Key Insights

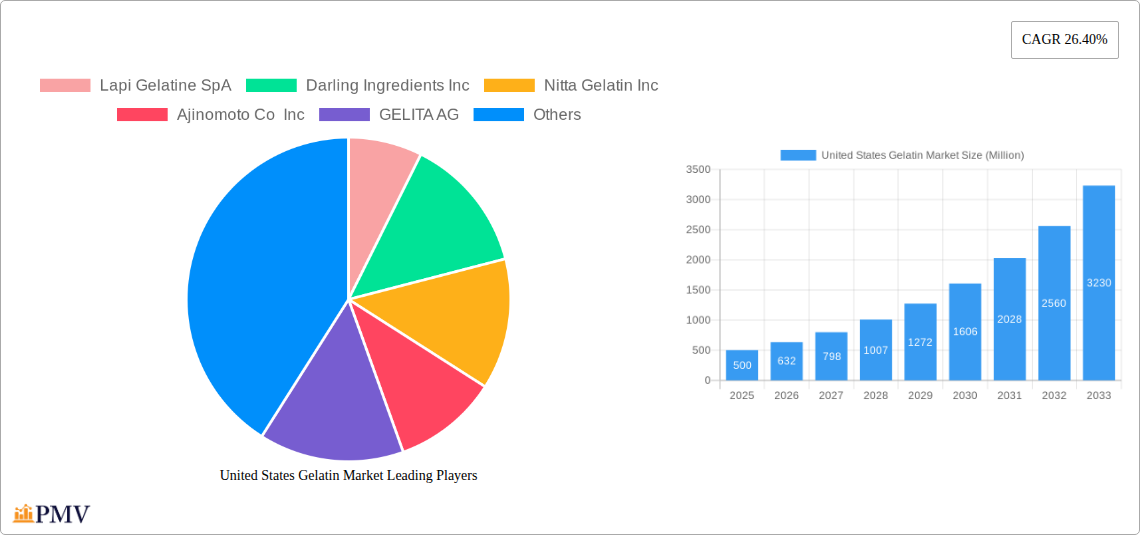

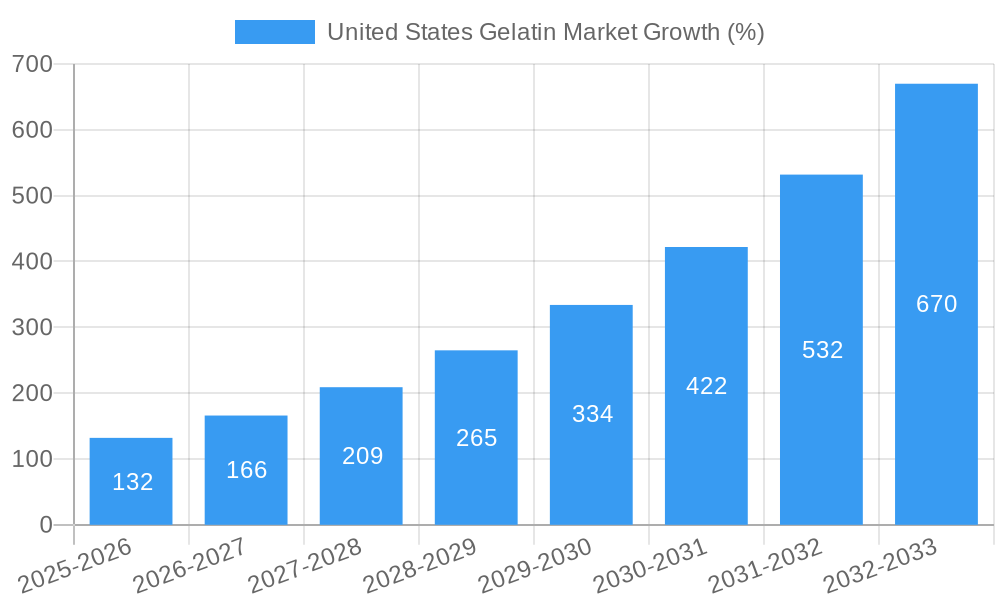

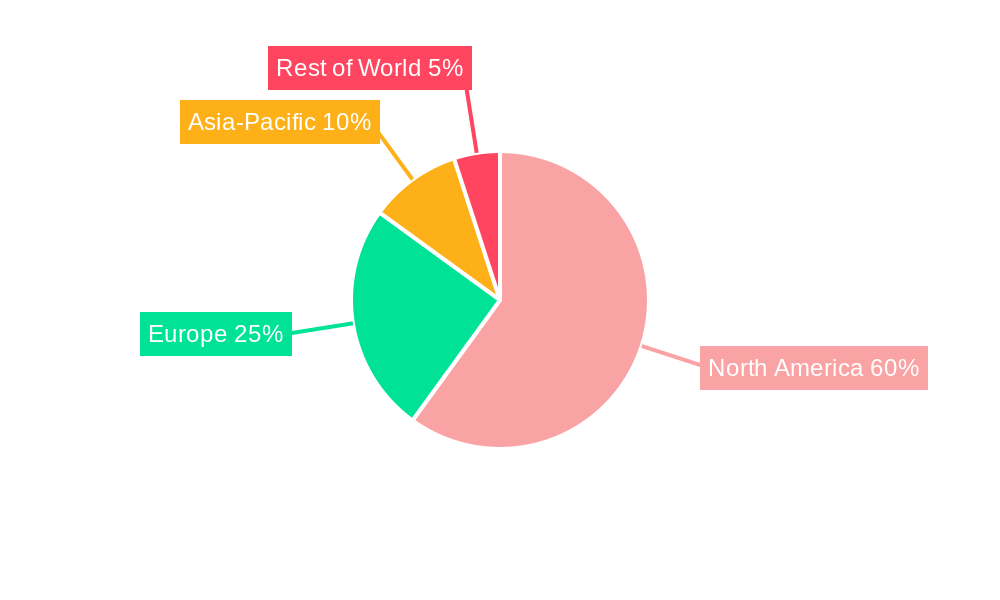

The United States gelatin market, valued at approximately $500 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 26.40% from 2025 to 2033. This significant expansion is driven by several key factors. The increasing demand for gelatin in the food and beverage sector, particularly in confectionery, desserts, and dairy products, is a major contributor. Furthermore, the growing popularity of health and wellness products, including dietary supplements and functional foods incorporating gelatin, fuels market growth. The rising consumer awareness of gelatin's health benefits, such as improved gut health and joint support, further propels market demand. The personal care and cosmetics industry also contributes significantly, with gelatin used as a thickening and stabilizing agent in various products. While challenges exist, such as fluctuations in raw material prices and concerns regarding the sourcing of gelatin from certain animal sources, the overall market outlook remains positive. Innovation in gelatin production methods, focusing on sustainability and ethical sourcing, is expected to mitigate some of these concerns.

The segmentation of the US gelatin market reveals a strong preference for animal-based gelatin, although the marine-based segment is experiencing steady growth, driven by the increasing preference for halal and kosher products and growing consumer interest in sustainable and ethically sourced ingredients. Within end-use applications, the food and beverage sector dominates, followed by the snacks and personal care industries. Leading players in the US gelatin market, such as Lapi Gelatine SpA, Darling Ingredients Inc., and GELITA AG, are investing heavily in research and development, focusing on product innovation and expanding their product portfolio to meet the evolving consumer demands. This competitive landscape fosters innovation and ensures the continued growth and evolution of the US gelatin market.

United States Gelatin Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United States gelatin market, covering market size, growth drivers, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for businesses operating in or seeking to enter this dynamic market. The report's detailed segmentation allows for a granular understanding of market trends across different product forms and end-use applications. The report value is xx Million.

United States Gelatin Market Market Structure & Competitive Dynamics

The United States gelatin market exhibits a moderately concentrated structure, with several key players holding significant market share. The market's competitive dynamics are shaped by factors including innovation in product formulations, stringent regulatory frameworks concerning food safety and sourcing, and the presence of substitute ingredients like plant-based alternatives. Mergers and acquisitions (M&A) activity has played a role in shaping the market landscape, with deal values varying significantly depending on the size and strategic importance of the acquired company. For example, a recent M&A deal involved xx Million.

- Market Concentration: The top five players account for an estimated xx% of the market share in 2025.

- Innovation Ecosystems: Companies are actively investing in research and development to improve gelatin quality, expand application areas, and develop sustainable sourcing practices.

- Regulatory Frameworks: FDA regulations pertaining to food safety, labeling, and sourcing significantly impact market operations.

- Product Substitutes: Plant-based alternatives are emerging as a competitive threat, particularly in certain end-use segments.

- End-User Trends: The growing demand for convenient, functional foods and beverages is driving growth in the gelatin market.

- M&A Activity: Strategic acquisitions are expected to continue, driven by the desire to expand product portfolios and gain access to new markets.

United States Gelatin Market Industry Trends & Insights

The United States gelatin market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: the increasing demand for gelatin in the food and beverage industry, particularly in confectionery and dairy products; the rising popularity of gelatin-based dietary supplements; and the expansion of the personal care and cosmetics sectors. Technological advancements are leading to the development of novel gelatin products with enhanced functionalities and improved properties. Consumer preferences are shifting towards natural and sustainably sourced gelatin. However, the market is not without challenges; the rising cost of raw materials and the emergence of plant-based alternatives pose significant hurdles. Market penetration within specific end-user segments remains a key area of focus for manufacturers.

Dominant Markets & Segments in United States Gelatin Market

The food and beverage segment dominates the United States gelatin market, accounting for approximately xx% of total consumption in 2025. Within this segment, the confectionery sub-segment is a major driver, fueled by the increasing popularity of gummies, marshmallows, and other gelatin-based treats. Animal-based gelatin currently holds a larger market share compared to marine-based gelatin, but the latter is experiencing growth due to rising consumer demand for sustainable and ethically sourced ingredients.

- Key Drivers for Food & Beverage Dominance:

- High consumption of gelatin-based products.

- Innovative product development in confectionery and dairy.

- Established distribution channels.

- Geographic Dominance: The Northeast and West Coast regions show higher per capita consumption due to factors like higher disposable income and consumer preference.

- Animal-Based Gelatin: Maintains market leadership due to established consumer acceptance and cost-effectiveness.

- Marine-Based Gelatin: Experiencing growth driven by the increasing demand for sustainable and ethically sourced gelatin.

United States Gelatin Market Product Innovations

Recent innovations in the United States gelatin market focus on enhancing functionality, improving purity, and expanding applications. Companies are developing specialized gelatins for specific applications, such as pharmaceutical-grade gelatin for capsules and modified gelatins with improved clarity and stability. The emphasis is on creating products that meet the needs of both consumers and manufacturers, addressing issues such as cost, sustainability, and functionality.

Report Segmentation & Scope

This report segments the United States gelatin market based on:

Form: Animal-based gelatin and marine-based gelatin. Animal-based gelatin is expected to maintain its market dominance, but marine-based gelatin is projected to exhibit faster growth due to increasing consumer preference for sustainable products. The market size for animal-based gelatin is projected to reach xx Million by 2033, while marine-based gelatin will reach xx Million.

End-User: Food and beverages (including confectionery, dairy, and meat products), snacks, and personal care and cosmetics. The food and beverage segment is expected to continue to be the largest end-use segment, driven by growing demand for gelatin-based products in these sectors. The personal care and cosmetics segment is projected to experience significant growth due to the increasing use of gelatin in skincare and haircare products.

Key Drivers of United States Gelatin Market Growth

Several factors are contributing to the growth of the United States gelatin market:

- Rising Demand for Convenient Foods: The increasing demand for convenient and ready-to-eat foods is driving the consumption of gelatin-based products.

- Growing Popularity of Gummies and Dietary Supplements: The rise in popularity of gummy vitamins, supplements, and confectionery products is fueling market growth.

- Technological Advancements: Innovations in gelatin production are leading to the development of new products with improved properties.

Challenges in the United States Gelatin Market Sector

The United States gelatin market faces several challenges:

- Fluctuations in Raw Material Prices: The cost of raw materials, such as animal hides and skins, can fluctuate, impacting production costs.

- Stringent Regulatory Compliance: Meeting regulatory requirements related to food safety and labeling adds complexity to operations.

- Competition from Plant-Based Alternatives: The emergence of plant-based alternatives is posing a competitive threat.

Leading Players in the United States Gelatin Market Market

- Lapi Gelatine SpA

- Darling Ingredients Inc. (Darling Ingredients Inc.)

- Nitta Gelatin Inc.

- Ajinomoto Co Inc. (Ajinomoto Co Inc.)

- GELITA AG (GELITA AG)

- Gelatines Weishardt SAS

- Hangzhou Qunli Gelatin Chemical Co Ltd

- Italgelatine SpA

- Baotou Dongbao Bio Tech Co Ltd

Key Developments in United States Gelatin Market Sector

- November 2020: Rousselot launched gummy caps for nutraceutical and pharmaceutical gelatin ingredients, tapping into the growing popularity of chewable supplements.

- January 2021: Nitta Gelatin India introduced an international-standard fine-grade gelatin for the HoReCa sector, leveraging Japanese technology and GMP standards.

- May 2021: Darling Ingredients Inc.'s Rousselot brand expanded its gelatin range with the launch of X-Pure® GelDAT – Gelatin Desaminotyrosine, a purified, pharmaceutical-grade gelatin.

Strategic United States Gelatin Market Market Outlook

The United States gelatin market holds significant potential for future growth. Continued innovation in product development, expansion into new applications, and strategic acquisitions will be key factors driving market expansion. The increasing demand for convenient, functional foods, coupled with the growing popularity of dietary supplements and personal care products containing gelatin, positions the market for robust expansion in the coming years. Addressing challenges related to raw material costs and competition from plant-based alternatives will be crucial for sustained growth.

United States Gelatin Market Segmentation

-

1. Form

- 1.1. Animal Based

- 1.2. Marine Based

-

2. End User

-

2.1. Food and Beverages

-

2.1.1. By Sub End User

- 2.1.1.1. Bakery

- 2.1.1.2. Condiments/Sauces

- 2.1.1.3. Confectionery

- 2.1.1.4. Dairy and Dairy Alternative Products

- 2.1.1.5. RTE/RTC Food Products

- 2.1.1.6. Snacks

-

2.1.1. By Sub End User

- 2.2. Personal Care and Cosmetics

-

2.1. Food and Beverages

United States Gelatin Market Segmentation By Geography

- 1. United States

United States Gelatin Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Gelatin Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Animal Based

- 5.1.2. Marine Based

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food and Beverages

- 5.2.1.1. By Sub End User

- 5.2.1.1.1. Bakery

- 5.2.1.1.2. Condiments/Sauces

- 5.2.1.1.3. Confectionery

- 5.2.1.1.4. Dairy and Dairy Alternative Products

- 5.2.1.1.5. RTE/RTC Food Products

- 5.2.1.1.6. Snacks

- 5.2.1.1. By Sub End User

- 5.2.2. Personal Care and Cosmetics

- 5.2.1. Food and Beverages

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. United States United States Gelatin Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada United States Gelatin Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico United States Gelatin Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Lapi Gelatine SpA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Darling Ingredients Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Nitta Gelatin Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Ajinomoto Co Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 GELITA AG

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Gelatines Weishardt SAS

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Hangzhou Qunli Gelatin Chemical Co Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Italgelatine SpA

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Baotou Dongbao Bio Tech Co Ltd

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Lapi Gelatine SpA

List of Figures

- Figure 1: United States Gelatin Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Gelatin Market Share (%) by Company 2024

List of Tables

- Table 1: United States Gelatin Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Gelatin Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: United States Gelatin Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: United States Gelatin Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Gelatin Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States United States Gelatin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada United States Gelatin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico United States Gelatin Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States Gelatin Market Revenue Million Forecast, by Form 2019 & 2032

- Table 10: United States Gelatin Market Revenue Million Forecast, by End User 2019 & 2032

- Table 11: United States Gelatin Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Gelatin Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the United States Gelatin Market?

Key companies in the market include Lapi Gelatine SpA, Darling Ingredients Inc, Nitta Gelatin Inc, Ajinomoto Co Inc, GELITA AG, Gelatines Weishardt SAS, Hangzhou Qunli Gelatin Chemical Co Ltd, Italgelatine SpA, Baotou Dongbao Bio Tech Co Ltd.

3. What are the main segments of the United States Gelatin Market?

The market segments include Form, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

May 2021: Darling Ingredients Inc. announced that its Rousselot brand expanded its range of purified, pharmaceutical-grade, and modified gelatin with the launch of X-Pure® GelDAT – Gelatin Desaminotyrosine.January 2021: Nitta Gelatin India has introduced an international-standard fine-grade gelatin under its Hotel/Restaurant/Catering (HoReCa) business. The superior-grade gelatin is produced using Japanese technology in accordance with Good Manufacturing Practice (GMP) and the Hazard Analysis and Critical Control Point (HACCP) system, in line with the European Regulation hygiene standards (EC). This gelatin is derived from natural sources that contain all essential amino acids except tryptophan.November 2020: Rousselot launched a new delivery format, the gummy caps, for nutraceutical and pharmaceutical gelatin ingredients offered under its SiMoGel brand, enabling manufacturers to tap into the growing popularity of chews and gummies. Gummy caps combine the benefits of capsules, soft gels, and gummies in a singl

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Gelatin Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Gelatin Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Gelatin Market?

To stay informed about further developments, trends, and reports in the United States Gelatin Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence