Key Insights

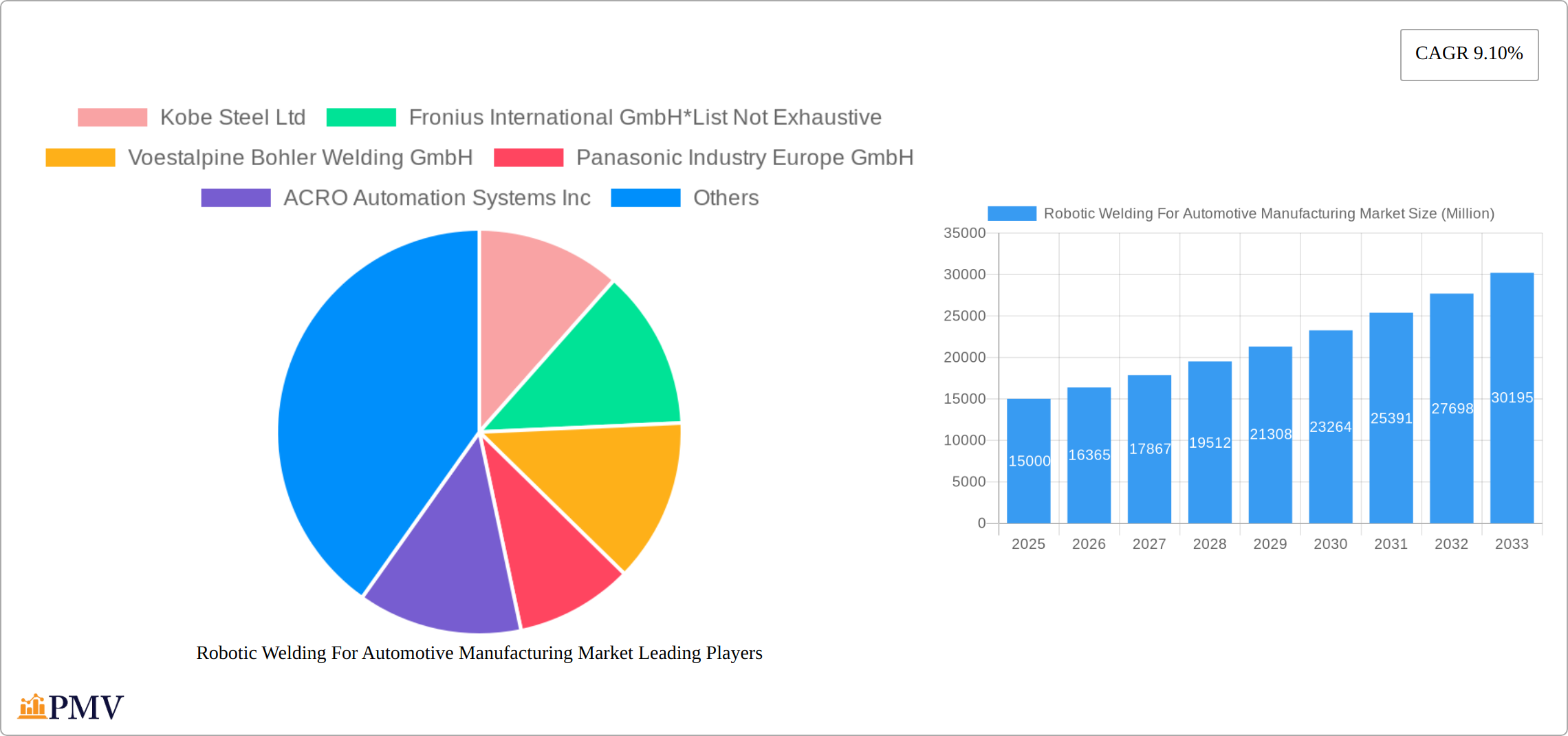

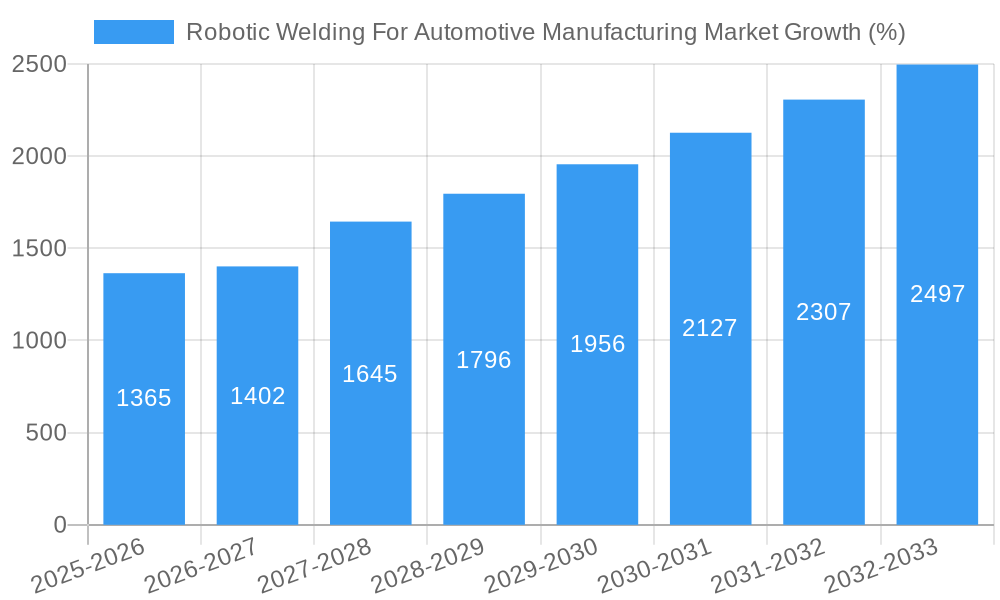

The Robotic Welding for Automotive Manufacturing market is experiencing robust growth, driven by the increasing automation needs within the automotive sector. The market's Compound Annual Growth Rate (CAGR) of 9.10% from 2019 to 2024 suggests a significant expansion, projected to continue through 2033. Key drivers include the rising demand for high-quality, consistent welds, improved productivity and efficiency gains from automation, and the increasing adoption of electric vehicles (EVs), which require more complex welding processes. Furthermore, advancements in robotic technology, such as improved dexterity, precision, and integration with advanced manufacturing systems, are fueling market growth. The market is segmented by welding type, encompassing Resistance Spot Welding, Resistance Seam Welding, and Laser Beam Welding, each catering to specific automotive manufacturing needs. Major players like Kobe Steel, Fronius International, and Lincoln Electric are actively shaping the market through technological innovations and strategic partnerships. While challenges such as high initial investment costs and the need for skilled labor in system integration exist, the long-term benefits of improved quality, reduced labor costs, and increased production output outweigh these restraints, ensuring continued market expansion.

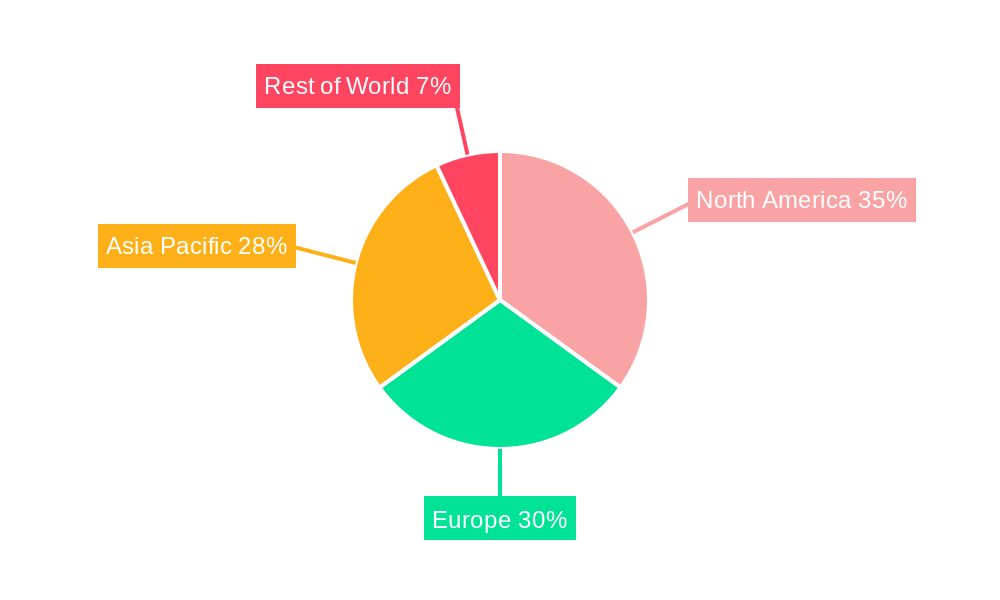

The geographical distribution of the market is expected to be influenced by established automotive manufacturing hubs. North America and Europe currently hold significant market share, owing to well-established automotive industries and early adoption of robotic welding technologies. However, the Asia-Pacific region is anticipated to witness substantial growth in the coming years due to the rapid expansion of automotive manufacturing in countries like China, Japan, and South Korea. This growth will be fueled by increasing investments in automation and the growing demand for cost-effective manufacturing solutions. The Rest of the World segment, while smaller currently, also shows potential for growth as automotive manufacturing expands in emerging economies. The forecast period (2025-2033) will likely see a continued shift towards sophisticated robotic welding solutions, integrating AI and machine learning for enhanced process optimization and further productivity gains. The market is expected to reach a substantial value by 2033, driven by continued technological advancements and the unwavering need for efficiency and quality in automotive manufacturing. We estimate the 2025 market size to be approximately $15 Billion USD, based on the provided CAGR and industry trends.

Robotic Welding for Automotive Manufacturing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Robotic Welding for Automotive Manufacturing Market, offering valuable insights for stakeholders across the automotive and robotics industries. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. The report analyzes market size, growth drivers, competitive dynamics, technological advancements, and key industry developments, providing actionable intelligence for strategic decision-making. The market is segmented by product type: Resistance Spot Welding, Resistance Seam Welding, and Laser Beam Welding. Key players analyzed include Kobe Steel Ltd, Fronius International GmbH, Voestalpine Bohler Welding GmbH, Panasonic Industry Europe GmbH, ACRO Automation Systems Inc, Ador Welding Limited, Lincoln Electric Holdings Inc, Kawasaki Heavy Industries Ltd, Miller Electric Manufacturing LLC, RobotWorx, and Yaskawa Electric Corporation.

Robotic Welding For Automotive Manufacturing Market Market Structure & Competitive Dynamics

The global robotic welding market for automotive manufacturing exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the market is also characterized by a vibrant innovation ecosystem, with numerous smaller companies contributing to technological advancements and niche applications. Regulatory frameworks, particularly concerning safety and environmental standards, play a significant role in shaping market dynamics. Product substitutes, such as manual welding, are increasingly less competitive due to higher labor costs and lower productivity. End-user trends, including the rising demand for lightweight vehicles and electric vehicles, are driving the adoption of advanced robotic welding technologies. The market has witnessed several M&A activities in recent years, with deal values exceeding xx Million in the last five years. For example, Path Robotics secured USD 56.0 Million in funding in May 2021. This consolidation trend is expected to continue, leading to further market concentration.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share.

- Innovation Ecosystem: Highly dynamic, with both established players and startups driving innovation.

- Regulatory Framework: Stringent safety and environmental regulations influence technology adoption and market growth.

- M&A Activity: Significant activity, with deal values exceeding xx Million in recent years.

- End-User Trends: Demand for lightweight and electric vehicles fuels growth.

Robotic Welding For Automotive Manufacturing Market Industry Trends & Insights

The robotic welding market for automotive manufacturing is experiencing robust growth, driven by factors such as increasing automation in automotive production, rising demand for high-quality welds, and the adoption of Industry 4.0 technologies. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) algorithms, are significantly improving the precision and efficiency of robotic welding systems. Consumer preferences for customized vehicles and shorter production cycles are also driving market growth. Increased competition is leading to the development of innovative solutions and improved cost-effectiveness. Market penetration of robotic welding in automotive manufacturing is increasing steadily, with a significant portion of new vehicle production lines now incorporating robotic systems.

Dominant Markets & Segments in Robotic Welding For Automotive Manufacturing Market

The Asia-Pacific region currently dominates the robotic welding market for automotive manufacturing, driven by the rapid expansion of the automotive industry in countries like China, Japan, and South Korea. Within this region, China holds a leading position due to its large automotive production base and government initiatives promoting industrial automation. Among the product segments, Resistance Spot Welding currently holds the largest market share, owing to its widespread use in automotive body assembly.

Key Drivers for Asia-Pacific Dominance:

- Rapid growth of the automotive industry.

- Favorable government policies and incentives.

- Expanding manufacturing infrastructure.

- Increasing adoption of advanced technologies.

Resistance Spot Welding Dominance:

- High adoption rate in automotive body assembly.

- Cost-effectiveness and high productivity.

- Established technological maturity.

Robotic Welding For Automotive Manufacturing Market Product Innovations

Recent advancements in robotic welding technology have focused on enhancing precision, speed, and flexibility. The integration of AI and machine learning enables robots to adapt to variations in workpiece geometry and material properties, resulting in improved weld quality and reduced scrap rates. Collaborative robots (cobots) are gaining traction, offering safer and more efficient human-robot interaction in welding operations. These innovations enhance the overall productivity and profitability of automotive manufacturing.

Report Segmentation & Scope

This report segments the robotic welding market for automotive manufacturing by product type:

- Resistance Spot Welding: This segment is expected to witness significant growth due to its continued relevance in body assembly.

- Resistance Seam Welding: This segment is projected to experience moderate growth, driven by the need for robust and airtight welds in specific applications.

- Laser Beam Welding: This segment is anticipated to show strong growth, fueled by its precision and adaptability to advanced materials.

Each segment's analysis includes growth projections, market size estimates, and competitive landscape assessment.

Key Drivers of Robotic Welding For Automotive Manufacturing Market Growth

Several factors are driving the growth of the robotic welding market in automotive manufacturing. These include:

- Increased automation in automotive production: Automakers are increasingly adopting robotics to boost efficiency and reduce labor costs.

- Demand for higher quality welds: Robotic welding consistently delivers superior weld quality compared to manual welding.

- Technological advancements: The integration of AI, machine learning, and advanced sensor technologies is enhancing robotic welding capabilities.

- Government regulations: Governments are promoting automation through supportive policies and incentives.

Challenges in the Robotic Welding For Automotive Manufacturing Market Sector

Despite the positive outlook, the market faces certain challenges.

- High initial investment costs: Implementing robotic welding systems requires significant upfront investment.

- Integration complexities: Integrating robotic welding systems into existing production lines can be complex and time-consuming.

- Skill gap: A shortage of skilled technicians to operate and maintain robotic welding equipment poses a challenge.

- Supply chain disruptions: Global supply chain volatility can impact the availability of components and equipment.

Leading Players in the Robotic Welding For Automotive Manufacturing Market Market

- Kobe Steel Ltd

- Fronius International GmbH

- Voestalpine Bohler Welding GmbH

- Panasonic Industry Europe GmbH

- ACRO Automation Systems Inc

- Ador Welding Limited

- Lincoln Electric Holdings Inc

- Kawasaki Heavy Industries Ltd

- Miller Electric Manufacturing LLC

- RobotWorx

- Yaskawa Electric Corporation

Key Developments in Robotic Welding For Automotive Manufacturing Market Sector

- June 2022: Kawasaki Robotics partnered with Realtime Robotics to automate robot programming and control in spot welding, improving efficiency and reducing programming time.

- May 2021: Path Robotics raised USD 56.0 Million to expand its AI-powered robotic welding systems, highlighting the growing investment in this sector.

Strategic Robotic Welding For Automotive Manufacturing Market Market Outlook

The future of the robotic welding market in automotive manufacturing is bright. Continued technological advancements, increasing automation demands, and the rising adoption of electric vehicles are expected to drive significant market growth. Strategic opportunities exist for companies focusing on developing innovative solutions that address the challenges of integration, cost-effectiveness, and skill development. The market presents significant potential for players who can effectively leverage AI, machine learning, and collaborative robotics to enhance productivity, improve weld quality, and offer flexible and adaptable welding solutions.

Robotic Welding For Automotive Manufacturing Market Segmentation

-

1. Product

- 1.1. Resistance Spot Welding

- 1.2. Resistance Seam Welding

- 1.3. Laser Beam Welding

Robotic Welding For Automotive Manufacturing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of The World

Robotic Welding For Automotive Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Intensifying adoption of Industry 4.0

- 3.3. Market Restrains

- 3.3.1. Government Regulations on Storage

- 3.4. Market Trends

- 3.4.1. Electric Vehicles Will Augment the Demand for Robotic Welding

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Robotic Welding For Automotive Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Resistance Spot Welding

- 5.1.2. Resistance Seam Welding

- 5.1.3. Laser Beam Welding

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of The World

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Robotic Welding For Automotive Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Resistance Spot Welding

- 6.1.2. Resistance Seam Welding

- 6.1.3. Laser Beam Welding

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Robotic Welding For Automotive Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Resistance Spot Welding

- 7.1.2. Resistance Seam Welding

- 7.1.3. Laser Beam Welding

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Robotic Welding For Automotive Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Resistance Spot Welding

- 8.1.2. Resistance Seam Welding

- 8.1.3. Laser Beam Welding

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of The World Robotic Welding For Automotive Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Resistance Spot Welding

- 9.1.2. Resistance Seam Welding

- 9.1.3. Laser Beam Welding

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. North America Robotic Welding For Automotive Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Robotic Welding For Automotive Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Robotic Welding For Automotive Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of The World Robotic Welding For Automotive Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Kobe Steel Ltd

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Fronius International GmbH*List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Voestalpine Bohler Welding GmbH

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Panasonic Industry Europe GmbH

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 ACRO Automation Systems Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Ador Welding Limited

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Lincoln Electric Holdings Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Kawasaki Heavy Industries Ltd

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Miller Electric Manufacturing LLC

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 RobotWorx

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Yaskawa Electric Corporation

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Kobe Steel Ltd

List of Figures

- Figure 1: Global Robotic Welding For Automotive Manufacturing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Robotic Welding For Automotive Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Robotic Welding For Automotive Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Robotic Welding For Automotive Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Robotic Welding For Automotive Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Robotic Welding For Automotive Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Robotic Welding For Automotive Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of The World Robotic Welding For Automotive Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of The World Robotic Welding For Automotive Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Robotic Welding For Automotive Manufacturing Market Revenue (Million), by Product 2024 & 2032

- Figure 11: North America Robotic Welding For Automotive Manufacturing Market Revenue Share (%), by Product 2024 & 2032

- Figure 12: North America Robotic Welding For Automotive Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Robotic Welding For Automotive Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Robotic Welding For Automotive Manufacturing Market Revenue (Million), by Product 2024 & 2032

- Figure 15: Europe Robotic Welding For Automotive Manufacturing Market Revenue Share (%), by Product 2024 & 2032

- Figure 16: Europe Robotic Welding For Automotive Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Robotic Welding For Automotive Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Robotic Welding For Automotive Manufacturing Market Revenue (Million), by Product 2024 & 2032

- Figure 19: Asia Pacific Robotic Welding For Automotive Manufacturing Market Revenue Share (%), by Product 2024 & 2032

- Figure 20: Asia Pacific Robotic Welding For Automotive Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Robotic Welding For Automotive Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of The World Robotic Welding For Automotive Manufacturing Market Revenue (Million), by Product 2024 & 2032

- Figure 23: Rest of The World Robotic Welding For Automotive Manufacturing Market Revenue Share (%), by Product 2024 & 2032

- Figure 24: Rest of The World Robotic Welding For Automotive Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of The World Robotic Welding For Automotive Manufacturing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Robotic Welding For Automotive Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Robotic Welding For Automotive Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Robotic Welding For Automotive Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Robotic Welding For Automotive Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 13: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 15: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 17: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Product 2019 & 2032

- Table 19: Global Robotic Welding For Automotive Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Robotic Welding For Automotive Manufacturing Market?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the Robotic Welding For Automotive Manufacturing Market?

Key companies in the market include Kobe Steel Ltd, Fronius International GmbH*List Not Exhaustive, Voestalpine Bohler Welding GmbH, Panasonic Industry Europe GmbH, ACRO Automation Systems Inc, Ador Welding Limited, Lincoln Electric Holdings Inc, Kawasaki Heavy Industries Ltd, Miller Electric Manufacturing LLC, RobotWorx, Yaskawa Electric Corporation.

3. What are the main segments of the Robotic Welding For Automotive Manufacturing Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Intensifying adoption of Industry 4.0.

6. What are the notable trends driving market growth?

Electric Vehicles Will Augment the Demand for Robotic Welding.

7. Are there any restraints impacting market growth?

Government Regulations on Storage.

8. Can you provide examples of recent developments in the market?

June 2022 - Kawasaki Robotics has teamed up with Realtime Robotics, a maker of autonomous motion planning for industrial robots, to automate the programming, implementation, and control of its industrial robots. Two BX100N Kawasaki robots are combined with Kawasaki Robotics' open programming platform, KRNX, and Realtime Robotics' breakthrough motion planning and collision avoidance software in the spot-welding demo cell.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Robotic Welding For Automotive Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Robotic Welding For Automotive Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Robotic Welding For Automotive Manufacturing Market?

To stay informed about further developments, trends, and reports in the Robotic Welding For Automotive Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence