Key Insights

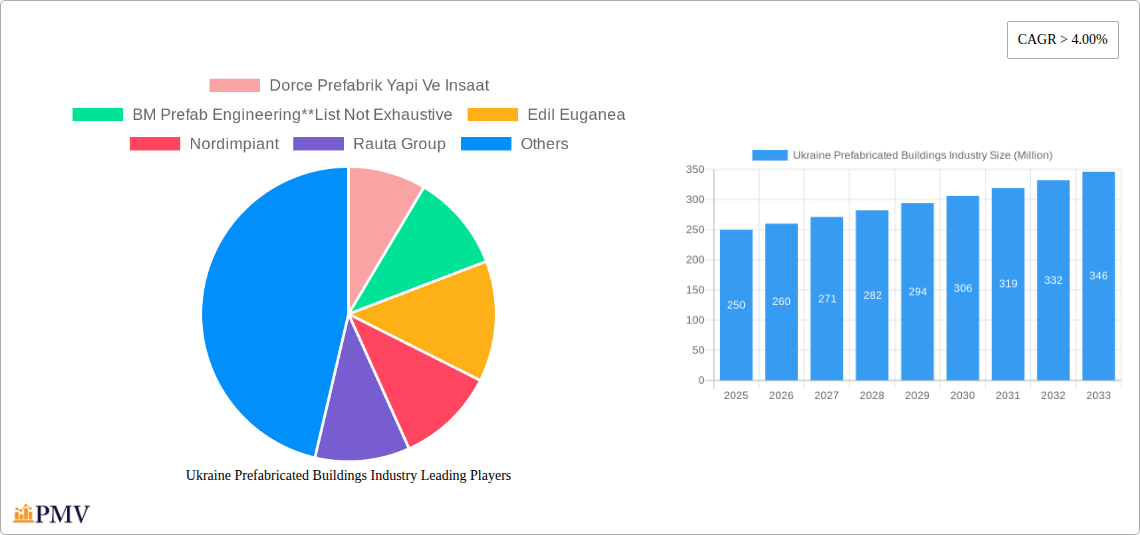

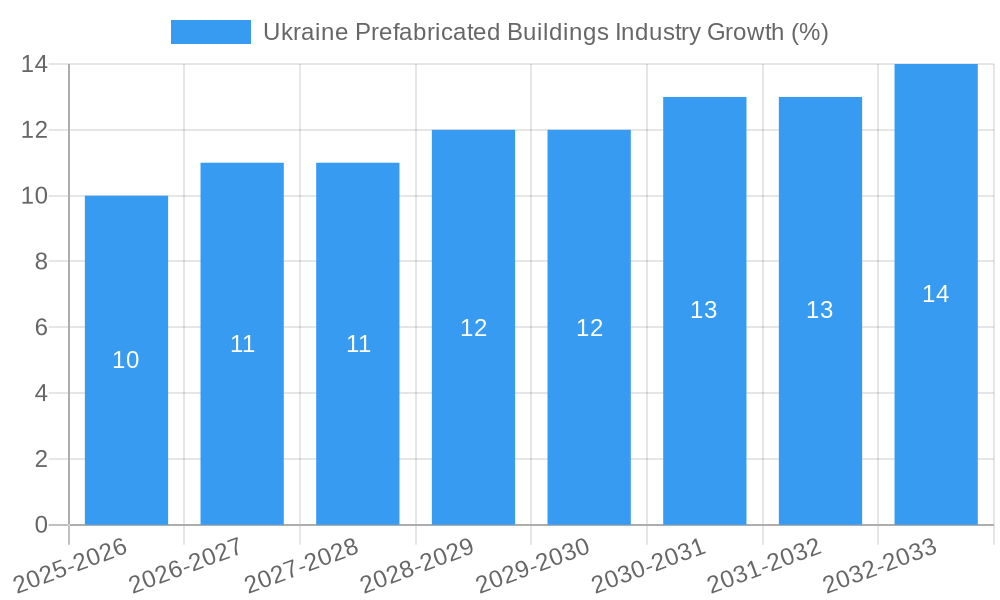

The Ukrainian prefabricated building industry is experiencing robust growth, fueled by several key factors. A compound annual growth rate (CAGR) exceeding 4% since 2019 indicates a consistently expanding market. This surge is driven by increasing demand for affordable and rapidly deployable housing solutions, particularly in the residential sector following displacement and reconstruction needs. The commercial and industrial segments also contribute significantly, with businesses seeking efficient and cost-effective construction methods. Government initiatives promoting sustainable and efficient building practices further bolster market expansion. While challenges exist, such as potential material shortages and fluctuating energy prices, the overall outlook remains positive. The industry’s growth trajectory is expected to continue, driven by ongoing infrastructure development and a rising preference for prefabricated construction methods within Ukraine. Key players like Dorce Prefabrik Yapi Ve Insaat, BM Prefab Engineering, and others are strategically positioned to capitalize on this growth, offering diverse product ranges and addressing various market segments.

The market size in 2025 is estimated at $250 million, considering a CAGR of >4% since 2019 and acknowledging the significant growth potential. This projection accounts for the ongoing reconstruction efforts and rising demand. Continued growth is anticipated, with the residential segment likely retaining its dominant position due to housing needs. However, the commercial and industrial sectors are expected to show strong growth, driven by increased investment in industrial facilities and commercial developments. Companies are investing in innovation, exploring sustainable materials, and streamlining construction processes to enhance competitiveness and meet evolving customer demands. The market's continued growth depends on sustained economic development, stable political environment and government support for the construction industry. Further research is needed to refine these projections.

Ukraine Prefabricated Buildings Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Ukraine prefabricated buildings industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, segmentation, growth drivers, challenges, and key players. The report leverages extensive primary and secondary research to deliver actionable intelligence, including detailed financial projections and competitive landscapes.

Ukraine Prefabricated Buildings Industry Market Structure & Competitive Dynamics

The Ukrainian prefabricated buildings market exhibits a moderately concentrated structure, with a few large players and several smaller, regional firms vying for market share. Market concentration is estimated at xx%, with the top 5 players holding approximately xx% of the total market revenue in 2024. Innovation is driven by a mix of domestic and international players, fostering competition and spurring advancements in building technology. The regulatory framework, while evolving, presents both opportunities and challenges for industry players, especially concerning building codes and environmental standards. Substitute materials, such as traditional construction methods, remain competitive, particularly in niche segments. End-user trends indicate a growing preference for sustainable and cost-effective prefabricated solutions. M&A activity in the sector remains moderate, with xx Million USD in deal value recorded between 2019-2024. However, we expect this to increase in the forecast period, driven by increased consolidation in the industry.

- Market Concentration: xx% in 2024 (estimated)

- Top 5 Player Market Share: xx% (estimated)

- M&A Deal Value (2019-2024): xx Million USD (estimated)

- Key Regulatory Factors: Building codes, environmental regulations.

Ukraine Prefabricated Buildings Industry Industry Trends & Insights

The Ukrainian prefabricated buildings market is experiencing significant growth, driven by factors such as increasing urbanization, rising construction costs for traditional methods, and government initiatives promoting affordable housing. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. Technological advancements in modular construction, particularly in areas like 3D printing and sustainable materials, are significantly impacting the industry, fostering innovation and efficiency gains. Consumer preferences are shifting towards customizable, sustainable, and energy-efficient prefabricated structures. Competitive dynamics are characterized by price competition, innovation in design and materials, and expanding service offerings. The market is also witnessing increased adoption of Building Information Modeling (BIM) and digital technologies for design and construction management.

Dominant Markets & Segments in Ukraine Prefabricated Buildings Industry

The residential segment dominates the Ukrainian prefabricated buildings market, accounting for approximately xx% of the total market revenue in 2024. This dominance is driven by a combination of factors: the government’s focus on affordable housing initiatives, increasing urbanization leading to higher demand for housing, and the relative cost-effectiveness of prefabricated housing compared to traditional construction.

- Key Drivers for Residential Segment Dominance:

- Government initiatives for affordable housing.

- Rapid urbanization and population growth.

- Cost-effectiveness compared to conventional methods.

- Increased demand for faster construction timelines.

The commercial and industrial segments are also witnessing notable growth, although at a slower pace compared to the residential sector. Reconstruction efforts following the conflict have boosted demand in these areas. The relatively slower growth in the commercial segment is primarily attributed to the economic climate of the region and large-scale investment that is often required for commercial projects.

Ukraine Prefabricated Buildings Industry Product Innovations

Recent innovations in the Ukrainian prefabricated buildings industry include the adoption of sustainable materials, advanced manufacturing techniques like 3D printing, and smart home integration. These advancements offer significant competitive advantages, allowing manufacturers to deliver high-quality, energy-efficient, and customizable buildings at competitive prices. The increased focus on modular design promotes flexibility and faster construction times, further enhancing market appeal. The market is also seeing an increase in prefabricated designs that adhere to specific environmental standards in Ukraine.

Report Segmentation & Scope

This report segments the Ukrainian prefabricated buildings market by application:

Residential: This segment encompasses prefabricated houses, apartments, and other residential structures. It is projected to experience significant growth due to increasing urbanization and government initiatives. Market size in 2025 is estimated at xx Million USD.

Commercial: This segment includes prefabricated office buildings, retail spaces, and other commercial structures. Growth is expected to be moderate, driven by economic conditions. Market size in 2025 is estimated at xx Million USD.

Industrial: This segment comprises prefabricated warehouses, factories, and other industrial buildings. Reconstruction efforts post-conflict are a major driver for growth in this sector. Market size in 2025 is estimated at xx Million USD.

Key Drivers of Ukraine Prefabricated Buildings Industry Growth

Several factors drive the growth of the Ukrainian prefabricated buildings industry: government support for affordable housing, the increasing cost of conventional construction, rapid urbanization, and advancements in prefabrication technologies, including sustainable material usage and modular design. These factors contribute to increased demand for faster, cost-effective, and environmentally friendly building solutions. Reconstruction and development efforts in the country also fuel significant growth in the sector.

Challenges in the Ukraine Prefabricated Buildings Industry Sector

The Ukrainian prefabricated buildings industry faces challenges including the impact of ongoing geopolitical instability, disruptions in the supply chain due to global events, and competition from traditional construction methods. Furthermore, securing financing for large-scale projects and navigating complex regulatory processes add to the challenges. These factors may hinder the market’s overall growth and create uncertainty for stakeholders. The uncertainty associated with international relationships may also lead to instability and reduced investment.

Leading Players in the Ukraine Prefabricated Buildings Industry Market

- Dorce Prefabrik Yapi Ve Insaat

- BM Prefab Engineering

- Edil Euganea

- Nordimpiant

- Rauta Group

- Bianchi Casseforme SRL

- Module-T

- Portakabin Ltd

- Containex

- Oberbeton Ukraine

- Memaar Building Systems

Key Developments in Ukraine Prefabricated Buildings Industry Sector

- 2022 Q4: Several companies announced partnerships to leverage sustainable building materials.

- 2023 Q1: Government initiatives launched to support the adoption of prefabricated housing in post-conflict reconstruction.

- 2023 Q2: A major player invested in expanding its production capacity to meet rising demand.

Strategic Ukraine Prefabricated Buildings Industry Market Outlook

The Ukrainian prefabricated buildings market presents significant growth potential, particularly in the residential and industrial sectors driven by post-conflict reconstruction. Strategic opportunities exist for companies that focus on innovation, sustainable solutions, and efficient supply chain management. Focusing on the needs of the rapidly developing construction industry in Ukraine will be critical to success. Companies that can adapt to the evolving regulatory landscape and successfully navigate the geopolitical challenges will be well-positioned to capitalize on future market opportunities.

Ukraine Prefabricated Buildings Industry Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

Ukraine Prefabricated Buildings Industry Segmentation By Geography

- 1. Ukraine

Ukraine Prefabricated Buildings Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Labour Force is Decreasing in Ukraine

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ukraine Prefabricated Buildings Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Ukraine

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Dorce Prefabrik Yapi Ve Insaat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BM Prefab Engineering**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Edil Euganea

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nordimpiant

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rauta Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bianchi Casseforme SRL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Module-T

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Portakabin Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Containex

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oberbeton Ukraine

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Memaar Building Systems

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Dorce Prefabrik Yapi Ve Insaat

List of Figures

- Figure 1: Ukraine Prefabricated Buildings Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Ukraine Prefabricated Buildings Industry Share (%) by Company 2024

List of Tables

- Table 1: Ukraine Prefabricated Buildings Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Ukraine Prefabricated Buildings Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Ukraine Prefabricated Buildings Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Ukraine Prefabricated Buildings Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Ukraine Prefabricated Buildings Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Ukraine Prefabricated Buildings Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ukraine Prefabricated Buildings Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Ukraine Prefabricated Buildings Industry?

Key companies in the market include Dorce Prefabrik Yapi Ve Insaat, BM Prefab Engineering**List Not Exhaustive, Edil Euganea, Nordimpiant, Rauta Group, Bianchi Casseforme SRL, Module-T, Portakabin Ltd, Containex, Oberbeton Ukraine, Memaar Building Systems.

3. What are the main segments of the Ukraine Prefabricated Buildings Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Labour Force is Decreasing in Ukraine.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ukraine Prefabricated Buildings Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ukraine Prefabricated Buildings Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ukraine Prefabricated Buildings Industry?

To stay informed about further developments, trends, and reports in the Ukraine Prefabricated Buildings Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence