Key Insights

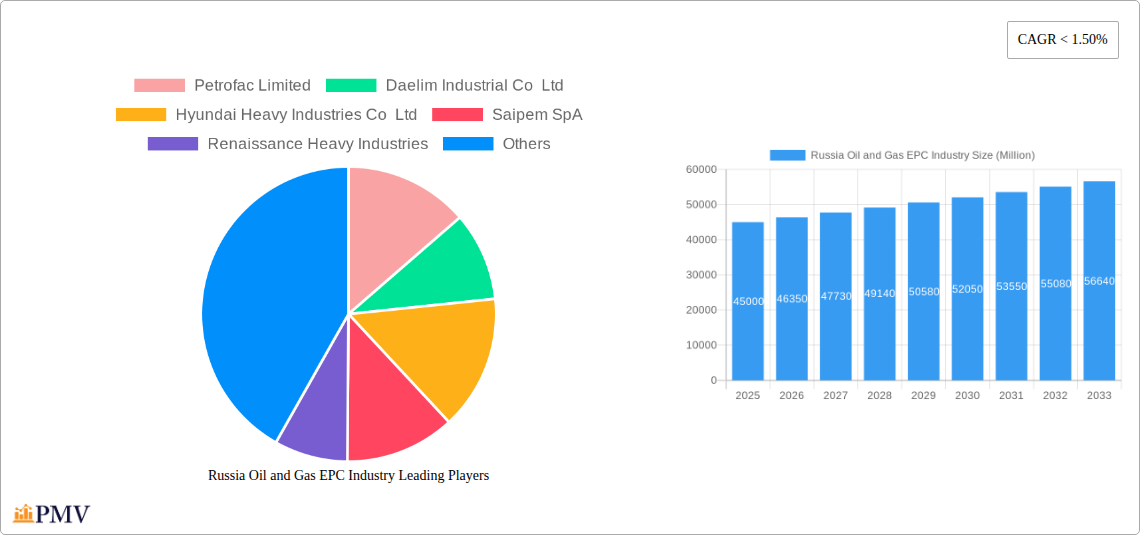

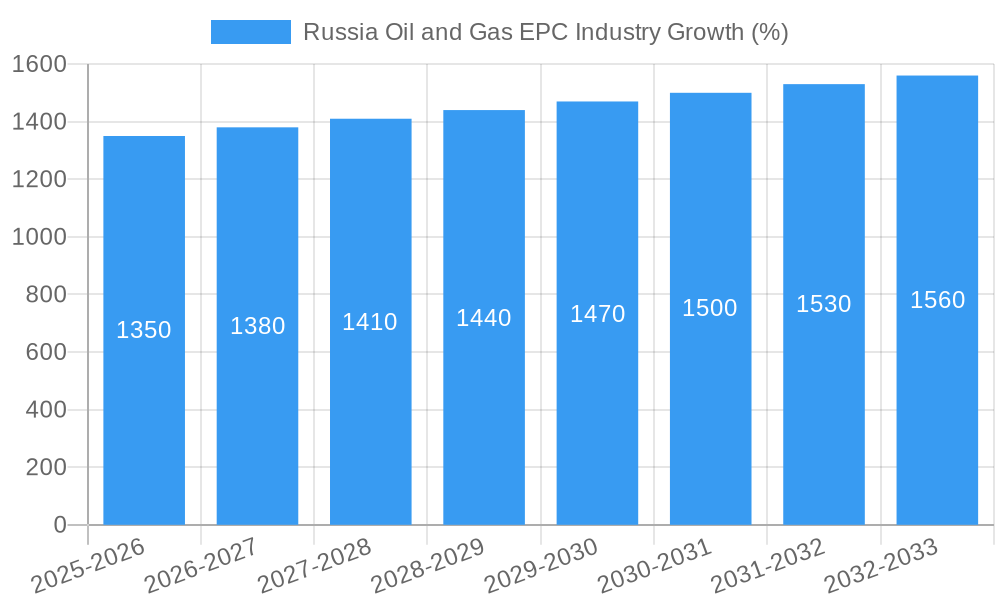

The Russia Oil and Gas EPC (Engineering, Procurement, and Construction) industry, while facing significant geopolitical challenges, presents a complex landscape of opportunity and risk. The period from 2019-2024 witnessed a fluctuating market size, influenced by global energy prices, sanctions, and domestic policy shifts. Let's assume, for illustrative purposes, a market size of $50 billion in 2024. Considering the ongoing energy demand and Russia's substantial hydrocarbon reserves, a conservative estimate for 2025 market size would be $45 billion, reflecting the impact of sanctions and reduced international collaboration. However, domestic investment and a focus on self-sufficiency could drive growth in subsequent years. The CAGR from 2025-2033 will likely be moderate, factoring in both domestic expansion and continued limitations due to geopolitical factors. A projected CAGR of 3% seems reasonable given these competing forces, leading to a projected market size exceeding $60 billion by 2033. This growth will be fueled by ongoing maintenance and upgrades to existing infrastructure, potentially offsetting the reduced international involvement.

The industry's future hinges on several factors. Governmental policies supporting domestic players will be pivotal. Technological advancements towards efficiency and sustainability within the oil and gas sector will also shape the market. Furthermore, the evolution of international relations and potential easing of sanctions will significantly impact foreign investment and collaboration, ultimately influencing the pace of growth. The industry's long-term trajectory will depend on the successful navigation of these geopolitical and economic headwinds, alongside the implementation of efficient and technologically advanced solutions.

Russia Oil and Gas EPC Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia Oil and Gas EPC industry, covering market size, competitive landscape, key trends, and future growth prospects from 2019 to 2033. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033 and the historical period 2019-2024. This report is invaluable for investors, industry professionals, and strategic planners seeking actionable insights into this dynamic market.

Russia Oil and Gas EPC Industry Market Structure & Competitive Dynamics

The Russian Oil and Gas EPC market is characterized by a moderate level of concentration, with a few major international players and several significant domestic companies vying for market share. The market size in 2025 is estimated at xx Million USD. Innovation ecosystems are developing, driven by the need for enhanced efficiency and technological advancements in upstream, midstream, and downstream operations. Regulatory frameworks, while evolving, present both opportunities and challenges. Product substitutes, such as alternative energy sources, exert some pressure, but the overall demand for oil and gas infrastructure remains robust. End-user trends lean towards sustainable and technologically advanced solutions. M&A activity has been relatively moderate in recent years, with deal values averaging xx Million USD per transaction.

- Market Concentration: Moderate, with xx% market share held by the top 5 players.

- Innovation Ecosystems: Focus on digitalization, automation, and sustainable solutions.

- Regulatory Frameworks: Undergoing changes influencing project approvals and investment decisions.

- M&A Activity: Consistent, with an average deal value of xx Million USD.

Russia Oil and Gas EPC Industry Industry Trends & Insights

The Russia Oil and Gas EPC industry is experiencing significant transformation, driven by several key factors. Market growth is primarily fueled by ongoing investments in existing and new oil and gas infrastructure projects, particularly in the upstream sector. Technological disruptions, such as the adoption of digital technologies and advanced materials, are leading to increased efficiency and reduced costs. Consumer preferences are shifting towards more sustainable and environmentally responsible practices, which are influencing project designs and construction methods. The competitive dynamics remain intense, with established players and new entrants competing on price, technology, and project execution capabilities. The CAGR for the forecast period (2025-2033) is projected to be xx%, with a market penetration rate of xx% by 2033. Challenges include geopolitical uncertainties and fluctuating oil prices that impact investment decisions. However, the long-term outlook for the Russian oil and gas sector, and consequently for the EPC industry, remains positive, driven by substantial reserves and increasing global demand.

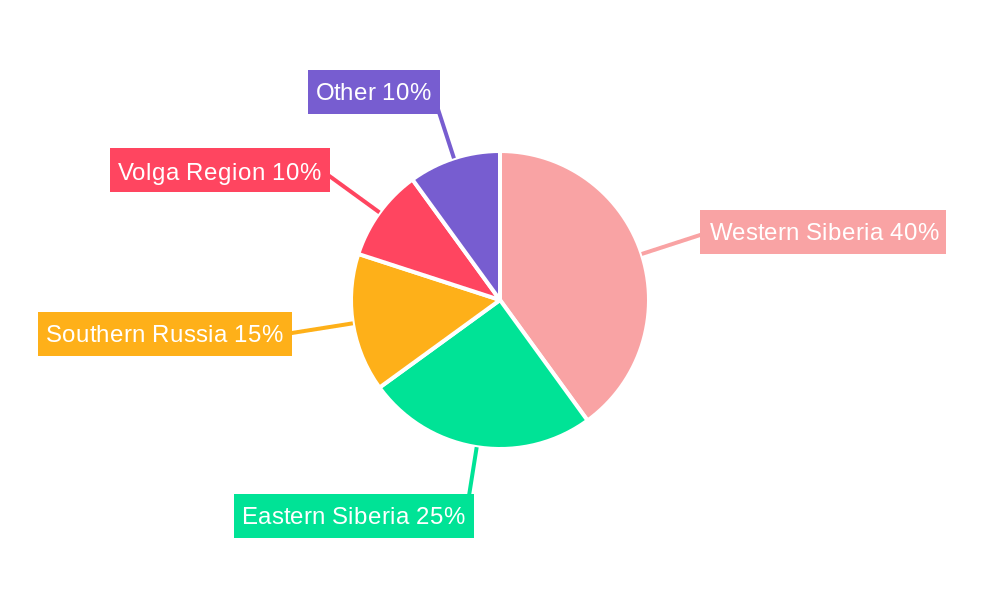

Dominant Markets & Segments in Russia Oil and Gas EPC Industry

The Russian domestic market represents the most dominant segment within the Russia Oil and Gas EPC industry.

- Key Drivers for Russia's Dominance:

- Extensive oil and gas reserves.

- Government support for energy infrastructure development.

- Significant investment in upgrading existing facilities.

- Focus on large-scale projects.

The Upstream sector currently holds the largest market share, followed by the Midstream and Downstream sectors. Oil and gas production applications dominate, owing to the ongoing exploration and production activities. The Middle East and Asia-Pacific regions represent significant but smaller markets for Russian EPC companies.

Russia Oil and Gas EPC Industry Product Innovations

Recent innovations include the adoption of advanced technologies such as Building Information Modeling (BIM), digital twins, and automation solutions to enhance project planning, execution, and monitoring. These innovations offer significant competitive advantages, enabling improved efficiency, cost reduction, and enhanced safety. The market is witnessing a growing emphasis on sustainable and environmentally friendly construction practices and materials.

Report Segmentation & Scope

This report segments the Russia Oil and Gas EPC market by sector (Upstream, Midstream, Downstream), application (Oil and gas production, Oil and gas transportation, Oil and gas refining), and geography (Russia, Middle East, Asia-Pacific). Each segment’s growth projections, market sizes, and competitive dynamics are analyzed in detail. Upstream is expected to show robust growth driven by exploration activities. Midstream investments are focused on pipeline upgrades and expansions. Downstream sees growth through refinery modernization and new plant construction. The Russia market holds the largest share, with significant opportunities for further expansion. The Middle East and Asia-Pacific show promising growth, with substantial projects underway.

Key Drivers of Russia Oil and Gas EPC Industry Growth

Several factors drive the growth of the Russian Oil and Gas EPC industry: robust domestic oil and gas production, government initiatives to modernize infrastructure, increasing demand for energy both domestically and internationally, and ongoing investments in large-scale projects. Technological advancements such as automation and digitalization also boost efficiency and productivity. Favorable regulatory environments (although undergoing change) foster investment and development.

Challenges in the Russia Oil and Gas EPC Industry Sector

The sector faces several challenges, including sanctions, geopolitical instability, fluctuating oil prices, and potential disruptions to the global supply chain. These factors can impact project timelines and costs. Intense competition from both domestic and international players further complicates the market dynamics. Strict environmental regulations also pose challenges.

Leading Players in the Russia Oil and Gas EPC Industry Market

- Petrofac Limited

- Daelim Industrial Co Ltd

- Hyundai Heavy Industries Co Ltd

- Saipem SpA

- Renaissance Heavy Industries

- McDermott International Inc

- VELESSTROY

- Assystem SA

- Linde plc

- TechnipFMC PLC

Key Developments in Russia Oil and Gas EPC Industry Sector

- January 2022: DL E&C signed an agreement for the Russian Baltic Complex Project (USD 1.33 Billion). This project involves constructing the world's largest single-line polymer plant, producing 3 Million tons of polyethylene annually.

- January 2022: Maire Tecnimont S.p.A. secured a USD 1.24 Billion EPC contract with Rosneft for the VGO Hydrocracking Complex at Ryazan Refining Company. This complex will have a capacity of 40,000 barrels per day.

Strategic Russia Oil and Gas EPC Industry Market Outlook

The long-term outlook for the Russian Oil and Gas EPC industry remains positive, driven by continued investment in energy infrastructure, technological advancements, and the country's significant oil and gas reserves. Strategic opportunities exist for companies that can adapt to evolving regulatory landscapes, embrace sustainable practices, and leverage technological innovations to enhance efficiency and reduce costs. The market presents significant potential for growth, particularly in the upstream and downstream sectors.

Russia Oil and Gas EPC Industry Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

Russia Oil and Gas EPC Industry Segmentation By Geography

- 1. Russia

Russia Oil and Gas EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Demand for Crude Oil and Natural Gas4.; Growing Emphasis on Safe

- 3.2.2 Economic

- 3.2.3 and Reliable Connectivity for Oil and Gas Exploration

- 3.3. Market Restrains

- 3.3.1 4.; Technical Challenges Like Construction

- 3.3.2 Deep-Water Challenges

- 3.3.3 and High Construction Costs

- 3.4. Market Trends

- 3.4.1. Midstream Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Western Russia Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Oil and Gas EPC Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Petrofac Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Daelim Industrial Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hyundai Heavy Industries Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Saipem SpA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Renaissance Heavy Industries

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 McDermott International Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 VELESSTROY

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Assystem SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Linde plc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TechnipFMC PLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Petrofac Limited

List of Figures

- Figure 1: Russia Oil and Gas EPC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Oil and Gas EPC Industry Share (%) by Company 2024

List of Tables

- Table 1: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Western Russia Russia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Eastern Russia Russia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Southern Russia Russia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Northern Russia Russia Oil and Gas EPC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 10: Russia Oil and Gas EPC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Oil and Gas EPC Industry?

The projected CAGR is approximately < 1.50%.

2. Which companies are prominent players in the Russia Oil and Gas EPC Industry?

Key companies in the market include Petrofac Limited, Daelim Industrial Co Ltd, Hyundai Heavy Industries Co Ltd, Saipem SpA, Renaissance Heavy Industries, McDermott International Inc, VELESSTROY, Assystem SA, Linde plc, TechnipFMC PLC.

3. What are the main segments of the Russia Oil and Gas EPC Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Crude Oil and Natural Gas4.; Growing Emphasis on Safe. Economic. and Reliable Connectivity for Oil and Gas Exploration.

6. What are the notable trends driving market growth?

Midstream Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Technical Challenges Like Construction. Deep-Water Challenges. and High Construction Costs.

8. Can you provide examples of recent developments in the market?

January 2022: an agreement was signed by DL E&C to participate in the Russian Baltic Complex Project. The contract is worth USD 1.33 billion, and DL E&C will be responsible for the project's design and procurement of all equipment. Among the objectives of the project is to construct the largest polymer plant in the world on a single-line basis in Ust-Luga, 110 kilometers southwest of St. Petersburg. Upon completion, the plant will be able to produce 3 million tons of polyethylene, 120,000 tons of butane, and 50,000 tons of hexane each year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Oil and Gas EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Oil and Gas EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Oil and Gas EPC Industry?

To stay informed about further developments, trends, and reports in the Russia Oil and Gas EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence