Key Insights

The global Third-Party Inspection (TIC) market is experiencing substantial expansion, driven by escalating international trade, stringent regulatory mandates, and a growing emphasis on quality assurance across numerous sectors. The market is projected for robust growth, with an estimated Compound Annual Growth Rate (CAGR) of 3.6%. The market size was valued at $417.76 billion in the 2025 base year and is expected to continue its upward trajectory.

TIC Industry Market Size (In Billion)

Key growth catalysts include the burgeoning e-commerce sector, which demands rigorous quality control, and an increasing focus on supply chain transparency and sustainability. Evolving product complexities and manufacturing processes further enhance the demand for specialized TIC services. Emerging trends in the TIC industry involve the integration of advanced technologies such as artificial intelligence (AI) and blockchain to improve efficiency and traceability. Digitalization initiatives are being adopted by companies to optimize operations and deliver data-driven insights to clients. However, the market faces challenges including intense price competition, the necessity for continuous skill development, and potential economic downturns impacting client expenditure on inspection services. Segment analysis indicates strong demand from industries like manufacturing, food and beverage, and healthcare, each with distinct compliance requirements.

TIC Industry Company Market Share

Global TIC Industry Market Analysis: 2025-2033

This comprehensive report delivers an in-depth analysis of the global Testing, Inspection, and Certification (TIC) industry. It covers market size, segmentation, competitive dynamics, and future growth potential. The study period spans from 2019 to 2033, with a detailed forecast from 2025 to 2033, using 2025 as the base year. The market size in 2025 was valued at $417.76 billion, with a projected CAGR of 3.6% during the forecast period.

TIC Industry Market Structure & Competitive Dynamics

The global TIC industry is characterized by a moderately concentrated market structure, with several multinational corporations holding significant market share. Key players include SGS Group, Bureau Veritas SA, Intertek Group Plc, TÜV SÜD Group, and TÜV Rheinland Group. These companies compete intensely on factors such as service breadth, technological innovation, global reach, and pricing. The industry is characterized by high barriers to entry, primarily due to the substantial investments needed in infrastructure, equipment, and personnel expertise. The market share for the top five players is estimated to be around xx%, indicating a moderately consolidated market.

- Market Concentration: High, with several dominant players.

- Innovation Ecosystems: Robust, with ongoing developments in digitalization and automation.

- Regulatory Frameworks: Complex and varying across regions, impacting operational costs and compliance.

- Product Substitutes: Limited, owing to the specialized nature of TIC services.

- End-User Trends: Increasing demand for faster, more efficient, and data-driven TIC solutions.

- M&A Activities: Frequent, driven by consolidation efforts and expansion into new markets. The total value of M&A deals in the TIC industry during the historical period (2019-2024) is estimated at xx Million. Examples include the recent acquisition of [Company Name] by [Company Name] for xx Million.

TIC Industry Industry Trends & Insights

The TIC industry is experiencing significant transformation driven by several key factors. The increasing globalization of supply chains necessitates robust TIC services to ensure quality, safety, and compliance across international borders. Technological advancements, such as artificial intelligence (AI) and the Internet of Things (IoT), are automating processes and enhancing efficiency. Consumer demand for sustainable and ethically sourced products is driving growth in related TIC services, such as environmental compliance and social responsibility audits. The market is also witnessing increasing adoption of digital TIC solutions, enabling remote inspection, faster turnaround times, and improved data management. This transition to digitalization is expected to boost market penetration of new services in the coming years. The CAGR of the digital TIC segment is projected to be xx% between 2025 and 2033.

Dominant Markets & Segments in TIC Industry

The Asia-Pacific region currently dominates the global TIC market, driven by rapid industrialization, robust economic growth, and a large manufacturing base. China, in particular, is a significant contributor, with a substantial demand for testing and certification services across various sectors.

- Key Drivers in Asia-Pacific:

- Rapid industrialization and economic growth.

- Increasing demand for quality control and safety assurance.

- Stringent regulatory requirements.

- Expanding infrastructure development.

The dominance of the Asia-Pacific region is primarily attributed to the high volume of manufacturing and export activities in the region, creating a significant demand for quality control, regulatory compliance and supply chain management services. This trend is expected to continue through the forecast period. Further dominance is also observed in specific segments like food and agriculture (driven by consumer concerns over food safety and traceability), and healthcare (driven by increasingly stringent regulatory requirements for medical devices and pharmaceuticals).

TIC Industry Product Innovations

The Inspection, Testing, and Certification (TIC) industry is experiencing a surge of innovation, fundamentally reshaping how businesses ensure quality, safety, and compliance. Cutting-edge advancements include the widespread integration of AI-powered inspection systems that analyze data with unprecedented speed and accuracy, identifying anomalies and potential risks more effectively than traditional methods. Complementing this are blockchain-based traceability solutions, offering immutable and transparent records of product journeys from origin to consumer, thereby bolstering supply chain integrity and consumer trust. Furthermore, sophisticated cloud-based data management platforms are revolutionizing how TIC data is collected, stored, analyzed, and shared, providing clients with real-time insights and fostering greater collaboration. These innovations collectively enhance speed, efficiency, and transparency, while the growing emphasis on digitalization and the development of specialized services to address emerging industry needs, such as cybersecurity and sustainable materials, are creating a significant competitive advantage for forward-thinking TIC providers.

Report Segmentation & Scope

This report segments the TIC industry by service type (testing, inspection, certification), industry vertical (automotive, food & beverage, healthcare, etc.), and geography (North America, Europe, Asia-Pacific, etc.). Growth projections, market sizes, and competitive dynamics are analyzed for each segment. Detailed analyses of the key growth factors and challenges within these segments are provided.

Key Drivers of TIC Industry Growth

The robust growth of the TIC industry is propelled by a confluence of powerful global and industry-specific forces. Increasing globalization and complex international trade necessitates comprehensive testing and certification to meet diverse market regulations. Equally significant are the stringent regulatory compliance requirements that continue to evolve across sectors, demanding rigorous adherence to safety, environmental, and ethical standards. A heightened consumer awareness about product safety and quality, coupled with a demand for transparency, further fuels the need for independent TIC services. Technological advancements, including automation and digitalization, are not only enabling more efficient TIC processes but also creating new avenues for service offerings. The expanding manufacturing sector in developing economies brings with it increased production volumes and a growing need for quality assurance. Lastly, the escalating demand for end-to-end traceability and supply chain transparency, driven by concerns over ethical sourcing, counterfeit goods, and product recalls, is a pivotal driver for the continued expansion of the TIC industry.

Challenges in the TIC Industry Sector

The TIC industry faces several challenges, including intense competition, regulatory complexities and variations across regions, and the need for continuous investment in advanced technologies. Maintaining data security and protecting client confidentiality are also significant concerns. The industry also faces the pressure of constantly adapting to evolving technological landscapes and regulatory compliance issues.

Leading Players in the TIC Industry Market

- SGS Group

- Bureau Veritas SA

- Intertek Group Plc

- TUV SUD Group

- TUV Rheinland Group

- AsiaInspection Ltd

- British Standards Institution Group

- Keller-Frei Zurich

- Centre Testing International (CTI)

- Hohenstein Institute

- SAI Global Ltd

- TESTEX AG

- Eurofins Scientific

Key Developments in TIC Industry Sector

- January 2022: SGS Group solidified its commitment to digital transformation by partnering with Microsoft. This strategic collaboration aims to co-develop next-generation digital TIC services, leveraging Microsoft's advanced data analytics and cloud infrastructure alongside SGS's extensive global network and industry expertise. This partnership signifies a major leap towards more integrated and intelligent service delivery within the TIC sector.

- March 2022: TÜV Rheinland joined forces with The BHive, a leader in chemical compliance management. This alliance offers the textile and fashion industry a streamlined and comprehensive solution for chemical testing and management. The collaboration is instrumental in accelerating the industry's efforts to phase out hazardous chemicals, underscoring the growing importance of sustainability, ethical sourcing, and regulatory adherence in the apparel supply chain.

Strategic TIC Industry Market Outlook

The Inspection, Testing, and Certification (TIC) industry is on a trajectory of sustained and significant growth. This expansion is underpinned by a dynamic interplay of factors including rapid technological advancements, increasingly stringent regulatory landscapes worldwide, and an ever-growing imperative for quality assurance and robust compliance across all commercial sectors. Strategic avenues for continued success and market leadership are abundant, particularly in the development and deployment of innovative digital solutions that enhance efficiency and provide deeper insights. Furthermore, there are substantial opportunities in expanding service offerings into new and emerging markets, as well as a pronounced focus on sustainability initiatives, encompassing environmental, social, and governance (ESG) compliance. The future prosperity of TIC companies will be intricately linked to their agility in adapting to evolving market demands, their commitment to investing in state-of-the-art technologies, and their ability to cultivate strong, value-driven partnerships that consistently deliver superior outcomes for their diverse clientele.

TIC Industry Segmentation

-

1. Application

- 1.1. Textile Testing

- 1.2. Textile Inspection

- 1.3. Textile Certification

TIC Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Latin America

- 5. Middle East

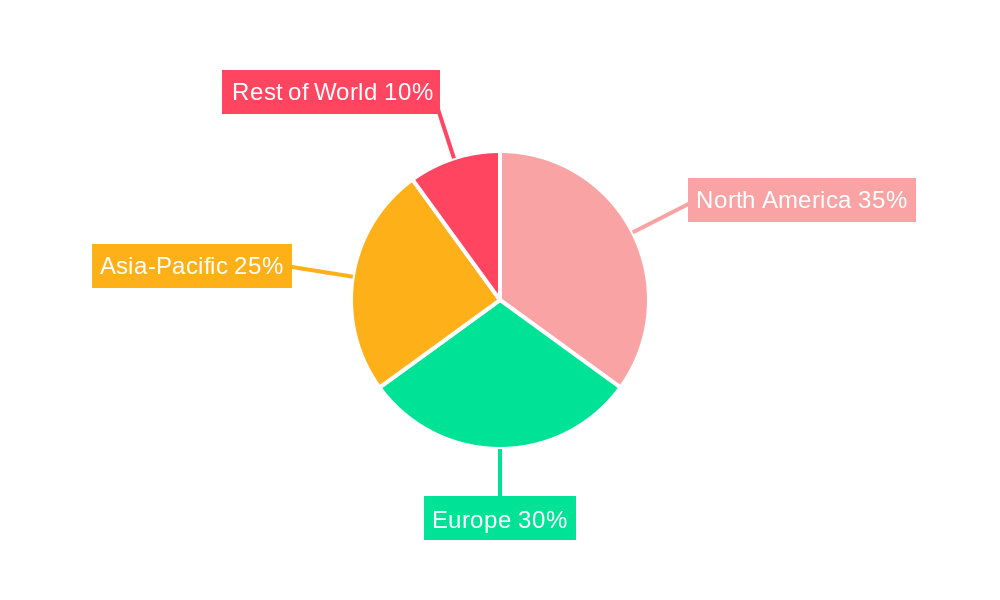

TIC Industry Regional Market Share

Geographic Coverage of TIC Industry

TIC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Trade of Textile Products Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global TIC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Textile Testing

- 5.1.2. Textile Inspection

- 5.1.3. Textile Certification

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Asia Pacific

- 5.2.3. Europe

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America TIC Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Textile Testing

- 6.1.2. Textile Inspection

- 6.1.3. Textile Certification

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Asia Pacific TIC Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Textile Testing

- 7.1.2. Textile Inspection

- 7.1.3. Textile Certification

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe TIC Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Textile Testing

- 8.1.2. Textile Inspection

- 8.1.3. Textile Certification

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America TIC Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Textile Testing

- 9.1.2. Textile Inspection

- 9.1.3. Textile Certification

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East TIC Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Textile Testing

- 10.1.2. Textile Inspection

- 10.1.3. Textile Certification

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SGS Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bureau Veritas SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intertek Group Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TUV SUD Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TUV Rheinland Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AsiaInspection Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 British Standards Institution Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Keller-Frei Zurich

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Centre Testing International (CTI)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hohenstein Institute

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SAI Global Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TESTEX AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eurofins Scientific**List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 SGS Group

List of Figures

- Figure 1: Global TIC Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: Asia Pacific TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Asia Pacific TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Asia Pacific TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Latin America TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Latin America TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East TIC Industry Revenue (billion), by Application 2025 & 2033

- Figure 19: Middle East TIC Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East TIC Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global TIC Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global TIC Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global TIC Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the TIC Industry?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the TIC Industry?

Key companies in the market include SGS Group, Bureau Veritas SA, Intertek Group Plc, TUV SUD Group, TUV Rheinland Group, AsiaInspection Ltd, British Standards Institution Group, Keller-Frei Zurich, Centre Testing International (CTI), Hohenstein Institute, SAI Global Ltd, TESTEX AG, Eurofins Scientific**List Not Exhaustive.

3. What are the main segments of the TIC Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 417.76 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Trade of Textile Products Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

Jan 2022: Switzerland-based testing and certification group SGS announced a partnership with Microsoft to develop a new digital TIC service. This collaboration will leverage Microsoft's cross-industry expertise, advanced data solutions and productivity platforms, integrated with SGS's global service network and leading industry capabilities to develop innovative solutions for customers in the Testing, Inspection and Certification (TIC) industry .

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "TIC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the TIC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the TIC Industry?

To stay informed about further developments, trends, and reports in the TIC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence