Key Insights

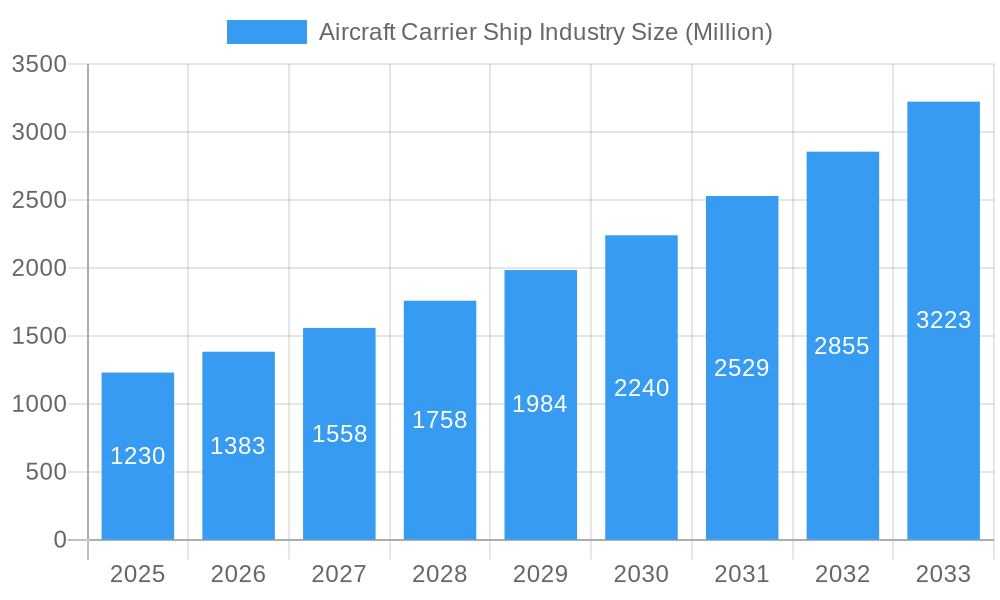

The global aircraft carrier ship market, valued at $1.23 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, the need for power projection capabilities, and advancements in carrier-borne aircraft technology. The Compound Annual Growth Rate (CAGR) of 12.75% from 2025 to 2033 indicates a significant expansion of this market over the forecast period. Key growth drivers include increasing defense budgets among major global powers, the development of next-generation aircraft carriers incorporating advanced technologies like electromagnetic catapults and advanced arresting gear (EMALS), and the growing demand for enhanced naval capabilities in strategically crucial regions. Market segmentation reveals strong demand across various carrier types – amphibious assault ships, helicopter carriers, and fleet carriers – with nuclear-powered carriers commanding a premium segment due to their extended operational range and superior power projection capabilities. Technological advancements, particularly in propulsion systems and aircraft integration, are reshaping the market landscape, leading to more efficient and versatile carrier designs. While technological advancements contribute significantly to market growth, the significant capital investment required for the construction and maintenance of these complex vessels constitutes a key restraint. Furthermore, variations in global geopolitical stability can influence national defense spending and thus impact market growth.

Aircraft Carrier Ship Industry Market Size (In Billion)

The regional distribution of the market reflects the strategic importance of naval power. North America and Asia Pacific are expected to dominate the market, driven by substantial defense budgets and significant naval modernization programs in countries such as the United States, China, and India. Europe, particularly countries with established naval forces like the UK and France, will also contribute significantly to market growth. The competitive landscape comprises major defense contractors, including Thales, General Dynamics, Lockheed Martin, Naval Group, Fincantieri, Navantia, Leonardo, BAE Systems, Northrop Grumman, and Huntington Ingalls Industries. These companies are constantly engaged in research and development, striving to offer cutting-edge technologies and innovative carrier designs to meet the evolving needs of their clients. The market’s future growth will hinge on the continued advancement of carrier technology, geopolitical developments, and the strategic priorities of nations with significant naval presence.

Aircraft Carrier Ship Industry Company Market Share

Aircraft Carrier Ship Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Aircraft Carrier Ship Industry, offering valuable insights for industry professionals, investors, and stakeholders. The study covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The report utilizes data from the historical period (2019-2024) to project future market trends, providing a robust and reliable forecast for this strategically important sector. The report values are expressed in Millions.

Aircraft Carrier Ship Industry Market Structure & Competitive Dynamics

The Aircraft Carrier Ship Industry is characterized by high capital investment, complex technological requirements, and a concentrated market structure. A few major players, including THALES, General Dynamics Corporation, Lockheed Martin Corporation, Naval Group, FINCANTIERI S p A, NAVANTIA S A, Leonardo S p A, BAE Systems plc, Northrop Grumman Corporation, and HUNTINGTON INGALLS INDUSTRIES INC, dominate the market, each possessing significant market share. The exact market share for each company is xx% in 2025, with minor fluctuations anticipated throughout the forecast period.

The industry is also influenced by stringent regulatory frameworks, particularly those related to national security and international trade. Innovation ecosystems are largely concentrated within defense research organizations and leading technology companies, resulting in a highly specialized and often closely guarded technological landscape. Product substitutes are virtually non-existent, given the unique capabilities of aircraft carriers. End-user trends reveal a growing demand for advanced technologies such as electromagnetic catapults and improved survivability features. M&A activities have been relatively limited in recent years; however, predicted M&A deal values are projected to reach $xx Million annually over the forecast period, driven by a desire for consolidation and access to cutting-edge technologies. Significant market share gains are likely to stem from technological advancements, successful project deliveries, and strategic alliances rather than mergers and acquisitions.

Aircraft Carrier Ship Industry Industry Trends & Insights

The global Aircraft Carrier Ship Industry is experiencing steady growth, driven by increasing geopolitical tensions and the need for naval power projection. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the ongoing modernization of existing fleets by major naval powers, the development of new carrier designs incorporating advanced technologies, and the emergence of new players in the market. Technological disruptions, particularly in areas such as propulsion systems, launch technologies (e.g., electromagnetic catapults), and sensor integration, are significantly impacting industry dynamics. Consumer preferences, primarily represented by the requirements of national navies, are strongly influencing the design and capabilities of newly built carriers. The competitive dynamics are characterized by intense competition among major players, with continuous efforts to enhance existing offerings and develop cutting-edge technologies to gain a competitive edge. Market penetration for new carrier technologies is anticipated to increase steadily, with xx% of new carriers expected to incorporate electromagnetic launch systems by 2033.

Dominant Markets & Segments in Aircraft Carrier Ship Industry

The United States remains the dominant market for aircraft carriers, driven by its large and technologically advanced navy. However, other regions, notably Asia-Pacific (specifically China), are rapidly expanding their carrier capabilities.

Type: Fleet carriers represent the largest segment in terms of both market size and revenue, while amphibious assault ships and helicopter carriers occupy smaller but growing niches. The Fleet Carrier segment is expected to retain its dominance throughout the forecast period. Projected Market size for Fleet Carriers in 2025 is $xx Million.

Technology: Nuclear-powered carriers account for a significant share of the market, but conventionally powered carriers maintain a strong presence, particularly in nations with less advanced nuclear technology capabilities. Nuclear-powered carrier Market Size is estimated to be $xx Million in 2025.

Configuration: CATOBAR (Catapult-assisted Take-off Barrier Arrested-recovery) remains the dominant launch configuration. STOBAR (Short Take-off but Arrested Recovery) and STOVL (Short Take-off but Vertical Landing) technologies are used primarily in lighter carriers.

Key drivers for regional dominance include economic strength, strategic geopolitical considerations, and national defense policies. Significant infrastructure investments, specifically within shipbuilding yards and related supporting industries, also play a significant role in market leadership.

Aircraft Carrier Ship Industry Product Innovations

Recent years have witnessed significant advancements in aircraft carrier technology, driven by the need for enhanced operational capabilities and increased survivability. The incorporation of electromagnetic launch systems (EMALS) and advanced arresting gear (AAG) represents a notable technological trend. These innovations provide increased aircraft sortie rates and improved operational flexibility. The integration of sophisticated sensor systems and advanced data networks further enhances the capabilities of modern aircraft carriers. These advancements are gaining strong market traction as they enhance operational efficiency, combat effectiveness, and safety.

Report Segmentation & Scope

This report segments the Aircraft Carrier Ship Industry based on:

Type: Amphibious Assault Ship, Helicopter Carrier, Fleet Carrier. Each type has distinct market size, growth trajectories, and competitive dynamics.

Technology: Conventional Powered and Nuclear Powered. Nuclear-powered carriers represent a premium segment with high initial investment but offer superior operational range and endurance.

Configuration: CATOBAR, STOBAR, and STOVL, reflecting different launch and recovery systems and their implications on aircraft types. Growth projections for each segment are detailed in the full report. Competition varies by segment, with some technologies being more strongly held by specific manufacturers.

Key Drivers of Aircraft Carrier Ship Industry Growth

Several factors drive growth in the Aircraft Carrier Ship Industry. These include:

Geopolitical Instability: Increasing global tensions necessitate strong naval capabilities, driving demand for aircraft carriers.

Technological Advancements: Continuous innovations in propulsion systems, launch and recovery systems, and sensor technology enhance the operational efficiency and effectiveness of aircraft carriers.

Government Funding: Substantial government investment in defense programs remains a crucial driver of market growth.

Challenges in the Aircraft Carrier Ship Industry Sector

The Aircraft Carrier Ship Industry faces several challenges:

High Development Costs: The substantial initial investment required for designing and constructing aircraft carriers represents a significant barrier to entry for many nations.

Complex Technological Requirements: Building and maintaining aircraft carriers necessitates high levels of technological expertise, specialized skills, and robust supply chains.

Intense Competition: The limited number of major players, combined with the high stakes, results in highly competitive dynamics within the industry.

Leading Players in the Aircraft Carrier Ship Industry Market

- THALES

- General Dynamics Corporation

- Lockheed Martin Corporation

- Naval Group

- FINCANTIERI S p A

- NAVANTIA S A

- Leonardo S p A

- BAE Systems plc

- Northrop Grumman Corporation

- HUNTINGTON INGALLS INDUSTRIES INC

Key Developments in Aircraft Carrier Ship Industry Sector

June 2022: China launched its third advanced aircraft carrier, Fujian, featuring an advanced electromagnetic catapult system, significantly enhancing its naval capabilities.

March 2023: The US Navy announced a five-and-a-half-month maintenance plan for the Nimitz, extending its operational lifespan and demonstrating a continued commitment to its carrier fleet. These developments highlight the ongoing technological advancements and sustained investment in this critical sector.

Strategic Aircraft Carrier Ship Industry Market Outlook

The Aircraft Carrier Ship Industry is poised for continued growth, propelled by ongoing geopolitical uncertainties and technological advancements. Future market potential lies in the development of even more advanced, capable, and survivable carriers. Strategic opportunities exist for companies that can successfully innovate and adapt to evolving naval requirements, providing the most cutting-edge technologies to meet the demands of global navies. The industry's future is intertwined with global security, technological innovation, and significant investments in defense capabilities.

Aircraft Carrier Ship Industry Segmentation

-

1. Type

- 1.1. Amphibious Assault Ship

- 1.2. Helicopter Carrier

- 1.3. Fleet Carrier

-

2. Technology

- 2.1. Conventional Powered

- 2.2. Nuclear Powered

-

3. Configuration

- 3.1. Catapult

- 3.2. Short Take-off but Arrested Recovery (STOBAR)

- 3.3. Short Take-off but Vertical Recovery (STOVL)

Aircraft Carrier Ship Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. South Korea

- 3.4. Japan

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Aircraft Carrier Ship Industry Regional Market Share

Geographic Coverage of Aircraft Carrier Ship Industry

Aircraft Carrier Ship Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Nuclear Powered Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Amphibious Assault Ship

- 5.1.2. Helicopter Carrier

- 5.1.3. Fleet Carrier

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Conventional Powered

- 5.2.2. Nuclear Powered

- 5.3. Market Analysis, Insights and Forecast - by Configuration

- 5.3.1. Catapult

- 5.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 5.3.3. Short Take-off but Vertical Recovery (STOVL)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Amphibious Assault Ship

- 6.1.2. Helicopter Carrier

- 6.1.3. Fleet Carrier

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Conventional Powered

- 6.2.2. Nuclear Powered

- 6.3. Market Analysis, Insights and Forecast - by Configuration

- 6.3.1. Catapult

- 6.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 6.3.3. Short Take-off but Vertical Recovery (STOVL)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Amphibious Assault Ship

- 7.1.2. Helicopter Carrier

- 7.1.3. Fleet Carrier

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Conventional Powered

- 7.2.2. Nuclear Powered

- 7.3. Market Analysis, Insights and Forecast - by Configuration

- 7.3.1. Catapult

- 7.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 7.3.3. Short Take-off but Vertical Recovery (STOVL)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Amphibious Assault Ship

- 8.1.2. Helicopter Carrier

- 8.1.3. Fleet Carrier

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Conventional Powered

- 8.2.2. Nuclear Powered

- 8.3. Market Analysis, Insights and Forecast - by Configuration

- 8.3.1. Catapult

- 8.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 8.3.3. Short Take-off but Vertical Recovery (STOVL)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Amphibious Assault Ship

- 9.1.2. Helicopter Carrier

- 9.1.3. Fleet Carrier

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Conventional Powered

- 9.2.2. Nuclear Powered

- 9.3. Market Analysis, Insights and Forecast - by Configuration

- 9.3.1. Catapult

- 9.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 9.3.3. Short Take-off but Vertical Recovery (STOVL)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 THALES

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 General Dynamics Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Lockheed Martin Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Naval Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 FINCANTIERI S p A

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NAVANTIA S A

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Leonardo S p A

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BAE Systems plc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Northrop Grumman Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 HUNTINGTON INGALLS INDUSTRIES INC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 THALES

List of Figures

- Figure 1: Global Aircraft Carrier Ship Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aircraft Carrier Ship Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Aircraft Carrier Ship Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Aircraft Carrier Ship Industry Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Aircraft Carrier Ship Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Aircraft Carrier Ship Industry Revenue (Million), by Configuration 2025 & 2033

- Figure 7: North America Aircraft Carrier Ship Industry Revenue Share (%), by Configuration 2025 & 2033

- Figure 8: North America Aircraft Carrier Ship Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Aircraft Carrier Ship Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aircraft Carrier Ship Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Aircraft Carrier Ship Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Aircraft Carrier Ship Industry Revenue (Million), by Technology 2025 & 2033

- Figure 13: Europe Aircraft Carrier Ship Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Aircraft Carrier Ship Industry Revenue (Million), by Configuration 2025 & 2033

- Figure 15: Europe Aircraft Carrier Ship Industry Revenue Share (%), by Configuration 2025 & 2033

- Figure 16: Europe Aircraft Carrier Ship Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Aircraft Carrier Ship Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Aircraft Carrier Ship Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Aircraft Carrier Ship Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Aircraft Carrier Ship Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Asia Pacific Aircraft Carrier Ship Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Aircraft Carrier Ship Industry Revenue (Million), by Configuration 2025 & 2033

- Figure 23: Asia Pacific Aircraft Carrier Ship Industry Revenue Share (%), by Configuration 2025 & 2033

- Figure 24: Asia Pacific Aircraft Carrier Ship Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Aircraft Carrier Ship Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Aircraft Carrier Ship Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Rest of the World Aircraft Carrier Ship Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Aircraft Carrier Ship Industry Revenue (Million), by Technology 2025 & 2033

- Figure 29: Rest of the World Aircraft Carrier Ship Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Rest of the World Aircraft Carrier Ship Industry Revenue (Million), by Configuration 2025 & 2033

- Figure 31: Rest of the World Aircraft Carrier Ship Industry Revenue Share (%), by Configuration 2025 & 2033

- Figure 32: Rest of the World Aircraft Carrier Ship Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Aircraft Carrier Ship Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2020 & 2033

- Table 4: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2020 & 2033

- Table 8: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 13: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2020 & 2033

- Table 14: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Germany Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Russia Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 22: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2020 & 2033

- Table 23: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: India Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: China Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 31: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2020 & 2033

- Table 32: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Carrier Ship Industry?

The projected CAGR is approximately 12.75%.

2. Which companies are prominent players in the Aircraft Carrier Ship Industry?

Key companies in the market include THALES, General Dynamics Corporation, Lockheed Martin Corporation, Naval Group, FINCANTIERI S p A, NAVANTIA S A, Leonardo S p A, BAE Systems plc, Northrop Grumman Corporation, HUNTINGTON INGALLS INDUSTRIES INC.

3. What are the main segments of the Aircraft Carrier Ship Industry?

The market segments include Type, Technology, Configuration.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Nuclear Powered Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

March 2023: The US Navy announced its plan to extend Nimitz as part of a five-and-a-half-month maintenance availability that will carry the carrier into May 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Carrier Ship Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Carrier Ship Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Carrier Ship Industry?

To stay informed about further developments, trends, and reports in the Aircraft Carrier Ship Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence