Key Insights

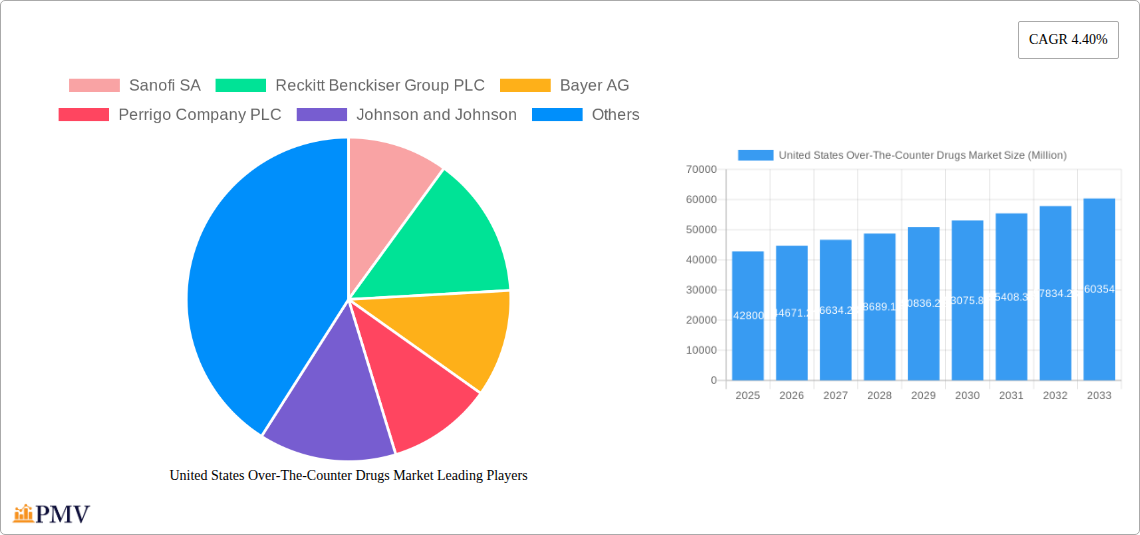

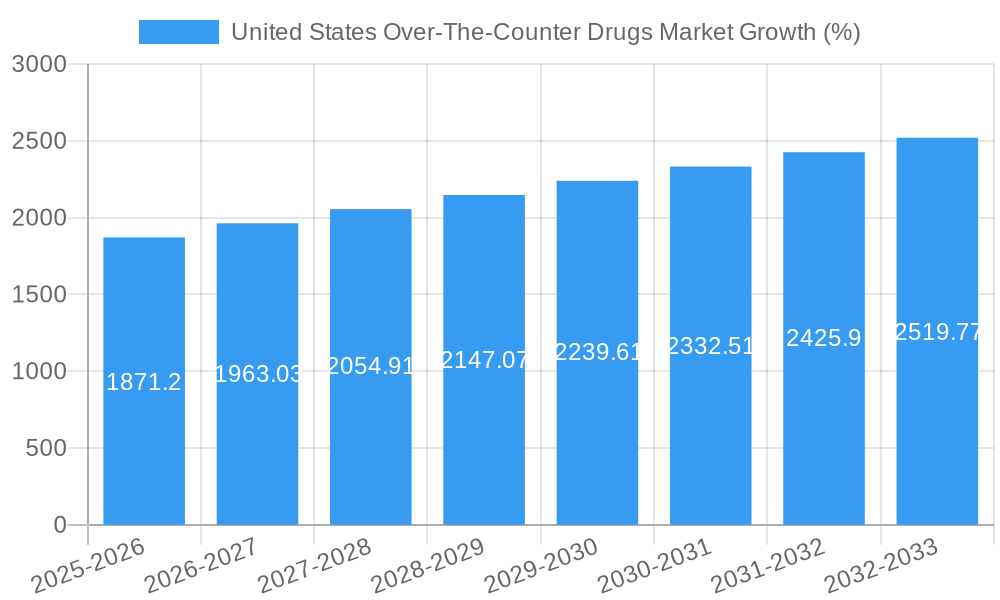

The United States over-the-counter (OTC) drug market, valued at approximately $42.80 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing prevalence of chronic diseases like allergies, arthritis, and digestive issues fuels demand for readily accessible self-treatment options. Consumer preference for convenient, self-care solutions, coupled with rising healthcare costs and limited access to primary care physicians, further bolsters market expansion. The market is segmented by product type (cough/cold/flu, analgesics, dermatology products, etc.), formulation (tablets, liquids, ointments), and distribution channels (retail pharmacies, online pharmacies, hospitals). Growth within the OTC segment is also being fueled by technological advancements and a rise in innovative product formulations such as targeted delivery systems and extended-release medications. The segment is extremely competitive, with major players like Johnson & Johnson, Pfizer, and Reckitt Benckiser vying for market share through brand building, product diversification, and strategic acquisitions. Specific growth areas include the expanding demand for natural and herbal remedies, and a surge in the use of online pharmacies as consumers seek convenient purchasing options.

However, the market faces certain challenges. Stringent regulatory requirements for product approval and safety pose hurdles for new entrants. Furthermore, generic competition and fluctuating raw material prices impact profitability for manufacturers. Pricing pressure from both consumers and insurance providers is another significant constraint. Despite these challenges, the US OTC drug market is anticipated to maintain a healthy CAGR of 4.40% from 2025 to 2033, reflecting the enduring demand for accessible, self-managed healthcare solutions. This growth will be influenced by factors like the aging population, increasing healthcare awareness, and the continuous development of novel and effective OTC medications.

United States Over-The-Counter Drugs Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United States Over-The-Counter (OTC) drugs market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period from 2025 to 2033. The report meticulously examines market size, growth drivers, competitive dynamics, and future trends, providing a 360-degree view of this dynamic sector. Key players like Sanofi SA, Reckitt Benckiser Group PLC, Bayer AG, Perrigo Company PLC, Johnson & Johnson, Amneal Pharmaceuticals LLC, Sandoz AG, Viatris Inc, Haleon PLC, and Pfizer Inc. are profiled, among others. The market is segmented by product type, formulation type, and distribution channel, enabling a granular understanding of market opportunities.

United States Over-The-Counter Drugs Market Market Structure & Competitive Dynamics

The U.S. OTC drug market exhibits a moderately concentrated structure, with a few multinational pharmaceutical companies holding significant market share. However, the presence of numerous smaller players, particularly in niche segments like dietary supplements, contributes to a competitive landscape. The market's innovation ecosystem is robust, driven by continuous R&D efforts focused on developing more effective, convenient, and targeted OTC medications. Stringent regulatory frameworks, primarily overseen by the FDA, ensure product safety and efficacy. The market also faces competitive pressure from generic drug manufacturers, which are aggressively expanding their OTC product portfolios. Significant M&A activity has been witnessed in recent years, primarily driven by companies seeking to expand their product lines and market presence. These deals have ranged from xx Million to several hundred Million dollars, reflecting the high value placed on established brands and promising new product pipelines. The market share of the leading players is subject to ongoing fluctuations due to new product launches and competitive pressures, with xx% representing a likely range for the top five companies combined in 2025.

- Market Concentration: Moderately concentrated, with top players holding significant shares.

- Innovation Ecosystem: Active R&D efforts leading to new product formulations and delivery systems.

- Regulatory Framework: Stringent FDA regulations impacting product development and approval.

- Product Substitutes: Generic drug competition and alternative therapies influencing market dynamics.

- End-User Trends: Growing consumer preference for convenience, efficacy, and natural ingredients.

- M&A Activity: Significant M&A activity with deal values ranging from xx Million to several hundred Million dollars.

United States Over-The-Counter Drugs Market Industry Trends & Insights

The U.S. OTC drug market is experiencing robust growth, driven by several key factors. Rising healthcare costs are prompting consumers to seek cost-effective alternatives to prescription drugs, boosting demand for OTC medications. An aging population, increasing prevalence of chronic diseases, and greater consumer awareness of self-care are also contributing significantly. Technological disruptions, such as the rise of e-commerce and telehealth, are transforming the distribution landscape, increasing accessibility and convenience for consumers. The market exhibits a compound annual growth rate (CAGR) projected at approximately xx% during the forecast period (2025-2033), while market penetration varies significantly across different product segments. For example, analgesic penetration is high, while niche categories like weight-loss products still represent considerable untapped potential. Competitive dynamics remain intense, with companies focused on innovation, brand building, and strategic partnerships to gain a competitive edge. Further growth is projected, fueled by the expansion of the online pharmacy sector and greater adoption of digital health solutions.

Dominant Markets & Segments in United States Over-The-Counter Drugs Market

The U.S. OTC drug market is dominated by several key segments. Analgesics, Cough, Cold, and Flu products hold the largest market share, driven by high prevalence of related illnesses and widespread consumer self-medication practices. Vitamins, Minerals, and Supplements (VMS) also represent a significant and rapidly growing segment, reflecting increasing consumer interest in preventative healthcare and wellness.

By Product Type:

- Analgesics: High market share due to widespread use for pain relief.

- Cough, Cold, and Flu Products: Substantial market share driven by common illnesses.

- VMS: Rapid growth due to increasing consumer health consciousness.

- Dermatology Products: Significant market share, with ongoing growth projected.

- Gastrointestinal Products: Steady demand driven by digestive health concerns.

- Other Product Types: Collectively representing a sizable portion of the market.

By Formulation Type:

- Tablets: High market share due to convenience and ease of use.

- Liquids: Significant share, particularly for pediatric and geriatric populations.

- Ointments & Sprays: Niche but steadily growing segments.

By Distribution Channel:

- Retail Pharmacies: Dominant distribution channel with broad reach.

- Online Pharmacies: Rapidly growing segment, expanding access and convenience.

- Hospital Pharmacies: Smaller but significant segment, particularly for specialized products.

Key Drivers:

- Increasing prevalence of chronic diseases

- Rising healthcare costs

- Growing consumer preference for self-care

- Technological advancements facilitating online sales and telehealth

United States Over-The-Counter Drugs Market Product Innovations

Recent innovations in the OTC drug market focus on improved formulations, targeted delivery systems, and enhanced efficacy. The development of more convenient formats, such as single-dose packets and pre-filled applicators, enhances consumer appeal. Technological advancements are leading to the development of personalized medicine approaches, enabling customized OTC solutions. Examples include the development of smart inhalers and wearable sensors, which improve medication adherence and provide real-time data on patient health. These product innovations provide competitive advantages by addressing unmet consumer needs, improving therapeutic outcomes, and facilitating easier administration.

Report Segmentation & Scope

This report segments the U.S. OTC drug market by product type (Cough, Cold, and Flu Products; Analgesics; Dermatology Products; Gastrointestinal Products; VMS; Weight Loss/Dietary Products; Ophthalmic Products; Sleeping Aids; Other Product Types), formulation type (Tablets; Liquids; Ointments; Sprays), and distribution channel (Hospital Pharmacies; Retail Pharmacies; Online Pharmacy; Other Distribution Channels). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. The market is expected to experience significant growth across most segments in the forecast period.

Key Drivers of United States Over-The-Counter Drugs Market Growth

The growth of the U.S. OTC drug market is propelled by several factors, including rising healthcare costs driving self-medication, the aging population requiring more healthcare products, increased consumer awareness of health and wellness, and ongoing technological advancements improving product efficacy and delivery methods. Government regulations also play a role, particularly in ensuring the safety and efficacy of OTC medications. Examples of recent growth include the rising popularity of VMS and the increased availability of online pharmacies.

Challenges in the United States Over-The-Counter Drugs Market Sector

The U.S. OTC drug market faces challenges such as stringent FDA regulations impacting product approval times and costs, supply chain disruptions affecting product availability, and intense competition from both established and emerging players. The regulatory environment creates a hurdle to market entry for new products, impacting innovation. Supply chain disruptions can lead to shortages and price increases, negatively impacting market stability. Competitive pressures are high due to the influx of generic drug manufacturers and the proliferation of private label products. These challenges collectively impact market growth and profitability.

Leading Players in the United States Over-The-Counter Drugs Market Market

- Sanofi SA

- Reckitt Benckiser Group PLC

- Bayer AG

- Perrigo Company PLC

- Johnson & Johnson

- Amneal Pharmaceuticals LLC

- Sandoz AG

- Viatris Inc

- Haleon PLC

- Pfizer Inc

Key Developments in United States Over-The-Counter Drugs Market Sector

March 2024: Perrigo Company PLC shipped its Opill, an OTC daily birth control pill, to major retailers and pharmacies in the United States. This launch signifies a significant shift in women's healthcare access and is expected to significantly boost the market for women’s health OTC products.

April 2024: Amneal Pharmaceuticals Inc. launched its OTC Naloxone Hydrochloride (Naloxone HCI) Nasal Spray, USP, 4 mg in the United States, receiving FDA approval for the emergency treatment of opioid overdose. This launch addresses a critical public health issue and is expected to drive growth in the segment of emergency treatment products.

Strategic United States Over-The-Counter Drugs Market Market Outlook

The U.S. OTC drug market presents significant growth opportunities, driven by an aging population, increasing consumer awareness of self-care, and technological advancements enabling personalized medicine. Strategic partnerships, acquisitions of smaller companies with innovative products, and expansion into e-commerce channels are key strategies for success. Companies focused on developing effective and convenient OTC products for chronic disease management, and those incorporating digital health technologies to improve patient adherence and outcomes, are expected to gain a competitive edge and capture market share. The increasing integration of telehealth will further drive market growth.

United States Over-The-Counter Drugs Market Segmentation

-

1. Product Type

- 1.1. Cough, Cold, and Flu Products

- 1.2. Analgesics

- 1.3. Dermatology Products

- 1.4. Gastrointestinal Products

- 1.5. Vitamins, Mineral, and Supplements (VMS)

- 1.6. Weight Loss/Dietary Products

- 1.7. Ophthalmic Products

- 1.8. Sleeping Aids

- 1.9. Other Product Types

-

2. Formulation Type

- 2.1. Tablets

- 2.2. Liquids

- 2.3. Ointments

- 2.4. Sprays

-

3. Distribution Channel

- 3.1. Hospital Pharmacies

- 3.2. Retail Pharmacies

- 3.3. Online Pharmacy

- 3.4. Other Distribution Channels

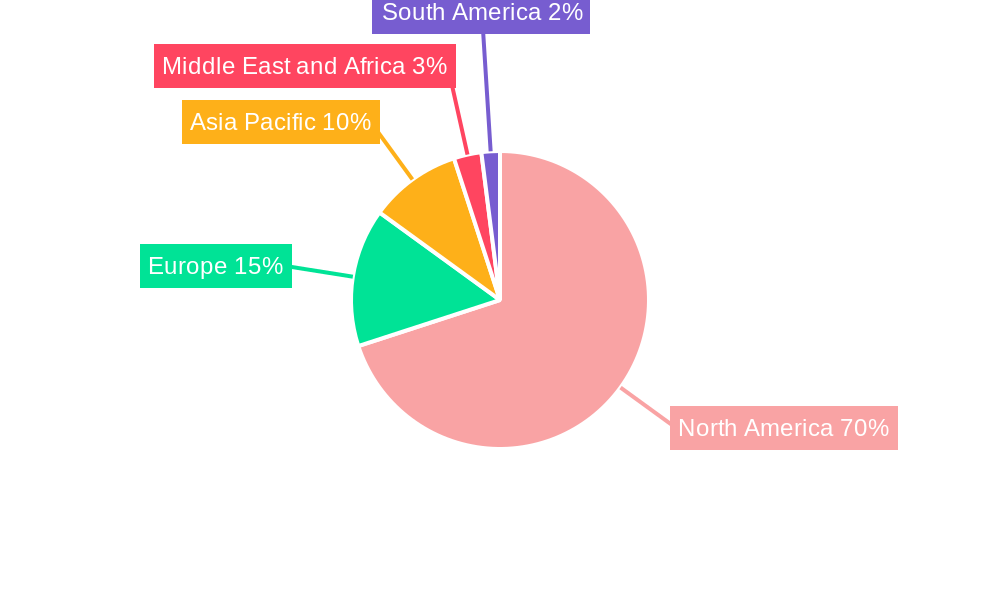

United States Over-The-Counter Drugs Market Segmentation By Geography

- 1. United States

United States Over-The-Counter Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Cost of Rx Drugs Leading to a Shift Toward OTC Drugs; Increasing Approval of OTC Drugs

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Policies

- 3.4. Market Trends

- 3.4.1. Dermatology Products are Expected to Witness Healthy Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Over-The-Counter Drugs Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cough, Cold, and Flu Products

- 5.1.2. Analgesics

- 5.1.3. Dermatology Products

- 5.1.4. Gastrointestinal Products

- 5.1.5. Vitamins, Mineral, and Supplements (VMS)

- 5.1.6. Weight Loss/Dietary Products

- 5.1.7. Ophthalmic Products

- 5.1.8. Sleeping Aids

- 5.1.9. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Formulation Type

- 5.2.1. Tablets

- 5.2.2. Liquids

- 5.2.3. Ointments

- 5.2.4. Sprays

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hospital Pharmacies

- 5.3.2. Retail Pharmacies

- 5.3.3. Online Pharmacy

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America United States Over-The-Counter Drugs Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. Europe United States Over-The-Counter Drugs Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Germany

- 7.1.2 United Kingdom

- 7.1.3 France

- 7.1.4 Italy

- 7.1.5 Spain

- 7.1.6 Rest of Europe

- 8. Asia Pacific United States Over-The-Counter Drugs Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 Australia

- 8.1.5 South Korea

- 8.1.6 Rest of Asia Pacific

- 9. Middle East and Africa United States Over-The-Counter Drugs Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 GCC

- 9.1.2 South Africa

- 9.1.3 Rest of Middle East and Africa

- 10. South America United States Over-The-Counter Drugs Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 Brazil

- 10.1.2 Argentina

- 10.1.3 Rest of South America

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sanofi SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Reckitt Benckiser Group PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bayer AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Perrigo Company PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson and Johnson

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Amneal Pharmaceuticals LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sandoz AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Viatris Inc *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Haleon PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pfizer Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Sanofi SA

List of Figures

- Figure 1: United States Over-The-Counter Drugs Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Over-The-Counter Drugs Market Share (%) by Company 2024

List of Tables

- Table 1: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Formulation Type 2019 & 2032

- Table 4: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America United States Over-The-Counter Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 33: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Formulation Type 2019 & 2032

- Table 34: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 35: United States Over-The-Counter Drugs Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Over-The-Counter Drugs Market?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the United States Over-The-Counter Drugs Market?

Key companies in the market include Sanofi SA, Reckitt Benckiser Group PLC, Bayer AG, Perrigo Company PLC, Johnson and Johnson, Amneal Pharmaceuticals LLC, Sandoz AG, Viatris Inc *List Not Exhaustive, Haleon PLC, Pfizer Inc.

3. What are the main segments of the United States Over-The-Counter Drugs Market?

The market segments include Product Type, Formulation Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.80 Million as of 2022.

5. What are some drivers contributing to market growth?

High Cost of Rx Drugs Leading to a Shift Toward OTC Drugs; Increasing Approval of OTC Drugs.

6. What are the notable trends driving market growth?

Dermatology Products are Expected to Witness Healthy Growth.

7. Are there any restraints impacting market growth?

Stringent Regulatory Policies.

8. Can you provide examples of recent developments in the market?

April 2024: Amneal Pharmaceuticals Inc. launched its OTC Naloxone Hydrochloride (Naloxone HCI) Nasal Spray, USP, 4 mg in the United States. Amneal Pharmaceuticals received approval from the FDA for the emergency treatment of an opioid overdose.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Over-The-Counter Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Over-The-Counter Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Over-The-Counter Drugs Market?

To stay informed about further developments, trends, and reports in the United States Over-The-Counter Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence