Key Insights

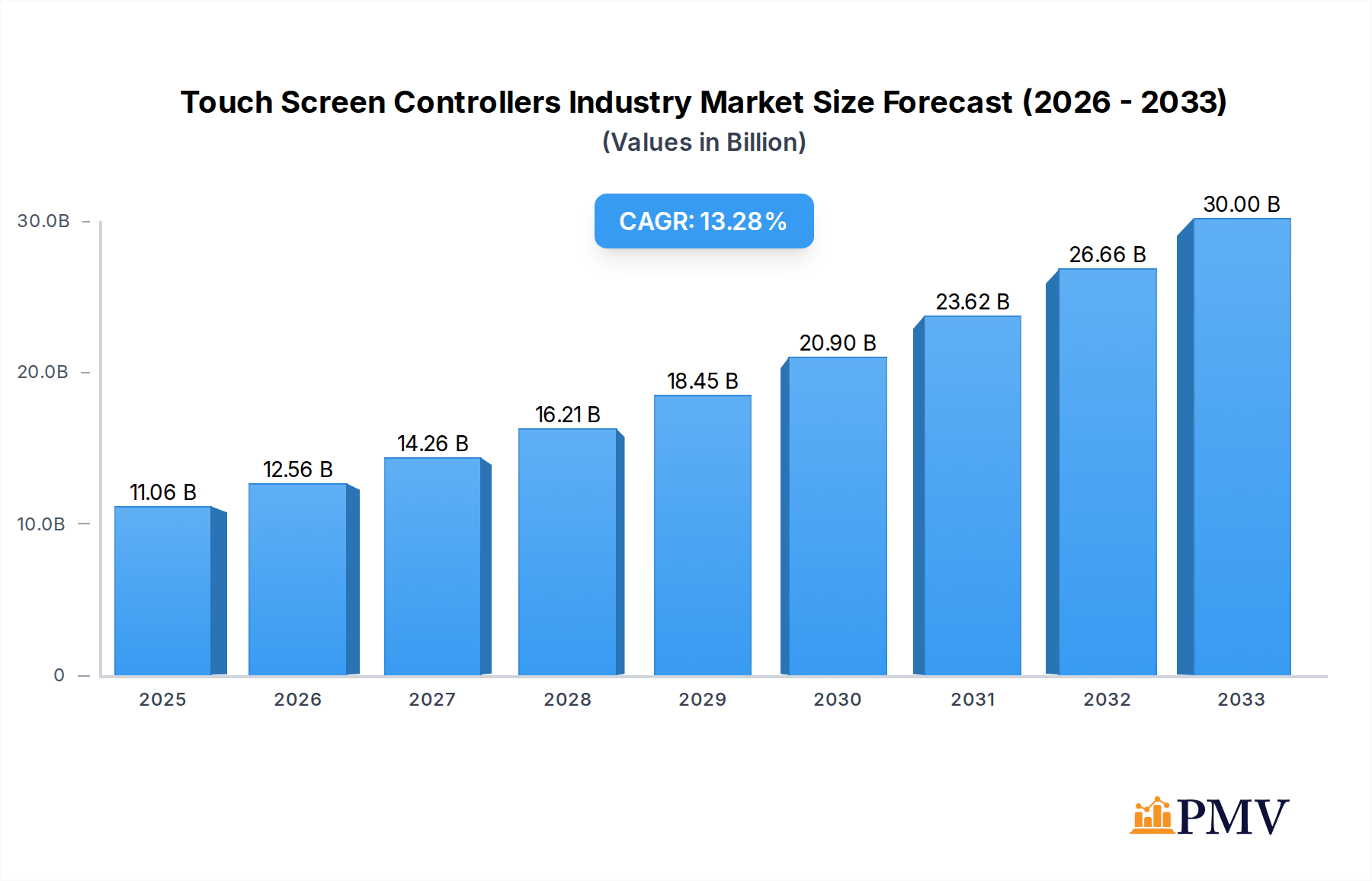

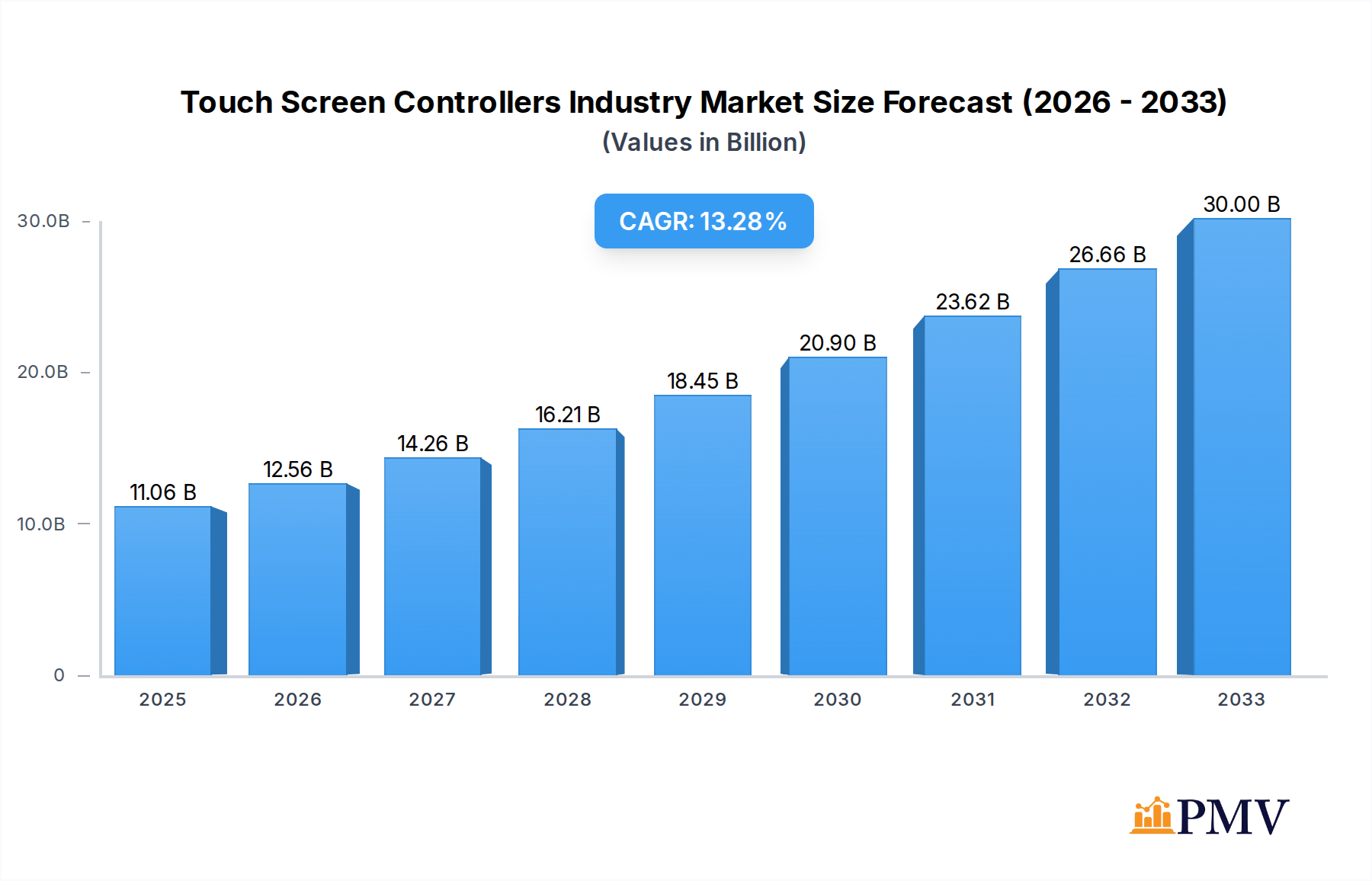

The global Touch Screen Controllers market is poised for substantial expansion, projected to reach an estimated $11.06 billion in 2025 with a remarkable Compound Annual Growth Rate (CAGR) of 13.8% throughout the forecast period of 2025-2033. This robust growth is primarily fueled by the escalating demand for advanced human-machine interfaces across a multitude of sectors. Key drivers include the pervasive integration of touch technology in consumer electronics, the rapid digitization of industrial automation, and the increasing adoption of smart devices in the healthcare sector. Furthermore, the automotive industry's commitment to incorporating sophisticated infotainment and control systems, alongside the burgeoning demand for interactive displays in retail environments, are significant contributors to this upward trajectory. The market is characterized by continuous innovation, with advancements in touch sensitivity, multi-touch capabilities, and power efficiency driving new product development and market penetration.

Touch Screen Controllers Industry Market Size (In Billion)

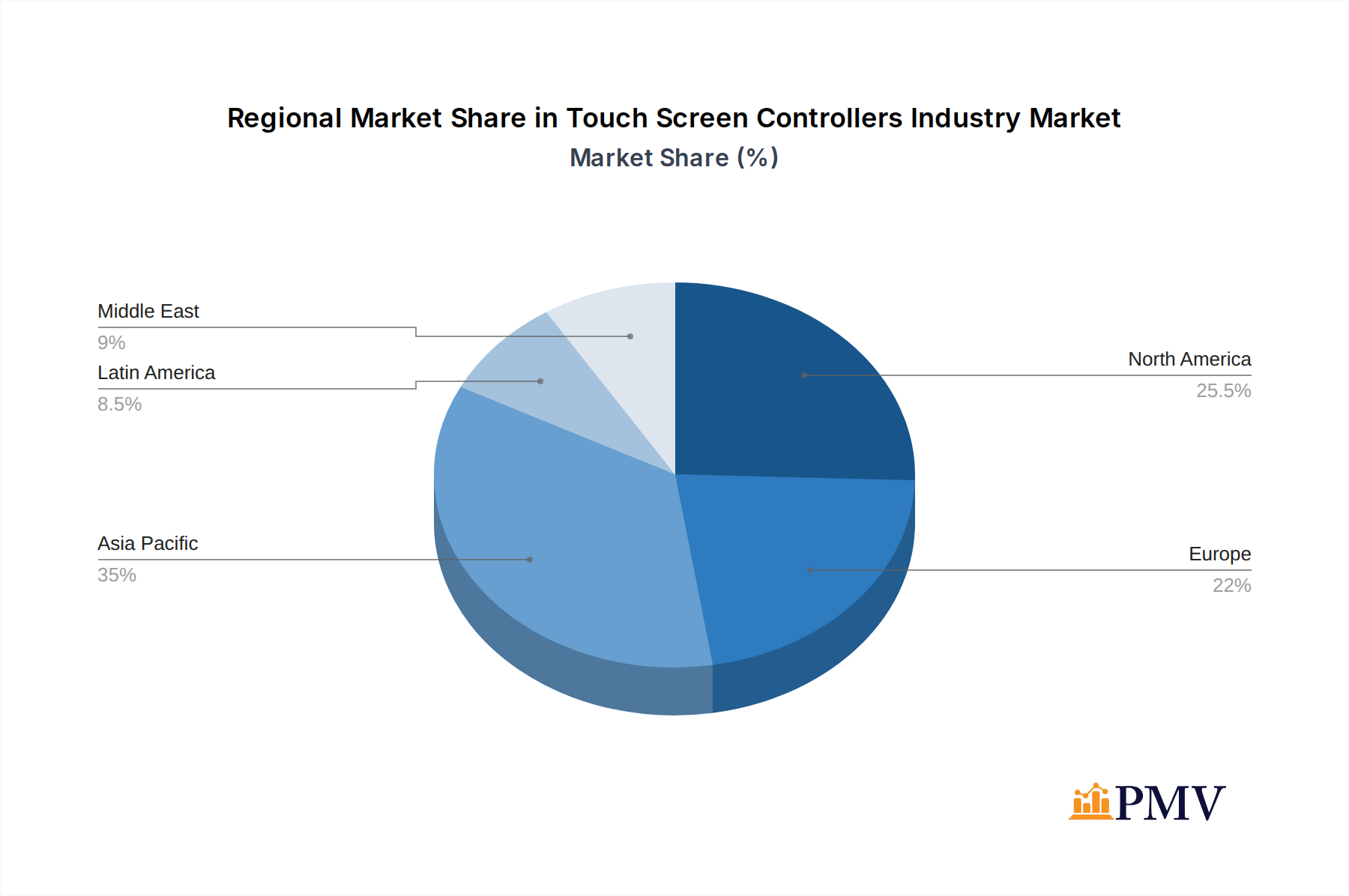

The competitive landscape is dynamic, featuring prominent players such as Renesas Electronic Corporation, Samsung Electronics Co Ltd, and Texas Instruments Incorporated, who are actively investing in research and development to enhance controller performance and expand their product portfolios. The market is segmented by type into Resistive and Capacitive controllers, with Capacitive technology dominating due to its superior responsiveness and multi-touch features. End-user segments are diverse, encompassing Industrial, Healthcare, Consumer Electronics, Retail, Automotive, and BFSI, each presenting unique growth opportunities. Geographically, Asia Pacific, led by China and India, is expected to be the largest and fastest-growing regional market, propelled by its massive consumer base and thriving electronics manufacturing industry. North America and Europe also represent significant markets, driven by technological advancements and increasing disposable incomes. While the market presents immense opportunities, potential restraints such as increasing component costs and the complexity of integration in certain niche applications could pose challenges.

Touch Screen Controllers Industry Company Market Share

This in-depth market research report provides a definitive analysis of the global Touch Screen Controllers Industry, a critical component underpinning the rapid expansion of interactive display technology across numerous sectors. Spanning the historical period 2019–2024, base year 2025, and a robust forecast period 2025–2033, this report delivers actionable insights for stakeholders seeking to capitalize on this dynamic market. The global touch screen controllers market is projected to reach an estimated value exceeding $50 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 8.5% throughout the forecast period.

Touch Screen Controllers Industry Market Structure & Competitive Dynamics

The touch screen controllers market exhibits a moderately consolidated structure, with a mix of large, established players and agile, specialized manufacturers. Innovation ecosystems are thriving, driven by intense competition and the relentless pursuit of enhanced user experience, precision, and durability. Key players, including Renesas Electronic Corporation, Semtech Corporation, Synaptics Incorporated, MELFAS Co Ltd, Microchip Technology Inc., SAMSUNG Electronics Co Ltd, STMicroelectronics, NXP Semiconductors, Texas Instruments Incorporated, and Analog Devices Inc., are actively investing in research and development. Regulatory frameworks primarily focus on safety standards, electromagnetic compatibility (EMC), and, increasingly, environmental sustainability. Product substitutes, such as physical buttons and remote controls, are diminishing in relevance across many applications. End-user trends reveal a strong preference for capacitive touchscreens due to their superior responsiveness and multi-touch capabilities. Mergers and acquisitions (M&A) activity remains a strategic tool for market expansion and technology acquisition, with deal values often ranging from hundreds of millions to several billion dollars, further shaping the competitive landscape. For instance, the acquisition of smaller technology firms by semiconductor giants aims to integrate advanced touch functionalities into broader chip offerings, solidifying market share.

Touch Screen Controllers Industry Industry Trends & Insights

The touch screen controllers industry is experiencing significant growth, propelled by an escalating demand for intuitive and responsive interfaces in virtually every consumer and industrial application. Market growth drivers are multifaceted, encompassing the pervasive adoption of smart devices, the burgeoning Internet of Things (IoT) ecosystem, and the increasing sophistication of human-machine interfaces (HMIs). Technological disruptions, such as the advancement of projected capacitive (PCAP) technology, enabling thinner bezels, higher transparency, and improved resistance to environmental interference, are reshaping product development. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into touch controllers is unlocking new functionalities, including gesture recognition and predictive input, thereby enhancing user experience. Consumer preferences are strongly leaning towards seamless, multi-touch interactions, edge-to-edge displays, and robust, durable touch surfaces. The competitive dynamics are characterized by a constant race for miniaturization, power efficiency, and cost-effectiveness, alongside the development of specialized controllers for niche applications like automotive infotainment systems and medical devices. The market penetration of advanced touch solutions is rapidly increasing, with capacitive technology now dominating over resistive touchscreens in most consumer-facing products. The global touch screen controllers market size is estimated to reach over $60 billion by 2033.

Dominant Markets & Segments in Touch Screen Controllers Industry

The touch screen controllers industry is witnessing a significant surge in dominance within several key segments. The Capacitive type segment, particularly projected capacitive (PCAP) technology, is outperforming its Resistive counterpart due to its superior performance, multi-touch capabilities, and enhanced durability, making it the preferred choice for a vast array of applications.

Within end-users, Consumer Electronics remains a colossal market, fueled by the insatiable demand for smartphones, tablets, and smart wearables. The market for consumer electronics is estimated to be worth over $25 billion in 2025. Key drivers include increasing disposable incomes in emerging economies, the continuous innovation in device form factors, and the integration of advanced display technologies.

The Automotive sector is rapidly emerging as a crucial growth engine. The increasing integration of advanced infotainment systems, digital dashboards, and driver-assistance systems (ADAS) necessitates sophisticated and reliable touch screen controllers. Government mandates for in-car safety features and the growing consumer expectation for a connected automotive experience are significant accelerators. The automotive segment is projected to exceed $15 billion by 2025.

Industrial applications, encompassing automation, control panels, and human-machine interfaces (HMIs) in manufacturing and process control, also represent a substantial market. The drive for operational efficiency, enhanced safety, and the adoption of Industry 4.0 principles are fueling demand. The industrial segment is valued at over $10 billion in 2025.

The Healthcare sector is experiencing steady growth, driven by the demand for user-friendly interfaces in medical imaging equipment, patient monitoring devices, and diagnostic tools. The need for hygienic, easily sterilizable touch surfaces and precise control in critical medical procedures contributes to this demand. The healthcare segment is projected to be worth over $5 billion by 2025.

Retail applications, including point-of-sale (POS) systems, interactive kiosks, and digital signage, are also significant contributors. The enhanced customer experience and operational efficiencies offered by touch-enabled solutions are key drivers. The retail segment is estimated to reach over $3 billion by 2025.

The BFSI (Banking, Financial Services, and Insurance) sector is increasingly adopting touch screen technology for ATMs, self-service banking terminals, and interactive customer service points, driving steady growth.

Touch Screen Controllers Industry Product Innovations

Product innovations in the touch screen controllers industry are primarily focused on enhancing performance, reducing power consumption, and integrating advanced features. Companies are developing ultra-thin and flexible touch solutions, multi-modal interaction capabilities (combining touch with gesture or voice), and controllers with improved noise immunity for harsh environments. These innovations are critical for meeting the evolving demands of consumer electronics, automotive, and industrial sectors, offering competitive advantages through superior responsiveness, enhanced durability, and seamless integration.

Report Segmentation & Scope

This report meticulously segments the Touch Screen Controllers Industry by Type and End-user. The Type segmentation includes Resistive and Capacitive touch screen controllers. The Capacitive segment, further subdivided into projected capacitive (PCAP) and surface capacitive technologies, is projected to dominate with a market share exceeding 80% by 2033, driven by its superior performance and widespread adoption in consumer electronics and automotive. The Resistive segment, while still relevant for specific industrial and legacy applications, is expected to witness a declining market share.

The End-user segmentation encompasses Industrial, Healthcare, Consumer Electronics, Retail, Automotive, BFSI, and Other End-users. The Consumer Electronics segment is anticipated to retain the largest market share throughout the forecast period, with projected growth fueled by the smartphone and tablet markets. The Automotive segment is poised for the fastest growth, driven by the increasing demand for in-car digital interfaces. The Industrial segment will continue to be a robust contributor, with advancements in automation and IoT.

Key Drivers of Touch Screen Controllers Industry Growth

Several key factors are propelling the growth of the touch screen controllers industry. Technological advancements, such as the development of more sensitive and accurate touch sensors and sophisticated controller algorithms, are fundamental drivers. The burgeoning IoT ecosystem, requiring seamless human-device interaction, is creating new avenues for market expansion. Economic growth, particularly in emerging markets, is increasing disposable incomes, leading to higher demand for touch-enabled consumer electronics and vehicles. Furthermore, government initiatives promoting digitalization and smart infrastructure development are indirectly boosting the demand for touch screen controllers across various sectors.

Challenges in the Touch Screen Controllers Industry Sector

Despite robust growth, the touch screen controllers industry sector faces certain challenges. Intense competition among numerous players can lead to price pressures and impact profit margins. Supply chain disruptions, as observed in recent years, can affect the availability of critical components and raw materials. Evolving regulatory standards, particularly concerning environmental impact and data privacy, require continuous adaptation from manufacturers. The high cost of advanced R&D for next-generation touch technologies also presents a barrier for smaller companies.

Leading Players in the Touch Screen Controllers Industry Market

- Renesas Electronic Corporation

- Semtech Corporation

- Synaptics Incorporated

- MELFAS Co Ltd

- Microchip Technology Inc.

- SAMSUNG Electronics Co Ltd

- STMicroelectronics

- NXP Semiconductors

- Texas Instruments Incorporated

- Analog Devices Inc.

Key Developments in Touch Screen Controllers Industry Sector

- June 2022: Review Display Systems (RDS), a display solutions and embedded systems provider, announced the availability of a new generation of projected capacitive (PCAP) touchscreens from AMT. The availability of an extensive range of high-quality PCAP touchscreens, touch controllers, and drivers will enable the company to provide dependable, fully integrated touch solutions.

- June 2022: Microchip Technology Inc. announced the maXTouch Knob-on-Display (KoD) family of touchscreen controllers. It is the first automotive-grade touchscreen controller family to natively support the detection and reporting of capacitive rotary encoders and mechanical switches on top of a touch panel.

Strategic Touch Screen Controllers Industry Market Outlook

The strategic outlook for the touch screen controllers industry is exceptionally positive, characterized by sustained innovation and expanding application frontiers. The increasing demand for immersive user experiences across all verticals, from augmented reality in consumer electronics to advanced driver-assistance systems in automotive, will continue to fuel market growth. Strategic opportunities lie in the development of ultra-low power controllers for battery-operated devices, integration of haptic feedback technologies, and the creation of controllers capable of supporting novel display technologies like flexible and transparent OLEDs. Partnerships and collaborations aimed at developing integrated solutions for emerging markets, such as smart cities and advanced robotics, will be crucial for long-term success and market leadership in the evolving landscape of interactive technology.

Touch Screen Controllers Industry Segmentation

-

1. Type

- 1.1. Resistive

- 1.2. Capacitive

-

2. End-user

- 2.1. Industrial

- 2.2. Healthcare

- 2.3. Consumer Electronics

- 2.4. Retail

- 2.5. Automotive

- 2.6. BFSI

- 2.7. Other End-users

Touch Screen Controllers Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Rest of Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Rest of Middle East

Touch Screen Controllers Industry Regional Market Share

Geographic Coverage of Touch Screen Controllers Industry

Touch Screen Controllers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Number of Smart Devices; Increased Usage across Various Industries

- 3.3. Market Restrains

- 3.3.1. Complexities Associated with the Technology

- 3.4. Market Trends

- 3.4.1. Consumer Electronics to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Touch Screen Controllers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Resistive

- 5.1.2. Capacitive

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Industrial

- 5.2.2. Healthcare

- 5.2.3. Consumer Electronics

- 5.2.4. Retail

- 5.2.5. Automotive

- 5.2.6. BFSI

- 5.2.7. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Touch Screen Controllers Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Resistive

- 6.1.2. Capacitive

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Industrial

- 6.2.2. Healthcare

- 6.2.3. Consumer Electronics

- 6.2.4. Retail

- 6.2.5. Automotive

- 6.2.6. BFSI

- 6.2.7. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Touch Screen Controllers Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Resistive

- 7.1.2. Capacitive

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Industrial

- 7.2.2. Healthcare

- 7.2.3. Consumer Electronics

- 7.2.4. Retail

- 7.2.5. Automotive

- 7.2.6. BFSI

- 7.2.7. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Touch Screen Controllers Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Resistive

- 8.1.2. Capacitive

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Industrial

- 8.2.2. Healthcare

- 8.2.3. Consumer Electronics

- 8.2.4. Retail

- 8.2.5. Automotive

- 8.2.6. BFSI

- 8.2.7. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Touch Screen Controllers Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Resistive

- 9.1.2. Capacitive

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Industrial

- 9.2.2. Healthcare

- 9.2.3. Consumer Electronics

- 9.2.4. Retail

- 9.2.5. Automotive

- 9.2.6. BFSI

- 9.2.7. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Touch Screen Controllers Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Resistive

- 10.1.2. Capacitive

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Industrial

- 10.2.2. Healthcare

- 10.2.3. Consumer Electronics

- 10.2.4. Retail

- 10.2.5. Automotive

- 10.2.6. BFSI

- 10.2.7. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates Touch Screen Controllers Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Resistive

- 11.1.2. Capacitive

- 11.2. Market Analysis, Insights and Forecast - by End-user

- 11.2.1. Industrial

- 11.2.2. Healthcare

- 11.2.3. Consumer Electronics

- 11.2.4. Retail

- 11.2.5. Automotive

- 11.2.6. BFSI

- 11.2.7. Other End-users

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Renesas Electronic Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Semtech Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Synaptics Incorporated

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 MELFAS Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Microchip Technology Inc *List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 SAMSUNG Electronics Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 STMicroelectronics

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 NXP Semiconductors

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Texas Instruments Incorporated

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Analog Devices Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Renesas Electronic Corporation

List of Figures

- Figure 1: Global Touch Screen Controllers Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Touch Screen Controllers Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Touch Screen Controllers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Touch Screen Controllers Industry Revenue (billion), by End-user 2025 & 2033

- Figure 5: North America Touch Screen Controllers Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 6: North America Touch Screen Controllers Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Touch Screen Controllers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Touch Screen Controllers Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Touch Screen Controllers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Touch Screen Controllers Industry Revenue (billion), by End-user 2025 & 2033

- Figure 11: Europe Touch Screen Controllers Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 12: Europe Touch Screen Controllers Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Touch Screen Controllers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Touch Screen Controllers Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Touch Screen Controllers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Touch Screen Controllers Industry Revenue (billion), by End-user 2025 & 2033

- Figure 17: Asia Pacific Touch Screen Controllers Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 18: Asia Pacific Touch Screen Controllers Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Touch Screen Controllers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Touch Screen Controllers Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Latin America Touch Screen Controllers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Touch Screen Controllers Industry Revenue (billion), by End-user 2025 & 2033

- Figure 23: Latin America Touch Screen Controllers Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 24: Latin America Touch Screen Controllers Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Touch Screen Controllers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Touch Screen Controllers Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East Touch Screen Controllers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Touch Screen Controllers Industry Revenue (billion), by End-user 2025 & 2033

- Figure 29: Middle East Touch Screen Controllers Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Middle East Touch Screen Controllers Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Touch Screen Controllers Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: United Arab Emirates Touch Screen Controllers Industry Revenue (billion), by Type 2025 & 2033

- Figure 33: United Arab Emirates Touch Screen Controllers Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: United Arab Emirates Touch Screen Controllers Industry Revenue (billion), by End-user 2025 & 2033

- Figure 35: United Arab Emirates Touch Screen Controllers Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 36: United Arab Emirates Touch Screen Controllers Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: United Arab Emirates Touch Screen Controllers Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Touch Screen Controllers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Touch Screen Controllers Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Global Touch Screen Controllers Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Touch Screen Controllers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Touch Screen Controllers Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Touch Screen Controllers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Touch Screen Controllers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Touch Screen Controllers Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 11: Global Touch Screen Controllers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Touch Screen Controllers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Touch Screen Controllers Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 19: Global Touch Screen Controllers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: South Korea Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Australia Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Touch Screen Controllers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global Touch Screen Controllers Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 28: Global Touch Screen Controllers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Mexico Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Argentina Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Latin America Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Touch Screen Controllers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global Touch Screen Controllers Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 35: Global Touch Screen Controllers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Touch Screen Controllers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 37: Global Touch Screen Controllers Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 38: Global Touch Screen Controllers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 39: Saudi Arabia Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East Touch Screen Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Touch Screen Controllers Industry?

The projected CAGR is approximately 13.8%.

2. Which companies are prominent players in the Touch Screen Controllers Industry?

Key companies in the market include Renesas Electronic Corporation, Semtech Corporation, Synaptics Incorporated, MELFAS Co Ltd, Microchip Technology Inc *List Not Exhaustive, SAMSUNG Electronics Co Ltd, STMicroelectronics, NXP Semiconductors, Texas Instruments Incorporated, Analog Devices Inc.

3. What are the main segments of the Touch Screen Controllers Industry?

The market segments include Type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.06 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Number of Smart Devices; Increased Usage across Various Industries.

6. What are the notable trends driving market growth?

Consumer Electronics to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Complexities Associated with the Technology.

8. Can you provide examples of recent developments in the market?

June 2022 - Review Display Systems (RDS), display solutions, and embedded systems provider announced the availability of a new generation of projected capacitive (PCAP) touchscreens from AMT. The availability of an extensive range of high-quality PCAP touchscreens, touch controllers, and drivers will enable the company to provide dependable, fully integrated touch solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Touch Screen Controllers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Touch Screen Controllers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Touch Screen Controllers Industry?

To stay informed about further developments, trends, and reports in the Touch Screen Controllers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence