Key Insights

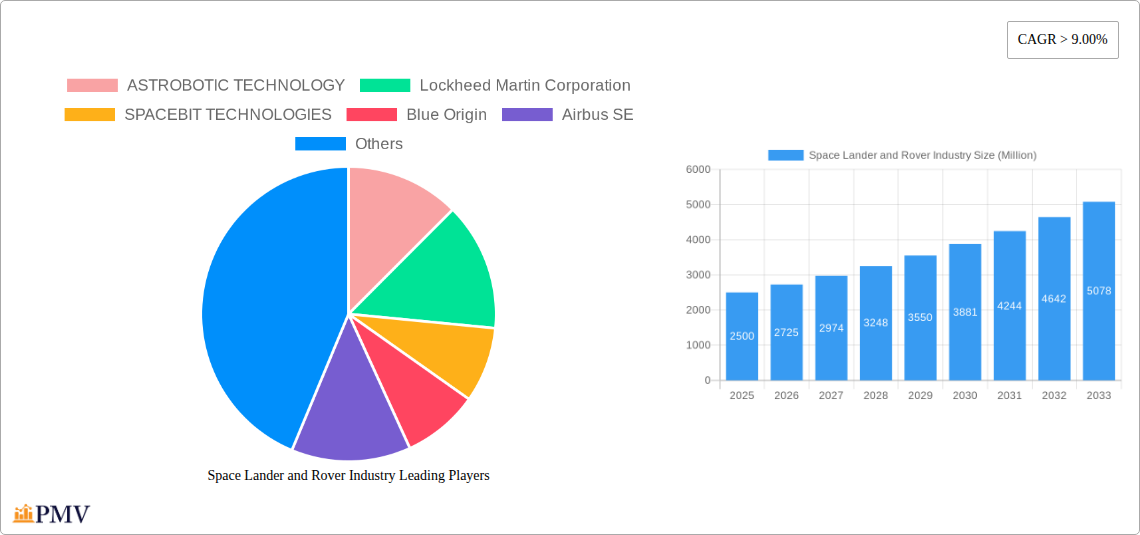

The global space lander and rover market is experiencing robust growth, projected to exceed a value of $XX million by 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 9% through 2033. This expansion is driven by several key factors. Increased governmental and private investment in space exploration programs, particularly focused on lunar and Martian missions, is a significant catalyst. Furthermore, advancements in robotics, autonomous navigation, and miniaturization technologies are enabling the development of more sophisticated and cost-effective landers and rovers capable of performing complex scientific tasks. The growing demand for in-situ resource utilization (ISRU) technologies, aiming to utilize resources found on other celestial bodies, further fuels market growth. Competition among both established aerospace giants and emerging space technology companies is fostering innovation and accelerating the development of new lander and rover capabilities. The market is segmented into lunar, Martian, and asteroid surface exploration, with lunar exploration currently dominating but Martian exploration rapidly gaining traction as ambitious missions are planned and launched.

Space Lander and Rover Industry Market Size (In Billion)

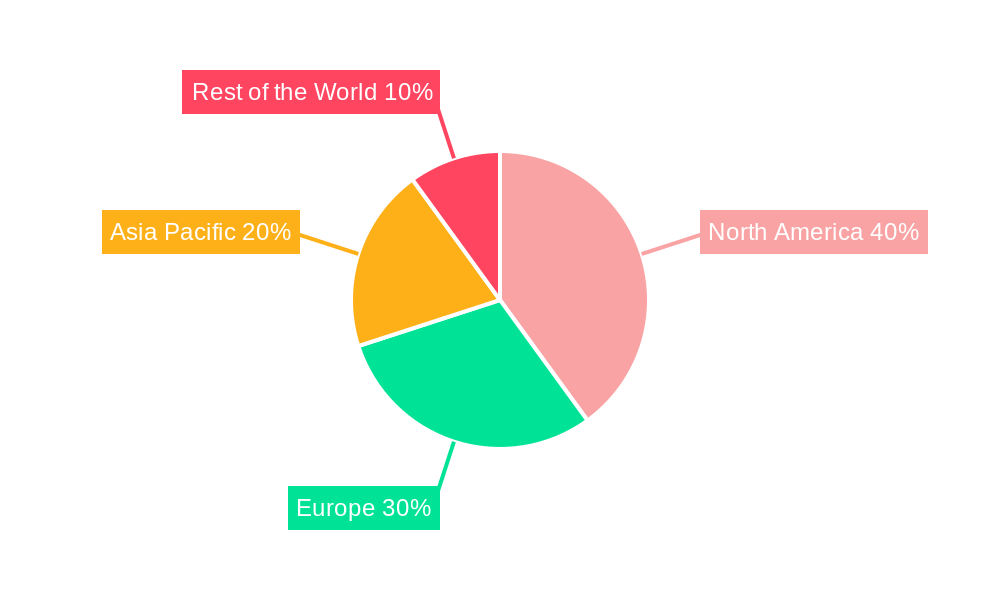

The market's growth trajectory, however, isn't without challenges. High development and launch costs remain a significant restraint, limiting widespread participation. Technological complexities, particularly related to landing on and operating on challenging terrains, pose hurdles. Regulatory frameworks and international collaborations, essential for successful space missions, also impact market dynamics. Despite these challenges, the long-term outlook for the space lander and rover market remains highly positive, driven by the enduring human desire for space exploration, the potential for scientific discovery, and the emerging possibilities presented by resource utilization in space. North America and Europe currently hold significant market shares, however the Asia-Pacific region is poised for substantial growth in the coming years as national space programs expand.

Space Lander and Rover Industry Company Market Share

Space Lander and Rover Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Space Lander and Rover industry, projecting a market value exceeding xx Million by 2033. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report is crucial for stakeholders seeking to understand market dynamics, technological advancements, and future growth opportunities within this rapidly evolving sector.

Space Lander and Rover Industry Market Structure & Competitive Dynamics

The space lander and rover industry exhibits a moderately concentrated market structure, with key players like Lockheed Martin Corporation, Northrop Grumman Corporation, and Airbus SE holding significant market share. However, the emergence of innovative startups such as ASTROBOTIC TECHNOLOGY and ispace inc. is intensifying competition. The industry is characterized by a complex interplay of government agencies (NASA, ESA, JAXA, ISRO, Roscosmos, Canadian Space Agency), private companies, and research institutions, fostering a dynamic innovation ecosystem. Regulatory frameworks, primarily driven by national space programs and international treaties, significantly influence market access and operations. While direct substitutes are limited, the industry faces indirect competition from alternative exploration technologies. End-user trends, particularly increased focus on lunar and Martian exploration, are driving substantial growth. M&A activity has been moderate, with deal values ranging from tens of Millions to hundreds of Millions USD, reflecting strategic consolidation efforts within the sector. Examples include the Lockheed Martin and General Motors collaboration (see Key Developments).

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- M&A Deal Values: Average deal value: xx Million USD (2019-2024). Highest deal value: xx Million USD.

- Innovation Ecosystems: Strong collaboration between government agencies, private companies, and research institutions.

- Regulatory Frameworks: Primarily driven by national space programs and international treaties.

Space Lander and Rover Industry Industry Trends & Insights

The space lander and rover market is experiencing robust growth, fueled by several key trends. Increased government investments in space exploration programs, particularly focusing on lunar and Martian missions, are a primary growth driver. The development of reusable launch vehicles and advancements in robotics and autonomous navigation technologies are reducing costs and improving mission efficiency. Consumer preferences, increasingly driven by public interest in space exploration, further amplify demand for innovative and cost-effective solutions. Competitive dynamics are characterized by intense innovation and collaboration, with companies focusing on developing unique capabilities and strategic partnerships. The market is projected to experience a compound annual growth rate (CAGR) of xx% from 2025 to 2033, with market penetration in key segments expected to reach xx% by 2033. Technological disruptions, such as advancements in AI and machine learning, are reshaping mission design and operational capabilities. The increasing demand for smaller, more agile rovers for specialized tasks like sample collection and scientific analysis is also noteworthy.

Dominant Markets & Segments in Space Lander and Rover Industry

The Lunar Surface Exploration segment currently dominates the space lander and rover market, driven by the renewed focus on lunar missions. The United States holds a leading position, followed by China and several European nations.

- Key Drivers for Lunar Surface Exploration Dominance:

- Significant government investment in lunar programs (e.g., Artemis program).

- Abundant resources and scientific potential of the Moon.

- Development of advanced lunar landing technologies.

- Establishment of lunar bases as a stepping stone for further deep-space exploration.

The Mars Surface Exploration segment is exhibiting significant growth potential, spurred by the ongoing pursuit of manned missions and the increased interest in finding evidence of past or present life. The Asteroids Surface Exploration segment is smaller but growing, fueled by scientific interest in asteroid composition and resource utilization opportunities.

Space Lander and Rover Industry Product Innovations

Recent advancements in space lander and rover technology include improved propulsion systems, autonomous navigation capabilities, advanced scientific instruments, and enhanced durability for extreme environments. These innovations are enabling more ambitious and complex exploration missions. Miniaturization of components and the use of lightweight materials are improving payload capacity and fuel efficiency, expanding mission possibilities. The market is witnessing a rise in specialized rovers designed for specific tasks, such as sample collection, surface analysis, and construction support. This focus on specialized functionalities significantly improves the operational efficiency and scientific output of future exploration missions.

Report Segmentation & Scope

This report segments the space lander and rover market by type:

Lunar Surface Exploration: This segment comprises landers and rovers designed for lunar missions. It is projected to witness substantial growth due to increased government funding and private investment in lunar exploration. The segment is characterized by fierce competition among both established aerospace companies and emerging players. Market size in 2025 is estimated at xx Million USD.

Mars Surface Exploration: This segment includes landers and rovers capable of operating on the Martian surface. Growth is driven by ongoing NASA missions and international collaborations. The segment's competitive landscape is dominated by a few large aerospace contractors. Market size in 2025 is estimated at xx Million USD.

Asteroids Surface Exploration: This emerging segment encompasses technology for exploring and potentially exploiting asteroids. While currently smaller than lunar and Martian exploration, its growth potential is high due to interest in asteroid mining and scientific investigation. Market size in 2025 is estimated at xx Million USD.

Key Drivers of Space Lander and Rover Industry Growth

Several key factors drive the growth of the space lander and rover industry: Increased government funding for space exploration programs (e.g., Artemis program, Mars exploration initiatives), advancements in robotics and AI, enabling greater autonomy and efficiency, falling launch costs due to reusable launch systems, and growing commercial interest in space resources. The demand for advanced scientific instruments and greater mission complexity further fuels the sector's expansion.

Challenges in the Space Lander and Rover Industry Sector

The space lander and rover industry faces several challenges: The high cost of development and deployment, the harsh and unpredictable nature of space environments, and the stringent regulatory requirements for space operations. Supply chain complexities and the need for reliable and durable components also present significant hurdles. Intense competition and the need for constant technological innovation to maintain a competitive edge are further challenges.

Leading Players in the Space Lander and Rover Industry Market

- ASTROBOTIC TECHNOLOGY

- Lockheed Martin Corporation

- SPACEBIT TECHNOLOGIES

- Blue Origin

- Airbus SE

- Canadian Space Agency

- ISRO

- National Aeronautics and Space Administration

- Roscosmos

- ispace inc

- Japanese Aerospace Exploration Agency (JAXA)

- Northrop Grumman Corporation

- China Academy of Space Technology

Key Developments in Space Lander and Rover Industry Sector

- May 2021: Lockheed Martin partnered with General Motors to design next-generation lunar rovers.

- March 2021: NASA awarded Northrop Grumman a contract (USD 60.2 Million - 84.5 Million potential value) for Mars Ascent Vehicle (MAV) propulsion systems and controls.

Strategic Space Lander and Rover Industry Market Outlook

The future of the space lander and rover industry is bright, driven by increasing demand for lunar and Martian exploration, the potential for asteroid resource utilization, and continuous technological advancements. Strategic opportunities lie in developing innovative technologies, forging strategic partnerships, and capitalizing on the growing commercial space sector. The market is poised for significant expansion, creating substantial opportunities for companies that can innovate and adapt to the evolving needs of space exploration.

Space Lander and Rover Industry Segmentation

-

1. Type

- 1.1. Lunar Surface Exploration

- 1.2. Mars Surface Exploration

- 1.3. Asteroids Surface Exploration

Space Lander and Rover Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Space Lander and Rover Industry Regional Market Share

Geographic Coverage of Space Lander and Rover Industry

Space Lander and Rover Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growing Focus On Space Exploration Driving the Demand for Landers and Rovers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lunar Surface Exploration

- 5.1.2. Mars Surface Exploration

- 5.1.3. Asteroids Surface Exploration

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lunar Surface Exploration

- 6.1.2. Mars Surface Exploration

- 6.1.3. Asteroids Surface Exploration

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lunar Surface Exploration

- 7.1.2. Mars Surface Exploration

- 7.1.3. Asteroids Surface Exploration

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lunar Surface Exploration

- 8.1.2. Mars Surface Exploration

- 8.1.3. Asteroids Surface Exploration

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Space Lander and Rover Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lunar Surface Exploration

- 9.1.2. Mars Surface Exploration

- 9.1.3. Asteroids Surface Exploration

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ASTROBOTIC TECHNOLOGY

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lockheed Martin Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SPACEBIT TECHNOLOGIES

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Blue Origin

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Airbus SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Canadian Space Agency

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ISRO

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 National Aeronautics and Space Administration

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Roscosmos

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ispace inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Japanese Aerospace Exploration Agency (JAXA)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Northrop Grumman Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 China Academy of Space Technology

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 ASTROBOTIC TECHNOLOGY

List of Figures

- Figure 1: Global Space Lander and Rover Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Space Lander and Rover Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Rest of the World Space Lander and Rover Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Rest of the World Space Lander and Rover Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Space Lander and Rover Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Space Lander and Rover Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Space Lander and Rover Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Space Lander and Rover Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Space Lander and Rover Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the Space Lander and Rover Industry?

Key companies in the market include ASTROBOTIC TECHNOLOGY, Lockheed Martin Corporation, SPACEBIT TECHNOLOGIES, Blue Origin, Airbus SE, Canadian Space Agency, ISRO, National Aeronautics and Space Administration, Roscosmos, ispace inc, Japanese Aerospace Exploration Agency (JAXA), Northrop Grumman Corporation, China Academy of Space Technology.

3. What are the main segments of the Space Lander and Rover Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growing Focus On Space Exploration Driving the Demand for Landers and Rovers.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2021, Lockheed Martin announced that it has teamed up with General Motors to design the next generation of lunar rovers, capable of transporting astronauts across farther distances on the lunar surface.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Space Lander and Rover Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Space Lander and Rover Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Space Lander and Rover Industry?

To stay informed about further developments, trends, and reports in the Space Lander and Rover Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence