Key Insights

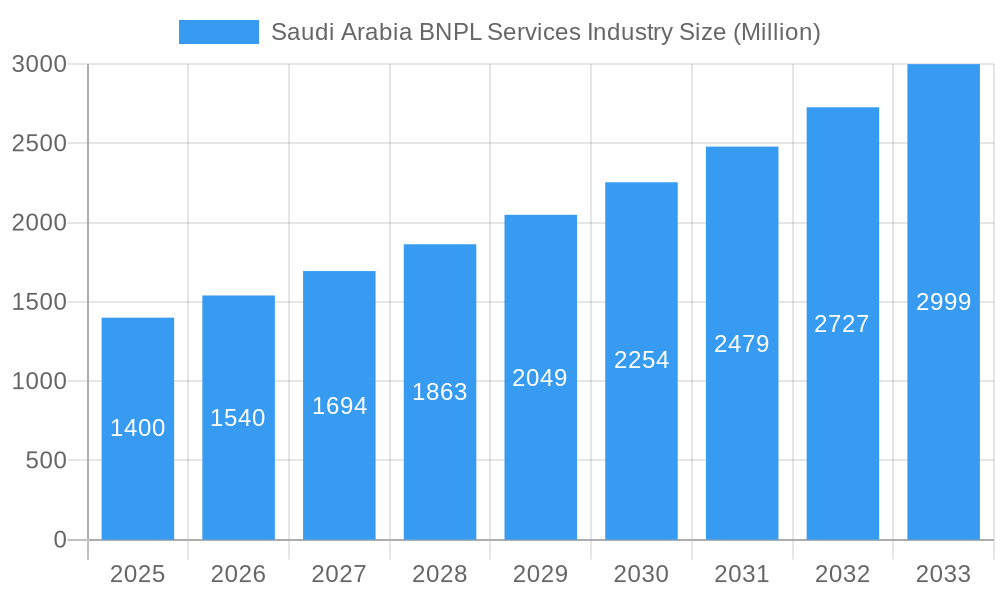

The Saudi Arabian Buy Now, Pay Later (BNPL) services market is experiencing a period of significant expansion, projected to reach an estimated 1.40 million in market size by 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) exceeding 10.00%, indicating a strong upward trajectory for the sector. Key drivers fueling this surge include the increasing adoption of digital payment solutions by consumers, a growing e-commerce landscape, and a supportive regulatory environment that fosters innovation within the fintech sector. Consumers are increasingly seeking flexible payment options for everyday purchases, from electronics and fashion to essential kitchen appliances, making BNPL an attractive alternative to traditional credit. The convenience and transparency offered by these services are resonating with a young, tech-savvy population eager to manage their finances more effectively.

Saudi Arabia BNPL Services Industry Market Size (In Billion)

The market segmentation reveals a balanced distribution across various channels, with both online platforms and Point of Sale (POS) terminals playing crucial roles in facilitating BNPL transactions. End-user segments such as Kitchen Appliances, Electronic Appliances, Fashion and Personal Care, and Healthcare are all demonstrating substantial demand for BNPL solutions. Major players like Tamara, Tabby, Postpay, and international giants such as Mastercard and VISA are actively shaping the market, introducing innovative features and expanding their service offerings. While the market enjoys strong growth, potential restraints could include increasing competition, evolving regulatory frameworks, and the need for robust consumer protection measures to ensure responsible lending practices. Nonetheless, the overarching trend points towards continued innovation and accessibility, solidifying BNPL's position as a transformative financial service in Saudi Arabia.

Saudi Arabia BNPL Services Industry Company Market Share

This comprehensive report delves into the rapidly expanding Saudi Arabia Buy Now Pay Later (BNPL) services industry. With a study period spanning from 2019 to 2033, a base and estimated year of 2025, and a forecast period from 2025 to 2033, this analysis provides deep insights into market dynamics, competitive landscapes, and future growth trajectories. Leveraging high-ranking keywords such as "Saudi Arabia BNPL," "Buy Now Pay Later Saudi," "digital payments KSA," "fintech Saudi Arabia," and "consumer credit Saudi Arabia," this report aims to engage industry professionals, investors, and businesses seeking to capitalize on this burgeoning market.

Saudi Arabia BNPL Services Industry Market Structure & Competitive Dynamics

The Saudi Arabia BNPL services industry is characterized by a dynamic and evolving market structure. While still in its growth phase, market concentration is increasing with the entry of both local fintech players and international giants. Innovation ecosystems are flourishing, driven by a strong focus on digital transformation and a young, tech-savvy population eager for convenient payment solutions. Regulatory frameworks are adapting to accommodate BNPL, with authorities like the Saudi Central Bank (SAMA) playing a crucial role in ensuring consumer protection and financial stability. Product substitutes, primarily traditional credit cards and point-of-sale financing, are facing increasing competition from the flexible and accessible nature of BNPL. End-user trends clearly favor seamless online and in-store payment experiences, with a significant uptake in segments like electronics and fashion. Mergers and acquisitions (M&A) are anticipated to become more prevalent as larger players seek to consolidate market share and acquire innovative technologies. For instance, early M&A activities have seen deal values ranging from $5 Million to $50 Million, signaling a healthy appetite for strategic consolidation. Current market share data indicates leading BNPL providers holding between 15% to 25% of the accessible market, with significant room for growth for emerging players.

Saudi Arabia BNPL Services Industry Industry Trends & Insights

The Saudi Arabia BNPL services industry is experiencing remarkable growth, fueled by a confluence of powerful market drivers. A key accelerator is the Saudi government's Vision 2030 initiative, which emphasizes economic diversification and digital transformation, creating a fertile ground for fintech innovation. The increasing smartphone penetration and widespread internet access empower consumers to embrace digital payment methods, with BNPL services offering a compelling alternative to traditional credit. Technological disruptions, including advancements in artificial intelligence (AI) for fraud detection and personalized credit scoring, are enhancing the efficiency and security of BNPL platforms. Consumer preferences are shifting towards flexible payment options that allow for immediate gratification without the burden of upfront costs, especially for high-value purchases like electronic appliances and kitchen appliances. This trend is further amplified by the growing e-commerce sector in Saudi Arabia, projected to reach $30 Billion by 2026. The competitive dynamics are intensifying, with companies like Tamara, Tabby, Postpay, and Spotti vying for market dominance. The average market penetration for BNPL services in Saudi Arabia currently stands at approximately 8%, with projections to reach 20% by 2028. The Compound Annual Growth Rate (CAGR) for the Saudi BNPL market is estimated to be a robust 35% over the forecast period. This sustained growth is attributed to the increasing adoption across various retail verticals and the continuous introduction of innovative features that cater to evolving consumer needs. The ease of integration for merchants and the frictionless checkout experience for consumers are also significant contributing factors to the sector's upward trajectory. Furthermore, the development of open banking initiatives in Saudi Arabia is expected to further democratize financial services and create new opportunities for BNPL providers to offer integrated solutions.

Dominant Markets & Segments in Saudi Arabia BNPL Services Industry

The Saudi Arabia BNPL services industry exhibits clear dominance across specific channels and end-user segments, reflecting consumer behavior and market demand. The Online channel is the most dominant, driven by the explosive growth of e-commerce in the Kingdom. Consumers increasingly prefer the convenience of browsing and purchasing products online, with BNPL offering a seamless and accessible payment option at checkout. This segment accounts for an estimated 75% of the total BNPL transaction volume. Key drivers for this dominance include extensive internet penetration, the proliferation of user-friendly e-commerce platforms, and the continuous expansion of online retail offerings. The Point of Sale (POS) segment, while growing, currently holds a smaller market share of approximately 25%. However, its importance is rising as BNPL providers forge partnerships with brick-and-mortar retailers, enabling in-store installment payments. This expansion is supported by government initiatives to digitize retail payments and a consumer desire for flexible payment options even during physical shopping experiences.

In terms of end-user segments, Electronic Appliances and Fashion and Personal Care are the leading sectors for BNPL adoption. Electronic Appliances benefit from higher average transaction values, making BNPL an attractive option for consumers looking to spread the cost of expensive devices like smartphones, laptops, and home entertainment systems. The market size for BNPL in electronic appliances is estimated at $500 Million in 2025, with strong growth anticipated. Similarly, the Fashion and Personal Care segment sees significant uptake due to impulse purchases and the desire for immediate access to new trends. The accessibility of BNPL services allows consumers to purchase desired fashion items and beauty products without significant upfront financial commitment. This segment is projected to reach $400 Million in market value by 2025. Kitchen Appliances represent another growing segment, with consumers utilizing BNPL for major kitchen upgrades. The Healthcare segment, while less developed for BNPL currently, shows potential for future growth as more healthcare providers explore flexible payment options for medical procedures and treatments, with an estimated market size of $100 Million by 2025. The economic policies encouraging consumer spending, coupled with robust digital infrastructure, are pivotal in shaping the dominance of these segments.

Saudi Arabia BNPL Services Industry Product Innovations

Product innovations in the Saudi Arabia BNPL services industry are primarily focused on enhancing user experience, expanding merchant offerings, and leveraging advanced technology. Key developments include the introduction of personalized credit limits based on AI-driven risk assessments, offering more flexible repayment schedules tailored to individual financial situations, and the integration of BNPL options directly into loyalty programs and e-commerce checkout flows. Competitive advantages are being forged through seamless app integration, instant approval processes, and the ability to offer interest-free installment plans. The emphasis is on creating a frictionless and value-added payment solution that goes beyond mere credit provision, fostering customer loyalty and increasing average order values for merchants.

Report Segmentation & Scope

This report segments the Saudi Arabia Buy Now Pay Later (BNPL) Services Industry based on critical market dimensions to provide granular insights.

- Channel: The market is analyzed across Online channels, encompassing e-commerce platforms and mobile applications, and POS (Point of Sale), covering in-store transactions. The online segment is projected to lead in market share due to the rapid growth of e-commerce, while the POS segment is expected to see substantial expansion as physical retailers adopt BNPL solutions.

- End User: The report further segments the market by end-user industries, including Kitchen Appliances, Electronic Appliances, Fashion and Personal Care, and Healthcare. Electronic Appliances and Fashion & Personal Care are anticipated to exhibit the highest adoption rates due to the nature of their purchases and consumer purchasing power. The Healthcare segment, though currently smaller, holds significant untapped potential for growth as payment flexibility becomes more crucial for medical services.

Key Drivers of Saudi Arabia BNPL Services Industry Growth

The growth of the Saudi Arabia BNPL services industry is propelled by several key factors. The digital transformation agenda championed by Vision 2030 is creating a highly conducive environment for fintech adoption. A young and digitally native population, coupled with high smartphone penetration, fuels the demand for convenient and accessible payment solutions. Government initiatives promoting financial inclusion and e-commerce growth further bolster BNPL adoption. Technological advancements in AI and machine learning are enabling more sophisticated credit scoring and fraud detection, enhancing platform security and efficiency. The increasing number of partnerships between BNPL providers and merchants, both online and offline, expands accessibility and merchant acceptance.

Challenges in the Saudi Arabia BNPL Services Industry Sector

Despite its rapid growth, the Saudi Arabia BNPL services industry faces several challenges. Regulatory uncertainties and the evolving nature of financial regulations can create hurdles for new entrants and existing players. Intensifying competition from both established BNPL providers and traditional financial institutions requires continuous innovation and competitive pricing. Consumer awareness and education regarding BNPL terms and conditions are crucial to prevent potential over-indebtedness. Data security and privacy concerns remain paramount, demanding robust cybersecurity measures. Furthermore, potential economic downturns could impact consumer spending and the ability to repay BNPL installments, posing a credit risk. Supply chain disruptions impacting the availability of goods for purchase can indirectly affect BNPL transaction volumes.

Leading Players in the Saudi Arabia BNPL Services Industry Market

- Tamara

- Tabby

- Spotti

- Postpay

- Telr

- Mastercard

- Cashew Payments

- VISA

- Affirm Inc

- Zippay

Key Developments in Saudi Arabia BNPL Services Industry Sector

- January 2023: ToYou, a delivery app established in Saudi Arabia, and the shopping and payment app Tabby partnered to create a new BNPL service in the country, enhancing convenience for users of both platforms and expanding Tabby's reach.

- June 2022: Postpay, a leading BNPL provider in the Middle East, partnered with Tap Payments to offer more innovative and popularly used payment methods to businesses, aiming to streamline payment processing for merchants and offer more flexible options to their customers.

Strategic Saudi Arabia BNPL Services Industry Market Outlook

The strategic outlook for the Saudi Arabia BNPL services industry remains exceptionally positive, driven by continued digital adoption and supportive government policies. Growth accelerators include the increasing penetration of e-commerce, the expansion of BNPL services into new retail verticals such as travel and education, and the development of innovative financing models tailored to specific consumer needs. Future market potential lies in deeper integration with existing banking infrastructure, the adoption of embedded finance solutions, and the exploration of cross-border BNPL services within the GCC region. Strategic opportunities for market players involve forming robust partnerships with merchants, leveraging data analytics for hyper-personalized offerings, and investing in advanced fraud prevention technologies to build trust and ensure sustainable growth.

Saudi Arabia BNPL Services Industry Segmentation

-

1. Channel

- 1.1. Online

- 1.2. POS (Point of Sale)

-

2. End User

- 2.1. Kitchen Appliances

- 2.2. Electronic Appliances

- 2.3. Fashion and Personal Care

- 2.4. Healthcare

Saudi Arabia BNPL Services Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia BNPL Services Industry Regional Market Share

Geographic Coverage of Saudi Arabia BNPL Services Industry

Saudi Arabia BNPL Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 10.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping

- 3.3. Market Restrains

- 3.3.1. Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping

- 3.4. Market Trends

- 3.4.1. Raising E-Commerce Platforms with Online Payment Methods Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia BNPL Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Online

- 5.1.2. POS (Point of Sale)

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Kitchen Appliances

- 5.2.2. Electronic Appliances

- 5.2.3. Fashion and Personal Care

- 5.2.4. Healthcare

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tamara

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tabby

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Spotti

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Postpay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Telr

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mastercard

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cashew Payments

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 VISA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Affirm Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zippay**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tamara

List of Figures

- Figure 1: Saudi Arabia BNPL Services Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia BNPL Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 2: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Channel 2020 & 2033

- Table 3: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Channel 2020 & 2033

- Table 8: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Channel 2020 & 2033

- Table 9: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Saudi Arabia BNPL Services Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia BNPL Services Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia BNPL Services Industry?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the Saudi Arabia BNPL Services Industry?

Key companies in the market include Tamara, Tabby, Spotti, Postpay, Telr, Mastercard, Cashew Payments, VISA, Affirm Inc, Zippay**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia BNPL Services Industry?

The market segments include Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping.

6. What are the notable trends driving market growth?

Raising E-Commerce Platforms with Online Payment Methods Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Consumer Demand for Flexible Payment Options; Rise in E-commerce and Online Shopping.

8. Can you provide examples of recent developments in the market?

January 2023: ToYou, a delivery app established in Saudi Arabia, and the shopping and payment app Tabby partnered to create a new BNPL service in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia BNPL Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia BNPL Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia BNPL Services Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia BNPL Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence