Key Insights

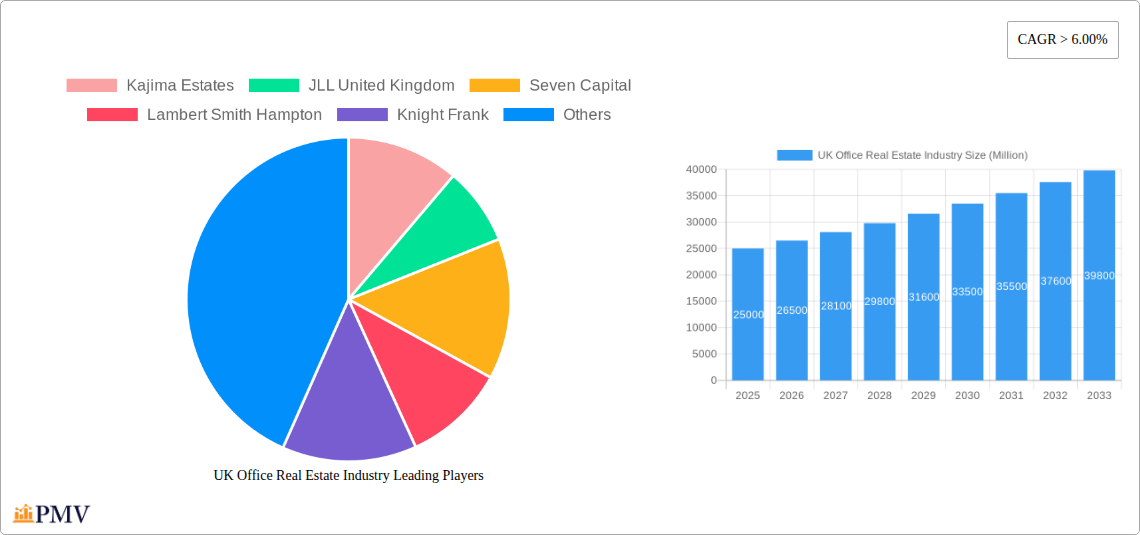

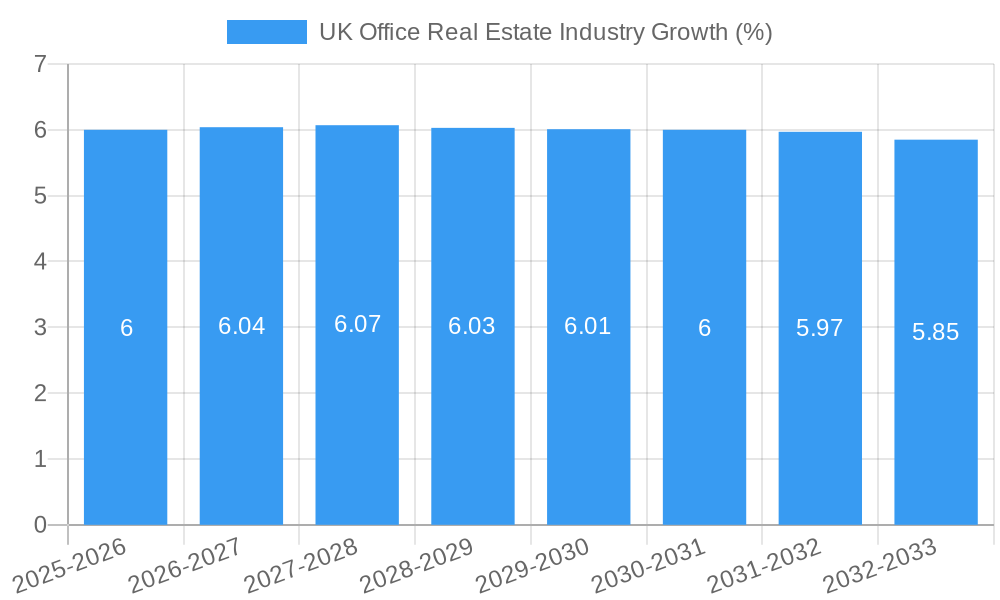

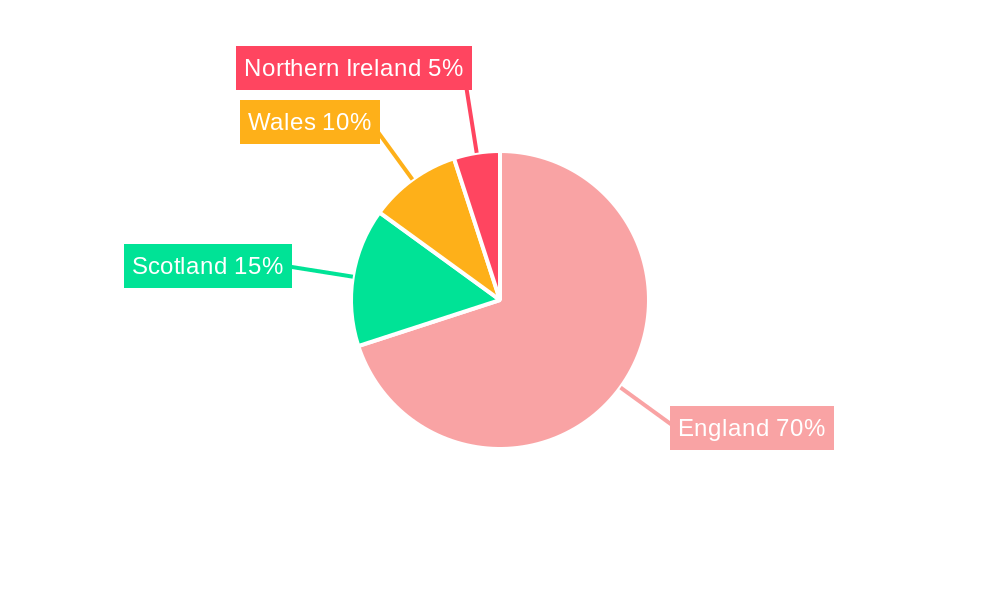

The UK office real estate market, encompassing England, Wales, Scotland, and Northern Ireland, demonstrates robust growth potential. While precise market size figures for 2019-2024 are unavailable, the provided data indicates a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033, suggesting a consistently expanding sector. Key drivers include sustained economic activity in major cities like London, Birmingham, and Manchester, increasing demand from technology and financial services firms, and a shift towards flexible and hybrid working models. This latter trend presents both challenges and opportunities, requiring landlords to adapt their offerings to meet evolving tenant needs. However, potential constraints include Brexit's lingering economic effects, fluctuations in interest rates impacting investment decisions, and the ongoing transition to more sustainable and technologically advanced office spaces. The segmentation by key cities highlights London's dominant position, with Birmingham and Manchester experiencing significant but less pronounced growth. Prominent players like Kajima Estates, JLL, and others are navigating this dynamic landscape, competing for prime locations and adjusting their strategies to accommodate changing market conditions. The forecast period of 2025-2033 paints a picture of continued expansion, although managing economic uncertainties and adapting to evolving workplace trends will be crucial for continued success within the UK office real estate sector.

The competitive landscape is characterized by a blend of established players and emerging developers. London's central business district (CBD) remains a highly sought-after location, attracting significant investment despite ongoing global economic uncertainty. However, secondary cities like Birmingham and Manchester are experiencing rising demand, fueled by lower rental costs and regional economic development initiatives. The interplay between traditional office spaces and the rise of co-working environments and flexible lease options necessitates a strategic response from market participants. The market's future trajectory hinges on successfully navigating macroeconomic factors, adapting to evolving tenant requirements, and embracing sustainable and technological advancements within building design and management. Furthermore, government policies and infrastructure investments will significantly influence regional growth dynamics within the UK office market.

UK Office Real Estate Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the UK office real estate market, offering crucial insights for investors, developers, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers actionable intelligence on market structure, competitive dynamics, dominant segments, and future growth potential. The report leverages extensive data analysis to project a market value exceeding £xx Million by 2033.

UK Office Real Estate Industry Market Structure & Competitive Dynamics

The UK office real estate market exhibits a moderately concentrated structure, with key players like CBRE, JLL United Kingdom, Knight Frank, and Hines United Kingdom holding significant market share. However, a vibrant ecosystem of smaller developers and investors contributes to dynamic competition. The regulatory landscape, including planning permissions and environmental regulations, significantly influences market activity. Product substitutes, such as co-working spaces and remote working models, are increasingly impacting traditional office demand. End-user trends toward flexible workspaces and sustainable buildings are shaping market preferences. M&A activity remains robust, with deal values totaling £xx Million in 2024, driven by consolidation and portfolio expansion strategies. Key metrics analyzed include:

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- M&A Activity: Total deal value for 2024 estimated at £xx Million, with an average deal size of £xx Million.

- Market Share: CBRE holds an estimated xx% market share in 2025, followed by JLL UK at xx%.

UK Office Real Estate Industry Industry Trends & Insights

The UK office real estate market is experiencing a period of significant transformation. While the COVID-19 pandemic initially dampened demand, a recovery is underway, driven by factors such as sustained economic growth (estimated at xx% CAGR from 2025 to 2033), increasing urbanization, and the ongoing need for collaborative workspaces, albeit in a more flexible format. Technological disruptions, including smart building technologies and PropTech solutions, are enhancing efficiency and sustainability. Consumer preferences are shifting towards flexible lease terms, enhanced amenities, and sustainable office spaces, leading to a growing demand for high-quality, modern office stock. Intense competition is driving innovation and a focus on delivering exceptional tenant experiences. Market penetration of smart building technologies is projected to reach xx% by 2033, contributing to a significant increase in rental values and investment returns.

Dominant Markets & Segments in UK Office Real Estate Industry

London remains the dominant market in the UK office real estate sector, accounting for approximately xx% of total market value in 2025. Its robust economy, extensive transport infrastructure, and concentration of businesses drive high demand.

- London: Key drivers include a strong financial services sector, a large and diverse workforce, and a highly developed transport network.

- Birmingham: Experiencing strong growth due to significant investment in infrastructure and regeneration projects.

- Manchester: Attracting tech companies and creative businesses, with a growing reputation as a vibrant and innovative city.

- Other Cities: Smaller cities show steady growth, driven by regional economic development initiatives and improving infrastructure.

This dominance is primarily due to London's position as a global financial hub, attracting significant investment and driving up property prices. The other key cities show varying degrees of growth, influenced by local economic conditions and infrastructure development.

UK Office Real Estate Industry Product Innovations

The UK office real estate sector is witnessing significant product innovation, driven by technological advancements and evolving tenant demands. Smart building technologies, including energy-efficient systems and integrated security solutions, are becoming standard features in modern office developments. Flexible workspace designs, incorporating modular layouts and collaborative work areas, are increasingly popular. Emphasis on sustainability and wellness features, such as green building certifications and enhanced indoor air quality, are crucial for attracting tenants. These innovations provide competitive advantages by attracting and retaining high-quality tenants and achieving higher rental yields.

Report Segmentation & Scope

This report segments the UK office real estate market by key cities: London, Birmingham, Manchester, and Other Cities. Each segment's analysis includes growth projections, market size estimates for 2025 and 2033, and an assessment of competitive dynamics. London is projected to experience a xx% CAGR from 2025 to 2033, while Birmingham and Manchester are expected to see growth rates of xx% and xx% respectively. The "Other Cities" segment is expected to grow at a rate of xx%. The competitive landscape varies across these segments, with London showing a higher level of concentration compared to other regions.

Key Drivers of UK Office Real Estate Industry Growth

Several factors contribute to the growth of the UK office real estate industry. Sustained economic growth in the UK, particularly in key sectors like finance and technology, fuels demand for office space. Government policies supporting infrastructure development and urban regeneration positively impact market conditions. Technological advancements are leading to more efficient and sustainable building practices, attracting environmentally conscious businesses. The increasing popularity of co-working spaces and flexible office solutions also drives market expansion.

Challenges in the UK Office Real Estate Industry Sector

The UK office real estate sector faces several challenges. Brexit-related uncertainties initially impacted market sentiment, although the sector is now showing recovery. Supply chain disruptions and increasing construction costs exert upward pressure on development costs. Intense competition and the rise of remote working models present challenges for landlords seeking to maintain occupancy rates. These factors result in an estimated xx% decrease in profitability for some segments between 2024 and 2025.

Leading Players in the UK Office Real Estate Industry Market

- Kajima Estates

- JLL United Kingdom

- Seven Capital

- Lambert Smith Hampton

- Knight Frank

- LBS Properties

- Hines United Kingdom

- Salboy Ltd

- CBRE

Key Developments in UK Office Real Estate Industry Sector

- 2023 Q4: Increased investment in sustainable building technologies by major players.

- 2024 Q1: Several significant M&A deals involving leading real estate companies.

- 2024 Q2: Launch of several new co-working spaces in major cities across the UK.

- 2024 Q3: Government announcements of new infrastructure projects supporting urban regeneration in various cities.

Strategic UK Office Real Estate Industry Market Outlook

The UK office real estate market is poised for continued growth, driven by long-term economic trends, technological advancements, and evolving workplace dynamics. Strategic opportunities exist for developers focusing on sustainable and flexible office solutions, catering to the increasing demand for high-quality, adaptable workspaces. Investment in smart building technologies and data-driven decision-making will be crucial for success in the years to come. The sector is expected to experience a robust recovery, with the market value projected to surpass £xx Million by 2033.

UK Office Real Estate Industry Segmentation

-

1. Key Cities

- 1.1. London

- 1.2. Birmingham

- 1.3. Manchester

- 1.4. Other Cities

UK Office Real Estate Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Office Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Number of Startups4.; The Development of Sustainable Co-working Spaces

- 3.3. Market Restrains

- 3.3.1 4.; A Rise in Remote Work4.; Traditional Work Culture in India

- 3.3.2 Which May Not Align Well With the Open and Collaborative Environment of Co-working Spaces

- 3.4. Market Trends

- 3.4.1. Declining Vacancy Rates and Increasing Rents of Office Spaces in London

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. London

- 5.1.2. Birmingham

- 5.1.3. Manchester

- 5.1.4. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. North America UK Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Key Cities

- 6.1.1. London

- 6.1.2. Birmingham

- 6.1.3. Manchester

- 6.1.4. Other Cities

- 6.1. Market Analysis, Insights and Forecast - by Key Cities

- 7. South America UK Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Key Cities

- 7.1.1. London

- 7.1.2. Birmingham

- 7.1.3. Manchester

- 7.1.4. Other Cities

- 7.1. Market Analysis, Insights and Forecast - by Key Cities

- 8. Europe UK Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Key Cities

- 8.1.1. London

- 8.1.2. Birmingham

- 8.1.3. Manchester

- 8.1.4. Other Cities

- 8.1. Market Analysis, Insights and Forecast - by Key Cities

- 9. Middle East & Africa UK Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Key Cities

- 9.1.1. London

- 9.1.2. Birmingham

- 9.1.3. Manchester

- 9.1.4. Other Cities

- 9.1. Market Analysis, Insights and Forecast - by Key Cities

- 10. Asia Pacific UK Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Key Cities

- 10.1.1. London

- 10.1.2. Birmingham

- 10.1.3. Manchester

- 10.1.4. Other Cities

- 10.1. Market Analysis, Insights and Forecast - by Key Cities

- 11. England UK Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Office Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Kajima Estates

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 JLL United Kingdom

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Seven Capital

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Lambert Smith Hampton

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Knight Frank

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 LBS Properties

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Hines United Kingdom

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Salboy Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 CBRE

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Kajima Estates

List of Figures

- Figure 1: Global UK Office Real Estate Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Office Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Office Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Office Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 5: North America UK Office Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 6: North America UK Office Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: North America UK Office Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America UK Office Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 9: South America UK Office Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 10: South America UK Office Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America UK Office Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe UK Office Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 13: Europe UK Office Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 14: Europe UK Office Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe UK Office Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa UK Office Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 17: Middle East & Africa UK Office Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 18: Middle East & Africa UK Office Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa UK Office Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific UK Office Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 21: Asia Pacific UK Office Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 22: Asia Pacific UK Office Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific UK Office Real Estate Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Office Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Office Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 3: Global UK Office Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global UK Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: England UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Wales UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Scotland UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Northern UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Ireland UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global UK Office Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 11: Global UK Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global UK Office Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 16: Global UK Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global UK Office Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 21: Global UK Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Russia UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Benelux UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Nordics UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global UK Office Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 32: Global UK Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global UK Office Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 40: Global UK Office Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific UK Office Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Office Real Estate Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the UK Office Real Estate Industry?

Key companies in the market include Kajima Estates, JLL United Kingdom, Seven Capital, Lambert Smith Hampton, Knight Frank, LBS Properties, Hines United Kingdom, Salboy Ltd, CBRE.

3. What are the main segments of the UK Office Real Estate Industry?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Number of Startups4.; The Development of Sustainable Co-working Spaces.

6. What are the notable trends driving market growth?

Declining Vacancy Rates and Increasing Rents of Office Spaces in London.

7. Are there any restraints impacting market growth?

4.; A Rise in Remote Work4.; Traditional Work Culture in India. Which May Not Align Well With the Open and Collaborative Environment of Co-working Spaces.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Office Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Office Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Office Real Estate Industry?

To stay informed about further developments, trends, and reports in the UK Office Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence