Key Insights

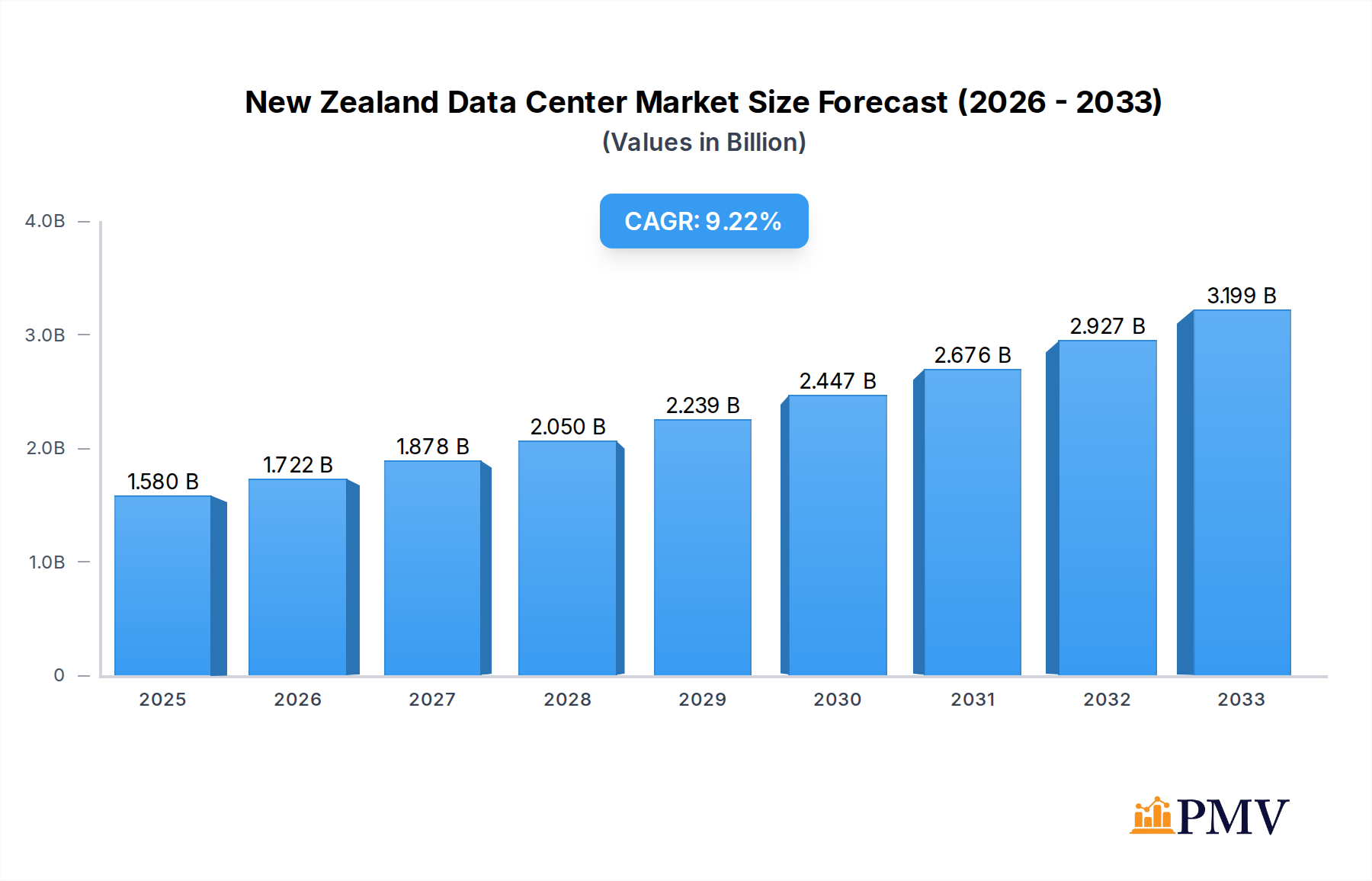

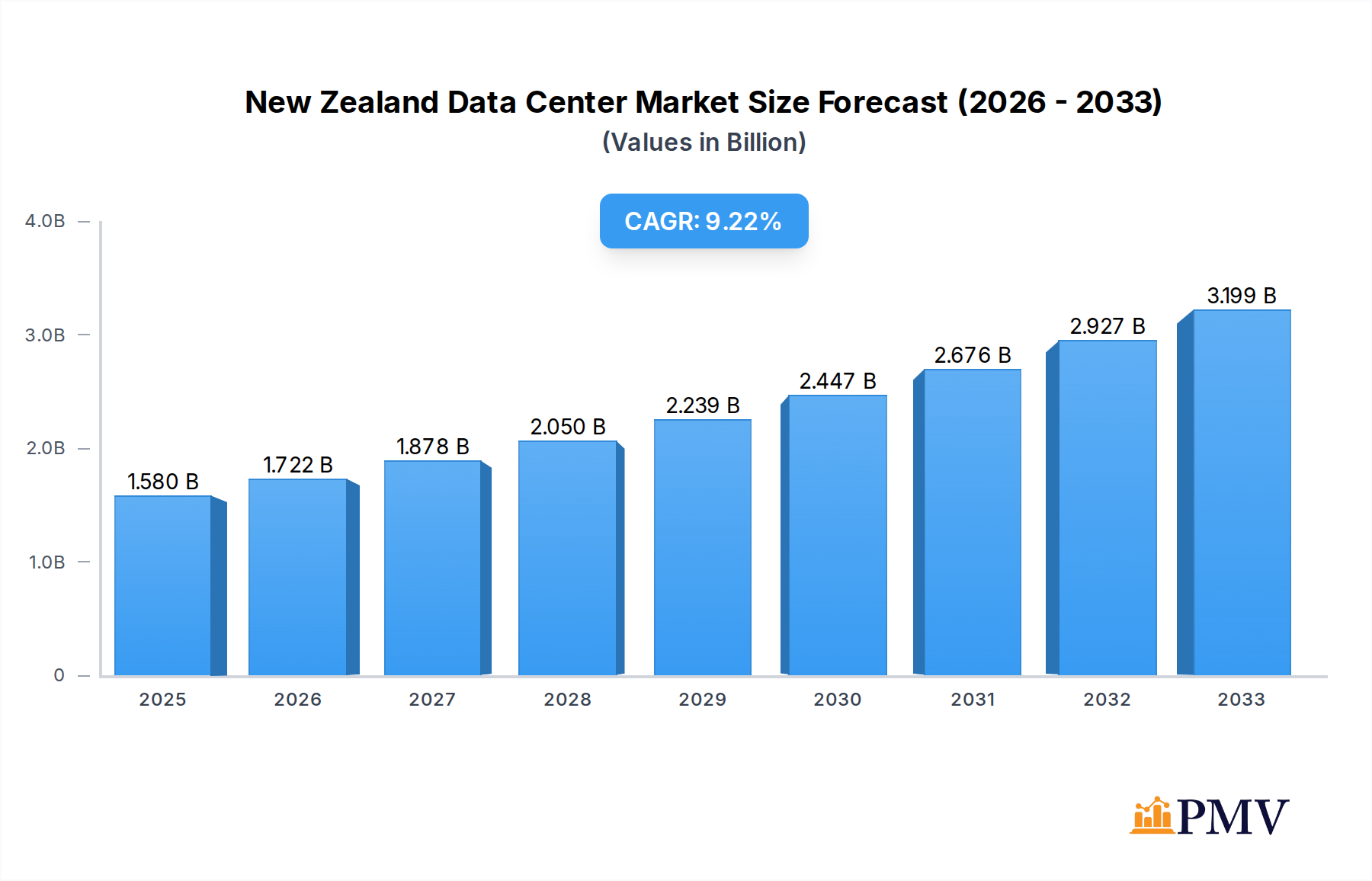

The New Zealand data center market is poised for substantial growth, projected to reach USD 1.58 billion in 2025 with an impressive Compound Annual Growth Rate (CAGR) of 8.97% through 2033. This robust expansion is fueled by a confluence of factors, including the escalating demand for cloud services, the burgeoning e-commerce sector, and increasing digital transformation initiatives across various industries. The government's focus on digital infrastructure development and the growing adoption of sophisticated technologies like AI and IoT are also significant drivers. Furthermore, the expansion of hyperscale and wholesale colocation services, catering to the needs of large cloud providers and enterprises seeking dedicated infrastructure, is a key trend shaping the market. The ongoing digitization of sectors like BFSI, media & entertainment, and manufacturing necessitates advanced data storage and processing capabilities, further propelling market expansion.

New Zealand Data Center Market Market Size (In Billion)

Restraints such as the high cost of land acquisition, skilled labor shortages, and stringent environmental regulations pose challenges to market participants. However, strategic investments in expanding data center capacities, particularly in urban hubs like Auckland and Wellington, are expected to mitigate these limitations. The market segmentation reveals a diverse landscape, with large and massive data center sizes dominating, alongside a preference for Tier 3 and Tier 4 facilities, indicative of the need for high reliability and performance. The absorption of non-utilized space is also a critical factor, with colocation providers actively working to optimize their existing infrastructure. Key players like Spark New Zealand Limited, Datacom Group Ltd, and Chorus are at the forefront, driving innovation and contributing to the market's dynamic evolution.

New Zealand Data Center Market Company Market Share

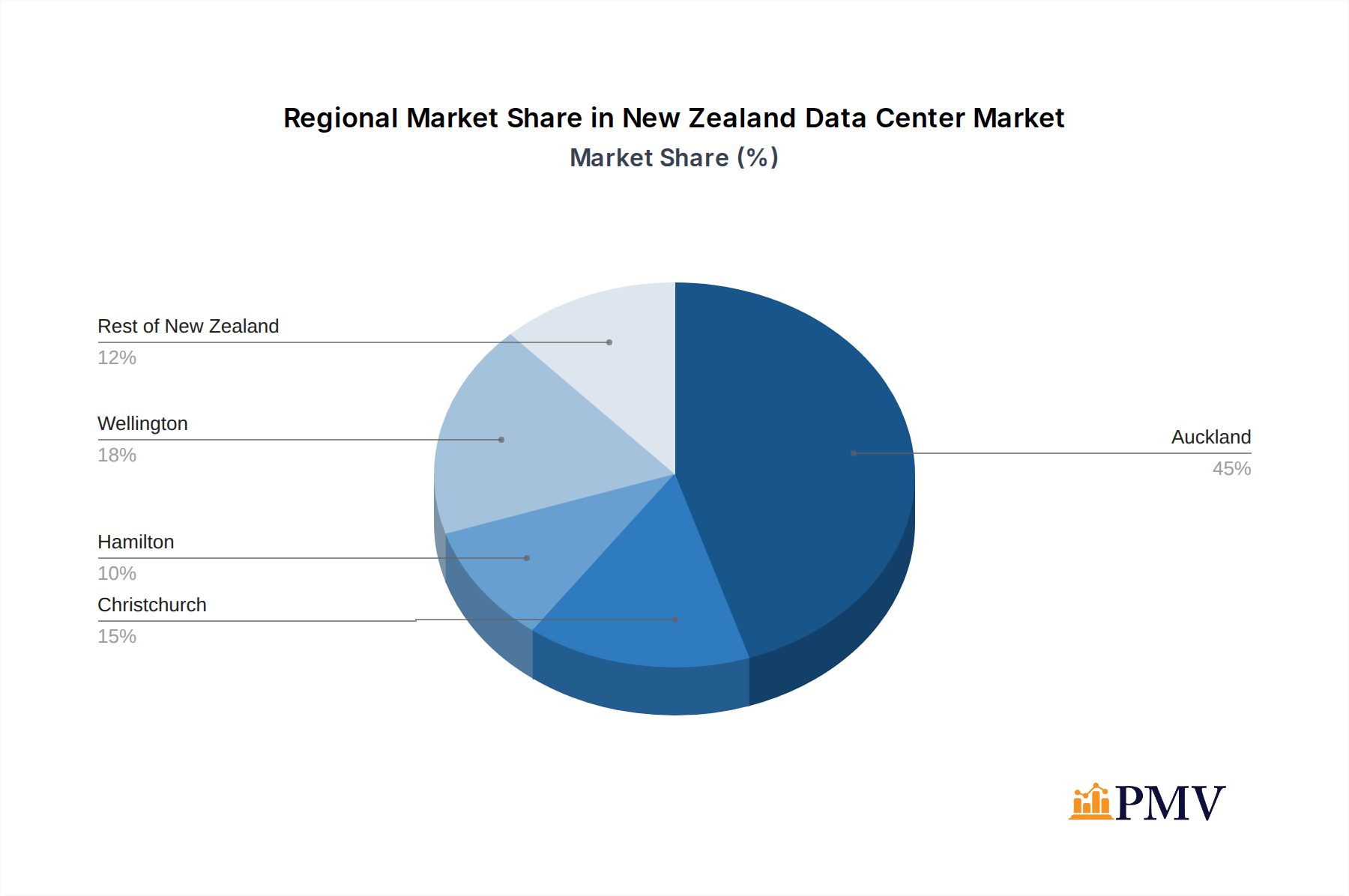

This in-depth report provides an unparalleled analysis of the New Zealand data center market, offering critical insights into its structure, competitive dynamics, evolving trends, and future trajectory. Spanning the historical period of 2019–2024, base year of 2025, and a robust forecast period from 2025–2033, this study is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this rapidly expanding sector. We meticulously examine key segments, including Auckland, Christchurch, Hamilton, Wellington, and Rest of New Zealand, along with data center sizes (Small to Mega), tier types (Tier 1 & 2 to Tier 4), absorption rates (Non-Utilized), colocation types (Hyperscale, Retail, Wholesale), and end-user industries (BFSI, Cloud, E-Commerce, Government, Manufacturing, Media & Entertainment, Telecom, Other).

New Zealand Data Center Market Market Structure & Competitive Dynamics

The New Zealand data center market exhibits a moderate level of market concentration, with a few key players dominating the landscape while a growing number of smaller providers cater to niche demands. Companies such as Spark New Zealand Limited, Datacom Group Ltd, and Vocus Group Limited hold significant market share, driven by their extensive infrastructure and established client bases. Innovation ecosystems are flourishing, particularly around the adoption of cloud services and advancements in energy-efficient cooling technologies. Regulatory frameworks, while supportive of digital infrastructure growth, also present considerations regarding data sovereignty and environmental compliance. Product substitutes, such as distributed cloud solutions and edge computing, are emerging but have yet to significantly disrupt the core data center market. End-user trends reveal a strong demand for scalable and secure colocation solutions, fueled by the continuous digital transformation across industries. Merger and acquisition (M&A) activities, while not extensive, are strategically significant, exemplified by the April 2020 acquisition of HD Net by Voyager Internet, which consolidated capabilities and expanded market reach. The overall M&A deal value in this segment is anticipated to grow as larger players seek to bolster their portfolios and smaller providers look for strategic partnerships.

New Zealand Data Center Market Industry Trends & Insights

The New Zealand data center market is experiencing robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) throughout the forecast period. This expansion is primarily driven by the escalating demand for digital services, the pervasive adoption of cloud computing, and the increasing need for localized data processing and storage. Technological disruptions, including the proliferation of artificial intelligence (AI), the Internet of Things (IoT), and advancements in networking technologies like 5G, are compelling businesses to invest in enhanced data center capabilities. Consumer preferences are shifting towards more accessible, reliable, and secure digital experiences, putting pressure on organizations to modernize their IT infrastructure. Competitive dynamics are intensifying, with established providers investing in capacity expansion and sustainability initiatives to attract and retain customers. The market penetration of hyperscale and wholesale colocation services is on an upward trajectory, catering to the immense data processing needs of global cloud providers and large enterprises. Conversely, retail colocation continues to serve small and medium-sized businesses (SMBs) seeking flexible and cost-effective solutions. The increasing digitalization of government services and the burgeoning e-commerce sector are also significant growth catalysts. Furthermore, a growing emphasis on sustainability is driving innovation in renewable energy sources and efficient cooling systems for data centers, positioning New Zealand as a potentially attractive hub for environmentally conscious digital infrastructure.

Dominant Markets & Segments in New Zealand Data Center Market

The New Zealand data center market is characterized by distinct regional and sectoral dominance. Auckland emerges as the undisputed hotspot, accounting for the largest share of data center capacity and demand due to its economic significance, dense population, and status as a primary connectivity hub. This dominance is further reinforced by the presence of major telecommunications providers and a vibrant business ecosystem. In terms of data center size, Mega and Large facilities are increasingly sought after to accommodate the exponential growth of data, particularly driven by hyperscale cloud providers and large enterprises. The focus on Tier 3 and Tier 4 data centers is paramount, reflecting the critical need for high availability, redundancy, and reliability for mission-critical applications.

- Key Drivers for Auckland's Dominance:

- Concentration of businesses and government agencies.

- Primary international and domestic network connectivity.

- Skilled workforce availability for operations and maintenance.

- Proximity to major end-user industries.

The Cloud and BFSI (Banking, Financial Services, and Insurance) sectors are the most dominant end-users, driving substantial demand for secure, high-performance data center services. The rapid adoption of cloud-native strategies and the need for robust data analytics within the BFSI sector are key contributors. E-Commerce also presents a significant growth segment, especially during peak shopping periods.

Dominance Analysis by Colocation Type:

- Hyperscale colocation is experiencing exponential growth, fueled by global cloud providers establishing or expanding their presence in New Zealand to serve the local market and leverage the country's favorable geography and regulatory environment. This segment requires massive scale and significant power infrastructure.

- Wholesale colocation also plays a crucial role, catering to larger enterprises and managed service providers that require dedicated space, power, and cooling within a shared facility, offering greater control and customization than retail colocation.

- Retail colocation continues to be vital for SMBs and emerging businesses, providing flexible, smaller footprint solutions with a focus on accessibility and managed services.

Tier Type Dominance:

- Tier 3 and Tier 4 data centers are the clear preference for organizations handling sensitive data or mission-critical operations. The demand for fault-tolerant designs, redundant power and cooling, and high levels of uptime is non-negotiable, making these tiers the benchmark for new investments and upgrades.

New Zealand Data Center Market Product Innovations

Product innovations in the New Zealand data center market are primarily focused on enhancing efficiency, sustainability, and scalability. Advancements in liquid cooling technologies are gaining traction to manage the thermal demands of high-density computing environments, crucial for AI and high-performance computing. The development of modular and prefabricated data center solutions offers greater flexibility and faster deployment times. Furthermore, there is a significant push towards integrating renewable energy sources, such as solar and wind power, directly into data center operations, alongside sophisticated energy management systems to reduce carbon footprints. These innovations not only provide competitive advantages by lowering operational costs and improving environmental credentials but also align with the growing market demand for sustainable digital infrastructure.

Report Segmentation & Scope

This report meticulously segments the New Zealand data center market across several critical dimensions to provide granular insights. The geographical segmentation covers Hotspot: Auckland, Christchurch, Hamilton, Wellington, and Rest of New Zealand, each with unique growth drivers and market dynamics. Data Center Size is analyzed from Small to Mega, identifying distinct demand patterns for different scales of operations. Tier Type is categorized from Tier 1 and 2 to Tier 4, highlighting the critical importance of reliability and uptime for various applications. The analysis of Absorption: Non-Utilized provides insights into available capacity and market readiness. Furthermore, the report delves into Colocation Type, differentiating between Hyperscale, Retail, and Wholesale offerings, and examines End User segments, including BFSI, Cloud, E-Commerce, Government, Manufacturing, Media & Entertainment, Telecom, and Other End User, projecting their respective market sizes and growth trajectories.

Key Drivers of New Zealand Data Center Market Growth

Several pivotal factors are propelling the growth of the New Zealand data center market. The accelerating digital transformation across all industries, driven by the increasing adoption of cloud services, big data analytics, and AI, is a primary catalyst. Government initiatives promoting digital infrastructure development and the "smart nation" agenda also provide a supportive environment. The burgeoning e-commerce sector, coupled with the media and entertainment industry's demand for robust content delivery networks, further fuels expansion. Additionally, the growing need for data localization due to privacy regulations and enhanced cybersecurity concerns is encouraging investment in domestic data center capacity. The increasing deployment of 5G networks is also set to drive demand for edge data centers and enhanced connectivity.

Challenges in the New Zealand Data Center Market Sector

Despite its promising growth, the New Zealand data center market faces notable challenges. High energy costs and the country's reliance on renewable energy sources present a complex balancing act for operational expenditure. Acquiring suitably zoned land in accessible locations, particularly near major urban centers like Auckland, can be difficult and costly. A shortage of skilled labor for data center design, construction, and operation poses a constraint on rapid expansion. Furthermore, supply chain disruptions for specialized equipment and the logistical complexities of importing hardware can lead to project delays. The evolving regulatory landscape, particularly concerning environmental sustainability and data sovereignty, requires continuous adaptation and investment.

Leading Players in the New Zealand Data Center Market Market

- Spark New Zealand Limited

- Datacom Group Ltd

- Plan B Limited

- Advantage Computers Limited

- Chorus

- T4 Group (Advanced Data Centres)

- SiteHost NZ

- Vocus Group Limited

- DTS New Zealand Limited

- HD Net Limited

- Canberra Data Centers

- Mikipro Limited

Key Developments in New Zealand Data Center Market Sector

- April 2020: Voyager Internet completed its acquisition of HD Net. Both the companies were started at the same time period. The HD data center is the primary reason that Voyager was attracted to HD. The continued growth of cloud services and as a permanent home for Voyager to grow its infrastructure technology base from makes longer-term strategic sense.

- Ongoing investments by major players in expanding hyperscale and wholesale colocation capacity to meet growing demand.

- Increased focus on sustainability, with data center operators exploring renewable energy solutions and energy-efficient designs.

- Emergence of new market entrants and strategic partnerships aimed at enhancing service offerings and expanding geographical reach.

Strategic New Zealand Data Center Market Market Outlook

The strategic outlook for the New Zealand data center market is overwhelmingly positive, driven by sustained demand for digital services and a supportive regulatory environment. The continued expansion of cloud adoption, coupled with the increasing data generation from emerging technologies like AI and IoT, will necessitate further investment in high-capacity and high-availability data center infrastructure. Opportunities lie in developing specialized facilities, such as edge data centers for low-latency applications and green data centers powered by renewable energy. Strategic alliances between technology providers, colocation operators, and end-users will be crucial for navigating market complexities and capitalizing on growth accelerators. The market is poised for continued innovation and expansion, solidifying New Zealand's position as a key digital hub in the Asia-Pacific region.

New Zealand Data Center Market Segmentation

-

1. Hotspot

- 1.1. Auckland

- 1.2. Christchurch

- 1.3. Hamilton

- 1.4. Wellington

- 1.5. Rest of New Zealand

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

4.2. By Colocation Type

- 4.2.1. Hyperscale

- 4.2.2. Retail

- 4.2.3. Wholesale

-

5. End User

- 5.1. BFSI

- 5.2. Cloud

- 5.3. E-Commerce

- 5.4. Government

- 5.5. Manufacturing Media & Entertainment

- 5.6. Telecom

- 5.7. Other End User

New Zealand Data Center Market Segmentation By Geography

- 1. New Zealand

New Zealand Data Center Market Regional Market Share

Geographic Coverage of New Zealand Data Center Market

New Zealand Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness of Energy Consumption Control

- 3.3. Market Restrains

- 3.3.1. High Risk Associated with Data

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Zealand Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Auckland

- 5.1.2. Christchurch

- 5.1.3. Hamilton

- 5.1.4. Wellington

- 5.1.5. Rest of New Zealand

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.4.2. By Colocation Type

- 5.4.2.1. Hyperscale

- 5.4.2.2. Retail

- 5.4.2.3. Wholesale

- 5.5. Market Analysis, Insights and Forecast - by End User

- 5.5.1. BFSI

- 5.5.2. Cloud

- 5.5.3. E-Commerce

- 5.5.4. Government

- 5.5.5. Manufacturing Media & Entertainment

- 5.5.6. Telecom

- 5.5.7. Other End User

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Spark New Zealand Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Datacom Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Plan B Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Advantage Computers Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chorus

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 T4 Group (Advanced Data Centres)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SiteHost NZ

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vocus Group Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DTS New Zealand Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 HD Net Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Canberra Data Centers

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mikipro Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Spark New Zealand Limited

List of Figures

- Figure 1: New Zealand Data Center Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: New Zealand Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: New Zealand Data Center Market Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 2: New Zealand Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 3: New Zealand Data Center Market Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 4: New Zealand Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 5: New Zealand Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 6: New Zealand Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 7: New Zealand Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 8: New Zealand Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 9: New Zealand Data Center Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: New Zealand Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: New Zealand Data Center Market Revenue billion Forecast, by Region 2020 & 2033

- Table 12: New Zealand Data Center Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 13: New Zealand Data Center Market Revenue billion Forecast, by Hotspot 2020 & 2033

- Table 14: New Zealand Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 15: New Zealand Data Center Market Revenue billion Forecast, by Data Center Size 2020 & 2033

- Table 16: New Zealand Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 17: New Zealand Data Center Market Revenue billion Forecast, by Tier Type 2020 & 2033

- Table 18: New Zealand Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 19: New Zealand Data Center Market Revenue billion Forecast, by Absorption 2020 & 2033

- Table 20: New Zealand Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 21: New Zealand Data Center Market Revenue billion Forecast, by End User 2020 & 2033

- Table 22: New Zealand Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: New Zealand Data Center Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: New Zealand Data Center Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Zealand Data Center Market?

The projected CAGR is approximately 8.97%.

2. Which companies are prominent players in the New Zealand Data Center Market?

Key companies in the market include Spark New Zealand Limited, Datacom Group Ltd, Plan B Limited, Advantage Computers Limited, Chorus, T4 Group (Advanced Data Centres), SiteHost NZ, Vocus Group Limited, DTS New Zealand Limited, HD Net Limited, Canberra Data Centers, Mikipro Limited.

3. What are the main segments of the New Zealand Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness of Energy Consumption Control.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Risk Associated with Data.

8. Can you provide examples of recent developments in the market?

April 2020: Voyager Internet completed its acquisition of HD Net. Both the companies were started at the same time period. The HD data center is the primary reason that Voyager was attracted to HD. The continued growth of cloud services and as a permanent home for Voyager to grow its infrastructure technology base from makes longer-term strategic sense.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Zealand Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Zealand Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Zealand Data Center Market?

To stay informed about further developments, trends, and reports in the New Zealand Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence