Key Insights

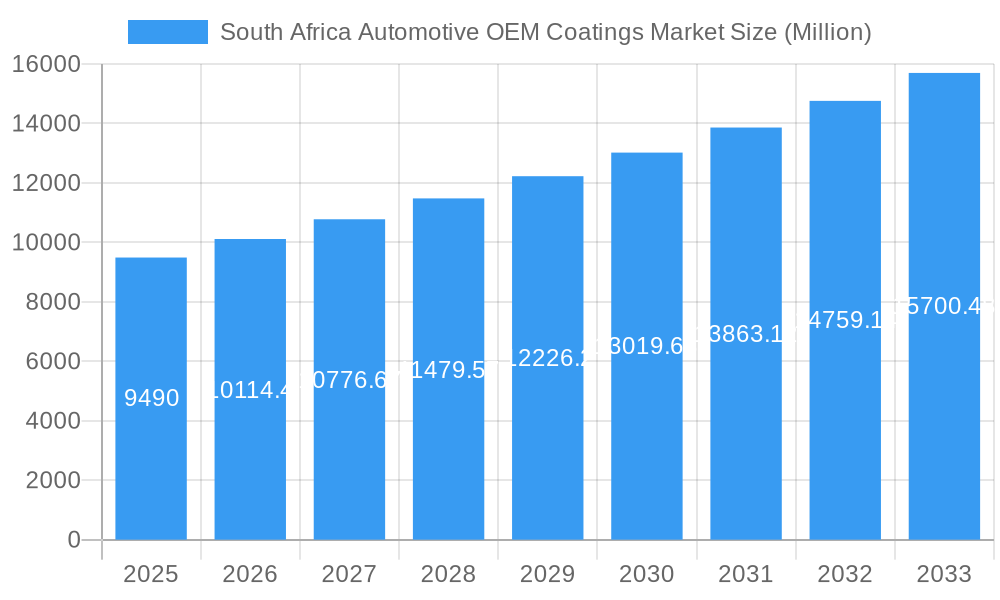

The South Africa Automotive OEM Coatings market is forecast to reach 118.5 million by 2025, with a projected CAGR of 4.3 from 2025 to 2033. This growth is propelled by a robust automotive industry, with increasing demand for high-quality, durable, and aesthetically pleasing OEM coatings for both passenger and commercial vehicles. Technological advancements in eco-friendly coatings, such as water-borne solutions, are gaining prominence due to environmental regulations. Acrylic and polyurethane resins are leading segments due to their superior performance. Key application layers include e-coat, primer, base coat, and clear coat. Major industry players like BASF SE, Akzo Nobel N.V., and PPG Industries are capitalizing on their expertise and distribution networks to meet manufacturer demands. The market is segmented by resin type (acrylic, alkyd, epoxy, polyurethane, polyester, other), layer (e-coat, primer, base coat, clear coat), and technology (water-borne, solvent-borne, electrocoats, powder coatings), offering opportunities for specialized market players.

South Africa Automotive OEM Coatings Market Market Size (In Million)

Market growth will be influenced by automotive production volumes, which are tied to economic conditions and global automotive trends. However, sustained vehicle ownership growth and infrastructure development in South Africa provide a positive long-term outlook. The transition to sustainable manufacturing and advanced coating technologies presents both challenges and opportunities. Intense competition from global and regional players necessitates a focus on cost optimization and the delivery of superior quality coatings that meet evolving demands for sustainability and performance. Growth potential is particularly noted in South Africa and other developing African economies including Sudan, Uganda, Tanzania, and Kenya.

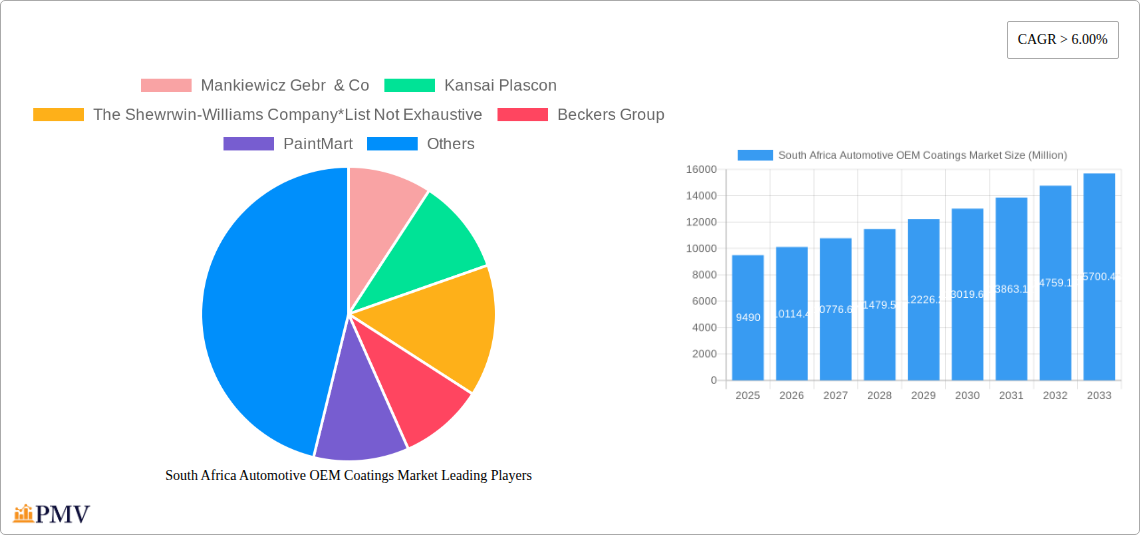

South Africa Automotive OEM Coatings Market Company Market Share

South Africa Automotive OEM Coatings Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Africa Automotive OEM Coatings Market, offering invaluable insights for stakeholders across the automotive and coatings industries. The study covers the period 2019-2033, with a base year of 2025 and a forecast period from 2025-2033. It meticulously examines market size, growth drivers, challenges, and competitive dynamics, equipping businesses with actionable intelligence for strategic decision-making. The report analyzes various segments including application (Passenger Vehicles, Commercial Vehicles, ACE), resin type (Acrylic, Alkyd, Epoxy, Polyurethane, Polyester, Other), coating layer (E-Coat, Primer, Base Coat, Clear Coat), and technology (Water-Borne, Solvent-Borne, Electrocoats, Powder Coatings). Key players like Mankiewicz Gebr & Co, Kansai Plascon, The Sherwin-Williams Company, Beckers Group, PaintMart, BASF SE, Axalta Coating Systems, Akzo Nobel N.V., PPG Industries, and Autoboys Holdings are profiled, providing a detailed competitive landscape. The report also details significant industry developments, such as sustainability initiatives and production upgrades. The expected market value is xx Million in 2025.

South Africa Automotive OEM Coatings Market Structure & Competitive Dynamics

This section delves into the competitive landscape of the South Africa Automotive OEM Coatings Market. The market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller players creates a dynamic environment. Innovation ecosystems are growing, driven by the need for sustainable and high-performance coatings. Regulatory frameworks, including environmental regulations, significantly influence the market. Product substitutes, such as powder coatings gaining traction, pose challenges to traditional coatings. End-user trends, such as the increasing demand for lightweight vehicles, impact the demand for specific coating types. Recent M&A activities in the global coatings industry, though not extensively documented for South Africa specifically, indirectly affect the competitive dynamics and pricing strategies in this market. The estimated market share of the top 5 players is approximately xx%, with considerable variation across segments. M&A deal values in the related global sector have reached xx Million in recent years.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation: Growing focus on sustainable and high-performance coatings.

- Regulatory: Stringent environmental regulations driving technological advancements.

- Substitutes: Powder coatings present a competitive challenge.

- End-User Trends: Demand influenced by lightweight vehicle trends.

- M&A: Global M&A activity impacts local dynamics indirectly.

South Africa Automotive OEM Coatings Market Industry Trends & Insights

The South Africa Automotive OEM Coatings Market is projected to witness a CAGR of xx% during the forecast period (2025-2033). Key growth drivers include the increasing demand for vehicles, driven by economic growth and urbanization. Technological disruptions, such as the adoption of water-borne coatings for environmental reasons and the increasing use of advanced coating technologies like electrocoats for corrosion resistance, are significantly shaping the market. Consumer preferences, notably towards aesthetic appeal and durability, influence product demand. Competitive dynamics are characterized by ongoing innovation, strategic partnerships, and a focus on sustainability. Market penetration of water-borne coatings is expected to reach xx% by 2033, reflecting the environmental concerns and regulatory pressures. The automotive industry's investment in new assembly plants and production upgrades further fuels market growth.

Dominant Markets & Segments in South Africa Automotive OEM Coatings Market

Within the South Africa Automotive OEM Coatings Market, the passenger vehicle segment currently holds the largest market share. This is driven by the high volume of passenger vehicle production and sales in the country. Within resins, polyurethane is dominant due to its superior performance characteristics. The e-coat layer segment is also significant due to its crucial role in corrosion protection. Water-borne technology is gaining traction, propelled by sustainability concerns and environmental regulations.

- Key Drivers for Passenger Vehicle Segment Dominance:

- High volume of passenger vehicle production and sales.

- Growing demand for aesthetically pleasing and durable finishes.

- Key Drivers for Polyurethane Resin Dominance:

- Superior performance properties such as durability and flexibility.

- Increasing demand for high-quality finishes in the automotive sector.

- Key Drivers for E-Coat Layer Dominance:

- Essential for corrosion protection in automotive applications.

- Growing demand for longer vehicle lifespan.

- Key Drivers for Water-Borne Technology Dominance:

- Stricter environmental regulations favouring low-VOC coatings.

- Growing consumer awareness of environmental issues.

South Africa Automotive OEM Coatings Market Product Innovations

Recent innovations focus on developing sustainable, high-performance coatings with reduced environmental impact. Water-borne and powder coatings are gaining popularity. New resin technologies are improving durability, appearance, and corrosion resistance. Manufacturers are emphasizing customized solutions to meet specific OEM requirements, improving application efficiency and reducing production costs. These advancements enable better scratch and chip resistance, leading to extended vehicle lifespan and enhanced consumer satisfaction.

Report Segmentation & Scope

This report segments the South Africa Automotive OEM Coatings market across various parameters:

Application: Passenger Vehicles (xx Million, xx% CAGR), Commercial Vehicles (xx Million, xx% CAGR), ACE (xx Million, xx% CAGR). The passenger vehicle segment is the largest, driven by high vehicle production.

Resin: Acrylic (xx Million, xx% CAGR), Alkyd (xx Million, xx% CAGR), Epoxy (xx Million, xx% CAGR), Polyurethane (xx Million, xx% CAGR), Polyester (xx Million, xx% CAGR), Other (xx Million, xx% CAGR). Polyurethane shows strong growth due to its performance advantages.

Layer: E-Coat (xx Million, xx% CAGR), Primer (xx Million, xx% CAGR), Base Coat (xx Million, xx% CAGR), Clear Coat (xx Million, xx% CAGR). E-coat remains a crucial component for corrosion resistance.

Technology: Water-Borne (xx Million, xx% CAGR), Solvent-Borne (xx Million, xx% CAGR), Electrocoats (xx Million, xx% CAGR), Powder Coatings (xx Million, xx% CAGR). Water-borne technology shows the fastest growth due to environmental regulations. Competitive dynamics vary across each segment, reflecting the specific technological advancements and application requirements.

Key Drivers of South Africa Automotive OEM Coatings Market Growth

The South Africa Automotive OEM Coatings Market is driven by several factors: rising vehicle production, increasing demand for high-quality finishes, stringent environmental regulations promoting the use of eco-friendly coatings, and technological advancements in coating technologies like water-borne and powder coatings. Government initiatives promoting domestic auto manufacturing and infrastructure development also contribute to market growth.

Challenges in the South Africa Automotive OEM Coatings Market Sector

The market faces challenges like fluctuating raw material prices, economic instability impacting vehicle demand, and intense competition among coating manufacturers. Furthermore, stringent environmental regulations necessitate continuous innovation to comply with emission standards. Supply chain disruptions can also impact production and cost. These factors can result in decreased profitability and increased operational complexity for businesses operating in this sector.

Leading Players in the South Africa Automotive OEM Coatings Market

- Mankiewicz Gebr & Co

- Kansai Plascon

- The Sherwin-Williams Company

- Beckers Group

- PaintMart

- BASF SE

- Axalta Coating Systems

- Akzo Nobel N.V.

- PPG Industries

- Autoboys Holdings

Key Developments in South Africa Automotive OEM Coatings Market Sector

- 2022: BMW and BASF SE partnered to use BASF's biomass balance approach paints, including CathoGuard 800 ReSource e-coat, reducing CO2 emissions by over 15,000 metric tons by 2030. This showcases a significant shift toward sustainable coatings.

- 2021: Ford Motor Company of South Africa invested in upgrading its Silverton Assembly Plant, utilizing PPG's Coatings Services for electrocoat lines, supporting expanded Ranger production. This highlights the importance of specialized coating services for OEMs.

Strategic South Africa Automotive OEM Coatings Market Outlook

The South Africa Automotive OEM Coatings Market presents significant growth opportunities. The increasing demand for vehicles coupled with the growing adoption of sustainable and high-performance coatings positions the market for sustained expansion. Strategic partnerships, focusing on innovation and sustainability, will be crucial for success. Companies should prioritize R&D investment in eco-friendly technologies and explore customized solutions for OEMs to gain a competitive edge. The market's future hinges on adapting to regulatory changes and navigating supply chain challenges effectively.

South Africa Automotive OEM Coatings Market Segmentation

-

1. Resin

- 1.1. Acrylic

- 1.2. Alkyd

- 1.3. Epoxy

- 1.4. Polyurethane

- 1.5. Polyester

- 1.6. Other

-

2. Layer

- 2.1. E-Coat

- 2.2. Pirmer

- 2.3. Base Coat

- 2.4. Clear Coat

-

3. Technology

- 3.1. Water-Borne

- 3.2. Solvent-Borne

- 3.3. Electrocoats

- 3.4. Powder Coatings

-

4. Application

- 4.1. Passenger Vehicles

- 4.2. Commercial Vehicles

- 4.3. ACE

South Africa Automotive OEM Coatings Market Segmentation By Geography

- 1. South Africa

South Africa Automotive OEM Coatings Market Regional Market Share

Geographic Coverage of South Africa Automotive OEM Coatings Market

South Africa Automotive OEM Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the production of Automotive vehicles; Development of New Technologies in the Production of Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. Increasing costs of Raw material used in automotive coatings; Change in the trends of Resin Technologies used in Automotive coatings; Stringent VOC Regulations Set By The Governing Bodies

- 3.4. Market Trends

- 3.4.1. Growth in the production of Automotive vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Automotive OEM Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Acrylic

- 5.1.2. Alkyd

- 5.1.3. Epoxy

- 5.1.4. Polyurethane

- 5.1.5. Polyester

- 5.1.6. Other

- 5.2. Market Analysis, Insights and Forecast - by Layer

- 5.2.1. E-Coat

- 5.2.2. Pirmer

- 5.2.3. Base Coat

- 5.2.4. Clear Coat

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Water-Borne

- 5.3.2. Solvent-Borne

- 5.3.3. Electrocoats

- 5.3.4. Powder Coatings

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Passenger Vehicles

- 5.4.2. Commercial Vehicles

- 5.4.3. ACE

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mankiewicz Gebr & Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kansai Plascon

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Shewrwin-Williams Company*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Beckers Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PaintMart

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BASF SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Axalta Coating Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Akzo Nobel N V

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PPG Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Autoboys Holdings

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mankiewicz Gebr & Co

List of Figures

- Figure 1: South Africa Automotive OEM Coatings Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South Africa Automotive OEM Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Automotive OEM Coatings Market Revenue million Forecast, by Resin 2020 & 2033

- Table 2: South Africa Automotive OEM Coatings Market Volume K Tons Forecast, by Resin 2020 & 2033

- Table 3: South Africa Automotive OEM Coatings Market Revenue million Forecast, by Layer 2020 & 2033

- Table 4: South Africa Automotive OEM Coatings Market Volume K Tons Forecast, by Layer 2020 & 2033

- Table 5: South Africa Automotive OEM Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 6: South Africa Automotive OEM Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 7: South Africa Automotive OEM Coatings Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: South Africa Automotive OEM Coatings Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 9: South Africa Automotive OEM Coatings Market Revenue million Forecast, by Region 2020 & 2033

- Table 10: South Africa Automotive OEM Coatings Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 11: South Africa Automotive OEM Coatings Market Revenue million Forecast, by Resin 2020 & 2033

- Table 12: South Africa Automotive OEM Coatings Market Volume K Tons Forecast, by Resin 2020 & 2033

- Table 13: South Africa Automotive OEM Coatings Market Revenue million Forecast, by Layer 2020 & 2033

- Table 14: South Africa Automotive OEM Coatings Market Volume K Tons Forecast, by Layer 2020 & 2033

- Table 15: South Africa Automotive OEM Coatings Market Revenue million Forecast, by Technology 2020 & 2033

- Table 16: South Africa Automotive OEM Coatings Market Volume K Tons Forecast, by Technology 2020 & 2033

- Table 17: South Africa Automotive OEM Coatings Market Revenue million Forecast, by Application 2020 & 2033

- Table 18: South Africa Automotive OEM Coatings Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 19: South Africa Automotive OEM Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: South Africa Automotive OEM Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Automotive OEM Coatings Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the South Africa Automotive OEM Coatings Market?

Key companies in the market include Mankiewicz Gebr & Co, Kansai Plascon, The Shewrwin-Williams Company*List Not Exhaustive, Beckers Group, PaintMart, BASF SE, Axalta Coating Systems, Akzo Nobel N V, PPG Industries, Autoboys Holdings.

3. What are the main segments of the South Africa Automotive OEM Coatings Market?

The market segments include Resin, Layer, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 118.5 million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the production of Automotive vehicles; Development of New Technologies in the Production of Electric Vehicles.

6. What are the notable trends driving market growth?

Growth in the production of Automotive vehicles.

7. Are there any restraints impacting market growth?

Increasing costs of Raw material used in automotive coatings; Change in the trends of Resin Technologies used in Automotive coatings; Stringent VOC Regulations Set By The Governing Bodies.

8. Can you provide examples of recent developments in the market?

In 2022 BMW and BASF SE have entered into an agreement where BMW will be using the company's certified paints according to the biomass balance approach. The BMW Group has chosen to use BASF Coatings' CathoGuard 800 ReSource e-coat at its plants in South Africa. Through these products, BASF SE is making its products more sustainable and reduces 40% of the CO2 per coating layer. This will reduce the amount of CO2 emitted in the plants by more than 15,000 metric tons by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Automotive OEM Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Automotive OEM Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Automotive OEM Coatings Market?

To stay informed about further developments, trends, and reports in the South Africa Automotive OEM Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence