Key Insights

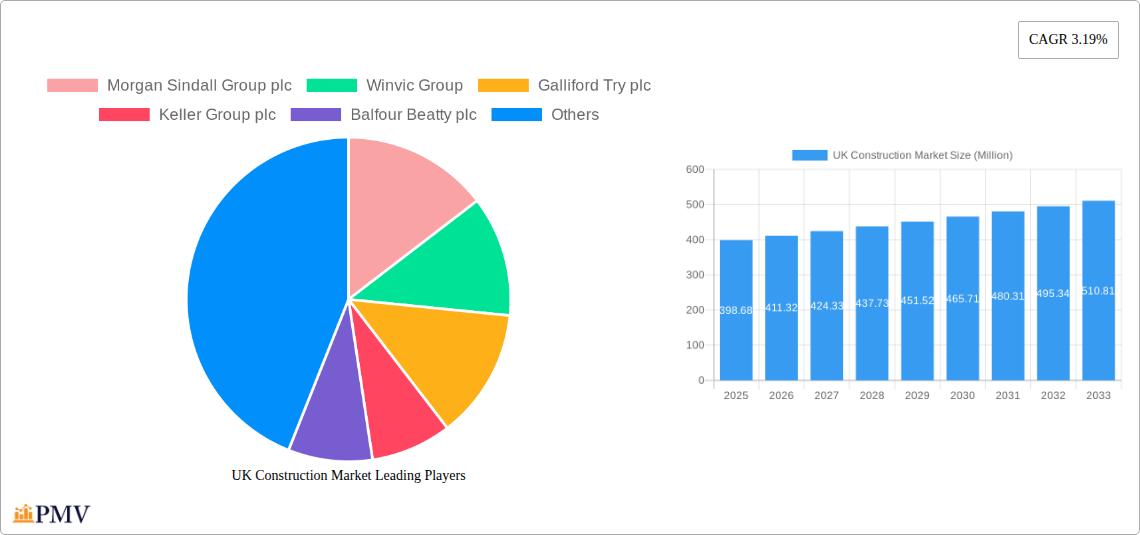

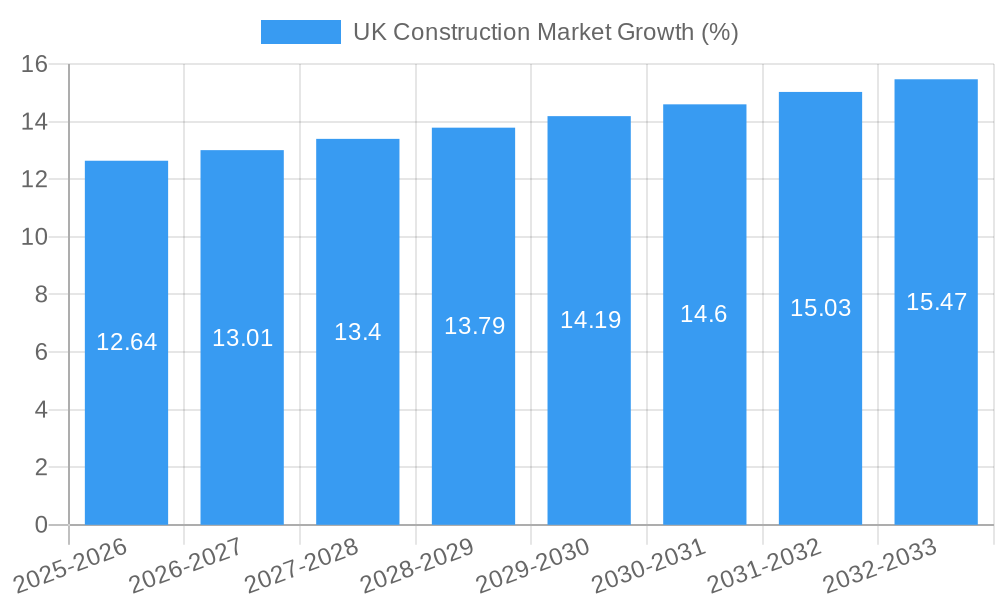

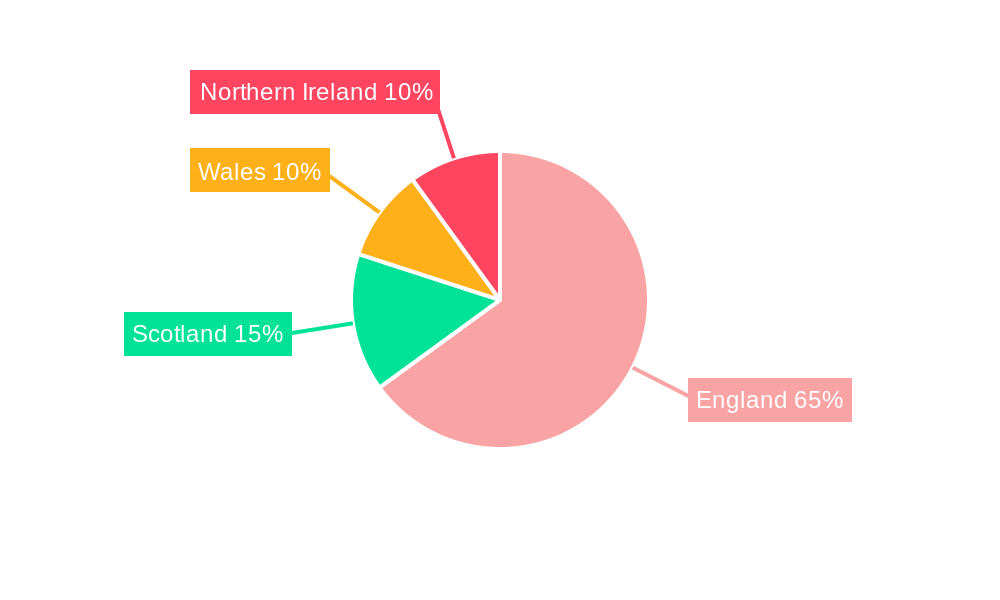

The UK construction market, valued at £398.68 million in 2025, is projected to experience steady growth, driven by sustained infrastructure investment, a recovering housing market, and ongoing demand for commercial and industrial spaces. The 3.19% Compound Annual Growth Rate (CAGR) from 2025 to 2033 indicates a positive outlook, although potential headwinds exist. Increased material costs, labor shortages, and regulatory hurdles pose challenges to consistent expansion. The market is segmented by sector (residential, commercial, industrial, infrastructure, energy and utilities) and geographically (England, Northern Ireland, Scotland, Wales), providing diverse investment opportunities. Residential construction is anticipated to remain a significant driver, fuelled by population growth and government initiatives aimed at increasing housing supply. However, the commercial sector is expected to be influenced by economic fluctuations and shifts in business activity. Infrastructure projects, particularly those relating to transport and renewable energy, will play a pivotal role in market growth, ensuring continued investment throughout the forecast period. While England dominates the market, Scotland and Wales will see notable growth driven by localized investment and development strategies.

Major players like Morgan Sindall Group plc, Balfour Beatty plc, and Kier Group plc are well-positioned to capitalize on these trends. However, competitive pressures remain high, requiring strategic partnerships and innovative approaches to project management and cost optimization. The success of individual firms will hinge on their ability to navigate the complexities of the regulatory landscape, secure skilled labor, and efficiently manage supply chains. Moreover, the UK's commitment to sustainable construction practices and carbon reduction targets will significantly influence the market, driving demand for green building technologies and methodologies. The anticipated growth trajectory, therefore, rests on effectively addressing labor shortages, material cost inflation, and adapting to ever-evolving sustainability regulations.

UK Construction Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the UK construction market, offering valuable insights for investors, industry professionals, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market structure, competitive dynamics, key trends, and future growth potential. The report segments the market by sector (Residential, Commercial, Industrial, Infrastructure, Energy and Utilities) and key regions (England, Northern Ireland, Scotland, Wales), providing granular data and analysis to help you navigate this dynamic market. The total market size in 2025 is estimated at £xx Million.

UK Construction Market Structure & Competitive Dynamics

The UK construction market exhibits a moderately concentrated structure, with several large players commanding significant market share. Key players like Morgan Sindall Group plc, Winvic Group, Galliford Try plc, Keller Group plc, Balfour Beatty plc, ISG plc, Bouygues UK, Kier Group plc, Laing O'Rourke plc, and Mace Ltd compete fiercely, driving innovation and shaping market dynamics. Market share fluctuates based on project wins and economic conditions. In 2024, the top five players held an estimated xx% market share collectively.

- Market Concentration: Moderate, with a few dominant players.

- Innovation Ecosystems: Strong emphasis on technological advancements, particularly in areas like BIM (Building Information Modelling) and offsite construction.

- Regulatory Frameworks: Stringent regulations regarding health and safety, environmental impact, and planning permissions significantly influence market operations.

- Product Substitutes: Limited direct substitutes, but alternative materials and construction methods are gaining traction.

- End-User Trends: Increasing demand for sustainable and energy-efficient buildings is a major trend shaping the market.

- M&A Activities: The sector witnesses regular mergers and acquisitions, with deal values varying significantly depending on the size and scope of the companies involved. Recent years have seen deals valued at several hundred Million pounds. For example, the Access Group's acquisition of COINS demonstrates a push toward technological integration in the industry.

UK Construction Market Industry Trends & Insights

The UK construction market is characterized by a complex interplay of growth drivers, technological disruptions, and evolving consumer preferences. The market experienced a CAGR of xx% during the historical period (2019-2024), and is projected to achieve a CAGR of xx% during the forecast period (2025-2033). Market penetration of innovative technologies like BIM and modular construction is steadily increasing, but adoption rates vary across different sectors and companies.

Major growth drivers include sustained government investment in infrastructure projects, robust residential construction fueled by population growth, and ongoing demand for commercial real estate. Technological advancements are improving efficiency, productivity, and sustainability across the value chain, though challenges remain with workforce skills and digital integration. Consumer preference for sustainable, eco-friendly construction practices influences material selection and building design. Competitive dynamics are influenced by fluctuating material costs, skilled labor shortages, and economic cycles.

Dominant Markets & Segments in UK Construction Market

England remains the dominant market within the UK, accounting for the largest share of construction activity across all sectors. The residential sector has historically been a major segment, driven by housing demand. However, infrastructure projects, spurred by government investment initiatives, are experiencing significant growth.

- By Sector:

- Residential: High demand for housing, particularly in major urban centers, fuels continuous growth, although affordability concerns remain a key factor.

- Commercial: Market activity fluctuates with economic cycles, driven by office developments, retail spaces, and other commercial projects.

- Industrial: Growth is tied to manufacturing output, warehousing needs, and logistics developments.

- Infrastructure: A major growth driver, propelled by substantial government investments in transport, energy, and utilities projects.

- Energy and Utilities: Steady growth driven by investments in renewable energy infrastructure and upgrades to existing networks.

- By Region:

- England: The largest market, driven by diverse economic activity and high population density.

- Scotland, Wales, Northern Ireland: Smaller markets with unique economic and regulatory contexts.

UK Construction Market Product Innovations

Recent innovations focus on prefabrication, modular construction, and the increased use of Building Information Modeling (BIM). These technologies improve efficiency, reduce construction times, and enhance the overall quality of projects. The adoption of sustainable materials and environmentally friendly construction practices is also gaining significant momentum, responding to both environmental concerns and government regulations. These innovations offer substantial competitive advantages in terms of cost, speed, and sustainability.

Report Segmentation & Scope

This report offers a detailed segmentation of the UK construction market, analyzing each sector (Residential, Commercial, Industrial, Infrastructure, Energy and Utilities) and key region (England, Northern Ireland, Scotland, Wales) individually. Growth projections, market size estimations, and competitive dynamics are provided for each segment, offering a comprehensive view of the market landscape. Detailed analysis reveals projected growth rates and market size for each sector and region, reflecting future market trends and opportunities.

Key Drivers of UK Construction Market Growth

Government infrastructure investment (e.g., the £40 billion transport investment announced in March 2023), population growth driving residential construction, and increasing demand for commercial and industrial space are key drivers. Technological advancements like BIM, offsite construction, and sustainable building materials further accelerate growth by improving efficiency and lowering costs. Favorable financing conditions and relaxed planning regulations (where applicable) can also spur market expansion.

Challenges in the UK Construction Market Sector

The industry faces challenges including skills shortages, fluctuating material costs, and supply chain disruptions leading to project delays and cost overruns. Stringent regulations increase complexity and costs for developers. Intense competition and pricing pressures create difficulties for smaller firms. These factors can negatively affect profitability and overall market growth if not effectively addressed.

Leading Players in the UK Construction Market Market

- Morgan Sindall Group plc

- Winvic Group

- Galliford Try plc

- Keller Group plc

- Balfour Beatty plc

- ISG plc

- Bouygues UK

- Kier Group plc

- Laing O'Rourke plc

- Mace Ltd

Key Developments in UK Construction Market Sector

- December 2022: The Access Group acquired Construction Industry Solutions (COINS), enhancing its software and service offerings for construction businesses. This signals a growing trend of technological integration within the sector.

- March 2023: The UK Department of Transport announced over £40 billion of capital investment in transport infrastructure, stimulating significant growth in the infrastructure segment.

Strategic UK Construction Market Outlook

The UK construction market is poised for sustained growth, driven by ongoing government investment in infrastructure, robust residential demand, and the adoption of innovative technologies. Strategic opportunities lie in specializing in sustainable construction, embracing technological advancements, and effectively managing supply chain risks. Focus on niche segments, expansion into new markets, and strategic partnerships will be crucial for future success.

UK Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure

- 1.5. Energy and Utilities

UK Construction Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Transport Infrstructure Investment

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Increase in GVA of construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America UK Construction Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Infrastructure

- 6.1.5. Energy and Utilities

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America UK Construction Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Infrastructure

- 7.1.5. Energy and Utilities

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe UK Construction Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Infrastructure

- 8.1.5. Energy and Utilities

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa UK Construction Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Infrastructure

- 9.1.5. Energy and Utilities

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific UK Construction Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Infrastructure

- 10.1.5. Energy and Utilities

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. England UK Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Construction Market Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Construction Market Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Construction Market Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Construction Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Morgan Sindall Group plc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Winvic Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Galliford Try plc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Keller Group plc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Balfour Beatty plc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 ISG plc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Bouygues UK

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Kier Group plc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Laing O'Rourke plc**List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Mace Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Morgan Sindall Group plc

List of Figures

- Figure 1: Global UK Construction Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Construction Market Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America UK Construction Market Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America UK Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America UK Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America UK Construction Market Revenue (Million), by Sector 2024 & 2032

- Figure 9: South America UK Construction Market Revenue Share (%), by Sector 2024 & 2032

- Figure 10: South America UK Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America UK Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe UK Construction Market Revenue (Million), by Sector 2024 & 2032

- Figure 13: Europe UK Construction Market Revenue Share (%), by Sector 2024 & 2032

- Figure 14: Europe UK Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe UK Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa UK Construction Market Revenue (Million), by Sector 2024 & 2032

- Figure 17: Middle East & Africa UK Construction Market Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Middle East & Africa UK Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa UK Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific UK Construction Market Revenue (Million), by Sector 2024 & 2032

- Figure 21: Asia Pacific UK Construction Market Revenue Share (%), by Sector 2024 & 2032

- Figure 22: Asia Pacific UK Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific UK Construction Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global UK Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global UK Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: England UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Wales UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Scotland UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Northern UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Ireland UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global UK Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 11: Global UK Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global UK Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 16: Global UK Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global UK Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 21: Global UK Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Russia UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Benelux UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Nordics UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global UK Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 32: Global UK Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global UK Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 40: Global UK Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific UK Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Construction Market?

The projected CAGR is approximately 3.19%.

2. Which companies are prominent players in the UK Construction Market?

Key companies in the market include Morgan Sindall Group plc, Winvic Group, Galliford Try plc, Keller Group plc, Balfour Beatty plc, ISG plc, Bouygues UK, Kier Group plc, Laing O'Rourke plc**List Not Exhaustive, Mace Ltd.

3. What are the main segments of the UK Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 398.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Transport Infrstructure Investment.

6. What are the notable trends driving market growth?

Increase in GVA of construction Industry.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor.

8. Can you provide examples of recent developments in the market?

December 2022: The Access Group has announced that it has successfully acquired Construction Industry Solutions (COINS), enhancing its capacity to offer international software and services to businesses engaged in the construction industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Construction Market?

To stay informed about further developments, trends, and reports in the UK Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence