Key Insights

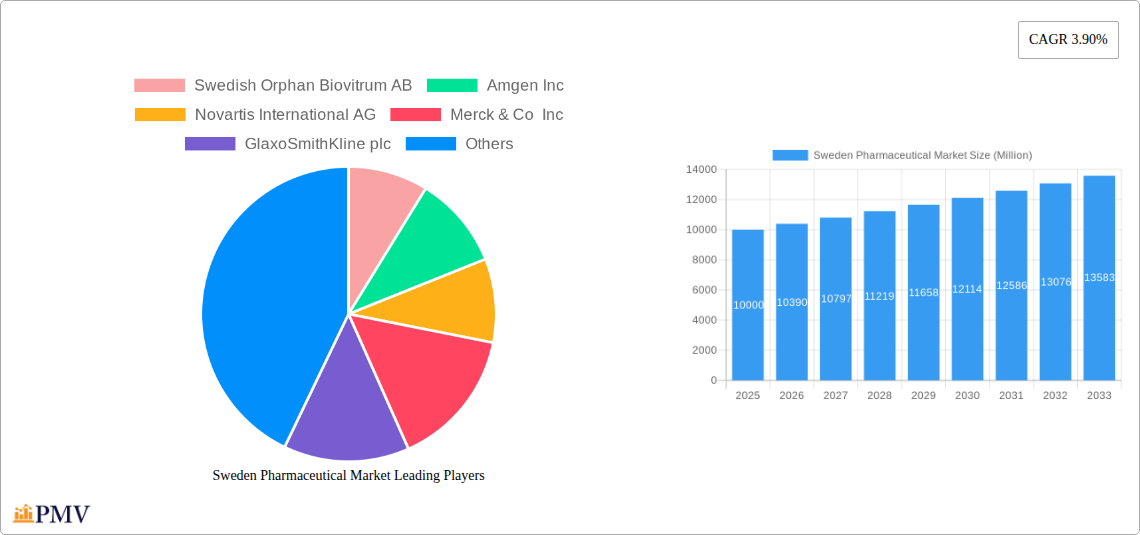

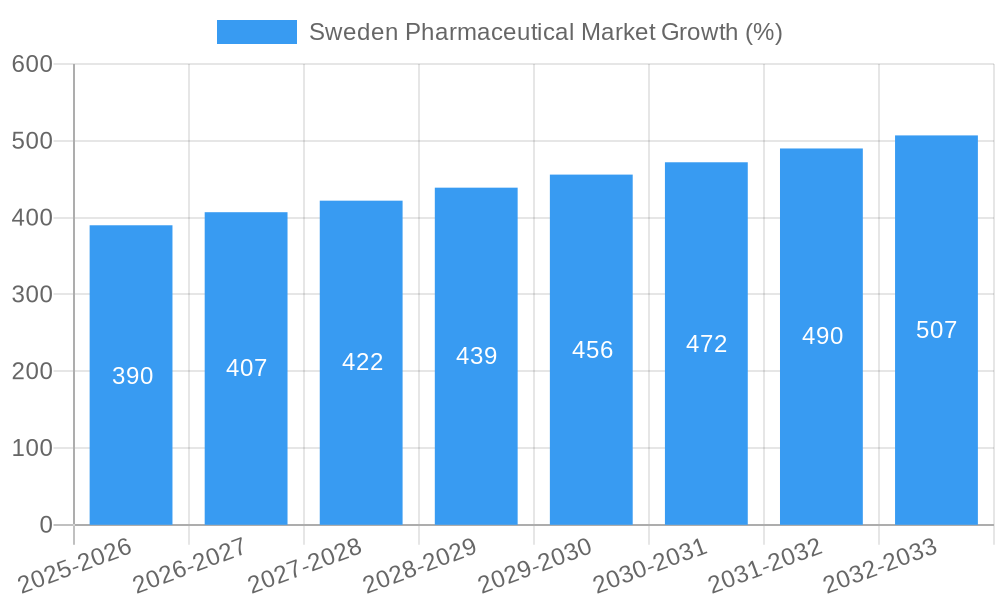

The Swedish pharmaceutical market, valued at approximately SEK 100 billion (assuming a reasonable market size based on a comparable European nation with similar population and healthcare spending) in 2025, is projected to experience steady growth at a compound annual growth rate (CAGR) of 3.90% from 2025 to 2033. This growth is driven by several key factors. An aging population necessitates increased demand for chronic disease treatments, particularly within segments like cardiovascular, metabolic, and neurological disorders. Furthermore, rising healthcare expenditure and increased government initiatives promoting pharmaceutical innovation and accessibility contribute positively to market expansion. The rise of biosimilars and generic drugs presents a significant opportunity for cost optimization within the market, influencing both the branded and generic drug segments. However, stringent regulatory procedures and pricing pressures from the government remain key challenges impacting overall market growth. The market segmentation highlights the significant share held by therapeutic classes targeting digestive organs, blood disorders, and cardiovascular diseases, reflecting the prevalence of these conditions within the Swedish population.

The competitive landscape is characterized by a mix of multinational pharmaceutical giants like AstraZeneca, Pfizer, and Novartis, alongside smaller, specialized companies focusing on niche therapeutic areas. These companies are actively engaging in research and development to bring innovative therapies to market, while simultaneously navigating the complexities of the regulatory environment and competition from generic drug manufacturers. The forecast for the Swedish pharmaceutical market anticipates continued growth, spurred by technological advancements, an increasingly aging population, and sustained investment in healthcare infrastructure. However, proactive management of pricing pressures and the integration of digital health solutions will play a critical role in shaping the market's trajectory over the next decade. Further market segmentation analysis will provide a detailed understanding of growth opportunities within specific therapeutic areas and drug types.

Sweden Pharmaceutical Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Sweden pharmaceutical market, covering market structure, competitive dynamics, industry trends, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, encompassing the historical period from 2019 to 2024. This report is essential for pharmaceutical companies, investors, and market researchers seeking to understand and capitalize on opportunities within the dynamic Swedish pharmaceutical landscape. The report's value is xx Million.

Sweden Pharmaceutical Market Market Structure & Competitive Dynamics

The Swedish pharmaceutical market exhibits a moderately concentrated structure, with several multinational pharmaceutical giants alongside smaller domestic players. The market’s competitive dynamics are shaped by factors including stringent regulatory frameworks enforced by the Swedish Medical Products Agency (MPA), a robust innovation ecosystem fostered through collaborations between academia and industry, and a growing demand for innovative therapies. Product substitution, driven by generic drug penetration and the emergence of biosimilars, significantly influences market dynamics. End-user trends, characterized by an aging population and rising prevalence of chronic diseases, are key growth drivers. Mergers and acquisitions (M&A) activities play a crucial role in shaping the competitive landscape. While precise M&A deal values for the Swedish market are difficult to publicly source in a consolidated manner, the number of deals in the last five years indicates significant activity within the sector with an estimated xx Million in total deal value. Key players' market share fluctuates based on product launches and regulatory approvals. For example, AstraZeneca plc and Swedish Orphan Biovitrum AB consistently hold notable market shares, but competition is fierce, with other major players consistently vying for prominence.

Sweden Pharmaceutical Market Industry Trends & Insights

The Swedish pharmaceutical market exhibits robust growth, driven by factors such as increased healthcare expenditure, a rising prevalence of chronic diseases (e.g., cardiovascular diseases, diabetes, cancer), and an aging population. Technological advancements, particularly in biopharmaceuticals, personalized medicine, and digital health, are revolutionizing drug development and delivery. Consumer preferences are shifting towards more convenient, targeted therapies, and greater patient empowerment. The market is witnessing increased competition, with both established players and emerging biotech companies vying for market share. The compound annual growth rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, indicating substantial market expansion. Market penetration for innovative drugs varies considerably based on the therapeutic area, but overall penetration rates demonstrate a healthy rate of growth. The regulatory landscape is evolving, focusing on greater transparency, and cost-effectiveness, which will continuously influence the market dynamics. The influence of these trends is further analyzed with the use of Porter's five forces model, indicating strong competitive rivalry, and relatively high bargaining power of buyers given Sweden's universal healthcare system.

Dominant Markets & Segments in Sweden Pharmaceutical Market

By ATC/Therapeutic Class: The segments exhibiting the most significant market share include Blood and Blood Forming Organs, Nervous System, and Cardiovascular diseases. These areas benefit from high prevalence, strong pipeline activity and consequently higher revenues and market share. Other notable segments are Digestive Organs and Metabolism and Tumors and Disorders of the Immune System, showing consistent growth fuelled by novel therapies and rising disease prevalence.

By Drug Type: Branded drugs currently dominate the market, though the penetration of generic drugs is expected to increase in the coming years, driven by patent expirations. This shift is expected to lead to price competition and influence the market dynamics significantly.

By Prescription Type: Prescription drugs (Rx) represent the largest segment of the market. However, the OTC (over-the-counter) market also shows consistent growth, propelled by consumer preference for self-medication and the rising affordability of OTC products. The growth of the OTC segment is expected to be driven by increased consumer awareness and self-care initiatives.

Sweden Pharmaceutical Market Product Innovations

The Swedish pharmaceutical market is witnessing significant product innovations, primarily in areas like oncology, immunology, and cardiovascular diseases. Technological advancements in areas such as targeted therapies, biosimilars, and gene therapy are contributing to the development of more effective and safer medications. These innovations are driven by the need for better treatment outcomes, reduced side effects, and improved patient adherence. The market shows a healthy appetite for innovation, with multiple new product launches expected within the forecast period.

Report Segmentation & Scope

This report segments the Sweden pharmaceutical market across multiple dimensions:

By ATC/Therapeutic Class: The report provides detailed analysis for each ATC class, covering market size, growth projections, and competitive landscape. Each class will be analysed based on individual disease prevalence, and treatment trends, as well as economic factors that dictate the development and use of medications.

By Drug Type: The report analyzes both branded and generic drugs, highlighting the dynamics of market share, pricing, and competition.

By Prescription Type: The report provides in-depth analysis of the prescription drug (Rx) and over-the-counter (OTC) drug markets.

Growth projections for each segment are provided, with specific consideration of emerging technologies and global market trends.

Key Drivers of Sweden Pharmaceutical Market Growth

Several key factors are driving the growth of the Swedish pharmaceutical market. These include an aging population increasing demand for healthcare services, rising prevalence of chronic diseases leading to increased medication usage, and significant investments in research and development creating innovative therapies. The supportive regulatory environment, coupled with government initiatives aimed at improving healthcare access, further accelerate market growth. Strong economic performance and access to advanced healthcare infrastructure also contribute to the positive market outlook.

Challenges in the Sweden Pharmaceutical Market Sector

The Swedish pharmaceutical market faces challenges such as stringent regulatory approvals lengthening the time-to-market for new drugs, rising healthcare costs affecting medicine affordability, and price pressures from generic drug competition. Supply chain vulnerabilities due to global events have also presented challenges in recent years. The increasing complexity of the healthcare system coupled with potential workforce shortages within the sector also creates significant pressures. These challenges collectively create an unpredictable environment that requires consistent adaptation and innovation to overcome.

Leading Players in the Sweden Pharmaceutical Market Market

- Swedish Orphan Biovitrum AB

- Amgen Inc

- Novartis International AG

- Merck & Co Inc

- GlaxoSmithKline plc

- Eli Lilly and Company

- Life Medical Sweden A

- F Hoffmann-La Roche AG

- AstraZeneca plc

- AbbVie Inc

- Medartuum AB

- InDex Pharmaceuticals Holding AB

- Sanofi S A

- Pfizer Inc

Key Developments in Sweden Pharmaceutical Market Sector

July 2022: The European Union approved a drug developed by AstraZeneca and Daiichi Sankyo for treating aggressive HER2-positive breast cancer. This approval significantly expanded treatment options and boosted AstraZeneca's market position within the oncology segment.

January 2022: Annexin Pharmaceuticals AB initiated a clinical trial for ANXV in hospitalized COVID-19 patients. This development highlighted the ongoing efforts to develop innovative treatments for infectious diseases.

Strategic Sweden Pharmaceutical Market Market Outlook

The Swedish pharmaceutical market presents substantial growth opportunities driven by a confluence of factors, including increasing healthcare spending, innovative drug development, and a supportive regulatory environment. Strategic partnerships, investment in research and development, and a focus on personalized medicine and digital health will be crucial for success. The focus on enhancing supply chain resilience and navigating pricing pressures will also shape the strategic landscape of the coming decade. The market's future growth potential is substantial, particularly in areas like oncology, immunology, and chronic disease management.

Sweden Pharmaceutical Market Segmentation

-

1. ATC/Therapeutic Class

- 1.1. Digestive orgnas and metabolism

- 1.2. Blood and Blood Forming Organs

- 1.3. Heart and Circulation

- 1.4. Skin Preparation

- 1.5. Urinary and Genital Organs and Sex Hormones

- 1.6. Systemic

- 1.7. Antiinfectives For Systemic Use

- 1.8. Tumors and Disorder of Immune System

- 1.9. Musculo-Skeletal System

- 1.10. Nervous System

- 1.11. Antipara

- 1.12. Respiratory System

- 1.13. Sensory Organs

- 1.14. Others

-

2. Drug Type

- 2.1. Branded

- 2.2. Generic

-

3. Prescription Type

- 3.1. Prescription Drugs (Rx)

- 3.2. OTC Drugs

Sweden Pharmaceutical Market Segmentation By Geography

- 1. Sweden

Sweden Pharmaceutical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Geriatric Population; Rising Incidence of Chronic Disease

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Scenario

- 3.4. Market Trends

- 3.4.1. Prescription Drugs segment Holds the Largest Share and Expected to do Same in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Pharmaceutical Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 5.1.1. Digestive orgnas and metabolism

- 5.1.2. Blood and Blood Forming Organs

- 5.1.3. Heart and Circulation

- 5.1.4. Skin Preparation

- 5.1.5. Urinary and Genital Organs and Sex Hormones

- 5.1.6. Systemic

- 5.1.7. Antiinfectives For Systemic Use

- 5.1.8. Tumors and Disorder of Immune System

- 5.1.9. Musculo-Skeletal System

- 5.1.10. Nervous System

- 5.1.11. Antipara

- 5.1.12. Respiratory System

- 5.1.13. Sensory Organs

- 5.1.14. Others

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. Branded

- 5.2.2. Generic

- 5.3. Market Analysis, Insights and Forecast - by Prescription Type

- 5.3.1. Prescription Drugs (Rx)

- 5.3.2. OTC Drugs

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Swedish Orphan Biovitrum AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amgen Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novartis International AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Merck & Co Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GlaxoSmithKline plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eli Lilly and Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Life Medical Sweden A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 F Hoffmann-La Roche AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AstraZeneca plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AbbVie Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Medartuum AB

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 InDex Pharmaceuticals Holding AB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sanofi S A

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Pfizer Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Swedish Orphan Biovitrum AB

List of Figures

- Figure 1: Sweden Pharmaceutical Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Pharmaceutical Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Pharmaceutical Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Pharmaceutical Market Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 3: Sweden Pharmaceutical Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 4: Sweden Pharmaceutical Market Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 5: Sweden Pharmaceutical Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Sweden Pharmaceutical Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Sweden Pharmaceutical Market Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 8: Sweden Pharmaceutical Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 9: Sweden Pharmaceutical Market Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 10: Sweden Pharmaceutical Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Pharmaceutical Market?

The projected CAGR is approximately 3.90%.

2. Which companies are prominent players in the Sweden Pharmaceutical Market?

Key companies in the market include Swedish Orphan Biovitrum AB, Amgen Inc, Novartis International AG, Merck & Co Inc, GlaxoSmithKline plc, Eli Lilly and Company, Life Medical Sweden A, F Hoffmann-La Roche AG, AstraZeneca plc, AbbVie Inc, Medartuum AB, InDex Pharmaceuticals Holding AB, Sanofi S A, Pfizer Inc.

3. What are the main segments of the Sweden Pharmaceutical Market?

The market segments include ATC/Therapeutic Class, Drug Type, Prescription Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Geriatric Population; Rising Incidence of Chronic Disease.

6. What are the notable trends driving market growth?

Prescription Drugs segment Holds the Largest Share and Expected to do Same in the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Scenario.

8. Can you provide examples of recent developments in the market?

In July 2022, The European Union approved a drug developed by British-Swedish pharmaceutical company AstraZeneca and Japanese Daiichi Sankyo to treat an aggressive form of breast cancer. The drug was approved for the treatment of patients with unresectable or metastatic HER2-positive breast cancer who have received one or more prior anti-HER2-based regimens

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Pharmaceutical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Pharmaceutical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Pharmaceutical Market?

To stay informed about further developments, trends, and reports in the Sweden Pharmaceutical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence