Key Insights

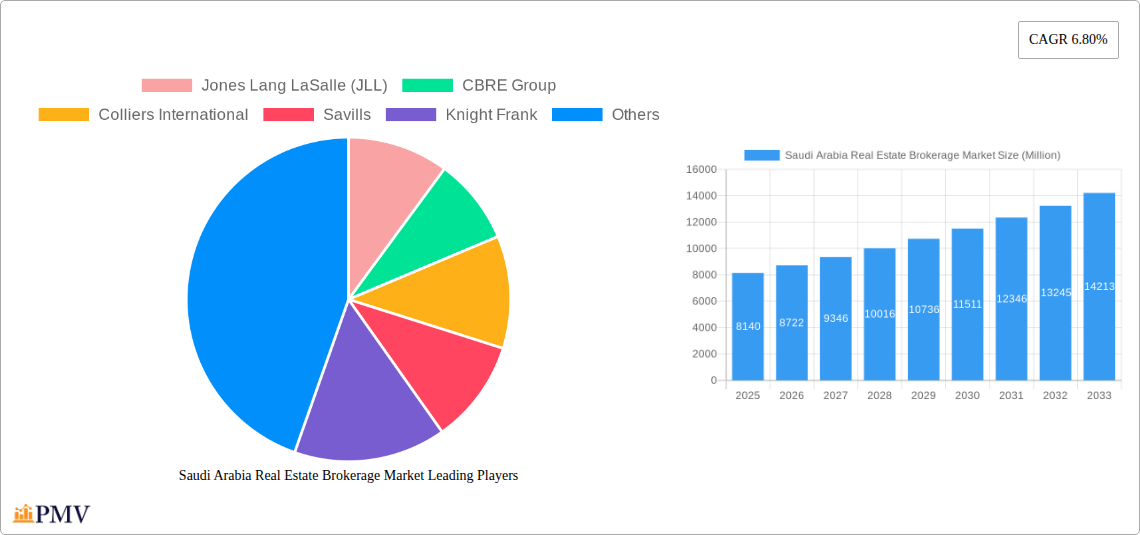

The Saudi Arabian real estate brokerage market, valued at $8.14 billion in 2025, is projected to experience robust growth, driven by significant government investments in infrastructure development, Vision 2030 initiatives promoting diversification away from oil, and a burgeoning population necessitating increased housing and commercial spaces. This expansion is further fueled by a rising middle class with increased disposable income and a growing preference for professionally managed real estate transactions. Key players like Jones Lang LaSalle (JLL), CBRE Group, and Colliers International are leveraging their global expertise and local partnerships to capitalize on this market opportunity, while regional firms like Ewaan Global Residential Company and Al Andalusia Real Estate contribute significantly to the market's dynamism. The market's segmentation likely reflects variations in property types (residential, commercial, industrial), transaction values (luxury, mid-range, budget), and geographical locations within the kingdom. While potential restraints might include regulatory hurdles or economic fluctuations, the overall trajectory indicates a positive outlook for the foreseeable future.

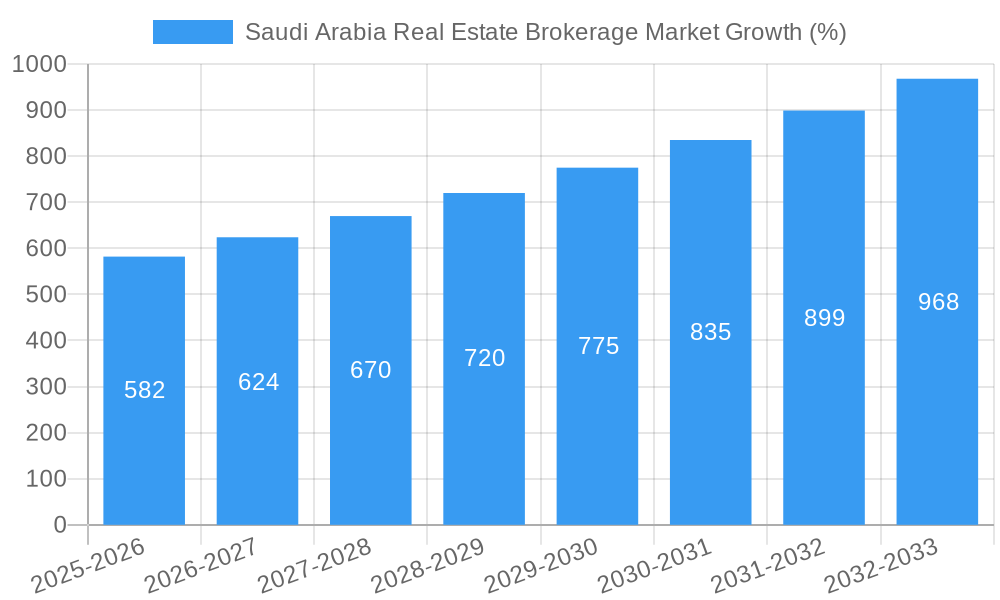

The projected Compound Annual Growth Rate (CAGR) of 6.80% suggests a steady increase in market value over the forecast period (2025-2033). This growth is expected to be influenced by government policies aimed at boosting private sector involvement in the real estate sector, improving transparency and efficiency in the transaction process, and fostering a more attractive investment climate. Competitive landscape analysis reveals a mix of international and domestic brokerage firms vying for market share, leading to innovations in service offerings, technological adoption, and enhanced customer experiences. The ongoing development of mega-projects and smart cities under Vision 2030 is expected to be a primary catalyst for market expansion in the coming years, attracting both domestic and international investment. Further research into specific segments and regional variations within Saudi Arabia will provide a more granular understanding of market dynamics.

Saudi Arabia Real Estate Brokerage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia real estate brokerage market, covering its structure, competitive landscape, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period extends from 2025 to 2033, and the historical period encompasses 2019-2024. This report is crucial for investors, industry stakeholders, and market analysts seeking to understand the dynamics of this rapidly evolving market.

Saudi Arabia Real Estate Brokerage Market Structure & Competitive Dynamics

The Saudi Arabian real estate brokerage market exhibits a moderately concentrated structure, with a mix of international giants and local players vying for market share. Key players include Jones Lang LaSalle (JLL), CBRE Group, Colliers International, Savills, Knight Frank, Ewaan Global Residential Company, Al Andalusia Real Estate, Tamkeen Real Estate, Rafal Real Estate Development, and Sakan Real Estate Solutions, along with 73 other companies. Market share data for individual companies is unavailable (xx%) but varies considerably. The market is witnessing increased M&A activity, although precise deal values remain undisclosed (xx Million).

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Ecosystems: Emerging, with increasing adoption of proptech solutions.

- Regulatory Frameworks: The recent Real Estate Brokerage Law has significantly impacted market operations, increasing transparency and licensing.

- Product Substitutes: Limited direct substitutes, but online platforms pose indirect competition.

- End-User Trends: Growing demand for luxury properties and high-end services in major cities like Riyadh and Jeddah.

- M&A Activities: Increasing, driven by consolidation and expansion strategies.

Saudi Arabia Real Estate Brokerage Market Industry Trends & Insights

The Saudi Arabian real estate brokerage market is experiencing robust growth, fueled by Vision 2030 initiatives and substantial government investments in infrastructure development. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%, driven by factors such as increasing urbanization, rising disposable incomes, and a burgeoning population. Market penetration of online brokerage services is steadily increasing, projected to reach xx% by 2033. Technological disruptions, such as the adoption of virtual reality for property viewing and AI-powered valuation tools, are transforming market dynamics. Consumer preferences are shifting towards transparency, efficiency, and personalized service. Competitive dynamics are characterized by increasing consolidation, strategic partnerships, and the emergence of innovative business models.

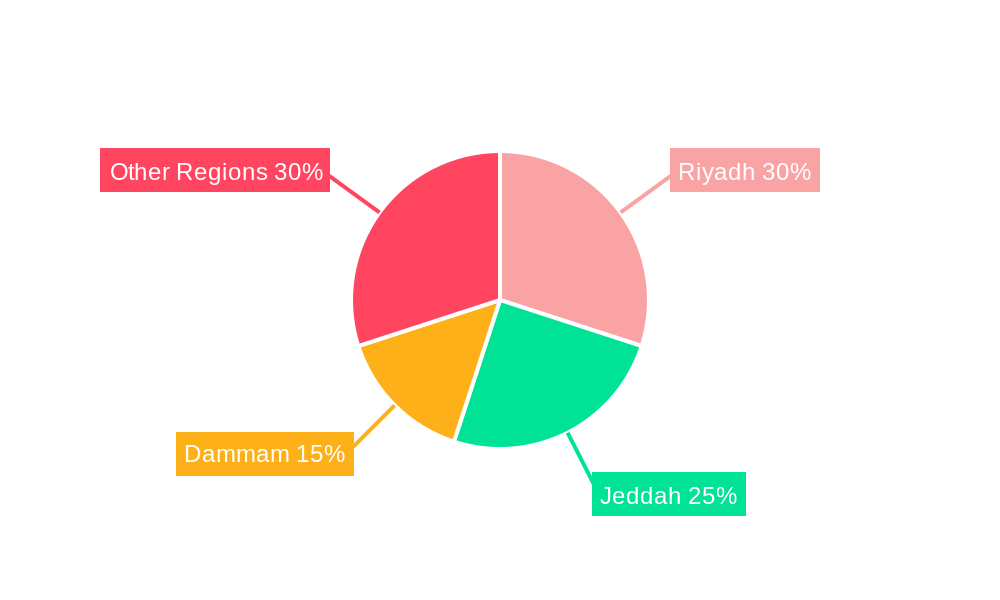

Dominant Markets & Segments in Saudi Arabia Real Estate Brokerage Market

The Riyadh and Jeddah metropolitan areas represent the dominant segments of the Saudi Arabian real estate brokerage market. These cities are witnessing significant development, attracting both domestic and international investors.

- Key Drivers for Riyadh & Jeddah Dominance:

- Economic Policies: Government incentives and investments under Vision 2030.

- Infrastructure Development: Construction of new residential and commercial projects.

- Population Growth: Migration to urban centers for employment opportunities.

- High Disposable Incomes: Increased purchasing power driving demand for premium properties.

Riyadh and Jeddah's dominance is fueled by a combination of factors, creating a high concentration of real estate transactions compared to other regions. The availability of premium properties, favorable government policies, and significant investment in infrastructure significantly influence the market share these regions command. This trend is likely to continue over the forecast period.

Saudi Arabia Real Estate Brokerage Market Product Innovations

The Saudi Arabian real estate brokerage market is witnessing increasing adoption of PropTech solutions, particularly in areas like online property listings, virtual tours, and data-driven valuation tools. These innovations streamline processes, enhance customer experience, and contribute to greater market transparency. However, the integration of these technologies remains uneven, with some players adopting innovation more rapidly than others. The market fit of these technological advancements will largely depend on consumer acceptance and regulatory support.

Report Segmentation & Scope

This report segments the Saudi Arabian real estate brokerage market based on various parameters, including property type (residential, commercial, industrial), transaction type (sale, lease), service type (full-service brokerage, specialized services), and geographic location. Each segment presents unique growth projections, market sizes, and competitive dynamics. For example, the residential segment is expected to show the fastest growth during the forecast period, driven by strong housing demand. In contrast, the commercial segment may exhibit more moderate growth, while industrial property brokerage could see slower, but stable expansion. Geographic segmentation will reveal marked differences between the dominant metropolitan markets (Riyadh and Jeddah) and other regions of the country.

Key Drivers of Saudi Arabia Real Estate Brokerage Market Growth

Several factors drive the growth of the Saudi Arabian real estate brokerage market. Vision 2030 initiatives are stimulating economic expansion and infrastructure development, creating significant investment opportunities. The recent Real Estate Brokerage Law enhances market transparency and regulation, attracting foreign investment. Technological advancements, like online platforms and data analytics, are streamlining transactions and improving efficiency. Moreover, a growing population and rising disposable incomes are fueling demand for housing and commercial spaces.

Challenges in the Saudi Arabia Real Estate Brokerage Market Sector

Despite positive growth projections, the Saudi Arabian real estate brokerage market faces several challenges. Navigating the regulatory landscape, particularly new laws and regulations, can be complex for businesses. Supply chain issues, such as construction material shortages, can impact project timelines and market sentiment. Intense competition from both established players and new entrants requires businesses to constantly innovate and adapt. Moreover, fluctuating oil prices and global economic uncertainty can influence market stability.

Leading Players in the Saudi Arabia Real Estate Brokerage Market Market

- Jones Lang LaSalle (JLL)

- CBRE Group

- Colliers International

- Savills

- Knight Frank

- Ewaan Global Residential Company

- Al Andalusia Real Estate

- Tamkeen Real Estate

- Rafal Real Estate Development

- Sakan Real Estate Solutions

- 73 Other Companies

Key Developments in Saudi Arabia Real Estate Brokerage Market Sector

- June 2024: Announcement of inaugural facility management legislation by REGA, enhancing industry reliability and investment appeal.

- January 2023: Over 89,000 license requests received within two days of the new Real Estate Brokerage Law's enactment, signifying high market activity.

Strategic Saudi Arabia Real Estate Brokerage Market Outlook

The Saudi Arabian real estate brokerage market holds significant growth potential, driven by government initiatives, technological advancements, and a dynamic economic landscape. Strategic opportunities exist for companies that can adapt to the evolving regulatory framework, leverage technology effectively, and cater to diverse consumer preferences. Growth will continue to be centered around major metropolitan areas, requiring brokers to possess a deep understanding of local market dynamics. The long-term outlook remains positive, with substantial opportunities for both domestic and international players.

Saudi Arabia Real Estate Brokerage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Non-residential

-

2. Services

- 2.1. Sales

- 2.2. Rental

Saudi Arabia Real Estate Brokerage Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Real Estate Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Diversification Efforts; Regulatory Reforms and Foreign Investment

- 3.3. Market Restrains

- 3.3.1. Economic Diversification Efforts; Regulatory Reforms and Foreign Investment

- 3.4. Market Trends

- 3.4.1. Government-led Initiatives Driving the Saudi Arabian Real Estate Brokerage Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Real Estate Brokerage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Non-residential

- 5.2. Market Analysis, Insights and Forecast - by Services

- 5.2.1. Sales

- 5.2.2. Rental

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Jones Lang LaSalle (JLL)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CBRE Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Colliers International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Savills

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Knight Frank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ewaan Global Residential Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Al Andalusia Real Estate

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tamkeen Real Estate

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rafal Real Estate Development

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sakan Real Estate Solutions**List Not Exhaustive 7 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Jones Lang LaSalle (JLL)

List of Figures

- Figure 1: Saudi Arabia Real Estate Brokerage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Real Estate Brokerage Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Real Estate Brokerage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Real Estate Brokerage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Real Estate Brokerage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Saudi Arabia Real Estate Brokerage Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Saudi Arabia Real Estate Brokerage Market Revenue Million Forecast, by Services 2019 & 2032

- Table 6: Saudi Arabia Real Estate Brokerage Market Volume Billion Forecast, by Services 2019 & 2032

- Table 7: Saudi Arabia Real Estate Brokerage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Saudi Arabia Real Estate Brokerage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Saudi Arabia Real Estate Brokerage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Saudi Arabia Real Estate Brokerage Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Saudi Arabia Real Estate Brokerage Market Revenue Million Forecast, by Services 2019 & 2032

- Table 12: Saudi Arabia Real Estate Brokerage Market Volume Billion Forecast, by Services 2019 & 2032

- Table 13: Saudi Arabia Real Estate Brokerage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Saudi Arabia Real Estate Brokerage Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Real Estate Brokerage Market?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Saudi Arabia Real Estate Brokerage Market?

Key companies in the market include Jones Lang LaSalle (JLL), CBRE Group, Colliers International, Savills, Knight Frank, Ewaan Global Residential Company, Al Andalusia Real Estate, Tamkeen Real Estate, Rafal Real Estate Development, Sakan Real Estate Solutions**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Saudi Arabia Real Estate Brokerage Market?

The market segments include Type, Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Diversification Efforts; Regulatory Reforms and Foreign Investment.

6. What are the notable trends driving market growth?

Government-led Initiatives Driving the Saudi Arabian Real Estate Brokerage Market.

7. Are there any restraints impacting market growth?

Economic Diversification Efforts; Regulatory Reforms and Foreign Investment.

8. Can you provide examples of recent developments in the market?

June 2024: Abdullah Al-Hammad, CEO of the Real Estate General Authority (REGA), announced that Saudi Arabia was set to unveil its inaugural legislation for facility management within the real estate industry in Q1 of 2024. This legislation enhances the industry's reliability and investment appeal by establishing clear regulations. Al-Hammad emphasized the pivotal role of the Real Estate Brokerage Law in advancing the industry. He highlighted its functions in modernizing operations, enhancing governance, and positioning real estate as a transparent and reliable investment avenue.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Real Estate Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Real Estate Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Real Estate Brokerage Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Real Estate Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence