Key Insights

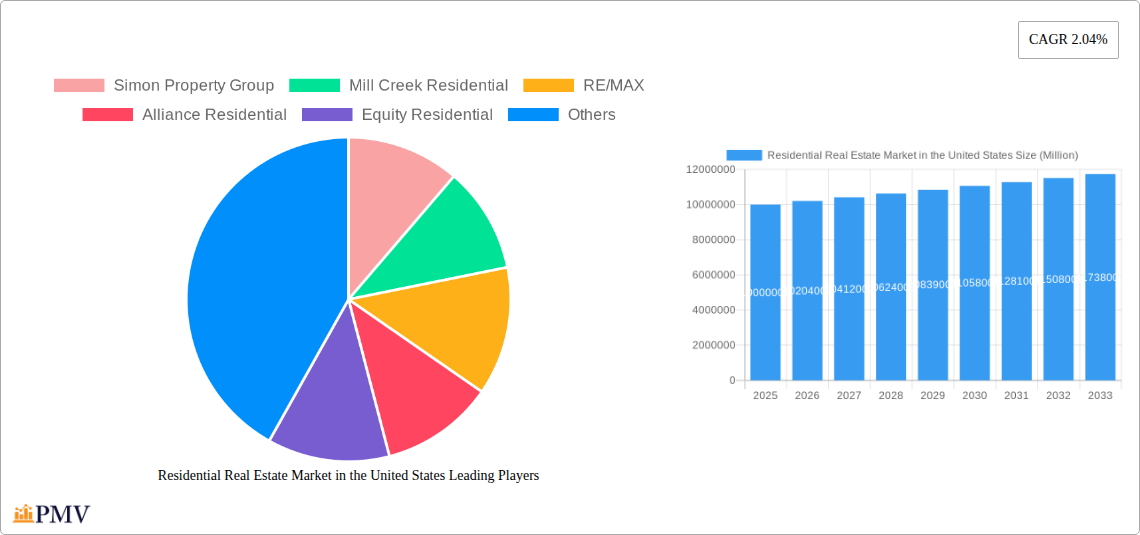

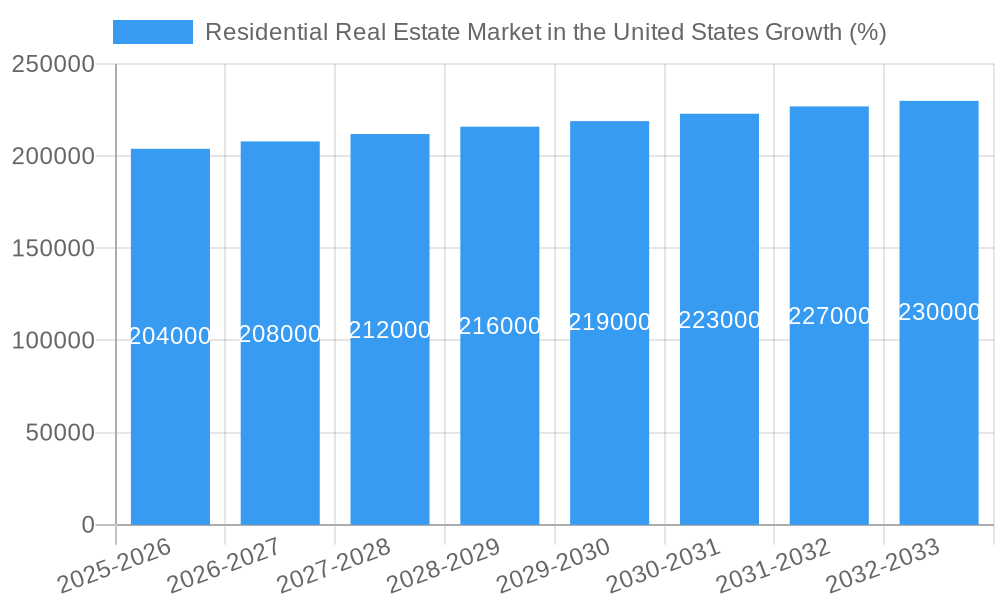

The U.S. residential real estate market, while exhibiting a moderate CAGR of 2.04%, reveals a complex landscape influenced by several key factors. The market size in 2025 is estimated at $10 trillion (a reasonable assumption based on the significant size and activity of the US housing market). Strong drivers include sustained population growth, particularly in urban areas, coupled with increasing household formations among millennials and Gen Z. Furthermore, low interest rates (though this is subject to change based on current economic conditions) historically fueled demand, contributing to market expansion. However, trends such as rising construction costs, material shortages, and increasing regulatory hurdles are placing upward pressure on prices, potentially impacting affordability and dampening future growth. The segment breakdown shows a strong demand for apartments and condominiums, reflecting the preference for urban living and ease of maintenance, while landed houses and villas maintain their appeal in suburban and rural areas. Competition among major players like Simon Property Group, Mill Creek Residential, and others remains fierce, driving innovation and efficiency improvements within the industry. Sustained economic growth and government policies that support homeownership will be crucial in determining the market trajectory in the coming years.

The forecast period (2025-2033) suggests continued, albeit modest, expansion, driven by the aforementioned factors. Restraints such as inflation, potential economic downturns, and changing demographic trends (e.g., shifts in family size) present ongoing challenges. The regional distribution likely reflects the varying economic conditions and housing markets across different states. A deeper dive into regional data (for example, focusing on specific states with high population growth) would offer a more granular understanding of market dynamics and opportunities. The continued dominance of major players underscores the importance of scale and efficient operations in navigating the complexities of the market. Adaptability to evolving consumer preferences and the incorporation of sustainable building practices will be pivotal for long-term success.

Residential Real Estate Market in the United States: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Residential Real Estate Market in the United States, covering the period 2019-2033. With a focus on key market segments, industry trends, and leading players, this report offers invaluable insights for investors, industry professionals, and strategic decision-makers. The report utilizes a robust methodology, combining historical data (2019-2024), current estimations (2025), and forward-looking forecasts (2025-2033) to paint a clear picture of this dynamic market.

Residential Real Estate Market in the United States: Market Structure & Competitive Dynamics

The U.S. residential real estate market is characterized by a complex interplay of factors influencing its structure and competitive dynamics. Market concentration is moderate, with a few large players like Simon Property Group, Mill Creek Residential, and RE/MAX holding significant market share, but a large number of smaller firms and independent brokers also contributing significantly. Innovation ecosystems are thriving, driven by PropTech advancements in areas such as online property portals, virtual tours, and data analytics. Regulatory frameworks, including zoning laws and environmental regulations, vary across states and municipalities, significantly impacting market access and development. Product substitutes, such as manufactured housing and co-living spaces, are gaining traction, presenting both opportunities and challenges for traditional players. End-user trends, particularly among millennials and Gen Z, are shifting towards urban living and sustainable housing options. Finally, M&A activity remains robust, with several high-value transactions occurring recently. For instance, the USD 3.7 Billion acquisition of Resource REIT by Blackstone reflects this trend. The average M&A deal value in the last five years has been approximately USD xx Billion.

- Market Concentration: Moderate, with significant presence of large players and numerous smaller firms.

- Innovation: Driven by PropTech advancements.

- Regulations: Varied across states and localities, impacting development.

- Product Substitutes: Growing presence of alternative housing options.

- End-User Trends: Shift towards urban living and sustainable housing.

- M&A Activity: Robust, with high deal values observed.

Residential Real Estate Market in the United States: Industry Trends & Insights

The US residential real estate market exhibits a complex interplay of growth drivers, technological disruptions, consumer preferences, and competitive pressures. From 2019 to 2024, the market experienced a CAGR of xx%, primarily driven by factors such as population growth, increasing urbanization, and historically low-interest rates. However, the market penetration of new technologies like smart home integration remains relatively low, but it's gradually increasing. Consumer preferences are evolving, with a growing demand for sustainable, energy-efficient homes. This is influencing new construction and renovation projects. Meanwhile, stiff competition among both established and new entrants and fluctuations in economic indicators (interest rates, inflation) impact market dynamics. Looking forward, the market is projected to witness a CAGR of xx% during the forecast period (2025-2033), fueled by continued population growth, economic recovery, and increased government investment in infrastructure.

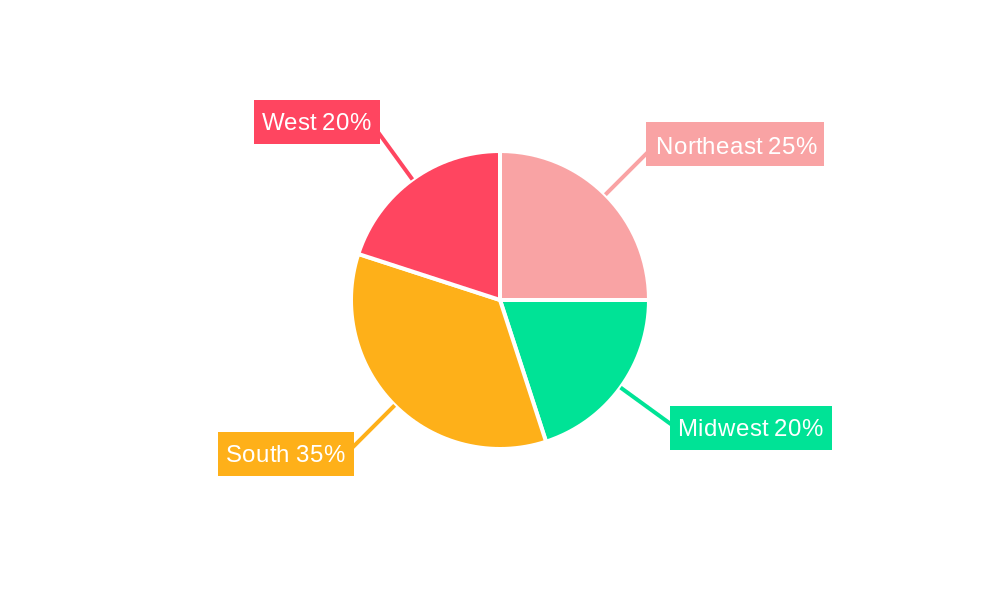

Dominant Markets & Segments in Residential Real Estate Market in the United States

The U.S. residential real estate market shows diverse performance across different segments and regions. While data varies by year, the Sun Belt states consistently demonstrate strong growth in both landed houses and villas, and apartments and condominiums.

- Key Drivers for Sun Belt Dominance:

- Favorable climate and lifestyle appeal.

- Relatively lower cost of living compared to coastal areas.

- Population influx due to job growth and migration.

- Strong economic performance and infrastructure development.

The Apartments and Condominiums segment exhibits particularly robust growth in urban centers driven by the increasing preference for multi-family housing among millennials and Gen Z, along with limited availability of single-family homes in densely populated areas. The Landed Houses and Villas segment is primarily driven by the desire for more space and privacy, particularly among families and higher-income earners.

Residential Real Estate Market in the United States: Product Innovations

The residential real estate sector is witnessing significant product innovation, primarily driven by technological advancements. Smart home technology, sustainable building materials, and energy-efficient designs are gaining traction. These innovations offer improved functionality, reduced environmental impact, and enhanced comfort, thereby appealing to environmentally conscious and tech-savvy buyers. Prefabricated and modular housing are also gaining popularity, offering faster construction times and cost-effectiveness. The market fit for these innovations is strong, as consumers increasingly prioritize convenience, sustainability, and technology integration in their homes.

Report Segmentation & Scope

This report segments the U.S. residential real estate market by property type:

Apartments and Condominiums: This segment is expected to experience significant growth due to increasing urbanization and rising demand for rental properties. Market size is projected at USD xx Billion in 2025, with a CAGR of xx% during the forecast period. Competition is intense, with numerous large and small players vying for market share.

Landed Houses and Villas: This segment is characterized by higher price points and a focus on luxury and spacious living. The market size is projected at USD xx Billion in 2025, with a slightly lower CAGR of xx% due to higher entry barriers and slower growth in some areas. Competition is less intense than in the apartments and condominiums segment, but still significant.

Key Drivers of Residential Real Estate Market in the United States Growth

Several factors drive the growth of the U.S. residential real estate market. Strong economic growth, leading to increased disposable income and purchasing power, is a major factor. Population growth and urbanization further fuel demand for housing. Government policies, such as tax incentives for homebuyers and infrastructure investments, also play a significant role. Finally, technological innovations in construction and home automation enhance efficiency and appeal to consumers.

Challenges in the Residential Real Estate Market in the United States Sector

The U.S. residential real estate market faces several challenges. High construction costs and supply chain disruptions significantly impact affordability and availability. Stricter lending regulations and higher interest rates can dampen buyer demand. Increased competition among developers and real estate agents also affects profitability. These factors combine to create significant headwinds for the market, particularly in certain segments and regions.

Leading Players in the Residential Real Estate Market in the United States Market

- Simon Property Group

- Mill Creek Residential

- RE/MAX

- Alliance Residential

- Equity Residential

- Greystar Real Estate Partners

- Keller Williams Realty Inc

- Essex Property Trust

- Brookfield

- The Michaels Organization

- AvalonBay Communities

- Lincoln Property Company

Key Developments in Residential Real Estate Market in the United States Sector

- May 2022: Resource REIT Inc. sold all its outstanding shares to Blackstone Real Estate Income Trust Inc. for USD 3.7 Billion, highlighting consolidation trends in the REIT sector.

- February 2022: Blackstone acquired Preferred Apartment Communities for approximately USD 6 Billion, demonstrating significant investment in the multifamily rental sector.

Strategic Residential Real Estate Market in the United States Market Outlook

The U.S. residential real estate market presents a compelling long-term investment opportunity. Continued population growth, coupled with technological advancements and evolving consumer preferences, will drive sustained market expansion. Strategic opportunities exist in sustainable building, smart home integration, and catering to the evolving needs of diverse demographics. Addressing affordability concerns and navigating regulatory changes will be crucial for success in this dynamic market.

Residential Real Estate Market in the United States Segmentation

-

1. Property Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

Residential Real Estate Market in the United States Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Residential Real Estate Market in the United States REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investment Plan Towards Urban Rail Development

- 3.3. Market Restrains

- 3.3.1. Italy’s Fragmented Approach to Tenders

- 3.4. Market Trends

- 3.4.1. Existing Home Sales Witnessing Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. North America Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Property Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.1. Market Analysis, Insights and Forecast - by Property Type

- 7. South America Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Property Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.1. Market Analysis, Insights and Forecast - by Property Type

- 8. Europe Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Property Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.1. Market Analysis, Insights and Forecast - by Property Type

- 9. Middle East & Africa Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Property Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.1. Market Analysis, Insights and Forecast - by Property Type

- 10. Asia Pacific Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Property Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Landed Houses and Villas

- 10.1. Market Analysis, Insights and Forecast - by Property Type

- 11. Brazil Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Mexico Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Argentina Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Colombia Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Chile Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Rest of Latin America Residential Real Estate Market in the United States Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Simon Property Group

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Mill Creek Residential

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 RE/MAX

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Alliance Residential

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Equity Residential

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Greystar Real Estate Partners

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Keller Williams Realty Inc **List Not Exhaustive

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Essex Property Trust

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Brookfield

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 The Michaels Organization

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 AvalonBay Communities

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Lincoln Property Company

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 Simon Property Group

List of Figures

- Figure 1: Global Residential Real Estate Market in the United States Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Brazil Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 3: Brazil Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 4: Mexico Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 5: Mexico Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 6: Argentina Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 7: Argentina Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 8: Colombia Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 9: Colombia Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 10: Chile Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 11: Chile Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 12: Rest of Latin America Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 13: Rest of Latin America Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 15: North America Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 16: North America Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 19: South America Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 20: South America Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 21: South America Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 23: Europe Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 24: Europe Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East & Africa Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 27: Middle East & Africa Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 28: Middle East & Africa Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 29: Middle East & Africa Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Residential Real Estate Market in the United States Revenue (Million), by Property Type 2024 & 2032

- Figure 31: Asia Pacific Residential Real Estate Market in the United States Revenue Share (%), by Property Type 2024 & 2032

- Figure 32: Asia Pacific Residential Real Estate Market in the United States Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Residential Real Estate Market in the United States Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 3: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 17: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 22: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 27: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 38: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Turkey Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Israel Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: GCC Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: North Africa Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Africa Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Middle East & Africa Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Property Type 2019 & 2032

- Table 46: Global Residential Real Estate Market in the United States Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific Residential Real Estate Market in the United States Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Real Estate Market in the United States?

The projected CAGR is approximately 2.04%.

2. Which companies are prominent players in the Residential Real Estate Market in the United States?

Key companies in the market include Simon Property Group, Mill Creek Residential, RE/MAX, Alliance Residential, Equity Residential, Greystar Real Estate Partners, Keller Williams Realty Inc **List Not Exhaustive, Essex Property Trust, Brookfield, The Michaels Organization, AvalonBay Communities, Lincoln Property Company.

3. What are the main segments of the Residential Real Estate Market in the United States?

The market segments include Property Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Investment Plan Towards Urban Rail Development.

6. What are the notable trends driving market growth?

Existing Home Sales Witnessing Strong Growth.

7. Are there any restraints impacting market growth?

Italy’s Fragmented Approach to Tenders.

8. Can you provide examples of recent developments in the market?

May 2022: Resource REIT Inc. completed the sale of all of its outstanding shares of common stock to Blackstone Real Estate Income Trust Inc. for USD 14.75 per share in an all-cash deal valued at USD 3.7 billion, including the assumption of the REIT's debt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Real Estate Market in the United States," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Real Estate Market in the United States report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Real Estate Market in the United States?

To stay informed about further developments, trends, and reports in the Residential Real Estate Market in the United States, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence