Key Insights

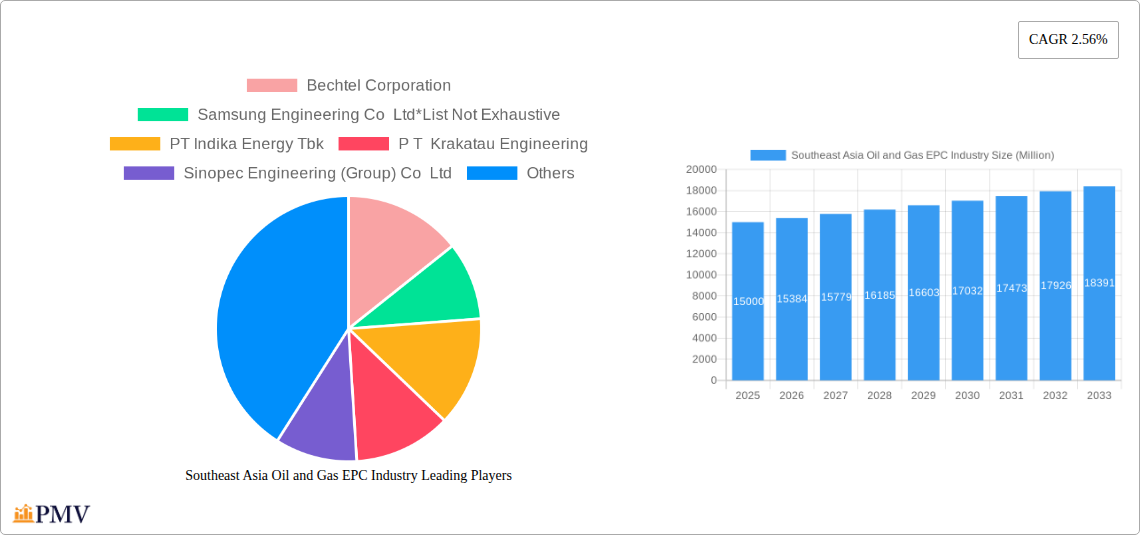

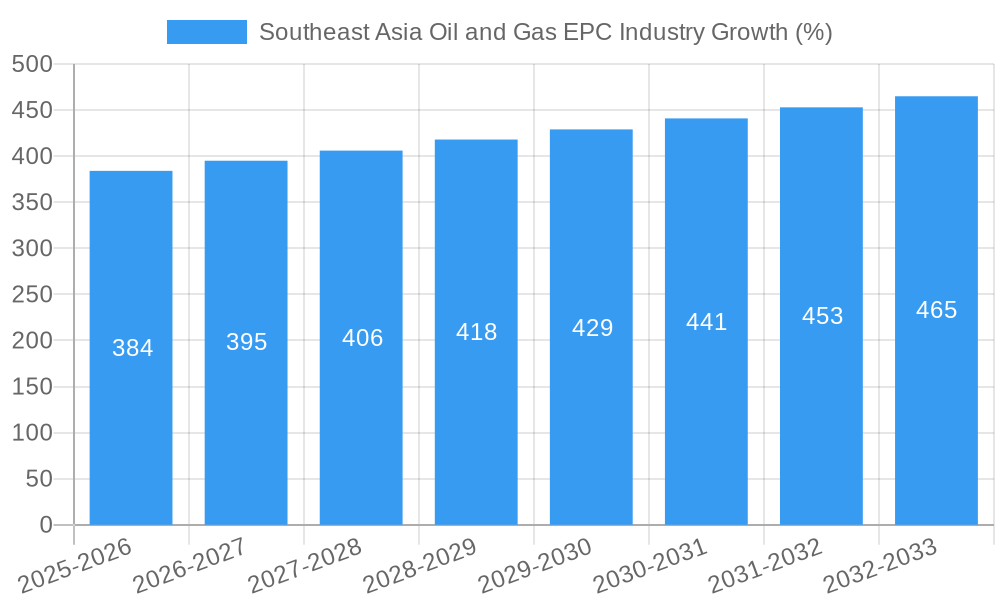

The Southeast Asia Oil and Gas Engineering, Procurement, and Construction (EPC) industry is experiencing moderate growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 2.56% from 2025 to 2033. While precise market sizing for Southeast Asia is unavailable, extrapolating from global trends and considering the region's significant energy demand and infrastructure development, we can estimate the 2025 market value to be approximately $15 billion. Key drivers include rising energy consumption fueled by economic growth in countries like Indonesia, Vietnam, and the Philippines, coupled with government initiatives to improve energy infrastructure and enhance energy security. The upstream sector, encompassing exploration and production, is expected to be a significant contributor to this growth, driven by ongoing investments in new oil and gas fields and expansion of existing facilities. However, the industry faces constraints such as fluctuating oil prices, environmental regulations tightening around carbon emissions, and competition from renewable energy sources. The midstream and downstream segments (processing and distribution) will also see growth, albeit potentially at a slightly slower pace, as companies focus on optimizing existing infrastructure and enhancing efficiency. Major players like Bechtel, Samsung Engineering, and several Indonesian EPC firms, are expected to maintain a significant market presence due to their experience and established regional networks. The Asia-Pacific region, with its substantial energy needs, is a key focus area for these companies, making countries within Southeast Asia attractive locations for both investment and project execution.

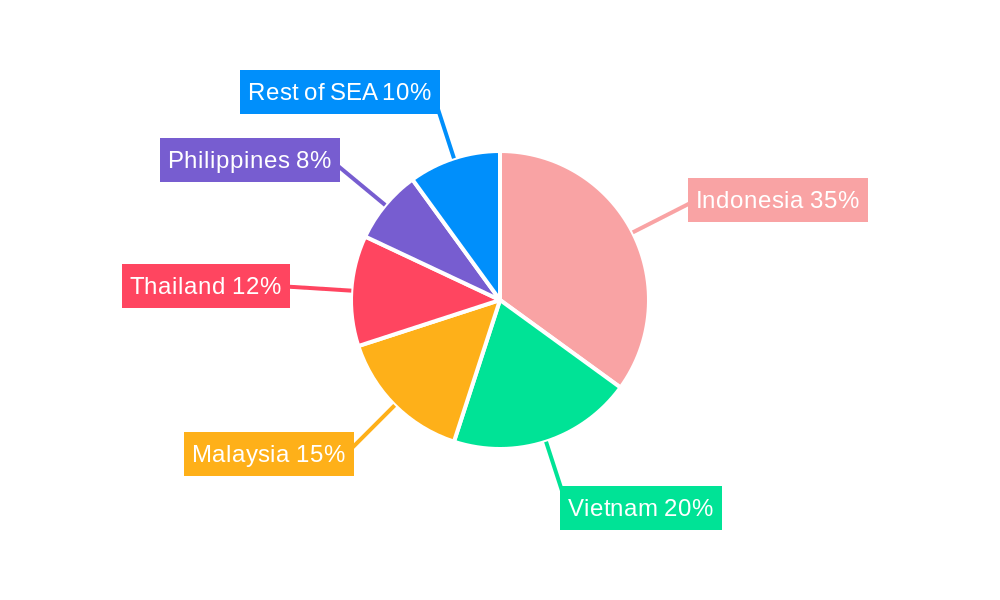

This growth is anticipated to be regionally diverse, with countries like Indonesia and Vietnam potentially leading in terms of project volume and value. The competitive landscape is characterized by both international EPC giants and regional players vying for contracts. This necessitates a strategic approach to project management, cost optimization, and compliance with environmental regulations. Focus areas include the development of innovative technologies to enhance efficiency, reduce environmental impact, and address the challenges posed by fluctuating commodity prices. The future of the Southeast Asia Oil and Gas EPC industry is inextricably linked to the region's energy needs and policy direction, emphasizing the importance of ongoing analysis of government regulations and investment trends. Success will depend upon a flexible and adaptable approach to project execution and leveraging local expertise and partnerships.

Southeast Asia Oil & Gas EPC Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Southeast Asia Oil & Gas Engineering, Procurement, and Construction (EPC) industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report dissects market trends, competitive dynamics, and future growth potential.

Southeast Asia Oil & Gas EPC Industry Market Structure & Competitive Dynamics

The Southeast Asian Oil & Gas EPC market exhibits a moderately concentrated structure, with a few large multinational players and several regional players competing for market share. Market concentration is influenced by project size, geographical location, and client relationships. Innovation ecosystems are developing, with increased focus on digitalization and sustainable technologies. Regulatory frameworks vary across countries, impacting project timelines and costs. Product substitutes are limited, although renewable energy sources pose a long-term threat. End-user trends are shifting towards cleaner energy solutions and enhanced environmental sustainability. M&A activity has been relatively moderate in recent years, with deal values fluctuating based on market conditions.

- Market Share: Dominant players hold approximately xx% of the market share, with the remaining share distributed among smaller companies.

- M&A Deal Values: Recent years have seen M&A deals ranging from USD xx Million to USD xx Million, driven by strategic expansion and consolidation efforts. This value has shown an increase of xx% in the past five years.

Southeast Asia Oil & Gas EPC Industry Industry Trends & Insights

The Southeast Asia Oil & Gas EPC industry is experiencing dynamic shifts influenced by factors such as rising energy demand, evolving energy policies, and technological advancements. The market is driven by continuous investments in upstream, midstream, and downstream projects across the region. Technological disruption is evident in the adoption of digitalization, automation, and advanced materials, improving efficiency and safety. However, consumer preferences are shifting towards cleaner and more sustainable energy sources, necessitating adaptation and innovation within the industry. Competitive dynamics are intensifying, with companies focused on cost optimization, technological differentiation, and securing project pipelines. The Compound Annual Growth Rate (CAGR) for the forecast period is estimated at xx%, with market penetration expected to reach xx% by 2033.

Dominant Markets & Segments in Southeast Asia Oil & Gas EPC Industry

Indonesia and Malaysia are the dominant markets in the Southeast Asia Oil & Gas EPC sector due to their extensive reserves and ongoing investments in oil and gas infrastructure. Upstream projects, such as exploration and production, represent a significant segment, while downstream activities, including refining and petrochemicals, also contribute substantially. The Midstream sector, comprising pipelines and storage, is also a key area of growth.

- Key Drivers in Indonesia: Favorable government policies, abundant resources, and substantial investment in infrastructure development are propelling growth.

- Key Drivers in Malaysia: Mature oil and gas industry, existing infrastructure, and skilled workforce contribute to its dominance.

- Upstream Segment Dominance: Driven by ongoing exploration activities and field development projects, generating significant demand for EPC services.

The dominance of these markets and segments is expected to continue in the forecast period, with potential for further growth in Vietnam and Thailand.

Southeast Asia Oil & Gas EPC Industry Product Innovations

The industry is witnessing significant product innovations, driven by the need to enhance efficiency, safety, and sustainability. Advanced technologies like digital twins, AI-powered predictive maintenance, and modular construction are gaining traction. These innovations improve project delivery timelines, reduce operational costs, and enhance the environmental footprint of oil and gas operations. The market fit for these innovations is strong, due to their ability to address major challenges faced by the industry.

Report Segmentation & Scope

This report segments the Southeast Asia Oil & Gas EPC market across three key sectors: Upstream, Midstream, and Downstream.

Upstream: This segment covers exploration, drilling, and production activities. Growth projections for the Upstream segment are pegged at xx% CAGR, with market size reaching USD xx Million by 2033. The competitive landscape is characterized by both international and local players vying for large projects.

Midstream: This segment encompasses pipelines, storage, and transportation. The Midstream segment is projected to exhibit xx% CAGR, reaching a market size of USD xx Million by 2033, driven by increased demand for efficient and reliable transportation solutions.

Downstream: This segment focuses on refining, petrochemicals, and marketing. Growth in this segment is expected to be driven by the need for enhanced processing capacity and the production of value-added products, with a projected CAGR of xx% and market size of USD xx Million by 2033.

Key Drivers of Southeast Asia Oil & Gas EPC Industry Growth

Several factors fuel the growth of the Southeast Asia Oil & Gas EPC industry. Strong economic growth in the region stimulates energy demand, requiring expansion of existing and development of new oil and gas infrastructure. Government support, through favorable policies and investment initiatives, drives significant capital expenditure. Technological advancements in efficiency, safety, and sustainability enhance project viability.

Challenges in the Southeast Asia Oil & Gas EPC Industry Sector

The industry faces challenges, including the volatility of oil and gas prices, impacting project financing and profitability. Geopolitical risks and regulatory uncertainties create operational hurdles. The availability of skilled labor remains an ongoing concern. Supply chain disruptions, exacerbated by global events, pose additional challenges. These factors can lead to project delays and cost overruns, potentially impacting overall market growth.

Leading Players in the Southeast Asia Oil & Gas EPC Industry Market

- Bechtel Corporation

- Samsung Engineering Co Ltd

- PT Indika Energy Tbk

- P T Krakatau Engineering

- Sinopec Engineering (Group) Co Ltd

- PT Barata Indonesia (Persero)

- PT Meindo Elang Indah

- Petrofac Limited

- PT Rekayasa Industri

- Saipem SpA

- Fluor Corporation

- John Wood Group PLC

- PT JGC Indonesia

- TechnipFMC PLC

Key Developments in Southeast Asia Oil & Gas EPC Industry Sector

August 2021: Hyundai Engineering Co. secures a USD 256 Million contract to revamp IRPC Pcl's refinery in Rayong, Thailand, increasing its capacity to produce Euro V standard diesel. This highlights the growing demand for cleaner fuel technologies.

2020: The Indonesia Deepwater Development project, involving Chevron, Pertamina, Eni Indonesia, and Sinopec, commences, focusing on the Gendalo, Gehem, Bangka, and Gandang fields. This signifies significant investment in deepwater exploration and production. The project's scale highlights the increasing complexity of oil and gas projects in the region.

Strategic Southeast Asia Oil & Gas EPC Industry Market Outlook

The Southeast Asia Oil & Gas EPC market is poised for continued growth, driven by increasing energy demand and significant investment in infrastructure development. Strategic opportunities exist in the adoption of innovative technologies, focusing on sustainability, and pursuing partnerships to leverage expertise and resources. Companies that successfully navigate the challenges of regulatory changes, supply chain disruptions, and geopolitical uncertainties will be well-positioned to capitalize on this market's potential.

Southeast Asia Oil and Gas EPC Industry Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

-

2. Geography

- 2.1. Indonesia

- 2.2. Malaysia

- 2.3. Thailand

- 2.4. Rest of Southeast Asia

Southeast Asia Oil and Gas EPC Industry Segmentation By Geography

- 1. Indonesia

- 2. Malaysia

- 3. Thailand

- 4. Rest of Southeast Asia

Southeast Asia Oil and Gas EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. The Downstream Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Indonesia

- 5.2.2. Malaysia

- 5.2.3. Thailand

- 5.2.4. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.3.2. Malaysia

- 5.3.3. Thailand

- 5.3.4. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Indonesia Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Indonesia

- 6.2.2. Malaysia

- 6.2.3. Thailand

- 6.2.4. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Malaysia Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Indonesia

- 7.2.2. Malaysia

- 7.2.3. Thailand

- 7.2.4. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Thailand Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Indonesia

- 8.2.2. Malaysia

- 8.2.3. Thailand

- 8.2.4. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Rest of Southeast Asia Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Indonesia

- 9.2.2. Malaysia

- 9.2.3. Thailand

- 9.2.4. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. China Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 11. Japan Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 12. India Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 15. Australia Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Southeast Asia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Bechtel Corporation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Samsung Engineering Co Ltd*List Not Exhaustive

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 PT Indika Energy Tbk

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 P T Krakatau Engineering

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Sinopec Engineering (Group) Co Ltd

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 PT Barata Indonesia (Persero)

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 PT Meindo Elang Indah

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Petrofac Limited

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 PT Rekayasa Industri

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Saipem SpA

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Fluor Corporation

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 John Wood Group PLC

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 PT JGC Indonesia

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 TechnipFMC PLC

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.1 Bechtel Corporation

List of Figures

- Figure 1: Southeast Asia Oil and Gas EPC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Southeast Asia Oil and Gas EPC Industry Share (%) by Company 2024

List of Tables

- Table 1: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Southeast Asia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 14: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 17: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 20: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 23: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Southeast Asia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Oil and Gas EPC Industry?

The projected CAGR is approximately 2.56%.

2. Which companies are prominent players in the Southeast Asia Oil and Gas EPC Industry?

Key companies in the market include Bechtel Corporation, Samsung Engineering Co Ltd*List Not Exhaustive, PT Indika Energy Tbk, P T Krakatau Engineering, Sinopec Engineering (Group) Co Ltd, PT Barata Indonesia (Persero), PT Meindo Elang Indah, Petrofac Limited, PT Rekayasa Industri, Saipem SpA, Fluor Corporation, John Wood Group PLC, PT JGC Indonesia, TechnipFMC PLC.

3. What are the main segments of the Southeast Asia Oil and Gas EPC Industry?

The market segments include Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

The Downstream Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

In August 2021, Hyundai Engineering Co. won a USD 256 million order from Thailand's third-largest refiner, IRPC Pcl, to revamp its refinery with a total capacity of 215,000 barrels per day in Rayong. Hyundai Engineering Co. has to upgrade its refinery, allowing the Thai integrated petrochemical company to produce cleaner diesel of Euro V standard. The construction started in August 2021, and the refinery is expected to come into operation by 2024 with new facilities such as a Diesel Hydrotreating Unit (DHT) and upgraded existing plants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Oil and Gas EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Oil and Gas EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Oil and Gas EPC Industry?

To stay informed about further developments, trends, and reports in the Southeast Asia Oil and Gas EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence