Key Insights

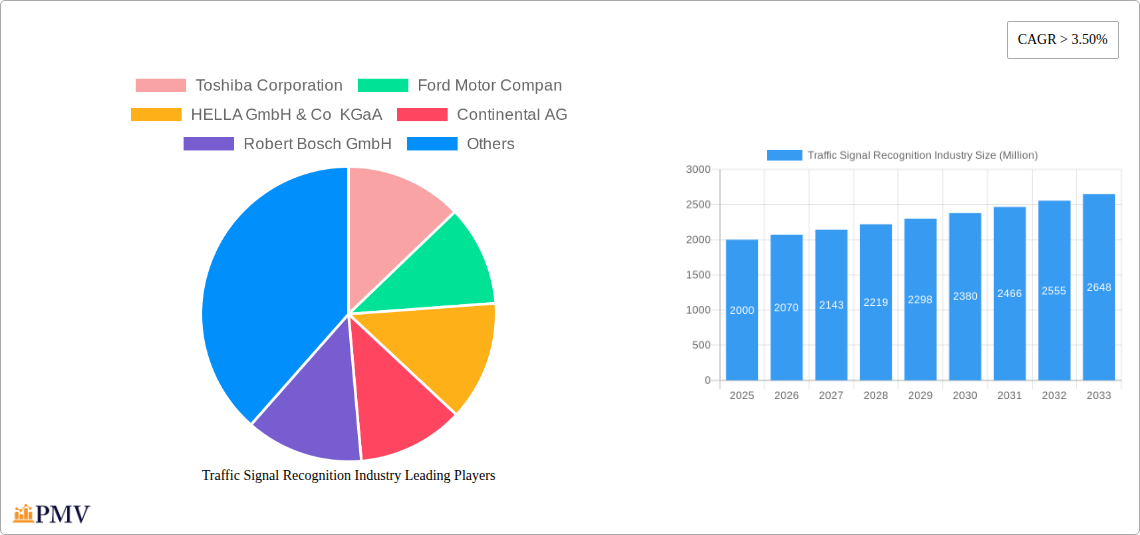

The Traffic Signal Recognition (TSR) industry is experiencing robust growth, driven by increasing adoption of Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles. The market, currently valued at approximately $2 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 3.5% through 2033. This growth is fueled by several key factors. Firstly, stringent government regulations mandating safety features in vehicles are pushing automakers to integrate TSR technology. Secondly, the continuous advancements in sensor technology, particularly computer vision and artificial intelligence, are leading to more accurate and reliable TSR systems. Furthermore, the rising demand for enhanced driver safety and the increasing prevalence of smart city initiatives are further contributing to market expansion. Segmentation analysis reveals a significant portion of the market is dominated by passenger car applications, with color-based detection remaining the most prevalent method due to its relative simplicity and cost-effectiveness. However, shape-based and feature-based detection are gaining traction owing to their enhanced accuracy in complex scenarios, including adverse weather conditions.

Traffic Signal Recognition Industry Market Size (In Billion)

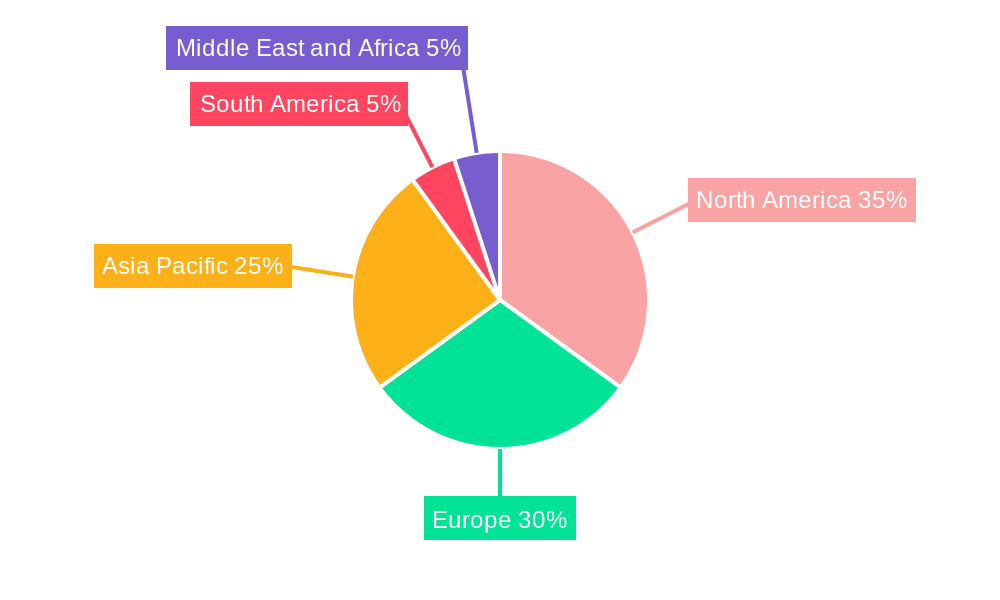

Competition in the TSR market is intense, with established automotive suppliers like Bosch, Continental, and Denso competing alongside specialized technology companies such as Mobileye. Geographic analysis suggests North America and Europe currently hold a larger market share due to higher adoption rates and stringent safety regulations. However, the Asia-Pacific region is poised for significant growth due to rapid urbanization and increasing vehicle production. While the initial investment in TSR technology can be substantial, restraints such as the high cost of advanced sensor systems and the need for robust data processing capabilities are gradually being mitigated by technological advancements and economies of scale. The future of the TSR market appears promising, with ongoing innovation driving the development of even more sophisticated and reliable systems, paving the way for safer and more efficient transportation.

Traffic Signal Recognition Industry Company Market Share

Traffic Signal Recognition Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global Traffic Signal Recognition industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on the estimated year 2025, this report projects a market valued at $XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX%. The study meticulously segments the market by Traffic Sign Detection (Color-based, Shape-based, Feature-based) and Vehicle Type (Passenger Cars, Commercial Vehicles), providing granular market size and growth projections for each segment. Leading companies like Toshiba Corporation, Ford Motor Company, HELLA GmbH & Co. KGaA, Continental AG, Robert Bosch GmbH, Mobileye Corporation, and DENSO Corporation are profiled, examining their market share, strategies, and competitive dynamics.

Traffic Signal Recognition Industry Market Structure & Competitive Dynamics

The Traffic Signal Recognition market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. The industry's innovation ecosystem is dynamic, fueled by advancements in computer vision, AI, and sensor technologies. Regulatory frameworks, varying across different geographies, significantly influence market growth and adoption. Product substitutes, such as driver assistance systems relying on alternative technologies, pose a moderate competitive threat. End-user trends, primarily focused on enhanced safety and autonomous driving capabilities, drive market demand. Mergers and acquisitions (M&A) activity has been moderate, with deal values totaling approximately $XX Million in the period 2019-2024. Key M&A activities included (Examples: Company X acquired Company Y for $XX Million to expand its product portfolio; Company Z formed a strategic partnership with Company A to jointly develop new technology).

- Market Concentration: High concentration in the upper segments, with the top 5 players holding approximately XX% of the global market share in 2024.

- Innovation Ecosystem: Rapid advancements in AI and computer vision drive continuous product improvements.

- Regulatory Framework: Government regulations mandating advanced driver-assistance systems (ADAS) are driving market growth.

- Product Substitutes: GPS navigation systems and alternative ADAS technologies pose a potential threat, but niche applications provide resilience.

- End-User Trends: Increased demand for safety and autonomous driving features drives adoption.

- M&A Activity: Moderate activity observed with a focus on technological integration and market expansion.

Traffic Signal Recognition Industry Industry Trends & Insights

The Traffic Signal Recognition industry is experiencing robust growth, primarily driven by the increasing adoption of Advanced Driver-Assistance Systems (ADAS) and autonomous driving technologies globally. Technological advancements, particularly in computer vision and artificial intelligence (AI), are enabling the development of more accurate and reliable traffic signal recognition systems. Consumer preference for enhanced vehicle safety features significantly fuels market growth. Competitive dynamics are characterized by both intense innovation and strategic partnerships between technology providers and automotive manufacturers. The market penetration of Traffic Signal Recognition systems in passenger cars is estimated at XX% in 2024, projected to increase to XX% by 2033. The overall market is projected to grow at a CAGR of XX% during the forecast period (2025-2033). The increasing integration of this technology in commercial vehicles also adds to the market size. This growth is fueled by stricter safety standards imposed across many regions globally.

Dominant Markets & Segments in Traffic Signal Recognition Industry

The North American region currently holds the leading position in the Traffic Signal Recognition market, driven by strong demand for advanced safety features and the early adoption of autonomous driving technologies. Within the segment breakdown:

- Traffic Sign Detection: Feature-based detection is the fastest growing segment due to its superior accuracy and robustness.

- Vehicle Type: The passenger car segment dominates, but the commercial vehicle segment is witnessing significant growth, owing to the demand for safety in heavy-duty vehicles and fleet management applications.

Key Drivers:

- North America: Strong government support for autonomous driving initiatives and stringent safety standards.

- Europe: High vehicle ownership rates and government regulations promoting ADAS adoption.

- Asia-Pacific: Rapid economic growth, increasing vehicle sales, and investments in smart city infrastructure.

The dominance of North America is attributed to factors like early technological advancements, favorable regulatory landscapes, and substantial investments in research and development.

Traffic Signal Recognition Industry Product Innovations

Recent product innovations focus on improving the accuracy and robustness of traffic signal recognition systems under various environmental conditions (e.g., adverse weather, poor lighting). Advanced algorithms employing deep learning and computer vision are enhancing system performance, leading to better detection and classification of traffic signals. The integration of these systems with other ADAS features, creating a more comprehensive suite of safety solutions, further strengthens their market position and contributes to growth. The emergence of edge computing is also enabling faster processing and reduced latency, increasing the reliability of this technology.

Report Segmentation & Scope

This report segments the Traffic Signal Recognition market by Traffic Sign Detection (Color-based, Shape-based, and Feature-based) and Vehicle Type (Passenger Cars and Commercial Vehicles).

Traffic Sign Detection: Each detection method has a specific market size and growth projection. Color-based detection, while simpler, holds a considerable market share. Shape-based detection is experiencing steady growth, while feature-based detection is rapidly emerging as the dominant technology due to its superior performance.

Vehicle Type: The passenger car segment currently dominates, reflecting the higher volume of passenger vehicles on the road. However, the commercial vehicle segment is projected to exhibit higher growth due to increasing regulatory pressure and a rising focus on fleet safety and operational efficiency. Competitive landscapes are distinct for each segment, reflecting differing technology needs and customer priorities.

Key Drivers of Traffic Signal Recognition Industry Growth

The growth of the Traffic Signal Recognition industry is propelled by several key factors. Firstly, the increasing adoption of Advanced Driver-Assistance Systems (ADAS) and autonomous driving technologies globally is a significant driver. Secondly, stringent government regulations promoting vehicle safety and the integration of ADAS features are pushing market expansion. Thirdly, advancements in artificial intelligence (AI), computer vision, and sensor technology are leading to more accurate, reliable, and cost-effective Traffic Signal Recognition systems. Lastly, the increasing demand for enhanced vehicle safety from consumers further stimulates market growth.

Challenges in the Traffic Signal Recognition Industry Sector

The Traffic Signal Recognition industry faces challenges, including the high initial investment cost for advanced systems, complexities in integrating the technology into existing vehicle infrastructure, and the need for robust algorithms to handle varying environmental conditions. Furthermore, ensuring data privacy and security is paramount, representing a potential barrier for adoption. Competition from established automotive component manufacturers and emerging technology companies also present challenges. These factors could hinder the market's growth trajectory if not properly addressed. The impact is estimated to reduce the overall CAGR by approximately XX% in the near future.

Leading Players in the Traffic Signal Recognition Industry Market

Key Developments in Traffic Signal Recognition Industry Sector

- 2022 Q3: Mobileye announced a significant expansion of its Traffic Signal Recognition technology in its SuperVision driver assistance system.

- 2023 Q1: Bosch launched a new generation of Traffic Signal Recognition sensors with enhanced performance in challenging lighting conditions.

- 2024 Q2: Continental and HELLA formed a strategic partnership to jointly develop next-generation Traffic Signal Recognition solutions. (Further developments can be added here, including specific details like the impact on market share or revenue).

Strategic Traffic Signal Recognition Industry Market Outlook

The Traffic Signal Recognition market exhibits significant growth potential, driven by the increasing demand for autonomous vehicles and the integration of ADAS features in vehicles. Technological advancements will continue to improve the accuracy and reliability of these systems, expanding their applications and creating new market opportunities. Strategic partnerships and acquisitions will shape the industry landscape, leading to the consolidation of market players and the emergence of innovative solutions. The focus on improving system performance and addressing challenges related to data security and privacy will be crucial in driving future growth. Expansion into new geographical markets, particularly in developing economies, represents a significant avenue for market expansion.

Traffic Signal Recognition Industry Segmentation

-

1. Traffic Sign Detection

- 1.1. Color-based Detection

- 1.2. Shape-based Detection

- 1.3. Feature-based Detection

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicle

Traffic Signal Recognition Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Traffic Signal Recognition Industry Regional Market Share

Geographic Coverage of Traffic Signal Recognition Industry

Traffic Signal Recognition Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Enhanced Ride Comfort

- 3.3. Market Restrains

- 3.3.1. High Upfront Cost of Advanced Suspension Systems

- 3.4. Market Trends

- 3.4.1. Rise in Stringent Government Regulations and Growing Demand for Autonomous Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Traffic Signal Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 5.1.1. Color-based Detection

- 5.1.2. Shape-based Detection

- 5.1.3. Feature-based Detection

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 6. North America Traffic Signal Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 6.1.1. Color-based Detection

- 6.1.2. Shape-based Detection

- 6.1.3. Feature-based Detection

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 7. Europe Traffic Signal Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 7.1.1. Color-based Detection

- 7.1.2. Shape-based Detection

- 7.1.3. Feature-based Detection

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 8. Asia Pacific Traffic Signal Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 8.1.1. Color-based Detection

- 8.1.2. Shape-based Detection

- 8.1.3. Feature-based Detection

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 9. South America Traffic Signal Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 9.1.1. Color-based Detection

- 9.1.2. Shape-based Detection

- 9.1.3. Feature-based Detection

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 10. Middle East and Africa Traffic Signal Recognition Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 10.1.1. Color-based Detection

- 10.1.2. Shape-based Detection

- 10.1.3. Feature-based Detection

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Cars

- 10.2.2. Commercial Vehicle

- 10.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Toshiba Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ford Motor Compan

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HELLA GmbH & Co KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Continental AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Robert Bosch GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mobileye Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DENSO Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Toshiba Corporation

List of Figures

- Figure 1: Global Traffic Signal Recognition Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Traffic Signal Recognition Industry Revenue (undefined), by Traffic Sign Detection 2025 & 2033

- Figure 3: North America Traffic Signal Recognition Industry Revenue Share (%), by Traffic Sign Detection 2025 & 2033

- Figure 4: North America Traffic Signal Recognition Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 5: North America Traffic Signal Recognition Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Traffic Signal Recognition Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Traffic Signal Recognition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Traffic Signal Recognition Industry Revenue (undefined), by Traffic Sign Detection 2025 & 2033

- Figure 9: Europe Traffic Signal Recognition Industry Revenue Share (%), by Traffic Sign Detection 2025 & 2033

- Figure 10: Europe Traffic Signal Recognition Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 11: Europe Traffic Signal Recognition Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Traffic Signal Recognition Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Traffic Signal Recognition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Traffic Signal Recognition Industry Revenue (undefined), by Traffic Sign Detection 2025 & 2033

- Figure 15: Asia Pacific Traffic Signal Recognition Industry Revenue Share (%), by Traffic Sign Detection 2025 & 2033

- Figure 16: Asia Pacific Traffic Signal Recognition Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Traffic Signal Recognition Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Traffic Signal Recognition Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Traffic Signal Recognition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Traffic Signal Recognition Industry Revenue (undefined), by Traffic Sign Detection 2025 & 2033

- Figure 21: South America Traffic Signal Recognition Industry Revenue Share (%), by Traffic Sign Detection 2025 & 2033

- Figure 22: South America Traffic Signal Recognition Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 23: South America Traffic Signal Recognition Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: South America Traffic Signal Recognition Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Traffic Signal Recognition Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Traffic Signal Recognition Industry Revenue (undefined), by Traffic Sign Detection 2025 & 2033

- Figure 27: Middle East and Africa Traffic Signal Recognition Industry Revenue Share (%), by Traffic Sign Detection 2025 & 2033

- Figure 28: Middle East and Africa Traffic Signal Recognition Industry Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 29: Middle East and Africa Traffic Signal Recognition Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Middle East and Africa Traffic Signal Recognition Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Traffic Signal Recognition Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Traffic Sign Detection 2020 & 2033

- Table 2: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Traffic Sign Detection 2020 & 2033

- Table 5: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Traffic Sign Detection 2020 & 2033

- Table 8: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 9: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Traffic Sign Detection 2020 & 2033

- Table 11: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Traffic Sign Detection 2020 & 2033

- Table 14: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Traffic Sign Detection 2020 & 2033

- Table 17: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Traffic Signal Recognition Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Traffic Signal Recognition Industry?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Traffic Signal Recognition Industry?

Key companies in the market include Toshiba Corporation, Ford Motor Compan, HELLA GmbH & Co KGaA, Continental AG, Robert Bosch GmbH, Mobileye Corporation, DENSO Corporation.

3. What are the main segments of the Traffic Signal Recognition Industry?

The market segments include Traffic Sign Detection, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Enhanced Ride Comfort.

6. What are the notable trends driving market growth?

Rise in Stringent Government Regulations and Growing Demand for Autonomous Vehicles.

7. Are there any restraints impacting market growth?

High Upfront Cost of Advanced Suspension Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Traffic Signal Recognition Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Traffic Signal Recognition Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Traffic Signal Recognition Industry?

To stay informed about further developments, trends, and reports in the Traffic Signal Recognition Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence