Key Insights

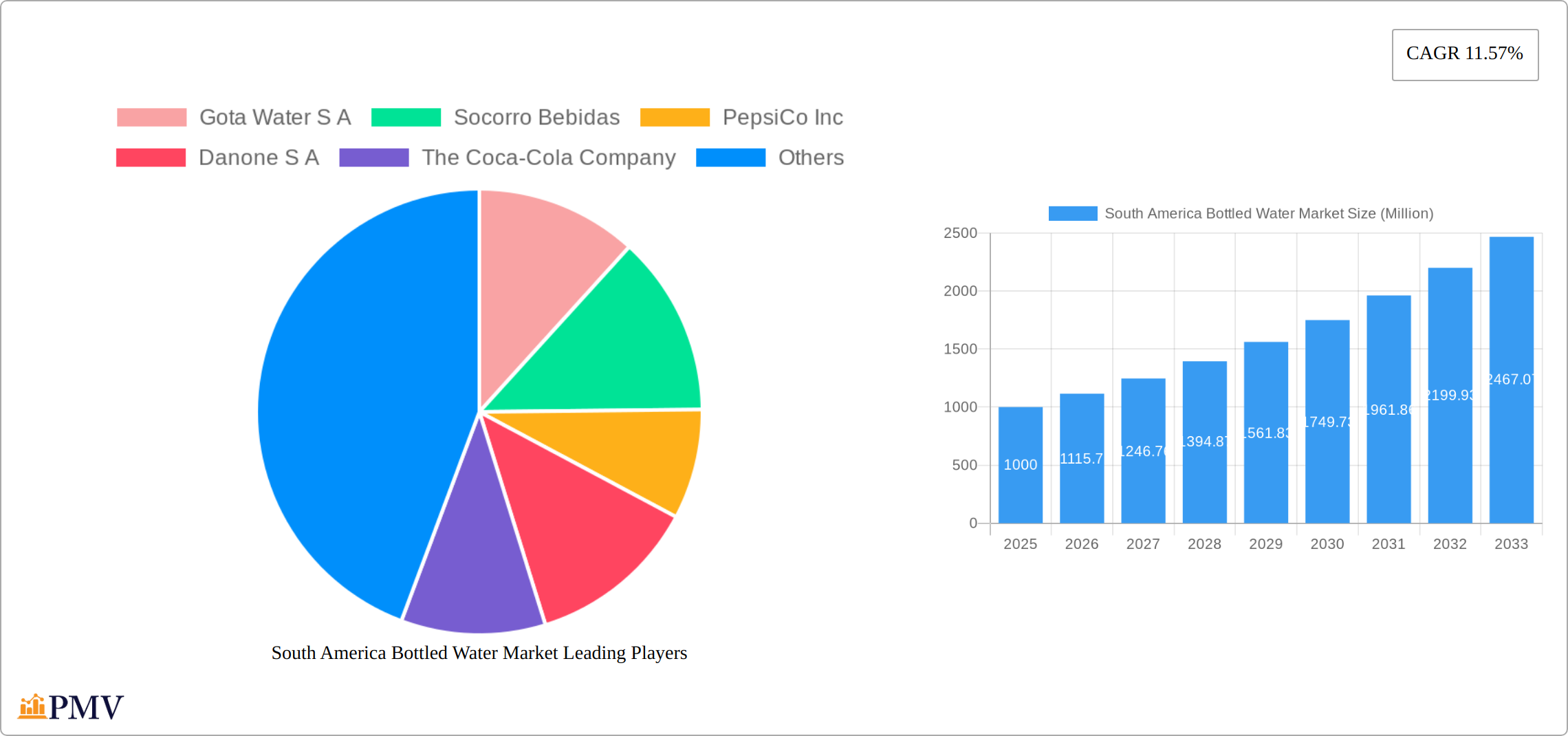

The South American bottled water market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.57% from 2025 to 2033. This expansion is fueled by several key factors. Rising health consciousness among consumers is driving demand for healthier hydration alternatives, leading to increased consumption of bottled water, especially in urban areas. The growing prevalence of lifestyle diseases and increasing disposable incomes are also contributing significantly to market growth. Furthermore, the burgeoning e-commerce sector is expanding access to bottled water, particularly in regions with limited access to reliable piped water. The market is segmented by distribution channel (supermarkets/hypermarkets, convenience stores, online retail stores, on-trade, other channels) and product type (still water, sparkling water, functional water). Brazil is expected to dominate the market due to its large population and established infrastructure, followed by Argentina and other South American countries exhibiting varying growth rates dependent on economic conditions and infrastructure development. While the market faces certain restraints, such as fluctuating raw material prices and stringent regulations, the overall outlook remains positive, particularly for premium and functional water segments which are anticipated to witness faster growth rates than traditional still water.

The competitive landscape is dominated by both multinational giants such as PepsiCo, Coca-Cola, Nestlé, and Danone, alongside regional players like Gota Water S.A., Socorro Bebidas, Minalba Brasil, and Poty Cia de Bebidas. These companies are investing heavily in brand building, product innovation (e.g., flavored and enhanced waters), and sustainable packaging solutions to gain a competitive edge. The increasing adoption of sustainable practices within the industry is also a noteworthy trend, with companies focusing on eco-friendly packaging and sourcing strategies to cater to environmentally conscious consumers. The strategic partnerships and acquisitions by major players will further consolidate the market and drive further growth in the coming years. The market’s success will hinge on adapting to evolving consumer preferences, embracing innovation, and navigating the challenges of maintaining sustainable operations.

South America Bottled Water Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America bottled water market, offering valuable insights for businesses, investors, and stakeholders seeking to understand and capitalize on this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to provide a robust and future-oriented perspective. The market is segmented by distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, On-Trade, Other Distribution Channels) and product type (Still Water, Sparkling Water, Functional Water). Key players such as Gota Water S A, Socorro Bebidas, PepsiCo Inc, Danone S A, The Coca-Cola Company, Minalba Brasil, Poty Cia de Bebidas, AlunCo, and Nestlé S A are extensively profiled. The market is projected to reach xx Million by 2033.

South America Bottled Water Market Structure & Competitive Dynamics

The South American bottled water market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The Coca-Cola Company and PepsiCo Inc., through their extensive distribution networks and strong brand recognition, command leading positions. However, regional players like Minalba Brasil and Gota Water S A also contribute significantly, showcasing the potential for both established multinationals and local brands. The market is characterized by ongoing innovation in packaging, flavor profiles (functional waters), and sustainability initiatives (recyclable packaging). Regulatory frameworks vary across South American nations, impacting pricing, labeling, and resource management. The primary product substitutes include tap water and other beverages, with bottled water facing increasing competition from functional drinks and enhanced water options. Consumer preferences are shifting towards healthier options, including functional water and sustainably packaged products. M&A activities have been observed, such as the strategic alliance between CCU and Danone in Argentina (May 2022), demonstrating the industry's consolidation trends. While precise M&A deal values are not publicly available for all transactions, the CCU-Danone deal alone signals a significant investment in the region's bottled water sector. The market share of the top 5 players is estimated to be approximately xx%.

South America Bottled Water Market Industry Trends & Insights

The South American bottled water market is experiencing robust growth, driven by several factors. Rising disposable incomes, increasing urbanization, and a growing health-conscious population are fueling demand for bottled water as a convenient and perceived healthier alternative to other beverages. Technological advancements in packaging, such as the adoption of infinitely recyclable cans by Socorro Bebidas (August 2022), contribute to market expansion by addressing sustainability concerns. The shift in consumer preferences towards healthier lifestyles and the increasing awareness of hydration benefits are positively impacting the market. Furthermore, the burgeoning e-commerce sector and improved distribution infrastructure are enhancing market accessibility. The CAGR for the forecast period (2025-2033) is estimated to be xx%, while market penetration in key regions remains significantly below saturation levels, suggesting substantial future growth potential. Competitive dynamics are shaping the market with a focus on product differentiation, innovative packaging, and strategic alliances to enhance market share and distribution reach.

Dominant Markets & Segments in South America Bottled Water Market

- Leading Region: Brazil dominates the South American bottled water market due to its large population, high consumption rates, and established distribution networks.

- Leading Country: Brazil's dominance extends to the country level, boasting the largest market share within the region.

- Leading Distribution Channel: Supermarkets/Hypermarkets command the largest segment of the distribution channel, driven by high consumer traffic and established product placement strategies.

- Leading Product Type: Still water remains the dominant product type, followed by sparkling water, with functional water showing promising growth potential.

Brazil's dominance is fueled by several key drivers: a large and growing middle class with increased disposable income, extensive supermarket and convenience store networks, and relatively stable economic conditions. However, other South American countries also show potential, particularly those with rising urbanization and improving infrastructure. Factors such as government regulations concerning water quality and access also play a role. The convenience of supermarkets/hypermarkets makes them the preferred choice, while the growth of e-commerce is slowly increasing the importance of online retail stores. Still water's dominance reflects traditional consumer preference, while the rise of health-conscious consumers drives the growth of the functional water segment.

South America Bottled Water Market Product Innovations

The South American bottled water market is experiencing a wave of innovation driven by evolving consumer preferences and sustainability concerns. Recent examples highlight this trend: Mineral Water Indaiá's successful World Cup-themed limited edition (October 2022) showcases the power of strategic marketing tied to popular events to boost sales. Furthermore, the adoption of infinitely recyclable aluminum cans by Socorro Bebidas exemplifies a growing commitment to environmentally friendly packaging within the industry. This shift towards sustainable materials is not just a response to consumer demand for eco-conscious products; it also reflects a proactive approach by manufacturers to reduce their environmental footprint. Beyond packaging, innovations in lightweight, recyclable materials and innovative cap designs are enhancing the overall consumer experience and minimizing waste. These advancements are crucial for differentiation in a competitive market, contributing significantly to market growth.

Report Segmentation & Scope

Distribution Channel: This report segments the South American bottled water market by distribution channel, encompassing Supermarkets/Hypermarkets (projected xx Million units by 2033), Convenience Stores (xx Million units), Online Retail Stores (xx Million units), On-Trade establishments (xx Million units), and Other Distribution Channels (xx Million units). Analysis reveals varying growth trajectories across these channels, with online retail demonstrating particularly robust expansion.

Product Type: Market segmentation also considers product type: Still Water (projected xx Million units by 2033), Sparkling Water (xx Million units), and Functional Water (xx Million units). The functional water segment is poised for exceptional growth, driven by a rising consumer focus on health and wellness, and the increasing demand for enhanced hydration and added nutritional benefits.

Key Drivers of South America Bottled Water Market Growth

Several key factors drive growth in the South American bottled water market. Increasing disposable incomes in several countries are boosting consumer spending on packaged goods, including bottled water. Rapid urbanization leads to higher water demand, particularly in urban areas with limited access to safe tap water. Growing health awareness among consumers drives the preference for bottled water as a convenient and readily available source of hydration. The expansion of retail networks, including supermarkets, convenience stores, and e-commerce platforms, enhances product accessibility. Finally, government initiatives to improve water infrastructure in certain regions contribute to the sector's overall growth.

Challenges in the South America Bottled Water Market Sector

Several key challenges impact the South American bottled water market. Economic volatility and fluctuating currency exchange rates significantly influence raw material costs and consumer purchasing power. Supply chain disruptions and logistical complexities, particularly in geographically challenging regions, hinder efficient product delivery. The intensely competitive landscape, featuring both established multinational corporations and emerging local brands, necessitates continuous product innovation and robust marketing strategies for sustained success. Furthermore, navigating diverse regulatory environments across South American countries, encompassing water sourcing regulations, packaging standards, and labeling requirements, presents a significant hurdle for market players. Effectively addressing these challenges is crucial for ensuring market growth and profitability.

Leading Players in the South America Bottled Water Market Market

- PepsiCo Inc

- Danone S A

- The Coca-Cola Company

- Nestlé S A

- Gota Water S A

- Socorro Bebidas

- Minalba Brasil

- Poty Cia de Bebidas

- AlunCo

Key Developments in South America Bottled Water Market Sector

- October 2022: Mineral Water Indaiá (Minalba Brasil) launched a World Cup-themed limited edition.

- August 2022: Socorro Bebidas partnered with Crown Holdings to introduce infinitely recyclable cans.

- May 2022: CCU and Danone formed a strategic alliance in Argentina.

Strategic South America Bottled Water Market Outlook

The South American bottled water market holds significant growth potential, driven by long-term trends in rising disposable incomes, urbanization, and increasing health consciousness. Strategic opportunities exist for companies to invest in sustainable packaging solutions, expand distribution networks in underserved areas, and cater to the growing demand for functional waters. By focusing on innovation, effective marketing, and navigating the diverse regulatory landscape, companies can capitalize on this dynamic market and achieve sustained growth.

South America Bottled Water Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South America Bottled Water Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Bottled Water Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries

- 3.3. Market Restrains

- 3.3.1. Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production

- 3.4. Market Trends

- 3.4.1. Increasing Consumer Spending Towards Bottled Water

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Brazil South America Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Bottled Water Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Gota Water S A

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Socorro Bebidas

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 PepsiCo Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Danone S A

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 The Coca-Cola Company

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Minalba Brasil

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Poty Cia de Bebidas

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 AlunCo

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Nestlé S A

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Gota Water S A

List of Figures

- Figure 1: South America Bottled Water Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Bottled Water Market Share (%) by Company 2024

List of Tables

- Table 1: South America Bottled Water Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Bottled Water Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: South America Bottled Water Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: South America Bottled Water Market Volume K Units Forecast, by Production Analysis 2019 & 2032

- Table 5: South America Bottled Water Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: South America Bottled Water Market Volume K Units Forecast, by Consumption Analysis 2019 & 2032

- Table 7: South America Bottled Water Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: South America Bottled Water Market Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: South America Bottled Water Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: South America Bottled Water Market Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: South America Bottled Water Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: South America Bottled Water Market Volume K Units Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: South America Bottled Water Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: South America Bottled Water Market Volume K Units Forecast, by Region 2019 & 2032

- Table 15: South America Bottled Water Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: South America Bottled Water Market Volume K Units Forecast, by Country 2019 & 2032

- Table 17: Brazil South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Brazil South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Argentina South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: South America Bottled Water Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 24: South America Bottled Water Market Volume K Units Forecast, by Production Analysis 2019 & 2032

- Table 25: South America Bottled Water Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 26: South America Bottled Water Market Volume K Units Forecast, by Consumption Analysis 2019 & 2032

- Table 27: South America Bottled Water Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 28: South America Bottled Water Market Volume K Units Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 29: South America Bottled Water Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 30: South America Bottled Water Market Volume K Units Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 31: South America Bottled Water Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 32: South America Bottled Water Market Volume K Units Forecast, by Price Trend Analysis 2019 & 2032

- Table 33: South America Bottled Water Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: South America Bottled Water Market Volume K Units Forecast, by Country 2019 & 2032

- Table 35: Brazil South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Brazil South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 37: Argentina South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Argentina South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 39: Chile South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Chile South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 41: Colombia South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Colombia South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 43: Peru South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Peru South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 45: Venezuela South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Venezuela South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 47: Ecuador South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Ecuador South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 49: Bolivia South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Bolivia South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 51: Paraguay South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Paraguay South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 53: Uruguay South America Bottled Water Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Uruguay South America Bottled Water Market Volume (K Units) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Bottled Water Market?

The projected CAGR is approximately 11.57%.

2. Which companies are prominent players in the South America Bottled Water Market?

Key companies in the market include Gota Water S A, Socorro Bebidas, PepsiCo Inc, Danone S A, The Coca-Cola Company, Minalba Brasil, Poty Cia de Bebidas, AlunCo, Nestlé S A.

3. What are the main segments of the South America Bottled Water Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries.

6. What are the notable trends driving market growth?

Increasing Consumer Spending Towards Bottled Water.

7. Are there any restraints impacting market growth?

Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production.

8. Can you provide examples of recent developments in the market?

In October 2022, Mineral Water Indaiá, a brand of Minalba Brasil, launched an exclusive edition in celebration of the World Cup, held this year in Qatar. The launch features a special design for the time, with a label designed with the colors of the Brazilian flag in two versions such as 500 ml sparkling water and 1.5 liters still water. The product was available from October to December.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Bottled Water Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Bottled Water Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Bottled Water Market?

To stay informed about further developments, trends, and reports in the South America Bottled Water Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence