Key Insights

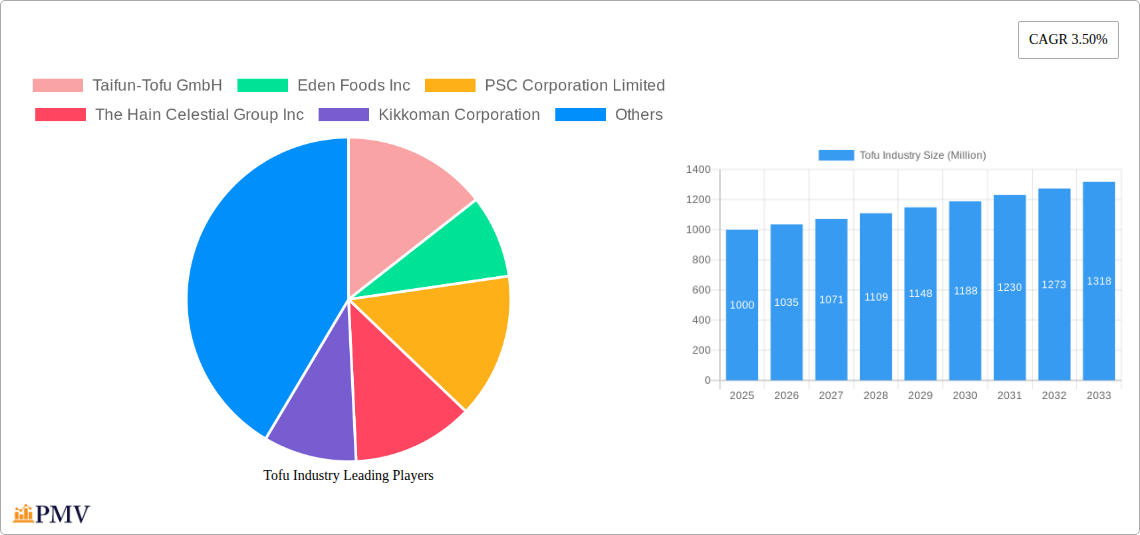

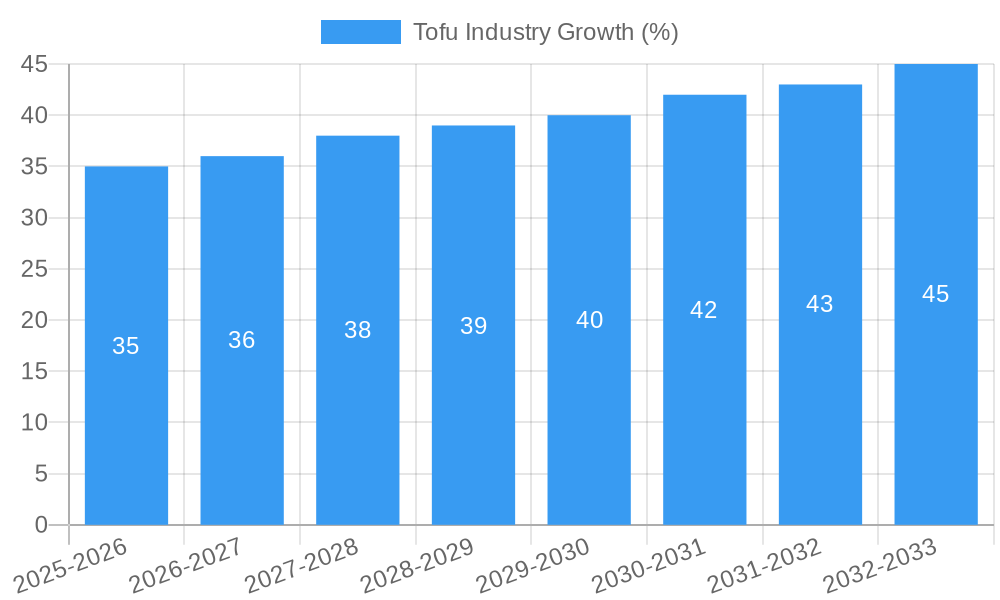

The global tofu market, valued at approximately $XX million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.50% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing consumer awareness of the health benefits associated with plant-based protein sources, including tofu's high protein content and low fat profile, is a significant factor. The rising popularity of vegetarian, vegan, and flexitarian diets globally further contributes to this growth. Innovation within the tofu industry, encompassing the development of new flavors, textures, and convenient ready-to-eat products, broadens the consumer base and appeals to a wider range of preferences. The expansion of retail channels, including online grocery platforms and specialized health food stores, also facilitates increased market penetration. However, challenges such as fluctuating soybean prices and potential competition from alternative protein sources represent constraints to market growth. Market segmentation reveals significant activity in both the on-trade (restaurants, food service) and off-trade (retail) distribution channels, reflecting the versatility of tofu in various culinary applications. Key players like Taifun-Tofu GmbH, Eden Foods Inc., and Kikkoman Corporation are driving innovation and expansion within the market. The competitive landscape is characterized by both established players and emerging brands, creating a dynamic environment.

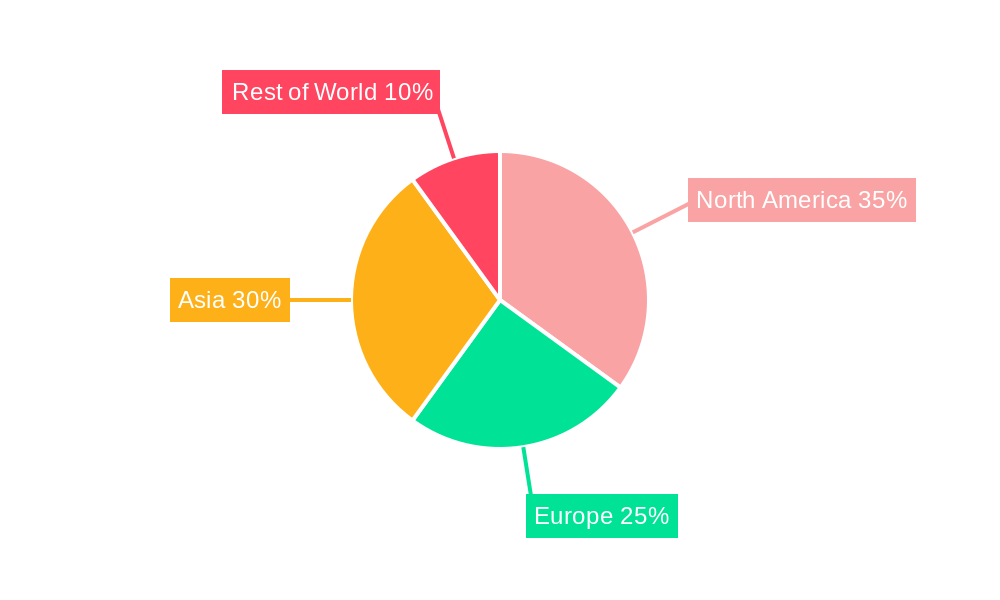

Geographic distribution of the tofu market is likely to show variations based on cultural preferences and dietary habits. Regions with established vegetarian and vegan populations, such as parts of Asia and North America, are anticipated to exhibit strong market performance. Europe and other regions are expected to see increasing adoption driven by growing health consciousness and the rise of plant-based alternatives. While precise regional breakdowns are unavailable, it can be assumed that the market's growth will be driven by a combination of existing strong markets and the ongoing expansion into newer, emerging markets. The historical period (2019-2024) likely saw slower growth compared to the projected period (2025-2033), based on the accelerating adoption of plant-based diets and increased availability.

Tofu Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global tofu industry, covering market size, growth drivers, competitive landscape, and future outlook from 2019 to 2033. With a focus on key players like Taifun-Tofu GmbH, Eden Foods Inc., and Kikkoman Corporation, this report offers actionable insights for businesses and investors seeking to navigate this dynamic market. The report utilizes a base year of 2025 and forecasts market trends until 2033, incorporating historical data from 2019-2024. The total market size is projected to reach XX Million by 2033.

Tofu Industry Market Structure & Competitive Dynamics

The global tofu market exhibits a moderately concentrated structure, with several key players holding significant market share. However, the presence of numerous smaller regional and local producers creates a dynamic competitive landscape. Innovation is crucial, with companies investing in product diversification, improved processing techniques, and sustainable sourcing. Regulatory frameworks concerning food safety and labeling vary across regions, impacting market access and operational costs. Plant-based protein alternatives, such as seitan and tempeh, present competitive pressure. Growing consumer demand for healthy and sustainable food options drives the industry's growth, while mergers and acquisitions significantly reshape the market structure.

- Market Concentration: The top five players account for approximately xx% of the global market share in 2025.

- Innovation Ecosystem: Significant R&D investment focuses on developing new tofu-based products and improving production efficiency.

- Regulatory Landscape: Stringent food safety regulations and labeling requirements influence manufacturing costs and market access.

- Product Substitutes: Competition exists from other plant-based proteins, impacting tofu's market penetration.

- End-User Trends: Increasing consumer awareness of health and sustainability is a key driver of demand.

- M&A Activities: Recent years have witnessed a surge in mergers and acquisitions, with deal values exceeding xx Million in the past five years. Examples include Morinaga's acquisition of Tofurky and House Foods' acquisition of Keystone Natural Holdings.

Tofu Industry Industry Trends & Insights

The global tofu market is experiencing robust growth, driven by several factors. The rising popularity of vegetarian and vegan diets globally fuels demand for plant-based protein sources like tofu. Health-conscious consumers are increasingly seeking healthier alternatives to traditional meat products, boosting tofu consumption. Technological advancements in tofu production, including automation and improved processing techniques, enhance efficiency and reduce costs. However, price fluctuations in soybeans, a key raw material, pose a challenge. Consumer preference shifts towards organic and non-GMO tofu present opportunities for specialized producers. The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration increasing from xx% in 2025 to xx% by 2033.

Dominant Markets & Segments in Tofu Industry

Asia, particularly China and Japan, remain the dominant markets for tofu consumption, driven by established cultural preferences and high population density. However, North America and Europe are experiencing significant growth due to rising veganism and vegetarianism.

Key Drivers of Market Dominance:

- Asia: Strong cultural acceptance of tofu, established supply chains, and large consumer base.

- North America: Growing adoption of plant-based diets, increasing health consciousness, and innovative product development.

- Europe: Rising awareness of the environmental benefits of plant-based protein sources and increasing demand for sustainable food options.

Segment Analysis:

- Off-Trade: This segment constitutes the majority of the tofu market, driven by retail sales through supermarkets, hypermarkets, and specialty stores. The convenience and affordability of packaged tofu contribute to its popularity in this channel.

- On-Trade: The On-Trade segment, encompassing restaurants and food service establishments, is experiencing moderate growth, driven by the increasing inclusion of tofu in menus catering to diverse dietary preferences. The demand is influenced by restaurant trends and consumer preferences.

Tofu Industry Product Innovations

Recent innovations focus on enhancing tofu's versatility and appeal to a broader consumer base. This includes the development of novel tofu textures, flavors, and forms, such as marinated tofu, crumbled tofu, and tofu-based meat alternatives. Technological advances in processing techniques lead to improved nutritional profiles and shelf life. Companies are also exploring sustainable packaging solutions and exploring different soybean varieties for improved yield and quality.

Report Segmentation & Scope

The report segments the tofu market by region (Asia, North America, Europe, and Rest of World), distribution channel (Off-Trade and On-Trade), and product type (firm tofu, silken tofu, etc.). Growth projections, market sizes, and competitive dynamics are analyzed for each segment. The Off-Trade segment is expected to dominate throughout the forecast period, showcasing robust growth driven by increasing retail sales. The On-Trade segment, although smaller, is anticipated to witness considerable expansion, propelled by the rising popularity of plant-based cuisine in restaurants and food service.

Key Drivers of Tofu Industry Growth

Several factors drive the growth of the tofu industry. The rising adoption of vegan and vegetarian lifestyles fuels demand for plant-based protein sources. Growing awareness of health benefits associated with tofu consumption, including its high protein content and low fat, contributes to its popularity. Technological advancements in production methods improve efficiency and lower costs. Government initiatives promoting sustainable and healthy food options, as well as favorable economic conditions in many key markets, further bolster the industry's growth.

Challenges in the Tofu Industry Sector

The tofu industry faces challenges such as fluctuations in soybean prices, which affect production costs and profitability. Competition from other plant-based protein sources like seitan and tempeh requires constant innovation and product diversification. Maintaining consistent product quality and extending shelf life remain key technical challenges. Regulatory compliance concerning food safety and labeling adds to operational complexities. Supply chain disruptions can significantly impact market availability and pricing. These challenges necessitate strategic management and adaptation.

Leading Players in the Tofu Industry Market

- Taifun-Tofu GmbH

- Eden Foods Inc

- PSC Corporation Limited

- The Hain Celestial Group Inc

- Kikkoman Corporation

- Pulmuone Corporate

- Monde Nissin Corporation

- Vitasoy International Holdings Lt

- House Foods Group Inc

- Morinaga Milk Industry Co Ltd

- Tofu Restaurant Co Ltd

Key Developments in Tofu Industry Sector

- February 2023: Morinaga Nutritional Foods acquired Tofurky and Moocho, strengthening its supply chain and market position.

- September 2022: House Foods Holding USA acquired Keystone Natural Holdings LLC, expanding its product portfolio and US market presence.

- July 2022: Kikkoman Corporation entered the Indian market, signifying expansion into a new high-growth region.

Strategic Tofu Industry Market Outlook

The tofu industry presents significant opportunities for growth, driven by escalating consumer demand for plant-based proteins and the rising popularity of vegan and vegetarian diets. Strategic investments in research and development, focusing on product innovation and improved production efficiency, are crucial for sustained competitiveness. Exploring new markets and distribution channels, particularly in emerging economies, offers substantial growth potential. Companies adopting sustainable practices and transparent supply chains will enjoy a competitive advantage. The future outlook remains positive, with continued growth expected throughout the forecast period.

Tofu Industry Segmentation

-

1. Distribution Channel

-

1.1. Off-Trade

- 1.1.1. Convenience Stores

- 1.1.2. Online Channel

- 1.1.3. Supermarkets and Hypermarkets

- 1.1.4. Others

- 1.2. On-Trade

-

1.1. Off-Trade

Tofu Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Tofu Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology

- 3.3. Market Restrains

- 3.3.1. Deteriorating Fertility of Agricultural Lands

- 3.4. Market Trends

- 3.4.1. Regional soybean production and consumption demand are the primary drivers of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tofu Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Off-Trade

- 5.1.1.1. Convenience Stores

- 5.1.1.2. Online Channel

- 5.1.1.3. Supermarkets and Hypermarkets

- 5.1.1.4. Others

- 5.1.2. On-Trade

- 5.1.1. Off-Trade

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America Tofu Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Off-Trade

- 6.1.1.1. Convenience Stores

- 6.1.1.2. Online Channel

- 6.1.1.3. Supermarkets and Hypermarkets

- 6.1.1.4. Others

- 6.1.2. On-Trade

- 6.1.1. Off-Trade

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. South America Tofu Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Off-Trade

- 7.1.1.1. Convenience Stores

- 7.1.1.2. Online Channel

- 7.1.1.3. Supermarkets and Hypermarkets

- 7.1.1.4. Others

- 7.1.2. On-Trade

- 7.1.1. Off-Trade

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Europe Tofu Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Off-Trade

- 8.1.1.1. Convenience Stores

- 8.1.1.2. Online Channel

- 8.1.1.3. Supermarkets and Hypermarkets

- 8.1.1.4. Others

- 8.1.2. On-Trade

- 8.1.1. Off-Trade

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. Middle East & Africa Tofu Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Off-Trade

- 9.1.1.1. Convenience Stores

- 9.1.1.2. Online Channel

- 9.1.1.3. Supermarkets and Hypermarkets

- 9.1.1.4. Others

- 9.1.2. On-Trade

- 9.1.1. Off-Trade

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Asia Pacific Tofu Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.1.1. Off-Trade

- 10.1.1.1. Convenience Stores

- 10.1.1.2. Online Channel

- 10.1.1.3. Supermarkets and Hypermarkets

- 10.1.1.4. Others

- 10.1.2. On-Trade

- 10.1.1. Off-Trade

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Taifun-Tofu GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eden Foods Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PSC Corporation Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Hain Celestial Group Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kikkoman Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pulmuone Corporate

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Monde Nissin Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Vitasoy International Holdings Lt

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 House Foods Group Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Morinaga Milk Industry Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tofu Restaurant Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Taifun-Tofu GmbH

List of Figures

- Figure 1: Global Tofu Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Tofu Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 3: North America Tofu Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 4: North America Tofu Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: North America Tofu Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: South America Tofu Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: South America Tofu Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: South America Tofu Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Tofu Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Tofu Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 11: Europe Tofu Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 12: Europe Tofu Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe Tofu Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Middle East & Africa Tofu Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 15: Middle East & Africa Tofu Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 16: Middle East & Africa Tofu Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Middle East & Africa Tofu Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Tofu Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Asia Pacific Tofu Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Asia Pacific Tofu Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Tofu Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tofu Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Tofu Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 3: Global Tofu Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Tofu Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Global Tofu Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Tofu Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 10: Global Tofu Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Argentina Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Tofu Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Global Tofu Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Russia Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Benelux Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Nordics Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Tofu Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 26: Global Tofu Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Turkey Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Israel Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: GCC Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: North Africa Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East & Africa Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Tofu Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 34: Global Tofu Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: China Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: India Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Japan Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: South Korea Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: ASEAN Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Oceania Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Asia Pacific Tofu Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tofu Industry?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Tofu Industry?

Key companies in the market include Taifun-Tofu GmbH, Eden Foods Inc, PSC Corporation Limited, The Hain Celestial Group Inc, Kikkoman Corporation, Pulmuone Corporate, Monde Nissin Corporation, Vitasoy International Holdings Lt, House Foods Group Inc, Morinaga Milk Industry Co Ltd, Tofu Restaurant Co Ltd.

3. What are the main segments of the Tofu Industry?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology.

6. What are the notable trends driving market growth?

Regional soybean production and consumption demand are the primary drivers of the market.

7. Are there any restraints impacting market growth?

Deteriorating Fertility of Agricultural Lands.

8. Can you provide examples of recent developments in the market?

February 2023: Morinaga Nutritional Foods acquired US plant-based company, Tofurky and its sister brand Moocho. Morinaga has been a tofu supplier for Tofurky products for 17 years. The acquisition of Tofurky and Moocho will help the company to strengthen the integrated supply chain and category growth for the brands.September 2022: Keystone Capital has signed a definitive agreement for House Foods Holding USA to acquire 100% of Keystone Natural Holdings LLC, a leading manufacturer of tofu and plant-based foods in North America. Through this acquisition, House Foods will expand its portfolio of value-added tofu and plant-based food products and accelerate its U.S. market expansion plans. The combined company will have eight manufacturing facilities across North America.July 2022: Kikkoman Corporation officially entered the Indian market by establishing its subsidiary in Mumbai, Kikkoman India Pvt. Ltd (KID).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tofu Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tofu Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tofu Industry?

To stay informed about further developments, trends, and reports in the Tofu Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence