Key Insights

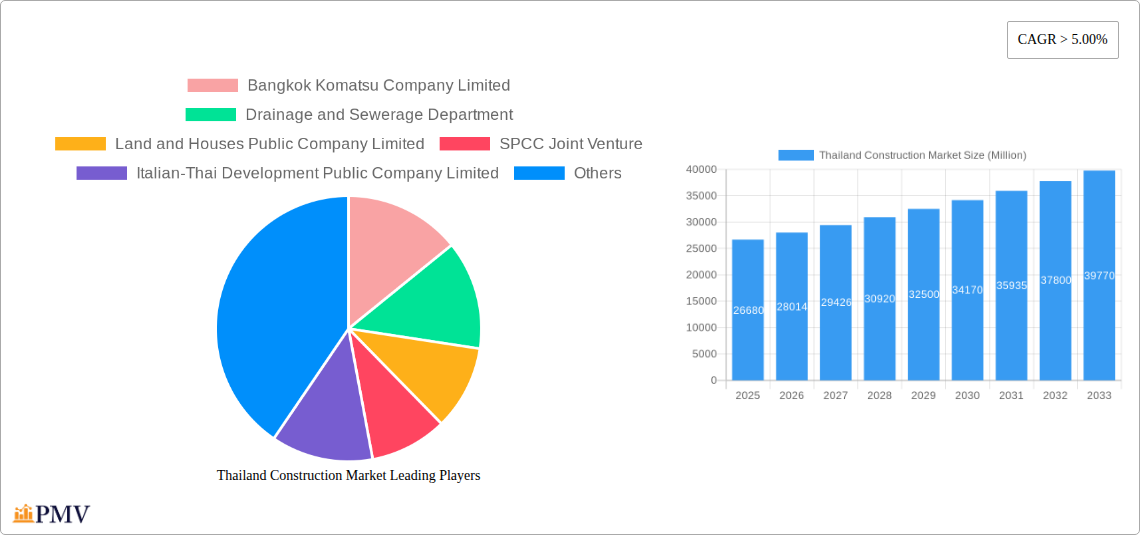

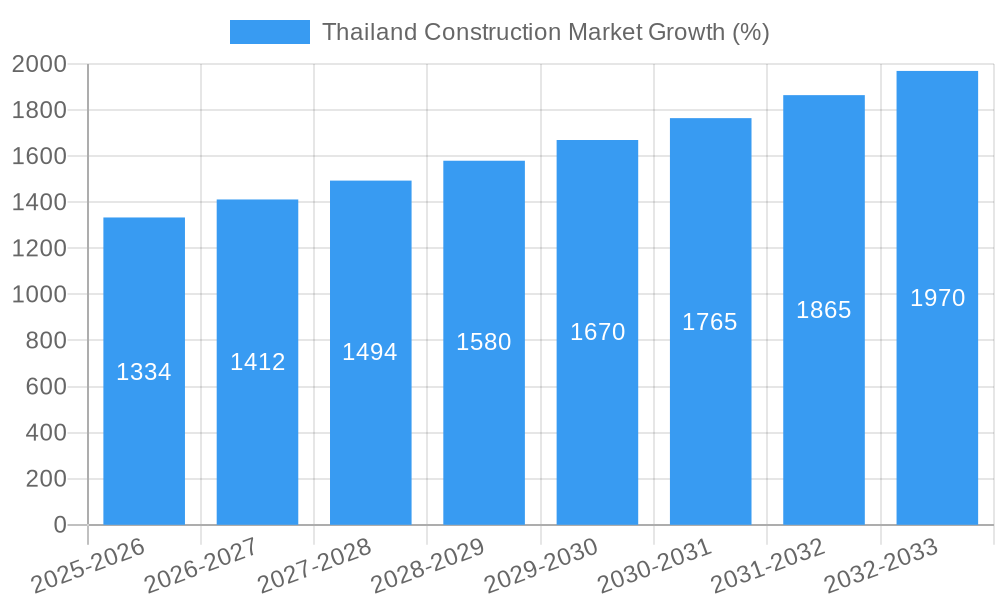

The Thailand construction market, valued at 26.68 billion USD in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 5.00% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, substantial government investment in infrastructure projects, particularly in transportation and energy, is stimulating demand for construction services. Secondly, a burgeoning population and rising urbanization are driving increased residential and commercial construction activity. Furthermore, the tourism sector's recovery post-pandemic is further boosting demand for hospitality and related infrastructure. However, the market faces certain constraints, including potential fluctuations in material costs, skilled labor shortages, and regulatory complexities. The market is segmented by sector (residential, commercial, industrial, infrastructure, energy & utilities) and construction type (new construction, addition, alteration). Major players include Bangkok Komatsu, Drainage and Sewerage Department, Land and Houses Public Company Limited, and several other prominent national and international firms. The strong growth trajectory is expected to continue throughout the forecast period, driven by sustained government spending and private sector investment in various construction projects across the country.

The projected growth of the Thai construction market is underpinned by several long-term trends. The government's commitment to sustainable development initiatives encourages environmentally friendly construction practices and technologies. Moreover, technological advancements in construction methods, such as prefabrication and Building Information Modeling (BIM), are improving efficiency and reducing project timelines. While challenges remain, the market's fundamentals are strong, suggesting a positive outlook. Continued economic growth and a focus on improving infrastructure will likely outweigh the constraints, ensuring consistent expansion of the market in the coming years. Analysis of historical data (2019-2024) indicates a consistent upward trend, supporting the projected CAGR and highlighting the market's resilience. The diverse segments and the presence of both local and international players contribute to the dynamism and competitiveness of the Thai construction sector.

Thailand Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Thailand construction market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, key trends, and future growth projections. The analysis encompasses various market segments, including residential, commercial, industrial, infrastructure (transportation), and energy & utilities, further categorized by construction type: new construction, addition, and alteration. The report features detailed profiles of leading players such as Bangkok Komatsu Company Limited, Drainage and Sewerage Department, Land and Houses Public Company Limited, SPCC Joint Venture, Italian-Thai Development Public Company Limited, CRC Thai Watsadu Limited, SCG International Corporation Company Limited, Caterpillar (Thailand) Limited, Dohome Public Company Limited, and Siam Global House Public Company Limited (list not exhaustive). Expect detailed data on market size (in Millions), CAGR, and market share, enabling informed strategic planning and investment decisions.

Thailand Construction Market Market Structure & Competitive Dynamics

The Thailand construction market exhibits a moderately concentrated structure, with a few large players holding significant market share, while numerous smaller companies compete in niche segments. The market is characterized by a dynamic innovation ecosystem, driven by technological advancements in construction materials and techniques. The regulatory framework, while generally supportive of growth, faces challenges in streamlining approvals and ensuring consistent enforcement. Product substitution is limited, mainly confined to alternative building materials, impacting niche segments. End-user trends increasingly favor sustainable and technologically advanced construction solutions. M&A activity has been moderate in recent years, with deal values averaging approximately xx Million annually. For instance, a significant merger between two mid-sized companies in 2023 resulted in a combined market share of approximately x%. This analysis will delve deeper into the competitive landscape, including detailed analysis of market concentration ratios, and a comprehensive overview of recent mergers and acquisitions.

- Market Concentration: xx% held by top 5 players (2024).

- M&A Activity (2019-2024): Average deal value: xx Million. Number of deals: xx.

- Innovation Ecosystem: Focus on prefabricated construction, green building technologies, and digitalization.

- Regulatory Landscape: Emphasis on infrastructure development and sustainable construction practices.

Thailand Construction Market Industry Trends & Insights

The Thailand construction market is experiencing robust growth, driven by sustained economic expansion, rising urbanization, and government initiatives focused on infrastructure development. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is projected to be xx%, fueled by significant investments in transportation infrastructure and energy projects. Technological disruptions are transforming the industry, with increasing adoption of Building Information Modeling (BIM), prefabrication techniques, and advanced construction machinery. Consumer preferences are shifting towards sustainable and energy-efficient buildings. Competitive dynamics are characterized by fierce rivalry among established players, alongside the emergence of new entrants offering innovative solutions. Market penetration of green building materials is estimated at xx% in 2024, projected to reach xx% by 2033. This detailed section will analyze the impact of these trends, and quantify the contribution of each driver to the market’s growth trajectory.

Dominant Markets & Segments in Thailand Construction Market

The residential sector consistently dominates the Thailand construction market, driven by a growing population and rising disposable incomes. Infrastructure development, particularly transportation projects, represents another significant segment exhibiting rapid expansion. Within the construction types, new construction projects constitute the largest segment, owing to ongoing urbanization and infrastructure expansion.

- Leading Segment (by sector): Residential (xx% market share in 2024)

- Key Drivers (Residential): Increasing urbanization, rising disposable incomes, government housing initiatives.

- Key Drivers (Infrastructure): Government investments in transportation networks (high-speed rail, road expansions), and utility projects.

- Leading Segment (by type): New Construction (xx% market share in 2024)

- Key Drivers (New Construction): Infrastructure projects, real estate development, and rising demand for housing.

Thailand Construction Market Product Innovations

Recent innovations include the increased use of sustainable building materials, such as bamboo and recycled concrete, alongside the widespread adoption of prefabricated construction methods to enhance efficiency and reduce construction timelines. The integration of smart technologies, including IoT-enabled sensors and building management systems, is also gaining traction, improving building performance and occupant comfort. These innovations offer competitive advantages by reducing costs, improving sustainability, and enhancing building performance.

Report Segmentation & Scope

This report segments the Thailand construction market by sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities) and by construction type (New Construction, Addition, Alteration). Each segment's growth projections, market size (in Millions), and competitive dynamics are meticulously analyzed. The residential sector is projected to continue its dominance with a xx Million market size in 2033, while the infrastructure sector is expected to witness significant expansion driven by large-scale government projects. The new construction segment will maintain its largest share, largely due to ongoing urbanization and infrastructure projects.

Key Drivers of Thailand Construction Market Growth

Strong economic growth, government infrastructure investments (particularly in transport and energy), increasing urbanization, and a robust tourism sector are key drivers of the Thailand construction market's expansion. Technological advancements, like prefabrication and BIM, further enhance efficiency and productivity. Supportive government policies and regulatory frameworks also facilitate growth. The Eastern Economic Corridor (EEC) initiative exemplifies this government support, driving considerable investment in infrastructure development.

Challenges in the Thailand Construction Market Sector

The Thailand construction market faces challenges such as labor shortages, rising material costs, and complex regulatory processes impacting project timelines. Supply chain disruptions, particularly during periods of global economic uncertainty, pose additional risks. Increased competition among firms and fluctuating demand also influence market dynamics. These challenges are estimated to reduce annual growth by approximately x% during certain periods.

Leading Players in the Thailand Construction Market Market

- Bangkok Komatsu Company Limited

- Drainage and Sewerage Department

- Land and Houses Public Company Limited

- SPCC Joint Venture

- Italian-Thai Development Public Company Limited

- CRC Thai Watsadu Limited

- SCG International Corporation Company Limited

- Caterpillar (Thailand) Limited

- Dohome Public Company Limited

- Siam Global House Public Company Limited

Key Developments in Thailand Construction Market Sector

- 2022 Q4: Government announces a new infrastructure investment plan, allocating xx Million to transportation projects.

- 2023 Q1: Launch of a new prefabricated building technology by a major construction firm.

- 2023 Q3: Merger of two mid-sized construction companies resulting in a combined market share of x%.

Strategic Thailand Construction Market Market Outlook

The Thailand construction market presents significant long-term growth potential, driven by continuous urbanization, sustained economic growth, and ongoing government investments in infrastructure. Strategic opportunities exist for companies that embrace technological innovation, adopt sustainable construction practices, and effectively navigate the regulatory landscape. Focusing on niche segments, such as green building and smart city development, can offer a competitive edge in this dynamic market. The long-term outlook remains positive, with substantial growth anticipated in the forecast period.

Thailand Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure (Transportation)

- 1.5. Energy and Utilities

-

2. Type

- 2.1. New Construction

- 2.2. Addition

- 2.3. Alteration

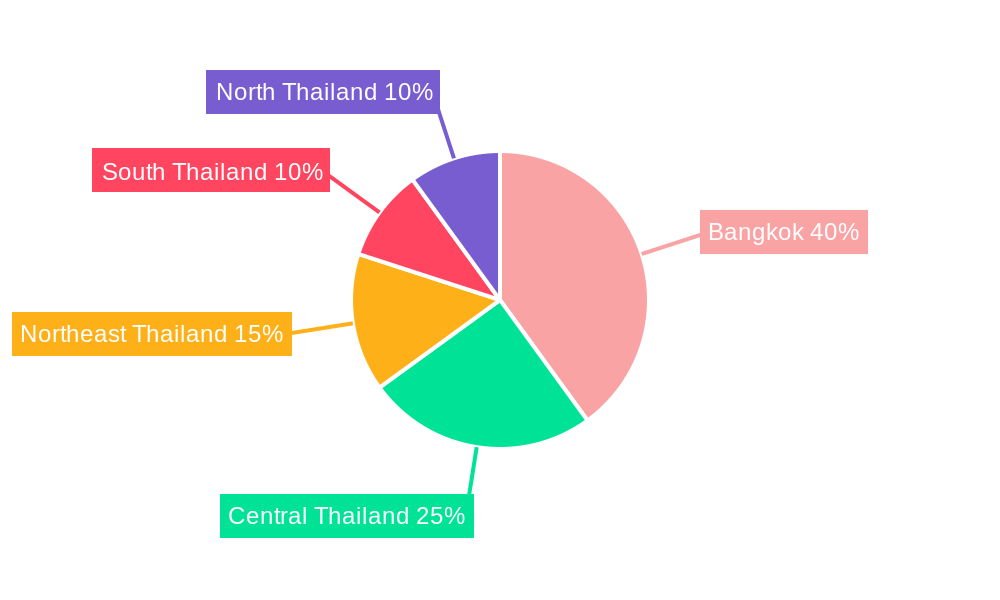

Thailand Construction Market Segmentation By Geography

- 1. Thailand

Thailand Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Thailand was emphasizing renewable energy projects and sustainable construction practices; Thai government was investing in various infrastructure projects to improve connectivity

- 3.2.2 transportation

- 3.3. Market Restrains

- 3.3.1. Construction projects in Thailand often experienced delays and cost overruns due to factors such as unforeseen site conditions; Political and Economic Uncertainty

- 3.4. Market Trends

- 3.4.1. Increase in road infrastructure projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. New Construction

- 5.2.2. Addition

- 5.2.3. Alteration

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bangkok Komatsu Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Drainage and Sewerage Department

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Land and Houses Public Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SPCC Joint Venture

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Italian-Thai Development Public Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CRC Thai Watsadu Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SCG International Corporation Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Caterpillar (Thailand) Limited**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dohome Public Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Siam Global House Public Company Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bangkok Komatsu Company Limited

List of Figures

- Figure 1: Thailand Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Thailand Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Thailand Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Thailand Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Thailand Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Thailand Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 7: Thailand Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Thailand Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Construction Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Thailand Construction Market?

Key companies in the market include Bangkok Komatsu Company Limited, Drainage and Sewerage Department, Land and Houses Public Company Limited, SPCC Joint Venture, Italian-Thai Development Public Company Limited, CRC Thai Watsadu Limited, SCG International Corporation Company Limited, Caterpillar (Thailand) Limited**List Not Exhaustive, Dohome Public Company Limited, Siam Global House Public Company Limited.

3. What are the main segments of the Thailand Construction Market?

The market segments include Sector, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Thailand was emphasizing renewable energy projects and sustainable construction practices; Thai government was investing in various infrastructure projects to improve connectivity. transportation.

6. What are the notable trends driving market growth?

Increase in road infrastructure projects.

7. Are there any restraints impacting market growth?

Construction projects in Thailand often experienced delays and cost overruns due to factors such as unforeseen site conditions; Political and Economic Uncertainty.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Construction Market?

To stay informed about further developments, trends, and reports in the Thailand Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence