Key Insights

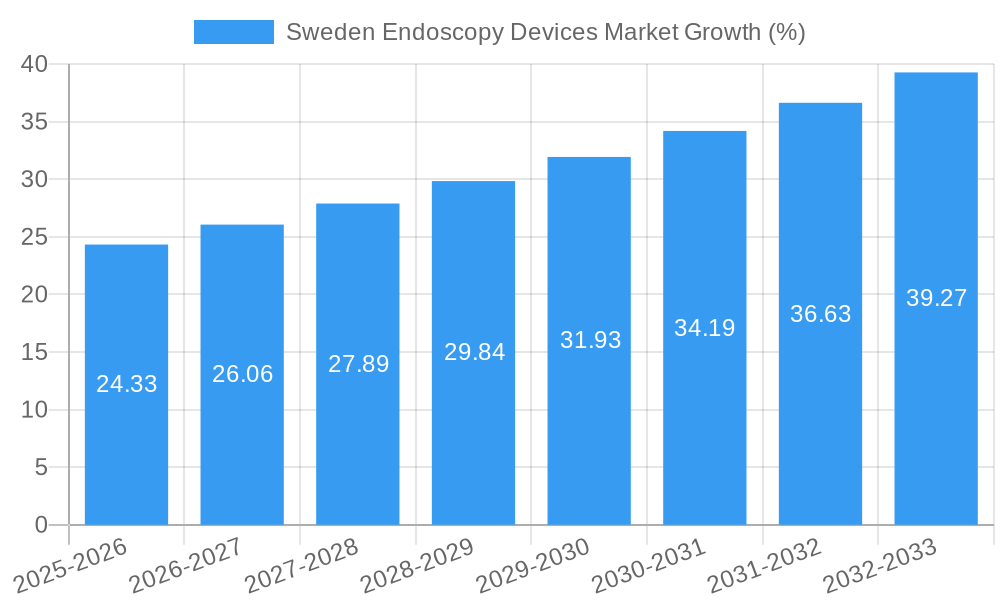

The Sweden endoscopy devices market, valued at €355.34 million in 2025, is projected to experience robust growth, driven by a rising prevalence of chronic diseases requiring minimally invasive procedures, an aging population necessitating increased diagnostic and therapeutic interventions, and ongoing technological advancements leading to improved device efficacy and safety. The market's Compound Annual Growth Rate (CAGR) of 6.84% from 2025 to 2033 indicates substantial expansion opportunities. Key segments driving this growth include endoscopes (flexible and rigid), endoscopic operative devices (e.g., staplers, clips, retrieval devices), and visualization equipment (e.g., high-definition cameras, monitors). The application segment is diverse, encompassing gastroenterology, pulmonology, orthopedic surgery, cardiology, ENT surgery, gynecology, and neurology, reflecting the versatility of endoscopy in various medical specialties. Growth is expected to be particularly strong within gastroenterology and pulmonology due to the increasing incidence of gastrointestinal and respiratory disorders.

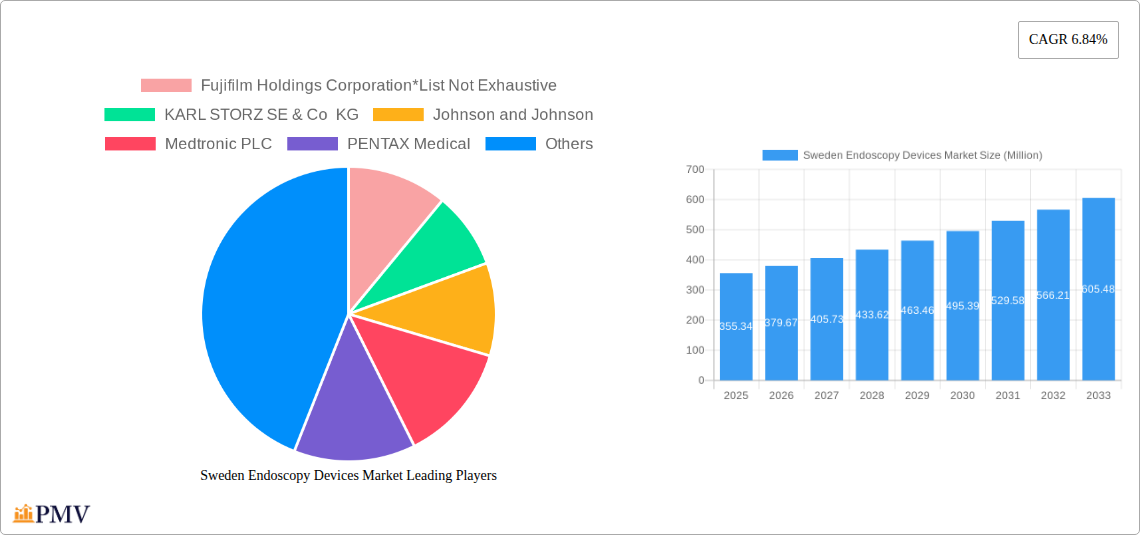

While the market shows considerable promise, challenges exist. These include high device costs, stringent regulatory approvals, and the need for skilled medical professionals to operate advanced endoscopic equipment. However, ongoing investments in healthcare infrastructure and the adoption of advanced visualization technologies are mitigating these constraints. Leading companies like Fujifilm Holdings Corporation, KARL STORZ SE & Co KG, Johnson & Johnson, Medtronic PLC, PENTAX Medical, Richard Wolf GmbH, and Boston Scientific Corporation are actively shaping market dynamics through product innovation, strategic partnerships, and expansion into new application areas. The continued focus on minimally invasive procedures and improved patient outcomes will be pivotal in propelling the growth of the Sweden endoscopy devices market over the forecast period.

Sweden Endoscopy Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Sweden endoscopy devices market, offering valuable insights into market structure, competitive dynamics, industry trends, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The report meticulously segments the market by device type (Endoscopes, Endoscopic Operative Devices, Visualization Equipment) and application (Gastroenterology, Pulmonology, Orthopedic Surgery, Cardiology, ENT Surgery, Gynecology, Neurology, Other Applications), offering granular data and forecasts for each segment. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Sweden Endoscopy Devices Market Market Structure & Competitive Dynamics

The Sweden endoscopy devices market exhibits a moderately concentrated structure, with key players holding significant market share. The market is characterized by intense competition driven by technological advancements, product innovation, and strategic mergers and acquisitions (M&A). Regulatory frameworks, including those set by the Swedish Medical Products Agency (MPA), play a crucial role in shaping market dynamics. The presence of substitute technologies, such as advanced imaging techniques, poses a moderate competitive threat. End-user trends, such as a growing preference for minimally invasive procedures, are driving market growth. Recent M&A activities have involved both large multinational corporations and smaller specialized companies, with deal values ranging from xx Million to xx Million in recent years.

- Market Concentration: High, with top 5 players holding approximately xx% of market share in 2025.

- Innovation Ecosystem: Active, driven by continuous R&D investments and collaborations among device manufacturers, healthcare providers, and research institutions.

- Regulatory Framework: Stringent, with emphasis on safety and efficacy, governed primarily by the Swedish Medical Products Agency (MPA).

- Product Substitutes: Moderate competitive threat from alternative diagnostic and therapeutic techniques.

- End-User Trends: Increasing preference for minimally invasive procedures fuels market growth.

- M&A Activity: Moderate activity with deal values ranging from xx Million to xx Million in recent years.

Sweden Endoscopy Devices Market Industry Trends & Insights

The Sweden endoscopy devices market is experiencing robust growth driven by several key factors. The aging population, rising prevalence of chronic diseases necessitating endoscopic procedures, and technological advancements leading to improved device efficacy and safety are key growth drivers. The market is witnessing a shift towards advanced endoscopy technologies, including high-definition imaging, robotic-assisted procedures, and single-use endoscopes. Consumer preferences are increasingly favoring minimally invasive and less traumatic procedures, which boosts demand for advanced endoscopy devices. The competitive landscape is dynamic, with companies continuously striving to innovate and expand their product portfolios. The market penetration of advanced endoscopy devices is steadily increasing, projected to reach xx% by 2033.

The market is characterized by increasing adoption of digital technologies and data management, enhanced connectivity, and integration with Electronic Health Records (EHR). This trend enhances efficiency and outcomes of endoscopic procedures. The CAGR for the market during the forecast period is estimated at xx%.

Dominant Markets & Segments in Sweden Endoscopy Devices Market

The Gastroenterology segment dominates the Sweden endoscopy devices market, driven by the high prevalence of gastrointestinal disorders and increasing adoption of minimally invasive procedures. The Endoscopes segment holds the largest share within the device type category, reflecting the fundamental role of endoscopes in various endoscopic procedures. The leading region within Sweden is expected to be the urban centers, due to the concentration of hospitals and specialized medical facilities.

- Key Drivers for Gastroenterology Segment Dominance:

- High prevalence of gastrointestinal diseases.

- Increased awareness and early diagnosis.

- Adoption of advanced endoscopic techniques.

- Key Drivers for Endoscopes Segment Dominance:

- Essential tool for most endoscopic procedures.

- Technological advancements leading to improved image quality and functionality.

- Growing demand from hospitals and clinics.

The Pulmonology segment exhibits significant growth potential due to the rising incidence of respiratory diseases and the need for minimally invasive diagnostic and therapeutic interventions. Orthopedic surgery is expected to show steady growth, driven by the increasing number of joint replacement surgeries and arthroscopic procedures.

Sweden Endoscopy Devices Market Product Innovations

Recent product innovations focus on enhanced image quality, improved ergonomics, and integration of advanced technologies such as artificial intelligence (AI) for image analysis and robotic assistance. Single-use endoscopes are gaining traction, offering advantages in terms of infection control and cost-effectiveness. These innovations aim to improve procedural outcomes, reduce complications, and enhance the overall patient experience. The market is also seeing integration of advanced visualization capabilities and improved workflow efficiency through digital connectivity and data management.

Report Segmentation & Scope

This report segments the Sweden endoscopy devices market by both type of device and application:

By Type of Device:

- Endoscopes: This segment is projected to grow at a CAGR of xx% during the forecast period, driven by technological advancements and increasing demand for minimally invasive procedures. Competition is high in this segment, with major players vying for market share.

- Endoscopic Operative Devices: This segment is expected to witness substantial growth driven by the rising adoption of minimally invasive surgical techniques. Market players are focusing on developing innovative tools for precise and efficient procedures.

- Visualization Equipment: This segment is experiencing growth due to the ongoing demand for improved image quality and sophisticated visualization capabilities. The increasing integration of AI-powered image analysis is further boosting the segment's growth.

By Application:

Each application segment is analyzed in detail, considering the prevalence of relevant diseases, technological trends, and regulatory landscape. Market growth projections, sizes, and competitive dynamics are provided for each segment.

Key Drivers of Sweden Endoscopy Devices Market Growth

The Sweden endoscopy devices market is propelled by several factors, including the aging population, increased prevalence of chronic diseases requiring endoscopic procedures, and technological advancements leading to safer and more effective devices. Government initiatives promoting minimally invasive surgeries and increasing healthcare expenditure also contribute to market expansion. Moreover, the rising adoption of advanced imaging technologies such as high-definition endoscopy and improved digital connectivity within healthcare infrastructure accelerate market growth.

Challenges in the Sweden Endoscopy Devices Market Sector

Challenges facing the Sweden endoscopy devices market include stringent regulatory approvals, high device costs limiting accessibility, and potential supply chain disruptions. Competition among established players and the emergence of new entrants also present challenges. The reimbursement policies for endoscopic procedures can impact market access and affordability.

Leading Players in the Sweden Endoscopy Devices Market Market

- Fujifilm Holdings Corporation

- KARL STORZ SE & Co KG

- Johnson and Johnson

- Medtronic PLC

- PENTAX Medical

- Richard Wolf GmbH

- Boston Scientific Corporation

Key Developments in Sweden Endoscopy Devices Market Sector

- June 2022: Getinge released an updated version of the ED-Flow automated endoscope reprocessor, enhancing digital connectivity and data management, improving uptime and productivity for its customers.

- October 2023: Creo Medical announced plans to launch its Speedboat UltraSlim device in early 2024, following EU regulatory guidance. This launch is expected to impact the market by providing a new minimally invasive device for specific procedures.

Strategic Sweden Endoscopy Devices Market Market Outlook

The Sweden endoscopy devices market holds significant growth potential, driven by the factors mentioned above. Strategic opportunities exist for companies to develop and launch innovative devices addressing unmet clinical needs, focusing on areas like single-use endoscopes, AI-powered image analysis, and improved workflow efficiency through digital connectivity and integration. Companies that effectively navigate regulatory hurdles, manage supply chain risks, and successfully market their products will be best positioned to capture market share and drive future growth.

Sweden Endoscopy Devices Market Segmentation

-

1. Type of Device

- 1.1. Endoscopes

- 1.2. Endoscopic Operative Device

- 1.3. Visualization Equipment

-

2. Application

- 2.1. Gastroenterology

- 2.2. Pulmonology

- 2.3. Orthopedic Surgery

- 2.4. Cardiology

- 2.5. ENT Surgery

- 2.6. Gynecology

- 2.7. Neurology

- 2.8. Other Applications

Sweden Endoscopy Devices Market Segmentation By Geography

- 1. Sweden

Sweden Endoscopy Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Endoscopy for Treatment and Diagnosis; Growing Preference for Minimally-invasive Surgeries; Technological Advancements Leading to Enhanced Applications

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Technicians; Infections Caused by Few Endoscopes

- 3.4. Market Trends

- 3.4.1. Visualization Equipment Segment is Expected to Witness a Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Endoscopy Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Endoscopes

- 5.1.2. Endoscopic Operative Device

- 5.1.3. Visualization Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gastroenterology

- 5.2.2. Pulmonology

- 5.2.3. Orthopedic Surgery

- 5.2.4. Cardiology

- 5.2.5. ENT Surgery

- 5.2.6. Gynecology

- 5.2.7. Neurology

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Fujifilm Holdings Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KARL STORZ SE & Co KG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson and Johnson

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Medtronic PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PENTAX Medical

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Richard Wolf GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boston Scientific Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Fujifilm Holdings Corporation*List Not Exhaustive

List of Figures

- Figure 1: Sweden Endoscopy Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Endoscopy Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Endoscopy Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Endoscopy Devices Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 3: Sweden Endoscopy Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Sweden Endoscopy Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Sweden Endoscopy Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Sweden Endoscopy Devices Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 7: Sweden Endoscopy Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Sweden Endoscopy Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Endoscopy Devices Market?

The projected CAGR is approximately 6.84%.

2. Which companies are prominent players in the Sweden Endoscopy Devices Market?

Key companies in the market include Fujifilm Holdings Corporation*List Not Exhaustive, KARL STORZ SE & Co KG, Johnson and Johnson, Medtronic PLC, PENTAX Medical, Richard Wolf GmbH, Boston Scientific Corporation.

3. What are the main segments of the Sweden Endoscopy Devices Market?

The market segments include Type of Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 355.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Endoscopy for Treatment and Diagnosis; Growing Preference for Minimally-invasive Surgeries; Technological Advancements Leading to Enhanced Applications.

6. What are the notable trends driving market growth?

Visualization Equipment Segment is Expected to Witness a Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Skilled Technicians; Infections Caused by Few Endoscopes.

8. Can you provide examples of recent developments in the market?

October 2023: Creo Medical planned to launch its Speedboat UltraSlim device, in early 2024 following guidance from the EU regulator.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Endoscopy Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Endoscopy Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Endoscopy Devices Market?

To stay informed about further developments, trends, and reports in the Sweden Endoscopy Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence