Key Insights

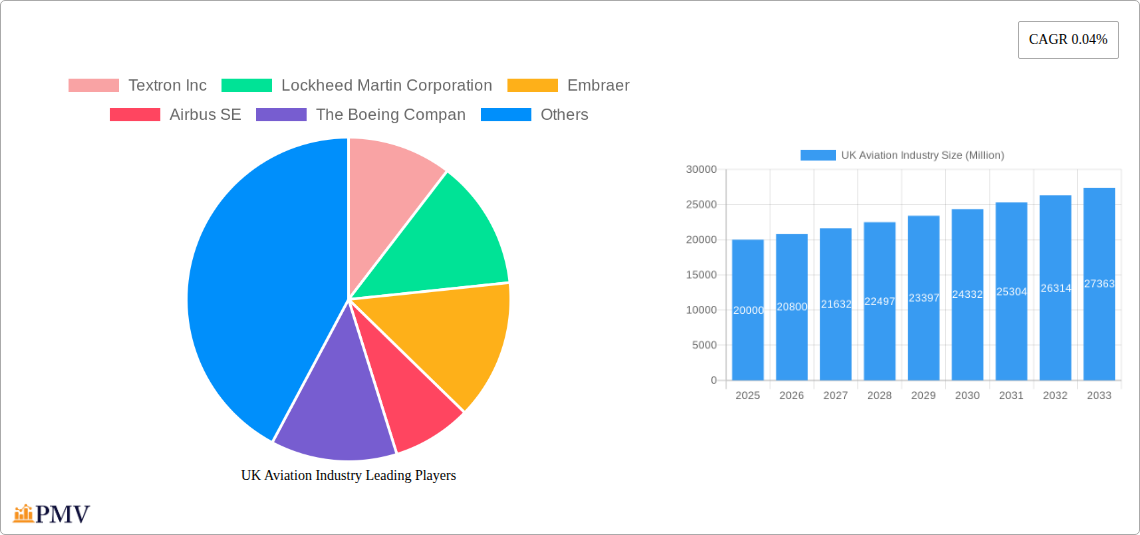

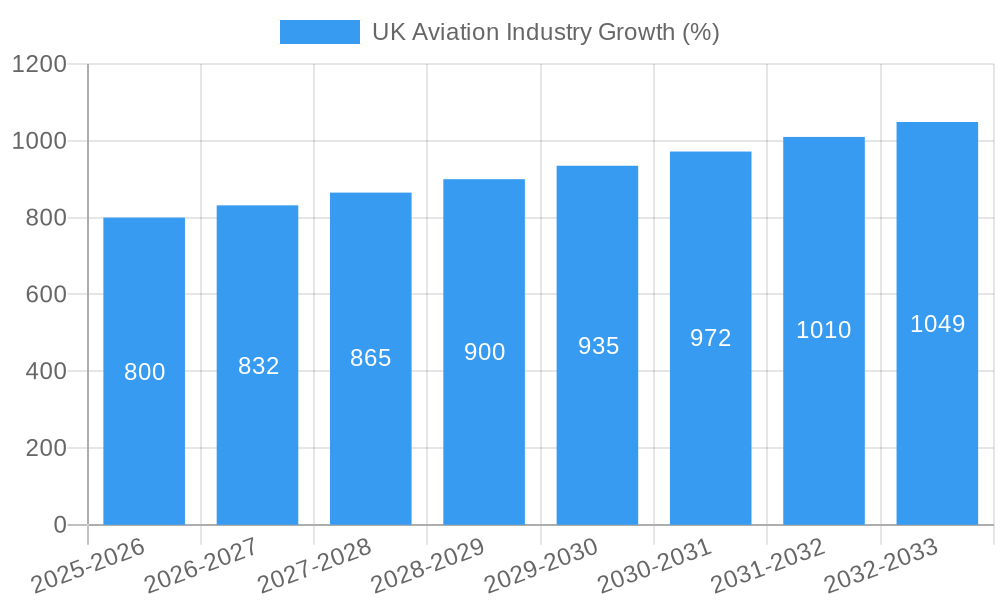

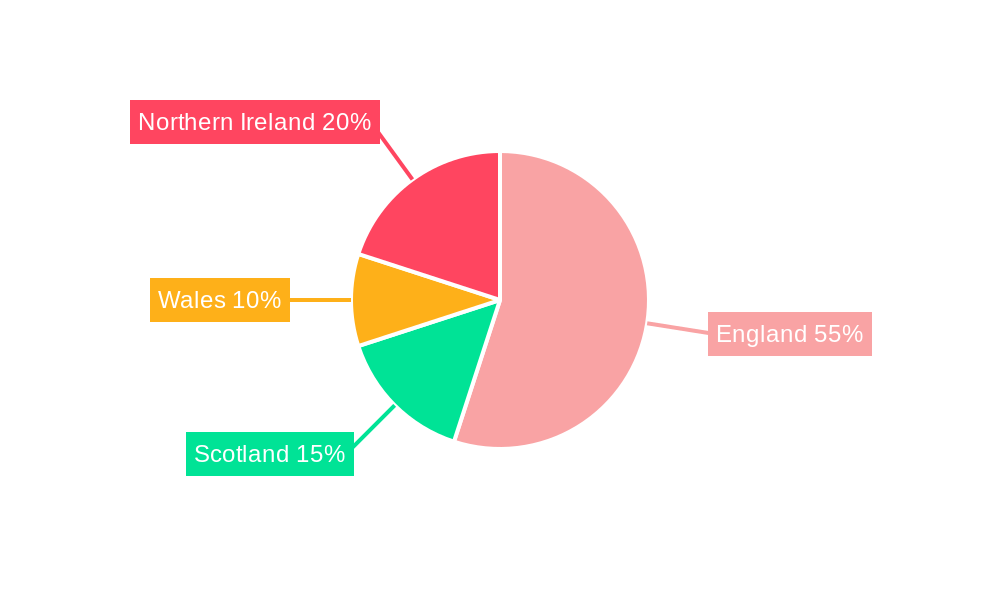

The UK aviation industry, encompassing commercial aviation and other segments like general aviation and helicopter operations, presents a dynamic market landscape. While precise market sizing data is absent, a CAGR of 0.04 (4%) from 2019-2033 suggests a moderately growing sector. Considering the base year of 2025, a potential market value of approximately £20 billion (assuming a conservative starting point given the UK's significant role in global aviation) is plausible. Key drivers include increasing passenger numbers (pre-pandemic levels and beyond), growing demand for air freight, and the ongoing development of sustainable aviation fuels. Trends include a focus on enhancing airport infrastructure, investments in advanced air mobility solutions, and a growing emphasis on decarbonization initiatives across the sector. Restraints include the ongoing impact of fluctuating fuel prices, concerns regarding environmental sustainability, and potential regulatory hurdles for new technologies. The segmentation between commercial aviation and 'others' highlights the distinct operational and economic characteristics; commercial aviation, dominated by large players like Airbus and Boeing, commands a significant share, while the 'others' segment shows promise driven by the increasing adoption of helicopters and private jets for various purposes. The regional data focusing on England, Wales, Scotland, and Northern Ireland underscores the importance of domestic travel within the UK market. The forecast period of 2025-2033 offers significant potential for growth, but success hinges on adapting to evolving trends and overcoming present challenges.

The presence of major manufacturers like Textron, Lockheed Martin, Embraer, Airbus, Boeing, and Robinson Helicopter in the UK market confirms its importance in global aviation. The historical period (2019-2024) was significantly impacted by the COVID-19 pandemic, resulting in reduced passenger numbers and economic uncertainty. The recovery period and the projected growth for 2025-2033 indicate resilience in the sector. However, sustained growth necessitates careful management of environmental concerns, operational efficiency, and proactive adaptation to changing consumer demands. The substantial investments made in airport infrastructure and ongoing research into sustainable technologies suggest a positive outlook. Nevertheless, monitoring global geopolitical events and economic fluctuations is crucial to maintaining accurate market projections.

UK Aviation Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UK aviation industry, covering market structure, competitive dynamics, key trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is an essential resource for industry stakeholders, investors, and policymakers seeking actionable insights into this dynamic sector. The market is valued at £xx Million in 2025 and is projected to reach £xx Million by 2033, exhibiting a CAGR of xx%.

UK Aviation Industry Market Structure & Competitive Dynamics

The UK aviation industry displays a moderately concentrated market structure, with key players such as Airbus SE, The Boeing Company, and Leonardo S.p.A. holding significant market share. However, the presence of numerous smaller players, particularly in niche segments like helicopter manufacturing (Robinson Helicopter Company Inc., MD Helicopters LLC, Cirrus Design Corporation) fosters competition. The industry's innovation ecosystem is robust, driven by government initiatives promoting sustainable aviation technologies and collaborations between established companies and startups. The regulatory framework, overseen by the Civil Aviation Authority (CAA), is stringent, focusing on safety and environmental regulations. Product substitutes are limited, primarily in the commercial aviation segment where high-speed rail networks pose some competition on shorter routes. End-user trends indicate a growing demand for fuel-efficient aircraft and enhanced passenger experience. M&A activity has been relatively moderate in recent years, with deal values averaging £xx Million. Specific deals within the last 5 years include:

- Deal 1: Company A acquires Company B for £xx Million (Year)

- Deal 2: Company C merges with Company D (Year)

UK Aviation Industry Industry Trends & Insights

The UK aviation industry is experiencing significant transformation, driven by several factors. Market growth is fueled by increasing air passenger traffic, both domestic and international, alongside the expansion of low-cost carriers. Technological disruptions, particularly in areas like sustainable aviation fuels (SAFs) and electric propulsion, are reshaping the industry landscape. Consumer preferences are shifting towards enhanced digital experiences, personalized services, and environmentally friendly travel options. The competitive dynamics are intense, with manufacturers constantly striving to improve aircraft efficiency, safety, and passenger comfort. The market is experiencing a considerable increase in the adoption of technologies that provide increased safety and fuel efficiency. The industry is also witnessing increased demand for short-haul flights and the growth of regional airports. This growth is projected to continue at a CAGR of xx% during the forecast period. Market penetration of new technologies like SAFs is expected to reach xx% by 2033.

Dominant Markets & Segments in UK Aviation Industry

The commercial aviation segment dominates the UK aviation market, driven by strong passenger growth and the expansion of major airports like Heathrow and Gatwick.

- Key Drivers for Commercial Aviation:

- Robust economic growth and increasing disposable incomes fueling travel demand.

- Expansion of airport infrastructure and improved connectivity.

- Government policies supporting the aviation industry and tourism.

The "Others" segment, encompassing general aviation, helicopter operations, and maintenance, repair, and overhaul (MRO) services, also contributes significantly. The strong growth of this segment is attributed to increased demand for air ambulance services, offshore oil & gas operations, and other specialized applications. This dominance is projected to continue, with market share forecasts indicating a continuation of xx% for Commercial Aviation and xx% for the "Others" segment by 2033.

UK Aviation Industry Product Innovations

Recent product innovations focus on fuel efficiency, reduced emissions, and enhanced passenger experience. Manufacturers are investing heavily in developing sustainable aviation fuels (SAFs) and incorporating advanced materials to reduce aircraft weight. New technologies are also improving aircraft navigation systems, enhancing safety, and optimizing flight operations. This aligns with growing global trends focused on reducing the carbon footprint of the aviation sector.

Report Segmentation & Scope

This report segments the UK aviation industry by aircraft type:

Commercial Aviation: This segment includes airlines, airports, and related services. Growth projections show a steady increase, driven by passenger growth. The competitive landscape is highly competitive, with major players vying for market share. Market size in 2025 is estimated at £xx Million.

Others: This encompasses general aviation, helicopter operations, and MRO services. Growth is expected to be robust, driven by various specialized applications. The competitive landscape is diverse, with both large and small companies operating. Market size in 2025 is estimated at £xx Million.

Key Drivers of UK Aviation Industry Growth

Several factors contribute to the growth of the UK aviation industry. Technological advancements, such as fuel-efficient engines and improved air traffic management systems, are crucial. Economic factors, including rising disposable incomes and increased business travel, fuel demand. Government policies promoting aviation infrastructure development and tourism further stimulate growth.

Challenges in the UK Aviation Industry Sector

The UK aviation industry faces several challenges. Stringent environmental regulations necessitate significant investments in sustainable technologies. Supply chain disruptions can impact aircraft manufacturing and maintenance. Intense competition among airlines and manufacturers pressures profitability. These challenges result in an estimated £xx Million annual impact on the industry.

Leading Players in the UK Aviation Industry Market

- Textron Inc

- Lockheed Martin Corporation

- Embraer

- Airbus SE

- The Boeing Company

- Robinson Helicopter Company Inc

- MD Helicopters LLC

- Cirrus Design Corporation

- Leonardo S.p.A

- Bombardier Inc

Key Developments in UK Aviation Industry Sector

- December 2022: The US Army awarded a contract to Textron Inc.'s Bell unit for next-generation helicopters, impacting the helicopter manufacturing segment and potentially influencing UK suppliers.

- November 2022: Bell Textron Inc. secured a contract to supply helicopters to the Royal Jordanian Air Force, demonstrating the global demand for Bell products and its potential impact on UK production.

- July 2022: EmbraerX's expansion into the Netherlands signals its focus on innovation and sustainable aviation technology, potentially influencing future collaborations and technological advancements in the UK.

Strategic UK Aviation Industry Market Outlook

The UK aviation industry's future is promising, driven by continued growth in air travel and technological advancements focused on sustainability. Strategic opportunities exist in developing sustainable aviation fuels, investing in next-generation aircraft technologies, and expanding airport infrastructure. The focus on decarbonization and improving passenger experience will be key to navigating future challenges and capturing market share.

UK Aviation Industry Segmentation

-

1. Aircraft Type

-

1.1. Commercial Aviation

-

1.1.1. By Sub Aircraft Type

- 1.1.1.1. Freighter Aircraft

-

1.1.1.2. Passenger Aircraft

-

1.1.1.2.1. By Body Type

- 1.1.1.2.1.1. Narrowbody Aircraft

- 1.1.1.2.1.2. Widebody Aircraft

-

1.1.1.2.1. By Body Type

-

1.1.1. By Sub Aircraft Type

-

1.2. General Aviation

-

1.2.1. Business Jets

- 1.2.1.1. Large Jet

- 1.2.1.2. Light Jet

- 1.2.1.3. Mid-Size Jet

- 1.2.2. Piston Fixed-Wing Aircraft

- 1.2.3. Others

-

1.2.1. Business Jets

-

1.3. Military Aviation

- 1.3.1. Multi-Role Aircraft

- 1.3.2. Training Aircraft

- 1.3.3. Transport Aircraft

-

1.3.4. Rotorcraft

- 1.3.4.1. Multi-Mission Helicopter

- 1.3.4.2. Transport Helicopter

-

1.1. Commercial Aviation

UK Aviation Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Aviation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Commercial Aviation

- 5.1.1.1. By Sub Aircraft Type

- 5.1.1.1.1. Freighter Aircraft

- 5.1.1.1.2. Passenger Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1.2.1.1. Narrowbody Aircraft

- 5.1.1.1.2.1.2. Widebody Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1. By Sub Aircraft Type

- 5.1.2. General Aviation

- 5.1.2.1. Business Jets

- 5.1.2.1.1. Large Jet

- 5.1.2.1.2. Light Jet

- 5.1.2.1.3. Mid-Size Jet

- 5.1.2.2. Piston Fixed-Wing Aircraft

- 5.1.2.3. Others

- 5.1.2.1. Business Jets

- 5.1.3. Military Aviation

- 5.1.3.1. Multi-Role Aircraft

- 5.1.3.2. Training Aircraft

- 5.1.3.3. Transport Aircraft

- 5.1.3.4. Rotorcraft

- 5.1.3.4.1. Multi-Mission Helicopter

- 5.1.3.4.2. Transport Helicopter

- 5.1.1. Commercial Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America UK Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Commercial Aviation

- 6.1.1.1. By Sub Aircraft Type

- 6.1.1.1.1. Freighter Aircraft

- 6.1.1.1.2. Passenger Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1.2.1.1. Narrowbody Aircraft

- 6.1.1.1.2.1.2. Widebody Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1. By Sub Aircraft Type

- 6.1.2. General Aviation

- 6.1.2.1. Business Jets

- 6.1.2.1.1. Large Jet

- 6.1.2.1.2. Light Jet

- 6.1.2.1.3. Mid-Size Jet

- 6.1.2.2. Piston Fixed-Wing Aircraft

- 6.1.2.3. Others

- 6.1.2.1. Business Jets

- 6.1.3. Military Aviation

- 6.1.3.1. Multi-Role Aircraft

- 6.1.3.2. Training Aircraft

- 6.1.3.3. Transport Aircraft

- 6.1.3.4. Rotorcraft

- 6.1.3.4.1. Multi-Mission Helicopter

- 6.1.3.4.2. Transport Helicopter

- 6.1.1. Commercial Aviation

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. South America UK Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Commercial Aviation

- 7.1.1.1. By Sub Aircraft Type

- 7.1.1.1.1. Freighter Aircraft

- 7.1.1.1.2. Passenger Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1.2.1.1. Narrowbody Aircraft

- 7.1.1.1.2.1.2. Widebody Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1. By Sub Aircraft Type

- 7.1.2. General Aviation

- 7.1.2.1. Business Jets

- 7.1.2.1.1. Large Jet

- 7.1.2.1.2. Light Jet

- 7.1.2.1.3. Mid-Size Jet

- 7.1.2.2. Piston Fixed-Wing Aircraft

- 7.1.2.3. Others

- 7.1.2.1. Business Jets

- 7.1.3. Military Aviation

- 7.1.3.1. Multi-Role Aircraft

- 7.1.3.2. Training Aircraft

- 7.1.3.3. Transport Aircraft

- 7.1.3.4. Rotorcraft

- 7.1.3.4.1. Multi-Mission Helicopter

- 7.1.3.4.2. Transport Helicopter

- 7.1.1. Commercial Aviation

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Europe UK Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Commercial Aviation

- 8.1.1.1. By Sub Aircraft Type

- 8.1.1.1.1. Freighter Aircraft

- 8.1.1.1.2. Passenger Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1.2.1.1. Narrowbody Aircraft

- 8.1.1.1.2.1.2. Widebody Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1. By Sub Aircraft Type

- 8.1.2. General Aviation

- 8.1.2.1. Business Jets

- 8.1.2.1.1. Large Jet

- 8.1.2.1.2. Light Jet

- 8.1.2.1.3. Mid-Size Jet

- 8.1.2.2. Piston Fixed-Wing Aircraft

- 8.1.2.3. Others

- 8.1.2.1. Business Jets

- 8.1.3. Military Aviation

- 8.1.3.1. Multi-Role Aircraft

- 8.1.3.2. Training Aircraft

- 8.1.3.3. Transport Aircraft

- 8.1.3.4. Rotorcraft

- 8.1.3.4.1. Multi-Mission Helicopter

- 8.1.3.4.2. Transport Helicopter

- 8.1.1. Commercial Aviation

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Middle East & Africa UK Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Commercial Aviation

- 9.1.1.1. By Sub Aircraft Type

- 9.1.1.1.1. Freighter Aircraft

- 9.1.1.1.2. Passenger Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1.2.1.1. Narrowbody Aircraft

- 9.1.1.1.2.1.2. Widebody Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1. By Sub Aircraft Type

- 9.1.2. General Aviation

- 9.1.2.1. Business Jets

- 9.1.2.1.1. Large Jet

- 9.1.2.1.2. Light Jet

- 9.1.2.1.3. Mid-Size Jet

- 9.1.2.2. Piston Fixed-Wing Aircraft

- 9.1.2.3. Others

- 9.1.2.1. Business Jets

- 9.1.3. Military Aviation

- 9.1.3.1. Multi-Role Aircraft

- 9.1.3.2. Training Aircraft

- 9.1.3.3. Transport Aircraft

- 9.1.3.4. Rotorcraft

- 9.1.3.4.1. Multi-Mission Helicopter

- 9.1.3.4.2. Transport Helicopter

- 9.1.1. Commercial Aviation

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Asia Pacific UK Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Commercial Aviation

- 10.1.1.1. By Sub Aircraft Type

- 10.1.1.1.1. Freighter Aircraft

- 10.1.1.1.2. Passenger Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1.2.1.1. Narrowbody Aircraft

- 10.1.1.1.2.1.2. Widebody Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1. By Sub Aircraft Type

- 10.1.2. General Aviation

- 10.1.2.1. Business Jets

- 10.1.2.1.1. Large Jet

- 10.1.2.1.2. Light Jet

- 10.1.2.1.3. Mid-Size Jet

- 10.1.2.2. Piston Fixed-Wing Aircraft

- 10.1.2.3. Others

- 10.1.2.1. Business Jets

- 10.1.3. Military Aviation

- 10.1.3.1. Multi-Role Aircraft

- 10.1.3.2. Training Aircraft

- 10.1.3.3. Transport Aircraft

- 10.1.3.4. Rotorcraft

- 10.1.3.4.1. Multi-Mission Helicopter

- 10.1.3.4.2. Transport Helicopter

- 10.1.1. Commercial Aviation

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. England UK Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Aviation Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Textron Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Lockheed Martin Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Embraer

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Airbus SE

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 The Boeing Compan

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Robinson Helicopter Company Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 MD Helicopters LLC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Cirrus Design Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Leonardo S p A

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Bombardier Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Textron Inc

List of Figures

- Figure 1: Global UK Aviation Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Aviation Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Aviation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Aviation Industry Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 5: North America UK Aviation Industry Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 6: North America UK Aviation Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: North America UK Aviation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America UK Aviation Industry Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 9: South America UK Aviation Industry Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 10: South America UK Aviation Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America UK Aviation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe UK Aviation Industry Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 13: Europe UK Aviation Industry Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 14: Europe UK Aviation Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe UK Aviation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa UK Aviation Industry Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 17: Middle East & Africa UK Aviation Industry Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 18: Middle East & Africa UK Aviation Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa UK Aviation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific UK Aviation Industry Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 21: Asia Pacific UK Aviation Industry Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 22: Asia Pacific UK Aviation Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific UK Aviation Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Aviation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Aviation Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 3: Global UK Aviation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global UK Aviation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: England UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Wales UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Scotland UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Northern UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Ireland UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global UK Aviation Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 11: Global UK Aviation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global UK Aviation Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 16: Global UK Aviation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global UK Aviation Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 21: Global UK Aviation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Russia UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Benelux UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Nordics UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global UK Aviation Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 32: Global UK Aviation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global UK Aviation Industry Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 40: Global UK Aviation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific UK Aviation Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Aviation Industry?

The projected CAGR is approximately 0.04%.

2. Which companies are prominent players in the UK Aviation Industry?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Embraer, Airbus SE, The Boeing Compan, Robinson Helicopter Company Inc, MD Helicopters LLC, Cirrus Design Corporation, Leonardo S p A, Bombardier Inc.

3. What are the main segments of the UK Aviation Industry?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: The US Army was awarded a contract to supply next-generation helicopters to Textron Inc.'s Bell unit. The Army`s "Future Vertical Lift" competition aimed at finding a replacement as the Army looks to retire more than 2,000 medium-class UH-60 Black Hawk utility helicopters.November 2022: Bell Textron Inc., a company of Textron Inc., forged an agreement to sell 10 Bell 505 helicopters to the Royal Jordanian Air Force (RJAF) at the Forces Exhibition and Conference. Combat Air Force (SOFEX) in Aqaba, Jordan.July 2022: EmbraerX establishes a presence in the Netherlands to further the development of innovative and sustainable aviation technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Aviation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Aviation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Aviation Industry?

To stay informed about further developments, trends, and reports in the UK Aviation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence