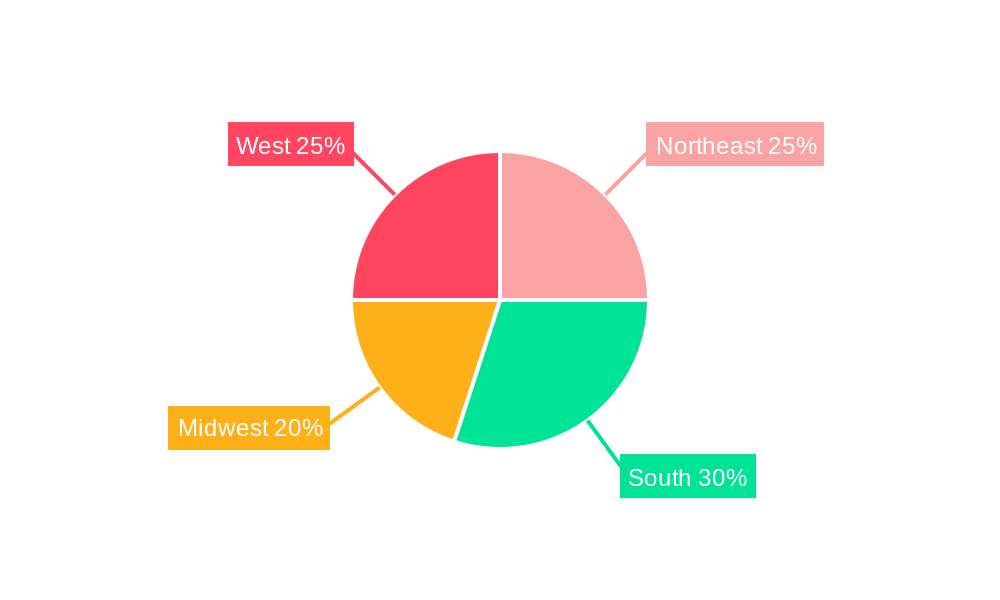

The U.S. real estate brokerage market is geographically diverse, with varying levels of activity across different states and regions. While precise regional market share data requires further analysis, populous states like California, Texas, Florida, and New York generally exhibit higher transaction volumes and broker activity than less populated states.

- Key Drivers of Regional Dominance:

- Strong Economic Growth: States with robust economies and high job growth often attract more real estate investment and activity.

- Population Growth: Areas experiencing significant population increases typically have higher demand for housing.

- Infrastructure Development: Investment in infrastructure, such as transportation and utilities, can boost real estate values and activity.

- Favorable Regulatory Environment: States with business-friendly regulations and streamlined processes may attract more real estate investment.

The market is segmented by property type (residential, commercial, industrial), transaction type (sales, rentals, leasing), and service offerings (full-service brokerage, limited-service brokerage, etc.). The residential segment holds the largest market share, followed by commercial and then industrial. Within residential, single-family homes dominate, while within commercial, office and retail properties are significant segments.

United States Real Estate Brokerage Market Product Innovations

The real estate brokerage sector is undergoing rapid technological transformation. Innovations include AI-powered property valuation tools, virtual staging and 3D tours, advanced search filters and personalized recommendations on online platforms, and CRM systems for enhanced client management. These innovations increase efficiency, improve customer experiences, and enhance competitive advantages for brokerages that adopt them. The market fit for these technologies is strong, as consumers increasingly expect and demand a more seamless and technologically advanced experience.

Report Segmentation & Scope

This report segments the market by:

Property Type: Residential, Commercial, Industrial. Residential is projected to grow at xx% CAGR, while Commercial and Industrial will grow at xx% and xx% respectively, driven by varying economic factors and investment patterns. Competitive dynamics vary across segments, with different players specializing in specific property types.

Transaction Type: Sales, Rentals, Leasing. The Sales segment holds the largest market share, followed by Rentals and then Leasing. Growth rates are influenced by economic factors and market conditions. Competitive intensity differs between transaction types, with varying degrees of specialization among brokerages.

Service Offering: Full-service, Limited-service. Full-service brokerages command higher fees but offer a wider range of services. Limited-service offerings are gaining popularity for their cost-effectiveness. The competition between full and limited-service providers is driven by client preferences and the efficiency of service delivery.

Key Drivers of United States Real Estate Brokerage Market Growth

Several factors fuel market growth: increasing urbanization and population growth necessitate more housing; a rising middle class and improved economic conditions increase purchasing power; favorable interest rates stimulate demand; and technological advancements enhance efficiency and consumer experience. Government policies influencing the mortgage market and zoning regulations also play a part.

Challenges in the United States Real Estate Brokerage Market Sector

Challenges include increasing competition from iBuyers and online platforms, regulatory hurdles around licensing and data privacy, economic fluctuations impacting transaction volumes, and supply chain disruptions potentially affecting new construction. These factors can lead to reduced profitability and market share for some players. The impact of these challenges on the market is estimated at $xx Million in lost revenue annually.

Leading Players in the United States Real Estate Brokerage Market Market

- Keller Williams

- RE/MAX

- Coldwell Banker

- Berkshire Hathaway Home Services

- Century 21

- Sotheby's International Realty

- Compass

- eXp Realty

- Realogy Holdings Corp

- Redfin

- 63 Other Companies

Key Developments in United States Real Estate Brokerage Market Sector

- May 2024: Compass Inc. acquired Parks Real Estate, significantly expanding its agent network and market presence in Tennessee.

- April 2024: Compass finalized its acquisition of Latter & Blum, strengthening its position in the Gulf Coast region.

Strategic United States Real Estate Brokerage Market Market Outlook

The U.S. real estate brokerage market presents significant long-term growth potential. Strategic opportunities exist in leveraging technological advancements to enhance efficiency, customer experience, and market reach. Companies focused on innovation, data analytics, and strategic acquisitions are well-positioned for success. The market is expected to continue its expansion, driven by demographic trends and technological advancements, offering lucrative opportunities for both established and emerging players.

United States Real Estate Brokerage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Non-Residential

-

2. Service

- 2.1. Sales

- 2.2. Rental

United States Real Estate Brokerage Market Segmentation By Geography

- 1. United States

United States Real Estate Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the market

- 3.4. Market Trends

- 3.4.1 Industrial Sector Leads Real Estate Absorption

- 3.4.2 Retail Tightens Vacancy Rates

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Real Estate Brokerage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Non-Residential

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Sales

- 5.2.2. Rental

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Keller Williams

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RE/MAX

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coldwell Banker

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Berkshire Hathaway Home Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Century

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sotheby's International Realty

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Compass

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 eXp Realty

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Realogy Holdings Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Redfin**List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Keller Williams

List of Figures

- Figure 1: United States Real Estate Brokerage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Real Estate Brokerage Market Share (%) by Company 2024

List of Tables

- Table 1: United States Real Estate Brokerage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Real Estate Brokerage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Real Estate Brokerage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United States Real Estate Brokerage Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: United States Real Estate Brokerage Market Revenue Million Forecast, by Service 2019 & 2032

- Table 6: United States Real Estate Brokerage Market Volume Billion Forecast, by Service 2019 & 2032

- Table 7: United States Real Estate Brokerage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Real Estate Brokerage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: United States Real Estate Brokerage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: United States Real Estate Brokerage Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: United States Real Estate Brokerage Market Revenue Million Forecast, by Service 2019 & 2032

- Table 12: United States Real Estate Brokerage Market Volume Billion Forecast, by Service 2019 & 2032

- Table 13: United States Real Estate Brokerage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Real Estate Brokerage Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Real Estate Brokerage Market?

The projected CAGR is approximately 2.10%.

2. Which companies are prominent players in the United States Real Estate Brokerage Market?

Key companies in the market include Keller Williams, RE/MAX, Coldwell Banker, Berkshire Hathaway Home Services, Century, Sotheby's International Realty, Compass, eXp Realty, Realogy Holdings Corp, Redfin**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the United States Real Estate Brokerage Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 197.33 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the market.

6. What are the notable trends driving market growth?

Industrial Sector Leads Real Estate Absorption. Retail Tightens Vacancy Rates.

7. Are there any restraints impacting market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the market.

8. Can you provide examples of recent developments in the market?

May 2024: Compass Inc., the leading residential real estate brokerage by sales volume in the United States, acquired Parks Real Estate, Tennessee's top residential real estate firm that boasts over 1,500 agents. Known for its strategic acquisitions and organic growth, Compass's collaboration with Parks Real Estate not only enriches its agent pool but also grants these agents access to Compass's cutting-edge technology and a vast national referral network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Real Estate Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Real Estate Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Real Estate Brokerage Market?

To stay informed about further developments, trends, and reports in the United States Real Estate Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence