Key Insights

Russia's automotive parts magnesium die casting market is set for significant expansion, driven by the increasing demand for lightweight vehicles to enhance fuel efficiency and reduce emissions. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5%. With a base year market size of 185 million in 2024, the market is anticipated to reach substantial value by 2033. This growth is underpinned by the modernization of the Russian automotive sector, supportive government initiatives for domestic manufacturing, and the adoption of advanced die casting technologies offering superior properties and design flexibility. Key applications include engine, transmission, and body components, all benefiting from magnesium's lightweight advantages. Despite potential challenges such as raw material price volatility and geopolitical factors, the long-term outlook remains robust, supported by continued investment in automotive manufacturing and technological innovation. Leading global and domestic players are actively contributing through innovation and strategic collaborations. Regional growth disparities are expected, with Western and Southern Russia likely leading due to higher automotive manufacturing concentrations. The proliferation of electric and hybrid vehicles further stimulates demand for lightweight components.

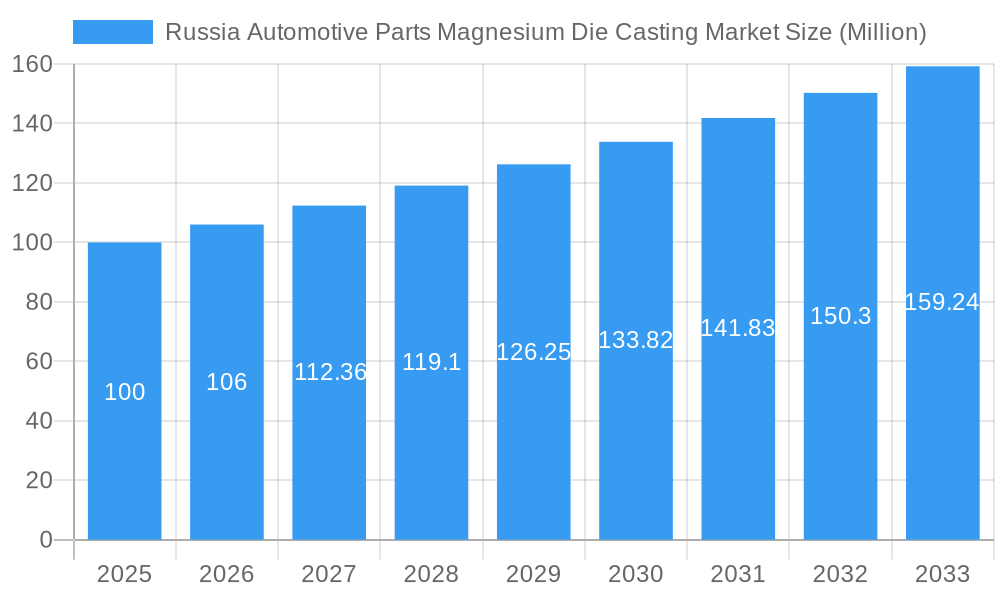

Russia Automotive Parts Magnesium Die Casting Market Market Size (In Million)

Market segmentation by production process (pressure, vacuum, squeeze, semi-solid die casting) and application (engine, transmission, body parts, etc.) offers detailed insights into market dynamics. The competitive landscape is diverse, comprising both international and domestic manufacturers, presenting opportunities for established firms and new entrants. Geographic segmentation (Western, Eastern, Southern, Northern Russia) allows for tailored market strategies, acknowledging regional economic and automotive production differences. Future growth will be shaped by technological advancements, infrastructure development, and supportive government policies within the Russian automotive sector. The market is poised for considerable growth, offering attractive prospects for industry stakeholders.

Russia Automotive Parts Magnesium Die Casting Market Company Market Share

Russia Automotive Parts Magnesium Die Casting Market: A Comprehensive Report 2019-2033

This comprehensive report provides an in-depth analysis of the Russia automotive parts magnesium die casting market, offering invaluable insights for industry stakeholders, investors, and market entrants. Covering the period from 2019 to 2033, with a focus on 2025, this study dissects market dynamics, competitive landscapes, and future growth projections. The report leverages extensive primary and secondary research to deliver actionable intelligence on market size, segmentation, key players, and emerging trends.

Russia Automotive Parts Magnesium Die Casting Market Market Structure & Competitive Dynamics

The Russian automotive parts magnesium die casting market presents a moderately concentrated landscape, with several key players commanding significant market share. The market's dynamism stems from a continuously evolving innovation ecosystem, fueled by advancements in die casting technologies and the automotive industry's ongoing pursuit of lightweighting. Stringent regulatory frameworks, encompassing environmental regulations and safety standards, exert considerable influence on market trends. Competitive pressures arise from substitute products, primarily aluminum die castings, while end-user demand is heavily shaped by the growing preference for fuel-efficient and high-performance vehicles. Mergers and acquisitions (M&A) activity has been relatively subdued in recent years (2019-2024), with average deal values estimated at approximately xx Million. Market share analysis indicates that the top 5 players account for roughly 60% of the market, with prominent participants including Brabant Alucast (https://www.brabantalucast.com/), Kinetic Die Casting, and Gibbs Die Casting Group. Future M&A activity is anticipated to intensify, driven by the ongoing consolidation within the automotive supply chain. The impact of geopolitical factors and sanctions on the market should also be considered.

- Market Concentration: Moderately concentrated

- Top 5 players market share: Approximately 60%

- Average M&A deal value (2019-2024): xx Million

Russia Automotive Parts Magnesium Die Casting Market Industry Trends & Insights

The Russian automotive parts magnesium die casting market is poised for robust growth, projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is primarily driven by the escalating demand for lightweight vehicles aimed at improving fuel efficiency and reducing emissions. Technological advancements, such as the adoption of sophisticated die casting techniques (e.g., high-pressure die casting, semi-solid die casting) and automation, are significantly enhancing production efficiency and product quality. The evolving consumer preference for safer, more fuel-efficient vehicles further fuels market expansion. The competitive landscape is characterized by intense rivalry among established players and the emergence of new entrants. Market penetration of magnesium die castings in the automotive sector is anticipated to reach xx% by 2033, a substantial increase from xx% in 2025. This growth, however, is subject to the ongoing geopolitical situation and its impact on the Russian automotive industry.

Dominant Markets & Segments in Russia Automotive Parts Magnesium Die Casting Market

The Pressure Die Casting segment dominates the production process type, accounting for over 70% of the market share in 2025. This dominance is attributed to its cost-effectiveness and suitability for high-volume production. The Engine Parts application type holds the largest share within the application segments, driven by the increasing demand for lightweight engine components. The growth of these segments is propelled by several key drivers:

- Pressure Die Casting: High volume production capabilities, cost-effectiveness.

- Engine Parts: stringent lightweighting demands in engine design.

- Geographic Dominance: While data for specific regions within Russia is limited, the Moscow and St. Petersburg regions are expected to lead due to higher automotive manufacturing concentration.

The dominance of these segments is expected to continue throughout the forecast period, driven by continuous innovation in die casting technology and the growing demand for fuel-efficient vehicles.

Russia Automotive Parts Magnesium Die Casting Market Product Innovations

Recent breakthroughs in product innovation include the development of high-strength magnesium alloys boasting improved castability and dimensional accuracy. These advancements directly address the automotive industry's need for lightweight yet robust components. The incorporation of advanced simulation and modeling techniques optimizes designs and accelerates development timelines. This trend is expected to propel further market growth and provide manufacturers who adopt these technologies with a substantial competitive edge. Further innovation will likely focus on addressing the challenges of magnesium's inherent flammability and corrosion susceptibility.

Report Segmentation & Scope

This report segments the Russian automotive parts magnesium die casting market based on Production Process Type (Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Semi-Solid Die Casting) and Application Type (Engine Parts, Transmission Components, Body Parts, Others). A comprehensive analysis of each segment's market size, growth projections, and competitive dynamics is provided. The Pressure Die Casting segment is anticipated to experience the most rapid growth, primarily due to its cost-effectiveness and adaptability. Similarly, the Engine Parts segment is projected to maintain its market leadership owing to the persistent demand for lightweight components in engine design. The report also considers the impact of sanctions and import restrictions on the availability of raw materials and equipment.

Key Drivers of Russia Automotive Parts Magnesium Die Casting Market Growth

The growth of the Russia automotive parts magnesium die casting market is propelled by several factors: the increasing demand for lightweight vehicles to enhance fuel efficiency, the adoption of advanced die casting technologies for improved production efficiency, supportive government policies promoting the use of lightweight materials in the automotive industry, and rising investments in automotive manufacturing within the country.

Challenges in the Russia Automotive Parts Magnesium Die Casting Market Sector

Significant challenges facing the market include the volatility of raw material prices (magnesium), the intricacies of the supply chain, and intense competition from alternative lightweight materials (e.g., aluminum). Furthermore, the fluctuating economic conditions in Russia, compounded by geopolitical instability and sanctions, pose a considerable risk to market growth and investment. Access to advanced technologies and skilled labor may also present hurdles to growth.

Leading Players in the Russia Automotive Parts Magnesium Die Casting Market Market

- Brabant Alucast

- Kinetic Die Casting

- Gibbs Die Casting Group

- MK Group Of Companies

- China Precision Diecasting

- Chicago White Metal Casting Inc

- Meridian Lightweight Technologies

- George Fischer Ltd

- Continental Casting LLC

- Magic Precision Inc

Key Developments in Russia Automotive Parts Magnesium Die Casting Market Sector

- 2023 Q4: Gibbs Die Casting Group announced a significant investment in expanding its production capacity in Russia.

- 2022 Q2: New environmental regulations impacting magnesium die casting manufacturing came into effect.

- 2021 Q1: Brabant Alucast launched a new high-strength magnesium alloy optimized for automotive applications.

Strategic Russia Automotive Parts Magnesium Die Casting Market Market Outlook

The Russia automotive parts magnesium die casting market presents significant growth potential driven by continued technological advancements, government support for the automotive sector, and the increasing adoption of lightweight materials. Strategic opportunities exist for companies to capitalize on this growth by investing in advanced technologies, expanding production capacity, and fostering strategic partnerships with automotive manufacturers. The focus on sustainable manufacturing practices and the adoption of Industry 4.0 technologies will also shape the future of the market.

Russia Automotive Parts Magnesium Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Application Type

- 2.1. Engine Parts

- 2.2. Transmission Components

- 2.3. Body Parts

- 2.4. Others

Russia Automotive Parts Magnesium Die Casting Market Segmentation By Geography

- 1. Russia

Russia Automotive Parts Magnesium Die Casting Market Regional Market Share

Geographic Coverage of Russia Automotive Parts Magnesium Die Casting Market

Russia Automotive Parts Magnesium Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of The Global Automotive Turbocharger Market

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Modern Vehicles

- 3.4. Market Trends

- 3.4.1. Increased Application in Body Assemblies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Automotive Parts Magnesium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Engine Parts

- 5.2.2. Transmission Components

- 5.2.3. Body Parts

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Brabant Alucast

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kinetic Die Casting

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gibbs Die Casting Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MK Group Of Companie

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Precision Diecasting

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chicago White Metal Casting Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Meridian Lightweight Technologies

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 George Fischer Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Continental Casting LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Magic Precision Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Brabant Alucast

List of Figures

- Figure 1: Russia Automotive Parts Magnesium Die Casting Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Russia Automotive Parts Magnesium Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Automotive Parts Magnesium Die Casting Market Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 2: Russia Automotive Parts Magnesium Die Casting Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: Russia Automotive Parts Magnesium Die Casting Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Russia Automotive Parts Magnesium Die Casting Market Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 5: Russia Automotive Parts Magnesium Die Casting Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 6: Russia Automotive Parts Magnesium Die Casting Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Automotive Parts Magnesium Die Casting Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Russia Automotive Parts Magnesium Die Casting Market?

Key companies in the market include Brabant Alucast, Kinetic Die Casting, Gibbs Die Casting Group, MK Group Of Companie, China Precision Diecasting, Chicago White Metal Casting Inc, Meridian Lightweight Technologies, George Fischer Ltd, Continental Casting LLC, Magic Precision Inc.

3. What are the main segments of the Russia Automotive Parts Magnesium Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 185 million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of The Global Automotive Turbocharger Market.

6. What are the notable trends driving market growth?

Increased Application in Body Assemblies.

7. Are there any restraints impacting market growth?

Increasing Complexity of Modern Vehicles.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Automotive Parts Magnesium Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Automotive Parts Magnesium Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Automotive Parts Magnesium Die Casting Market?

To stay informed about further developments, trends, and reports in the Russia Automotive Parts Magnesium Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence