Key Insights

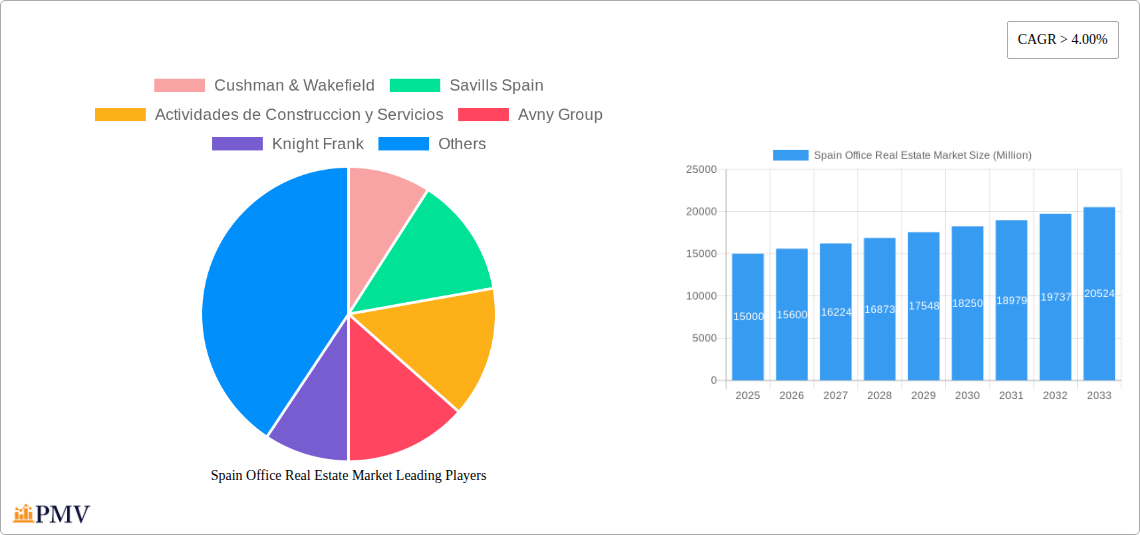

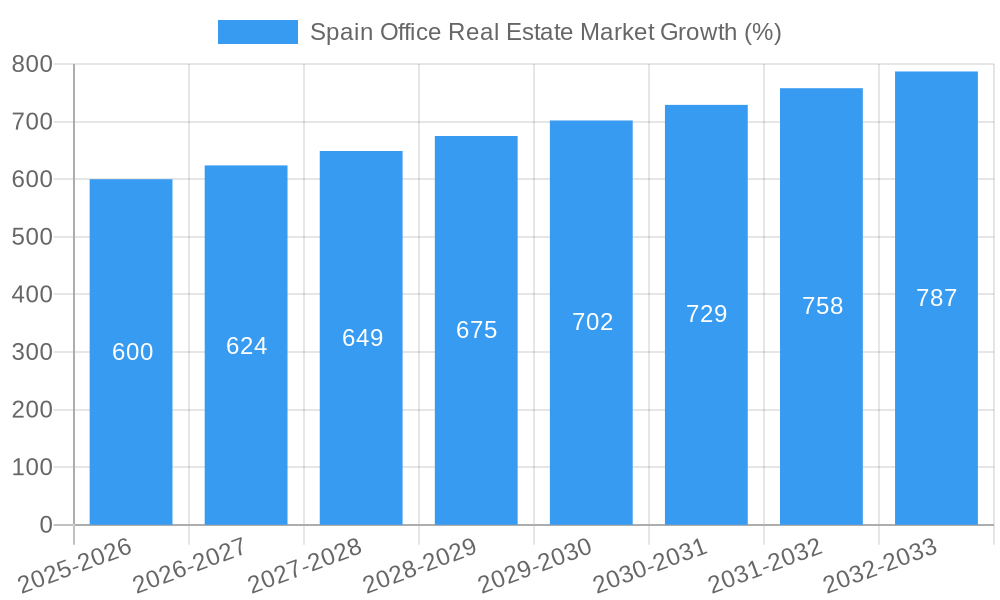

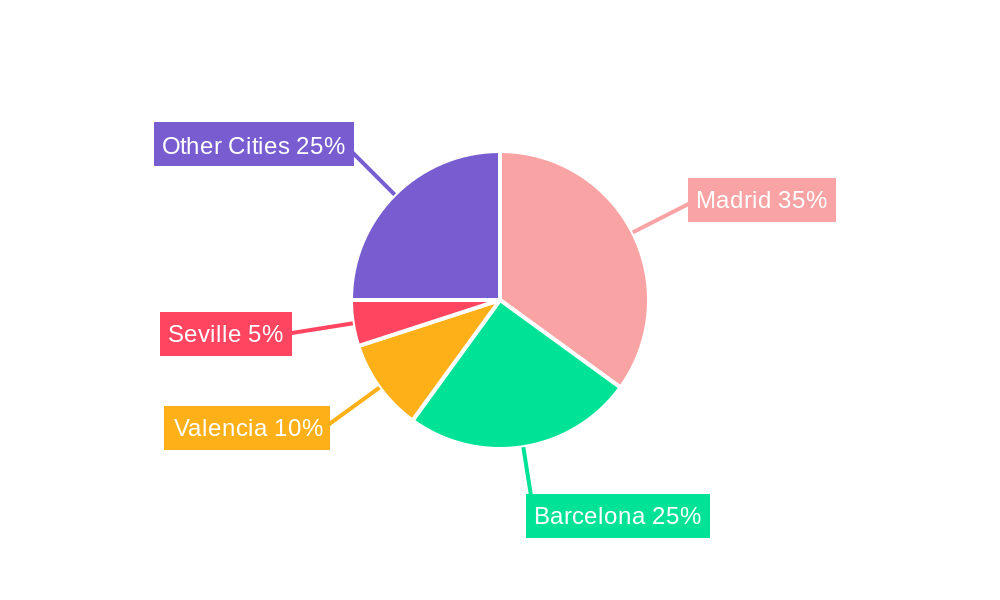

The Spain office real estate market exhibits robust growth potential, driven by a strengthening economy, increasing urbanization, and a burgeoning technology sector. The market's compound annual growth rate (CAGR) exceeding 4% indicates a consistently expanding market size, projected to reach significant value over the forecast period (2025-2033). Key cities like Madrid, Barcelona, Valencia, and Seville are the primary drivers of this growth, attracting both domestic and international investment. The presence of established global players like Cushman & Wakefield, Savills Spain, and CBRE Spain, alongside prominent local firms, signifies a competitive yet dynamic market landscape. While potential restraints like economic fluctuations and shifts in global investment patterns exist, the long-term outlook remains positive, fueled by ongoing infrastructure development and government initiatives promoting economic diversification. The market segmentation by key cities allows for targeted investment strategies, focusing on areas with the highest growth potential and optimal risk-adjusted returns. The historical period (2019-2024) likely showed varying performance levels, reflecting global economic trends and national policies, providing a valuable benchmark for the current projections.

The sustained growth trajectory is anticipated to continue, fueled by factors such as increasing demand for modern, sustainable office spaces, a growing population in urban centers, and the expansion of various industries. Foreign direct investment (FDI) plays a significant role, particularly in major cities. The market is further segmented by building class, with premium and Grade A spaces commanding higher rental rates and attracting significant investment. However, challenges include maintaining a balance between supply and demand, ensuring adequate infrastructure to support expansion, and managing potential environmental concerns related to new construction. Strategic partnerships and technological advancements in property management will likely play a key role in optimizing market performance and maintaining investor confidence in the coming years.

Spain Office Real Estate Market: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Spain office real estate market, offering invaluable insights for investors, developers, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report utilizes robust data and expert analysis to illuminate current market dynamics and future trends. The study period, 2019-2024, provides a historical context for accurate projections. Key segments analyzed include Madrid, Barcelona, Valencia, Seville, and other cities. Major players like Cushman & Wakefield, Savills Spain, and CBRE Spain are profiled, providing a complete picture of this dynamic market. The total market size is predicted to reach xx Million by 2033.

Spain Office Real Estate Market Structure & Competitive Dynamics

The Spanish office real estate market exhibits a moderately concentrated structure, with a few major players holding significant market share. Cushman & Wakefield, Savills Spain, and CBRE Spain command a substantial portion, estimated at a combined xx% in 2025. However, a number of regional and specialized firms contribute to a competitive landscape. Innovation within the sector is driven by technological advancements in building management, smart office solutions, and flexible workspace models. The regulatory framework, while generally supportive of real estate investment, undergoes periodic changes affecting development and investment. Product substitutes, such as co-working spaces and remote work arrangements, present a growing challenge. End-user trends favor sustainable, technologically advanced, and flexible office spaces, influencing both demand and supply. M&A activity in the period 2019-2024 involved xx deals, totaling approximately xx Million in value, indicating a consolidated market with strategic acquisitions driving growth.

- Market Concentration: Moderately concentrated, with top three players holding xx% market share in 2025.

- Innovation Ecosystems: Focus on smart building technologies and flexible workspaces.

- Regulatory Frameworks: Generally supportive, with ongoing revisions impacting development.

- M&A Activity (2019-2024): xx deals totaling approximately xx Million.

Spain Office Real Estate Market Industry Trends & Insights

The Spanish office real estate market is experiencing a period of significant transformation, driven by several key trends. Post-pandemic shifts in work patterns, a growing preference for flexible workspaces, and increasing demand for sustainable buildings are shaping the sector. The Compound Annual Growth Rate (CAGR) is projected to be xx% from 2025 to 2033, fueled by economic growth and increasing foreign investment. Technological disruptions, including the adoption of smart building technologies and the rise of PropTech firms, are enhancing efficiency and creating new business models. Consumer preferences are shifting towards high-quality, sustainable, and amenity-rich office spaces in prime locations. Competitive dynamics are intensifying, with firms vying for market share through innovation, strategic partnerships, and acquisitions. Market penetration of flexible workspace solutions is expected to reach xx% by 2033.

Dominant Markets & Segments in Spain Office Real Estate Market

Madrid remains the dominant market within Spain's office real estate sector, commanding the largest share of investment and development activity. Its robust economy, highly skilled workforce, and established infrastructure contribute to its dominance. Barcelona holds a strong second position, driven by its vibrant tech scene and tourism sector. Valencia and Seville are experiencing growth, though at a slower pace. "Other Cities" represent a diverse market with localized dynamics.

- Madrid: Key drivers include robust economy, skilled workforce, and established infrastructure.

- Barcelona: Strong tech scene and tourism sector fuel growth.

- Valencia & Seville: Experiencing growth, but at a slower rate than Madrid and Barcelona.

- Other Cities: Diverse market with localized dynamics.

Spain Office Real Estate Market Product Innovations

Recent innovations in the Spanish office real estate market include the integration of smart building technologies, the rise of flexible workspace solutions offering customizable lease terms and shared amenities, and an increased focus on sustainable building practices incorporating green technologies to minimize environmental impact and enhance energy efficiency. These innovations improve tenant experience and attract businesses prioritizing sustainability and flexibility, enhancing their competitive advantage in a dynamic market.

Report Segmentation & Scope

This report segments the Spain office real estate market by key cities:

- Madrid: Projected growth of xx% from 2025 to 2033, with a market size of xx Million in 2025. Competitive dynamics are intense, with a concentration of major players.

- Barcelona: Projected growth of xx% from 2025 to 2033, with a market size of xx Million in 2025. The market is driven by the tech sector and tourism.

- Valencia: Projected growth of xx% from 2025 to 2033, with a market size of xx Million in 2025. The market is characterized by a mix of local and national players.

- Seville: Projected growth of xx% from 2025 to 2033, with a market size of xx Million in 2025. Growth is moderate, driven by tourism and regional economic development.

- Other Cities: A diverse market with localized dynamics and varying growth projections.

Key Drivers of Spain Office Real Estate Market Growth

Several factors are driving growth in Spain's office real estate market: a recovering economy, increasing foreign investment, a growing preference for flexible workspaces, and ongoing urbanization. Government initiatives promoting sustainable development and technological advancements within the sector further contribute to expansion. The influx of technology companies and the growing importance of co-working spaces also stimulate demand.

Challenges in the Spain Office Real Estate Market Sector

The market faces challenges, including economic uncertainty impacting investment decisions, potential oversupply in some segments, and competition from alternative workspace solutions. Regulatory hurdles and rising construction costs also present difficulties. The increasing popularity of remote work poses a potential threat to traditional office space demand. These factors can lead to price fluctuations and impact overall market growth.

Leading Players in the Spain Office Real Estate Market Market

- Cushman & Wakefield

- Savills Spain

- Actividades de Construccion y Servicios

- Avny Group

- Knight Frank

- Fomento de Construcciones y Contratas

- Obrascon Huarte Lain

- CBRE Spain

- Dragados S A

Key Developments in Spain Office Real Estate Market Sector

- March 2022: Meta announced a new 2,000-staff Meta Lab in Madrid, boosting demand for flexible office space and supporting local tech start-ups.

- February 2023: limehome, a hospitality technology provider, signed a lease for 82 flats in Bremen's Balgequartier, signifying a shift toward mixed-use developments incorporating office space. (Note: While this development is in Bremen, Germany, not Spain, it is included as an example of a relevant industry trend.)

Strategic Spain Office Real Estate Market Outlook

The Spanish office real estate market presents a promising outlook, with continued growth anticipated in the coming years. Strategic opportunities exist in developing sustainable, technologically advanced, and flexible office spaces to cater to evolving end-user preferences. Investing in prime locations with strong infrastructure and focusing on innovation will be crucial for success in this dynamic market. The increasing demand for high-quality spaces and the ongoing urbanization trend present significant growth potential for investors and developers who adapt to the changing market landscape.

Spain Office Real Estate Market Segmentation

-

1. Key Cities

- 1.1. Madrid

- 1.2. Barcelona

- 1.3. Valencia

- 1.4. Seville

- 1.5. Other Cities

Spain Office Real Estate Market Segmentation By Geography

- 1. Spain

Spain Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Office Take-up Remains Strong in Spain

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Madrid

- 5.1.2. Barcelona

- 5.1.3. Valencia

- 5.1.4. Seville

- 5.1.5. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cushman & Wakefield

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Savills Spain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Actividades de Construccion y Servicios

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Avny Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Knight Frank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fomento de Construcciones y Contratas

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Obrascon Huarte Lain

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CBRE Spain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dragados S A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Cushman & Wakefield

List of Figures

- Figure 1: Spain Office Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Office Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Spain Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Office Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 3: Spain Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Spain Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Spain Office Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 6: Spain Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Office Real Estate Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Spain Office Real Estate Market?

Key companies in the market include Cushman & Wakefield, Savills Spain, Actividades de Construccion y Servicios, Avny Group, Knight Frank, Fomento de Construcciones y Contratas, Obrascon Huarte Lain, CBRE Spain, Dragados S A.

3. What are the main segments of the Spain Office Real Estate Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Office Take-up Remains Strong in Spain.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

Feb 2023: Hospitality technology provider and apartment operator, limehome, has signed 82 flats in the Balgequartier district of Bremen. The Balgequartier, a new inner-city district along Langenstraße, is currently being developed by Joh. Jacobs and Co. Four buildings of the mixed-use development will house shops and office space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Spain Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence