Key Insights

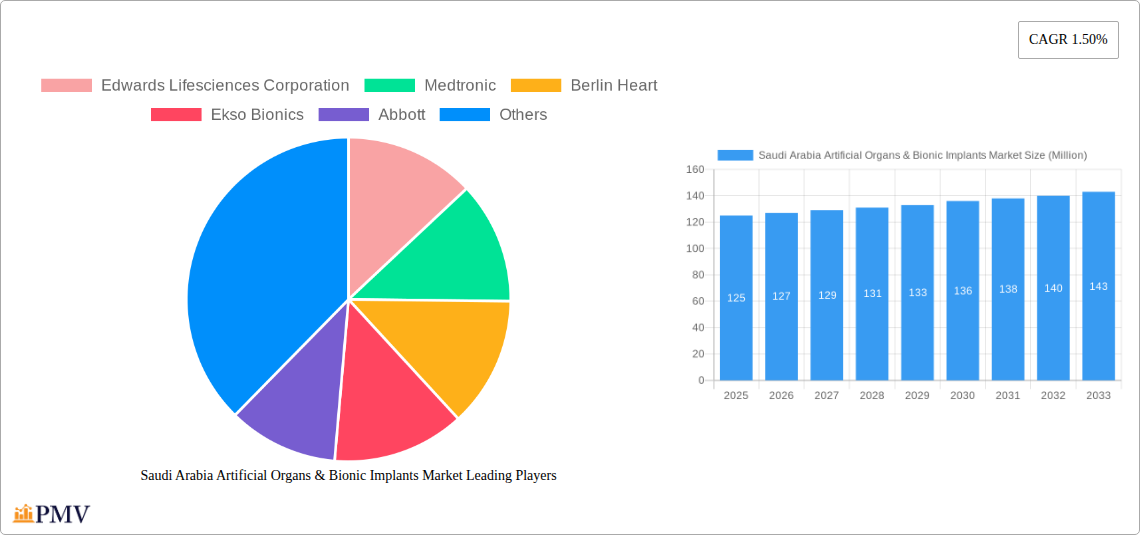

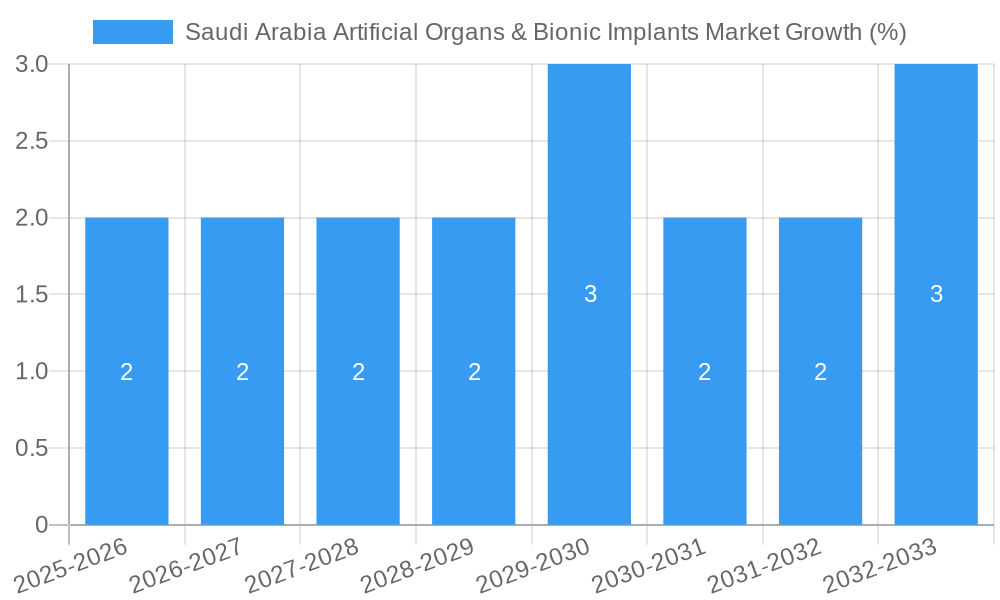

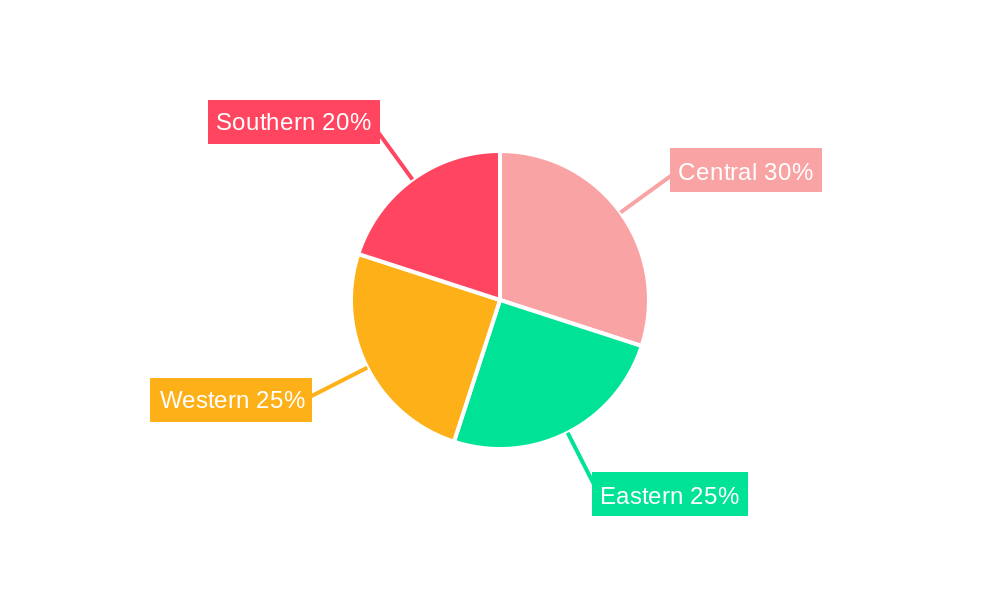

The Saudi Arabian artificial organs and bionic implants market is poised for steady growth, driven by factors such as increasing prevalence of chronic diseases like heart failure and diabetes necessitating organ replacements, rising geriatric population requiring joint replacements, and increasing government investments in healthcare infrastructure. Technological advancements leading to improved implant designs, minimally invasive surgical techniques, and enhanced patient outcomes are further fueling market expansion. While the relatively high cost of these devices and procedures might pose a restraint, the government’s focus on improving healthcare access and the growing adoption of advanced medical technologies are expected to mitigate this challenge. The market is segmented by type, encompassing artificial organs (e.g., cardiac pacemakers, artificial hearts), bionic implants (e.g., cochlear implants, prosthetic limbs), and other organ types. Key players like Edwards Lifesciences, Medtronic, and Abbott are actively contributing to market growth through innovation and expansion strategies within the region. The market's geographical distribution across Saudi Arabia's central, eastern, western, and southern regions indicates varying levels of adoption based on regional healthcare infrastructure and accessibility. While precise market sizing for 2025 requires more specific data, considering a CAGR of 1.50% and a starting point (extrapolated based on global market trends) of approximately $100 million in 2019, we can estimate the 2025 market size to be in the range of $120- $130 million. The forecast period of 2025-2033 suggests substantial growth potential, driven by consistent technological advancements and a growing need for life-enhancing medical solutions.

The competitive landscape is characterized by both established multinational corporations and specialized firms. The companies listed – Edwards Lifesciences, Medtronic, Berlin Heart, Ekso Bionics, Abbott, ABIOMED, Cochlear Ltd, JARVIK HEART INC, and Zimmer Biomet – represent a mix of leading players across different segments of the market. Their strategic initiatives, including research and development, partnerships, and product launches, are likely to shape the market's future trajectory. Future growth will be contingent on factors such as regulatory approvals, reimbursement policies, and the successful integration of novel technologies into clinical practice. Further, the market's expansion will be closely tied to the growth of the healthcare sector in Saudi Arabia, with investments in both public and private healthcare infrastructure playing a critical role. Data on the precise contribution of each regional segment within Saudi Arabia will require more specific market research data.

Saudi Arabia Artificial Organs & Bionic Implants Market: 2019-2033 Report

This comprehensive report provides an in-depth analysis of the burgeoning Saudi Arabia Artificial Organs & Bionic Implants Market, offering invaluable insights for stakeholders across the healthcare and medical technology sectors. With a detailed study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this report is an essential resource for strategic decision-making. The market is segmented by Type: Artificial Organ, Bionics, and Other Organ Types. Key players analyzed include Edwards Lifesciences Corporation, Medtronic, Berlin Heart, Ekso Bionics, Abbott, ABIOMED, Cochlear Ltd, JARVIK HEART INC, and Zimmer Biomet. Expect detailed analysis on market size (in Millions), CAGR, market share, and future growth projections.

Saudi Arabia Artificial Organs & Bionic Implants Market Market Structure & Competitive Dynamics

The Saudi Arabian artificial organs and bionic implants market exhibits a moderately concentrated structure, with a few multinational corporations holding significant market share. The market is characterized by a dynamic innovation ecosystem driven by both international players and emerging local initiatives focused on medical technology advancements. The regulatory framework, while evolving, generally supports the adoption of innovative medical devices, though stringent approvals processes can impact market entry timelines. Product substitutes, such as traditional treatments or less invasive procedures, present a degree of competition. However, the increasing prevalence of chronic diseases and the demand for improved quality of life are driving market growth despite such pressures. End-user trends indicate a preference for minimally invasive procedures and technologically advanced devices offering enhanced functionality and improved patient outcomes. Mergers and acquisitions (M&A) activity has been moderate, with deal values ranging from xx Million to xx Million over the past five years, largely driven by strategic expansions and technology acquisitions. Major players are aggressively pursuing market consolidation strategies. Market share data reveals that Medtronic and Edwards Lifesciences Corporation hold a combined share of approximately xx%, while smaller players, such as Berlin Heart and Ekso Bionics, contribute significantly to specific niches.

Saudi Arabia Artificial Organs & Bionic Implants Market Industry Trends & Insights

The Saudi Arabia artificial organs and bionic implants market is witnessing robust growth, driven by several key factors. The rising prevalence of chronic diseases like heart failure, kidney failure, and diabetes is a primary growth catalyst, creating a significant demand for artificial organs and bionic implants. Technological advancements, particularly in materials science and miniaturization, are leading to the development of more sophisticated and effective devices. This is enhancing patient outcomes and expanding the addressable market. The Saudi Arabian government's focus on improving healthcare infrastructure and access, coupled with increased investments in advanced medical technologies, further fuels market expansion. The CAGR for the market during the forecast period (2025-2033) is projected to be xx%, driven by increased adoption rates and a rising geriatric population. Consumer preferences are shifting towards minimally invasive procedures and personalized medicine approaches, leading to a demand for more sophisticated and customizable implants. Competitive dynamics are intensifying, with both established players and new entrants striving for market leadership through innovative product launches, strategic partnerships, and aggressive marketing strategies. The market penetration rate of artificial organs is estimated to be xx% in 2025, projected to increase to xx% by 2033, indicating a substantial untapped market potential.

Dominant Markets & Segments in Saudi Arabia Artificial Organs & Bionic Implants Market

Within the Saudi Arabia artificial organs and bionic implants market, the artificial organ segment currently dominates, representing approximately xx% of the total market value in 2025. This dominance stems from the high prevalence of conditions requiring organ replacement, coupled with ongoing technological advancements leading to improved device efficacy and longevity.

- Key Drivers for Artificial Organ Segment Dominance:

- High prevalence of chronic diseases requiring organ replacement (e.g., heart failure, kidney failure).

- Significant government investments in healthcare infrastructure and advanced medical technology.

- Growing awareness and acceptance of artificial organ transplantation among the population.

- Technological improvements enhancing device longevity and patient outcomes.

The bionic implants segment is projected to exhibit robust growth during the forecast period, driven by increasing demand for advanced prosthetics and assistive devices, particularly among the elderly population and individuals with disabilities. The other organ types segment will also showcase growth owing to the expanding range of therapeutic options available and new innovative technologies.

Saudi Arabia Artificial Organs & Bionic Implants Market Product Innovations

Recent years have witnessed significant advancements in artificial organ and bionic implant technology. The development of biocompatible materials, improved sensor technologies, and advancements in miniaturization are driving the creation of more sophisticated devices. These innovations are not only improving patient outcomes but also expanding the therapeutic applications of these devices. The focus on personalized medicine and minimally invasive procedures is also shaping product development, with companies investing heavily in developing customizable implants and refined surgical techniques. This trend is creating a competitive advantage for companies that can effectively meet the evolving needs of patients and healthcare professionals.

Report Segmentation & Scope

This report segments the Saudi Arabia artificial organs and bionic implants market by type:

Artificial Organ: This segment encompasses various artificial organs such as artificial hearts, kidneys, and livers. Market growth is projected to be xx% CAGR during the forecast period, driven by technological advancements and rising prevalence of organ failure. Competitive dynamics are intense, with major players focused on innovation and expansion.

Bionics: This segment includes bionic limbs, cochlear implants, and other assistive devices. The market size is expected to reach xx Million by 2033, driven by technological advancements and increasing adoption rates. Competition is moderate, with both established and emerging players vying for market share.

Other Organ Types: This segment comprises other specialized implants and devices. This segment is expected to show slower but steady growth due to its niche nature. Market competition is less intense compared to the other segments.

Key Drivers of Saudi Arabia Artificial Organs & Bionic Implants Market Growth

Several factors are driving the growth of the Saudi Arabia artificial organs and bionic implants market. Technological advancements in biomaterials, miniaturization, and sensor technology are leading to more effective and sophisticated devices. The rising prevalence of chronic diseases requiring organ replacement or functional augmentation fuels market demand. Government initiatives to improve healthcare infrastructure and access, coupled with significant investments in medical technology, further accelerate market growth. Furthermore, increasing awareness among patients and healthcare providers about the benefits of artificial organs and bionic implants is also playing a key role in boosting market expansion.

Challenges in the Saudi Arabia Artificial Organs & Bionic Implants Market Sector

Despite the growth opportunities, the Saudi Arabia artificial organs and bionic implants market faces several challenges. Stringent regulatory approvals can delay product launches and increase market entry barriers. High costs associated with these devices can limit accessibility for a significant portion of the population. The reliance on imports for many of these technologies presents potential supply chain vulnerabilities. Moreover, intense competition among established and emerging players can impact profitability. These challenges necessitate strategic planning and adaptation by market participants to navigate the complexities of the market successfully.

Leading Players in the Saudi Arabia Artificial Organs & Bionic Implants Market Market

- Edwards Lifesciences Corporation

- Medtronic

- Berlin Heart

- Ekso Bionics

- Abbott

- ABIOMED

- Cochlear Ltd

- JARVIK HEART INC

- Zimmer Biomet

Key Developments in Saudi Arabia Artificial Organs & Bionic Implants Market Sector

- 2022: Medtronic launched a new generation of cardiac rhythm management devices.

- 2023: Abbott secured regulatory approval for a novel artificial heart valve.

- 2024: A significant investment was made in local manufacturing of bionic limbs by a Saudi Arabian company. (Note: Further specific details require access to relevant market intelligence data.)

Strategic Saudi Arabia Artificial Organs & Bionic Implants Market Market Outlook

The Saudi Arabia artificial organs and bionic implants market holds substantial growth potential in the coming years, driven by a confluence of factors including technological advancements, rising prevalence of chronic diseases, and government support for healthcare infrastructure development. Strategic opportunities exist for companies focused on innovation, personalized medicine, and efficient supply chain management. Expanding access to these life-enhancing technologies through strategic partnerships and cost-effective solutions will be crucial for capturing market share. The market's future trajectory hinges on continued technological advancements, regulatory clarity, and a proactive approach to address the affordability challenges associated with these advanced medical devices.

Saudi Arabia Artificial Organs & Bionic Implants Market Segmentation

-

1. Type

-

1.1. Artificial Organ

- 1.1.1. Artificial Heart

- 1.1.2. Artificial Kidney

- 1.1.3. Cochlear Implants

- 1.1.4. Other Organ Types

-

1.2. Bionics

- 1.2.1. Ear Bionics

- 1.2.2. Orthopedic Bionic

- 1.2.3. Cardiac Bionics

- 1.2.4. Others

-

1.1. Artificial Organ

Saudi Arabia Artificial Organs & Bionic Implants Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Artificial Organs & Bionic Implants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Increased Incidence of Disabilities

- 3.2.2 Organ Failures and Scarcity of Donor Organs; Technological Advancements in the Artificial Organ and Bionics

- 3.3. Market Restrains

- 3.3.1. ; Expensive Procedures; Risk of Compatibility Issues and Malfunctions

- 3.4. Market Trends

- 3.4.1. Bionic Segment by Product is Estimated to Witness a Healthy Growth in Future.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Artificial Organ

- 5.1.1.1. Artificial Heart

- 5.1.1.2. Artificial Kidney

- 5.1.1.3. Cochlear Implants

- 5.1.1.4. Other Organ Types

- 5.1.2. Bionics

- 5.1.2.1. Ear Bionics

- 5.1.2.2. Orthopedic Bionic

- 5.1.2.3. Cardiac Bionics

- 5.1.2.4. Others

- 5.1.1. Artificial Organ

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Central Saudi Arabia Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Edwards Lifesciences Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Medtronic

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Berlin Heart

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ekso Bionics

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Abbott

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ABIOMED

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cochlear Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 JARVIK HEART INC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Zimmer Biomet

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Edwards Lifesciences Corporation

List of Figures

- Figure 1: Saudi Arabia Artificial Organs & Bionic Implants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Artificial Organs & Bionic Implants Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Saudi Arabia Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Saudi Arabia Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Central Saudi Arabia Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Eastern Saudi Arabia Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Saudi Arabia Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Saudi Arabia Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Saudi Arabia Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Artificial Organs & Bionic Implants Market?

The projected CAGR is approximately 1.50%.

2. Which companies are prominent players in the Saudi Arabia Artificial Organs & Bionic Implants Market?

Key companies in the market include Edwards Lifesciences Corporation, Medtronic, Berlin Heart, Ekso Bionics, Abbott, ABIOMED, Cochlear Ltd, JARVIK HEART INC, Zimmer Biomet.

3. What are the main segments of the Saudi Arabia Artificial Organs & Bionic Implants Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Incidence of Disabilities. Organ Failures and Scarcity of Donor Organs; Technological Advancements in the Artificial Organ and Bionics.

6. What are the notable trends driving market growth?

Bionic Segment by Product is Estimated to Witness a Healthy Growth in Future..

7. Are there any restraints impacting market growth?

; Expensive Procedures; Risk of Compatibility Issues and Malfunctions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Artificial Organs & Bionic Implants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Artificial Organs & Bionic Implants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Artificial Organs & Bionic Implants Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Artificial Organs & Bionic Implants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence