Key Insights

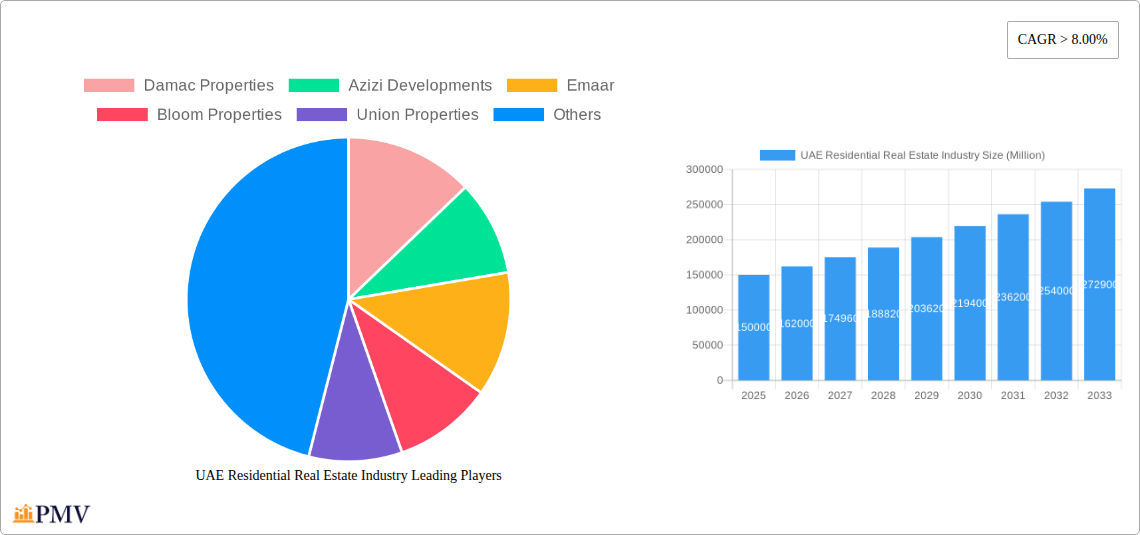

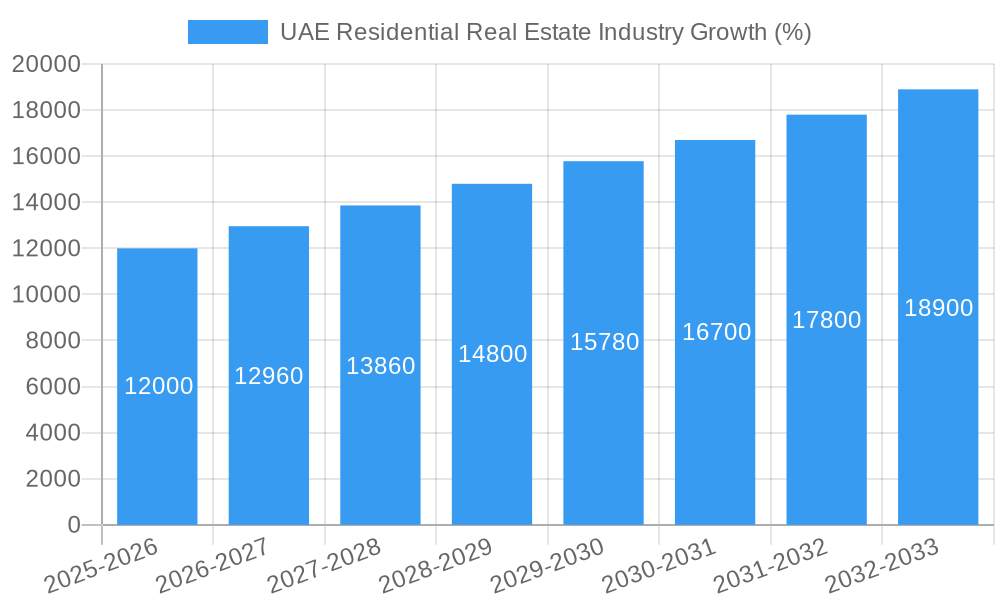

The UAE residential real estate market, encompassing villas/landed houses, condominiums/apartments across key cities like Dubai, Abu Dhabi, and Sharjah, exhibits robust growth potential. With a current market size exceeding $XX million (exact figure requires further data but can be estimated using available information and market reports on similar markets) and a Compound Annual Growth Rate (CAGR) exceeding 8%, the sector is poised for significant expansion throughout the forecast period (2025-2033). This growth is driven by several factors, including a burgeoning population, increasing tourism, robust economic activity, and strategic government initiatives aimed at infrastructure development and diversification of the economy. The preference for high-quality living spaces, coupled with a strong influx of foreign investment, further fuels demand. Key players such as Emaar, Damac Properties, Aldar Properties, and Nakheel PJSC are instrumental in shaping market dynamics, constantly innovating with projects catering to diverse needs and budgets. While potential restraints such as fluctuating oil prices and global economic uncertainty exist, the long-term outlook remains positive, driven by sustained government investments and strategic planning to attract both residents and tourists.

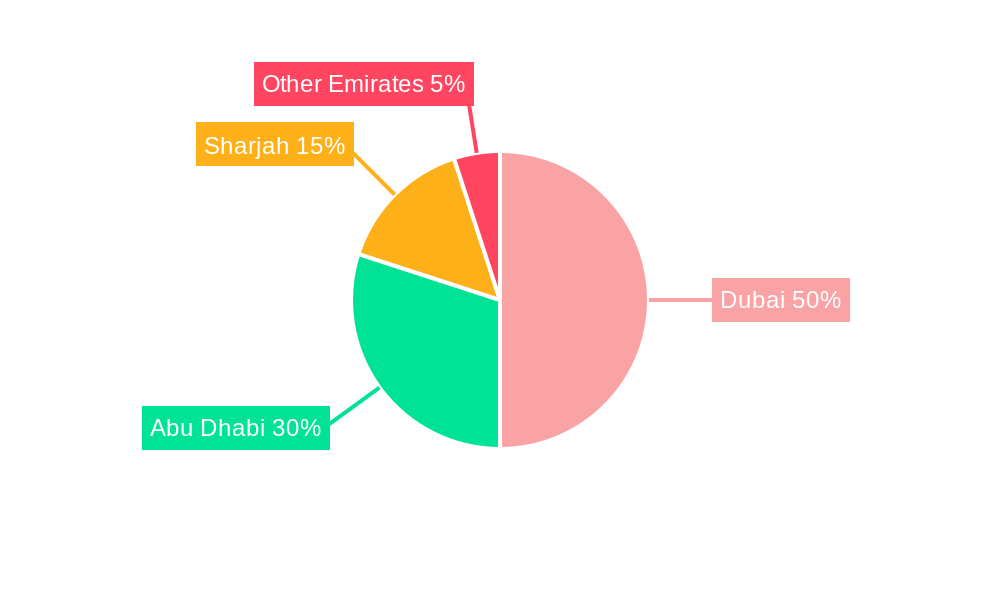

The segmentation of the market is largely defined by property type and location. Dubai consistently commands a significant share, followed by Abu Dhabi and Sharjah. The villa/landed house segment tends to attract high-net-worth individuals and families seeking larger living spaces, while condominiums/apartments cater to a wider demographic, including young professionals and investors. This segment diversification ensures the continued growth and resilience of the market across economic cycles. The market’s trajectory strongly indicates a sustained period of development, with a clear opportunity for investors and developers to capitalize on the expanding demand for quality residential properties across various price points and locations within the UAE. Future growth will depend on ongoing strategic infrastructure projects, sustainable development initiatives, and proactive regulatory frameworks.

UAE Residential Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the UAE residential real estate market, encompassing historical data (2019-2024), current estimations (2025), and future forecasts (2025-2033). It offers invaluable insights into market structure, competitive dynamics, key trends, and growth drivers, enabling informed decision-making for investors, developers, and industry stakeholders. The report covers major players such as Damac Properties, Azizi Developments, Emaar, Bloom Properties, Union Properties, Manazel, Dubai Properties, Deyaar Properties, Aldar Properties, Nakheel PJSC, and Arada, analyzing their market share and strategic initiatives. The analysis considers key segments including villas/landed houses and condominiums/apartments across major cities like Dubai, Abu Dhabi, and Sharjah.

UAE Residential Real Estate Industry Market Structure & Competitive Dynamics

The UAE residential real estate market exhibits a moderately concentrated structure, with a few large players holding significant market share. Emaar, Aldar Properties, and Nakheel PJSC are among the dominant players, known for their large-scale developments and brand recognition. However, a number of mid-sized and smaller developers contribute significantly to the overall market activity.

The regulatory framework, influenced by government initiatives promoting sustainable development and affordable housing, plays a significant role in shaping the market dynamics. Innovation ecosystems are emerging, focusing on smart home technology, sustainable building materials, and PropTech solutions. M&A activity has been prominent, with notable deals like Alpha Dhabi Holding's increased stake in Aldar Properties in January 2022, highlighting the ongoing consolidation within the industry. This deal, valued at approximately xx Million, reflects the strategic intent to gain a larger market share and leverage synergies. Other M&A transactions have involved smaller players and strategic partnerships, driving industry consolidation and enhancing competitiveness.

- Market Concentration: Moderately concentrated, with a few dominant players and many smaller developers.

- Innovation Ecosystem: Growing focus on smart home technology and sustainable development.

- Regulatory Framework: Government initiatives influence market trends and affordability.

- M&A Activity: Significant activity, including Alpha Dhabi Holding's acquisition of a larger stake in Aldar Properties. Total M&A deal value in the studied period (2019-2024) is estimated at xx Million.

- End-user trends: Increasing demand for sustainable and smart homes, coupled with a preference for properties in prime locations.

- Product Substitutes: Limited direct substitutes, but competition exists from alternative investment options.

UAE Residential Real Estate Industry Industry Trends & Insights

The UAE residential real estate market is experiencing robust growth, driven by factors such as a burgeoning population, increasing disposable incomes, government investment in infrastructure, and a favorable business environment. The compound annual growth rate (CAGR) during the historical period (2019-2024) is estimated at xx%, and the market is expected to continue expanding at a CAGR of xx% during the forecast period (2025-2033). Market penetration of smart home technologies is increasing steadily, with a significant segment of new developments incorporating such features. The preference for sustainable building practices is rising, and developers are increasingly incorporating environmentally friendly materials and designs to meet evolving consumer preferences. Competition is intensifying, with developers focusing on differentiation through innovative product offerings, superior amenities, and strategic location. The rising adoption of PropTech solutions is streamlining processes, enhancing transparency, and improving efficiency throughout the real estate value chain.

Dominant Markets & Segments in UAE Residential Real Estate Industry

Dubai continues to dominate the UAE residential real estate market, driven by strong economic growth, robust infrastructure development, and a diverse population. However, Abu Dhabi is witnessing significant growth fueled by government initiatives to boost the economy and residential development in strategically located areas. Sharjah’s market is showing steady growth, driven by affordability compared to Dubai and Abu Dhabi.

- Dubai: Strong economic growth, extensive infrastructure, and diverse population are key drivers of dominance.

- Abu Dhabi: Government investments and strategic initiatives are boosting the residential sector.

- Sharjah: Affordability compared to other emirates is attracting considerable interest.

- Villas/Landed Houses: High demand driven by preferences for larger spaces and privacy. Growth is expected to continue owing to the increasing appeal of lifestyle and large family units.

- Condominiums/Apartments: Strong demand owing to varied needs and affordability, though Villas/Landed Houses maintain a slightly higher share. Growth is expected owing to the increased population and preferences for apartments in prime locations.

UAE Residential Real Estate Industry Product Innovations

The UAE residential real estate sector is witnessing a surge in innovative product offerings, driven by technological advancements and changing consumer preferences. Smart home technologies, such as automated lighting and security systems, are becoming increasingly integrated into new developments. Sustainable building materials and practices are gaining traction, reflecting a growing focus on environmental responsibility. Developers are incorporating cutting-edge features such as virtual reality tours, online property management platforms, and flexible payment options to enhance customer experience. These innovations are improving the customer experience and enabling better market fit.

Report Segmentation & Scope

This report segments the UAE residential real estate market by property type (Villas/Landed Houses and Condominiums/Apartments) and key cities (Dubai, Abu Dhabi, and Sharjah). Each segment's growth projections, market size, and competitive dynamics are comprehensively analyzed.

- Villas/Landed Houses: This segment is expected to witness steady growth, driven by a preference for larger living spaces and privacy. The market size in 2025 is estimated at xx Million, with a projected growth rate of xx% from 2025-2033.

- Condominiums/Apartments: The demand for condominiums and apartments remains strong due to affordability and convenience, with a significant portion of the market targeting young professionals and first-time homebuyers. The market size in 2025 is estimated at xx Million, with a projected growth rate of xx% from 2025-2033.

- Dubai: The largest market, driven by strong economic growth and a diverse population, expected to grow at a CAGR of xx% from 2025-2033.

- Abu Dhabi: Steady growth fuelled by government investment and initiatives for housing development, expected to grow at a CAGR of xx% from 2025-2033.

- Sharjah: Significant market with a focus on affordability, expected to grow at a CAGR of xx% from 2025-2033.

Key Drivers of UAE Residential Real Estate Industry Growth

Several factors drive the growth of the UAE residential real estate market. The robust economic growth of the UAE, with its strong GDP growth and diversified economy, is a primary driver. The continuous infrastructure development, including transportation and utility upgrades, improves the appeal of residential areas. Government policies, such as initiatives promoting affordable housing and sustainable development, also contribute positively to the market. Finally, the influx of both expatriates and local residents boosts demand for housing, fueling market expansion.

Challenges in the UAE Residential Real Estate Industry Sector

The UAE residential real estate market faces certain challenges. The fluctuating global economic conditions and their ripple effects on investment can pose risks. Regulatory changes and compliance requirements can impact investment decisions and project timelines. Supply chain disruptions and increases in construction costs can also impact profitability and project delays.

Leading Players in the UAE Residential Real Estate Industry Market

- Damac Properties

- Azizi Developments

- Emaar

- Bloom Properties

- Union Properties

- Manazel

- Dubai Properties

- Deyaar Properties

- Aldar Properties

- Nakheel PJSC

- Arada

Key Developments in UAE Residential Real Estate Industry Sector

- January 2022: Alpha Dhabi Holding increased its stake in Aldar Properties to 29.8%.

- November 2021: Emaar Beachfront launched a new luxury residential development spanning 10 Million square feet.

Strategic UAE Residential Real Estate Industry Market Outlook

The UAE residential real estate market is poised for continued growth, driven by sustained economic development, population growth, and ongoing infrastructure improvements. Opportunities exist for developers to focus on sustainable and smart homes, catering to the evolving preferences of consumers. Strategic partnerships and collaborations among developers, technology providers, and financial institutions are expected to shape the future of the sector. The focus on affordable housing initiatives and government policies will play a pivotal role in shaping market dynamics and accessibility.

UAE Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Villas/Landed Houses

- 1.2. Condominiums/Apartments

-

2. Key Cities

- 2.1. Dubai

- 2.2. Abu Dhabi

- 2.3. Sharjah

UAE Residential Real Estate Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Disposable Incomes4.; Government Initiatives4.; Growing Expatriate Population

- 3.3. Market Restrains

- 3.3.1. 4.; Regulatory Framework4.; The Risk of Oversupply

- 3.4. Market Trends

- 3.4.1. New Project Launches in Dubai are Expected to Boost the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas/Landed Houses

- 5.1.2. Condominiums/Apartments

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Dubai

- 5.2.2. Abu Dhabi

- 5.2.3. Sharjah

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UAE Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Villas/Landed Houses

- 6.1.2. Condominiums/Apartments

- 6.2. Market Analysis, Insights and Forecast - by Key Cities

- 6.2.1. Dubai

- 6.2.2. Abu Dhabi

- 6.2.3. Sharjah

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UAE Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Villas/Landed Houses

- 7.1.2. Condominiums/Apartments

- 7.2. Market Analysis, Insights and Forecast - by Key Cities

- 7.2.1. Dubai

- 7.2.2. Abu Dhabi

- 7.2.3. Sharjah

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UAE Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Villas/Landed Houses

- 8.1.2. Condominiums/Apartments

- 8.2. Market Analysis, Insights and Forecast - by Key Cities

- 8.2.1. Dubai

- 8.2.2. Abu Dhabi

- 8.2.3. Sharjah

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UAE Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Villas/Landed Houses

- 9.1.2. Condominiums/Apartments

- 9.2. Market Analysis, Insights and Forecast - by Key Cities

- 9.2.1. Dubai

- 9.2.2. Abu Dhabi

- 9.2.3. Sharjah

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UAE Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Villas/Landed Houses

- 10.1.2. Condominiums/Apartments

- 10.2. Market Analysis, Insights and Forecast - by Key Cities

- 10.2.1. Dubai

- 10.2.2. Abu Dhabi

- 10.2.3. Sharjah

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Damac Properties

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Azizi Developments

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Emaar

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bloom Properties

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Union Properties

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Manazel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dubai Properties**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Deyaar Properties

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aldar Properties

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nakheel PJSC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Arada

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Damac Properties

List of Figures

- Figure 1: Global UAE Residential Real Estate Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: UAE UAE Residential Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: UAE UAE Residential Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UAE Residential Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 5: North America UAE Residential Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America UAE Residential Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 7: North America UAE Residential Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 8: North America UAE Residential Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: North America UAE Residential Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America UAE Residential Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 11: South America UAE Residential Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America UAE Residential Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 13: South America UAE Residential Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 14: South America UAE Residential Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: South America UAE Residential Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe UAE Residential Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe UAE Residential Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe UAE Residential Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 19: Europe UAE Residential Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 20: Europe UAE Residential Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe UAE Residential Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa UAE Residential Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Middle East & Africa UAE Residential Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa UAE Residential Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 25: Middle East & Africa UAE Residential Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 26: Middle East & Africa UAE Residential Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa UAE Residential Real Estate Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific UAE Residential Real Estate Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific UAE Residential Real Estate Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific UAE Residential Real Estate Industry Revenue (Million), by Key Cities 2024 & 2032

- Figure 31: Asia Pacific UAE Residential Real Estate Industry Revenue Share (%), by Key Cities 2024 & 2032

- Figure 32: Asia Pacific UAE Residential Real Estate Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific UAE Residential Real Estate Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 14: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 20: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 32: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 41: Global UAE Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific UAE Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Residential Real Estate Industry?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the UAE Residential Real Estate Industry?

Key companies in the market include Damac Properties, Azizi Developments, Emaar, Bloom Properties, Union Properties, Manazel, Dubai Properties**List Not Exhaustive, Deyaar Properties, Aldar Properties, Nakheel PJSC, Arada.

3. What are the main segments of the UAE Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Disposable Incomes4.; Government Initiatives4.; Growing Expatriate Population.

6. What are the notable trends driving market growth?

New Project Launches in Dubai are Expected to Boost the Market.

7. Are there any restraints impacting market growth?

4.; Regulatory Framework4.; The Risk of Oversupply.

8. Can you provide examples of recent developments in the market?

In January 2022, the UAE-based conglomerate Alpha Dhabi Holding (ADH) acquired an additional 17% stake in Abu Dhabi's largest property developer Aldar Properties, taking its stake to 29.8%. In this latest investment, Alpha Dhabi Holding completed the acquisition of Sublime 2, Sogno 2, and Sogno 3, which together own 17% of Aldar Properties.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the UAE Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence